Bodycote PLC Acquisition Update and Share Buyback Programme (3710A)

22 Enero 2024 - 1:00AM

UK Regulatory

TIDMBOY

RNS Number : 3710A

Bodycote PLC

22 January 2024

www.bodycote.com

22 January 2024

Bodycote plc

Acquisition Update and Announcement of GBP60m Share Buyback

Programme

Completion of Lake City HT Acquisition

Further to the announcement on 9 October 2023, the acquisition

of Lake City HT successfully completed on 19 January 2024. The

consideration paid on closing for Lake City HT was $66.5m (GBP52m)

on a cash and debt free basis. After expected tax benefits worth

approximately $7.5m, the net economic price paid was $59.0m

(GBP46m), resulting in an acquisition multiple of less than 7.5x

2024 EBITDA.

Lake City HT, based in Warsaw, Indiana, is a leading hot

isostatic pressing (HIP) and vacuum heat treatment business

primarily supplying the orthopaedic implant market as well as Civil

Aerospace. It will significantly increase Bodycote's customer reach

in the Medical market.

Lake City HT is forecast to have achieved 2023 full year

revenues of around $14m (GBP11m), with operating profit expected to

be around $6m (GBP5m). The business achieved 30% revenue growth in

2023 and looking ahead is expected to continue to deliver good

progress. The acquisition will be accretive to Group profit margins

and EPS in 2024 and is expected to exceed Bodycote's cost of

capital by 2025.

Bodycote has agreed with Stack Metallurgical Group (SMG) not to

complete the acquisition of the business due to a failure to

satisfy all closing conditions to the agreement.

Announcement of GBP60m Share Buyback Programme

In light of the lower than anticipated acquisition spend, the

Group's strong balance sheet and balanced approach to capital

allocation, Bodycote is pleased to announce the intention to launch

a share buyback programme of up to GBP60m. The share buyback

programme is expected to commence on 18 March 2024. Full details of

the programme will be provided on 15 March 2024 at the time of the

announcement of Bodycote's full year 2023 results.

Stephen Harris, Group Chief Executive of Bodycote plc,

commented:

"Completion of the acquisition of Lake City HT is an exciting

further step in our strategy to grow our Specialist Technologies

businesses and footprint. This acquisition is an excellent fit,

enhances our profitability and earnings per share in addition to

allowing us to capitalise on the appealing structural growth

opportunities in Medical and Aerospace markets.

The share buyback programme represents an attractive use of our

capital. It highlights the strength of the Group's balance sheet,

together with our commitment to a balanced and disciplined approach

to capital allocation to drive growth and shareholder value."

About Lake City Heat Treating (Lake City HT)

Lake City HT, previously owned by the Davis family, operates out

of a single site in Warsaw, Indiana. The site provides HIP and

associated heat treatment services. The business predominantly

serves the medical orthopaedic implant market but also encompasses

aerospace related business.

About Bodycote

With more than 165 accredited facilities in 22 countries,

Bodycote is the world's largest provider of thermal processing

services. Through Specialist Technologies and classical heat

treatment, Bodycote improves the properties of metals and alloys,

extending the life of vital components for a wide range of

industries, including aerospace, defence, automotive, power

generation, medical, oil & gas, construction, and

transportation. Customers in all of these industries have entrusted

their products to Bodycote's care for more than 50 years. For more

information, visit www.bodycote.com .

This announcement contains forward-looking statements based on

current expectations and assumptions. Various known and unknown

risks, uncertainties and other factors may cause actual results to

differ from future results or developments expressed or implied

from the forward-looking statements. Each forward-looking statement

speaks only as of the date of this document. Bodycote plc accepts

no obligation to revise or update these forward-looking statements

publicly or adjust them to future events or developments, whether

as a result of new information, future events or otherwise, except

to the extent legally required.

For further information, please contact:

Bodycote plc

Stephen Harris, Group Chief Executive

Ben Fidler, Chief Financial Officer

Peter Lapthorn, Head of FP&A and Investor Relations

Tel: +44 1625 505300

FTI Consulting

Richard Mountain

Susanne Yule

Tel: +44 203 727 1340

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQPPUQCGUPCGCG

(END) Dow Jones Newswires

January 22, 2024 02:00 ET (07:00 GMT)

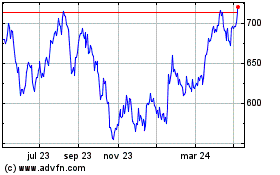

Bodycote (LSE:BOY)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

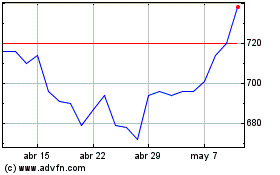

Bodycote (LSE:BOY)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025