RNS No 3654c

AMERICAN EXPRESS CO

30th January 1998

PART 1

CONTACT: Susan D. Miller

212-640-4953

Michael J. O'Neill

212-640-5951

AMERICAN EXPRESS REPORTS HIGHER OPERATING INCOME

FOR 1997 FOURTH-QUARTER AND FULL-YEAR

(millions, except per share amounts)

Quarter Ended Percentage Year Ended Percentage

December 31 Inc./(Dec) December 31 Inc./(Dec)

1997 1996 1997 1996

Operating

Income $ 493 $ 433* 13.9% $ 1,991 $ 1,739* 14.5%

Revenues $ 4,674 $ 4,301 8.7% $17,760 $16,380 8.4%

Per Share

Operating

Income:

Primary $ 1.04 $ 0.90* 15.6% $ 4.16 $ 3.57* 16.5%

Basic $ 1.07 $ 0.92* 16.3% $ 4.29 $ 3.67* 16.9%

Diluted $ 1.04 $ 0.89* 16.9% $ 4.15 $ 3.56* 16.6%

Average Common

Shares

Outstanding:

Primary 475 482 (1.5)% 479 486 (1.5)%

Basic 461 469 (1.8)% 464 472 (1.7)%

Diluted 475 483 (1.7)% 479 488 (1.9)%

Return on Average

Equity 23.5% 22.8% -

--------------------------------------------------------------------------------

* Fourth-quarter and full-year 1996 amounts exclude a $300 million gain

(after-tax) on the exchange of the Company's DECS (Debt Exchangeable for Common

Stock of First Data Corporation) and a $138 million restructuring charge

(after-tax).

NEW YORK, January 26, 1998 -- American Express Company today reported record

net income for 1997 of $1.99 billion, 14 percent higher than operating income

of $1.74 billion a year ago. The 1996 results exclude two fourth-quarter

items: a $300 million gain (after-tax) on the exchange of DECS for shares of

common stock of First Data Corporation and a $138 million restructuring charge

(after-tax). On a per share basis, 1997 primary earnings were $4.16, an

increase of 17 percent from $3.57 a year ago. Diluted earnings per share of

$4.15 also increased 17 percent, compared with $3.56 last year. Revenues of

$17.8 billion were up 8.4 percent from a year ago. The Company's return on

equity was 23.5 percent. These results exceeded American Express' long-term

targets of: 12-15 percent earnings per share growth, at least 8 percent growth

in revenues and a return on equity of 18-20 percent.

For the fourth quarter, American Express reported net income of $493 million, an

increase of 14 percent excluding the fourth-quarter 1996 gain and restructuring

charge.

Travel Related Services (TRS) reported record net income for 1997 of

$1.35 billion, up 10 percent from $1.23 billion a year ago. The 1996 results

exclude a fourth-quarter restructuring charge of $125 million ($196 million

pretax).

TRS' net revenues increased 8 percent compared with a year ago. Excluding

the 1996 restructuring charge, TRS' expenses were up 7 percent compared with

last year.

The increase in net revenues is primarily attributable to higher worldwide

billed business, growth in Cardmember loans outstanding and wider interest

margins. The growth in revenues also includes a benefit from increased

recognition of recoveries on abandoned property related to the Travelers Cheque

business, which was largely offset by higher investment spending on business

building initiatives. The improvement in billed business reflects a greater

number of cards outstanding and higher spending per basic Cardmember. The

growth in cards outstanding is largely attributable to the introduction of new

consumer and small business credit cards. Spending increased in part due to the

benefits of rewards programs and expanded merchant coverage.

Provisions for losses rose, reflecting both higher volumes and loss rates. The

increase in operating expenses resulted from the cost of Cardmember loyalty

programs, business growth and investment spending.

TRS reported record fourth quarter net income in 1997 of $328 million, compared

with $299 million in the 1996 fourth quarter, excluding the restructuring

charge.

American Express Financial Advisors (AEFA) reported record net income for

1997 of $707 million, a 19 percent increase over the $594 million reported a

year ago.

Revenue and earnings growth benefited from higher fee revenues due to an

increase in managed assets. The growth in Other Operating Expenses primarily

reflects costs related to systems technology and higher business volumes.

AEFA reported record sales of mutual funds in 1997. Sales of investment

certificates increased over last year; sales of annuities and life and other

insurance products declined.

AEFA reported record fourth quarter net income in 1997 of $183 million, compared

with $155 million in 1996.

American Express Bank (AEB) reported 1997 net income of $82 million, a 20

percent increase over the $68 million reported in 1996.

The growth in earnings reflects higher revenues, primarily due to strong

foreign exchange income. The revenue increase was partially offset by higher

operating expenses, including systems technology costs.

AEB reported fourth quarter net income of $19 million, compared with $17 million

in the 1996 fourth quarter.

Corporate and other reported 1997 net expenses of $152 million, compared with

$153 million a year ago. The 1996 figures exclude the $300 million after-tax

gain on the exchange of DECS ($480 million pre-tax) and a charge primarily

related to the early retirement of debt. Including these items, Corporate and

Other reported net income of $134 million in 1996. Both years include the

Company's share of the Travelers Inc. revenue and net income participations in

accordance with an agreement related to the 1993 sale of the Shearson Lehman

Brothers Division, which was offset by expenses related to certain business

building initiatives.

For the 1997 fourth quarter, net expenses were $37 million compared with $38

million a year ago, excluding the above gain and charge.

American Express Company (www.americanexpress.com), founded in 1850, is a

global travel, financial and network services provider.

American Express Company

Financial Summary

(Unaudited)

(Dollars in millions)

Quarter Ended

December 31 Percentage

1997 1996 Inc/(Dec)

Revenues by Industry Segment (A)

Travel Related Services $ 3,351 $ 3,103 8.0 %

American Express Financial

Advisors 1,202 1,069 12.5

American Express Bank 167 156 7.1

4,720 4,328 9.1

Corporate and Other,

including adjustments

and eliminations (46) (27) (58.1)

CONSOLIDATED REVENUES (A) $ 4,674 $ 4,301 8.7

Pretax Income by Industry Segment

Travel Related Services (B) $ 468 $ 403 16.1

American Express Financial Advisors 259 228 13.9

American Express Bank 30 26 15.6

757 657 15.3

Corporate and Other (C) (67) (78) 12.9

PRETAX OPERATING INCOME $ 690 $ 579 19.2

Operating Income by Industry Segment

Travel Related Services 328 $ 299 10.0

American Express Financial Advisors 183 155 18.1

American Express Bank 19 17 13.5

530 471 12.8

Corporate and Other (C) (37) (38) 0.2

OPERATING INCOME $ 493 $ 433 13.9

FDC Gain/(Restructuring) 0 162 -

NET INCOME $ 493 $ 595 (17.1)

Year Ended

December 31 Percentage

1997 1996 Inc/(Dec)

Revenues by Industry Segment (A)

Travel Related Services $ 12,667 $ 11,773 7.6 %

American Express Financial

Advisors 4,599 4,110 11.9

American Express Bank 637 591 7.7

17,903 16,474 8.7

Corporate and Other,

including adjustments

and eliminations (143) (94) (58.1)

CONSOLIDATED REVENUES (A) $ 17,760 $ 16,380 8.4

Pretax Income by Industry Segment

Travel Related Services (B) $ 1,905 $ 1,719 10.8

American Express Financial

Advisors 1,022 885 15.5

American Express Bank 130 105 23.0

3,057 2,709 12.8

Corporate and Other (C) (307) (309) 0.9

PRETAX OPERATING INCOME $ 2,750 $ 2,400 14.6

Operating Income by Industry Segment

Travel Related Services 1,354 $ 1,230 10.1

American Express Financial Advisors 707 594 19.1

American Express Bank 82 68 20.2

2,143 1,892 13.3

Corporate and Other (C) (152) (153) -

OPERATING INCOME $ 1,991 $ 1,739 14.5

FDC Gain/(Restructuring) 0 162 -

NET INCOME $ 1,991 $ 1,901 (4.7)

(A) Revenues are reported net of interest expense, where applicable.

(B) TRS' results for the quarter and year ended December 31, 1996 exclude a

pretax restructuring charge of $196 million ($125 million after-tax).

(C) Corporate and Other results for the quarter and year ended December 31,

1996 exclude a pretax gain of $480 million ($300 million after-tax) on the

exchange of the Company's DECS (Debt Exchangeable for Common Stock) for

shares of common stock of First Data corporation and a $20 million pretax

charge ($13 million after-tax) related to the early retirement of debt and

certain restructuring costs.

Quarter Ended Year Ended

December 31 December 31

1997 1996 1997 1996

EARNINGS PER SHARE

Primary

Operating Income Per

Common Share $ 1.04 $ 0.90 $ 4.16 $ 3.57

FDC Gain/(Restructuring) 0.00 0.33 0.00 0.33

Net Income Per Common Share $ 1.04 $ 1.23 $ 4.16 $ 3.90

Average common shares

outstanding (millions) 475.0 482.1 478.5 485.6

Basic

Operating Income Per

Common Share $ 1.07 $ 0.92 $ 4.29 $ 3.67

FDC Gain/(Restructuring) 0.00 0.35 0.00 0.35

Net Income Per Common Share $ 1.07 $ 1.27 $ 4.29 $ 4.02

Average common shares

outstanding (millions) 460.7 469.2 464.2 472.2

Diluted

Operating Income Per

Common Share $ 1.04 $ 0.89 $ 4.15 $ 3.56

FDC Gain/(Restructuring) 0.00 0.34 0.00 0.33

Net Income Per Common Share $ 1.04 $ 1.23 $ 4.15 $ 3.89

Average common shares

outstanding (millions) 475.1 483.5 479.2 488.3

Cash dividends declared per

common share $ 0.225 $ 0.225 $ 0.90 $ 0.90

Selected Statistical Information

(Unaudited)

Quarter Ended Year Ended

December 31 December 31

1997 1996 1997 1996

Return on Average Equity* 23.5% 22.8% 23.5% 22.8%

Common Shares Outstanding

(millions) 466.4 472.9 466.4 472.9

Book Value per Common Share:

Actual $ 20.53 $ 18.04 $ 20.53 $ 18.04

Pro Forma * $ 19.29 $ 17.22 $ 19.29 $ 17.22

Shareholders' Equity (billions) $ 9.6 $ 8.5 $ 9.6 $ 8.5

* Excludes the effect of SFAS no. 115 and for ROE, also excludes a fourth

quarter 1996 $300 million gain on the exchange of the Company's DECS and $138

million restructuring charge.

Financial Summary

(Unaudited)

(Dollars in millions) Quarter Ended

Dec 31 Sept 30 June 30 March 31 Dec 31

1997 1997 1997 1997 1996

Revenues by Industry Segment (A)

Travel Related

Services $ 3,351 $ 3,199 $ 3,147 $ 2,970 $ 3,103

American Express

Financial Advisors 1,202 1,169 1,143 1,084 1,069

American Express Bank 167 162 153 153 156

4,720 4,530 4,443 4,207 4,328

Corporate and Other,

including adjustments

and eliminations (46) (30) (21) (43) (27)

CONSOLIDATED REVENUES (A) 4,674 $ 4,500 $ 4,422 $ 4,164 $ 4,301

Pretax Operating Income by Industry Segment

Travel Related

Services (B) $ 468 $ 494 $ 493 $ 449 $ 403

American Express

Financial Advisors 259 261 265 236 228

American Express Bank 30 34 33 32 26

757 789 791 717 657

Corporate and Other (C) (67) (71) (89) (77) (78)

PRETAX OPERATING

INCOME $ 690 $ 718 $ 702 $ 640 $ 579

Operating Income by Industry Segment

Travel Related

Services (B) $ 328 $ 356 $ 355 $ 315 $ 299

American Express

Financial Advisors 183 184 183 157 155

American Express Bank 19 21 21 20 17

530 561 559 492 471

Corporate and Other (C) (37) (37) (39) (38) (38)

OPERATING INCOME $ 493 $ 524 $ 520 $ 454 $ 433

FDC Gain/(Restructuring) 0 0 0 0 162

NET INCOME $ 493 $ 524 $ 520 $ 454 $ 595

(A) Revenues are reported net of interest expense, where applicable.

(B) TRS' results for the quarter ended December 31, 1996 exclude a pretax

charge of $196 million ($125 million after-tax)

(C) Corporate and Other results for the quarter ended December 31, 1996 exclude

a pretax gain of $480 million ($300 million after-tax) on the exchange of

the Company's DECS (Debt Exchangeable for Common Stock) for shares of

common stock of First Data Corporation and a $20 million pretax charge ($13

million after-tax) related to the early retirement of debt and certain

restructuring costs.

Financial Summary (continued)

(Unaudited)

Quarter Ended

Dec 31, Sept 30, Jun 30, Mar 31, Dec 31,

1997 1997 1997 1997 1996

EARNINGS PER SHARE

Primary

Operating Income Per

Common Share $ 1.04 $ 1.10 $ 1.08 $ 0.94 $ 0.90

FDC Gain/

(Restructuring) 0.00 0.00 0.00 0.00 0.33

Net Income Per

Common Share $ 1.04 $ 1.10 $ 1.08 $ 0.94 $ 1.23

Average common shares

outstanding (000's) 475.0 477.2 479.5 482.1 482.1

Basic

Operating Income Per

Common Share $ 1.07 $ 1.13 $ 1.12 $ 0.97 $ 0.92

FDC Gain/

(Restructuring) 0.00 0.00 0.00 0.00 0.35

Net Income Per

Common Share $ 1.07 $ 1.13 $ 1.12 $ 0.97 $ 1.27

Average common shares

outstanding (000's) 460.7 463.0 465.1 467.9 469.2

Diluted

Operating Income Per

Common Share $ 1.04 $ 1.10 $ 1.08 $ 0.94 $ 0.89

FDC Gain/

(Restructuring) 0.00 0.00 0.00 0.00 0.34

Net Income Per

Common Share $ 1.04 $ 1.10 $ 1.08 $ 0.94 $ 1.23

Average common shares

outstanding (000's) 475.1 477.9 480.1 483.0 483.5

Cash dividends declared

per common share $ 0.225 $ 0.225 $ 0.225 $ 0.225 $ 0.225

Selected Statistical Information

(Unaudited)

Quarter Ended

Dec 31, Sept 30, Jun 30, Mar 31, Dec 31,

1997 1997 1997 1997 1996

Return on Average

Equity* 23.5% 23.3% 23.2% 23.0% 22.8%

Common Shares

Outstanding (millions) 466.4 465.8 468.9 470.9 472.9

Book Value per

Common Share:

Actual $ 20.53 $ 19.57 $ 18.82 $ 17.80 $ 18.04

Pro Forma * $ 19.29 $ 18.41 $ 17.95 $ 17.44 $ 17.22

Shareholers' Equity

(billions) $ 9.6 $ 9.1 $ 8.8 $ 8.4 $ 8.5

* Excludes the effect of SFAS No.115 and for ROE, also excludes a fourth quarter

1996 $300 million gain on the exchange of the Company's DECS and $138 million

restructuring charge.

(Preliminary) Travel Related Services

Statement of Income

(Unaudited)

(Dollars in millions)

Quarter Ended Year Ended

December 31, December 31,

1997 1996 1997 1996

Net Revenues:

Discount Revenue $ 1,530 $ 1,380 $ 5,666 $ 5,024

Net Card Fees 397 415 1,604 1,668

Travel Commissions & Fees 402 380 1,489 1,422

Interest and Dividends 136 156 561 724

Other Revenues 552 483 2,103 1,867

Lending:

Finance Charge Revenue 487 423 1,848 1,575

Interest Expense 153 134 604 507

Net Finance Charge Revenue 334 289 1,244 1,068

Total Net Revenues 3,351 3,103 12,667 11,773

Expenses:

Marketing & Promotion 315 268 1,062 998

Provision for Losses and Claims:

Charge Card 201 113 858 743

Lending 239 214 817 635

Other 22 22 88 101

Total 462 349 1,763 1,479

Interest Expense:

Charge Card 213 176 743 688

Other 41 65 177 347

Total 254 241 920 1,035

Net Discount Expense 139 174 597 554

Human Resources 826 794 3,154 2,984

Other Operating Expenses 887 874 3,266 3,004

Total Expenses 2,883 2,700 10,762 10,054

Pretax Income 468 403 1,905 1,719

Income Tax Provision 140 104 551 489

Operating Income $ 328 $ 299* $ 1,354 $ 1,230*

*Excludes restructuring charge of $125 million after-tax ($196 million pretax).

(Preliminary) Travel Related Services

Statement of Income

(Unaudited, Managed Asset Basis)

(Dollars in millions)

Quarter Ended Year Ended

December 31, December 31,

1997 1996 1997 1996

Net Revenues:

Discount Revenue $ 1,530 $ 1,380 $ 5,666 $ 5,024

Net Card Fees 398 415 1,609 1,664

Travel Commissions & Fees 402 380 1,489 1,422

Interest and Dividends 132 156 552 724

Other Revenues 499 450 1,903 1,714

Lending:

Finance Charge Revenue 574 463 2,105 1,691

Interest Expense 186 150 694 548

Net Finance Charge Revenue 388 313 1,411 1,143

Total Net Revenues 3,349 3,094 12,630 11,691

Expenses:

Marketing & Promotion 315 268 1,025 998

Provision for Losses and Claims:

Charge Card 255 199 1,105 989

Lending 269 235 937 678

Other 22 22 88 101

Total 546 456 2,130 1,768

Interest Expense:

Charge Card 266 234 973 871

Other 41 65 177 347

Total 307 299 1,150 1,218

Human Resources 826 794 3,154 2,984

Other Operating Expenses 887 874 3,266 3,004

Total Expenses 2,881 2,691 10,725 9,972

Pretax Income 468 403 1,905 1,719

Income Tax Provision 140 104 551 489

Operating Income $ 328 $ 299* $ 1,354 $ 1,230*

*Excludes restructuring charge of $125 million after-tax ($196 million pretax)

This Statement of Income is provided on a Managed Asset Basis for analytical

purposes only. It presents the income statement of TRS as if there has been no

securitization transactions.

Under Statement of Financial Accounting Standards No.125 (SFAS 125), which

prescribes the accounting for securitized loans and receivables, TRS recognized

a pretax gain of $37 million in the third quarter of 1997 ($24 million

after-tax) related to securitization of U.S. lending receiveables. This gain

was invested in additional Marketing and Promotion expenses and had no material

impact on net income or total expenses in 1997. For purposes of this

presentation such gain and a corresponding $37 million increase in Marketing and

Promotion expenses have been eliminated in the Year Ended December 31, 1997.

(Preliminary) Travel Related Services

Selected Statistical Information

(Unaudited)

(Amounts in billions, except percentages and where indicated)

Quarter Ended Year Ended

December 31, December 31,

1997 1996 1997 1996

Total Cards in Force

(millions):

United States 29.6 29.2 29.6 29.2

Outside the United States 13.1 12.3 13.1 12.3

Total 42.7 41.5 42.7 41.5

Basic Cards in Force

(millions):

United States 23.3 22.5 23.3 22.5

Outside the United States 10.0 9.6 10.0 9.6

Total 33.3 32.1 33.3 32.1

Card Billed Business:

United States $ 40.7 $ 36.2 $ 150.5 $ 131.0

Outside the United States 16.0 14.9 58.7 53.3

Total $ 56.7 $ 51.1 $ 209.2 $ 184.3

Average Discount Rate* 2.73% 2.72% 2.73% 2.75%

Average Basic Cardmember

Spending (dollars)* $ 1,731 $ 1,633 $ 6,473 $ 6,074

Average Fee per Card

(dollars)* $ 38 $ 41 $ 39 $ 42

Travel Sales $ 4.8 $ 4.3 $ 17.4 $ 15.8

Travel Commissions and

Fees/Sales** 8.4% 8.8% 8.6% 9.0%

Travelers Cheque:

Sales $ 5.2 $ 5.5 $ 25.0 $ 26.0

Ending Outstanding $ 5.6 $ 5.8 $ 5.6 $ 5.8

Average Outstanding $ 5.7 $ 6.0 $ 5.9 $ 6.0

Ending Investments $ 5.6 $ 5.6 $ 5.6 $ 5.6

Tax Equivalent Yield 9.2% 9.5% 9.2% 9.4%

Total Debt $ 26.9 $ 23.4 $ 26.9 $ 23.4

Shareholder's Equity $ 5.0 $ 4.7 $ 5.0 $ 4.7

Return on Average Equity*** 27.9% 25.6% 27.9% 25.6%

Return on Average Assets*** 3.0% 2.8% 3.0% 2.8%

* Computed excluding Cards issued by strategic alliance partners and

independent operators as well as business billed on those Cards.

** Computed from information provided herein.

*** Excluding the effect of SFAS No.115 and the fourth quarter 1996

restructuring charge of $125 million after-tax.

(Preliminary) Travel Related Services

Selected Statistical Information (continued)

(Unaudited)

(Amounts in billions, except percentages and where indicated)

Quarter Ended Year Ended

December 31, December 31,

1997 1996 1997 1996

Owned and Managed

Charge Card

Receivables:

Total Receivables $ 23.5 $ 22.5 $ 23.5 $ 22.5

90 Days Past Due as a

% of Total 3.1% 3.2% 3.1% 3.2%

Loss Reserves (millions) $ 951 $ 923 $ 951 $ 923

% of Receivables 4.0% 4.1% 4.0% 4.1%

% of 90 Days Past Due 132% 128% 132% 128%

Net Loss Ratio 0.49% 0.51% 0.50% 0.51%

Owned and Managed U.S.

Cardmember

Lending:

Total Loans $ 14.6 $ 12.7 $ 14.6 $ 12.7

Past Due Loans as a

% of Total:

30-89 Days 2.4% 2.4% 2.4% 2.4%

90+ Days 1.1% 0.9% 1.1% 0.9%

Loss Reserves (millions):

Beginning Balance $ 556 $ 427 $ 488 $ 443

Provision 247 220 867 607

Net Charge-Offs/Other (214) (159) (766) (562)

Ending Balance $ 589 $ 488 $ 589 $ 488

% of Loans 4.0% 3.8% 4.0% 3.8%

% of Past Due 116% 117% 116% 117%

Average Loans $ 13.9 $ 12.1 $ 13.3 $ 10.8

Net Write-Off Rate 6.3% 5.2% 6.0% 5.2%

Net Interest Yield 9.4% 8.6% 9.1% 8.8%

Statement of Income

(Unaudited)

(Dollars in million)

Quarter Ended

Dec 31, Sept 30, June 30, March 31, Dec 31,

1997 1997 1997 1997 1996

Net Revenues:

Discount Revenue $ 1,530 $ 1,422 $ 1,407 $ 1,306 $ 1,380

Net Card Fees 397 399 403 405 415

Travel Commissions

and Fees 402 370 381 336 380

Interest and Dividends 136 150 143 132 156

Other Revenues 552 540 509 503 483

Lending:

Finance Charge Revenue 487 472 458 431 423

Interest Expense 153 154 154 143 134

Net Finance Charge

Revenue 334 318 304 288 289

Total Net Revenues 3,351 3,199 3,147 2,970 3,103

Expenses:

Marketing and

Promotion 315 301 244 202 268

Provision for Losses

and Claims:

Charge Card 201 228 239 190 113

Lending 239 179 187 211 214

Other 22 22 21 24 22

Total 462 429 447 425 349

Interest Expense:

Charge Card 213 186 174 169 176

Other 41 50 52 35 65

Total 254 236 226 204 241

Net Discount Expense 139 142 165 151 174

Human Resources 826 796 783 749 794

Other Operating Expenses 887 801 789 790 874

Total Expenses 2,883 2,705 2,654 2,521 2,700

Pretax Income 468 494 493 449 403

Income Tax Provision 140 138 138 134 104

Operating Income $ 328 $ 356 $ 355 $ 315 $ 299*

*Excludes restructuring charge of $125 million after-tax ($196 million pretax).

(Preliminary) Travel Related Services

Statement of Income

(Unaudited, Managed Asset Basis)

(Dollars in millions)

Quarter Ended

Dec 31, Sept 30, Jun 30, Mar 31, Dec 31,

1997 1997 1997 1997 1996

Net Revenues:

Discount Revenues $ 1,530 $ 1,422 $ 1,407 $ 1,306 $ 1,380

Net Card Fees 398 403 404 405 415

Travel Commissions and Fees 402 370 381 336 380

Interest and Dividends 132 145 143 132 156

Other Revenues 499 485 466 453 450

Lending:

Finance Charge Revenue 574 548 505 478 463

Interest Expense 186 177 171 160 150

Net Finance Charge Revenue 388 371 334 318 313

Total Net Revenues 3,349 3,196 3,135 2,950 3,094

Expenses:

Marketing and Promotion 315 264 244 202 268

Provision for Losses and Claims:

Charge Card 255 284 313 252 199

Lending 269 243 203 222 235

Other 22 22 21 24 22

Total 546 549 537 498 456

Interest Expense:

Charge Card 266 242 237 227 234

Other 41 50 52 35 65

Total 307 292 289 262 299

Human Resources 826 796 783 749 794

Other Operating Expenses 887 801 789 790 874

Total Expenses 2,881 2,702 2,642 2,501 2,691

Pretax Income 468 494 493 449 403

Income Tax Provision 140 138 138 134 104

Operating Income # 328 $ 356 $ 355 $ 315 $ 299*

* Excludes restructuring charge of $125 million after-tax ($196 million pretax).

This Statement of Income is provided on a Managed Asset Basis for analytical

purposes only. It presents the income statement of TRS as if there has been no

securitization transactions.

Under Statement of Financial Accounting Standards No. 125 (SFAS 125), which

prescribes the accounting for securitized loans and receivables, TRS recognized

a pretax gain of $37 million in the third quarter of 1997 ($24 million

after-tax) related to securitization of U.S. lending receivables. This gain was

invested in additional Marketing and Promotion expenses and had no material

impact on net income or total expenses in the third quarter of 1997. For

purposes of this presentation such gain and a corresponding $37 million increase

in Marketing and Promotion expenses have been eliminated in the third quarter of

1997.

(Preliminary) Travel Related Services

Selected Statistical Information

(Unaudited)

(Amounts in billions, except percentages and where indicated)

Quarter Ended

Dec 31, Sept 30, June 30, March 31, Dec 31,

1997 1997 1997 1997 1996

Total Cards in Force (millions):

United States 29.6 29.6 29.7 29.6 29.2

Outside the United States 13.1 12.8 12.6 12.3 12.3

Total 42.7 42.4 42.3 41.9 41.5

Basic Cards in Force (millions):

United States 23.3 23.2 23.2 22.9 22.5

Outside the United States 10.0 9.8 9.7 9.6 9.6

Total 33.3 33.0 32.9 32.5 32.1

Card Billed Business:

United States $ 40.7 $ 38.0 $ 37.2 $ 34.6 $ 36.2

Outside the United States 16.0 14.7 14.7 13.3 14.9

Total $ 56.7 $ 52.7 $ 51.9 $ 47.9 $ 51.1

Average Discount Rate* 2.73% 2.72% 2.74% 2.75% 2.72%

Average Basic Cardmember

Spending (dollars)* $ 1,731 $ 1,616 $ 1,602 $ 1,498 $ 1,633

Average Fee per Card (dollars)* 38 38 39 39 41

Travel Sales 4.8 4.2 4.5 3.9 4.3

Travel Commissions and

Fees/Sales** 8.4% 8.8% 8.5% 8.6% 8.8%

Travelers Cheque:

Sales $ 5.2 $ 8.1 $ 6.6 $ 5.1 $ 5.5

Ending Outstanding $ 5.6 $ 6.1 $ 6.5 $ 5.8 $ 5.8

Average Outstanding $ 5.7 $ 6.4 $ 6.0 $ 5.8 $ 6.0

Ending Investments $ 5.6 $ 5.7 $ 6.0 $ 5.6 $ 5.6

Tax Equivalent Yield 9.2% 9.0% 9.3% 9.3% 9.5%

Total Debt $ 26.9 $ 25.2 $ 24.0 $ 22.1 $ 23.4

Shareholder's Equity $ 5.0 $ 5.3 $ 5.0 $ 4.8 $ 4.7

Return on Average Equity*** 27.9% 27.4% 27.0% 26.3% 25.6%

Return on Average Assets*** 3.0% 3.0% 3.0% 2.9% 2.8%

* Computed excluding Cards issued by strategic alliance partners and

independent operators as well as business billed on those Cards.

** Computed from information provided herein.

*** Excluding the effect of SFAS No. 115 and the fourth quarter 1996

restructuring charge of $125 million after-tax.

(Preliminary) Travel Related Services

Selected Statistical Information (continued)

(Unaudited)

(Amounts in billions, except percentages and where indicated)

Quarter Ended

Dec 31, Sept 30, Jun 30, Mar 31, Dec 31,

1997 1997 1997 1997 1996

Owned and Managed Charge Card

Receivables:

Total Receivables $ 23.5 $ 22.5 $ 22.2 $ 21.2 $ 22.5

90 Days Past Due as a

% of Total 3.1% 3.2% 3.3% 3.5% 3.2%

Loss Reserves (millions) $ 951 $ 970 $ 976 $ 921 $ 923

% of Receivables 4.0% 4.3% 4.4% 4.3% 4.1%

% of 90 Days Past Due 132% 133% 134% 124% 128%

Net Loss Ratio 0.49% 0.52% 0.50% 0.50% 0.51%

Owned and Managed U.S. Cardmember

Lending:

Total Loans $ 14.6 $ 13.5 $ 13.2 $ 12.9 $ 12.7

Past Due Loans as a % of Total:

30-89 Days 2.4% 2.5% 2.5% 2.6% 2.4%

90+ Days 1.1% 1.1% 1.1% 1.0% 0.9%

Loss Reserves (millions):

Beginning Balance $ 556 $ 534 $ 533 $ 488 $ 427

Provision 247 220 198 201 220

Net Charge-Offs/Other (214) (198) (197) (156) (159)

Ending Balance $ 589 $ 556 $ 534 $ 533 $ 488

% of Loans 4.0% 4.1% 4.1% 4.1% 3.8%

% of Past Due 116% 115% 113% 115% 117%

Average Loans $ 13.9 $ 13.4 $ 13.2 $ 12.8 $ 12.1

Net Write-Off Rate 6.3% 6.5% 6.0% 5.1% 5.2%

Net Interest Yield 9.4% 9.4% 8.7% 8.7% 8.6%

American Express Financial Advisors

Statement of Income

(Unaudited)

(Dollars in million)

Quarter Ended Year Ended

December 31, December 31,

1997 1996 1997 1996

Revenues:

Investment Income $ 595 $ 576 $ 2,339 $ 2,267

Management and

Distribution Fees 404 327 1,486 1,205

Other Revenues 203 166 774 638

Total Revenues 1,202 1,069 4,599 4,110

Expenses:

Provision for Losses

and Benefits:

Annuities 298 309 1,214 1,208

Insurance 121 108 452 420

Investment Certificates 53 51 200 197

Total 472 468 1,866 1,825

Human Resources 321 277 1,229 1,034

Other Operating Expenses 150 96 482 366

Total Expenses 943 841 3,577 3,225

Pretax Income 259 228 1,022 885

Income Tax Provision 76 73 315 291

Net Income $ 183 $ 155 $ 707 $ 594

Selected Statitical Information

(Unaudited)

(Dollars in millions, except where indicated)

Quarter Ended Year Ended

December 31, December 31,

1997 1996 1997 1996

Revenues, Net of

Provisions $ 731 $ 601 $ 2,732 $ 2,285

Investments

(billions) $ 30.7 $ 28.6 $ 30.7 $ 28.6

Client Contract

Reserves (billions) $ 30.2 $ 28.9 $ 30.2 $ 28.9

Shareholder's Equity

(billions) $ 3.7 $ 3.2 $ 3.7 $ 3.2

Return on Average

Equity* 21.8% 20.4% 21.8% 20.4%

Life Insurance in

Force (billions) $ 74.5 $ 67.3 $ 74.5 $ 67.3

Assets Owned and/or

Managed (billions):

Assets managed for

institutions $ 40.8 $ 37.3 $ 40.8 $ 37.3

Assets owned and

managed for

individuals:

Owned Assets:

Separate Account

Assets 23.2 18.5 23.2 18.5

Other Owned Assets 36.6 34.2 36.6 34.2

Total Owned Assets 59.8 52.7 59.8 52.7

Managed Assets 72.8 59.4 72.8 59.4

Total $ 173.4 $ 149.4 $ 173.4 $ 149.4

Market Appreciation

(Depreciation) During

the Period:

Owned Assets:

Separate Account

Assets $ (389) $ 735 $ 3,170 $ 1,937

Other Owned Assets $ 46 $ 126 $ 262 $ (232)

Total Managed Assets $ (415) $ 3,264 $11,735 $ 9,063

Sales of Selected

Products:

Mutual Funds $ 4,563 $ 3,686 $17,179 $ 14,331

Annunities $ 795 $ 1,085 $ 3,473 $ 4,311

Investment

Certificates $ 423 $ 233 $ 1,194 $ 736

Life and Other

Insurance Products $ 115 $ 131 $ 421 $ 449

Number of Financial

Advisors 8,776 8,340 8,776 8,340

Fees From Financial

Plans (thousands) $ 16,708 $ 13,205 $60,809 $ 48,072

Product Sales Generated

from Financial Plans as

a Percentage of Total

Sales 65.3% 64.9% 65.7% 64.0%

* Excluding the effect of SFAS No. 115.

Statement of Income

(Unaudited)

(Dollars in millions)

Quarter Ended

Dec 31, Sept 30, June 30, March 31, Dec 31,

1997 1997 1997 1997 1996

Revenues:

Investment Income $ 595 $ 587 $ 586 $ 570 $ 576

Management and

Distribution Fees 404 391 360 331 327

Other Revenues 203 191 197 183 166

Total Revenues 1,202 1,169 1,143 1,084 1,069

Expenses:

Provision for Losses

and Benefits:

Annuities 298 307 304 305 309

Insurance 121 114 113 104 108

Investment Certificates 53 48 58 42 51

Total 472 469 475 451 468

Human Resources 321 313 294 300 277

Other Operating Expenses 150 126 109 97 96

Total Expenses 943 908 878 848 841

Pretax Income 259 261 265 236 228

Income Tax Provision 76 77 82 79 73

Net Income $ 183 $ 184 $ 183 $ 157 $ 155

Selected Statistical Information

(Unaudited)

(Dollars in millions, except where indicated)

Quarter Ended

Dec 31, Sept 30, June 30, March 31, Dec 31,

1997 1997 1997 1997 1997

Revenues, Net of

Provisions $ 731 $ 701 $ 668 $ 633 $ 601

Investments

(billions) $ 30.7 $ 29.9 $ 29.3 $ 28.9 $ 28.6

Client Contract

Reserves (billions) $ 30.2 $ 29.8 $ 29.4 $ 29.1 $ 28.9

Shareholder's Equity

(billions) $ 3.7 $ 3.26 $ 3.4 $ 3.1 $ 3.2

Return on Average

Equity* 21.8% 21.6% 21.2% 20.8% 20.4%

Life Insurance in

Force (billions) $ 74.5 $ 72.8 $ 71.0 $ 69.2 $ 67.3

Assets Owned and/or

Managed (billions):

Assets managed for

institutions $ 40.8 $ 41.0 $ 39.3 $ 36.4 $ 37.3

Assets owned and

managed for

individuals:

Owned Assets:

Separate Account

Assets 23.2 23.2 21.1 18.4 18.5

Other Owned Assets 36.6 36.0 35.2 34.9 34.2

Total Owned Assets 59.8 59.2 56.3 53.3 52.7

Managed Assets 72.8 71.5 66.7 60.0 59.4

Total $ 173.4 $ 171.7 $ 162.3 $ 149.7 $ 149.4

Market Appreciation

(Depreciation) During

the Period:

Owned Assets:

Separate Account

Assets $ (389) $ 1,843 $ 2,260 $ (544) $ 735

Other Owned Assets $ 46 $ 195 $ 265 $ (244) $ 126

Total Managed Assets $ (415) $ 5,368 $ 8,406 $(1,624) $ 3,264

Sales of Selected

Products:

Mutual Funds $ 4,563 $ 4,496 $ 4,091 $ 4,029 $ 3,686

Annunities $ 795 $ 861 $ 947 $ 870 $ 1,085

Investment

Certificates $ 423 $ 295 $ 285 $ 190 $ 233

Life and Other

Insurance Products $ 115 $ 103 $ 100 $ 103 $ 131

Number of Financial

Advisors 8,776 8,592 8,476 8,426 8,340

Fees From Financial

Plans (thousands) $ 16,708 $15,538 $ 15,227 $ 13,336 $13,205

Product Sales Generated

from Financial Plans as

a Percentage of Total

Sales 65.3% 66.5% 66.3% 64.6% 64.9%

* Excluding the effect of SFAS No. 115.

(Preliminary) American Express Bank

Statement of Income

(Unaudited)

(Dollars in millions)

Quarter Ended Year Ended

December 31, December 31,

1997 1996 1997 1996

Net Revenues:

Interest Income $ 223 $ 223 $ 897 $ 842

Interest Expense 148 140 579 536

Net Interest Income 75 83 318 306

Commissions, Fees and Other Revenues 54 57 218 213

Foreign Exchange Income 38 16 101 72

Total Net Revenues 167 156 637 591

Provision for Credit Losses 10 10 20 23

Expenses:

Human Resources 64 56 242 224

Other Operating Expenses 63 64 245 239

Total Expenses 127 120 487 463

Pretax Income 30 26 130 105

Income Tax Provision 11 9 48 37

Net Income $ 19 $ 17 $ 82 $ 68

MORE TO FOLLOW

QRRWBUAGGBGRGGU

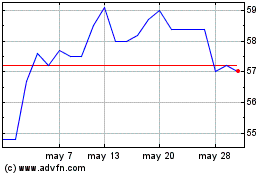

Accsys Technologies (LSE:AXS)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Accsys Technologies (LSE:AXS)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024