BlackRock World Mining Trust Plc Portfolio Update

14 Diciembre 2023 - 8:27AM

UK Regulatory

TIDMBRWM

BLACKROCK WORLD MINING TRUST PLC (LEI - LNFFPBEUZJBOSR6PW155)

All information is at 30 November 2023 and unaudited.

Performance at month end

with net income reinvested

One Three One Three Five

Month Months Year Years Years

Net asset value 3.2% -2.9% -12.7% 40.4% 97.2%

Share price 2.5% -5.0% -15.9% 42.7% 123.0%

MSCI ACWI Metals & Mining 4.4% 1.0% -5.4% 34.8% 72.6%

30% Buffer 10/40 Index

(Net)*

* (Total return)

Sources: BlackRock, MSCI

ACWI Metals & Mining 30%

Buffer 10/40 Index,

Datastream

At month end

Net asset value (including income)1: 574.09p

Net asset value (capital only): 559.35p

Share price: 548.00p

Discount to NAV2: 4.5%

Total assets: £1,248.4m

Net yield3: 7.3%

Net gearing: 13.5%

Ordinary shares in issue: 191,183,036

Ordinary shares held in Treasury: 1,828,806

Ongoing charges4: 0.95%

Ongoing charges5: 0.84%

1 Includes net revenue of 14.74p.

2 Discount to NAV including income.

3 Based on a final dividend of 23.50p per share declared on 2 March 2023 in

respect of year ended 31 December 2022, a first interim dividend of 5.50p per

share declared on 18 April, a second interim dividend of 5.50p per share

declared on 24 August and a third interim dividend of 5.50p per share declared

on 11 October 2023 with ex-date 23 November 2023 and pay date of 22 December

2023 in respect of the year ending 31 December 2023.

4 The Company's ongoing charges are calculated as a percentage of average daily

net assets and using the management fee and all other operating expenses,

excluding finance costs, direct transaction costs, custody transaction charges,

VAT recovered, taxation and certain other non-recurring items for the year ended

31 December 2022.

5 The Company's ongoing charges are calculated as a percentage of average daily

gross assets and using the management fee and all other operating expenses,

excluding finance costs, direct transaction costs, custody transaction charges,

VAT recovered, taxation and certain other non-recurring items for the year ended

31 December 2022.

Country Analysis Total

Assets (%)

Global 66.8

Latin America 7.8

Canada 7.6

Australasia 6.9

United States 6.9

Other Africa 2.8

Indonesia 0.8

South Africa 0.2

Net Current Assets 0.2

-----

100.0

=====

Sector Analysis Total

Assets (%)

Diversified 38.1

Copper 21.2

Gold 15.4

Steel 7.1

Industrial Minerals 5.7

Aluminium 3.0

Uranium 2.6

Iron Ore 2.5

Platinum Group Metals 1.7

Nickel 1.4

Mining Services 1.0

Zinc 0.1

Net Current Assets 0.2

-----

100.0

=====

Ten largest investments

Company Total Assets %

Vale:

Equity 6.8

Debenture 2.8

BHP:

Equity 7.6

Royalty 1.5

Glencore 8.1

Rio Tinto 7.0

Freeport-McMoRan 4.6

Newmont 3.5

Barrick Gold 3.2

Wheaton Precious Metals 3.1

Anglo American 2.8

Cameco Corp 2.6

Asset Analysis Total Assets (%)

Equity 97.1

Bonds 2.2

Convertible Bonds 0.6

Option -0.1

Net Current Assets 0.2

-----

100.0

=====

Commenting on the markets, Evy Hambro and Olivia Markham, representing the

Investment Manager noted:

Performance

The Company's NAV rose by 3.2% in November, underperforming its reference

index, the MSCI ACWI Metals and Mining 30% Buffer 10/40 Index (net return),

which rose by 4.4% (performance figures in GBP).

November was a strong month for broader equity markets, with the MSCI ACWI TR

Index rising by 3.8% (in GBP terms). Signs of moderating inflation and easing

interest rate expectations contributed to a positive market sentiment amongst

investors. The mining sector performed well but modestly lagged broader equity

markets. China's manufacturing PMI reached a three-month high, rising to 50.7

from 49.5 in October.

Mined commodities were up across the board, with the copper and iron ore

prices (62% fe) rising by 4.5% and 7.8% respectively. The copper price was

buoyed by the shock to supply caused by the closing of the Cobre de Panama

asset in Panama, which accounts for 1.5% of global copper supply. Iron ore

prices appeared to be up on China's seasonal restocking ahead of Chinese New

Year. Elsewhere, the precious metals also performed well on geopolitical risk

in the Middle East, an uncertain macroeconomic outlook, a fall in real rates

and weakness in the US dollar. For reference, gold and silver prices rose by

2.1% and 9.2% respectively.

Strategy and Outlook

China has re-opened but with less impact than had been expected early this

year. Uncertainty persists around China's commodity demand, but we are seeing

the Chinese administration announce financial support incrementally.

Longer-term, we are excited by the structural demand growth for a range of

mined commodities that will result from the low carbon transition. Meanwhile,

commodity supply is likely to be constrained by the capital discipline of

recent years, whilst inventories for many mined commodities are at historic

lows. Mining companies have low levels of debt, continue to return capital to

shareholders but appear to be entering a higher capital expenditure phase.

In 2023, we have seen Brown to Green emerge as a key theme, where mining

companies are focusing on reducing the greenhouse gas emissions intensity

associated with their production. We expect to see a re-rating for the mining

companies able to best navigate this and are playing this in the portfolio.

All data points are in USD terms unless stated otherwise.

14 December 2023

Latest information is available by typing www.blackrock.com/uk/brwm on the

internet. Neither the contents of the Manager's website nor the contents of

any website accessible from hyperlinks on the Manager's website (or any other

website) is incorporated into, or forms part of, this announcement.

This information was brought to you by Cision http://news.cision.com

The following files are available for download:

https://mb.cision.com/Main/22397/3893686/2495507.pdf Release

END

(END) Dow Jones Newswires

December 14, 2023 09:27 ET (14:27 GMT)

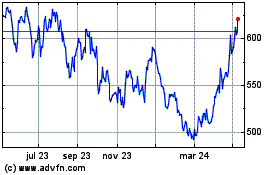

Blackrock World Mining (LSE:BRWM)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

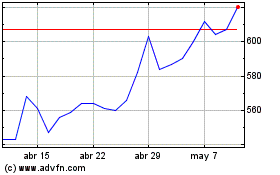

Blackrock World Mining (LSE:BRWM)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025