RNS No 0649v

AMERICAN EXPRESS COMPANY

26 July 1999

PART 2

American Express Company

Financial Summary

(Unaudited)

(Dollars in millions)

Quarter Ended Six Months Ended

June 30, Percentage June 30, Percentage

1999 1998 Inc/(Dec) 1999 1998 Inc/(Dec)

Net Revenues by

Segment (A)

Travel Related

Services $ 3,678 $ 3,270 12.5% $7,099 $ 6,353 11.7

American Express

Financial Advisors 916 807 13.6 1,802 1,541 16.9

American Express Bank/

Travelers Cheque 259 251 3.0 506 508 (0.6)

------- ------- ------ -------

4,853 4,328 12.1 9,407 8,402 12.0

Corporate and Other,

including adjustments

and eliminations (33) (42) 21.9 (75) (82) 8.5

CONSOLIDATED NET

REVENUES (A) $ 4,820 $ 4,286 12.5 $9,332 $ 8,320 12.2

Pretax Income by Segment

Travel Related Services $ 628 $ 546 15.0 $1,182 $ 1,028 15.0

American Express

Financial Advisors 353 309 14.2 665 580 14.5

American Express Bank/

Travelers Cheque 6 23 (73.9) 18 (151) -

987 878 12.4 1,865 1,457 28.0

Corporate and Other (92) (78) (17.1) (178) (44) *

PRETAX INCOME $ 895 $ 800 11.9 $ 1,687 $1,413 19.4

Net Income by Segment

Travel Related Services $ 411 $ 360 14.0 $ 774 $ 676 14.5

American Express

Financial Advisors 242 212 14.2 456 398 14.5

American Express Bank/

Travelers Cheque 38 47 (18.1) 79 (36) -

---- ---- ------ ----- ------

691 619 11.7 1,309 1,038 26.1

Corporate and Other (45) (41) (9.4) (88) (1) *

NET INCOME $ 646 $ 578 11.8 $ 1,221 $ 1,037 17.7

* Denotes variance of more than 100%.

(A) Net revenues are reported net of interest expense, where applicable,

and American Express Financial Advisors' provision for losses and benefits.

American Express Company

Financial Summary (continued)

(Unaudited)

Quarter Ended Six Months Ended

June 30, Percentage June 30, Percentage

1999 1998 (Inc/(Dec) 1999 1998 Inc/(Dec)

EARNINGS PER SHARE

Basic

Earnings Per Common

Share $ 1.44 $ 1.27 13.4% $ 2.73 $ 2.26 20.8%

Average common shares

outstanding (millions) 447.4 456.3 (2.0) 447.5 458.4 (2.4)

Diluted

Earnings Per Common

Share $ 1.41 $ 1.24 13.7 $ 2.67 $ 2.22 20.3

Average common shares

outstanding (millions) 457. 1 465.3 (1.8) 456.5 467.4 (2.3)

Cash dividends declared

per common share $ 0.225 $0.225 - $ 0.45 $ 0.45 -

Selected Statistical Information

(Unaudited)

Quarter Ended Six Months Ended

June 30, Percentage June 30, Percentage

1999 1998 Inc/(Dec) 1999 1998 Inc/(Dec)

Return on Average

Equity* 25.3% 23.5% - 25.3% 23.5% -

Common Shares

Outstanding (millions) 449.0 456.8 (1.7)% 449.0 456.8 (1.7)%

Book Value per Common Share:

Actual $ 21.74 $ 20.35 6.8% $21.74 $ 20.35 6.8%

Pro Forma* $ 21.77 $ 19.11 13.9% $21.77 $ 19.11 13.9%

Shareholders' Equity

(billions) $ 9.8 $ 9.3 5.0% $ 9.8 $ 9.3 5.0%

* Excludes the effect of SFAS No. 115.

American Express Company

Financial Summary

(Unaudited)

(Dollars in millions)

Quarter Ended

June 30, March 31, December 31, September 30, June 30,

1999 1999 1998 1998 1998

Net Revenues by

Segment (A)

Travel related

Services $ 3,678 $ 3,421 $ 3,545 $ 3,339 $ 3,270

American Express

Financial Advisors 916 885 837 802 807

American Express

Bank/Travelers Cheque 259 247 239 255 251

--------- -------- -------- -------- -------

4,853 4,553 4,621 4,396 4,328

Corporate and Other,

including adjustments

and eliminations (33) (42) (67) (54) (42)

CONSOLIDATED NET

REVENUES (A) $ 4,820 $ 4,511 $ 4,554 $ 4,342 $ 4,286

Pretax Income by Segment

Travel Related

Services $ 628 $ 554 $ 483 $ 554 $ 546

American Express

Financial Advisors 353 312 304 308 309

American Express

Bank/Travelers Cheque 6 12 2 20 23

-------- -------- -------- ------- -------

987 878 789 882 878

Corporate and Other (92) (87) (76) (83) (78)

PRETAX INCOME $ 895 $ 791 $ 713 $ 799 $ 800

Net Income by Segment

Travel Related

Services $ 411 $ 363 $ 326 $ 362 $ 360

American Express

Financial Advisors 242 214 209 211 212

American Express

Bank/Travelers Cheque 38 41 36 43 47

-------- -------- --------- ------- -------

691 618 571 616 619

Corporate and Other (45) (43) (41) (42) (41)

NET INCOME $ 646 $ 575 $ 530 $ 574 $ 578

(A) Net revenues are reported net of interest expense, where applicable, and

American Express Financial Advisors' provision for losses and benefits.

American Express Company

Financial Summary

(Unaudited)

Quarter Ended

June 30, March 31, December 31, September 30, June 30,

1999 1999 1998 1998 1998

EARNINGS PER SHARE

Basic

Earnings Per Common

Share $ 1.44 $ 1.28 $ 1.18 $ 1.27 $ 1.27

Average common shares

outstanding (millions) 447.4 447.7 448.7 451.6 456.3

Diluted

Earnings Per Common

Share $ 1.41 $ 1.26 $ 1.16 $ 1.25 $ 1.24

Average common shares

outstanding (millions) 457.1 456.2 456.0 459.6 465.3

Cash dividends declared

per common share $ 0.225 $ 0.225 $ 0.225 $ 0.225 $ 0.225

Selected Statistical Information

(Unaudited)

Quarter Ended

June 30, March 31, December 31, September 30, June 30,

1999 1999 1998 1998 1998

Return on Average

Equity* 25.3% 25.1% 24.0% 23.9% 23.5%

Common Shares

Outstanding (millions) 449.0 450.0 450.5 452.3 456.8

Book Value per Common

Share:

Actual $ 21.74 $ 21.74 $ 21.53 $ 20.79 $ 20.35

Pro Forma* $ 21.77 $ 20.92 $ 20.24 $ 19.28 $ 19.11

Shareholders' Equity

(billions) $ 9.8 $ 9.8 $ 9.7 $ 9.4 $ 9.3

* Excludes the effect of SFAS No. 115.

(Preliminary) Travel Related Services

Statement of Income

(Unaudited)

(Dollars in millions)

Quarter Ended

June 30, Percentage

1999 1998 Inc/(Dec)

Net Revenues:

Discount Revenue $ 1,662 $ 1,525 9.0 %

Net Card Fees 393 398 (1.4)

Travel Commissions and Fees 469 403 16.2

Other Revenues 845 614 37.8

Lending:

Finance Charge Revenue 465 493 (5.6)

Interest Expense 156 163 (4.3)

Net Finance Charge Revenue 309 330 (6.3)

Total Net Revenues 3,678 3,270 12.5

Expenses:

Marketing and Promotion 325 275 18.4

Provision for Losses and Claims:

Charge Card 249 236 5.2

Leading 137 187 (26.6)

Other 14 11 17.4

Total 400 434 (8.1)

Charge Card Interest Expense 198 203 (2.3)

Net Discount Expense 131 170 (23.1)

Human Resources 968 843 14.9

Other Operating Expenses 1,028 799 28.7

Total Expenses 3,050 2,724 12.0

Pretax Income 628 546 15.0

Income Tax Provision 217 186 16.8

Net Income $ 411 $ 360 14.0

(Preliminary) Travel Related Services

Statement of Income

(Unaudited, Managed Asset Basis)

(Dollars in million)

Quarter Ended

June 30, Percentage

1999 1998 Inc/(Dec)

Net Revenues:

Discount Revenue $ 1,662 $ 1,525 9.0 %

Net Card Fees 393 393 -

Travel Commissions and Fees 469 403 16.2

Other Revenues 669 536 25.0

Lending:

Finance Charge Revenue 684 595 14.9

Interest Expense 208 197 5.5

Net Finance Charge Revenue 476 398 19.5

Total Net Revenues 3,669 3,255 12.7

Expenses:

Marketing and Promotion 267 239 11.9

Provision for Losses and Claims:

Charge Card 288 307 (6.0)

Lending 260 251 3.6

Other 14 11 17.4

Total 562 569 (1.3)

Charge Card Interest Expense 257 259 (1.3)

Human Resources 968 843 14.9

Other Operating Expenses 987 799 23.6

Total Expenses 3,041 2,709 12.3

Pretax Income 628 546 15.0

Income Tax Provision 217 186 16.8

Net Income $ 411 $ 360 14.0

This Statement of Income is provided on a Managed Asset Oasis for analytical

purposes only. It presents the income statement of TRS as if there had been no

securitization transactions. Under Statement of Financial Accounting Standards

No. 125 (SFAS No. 125), which prescribes the accounting for securitized

receivables, TRS recognized pretax gains of $99 million ($64 million after-tax)

and $36 million ($23 million after-tax) in the second quarter of 1999 and

1998, respectively, related to the securitization of U.S. receivables. These

gains were invested in additional Marketing and Promotion expenses in both

years and other business building initiatives in 1999 and had no material

impact on Net Income or Total Expenses in either quarter. For purposes of this

presentation such gains and corresponding increases in Marketing and Promotion

and Other Operating Expenses have been eliminated in each quarter.

(Preliminary) Travel Related Services

Selected Statistical Information

(Unaudited)

(Amounts in billions, except percentages and where indicated)

Quarter Ended

June 30, Percentage

1999 1998 Inc/(Dec)

Total Cards in Force (millions):-

United States 28.7 29.6 (3.0) %

Outside the United States 15.2 14.2 6.8

Total 43.9 43.8 0.2

Basic Cards in Force (millions):

United States 22.5 23.3 (3.6)

Outside the United States 11.7 11.0 6.1

Total 34.2 34.3 (0.4)

Card Billed Business:

United States $ 46.0 $ 41.4 11.0

Outside the United States 16.4 15.4 7.3

Total $ 62.4 $ 56.8 10.0

Average Discount Rate* 2.73 % 2.72 % -

Average Basic Cardmember

Spending (dollars)* $ 1,933 $ 1,717 12.6

Average Fee per Card (dollars)* $ 38 $ 38 -

Travel Sales $ 6.0 $ 4.9 22.3

Travel Commissions and Fees/Sales** 7.8 % 8.2 % -

Total Debt $ 30.6 $ 24.0 27.6

Shareholder's Equity $ 5.3 $ 5.0 6.4

Return on Average Equity*** 28.8 % 26.5 % -

Return on Average Assets*** 3.3 % 3.2 % -

* Computed excluding Cards Issued by strategic alliance partners and

independent operators as well as business billed on those Cards.

** Computed from information provided herein.

*** Excluding the effect of SFAS No. 115.

Travel Related Services

Selected Statistical Information (continued)

(Unaudited)

(Amounts in billions,except percentages and where indicated)

Quarter Ended

June 30, Percentage

1999 1998 Inc/(Dec)

Owned and Managed Charge Card

Receivables:

Total Receivables $ 24.6 $ 23.4 5.3 %

90 Days Past Due as a % of Total 2.6 % 3.1 % -

Loss Reserves (millions) $ 932 $ 1,015 (8.2)

% of Receivables 3.8 % 4.3 % -

% of 90 Days Past Due 148 % 142 % -

Net Loss Ratio 0.39 % 0.46 % -

Owned and Managed U.S. Cardmember

Lending:

Total Loans $ 18.3 $ 14.8 23.2

Past Due Loans as a % of Total:

30-89 Days 1.8 % 2.3 % -

90+ Days 0.9 % 1.1 % -

Loss Reserves (millions):

Beginning Balance $ 623 $ 591 5.5

Provision 209 219 (4.4)

Net Charge-Offs/Other (230) (233) (0.8)

Ending Balance $ 602 $ 577 4.3

% of Loans 3.3 % 3.9 % -

% of Past Due 124 % 115 % -

Average Loans $ 17.4 % $ 14.5 20.5

Net Write-Off Rate 5.3 % 6.6 % -

Net Interest Yield 9.3 % 9.5 % -

(Preliminary) Travel Related Services

Statement of Income

(Dollars in millions) (Unaudited)

Quarter Ended

June 30, March 31, December 31, September 30, June 30,

1999 1999 1998 1998 1998

Net Revenues

Discount Revenue $1,662 $1,514 $1,639 $1,522 $1,525

Net Card Fees 393 403 398 393 398

Travel Commissions

and Fees 469 426 452 441 403

Other Revenues 845 731 687 645 614

Lending:

Finance Charge Revenue 465 503 535 502 493

Interest Expense 156 156 166 164 163

Net Finance Charge

Revenue 309 347 369 338 330

Total Net Revenues 3,678 3,421 3,545 3,339 3,270

Expenses:

Marketing and

Promotion 325 270 301 310 275

Provision for Losses

and Claims:

Charge Card 249 182 100 148 236

Lending 137 235 293 224 187

Other 14 14 14 17 11

Total 400 431 407 389 434

Charge Card

Interest Expense 198 183 211 199 203

Net Discount Expense 131 143 185 170 170

Human Resources 968 912 990 924 843

Other Operating

Expenses 1,028 928 968 793 799

Total Expenses 3,050 2,867 3,062 2,785 2,724

Pretax Income 628 554 483 554 546

Income Tax Provision 217 191 157 192 186

Net Income $ 411 $ 363 $ 326 $ 362 $ 360

(Preliminary) Travel Related Services

Statement of Income

(Dollars in millions) (Unaudited, Managed Asset Basis)

Quarter Ended

June 30, March 31, December 31, September 30, June 30,

1999 1999 1998 1998 1998

Net Revenues:

Discount $1,662 $1,514 $1,639 $1,522 $1,525

Revenue

New Card Fees 393 403 398 395 393

Travel Commissions

and Fees 469 426 452 441 403

Other Revenues 669 639 617 562 536

Lending:

Finance Charge

Revenue 684 652 655 636 595

Interest Expense 208 200 211 209 197

Net Finance 476 452 444 427 398

Charge Revenue

Total Net 3,669 3,434 3,550 3,347 3,255

Revenues

Expenses:

Marketing and 267 270 301 310 239

Promotion

Provision for Losses

and Claims:

Charge Card 288 233 192 224 307

Lending 260 282 331 263 251

Other 14 14 14 17 11

Total 562 529 537 504 569

Charge Card Interest

Expense 257 241 271 262 259

Human Resources 968 912 990 924 843

Other Operating 987 928 968 793 799

Expenses

Total Expenses 3,041 2,880 3,067 2,793 2,709

Pretax Income 628 554 483 554 546

Income Tax 217 191 157 192 186

Provision

Net Income $411 $363 $326 $362 $360

This statement of Income is provided on a Managed Asset Basis for analytical

purposes only. It presents the income statement of TRS as if there had been no

securitization transactions. Under Statement of Financial Accounting Standards

No.125 (SFAS No.125), which prescribes the accounting for securitized

receivables, TRS recognized pretax gains of $99 million ($64 million after-tax)

and $36 million ($23 million after-tax) in the second quarter of 1999 and 1998,

respectively, related to the securitization of U.S receivables. These gains h

were invested in additional Marketing and Promotion expenses in both years and

other business building initiatives in 1999 and had no material impact on Net

Income or Total Expenses in either quarter. For purposes of this presentation

such gains and corresponding increases in Marketing and Promotion and Other

Operating Expenses have been eliminated in each quarter.

(Preliminary) Travel Related Services

Selected Statistical Information

(Amounts in billions, except (Unaudited)

percentages and where indicated)

Quarter Ended

June 30, March 31, December 31, September 30, June 30,

1999 1999 1998 1998 1998

Total Cards in

Force (millions):

United States 28.7 27.9 27.8 29.5 29.6

Outside the 15.2 15.0 14.9 14.6 14.2

United States

Total 43.9 42.9 42.7 44.1 43.8

Basic Cards in

Force (millions):

United States 22.5 21.8 21.7 23.3 23.3

Outside the 11.7 11.5 11.5 11.3 11.0

United States

Total 34.2 33.3 33.2 34.6 34.3

Card Billed

Business:

United States $46.0 $41.6 $44.2 $41.5 $41.4

Outside the 16.4 15.2 17.2 15.2 15.4

United States

Total 62.4 56.8 61.4 56.7 56.8

Average Discount

Rate* 2.73% 2.73% 2.72% 2.72% 2.72%

Average Basic

Cardmember Spending

(dollars)* $ 1,933 $1,781 $1,861 $1,704 $1,717

Average Fee per $ 38 $ 40 $ 38 $ 37 $ 38

Card (dollars)*

Travel Sales $ 6.0 $ 5.3 $ 5.6 $ 5.1 $ 4.9

Travel Commissions

and Fees/Sales** 7.8% 8.0% 8.1% 8.6% 8.2%

Total Debt $ 30.6 $ 28.2 $28.0 $26.9 $24.0

Shareholder's Equity

Return on Average

Equity*** 28.8% 28.4% 27.8% 27.1% 26.5%

Return on Average

Assets*** 3.3% 3.3% 3.3% 3.3% 3.2%

* Computed excluding Cards issued by strategic alliance partners and

independent operators as well as business billed on those cards.

** Computed from information provided herein.

***Excluding the effect of SFAS No.115.

(Preliminary) Travel Related Services

Selected Statistical Information (continued)

(Unaudited)

(Amounts in billions, except percentages and where indicated)

Quarter Ended

June 30, March 31, December 31, September 30, June 30,

1999 1999 1998 1998 1998

Owned and Managed Charge Card

Receivables:

Total Receivables $ 24.6 $ 23.5 $ 24.0 $ 23.3 $ 23.4

90 Days Past Due as a

% of Total 2.6% 3.0% 2.7% 2.7% 3.1%

Loss Reserves (millions) $ 932 $ 876 $ 897 $ 961 $1,015

% of Receivables 3.8% 3.7% 3.7% 4.1% 4.3%

% of 90 Days Post Due 148% 126% 138% 151% 142%

Net Loss Ratio 0.39% 0.43% 0.42% 0.48% 0.46%

Owned and Managed U.S.

Cardmember Lending:

Total Loans $ 18.3 $ 16.7 $ 16.7 $ 15.4 $ 14.8

Past Due Loans as a %

of Total:

30-89 Days 1.8% 2.1% 2.2% 2.2% 2.3%

90+ Days 0.9% 1.0% 0.9% 1.0% 1.1%

Loss Reserves (millions):

Beginning Balance $ 623 $ 619 $ 579 $ 577 $ 591

Provision 209 244 285 236 219

Net Charge-Offs/Other (230) (240) (245) (234) (233)

Ending Balance $ 602 $ 623 $ 619 579 $ 577

% of Loans 3.3% 3.7% 3.7% 3.8% 3.9%

% of Past Due 124% 121% 120% 118% 115%

Average Loans $ 17.4 $ 16.7 $ 15.9 $ 15.2 $ 14.5

Net Write-Off Rate 5.3% 5.9% 6.2% 6.4% 6.6%

Net Interest Yield 9.3% 9.4% 9.5% 9.6% 9.5%

(Preliminary) American Express Financial Advisors

Statement of Income

(Unaudited)

(Dollars in millions)

Quarter Ended

June 30 Percentage

1999 1998 Inc/(Dec)

Net Revenues:

Investment Income $ 615 $ 603 1.9%

Management and

Distribution Fees 553 482 14.6

Other Revenues 226 197 15.3

Total Revenues 1,394 1,282 8.7

Provision for losses and

Benefits:

Annuities 273 292 (6.5)

Insurance 132 125 5.8

Investment Certificates 73 58 24.4

Total 478 475 0.5

Net Revenues 916 807 13.6

Expenses:

Human Resources 430 388 11.0

Other Operating Expenses 133 110 20.8

Total Expenses 563 498 13.2

Pretax Income 353 309 14.2

Income Tax Provision 111 97 14.3

Net Income 242 212 14.2

(Preliminary) American Express Financial Advisors

Selected Statistical Information,

(Unaudited)

(Dollars In millions, except where indicated)

Quarter Ended

June 30 Percentage

1999 1998 Inc/(Dec)

Investments (billions) $ 30.7 $ 31.0 (1.2) %

Client Contract Reserves (billions) $ 30.8 $ 30.2 2.0

Shareholder's Equity (billions) $ 4.0 $ 4.0 (0.3)

Return on Average Equity* 22.8% 22.3 % -

Life Insurance in Force (billions) $ 84.6 $ 77.8 8.7

Assets Owned, Managed or

Administered (billions):

Assets Managed for

Institutions $ 49.9 $ 44.0 13.3

Assets Owned, Managed or Administered

for Individuals:

Owned-Assets:

Separate Account Assets 30.1 26.6 13.1

Other Owned Assets 37.8 37.2 1.7

Total Owned Assets 67.9 63.8 6.5

Managed Assets 96.3 83.0 16.2

Administered Assets 18.3 11.2 62.5

Total $ 232.4 $ 202.0 15.1

Market Appreciation (Depreciation) During

the Period:

Owned Assets:

Separate Account Assets $ 1,520 $ 361 @

Other Owned Assets $ (395) $ 24 -

Total Managed Assets $ 5,063 $ 1,045 @

Sales of Selected Products:

Mutual Funds $ 6,207 $ 5,474 13.4

Annuities $ 750 $ 702 6.8

Investment Certificates $ 777 $ 383 @

Life and Other Insurance Products $ 110 $ 104 5.8

Number of Financial Advisors 10,489 9,869 6.3

Fees From

Financial Plans $ 22.8 $ 20.9 9.2

Product Sales Generated from

Financial Plans as a Percentage of

Total Sales 65.2% 64.7% -

* Excluding the effect of SFAS No. 115.

@ Denotes variance of more than 100%.

(Preliminary) American Express Financial Advisors

Statement of Income

(Unaudited)

(Dollars in millions) Quarter Ended

June 30, March 31,December 31, September30, June 30,

1999 1999 1998 1998 1998

Net Revenues:

Investment Income $ 615 $ 595 $ 647 $ 573 $ 603

Management and Distribution

Fees 553 522 476 476 482

Other Revenues 226 228 222 198 197

Total Revenues 1,394 1,345 1,345 1,247 1,282

Provision for Losses

and Benefits:

Annuities 273 270 282 280 292

Insurance 132 126 125 122 125

Investment Certificates 73 64 101 43 58

Total 478 460 508 445 475

Net Revenues 916 885 837 802 807

Expenses:

Human Resources 430 416 407 384 388

Other Operating Expenses 133 157 126 110 110

Total Expenses 563 573 533 494 498

Pretax Income 353 312 304 308 309

Income Tax Provision 111 98 95 97 97

Net Income $ 242 $ 214 $ 209 $ 211 $ 212

(Preliminary) American Express Financial Advisors

Selected Statistical Information

(unaudited)

(Dollars in millions, except where indicated)

Quarter Ended

June 30, March31, December 31,September 30, June 30,

1999 1999 1998 1998 1998

Investments (billions) $ 30.7 $ 30.6 $ 30.9 $ 30.8 $ 31.0

Client Contract

Reserves (billions) $ 30.8 $ 30.5 $ 30.3 $ 30.2 $ 30.2

Shareholder's Equity

(billions) $ 4.0 $ 4.1 $ 4.1 $ 4.1 $ 4.0

Return on Average

Equity* 22.8 % 22.6% 22.5% 22.4% 22.3%

Life Insurance in Force

(billions) $ 84.6 $ 82.9 $ 81.1 $ 79.2 $ 77.8

Assets Owned, Managed or

Administered (billions):

Assets Managed

for Institutions $ 49.9 $ 46.9 $ 45.9 $ 40.5 $ 44.0

Assets Owned, Managed

or Administered

for Individuals:

Owned Assets:

Separate Account Assets 30.1 28.2 27.3 23.0 26.6

Other Owned Assets 37.8 37.4 37.3 37.0 37.2

Total Owned Assets 67.9 65.6 64.6 60.0 63.8

Managed Assets 96.3 91.2 87.9 76.8 83.0

Administered Assets 18.3 15.7 14.0 11.2 11.2

Total $ 232.4 $ 219.4 $ 212.4 $ 188.5 $ 202.0

Market Appreciation

(Depreciation)

During the Period:

Owned Assets:

Separate Account

Assets $ 1,520 $ 912 $ 4,288 $ (3,712) $ 361

Other Owned Assets $ (395) $ (204) $ (243) $ 91 $ 24

Total Managed

Assets $ 5,063 $ 2,889 $ 14,493 $ (10,595) $ 1,045

Sales of Selected Products:

Mutual Funds $ 6,207 $ 6,033 $ 4,936 $ 5,262 $ 5,474

Annuities $ 750 $ 579 $ 557 $ 648 $ 702

Investment Certificates $ 777 $ 660 $ 575 $ 560 $ 383

Life and Other Insurance

Products $ 110 $ 92 $ 100 $ 102 $ 104

Number of

Financial Advisors 10,489 10,372 10,350 10,060 9,869

Fees From

Financial Plans $ 22.8 21.3 $ 18.4 $ 15.6 $ 20.9

Product Sales

Generated from Financial

Plans as a Percentage

of Total Sales 65.2% 66.5% 66.8% 65.4% 64.7%

* Excluding the effect of SFAS No. 115.

(Preliminary) American Express Bank/Travelers Cheque

Statement of Income

(Unaudited)

(Dollars in millions) Quarter Ended Percentage

June30, Inc(Dec)

1999 1998

Net Revenues:

Interest Income $ 183 $ 218 (16.1)%

Interest Expense 108 147 (26.2)

Net Interest Income 75 71 4.8

TC Investment Income 86 80 7.4

Foreign Exchange Income 14 35 (58.6)

Commissions,

Fees and Other Revenue 84 65 28.6

Total Net Revenues 259 251 3.0

Expenses:

Human Resources 85 79 6.6

Other Operating Expenses 150 136 10.3

Provision for Losses 18 13 38.7

Total Expenses 253 228 10.7

Pretax income 6 23 (73.9)

Income Tax Benefit (32) (24) 35.5

Net Income $ 38 $ 47 (18.1)

(Preliminary) American Express Bank/Travelers Cheque

Selected Statistical Information

(Unaudited)

(Dollars in billions, except where indicated)

Quarter Ended Percentage

June 30, Inc/(Dec)

1999 1998

Total Shareholder's

Equity (millions) $ 1,048 $ 1,135 (7.7)%

Return on Average

Common Equity* 18.5% 10.4% -

Return on Average Assets* 0.86% 0.50% -

American Express Bank:

Total Loans $ 5.2 $ 6.1 (14.9)

Total Nonperforming

Loans (millions) $ 210 $ 205 2.1

Other Nonperforming

Assets (millions) $ 55 $ 73 (24.5)

Reserve for Credit

Losses (millions)** $ 249 $ 350 (28.7)

Loan Loss Reserves as

a % of Total Loans 4.1% 4.3% -

Deposits $ 8.0 $ 8.1 (1.6)

Assets Managed /

Administered*** $ 7.0 $ 5.6 25.0

Assets of Non-Consolidated

Joint Ventures $ 2.2 $ 2.7 (20.3)

Risk-Based

Capital Ratios:

Tier 1 9.8% 9.2% -

Total 12.1% 12.2% -

Leverage Ratio 5.7% 5.6% -

Travelers Cheque:

Sales $ 6.1 $ 6.4 (5.7)

Average Outstanding $ 6.1 $ 6.0 1.2

Average Investments $ 5.7 $ 5.7 1.4

Tax equivalent yield 8.8% 9.0% -

* Excludes the effect of SFAS No. 115 for all periods presented.

** Allocation:

Loans $ 216 $ 265

Other Assets,

primarily derivatives 32 84

Other Liabilities 1 1

Total Credit Loss Reserves $ 249 $ 350

*** Includes assets managed by American Express Financial Advisors

(Preliminary) American Express Bank/Travelers Cheque

Statement of Income

(Unaudited)

(Dollars In millions) Quarter Ended

June 30, March31, December31, September 30, June 30,

1999 1999 1998 1998 1998

Net Revenues:

Interest Income $ 183 193 $ 210 $ 217 $ 218

Interest Expense 108 119 136 143 147

Net Interest Income 75 74 74 74 71

TC Investment Income 86 79 82 88 80

Foreign Exchange Income 14 18 32 30 35

Commissions, Fees

and Other Revenue 84 76 51 63 65

Total Net Revenues 259 247 239 255 251

Expenses:

Human Resources 85 82 86 83 79

Other Operating

Expenses 150 136 136 140 136

Provision for Losses 18 17 15 12 13

Total Expenses 253 235 237 235 228

Pretax Income 6 12 2 20 23

Income Tax Benefit (32) (29) (34) (23) (24)

Net Income $ 38 $ 41 $ 36 $ 43 $ 47

(Preliminary) American Express Bank/Travelers Cheque

Selected Statistical Information

(Unaudited)

(Dollars in billions. except where indicated)

Quarter Ended

June 30, March 31, December31, September 30, June30,

1999 1999 1998 1998 1998

Total Shareholder's

Equity (millions) $ 1,048 $ 1,148 $ 1,197 $ 1,210 $ 1,135

Return on Average

Common Equity* 18.5% 19.7% 4.9% 8.1 % 10.4%

Return on Average Assets* 86% 0.90% 0.23% 0.39% 0.50%

American Express Bank:

Total Loans $ 5.2 $ 5.3 $ 5.6 $ 6.1 $ 6.1

Total Non-performing

Loans (millions) $ 210 $ 209 $ 180 $ 239 $ 205

Other Non-performing

Assets (millions) $ 55 $ 64 $ 63 $ 92 $ 73

Reserve for Credit

Losses (millions)** $ 249 $ 261 $ 259 $ 348 $ 350

Loan Loss Reserves

as a % of Total Loans 4.1% 4.1% 3.8% 4.6% 4.3%

Deposits $ 8.0 $ 7.9 $ 8.3 $ 8.7 $ 8.1

Assets Managed/

Administered*** $ 7.0 $ 6.3 $ 6.2 $ 5.7 $ 5.6

Assets of Non-Consolidated

Joint Ventures $ 2.2 $ 2.6 $ 2.6 $ 2.4 $ 2.7

Risk-Based Capital Ratios:

Tier 1 9.8 % 9.8% 9.8% 9.4% 9.2%

Total 12.1 % 12.1 % 12.6% 12.2% 12.2%

Leverage Ratio 5.7% 5.4% 5.5% 5.6% 5.6%

Travelers Cheque:

Sales $ 6.1 $ 4.6 $ 5.0 7.8 $ 6.4

Average Outstanding $ 6.1 $ 5.8 $ 5.9 $ 6.4 $ 6.0

Average Investments $ 5.7 $ 5.6 $ 5.8 $ 6.1 $ 5.7

Tax equivalent yield 8.8% 8.9% 8.8 % 8.8% 9.0%

*Excludes the effect of SFAS No. 115 for all periods presented.

** Allocation

Loans $ 216 $ 218 $ 214 $ 279 $ 265

Other Assets,

primarily derivatives 32 41 43 66 84

Other Liabilities 1 2 2 3 1

Total Credit

Loss Reserves $ 249 $ 261 $ 259 $ 348 $ 350

*** Includes assets managed by American Express Financial Advisors.

American Express Bank

Exposures By Country and Region

(Unaudited)

($ in billions)

Net

Guarantees 6/30/99 3/31/99

FX and and Total Total

Country Loans Derivatives Contingents Other* Exposure** Exposure**

Hong Kong $ 0.6 - $ 0.2 $ 0.1 $ 0.9 $ 1.0

Indonesia 0.2 - - 0.2 0.4 0.4

Singapore 0.4 - 0.1 0.1 0.5 0.5

Korea 0.1 - 0.1 0.2 0.4 0.4

Taiwan 0.3 - 0.1 0.1 0.5 0.6

China - - - - - -

Japan - - - - 0.1 0.1

Thailand - - - - - -

Other - - - 0.1 0.2 0.1

Total Asia/Pacific

Region ** 1.8 $ 0.1 0.5 0.8 3.2 3.1

Chile 0.3 - - 0.1 0.4 0.4

Brazil 0.3 - - 0.1 0.3 0.4

Mexico 0.1 - - - 0.1 0.1

Peru 0.1 - - - 0.1 0.1

Argentina 0.1 - - - 0.1 0.1

Other 0.2 - 0.1 0.1 0.4 0.4

Total Latin

America ** 1.0 - 0.1 0.2 1.3 1.4

India 0.3 - 0.1 0.4 0.8 0.8

Pakistan 0.1 - - 0.1 0.2 0.2

Other 0.1 - 0.1 0.1 0.2 0.2

Total

Subcontinent** 0.5 - 0.2 0.5 1.2 1.2

Egypt 0.4 - - 0.2 0.7 0.6

Other 0.2 - 0.1 - 0.3 0.3

Total Middle East

& Africa ** 0.5 - 0.1 0.3 0.9 0.9

Total Europe *** 1.3 0.1 0.7 2.2 4.3 4.3

Total North

America ** 0.2 - 0.1 1.4 1.8 1.8

Total Worldwide** $ 5.2 $ 0.2 $ 1.8 $ 5.5 $ 12.8 $ 12.8

* Includes cash, placements and securities.

** Individual items may not add to totals due to rounding.

*** Total exposures at 6/30/99 and 3/31/99 includes $12 million and $20 million

of exposures to Russia, respectively.

Note: Includes cross-border and local exposure and does not net local funding

or liabilities against any local exposure.

END

QRSPBUGCMBGBGPM

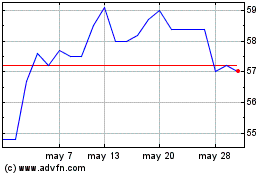

Accsys Technologies (LSE:AXS)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Accsys Technologies (LSE:AXS)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024