TIDMCPH2

RNS Number : 1332N

Clean Power Hydrogen

21 September 2023

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014 which is part of UK law by

virtue of the European Union (withdrawal) Act 2018. Upon the

publication of this announcement, this inside information is now

considered to be in the public domain.

21 September 2023

Clean Power Hydrogen plc

("CPH2", the "Company" or the "Group)

Interim Results for the six months ended 30 June 2023

Clean Power Hydrogen plc (AIM: CPH2), the UK-based green

hydrogen technology and manufacturing group that has developed the

IP-protected Membrane-Free Electrolyser ("MFE"), is pleased to

announce its unaudited results for the six months ended 30 June

2023.

Financial Highlights

-- Cash position remains strong at GBP12.9m

-- GBP1.3m investment on development work in the six months to June 2023

-- Loss of GBP1.6m in the six months to June 2023

Technology Highlights

-- The MFE110, the Company's first scaled membrane free

electrolyser, is in the final stage of testing.

-- Thorough testing of the MFE110 has identified upgrades and

the Company has successfully redesigned the cryogenic system as

well as validated the stack design.

-- Results of the MFE110 have informed valuable enhancements to the MFE220 design as expected.

-- Following the delivery of the MFE110, the Company will turn

its focus to finalising the design and build programme of the

MFE220, CPH2's 1MW System.

-- Applications now submitted to certifying bodies for CE marking, UKCA marking, NI CE marking.

Significant engineering milestones have been reached during the

period and although delivery of the MFE110 has been delayed to

ensure operational and safety compliance, delivery, commissioning

and installation of the unit at our customer's site will take place

imminently.

The commissioning process has given valuable design and

operability feedback which has resulted in further iterations of

the MFE design. This redesign process has been done in a methodical

and diligent manner and led to a number of components being

reworked, re-engineered, and reordered, which in turn has had a

knock-on impact on the commissioning schedule especially when new

components have long lead times. However, the Company has largely

finished this process and the improvement in the components and

design means that CPH2 is more confident now in its ability to

fully commercialise the product. The data and the learnings the

team has accrued place the Company in a much stronger position to

roll out the technology at CPH2's own facilities and at licence

holder facilities.

Commercially, CPH2 is in a strong position. The Group's pipeline

and order book is expected to increase once customers are able to

verify having a working unit in operation in the field. In tandem,

the Company is working with its licence partners to deliver the

blueprints for their own production and hope to have these ready

for late Q4 2023 or early Q1 2024. As a result of the delays the

Company does not expect any significant income in FY2023.

Change of Name of Nominated Adviser and Broker

The Company also announces that Cenkos Securities, its Nominated

Adviser and Broker, has changed its name to Cavendish Securities

plc following completion of its own corporate merger.

For more information, please contact:

Clean Power Hydrogen plc via Camarco

Jon Duffy, Chief Executive Officer

James Hobson, Chief Financial Officer

Cavendish Securities plc - NOMAD & Broker

+44 (0)131 220

Neil McDonald 9771

+44 (0)131 220

Peter Lynch 9772

+44 (0)131 220

Adam Rae 9778

+ 44(0) 20 3757

Camarco PR 4980

Billy Clegg

Owen Roberts

Lily Pettifar

To find out more, please visit: https://www.cph2.com

Overview of CPH2

CPH2 is the holding company of Clean Power Hydrogen Group

Limited ("Clean Power") which has almost a decade of dedicated

research and product development experience. This experience has

resulted in the creation of simple, safe and sustainable technology

which is designed to deliver a modular solution to the hydrogen

production market in a cost-effective, scalable, reliable and

long-lasting manner. The Group's strategic objective is to deliver

the lowest LCOH in the market in relation to the production of

green hydrogen. The Group's MFE technology is already commercially

available and demonstrating cost efficiencies and technological

advantages. CPH2 is listed on the AIM market and trades under the

ticker LON:CPH2.

Chief Executive's Statement

Technology update

Work during the period has concentrated on completion of the

MFE110 electrolysers, our 0.5 MW system being used to validate the

technology at scale and verify the design, following which they

will be shipped to customer sites for site validation.

The design of the MFE110 was completed in Q1 2023, following

which the Company undertook the pre-commissioning and then

commissioning of the system under the watchful eye of Paul Cassidy,

our CTO who joined in March 2023.

The pre-commissioning and commissioning process is a necessary

procedure to undertake in all engineering projects as it is the

first time we are commissioning our groundbreaking technology at

scale. The commissioning process has given valuable design and

operability feedback which has resulted in further iterations of

the MFE design. This design evolution has resulted in a longer

commissioning process than first anticipated, however, we are

confident that these iterations put the technology on a sound

basis.

Every component and system - including each valve, gauge, pipe,

electrical wire and pump - has been tested to ensure it is

correctly installed and functioning according to its specification.

Any components that were not working according to the design

specification, or otherwise as expected, were reviewed by the

engineering and research & development departments, who found a

solution to resolve the issue. At times this resulted in a redesign

of the component, which then were procured, for which in some cases

incurred additional lead time.

The Company is executing a staged commissioning process testing

firstly the stacks, then the stacks with the dryers, the

cryogenics, and then finally bringing together the stacks, dryers,

and cryogenics to have the complete system working together,

successfully generating separated hydrogen and oxygen gases. This

has given the Company the opportunity to make modifications before

bringing the entire system online.

Over the last five months we have been working through this

process in a methodical way, successfully resolving issues found,

while ensuring that safety is paramount, which has resulted in an

improvement to the unit operability, validation of stack design,

and design improvements of the cryogenic system.

I am pleased to advise that as at the date of this report, the

Company has reached the final stage of the commissioning process,

which will be to generate separated hydrogen and oxygen gases of

its first MFE110 electrolyser in the coming weeks, having already

successfully generated mixed gas. Significant firsts have been

achieved, and having successfully gone through nearly the whole

commissioning process, confidence is high as we embark on the

closing stage of commissioning.

The next stage of the process is achieving Factory Acceptance

Testing which includes customer acceptance, upon which the first

MFE110 will be shipped to the customer site.

The commissioning process has taken two months longer than

expected but has been a crucial learning experience for the Company

which has instilled the necessary disciplined approach which will

prove valuable going forward. In addition, the successful proving

of the technology at scale gives great confidence in the Company's

1MW system, the MFE220.

Work has continued on completing the design of the MFE220, and

the issues that were found and resolved in the commissioning

process of the MFE110, is informing the MFE220's development. We

are expecting to complete the design and then begin building the

unit in Q4 2023, with commissioning and customer delivery in the

new year.

Commercial update

We have been working closely with our licence partners, as well

as our customers and their respective engineering consultants, and

appreciate the strong support we have received.

During the period we signed a 10-year licensing deal with

Fabrum, an advanced energy company with deep expertise in

cryogenics and an important customer of CPH2, alongside two MFE220

orders. The licensing deal allows Fabrum to manufacture

membrane-free electrolysers in their factory in Christchurch, New

Zealand as well as a non-exclusive sales licence for Australia and

New Zealand. Under the agreement Fabrum will manufacture either

upon a CPH2 order or their own sale. The MFE220s built by Fabrum

will be in accordance with Australian & New Zealand standards,

and upon completion of the design and compliance work, there will

be a membrane free electrolyser ready for the Australian and New

Zealand market. Fabrum has since secured its first customer order

under the licencing agreement from Obayashi Construction

Company.

Financial review

The Company has prudently and carefully managed its cash

resources during the period, ensuring the cash spend is controlled

and focused on our route to commercialization. We remain in a

strong cash position with cash resources of GBP12.9m at 30 June

2023 (comprising term deposits of GBP8m and cash and cash

equivalents of GBP4.9m), a reduction of GBP2.4m from 31 December

2022 when the cash resources of the Company were GBP15.3m. The

Company incurred a loss of GBP1.6m for the six months ended 30 June

2023, an increase of GBP0.5m from the comparative period, but down

from the loss of GBP2.3m incurred in H2 2022. The Company invested

GBP1.3m in development work during the period.

Conclusion and Outlook

It has been a crucial time for the Company, and whilst we have

had delays, strong strides have been made during the period in

proving at scale the differentiated, groundbreaking membrane free

electrolyser technology on the back of a disciplined engineering

approach. Our key focus for the rest of the year is to complete and

ship MFE110s, to have a scaled working electrolyser at a customer

site, and to complete the design of the CPH2 1MW system, the

MFE220, in line with our stated milestones. The enormous global

hydrogen opportunity only continues to strengthen and we are

confident that our technology provides a compelling, disruptive and

attractive offering.

As we sit at the cusp of commercialising a truly ground-breaking

technology in the hydrogen sector, I would like to thank to all our

staff whose passion is inspiring and who have worked tirelessly to

progress the technology and the Company.

Jon Duffy

Chief Executive Officer

Consolidated Statement of Comprehensive Income

FOR THE PERIODED 30 JUNE 2023

Note 6 months 6 months Year ended

ended ended 31 December

30 June 30 June 2022

2023 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------------------- ---- ------------- ----------- -------------

Revenue - - -

Cost of sales - - -

----------------------------------------- ---- ------------- ----------- -------------

Gross profit - - -

Other operating income 2 2 -

Administrative expenses excluding

exceptional items (2,262) (2,158) (4,765)

Exceptional net credit 4 - 987 986

----------------------------------------- ---- ------------- ----------- -------------

Total administrative expenses (2,262) (1,171) (3,779)

----------------------------------------- ---- ------------- ----------- -------------

Operating loss (2,260) (1,169) (3,779)

Finance income 163 91 216

Finance expense (24) (28) (55)

Loss before taxation (2,121) (1,106) (3,618)

Taxation 5 512 - 174

----------------------------------------- ---- ------------- ----------- -------------

Loss for the financial period (1,609) (1,106) (3,444)

----------------------------------------- ---- ------------- ----------- -------------

Items that may be reclassified subsequently

to profit or loss:

Foreign currency translation differences 12 (9) (19)

Fair value decrease in respect of

investments (42) - (3)

----------------------------------------- ---- ------------- ----------- -------------

Total comprehensive expense for

the period (1,639) (1,115) (3,466)

----------------------------------------- ---- ------------- ----------- -------------

Basic and diluted earnings per

share (pence) 6 (0.60) (0.45) (1.35)

----------------------------------------- ---- ------------- ----------- -------------

The accompanying notes are an integral part of these condensed

consolidated financial statements.

Consolidated Statement of Financial Position

AS AT 30 JUNE 2023

Note 30 June 30 June 31 December

2023 2022 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

----------------------------------- ---- ------------ ---------- -----------

Assets

Non-current assets

Intangible assets 7 6,828 1,527 5,476

Property, plant and equipment 1,626 1,347 1,387

Fair value through OCI investments 8 1,455 - 1,497

Trade and other receivables 120 120 120

10,029 2,994 8,480

Current assets

Inventories 9 2,443 3,889 2,363

Trade and other receivables 10 2,304 2,085 3,239

Current asset investments 8,000 21,000 13,500

Cash and cash equivalents 4,907 2,175 1,790

----------------------------------- ---- ------------ ---------- -----------

17,654 29,149 20,892

----------------------------------- ---- ------------ ---------- -----------

Total assets 27,683 32,143 29,372

----------------------------------- ---- ------------ ---------- -----------

Liabilities

Current liabilities

Trade and other payables (717) (894) (844)

Deferred income (1,802) (2,636) (1,858)

Lease liabilities (124) (117) (121)

----------------------------------- ---- ------------ ---------- -----------

(2,643) (3,647) (2,823)

----------------------------------- ---- ------------ ---------- -----------

Non-current liabilities

Deferred income (630) (278) (641)

Lease liabilities (673) (797) (737)

(1,303) (1,075) (1,378)

----------------------------------- ---- ------------ ---------- -----------

Total liabilities (3,946) (4,722) (4,201)

----------------------------------- ---- ------------ ---------- -----------

Net assets 23,737 27,421 25,171

----------------------------------- ---- ------------ ---------- -----------

Equity

Called up share capital 2,682 2,654 2,654

Share premium account 27,707 27,638 27,638

Merger reserve 3,702 3,702 3,702

Currency translation reserve (3) (5) (15)

Accumulated loss (10,351) (6,568) (8,808)

----------------------------------- ---- ------------ ---------- -----------

Total equity 23,737 27,421 25,171

----------------------------------- ---- ------------ ---------- -----------

The accompanying notes are an integral part of these condensed

consolidated financial statements.

Consolidated Statement of Changes in Equity

FOR THE PERIODED 30 JUNE 2023

Called Share Merger Foreign Accumulated Total

up share premium reserve currency loss equity

capital account reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ --------- -------- -------- --------- ----------- --------

Balance as at 1 January 2022 9 5,545 - 4 (5,910) (352)

Loss for the financial year - - - - (3,444) (3,444)

Other comprehensive expense - - - (19) (3) (22)

------------------------------ --------- -------- -------- --------- ----------- --------

Total comprehensive expense

for the year - - - (19) (3,447) (3,466)

------------------------------ --------- -------- -------- --------- ----------- --------

Share based payments - - - 549 549

Capital reorganisation 1,843 (5,545) 3,702 - - -

Issue of share capital 802 27,638 - - - 28,440

------------------------------ --------- -------- -------- --------- ----------- --------

Total contributions by owners 2,645 22,093 3,702 - 549 28,989

------------------------------ --------- -------- -------- --------- ----------- --------

Balance as at 31 December

2022 2,654 27,638 3,702 (15) (8,808) 25,171

Loss for the financial period - - - - (1,609) (1,609)

Other comprehensive expense - - - 12 (42) (30)

------------------------------ --------- -------- -------- --------- ----------- --------

Total comprehensive expense

for the period - - - 12 (1,651) (1,639)

------------------------------ --------- -------- -------- --------- ----------- --------

Share based payments - - - - 108 108

Issue of share capital 28 69 - - - 97

------------------------------ --------- -------- -------- --------- ----------- --------

Total contributions by owners 28 69 - - 108 205

------------------------------ --------- -------- -------- --------- ----------- --------

Balance as at 30 June 2023 2,682 27,707 3,702 (3) (10,351) 23,737

------------------------------ --------- -------- -------- --------- ----------- --------

Comparatives for the six months ended 30 June 2022 are provided

separately below:

Called Share Merger Foreign Accumulated Total

up share premium reserve currency loss Equity

capital account reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ --------- -------- -------- --------- ----------- --------

Balance as at 1 January 2022 9 5,545 - 4 (5,910) (352)

Loss for the financial period - - - - (1,106) (1,106)

Other comprehensive expense - - - (9) - (9)

------------------------------ --------- -------- -------- --------- ----------- --------

Total comprehensive expense

for the year - - - (9) (1,106) (1,115)

------------------------------ --------- -------- -------- --------- ----------- --------

Share based payments - - - - 448 448

Capital reorganisation 1,843 (5,545) 3,702 - - -

Issue of share capital 802 27,638 - - - 28,440

------------------------------ --------- -------- -------- --------- ----------- --------

Total contributions by owners 2,645 22,093 3,702 - 448 28,888

------------------------------ --------- -------- -------- --------- ----------- --------

Balance as at 30 June 2022 2,654 27,638 3,702 (5) (6,568) 27,421

------------------------------ --------- -------- -------- --------- ----------- --------

Consolidated Cash Flow Statement

FOR THE PERIODED 30 JUNE 2023

6 months 6 months Year ended

ended ended 31 December

30 June 30 June 2022

2023 2022

Unaudited Unaudited Audited

GBP'000 GBP'000 GBP'000

---------------------------------------------- ---------- ---------- -------------

Cash flow from operating activities

Loss for the financial period (1,609) (1,106) (3,444)

Adjustment for:

Depreciation and amortisation 177 109 249

Loss on disposal - 10 5

Share based payments 108 (1,517) (1,416)

Foreign exchange 16 - (25)

Net finance income (139) (63) (161)

Taxation credit (512) - (174)

Changes in working capital

:

Increase in inventories (80) (1,807) (281)

Decrease/(increase) in trade

and other receivables 1,273 (1,381) (2,361)

(Decrease)/increase in trade

and other payables (194) 742 293

Cash used in operations (960) (5,013) (7,315)

Income tax received 174 143 143

----------------------------------------------- ---------- ---------- -------------

Net cash used in operating

activities (786) (4,870) (7,172)

----------------------------------------------- ---------- ---------- -------------

Cash flows from investing activities

Current asset investments disinvested/(made) 5,500 (21,000) (13,500)

Purchase of property, plant

and equipment (388) (129) (292)

Purchase of intangible assets (1,384) (354) (4,316)

Purchase of investments - - (1,500)

Net cash generated from/(used

in) investing activities 3,728 (21,483) (19,608)

----------------------------------------------- ---------- ---------- -------------

Cash flows from financing activities

Issue of share capital (net

of costs) 97 28,440 28,440

Interest received 163 91 216

Related party loan repaid - (382) (382)

Interest paid (24) (28) (55)

Payment of lease liabilities (61) (73) (129)

Net cash generated from financing

activities 175 28,048 28,090

----------------------------------------------- ---------- ---------- -------------

Net increase in cash and cash

equivalents 3,117 1,695 1,310

Cash and cash equivalents at

the beginning of the period 1,790 480 480

Cash and cash equivalents at

the end of the period 4,907 2,175 1,790

----------------------------------------------- ---------- ---------- -------------

Notes to the Condensed Interim Financial Statements

FOR THE PERIODED 30 JUNE 2023

1 Corporate information

Clean Power Hydrogen plc is a public company incorporated in the

United Kingdom and listed on the Alternative Investment Market

("AIM"). The registered address of the Company is Unit D Parkside

Business Park, Spinners Road, Doncaster, England, DN2 4BL. The

principal activity of the Company is as a holding company for

subsidiaries engaged in the development of a patented method of

hydrogen and oxygen production together with the development of a

gas separation technique which enables hydrogen to be produced as

'Green Hydrogen' and oxygen to medical grade purity.

2 Basis of preparation

This unaudited condensed consolidated interim financial

information for the six months ended 30 June 2023 and 30 June 2022

has been prepared in accordance with UK adopted international

accounting standards ('IFRS') including IAS 34 'Interim Financial

Reporting'.

The accounting policies applied by the Group include those as

set out in the consolidated financial statements for the Group for

the year ended 31 December 2022 and are consistent with those to be

used by the Group in its next financial statements for the year

ending 31 December 2023.

There are no new standards, interpretations and amendments which

are not yet effective in these financial statements, expected to

have a material effect on the Group's future financial

statements.

The financial information does not contain all of the

information that is required to be disclosed in a full set of IFRS

financial statements. The financial information for the six months

ended 30 June 2023 and 30 June 2022 is unaudited and does not

constitute the Group or Company's statutory financial statements

for those periods.

The comparative financial information for the full year ended 31

December 2022 has, however, been derived from the audited statutory

financial statements for Clean Power Hydrogen plc for that period.

A copy of those statutory financial statements has been delivered

to the Registrar of Companies. The auditor's report on those

accounts was unqualified and did not contain a statement under

section 498(2)-(3) of the Companies Act 2006.

These policies have been applied consistently to all periods

presented, unless otherwise stated.

The interim financial information has been prepared under the

historical cost convention with the exception of the fair values

applied in accounting for share based payments and investments. The

financial information and the notes to the historical financial

information are presented in thousands of pounds sterling

('GBP'000'), the functional and presentation currency of the Group,

except where otherwise indicated.

Going Concern

The Group's forecasts and projections to 31 December 2024 based

on the current trends in development and trading and after taking

account of the funds currently held, show that the Group will be

able to operate within the level of cash reserves.

The Directors therefore have a reasonable expectation that the

Group have adequate resources to continue in operational existence

for the foreseeable future and consider the going concern basis to

be appropriate.

3 Segment reporting

IFRS 8, Operating Segments, requires operating segments to be

identified on the basis of internal reports that are regularly

reviewed by the company's chief operating decision maker. The chief

operating decision maker is considered to be the executive

Directors.

The Group at this stage comprises only one operating segment for

the development and sale of equipment for the electrolytic

production of clean hydrogen and oxygen. This is monitored by the

chief operating decision maker and strategic decisions are made on

the basis of adjusted segment operating results.

4 Exceptional costs and credits

30 June 30 June 31 December

2023 2022 2022

Cash settled LTIP credit - 1,965 1,965

Accelerated share based payment on

IPO - (374) (374)

IPO related costs - (604) (605)

----------------------------------- ------------- -------- ------------

- 987 986

------------------------------------------------- -------- ------------

Pre IPO, the Group had an LTIP in place for a director with a

cash-settled bonus arrangement payable, linked to the Group value

and share price over the 3 year period to September 2023. This was

replaced with parent company options with new terms and on

cancelling the arrangement resulted in the reversal of previous

charges and an exceptional credit to income of GBP1,965,000.

5 Taxation

Tax credits in respect of research and development expenditure

have been recognised when submitted and on receipt to date whilst

experience of claims being collated and accepted is gained. The

credit for the period to 30 June 2023 relates to the claim

submitted for the year ended 31 December 2022 and the credit for

the year ended 31 December 2022 to the claim submitted and received

for 2021.

6 Earnings per share

30 June 30 June 31 December

2023 2022 2022

Loss used in calculating earnings per

share (GBP'000) (1,609) (1,106) (3,444)

Weighted average number of shares for

basic EPS ('000) 266,422 245,054 255,321

Basic and diluted loss per share (pence) (0.60) (0.45) (1.35)

----------------------------------------- ------------ -------- ------------

There is no dilutive effect on a loss. There are potentially

dilutive options in place over 22,333,279 ordinary shares at 30

June 2023.

7 Intangible fixed assets

Development Patents Software Total

costs GBP'000

GBP'000 GBP'000 GBP'000

Cost

At 1 January 2023 5,291 171 55 5,517

Additions 1,276 108 - 1,384

Reclassification (5) 5 - -

Exchange movements - (4) - (4)

At 30 June 2023 6,562 280 55 6,897

--------------------------- ----------- -------- -------- --------

Accumulated depreciation

At 1 January 2023 - 21 20 41

Charge for the period - 21 7 28

--------------------------- ----------- -------- -------- --------

At 30 June 2023 - 42 27 69

Net book amount

At 30 June 2023 6,562 238 28 6,828

--------------------------- ----------- -------- -------- --------

At 31 December 2022 5,291 150 35 5,476

--------------------------- ----------- -------- -------- --------

The development costs relate to the direct expenditure incurred

on the Group's membrane free electrolysis technology.

8 Investments held at fair value through other comprehensive income

GBP'000

--------------------------- ----------------------------

As at 1 January 2023 1,497

Movement in fair value (42)

----------------------------- ---------------------------

Fair value at 30 June 2023 1,455

----------------------------- ---------------------------

The Company holds 1,412,429 ordinary GBP0.02 shares in ATOME

Energy plc, representing 3.5% of its issued share capital at 30

June 2023 (3.9% at 1 January 2023). ATOME Energy plc is listed on

AIM and is focused on the production, marketing and distribution of

green hydrogen and ammonia.

The fair value at 30 June 2023 and 1 January 2023 is measured

using the quoted price on the AIM market at that date (a level 1

input using the price from an active market).

9 Inventories

30 June 30 June 31 December

2023 2022 2022

Group and Company GBP'000 GBP'000 GBP'000

Raw materials and consumables 1,692 570 1,692

Work in progress 751 3,319 671

------------------------------ ------------ -------- ------------

2,443 3,889 2,363

------------------------------ ------------ -------- ------------

No impairment of inventory has arisen.

Work in progress represents the costs incurred in the production

of machines for confirmed orders not yet completed at the balance

sheet date.

10 Trade and other receivables

30 June 30 June 31 December

2023 2022 2022

Current GBP'000 GBP'000 GBP'000

Trade receivables 81 - 84

Other receivables 849 688 2,053

Tax recoverable 512 - 174

Prepayments and accrued income 862 1,397 928

------------------------------- ------------ -------- ------------

2,304 2,085 3,239

------------------------------- ------------ -------- ------------

Non-current

------------------------------- ------------ -------- ------------

Other receivables 120 120 120

------------------------------- ------------ -------- ------------

There has been no significant revenue to 30 June 2023 and there

have been no impairment charges nor expected credit loss provisions

made, as the credit risk in respect of trade and other receivables

is considered low. The Directors consider that the carrying amount

of trade and other receivables approximates to their fair

value.

GBP475,000 of other receivables and deferred income relates to

cash from a customer held in escrow subject to completion of the

order.

11 Related party transactions

Directors remuneration during the 6 month period ended 30 June

2023 amounted to GBP337,000 (6 month period ended 30 June 2022 :

GBP367,000).

Independent Review Report to Clean Power Hydrogen plc

FOR THE PERIODED 30 JUNE 2023

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the condensed set of financial statements

in the half-yearly report for the six months ended 30 June 2023 is

not prepared, in all material respects, in accordance with UK

adopted International Accounting Standard 34, "Interim Financial

Reporting" and the requirements of the AIM Rules for Companies.

Basis for conclusion

We conducted our review in accordance with International

Standard on Review Engagements (UK) 2410 "Review of Interim

Financial Information Performed by the Independent Auditor of the

Entity", issued for use in the United Kingdom. A review of interim

financial information consists of making enquiries, primarily of

persons responsible for financial and accounting matters, and

applying analytical and other review procedures. A review is

substantially less in scope than an audit conducted in accordance

with International Standards on Auditing (UK), and consequently

does not enable us to obtain assurance that we would become aware

of all significant matters that might be identified in an audit.

Accordingly, we do not express an audit opinion.

As disclosed in note 2, the annual financial statements of the

group are prepared in accordance with UK adopted IASs. The

condensed set of financial statements included in this half-yearly

financial report has been prepared in accordance with UK adopted

International Accounting Standard 34 "Interim Financial

Reporting".

Conclusions related to going concern

Based on our review procedures, which are less extensive than

those performed in an audit as described in the Basis of conclusion

section of this report, nothing has come to our attention to

suggest that management have inappropriately adopted the going

concern basis of accounting or that management have identified

material uncertainties relating to going concern that are not

appropriately disclosed.

This conclusion is based on the review procedures performed in

accordance with ISRE (UK) 2410, however future events or conditions

may cause the group to cease to continue as a going concern.

Responsibilities of directors

The directors are responsible for preparing the half-yearly

financial report in accordance with the AIM Rules for

Companies.

In preparing the half-yearly financial report, the directors are

responsible for assessing the group's ability to continue as a

going concern, disclosing, as applicable, matters related to going

concern and using the going concern basis of accounting unless the

directors either intend to liquidate the group or to cease

operations, or have no realistic alternative but to do so.

Auditor's responsibilities for the review of the financial

information

In reviewing the half-yearly report, we are responsible for

expressing to the group a conclusion on the condensed set of

financial statement in the half-yearly financial report. Our

conclusion, including our Conclusions relating to going concern,

are based on procedures that are less extensive than audit

procedures, as described in the Basis for conclusion paragraph of

this report.

Use of our report

Our report has been prepared in accordance with the terms of our

engagement to assist the Company in meeting the requirements of the

rules of the London Stock Exchange AIM Rules for Companies for no

other purpose. No person is entitled to rely on this report unless

such a person is a person entitled to rely upon this report by

virtue of and for the purpose of our terms of engagement or has

been expressly authorised to do so by our prior written consent.

Save as above, we do not accept responsibility for this report to

any other person or for any other purpose and we hereby expressly

disclaim any and all such liability.

PKF Littlejohn LLP

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BCGDCSDDDGXG

(END) Dow Jones Newswires

September 21, 2023 02:00 ET (06:00 GMT)

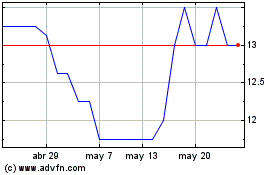

Clean Power Hydrogen (LSE:CPH2)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Clean Power Hydrogen (LSE:CPH2)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024