TIDMBSRT

RNS Number : 9096L

Baker Steel Resources Trust Ltd

11 September 2023

BAKER STEEL RESOURCES TRUST LIMITED

(Incorporated in Guernsey with registered number 51576 under the

provisions of The Companies (Guernsey) Law, 2008 as amended)

11 September 2023

LEI: 213800JUXEVF1QLKCC27

Futura Resources closes A$26.2 million financing

Baker Steel Resources Trust Limited ("the Company" or "BSRT")

announces that its second largest investment Futura Resources Ltd

("Futura") has completed a A$26.2 million financing package to fund

the commencement of production of steel making coals at its Wilton

Mine in Queensland, Australia.

The funding package comprises a A$21.2 million 3-year term

unsecured redeemable convertible note issue, accompanied by in-kind

commitments from a number of contractors and suppliers to the value

of c. A$5 million.

BSRT has committed to invest its approximate pro-rata interest

totalling A$4.7 million (GBP2.40 million), which will be satisfied

through the rolling of its existing outstanding A$0.7 million

bridging loan as well as a further investment of A$4 million in new

funds. Together with the investment in the convertible the

transaction will, assuming full conversion by noteholders,

approximately maintain BSRT's 27% equity interest in Futura.

The new investment will increase the Company's overall

investment exposure to Futura (which includes a 1.5% Gross Revenue

Royalty on Futura's mines), from the current 25.3% NAV to 28.2% NAV

on investment based on 31 August 2023 valuations, remaining below

the 35% NAV limit approved by shareholders on 9 November 2022. The

valuation of the various elements comprising the investment in

Futura will be reviewed at 31 December 2023, at which point the

Wilton Mine should be in or close to being in production.

It is currently expected that Futura's second mine, the Fairhill

mine can be brought into production utilising cash generated by

Wilton but this might be accelerated should Futura decide to raise

further finance, likely to be debt, once Wilton is up and running.

A total of around A$50 million is required in funding for

development of both the Wilton and Fairhill mines. Several parties

have expressed interest in participating in the convertible note

issue, but are yet to complete the subscription agreement, and as

such Futura will leave the convertible offer open for a short

period after this first closing to allow for potential further

subscriptions up to a maximum of A$30 million.

According to Futura management forecasts, the Wilton and

Fairhill mines are expected to produce around 2 million tonnes per

annum of saleable product once both mines are in full production in

2025 which based on forward price expectations is forecast to

generate an EBITDA of A$92m*. There remains potential to increase

production rates subject to additional licensing approval and

available processing capacity.

As these are open-pit operations with near surface coal and

utilising existing infrastructure, both projects benefit from low

capital intensity and can be brought into production within 3

months of the necessary funding being made available. A key

infrastructure cost saving is the right Futura has to process its

coal at the existing Gregory Crinum coal processing plant, which is

estimated to have a replacement cost of around A$300m.

Futura's economic model shows a net present value at a 10

percent discount rate (NPV(10) of A$339m over the 20 years of

planned production based on forward price expectations, or NPV(10)

of A$642m if current prices were maintained over the longer term*.

In addition, the overall mineral resource is extensive and could

sustain a mine life well beyond the currently planned term.

The convertible notes carry a 21% annual coupon with a

pre-conversion equity valuation of A$100 million, which equates to

A$2.38 per Futura share conversion price. Upon an IPO by Futura,

noteholders would have the right to convert at the lower of A$2.38

per share or a 20% discount to the IPO price. The high coupon

reflects recent precedents for the cost of financing for coal

development companies in Australia.

Approximately A$100m has been spent historically on exploration,

bulk sample testing and permitting in today's money to bring these

projects to the current stage of development with both Wilton and

Fairhill being granted Mining Licenses in November 2022.

The projects are coming into a coal market where supply is tight

for steel making coals and demand is strong, particularly from

developing countries like India, Vietnam and Indonesia, which are

all expanding steel production to meet domestic demand.

The Queensland government has expressed strong support for the

development of these two mines with Resources Minister Scott

Stewart saying,

"This investment is a strong vote of confidence in the

Queensland resources sector and our state's large deposits of

high-quality steelmaking coal"

"These projects are in the heart of the Bowen Basin and will

benefit from the existing infrastructure in place from nearby

mines".

"...regional communities will benefit from job opportunities and

the economic flow-on effects of these projects."

"Treasury forecasts show Queensland will likely remain the

world's largest seaborne exporter of steelmaking coal for many

decades to come,"

*Source: Futura management projections and mine plan financial

models

Further details of the Company and its investments are available

on the Company's website www.bakersteelresourcestrust.com

Enquiries:

Baker Steel Resources Trust Limited +44 20 7389 8237

Francis Johnstone

Trevor Steel

Numis Securities Limited +44 20 7260 1000

David Benda (corporate)

James Glass (sales)

The Net Asset Value ("NAV") figure stated is based on unaudited

estimated valuations of the underlying investments and not

necessarily based on observable inputs. Such estimates are not

subject to any independent verification or other due diligence and

may not comply with generally accepted accounting practices or

other generally accepted valuation principles. In addition, some

estimated valuations are based on the latest available information

which may relate to some time before the date set out above.

Accordingly, no reliance should be placed on such estimated

valuations and they should only be taken as an indicative guide.

Other risk factors which may be relevant to the NAV figure are set

out in the Company's Prospectus dated 26 January 2015.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCZVLFBXKLXBBB

(END) Dow Jones Newswires

September 11, 2023 02:00 ET (06:00 GMT)

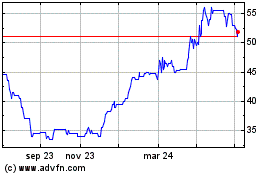

Baker Steel Resources (LSE:BSRT)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

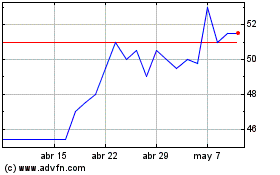

Baker Steel Resources (LSE:BSRT)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025