BlackRock Sustainable American Income Trust Plc Portfolio Update

20 Diciembre 2023 - 11:34AM

UK Regulatory

TIDMBRSA

BLACKROCK SUSTAINABLE AMERICAN INCOME TRUST PLC (LEI:549300WWOCXSC241W468)

All information is at 30 November 2023 and unaudited.

Performance at month end with net income reinvested

One Three Six One Three Five Years

Month Months Months Year Years

Net asset value 3.6 1.7 5.5 -5.3 28.4 39.6

Share price 5.1 0.4 1.9 -8.3 26.0 26.8

Russell 1000 Value Index 3.1 -0.2 4.9 -4.7 33.8 44.8

At month end

Net asset value - capital only: 198.18p

Net asset value - cum income: 198.52p

Share price: 181.00p

Discount to cum income NAV: 8.8%

Net yield1: 4.4%

Total assets including current year revenue: £158.3m

Net gearing: 0.8%

Ordinary shares in issue2: 79,718,091

Ongoing charges3: 1.01%

1 Based on four quarterly dividends of 2.00p per share declared on 22 March

2023, 11 May 2023, 3 August 2023 and 2 November 2023 for the year ended 31

October 2023 and based on the share price as at close of business on 30 November

2023.

² Excluding 20,643,214 ordinary shares held in treasury.

³ The Company's ongoing charges calculated as a percentage of average daily net

assets and using the management fee and all other operating expenses excluding

finance costs, direct transaction costs, custody transaction charges, VAT

recovered, taxation and certain non-recurring items for the year ended 31

October 2022.

Sector Analysis Total Assets (%)

Financials 20.1

Health Care 18.7

Information Technology 13.5

Consumer Discretionary 10.3

Industrials 8.9

Energy 8.7

Consumer Staples 7.0

Communication Services 4.4

Materials 3.8

Utilities 3.7

Real Estate 1.7

Net Current Liabilities -0.8

-----

100.0

=====

Country Analysis Total Assets (%)

United States 87.5

United Kingdom 4.4

Japan 3.0

France 1.9

Canada 1.7

Australia 1.7

Denmark 0.6

Net Current Liabilities -0.8

-----

100.0

=====

Top 10 Holdings Country % Total Assets

Citigroup United States 2.9

Shell United Kingdom 2.9

Willis Towers Watson United States 2.8

American International United States 2.8

Verizon Communications United States 2.8

L3Harris Technologies United States 2.7

Kraft Heinz United States 2.7

Cardinal Health United States 2.6

Cheniere Energy United States 2.5

Cisco Systems United States 2.5

Tony DeSpirito, David Zhao and Lisa Yang, representing the Investment Manager,

noted:

For the one-month period ended 30 November 2023, the Company's NAV increased by

3.6% and the share price by 5.1% (all in sterling). The Company's reference

index, the Russell 1000 Value Index, returned +3.1% for the period.

The largest contributor to relative performance, stemmed from stock selection in

consumer staples, particularly in consumer staples distribution and retail.

Selection decisions in consumer discretionary also boosted relative performance,

with stock selection in textiles and apparel proving beneficial. Other modest

contributors during the period at the sector level included selection decisions

in health care and energy.

The largest detractor from relative performance stemmed from stock selection in

information technology; notably at the industry level the decision to not invest

in semiconductors and semiconductor equipment weighed on the relative

performance. An underweight allocation to industrials, with selection decisions

in machinery, proved costly. Other modest detractors during the period included

stock selection in utilities and communication services.

Transactions

During the month, the Company purchased Aptiv. The Company exited its position

in Lear Corp.

Positioning

As of the period end, the Company's largest overweight positions relative to the

reference index were in the health care, consumer discretionary and financials

sectors. The Company's largest underweight positions relative to the reference

index were in the industrials, real estate and utilities sectors.

Source: BlackRock.

20 December 2023

Latest information is available by typing

blackrock.com/uk/brsa (http://www.blackrock.co.uk/brna) on the internet,

"BLRKINDEX" on Reuters, "BLRK" on Bloomberg or "8800" on Topic 3 (ICV

terminal). Neither the contents of the Manager's website nor the contents of

any website accessible from hyperlinks on the Manager's website (or any other

website) is incorporated into, or forms part of, this announcement.

This information was brought to you by Cision http://news.cision.com

The following files are available for download:

https://mb.cision.com/Main/22399/3896959/2509024.pdf Release

END

(END) Dow Jones Newswires

December 20, 2023 12:34 ET (17:34 GMT)

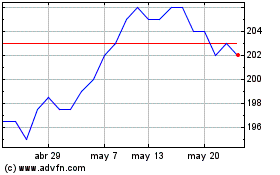

Blackrock Sustainable Am... (LSE:BRSA)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

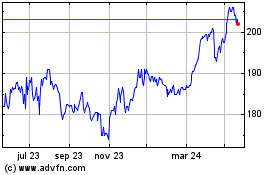

Blackrock Sustainable Am... (LSE:BRSA)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024