TIDMDEVO

RNS Number : 9189J

Devolver Digital, Inc.

16 December 2022

16(th) December 2022

Devolver Digital, Inc.

("Devolver Digital", "Devolver" or the "Company", and the

Company together with all of its subsidiary undertakings "the

Group")

LTIP Adoption, Grant of Awards and PDMR Dealing

Devolver Digital, an award-winning digital publisher and

developer of independent ("indie") video games, is pleased to

announce the terms of a long-term incentive plan for its senior

leadership and group employees charged with delivering on the

Group's strategic objectives for the three years to end 2024 (the

"2022 LTIP"). This follows the outcome of a Special Meeting held on

December 12, 2022 where shareholders voted in favour of the two

resolutions within the Shareholder Circular, which was distributed

to all shareholders of record. The resolutions approved the

adoption of the LTIP plan and rules, as well as grants to be made

in 2022 under the plan.

The 2022 LTIP is designed to reward employees at all levels of

the Company for performance that delivers value for shareholders,

through the award of long-term incentive shares ("LTIP Shares").

The Remuneration Committee, made up entirely of Independent

Non-Executive Directors, worked with independent consultants

Alvarez and Marsal throughout the development of the LTIP.

All LTIP Shares awarded to management are subject to a

three-year cliff vesting period from the date of award, with a

two-year cliff vesting period for all other employees. The LTIP

Shares are made up of Performance Stock Units ("PSUs"), award of

which are, amongst other things, subject to achieving ambitious

financial targets, and Restricted Stock Units ("RSUs"), award of

which are, amongst other things, subject to certain performance

criteria for management and senior employees. In addition to the

above, a grant of shares was recommended for the CEO and CFO, and a

grant of RSUs was recommended to a small employee cohort who have

joined the company since IPO.

The Remuneration Committee recommended the following 2022 grants

to the Board, laid out in the tables below. These initial 2022

awards granted under the 2022 LTIP plan will amount to, in

aggregate, 7,913,563 shares (on the assumption that all vest),

representing 1.8 per cent. of the issued and outstanding share

capital. Total dilution from the outstanding options (i.e.

excluding options previously exercised within the EBT) and these

initial grants would therefore amount to 10.5 per cent. of the

issued and outstanding share capital.

The following awards have been made to Directors of the

Company:

Number of

shares

Other Stock

or Cash-Based

Director/PDMR Position RSUs PSUs Awards Total

------------------- ---------- -------- -------- --------------- ----------

Douglas Morin CEO 154,454 308,908 338,893 802,255

Daniel Widdicombe CFO 119,684 239,368 354,498 713,550

Total 274,138 548,276 693,391 1,515,805

The following awards have been made to other management and

employees of the Group:

Number of shares

Other Stock

or Cash

Category RSUs PSUs Based Awards Total

---------------------- ---------- ---------- -------------- ----------

Other management and

senior employees 1,609,304 2,757,417 - 4,366,721

Other employees and

contractors 2,031,036 - - 2,031,036

Total 3,640,340 2,757,417 - 6,397,757

For the majority of the grants, the effective date for the award

of these LTIP shares would be 1st January 2022, i.e. shares with a

two-year cliff will vest on 31st December 2023. In addition to the

two-year and three-year cliffs for vesting, the LTIP shares are

subject to a range of further vesting conditions specified at the

time of award, and likewise will lapse if these conditions are not

met. For the PSUs, these include the following performance

conditions:

(i) the attainment of specified Group revenue targets at the end of a three-year period, and;

(ii) the attainment of specified Group EBITDA targets at the end of a three-year period.

The Company has set challenging financial targets (based upon

EBITDA and revenue metrics) for the PSUs, based upon the Group's

internal budgets. Targets are based on organic growth only and

exclude any potential M&A uplift. The PSUs only begin to be

earned once 90% of 2024 Revenue and EBITDA targets are achieved,

and management need to deliver 110% of the target to realise the

full award.

The metrics in the table below apply to actual 2024 Group

performance versus the prescribed targets for revenue and EBITDA in

2024:

Metric Weighting 0% Vesting 12.5% Vesting 50% Vesting 100% Vesting

(Below threshold) (Target) (Maximum)

Revenue 50% <90% of target 90% of target Target 110%+ of

target

---------- ------------------- --------------- ------------ -------------

EBITDA 50% <90% of target 90% of target Target 110%+ of

target

---------- ------------------- --------------- ------------ -------------

The RSUs for senior management, including the CEO and CFO,

require at least 60% of the 2024 EBITDA target to be achieved in

order for any LTIP Shares awarded under the 2022 grant to vest.

2024 EBITDA performance below this target level will result in all

the 2022 RSU grants for senior management lapsing. For other

management and senior employees, this only applies to 50% of their

RSU grant. These targets do not apply for all other employee grant

recipients.

Of the 3,640,341 RSUs awarded to other management and other

employees, 1,130,566 RSUs relate to the grant to the cohort of

employees who have joined the company since IPO. These RSUs vest on

a quarterly basis over 3 years with an effective date for award

between 31st December 2021 and 30th September 2022.

The RSU and PSU share grants for management and senior

employees, including Douglas Morin (CEO) and Daniel Widdicombe

(CFO) are made up of PSUs (2/3) and RSUs (1/3), with the number of

shares to be awarded calculated using a notional price of GBP1.20

(86% higher than the current share price of GBP0.65, to reflect the

currently depressed share price) and need to be held for three

years before vesting. The award for Douglas Morin (CEO) is 154,454

RSUs and 308,908 PSUs to a total of 463,362 LTIP Shares. The award

for Daniel Widdicombe (CFO) is 119,684 RSUs and 239,368 PSUs to a

total of 359,052 LTIP Shares.

The Remuneration Committee also recommended in the first half of

2022 that Douglas Morin (CEO) and Daniel Widdicombe (CFO) should be

awarded 338,893 and 354,498 common shares of $0.0001 each ("IPO

Award Shares") respectively in recognition of their contribution to

the successful listing of the Company in 2021. These are included

in the above table as Other Stock or Cash-Based Awards. There are

no performance, vesting or other conditions attached to these

shares. These shares will be issued on a net settlement basis,

where value of the shares received is equal to the post-tax (i.e.

net) value that would have been received on a sell-to-cover basis,

had all the shares been issued but some sold immediately to cover

the income taxes and social security taxes due. This reduces the

number of shares issued and resulting dilution. On a net-settled

basis, Douglas Morin (CEO) will be awarded 267,174 common shares,

and Daniel Widdicombe (CFO) will be awarded 187,884 common

shares.

The cohort of employees who have joined the company since IPO

will also receive net-settled shares for the already-vested first

four or fewer quarters, where applicable, of the 3-year vesting

period. The total net-settled share amount is 166,840 shares. Taken

together with the CEO and CFO net-settled IPO Award Shares, the

total number of shares to be immediately issued is 621,898

shares.

It should be noted that the co-founders of Devolver who are

fully employed at the company, including Executive Chairman Harry

Miller, without exception, declined to receive any share awards

under the 2022 LTIP.

Further information regarding the LTIP Shares and the Group's

remuneration framework will be set out in the Group's annual report

for the year ending 31 December 2022.

Devolver has made application to the London Stock Exchange for

the issue of securities in respect of 621,898 new common shares to

be admitted to trading on AIM in relation to the IPO Share Awards

and it is expected that admission will become effective on or

around 21 December 2022. Following the admission of the new common

shares, the Company's issued share capital will comprise

444,384,250 common shares and may be used by shareholders in the

Company as the denominator for the calculations by which they will

determine if they are required to notify their interest in, or a

change in their interest in, the share capital of the Company under

the FCA's Disclosure Guidance and Transparency Rules.

Enquiries :

Devolver Digital, Inc. ir@devolverdigital.com

Harry Miller, Executive Chairman

Douglas Morin, Chief Executive Officer

Daniel Widdicombe, Chief Financial Officer

Zeus (Nominated Adviser and Sole Broker)

Nick Cowles, Jamie Peel, Matt Hogg (Investment

Banking)

Ben Robertson (Equity Capital Markets) +44 (0)20 3829 5000

FTI Consulting (Financial PR) devolver@fticonsulting.com

Jamie Ricketts / Dwight Burden / Valerija +44 (0)20 3727 1000

Cymbal / Usama Ali

Devolver Digital overview

Devolver Digital is an award-winning video games publisher in

the indie games space with a balanced portfolio of third-party and

own-IP. The Company has an emphasis on premium games and has a back

catalogue of over 100 titles, with more than 30 titles in the

pipeline. Through recent acquisitions, Devolver now has its own-IP

franchises, in-house studios developing first-party IP and two

publishing brands. The Company is registered in Wilmington,

Delaware, USA.

The notification set out below is provided in accordance with

the requirements of Article 19 of the UK Market Abuse

Regulation.

Notification and public disclosure of transactions by persons

discharging managerial responsibilities and persons closely

associated with them.

Details of the person discharging managerial responsibilities/person

1. closely associated

a) Name Douglas Morin

-------------------------------- --------------------------------------

Reason for the notification

2.

------------------------------------------------------------------------

a) Position/status CEO

-------------------------------- --------------------------------------

b) Initial notification/Amendment Initial notification

-------------------------------- --------------------------------------

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

------------------------------------------------------------------------

a) Name Devolver Digital, Inc.

-------------------------------- --------------------------------------

b) LEI 213800PRI1918XI2H813

-------------------------------- --------------------------------------

Details of the transaction(s): section to be repeated

4 for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

------------------------------------------------------------------------

a) Description of the financial Common stock par value of $0.0001

instrument, type of instrument

Identification code ISIN: USU0858L1036

-------------------------------- --------------------------------------

b) Nature of the transaction Grant of Stock and Stock Units

-------------------------------- --------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

Nil consideration 154,454 RSUs

Nil consideration. 308,908 PSUs

Nil consideration 267,174 IPO Award

Shares

-------------------------------- --------------------------------------

d) Aggregated information Price Volume

Nil consideration 730,536

-------------------------------- --------------------------------------

e) Date of the transaction 12(th) December 2022

-------------------------------- --------------------------------------

f) Place of the transaction London Stock Exchange, AIM

---- -------------------------------- --------------------------------------

Details of the person discharging managerial responsibilities/person

1. closely associated

------------------------------------------------------------------------

a) Name Daniel Widdicombe

-------------------------------- --------------------------------------

Reason for the notification

2.

------------------------------------------------------------------------

a) Position/status CFO

-------------------------------- --------------------------------------

b) Initial notification/Amendment Initial notification

-------------------------------- --------------------------------------

Details of the issuer, emission allowance market participant,

3 auction platform, auctioneer or auction monitor

------------------------------------------------------------------------

a) Name Devolver Digital, Inc.

-------------------------------- --------------------------------------

b) LEI 213800PRI1918XI2H813

-------------------------------- --------------------------------------

Details of the transaction(s): section to be repeated

4 for (i) each type of instrument; (ii) each type of transaction;

(iii) each date; and (iv) each place where transactions

have been conducted

------------------------------------------------------------------------

a) Description of the financial Common stock par value of $0.0001

instrument, type of instrument

Identification code ISIN: USU0858L1036

-------------------------------- --------------------------------------

b) Nature of the transaction Grant of Stock and Stock Units

-------------------------------- --------------------------------------

c) Price(s) and volume(s) Price(s) Volume(s)

Nil consideration 119,684 RSUs

Nil consideration 239,368 PSUs

Nil consideration 187,884 IPO Award

Shares

-------------------------------- --------------------------------------

d) Aggregated information Price Volume

Nil consideration 546,936

-------------------------------- --------------------------------------

e) Date of the transaction 12(th) December 2022

-------------------------------- --------------------------------------

f) Place of the transaction London Stock Exchange, AIM

---- -------------------------------- --------------------------------------

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DSHFFEEFIEESEFE

(END) Dow Jones Newswires

December 16, 2022 02:00 ET (07:00 GMT)

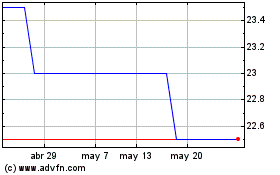

Devolver Digital (LSE:DEVO)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Devolver Digital (LSE:DEVO)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025