Edinburgh Investment Trust PLC Portfolio manager succession (4287O)

03 Octubre 2023 - 1:00AM

UK Regulatory

TIDMEDIN

RNS Number : 4287O

Edinburgh Investment Trust PLC

03 October 2023

THE EDINBURGH INVESTMENT TRUST PLC

LEI: 549300HV0VXCRONER808 Date: 3 OCTOBER 2023

Portfolio manager succession

The Directors of the Edinburgh Investment Trust plc ( the

"Company") have been informed by Liontrust Fund Partners LLP

("Liontrust") that James de Uphaugh, the Company's portfolio

manager, will retire in February 2024 after 36 years in the

industry. James will continue to manage the Company's portfolio

until February and will then be replaced as portfolio manager by

his colleague Imran Sattar. As part of the succession, Imran has

been appointed the Company's deputy portfolio manager, replacing

Chris Field who is due to retire from Liontrust in November. The

Directors thank James and Chris for their careful stewardship of

the Company's portfolio and strong investment results since the

appointment of the investment management team in March 2020.

Imran has been a member of the Liontrust Global Fundamental Team

("GFT") since 2018, managing UK equity client portfolios jointly

alongside James and Chris. Imran is also lead manager for another

UK equity strategy in his own right. Before joining the GFT, he was

a Managing Director and Fund Manager at Blackrock, where he managed

UK equity funds with combined assets of over GBP2 billion. Imran

joined Mercury Asset Management (now Blackrock) in 1997. He will

become head of the GFT in February 2024.

Once in place as the Company's portfolio manager, Imran will

continue to apply the same flexible investment process that has

been the hallmark of the portfolio since March 2020. Other than the

change of portfolio manager, there will be no change to the

Company's two investment objectives, strategy or the portfolio's

key features - namely a high conviction portfolio of 40 to 50

differentiated holdings, primarily invested in UK equities,

underpinned by fundamental company research. Imran, like James,

will also be supported by a collegiate team of nine fund managers

and analysts: the depth of experience across the GFT will be an

important factor to ensure the repeatability of attractive

long-term returns in the years ahead.

The Company's Chair, Elisabeth Stheeman, said:

"James oversaw the successful transition of the Company's

management to the Global Fundamental Team and has delivered

impressive investment performance in volatile market conditions.

Over this period, from 31 March 2020 to 28 September 2023, the Net

Asset Value per share (cum income, debt at fair value) has risen by

73.2% and the share price total return has risen by 80.2%, against

49.2% for the comparator index (the FTSE All Share)[1].

"Imran has a strong investment pedigree, deep knowledge of the

UK equity market, has long experience of managing large investment

portfolios, and has worked alongside James and Chris for many

years. He and his colleagues are well placed to build on the strong

foundations put in place since 2020 and we look forward to working

with him."

Enquiries

Edinburgh Investment Trust plc

Elisabeth Stheeman (Chair) via Montfort below

Liontrust Fund Partners LLP

James Mowat +44 20 3908 8822

Investec Bank plc

Tom Skinner +44 20 7597 4196

Montfort Communications

Gay Collins +44 7798 626282

Shireen Farhana +44 7757 299250

Ella Henderson +44 7762 245122

eit@montfort.london

Notes

The Company's twin objectives are (1) an increase of the Net

Asset Value per share in excess of the growth of the FTSE All-Share

index and (2) growth in dividends per share in excess of the rate

of inflation. To achieve this, the portfolio manager constructs a

high-conviction, differentiated and diversified portfolio of listed

equities. The investment approach is flexible and 'total return',

i.e. shareholder returns should come through a combination of

income and capital growth over the long term. Stocks that might be

labelled 'growth', 'value' and 'recovery' may all be held. At least

80% of assets are invested in UK-listed shares.

[1] Source: Liontrust Fund Partners LLP

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCUPGCAUUPWGAP

(END) Dow Jones Newswires

October 03, 2023 02:00 ET (06:00 GMT)

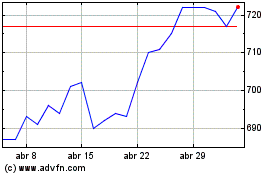

Edinburgh Investment (LSE:EDIN)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Edinburgh Investment (LSE:EDIN)

Gráfica de Acción Histórica

De May 2023 a May 2024