Cambria Africa PLC Trading Update and Extension of Reporting Deadline (5153Q)

26 Febrero 2021 - 5:21AM

UK Regulatory

TIDMCMB

RNS Number : 5153Q

Cambria Africa PLC

26 February 2021

Cambria Africa Plc

("Camb ria" or "the Company")

Trading Update and Extension of Reporting Deadline

Further to the announcement on 21 September 2020, the Company

provides the following update.

Net Asset Value (NAV)

The Company continues to expect FY 2020 (31 August 2020) NAV to

remain at or near the $7.17 million levels (1.32 US cents per

share) reported at the time of its interim results for 29 February

2020. Significant components of the NAV include a $2.5 million

valuation of Paynet Zimbabwe's Headquarters and its adjacent plot

with main road frontage and its investment in Radar Holdings

Limited valued at $1.74 million. Cash and cash resources outside

Zimbabwe at the end FY 2020 amounted to $1.8 million.

Subsequent to the end of the reporting period, Cambria utilised

some of its cash resources to settle $400,000 of its $500,000 loan

obligation to Ventures Africa Limited ("VAL") leaving an

outstanding balance to VAL of $100,000. Other than this, the Group

is virtually debt-free with current cash resources outside Zimbabwe

of $1.36 million, and the Company will save over $32,000 per annum

in interest expense.

Operating subsidiaries

Cambria's operating subsidiaries and divisions Tradanet (51%

owned), Millchem and Autopay continue to operate at near or above

cash flow break-even levels, albeit based on substantially lower

revenues.

Subsequent to the end of FY2020, Paynet Zimbabwe successfully

re-established its relationship with Paywell South Africa for the

provision of payroll software licenses allowing its Autopay

division to continue providing payroll outsourcing services and

payroll software licenses to its substantial client base in

Zimbabwe.

Old Mutual Limited Portfolio Value

The Company holds 204,000 Old Mutual shares on the Zimbabwe

Stock Exchange (ZSE:OMU) ("ZSE") which remain suspended since July

2020. Unlike other dual-listed shares which have regained

fungibility by moving their listing to the newly established

Victoria Falls Securities Exchange, Old Mutual has been unable or

unwilling to do the same. This has left Old Mutual shareholders on

the ZSE with no route to crystallize their Old Mutual investment.

The Company purchased its shares on 12 August 2019 on the

Johannesburg Stock Exchange (JSE:OMU) and transferred them to the

Zimbabwe register to guarantee Paynet's bid to increase ownership

in Radar Holdings Limited.

The Company has recently approached the regulatory authorities

in Zimbabwe to repatriate its remaining shares of Old Mutual

Limited to the JSE. If the Company succeeds, the market value of

its shares would be approximately US $200,000 based on the London

Stock Exchange's ("LSE") close price of 67.52p, on 23 February

2021.

The Company strongly believes that Old Mutual Limited abdicated

its fiduciary obligation to its shareholders by acquiescing to the

suspension of its shares on the ZSE. On 28 August 2020, the Company

received this unsatisfactory response from the Chief Legal Officer

and Head of Legal for Old Mutual Limited:

"As you may appreciate, this is a complex situation and we

vigorously continue to engage the relevant authorities to find a

feasible solution. We will update all of the stakeholders of the

company once we are in a position to do so."

The Company has not heard from Old Mutual Limited's Head of

Legal since 28 August nor has Old Mutual Limited ever disclosed its

strategy to re-establish liquidity for its effectively second-class

shareholders on the ZSE.

Extension of Reporting Deadline

Due to the effect of COVID-19 pandemic, the Company will not be

able to post its annual audited report and accounts for the

financial year ended 31 August 2020 (the "Annual Report") to

shareholders by 28 February 2021. The Company has applied, pursuant

to the guidance provided in "Inside AIM" on 27 January 2021, for an

additional period of up to three months to publish the Annual

Report. The Company has been granted the extension and therefore

the Company will publish the Annual Report by no later than 31 May

2021.

Contacts

Cambria Africa Plc www.cambriaafrica.com

Samir Shasha +44 (0)20 3287 8814

WH Ireland Limited https://www.whirelandplc.com/

James Joyce / Matthew Chan +44 (0) 20 7220 1666

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCPPURGPUPGGGQ

(END) Dow Jones Newswires

February 26, 2021 06:21 ET (11:21 GMT)

Cambria Africa (LSE:CMB)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

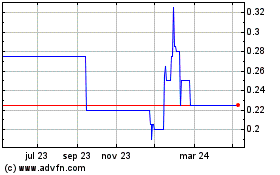

Cambria Africa (LSE:CMB)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024