Endeavour Achieves First Gold Pour at Lafigué Mine in Côte d’Ivoire

ENDEAVOUR ACHIEVES FIRST GOLD POUR AT

LAFIGUÉ MINE IN CÔTE D’IVOIRE

Constructed in only 21 months · Delivered on

budget and ahead of schedule · Investment phase completed

HIGHLIGHTS:

- First gold pour at the

Lafigué mine achieved on budget and ahead of

schedule, only 21 months after construction launch

- Commercial production and

subsequent ramp-up to nameplate plant capacity of 4.0Mtpa expected

to be achieved in Q3-2024

- Over 17.8Mt of total

material moved since Q4-2023 with over 1.8Mt of ore at 1.37g/t

totalling over 80koz mined and stockpiled ahead of the processing

plant ramp-up

- Lafigué is expected to

produce between 90-110koz of gold at a sector leading AISC of

between $900-975/oz in FY-2024, with production increasing to

approximately 200koz in FY-2025

- The Lafigué mine is the

fifth project Endeavour has built in West Africa in the last ten

years, all of which have been delivered on budget and on or ahead

of schedule, in two years or less

|

Abidjan, 2 July

2024 – Endeavour Mining plc (LSE:EDV, TSX:EDV,

OTCQX:EDVMF) (“Endeavour”, the “Group” or the “Company”) is pleased

to announce that the first gold pour from the Lafigué mine in Côte

d’Ivoire was achieved on 28 June 2024, marking the successful

delivery of the project construction on budget and a quarter ahead

of schedule.

Ian Cockerill, CEO, commented “We are proud

to have achieved our first gold pour at Lafigué, which, alongside

the first gold pour at the Sabodala-Massawa BIOX®

expansion that we achieved in April, marks the successful

completion of the recent phase of investment and growth that we

started in Q2-2022. We now begin a new phase of increased free cash

flow generation, de-levering and enhanced shareholder

returns.

The Lafigué project is the fifth project

that we have successfully built in West Africa in the last decade,

which is a testament to the strength of our in-house project

construction team and is a demonstration of our competitive

advantage in West Africa, the world’s most prospective and largest

gold producing region.

Lafigué is an excellent example of our

ability to leverage this advantage by self-generating a project

pipeline. We discovered Lafigué for a cost of $31 million,

equivalent to an industry-low discovery cost of just $12 per ounce

of M&I resources. The project was quickly advanced through

technical studies and permitting, before construction was launched

in Q4-2022, and first gold was delivered only 21 months later for a

low capital intensity of approximately $150/oz of M&I

resources. In less than eight years we have transformed Lafigué

from a discovery to production, creating a cornerstone asset that

has the potential to produce over 200koz per year, at an industry

leading all-in sustaining cost of approximately $900/oz for at

least 13 years, improving the quality of our existing

portfolio.

We believe this level of value creation is

repeatable in West Africa, and we have already identified the

Assafou deposit on the Tanda-Iguela property in Côte d’Ivoire,

where we have delineated a top tier resource and another potential

cornerstone asset, which will underpin our next phase of organic

growth in a few years time.

With the current phase of organic growth

completed, we are now focused on quickly ramping up our recent

development projects to maximise their returns and support our

near-term capital allocation priorities of de-levering our balance

sheet and enhancing our shareholder returns.”

Since the start of wet commissioning on 30 May

2024, approximately 77kt of ore has been processed through the

Lafigué processing plant, with all circuits operating in line with

expectations. The first gold pour included gold from both the

gravity and CIL circuits, and yielded approximately 380 ounces of

gold. The Lafigué mine is expected to achieve commercial production

and ramp up to its nameplate capacity of 4.0Mtpa in Q3-2024.

Figure 1: First gold pour at the

Lafigué mine

Please refer to figure in attached press release

Figure 2: Paul Day, General Manager

at Lafigué with the first gold bar poured at the

mine

Please refer to figure in attached press release

ABOUT THE LAFIGUÉ MINE

The Lafigué mine is located towards the northern

end of the Birimian aged Oumé-Fetekro greenstone belt, in

north-central Côte d’Ivoire, approximately 500km from Abidjan by

road. The Lafigué deposit is located in the northeast part of the

Fetekro exploration permit, adjacent to existing infrastructure,

including sealed paved roads and high voltage grid power. Endeavour

has an 80% ownership stake in the Lafigué mine (with 10% owned by

the Ivorian Government and 10% owned by SODEMI, a state-owned

mining company) and a 100% ownership stake in the remainder of the

Fetekro exploration licence.

Endeavour began exploration on the Fetekro

property in March 2017, following a strategic assessment of its

exploration tenements which identified the project as a top

priority target. To date, only a limited portion of the Fetekro

property has been explored, as the priority has been the

delineation of the Lafigué deposit. A maiden Mineral Resource

Estimate for the Lafigué deposit was published on 29 October 2018

and subsequently updated on 3 September 2019, 18 August 2020 and 15

May 2022. A Preliminary Economic Assessment (“PEA”) was published

on 18 August 2020 and a Preliminary Feasibility Study (“PFS”) was

completed with the effective date of 31 December 2020.

Construction of the Lafigué project in Côte

d'Ivoire was launched in Q4-2022, following the completion of a

Definitive Feasibility Study (“DFS”) which confirmed Lafigué’s

potential to be a cornerstone asset for Endeavour. The 2022 DFS

contemplates a 12.8 year LOM with average annual production of

203koz at a low AISC of $871/oz, with an initial capital cost of

$448 million. The project DFS displayed robust economics at an

$1,800/oz gold price assumption including an after-tax

NPV5% of $870m and an after-tax IRR of 33%. For FY-2024,

Lafigué is expected to produce between 90-110koz at an AISC of

between $900-975/oz.

As at 31 December 2023, Proven and Probable

reserves totalled 49.8Mt at 1.69 g/t containing 2.7Moz of gold and

Measured and Indicated resources (inclusive of reserves) totalled

46.2Mt at 2.04 g/t containing 3.0Moz of gold.

Given the strong exploration potential,

Endeavour is targeting the discovery of 1.2 – 1.8Moz of Indicated

resources across the Lafigué mining permit and the wider Fetekro

exploration permit area over the 2021 to 2025 period at a discovery

cost of $14/oz. To date 0.6Moz, or 50% of the lower end of the

target, has been discovered.

QUALIFIED PERSONS

Mark Morcombe, COO of Endeavour Mining plc., a

Fellow of the Australasian Institute of Mining and Metallurgy, is a

"Qualified Person" as defined by National Instrument 43-101 -

Standards of Disclosure for Mineral Projects ("NI 43-101") and has

reviewed and approved the technical information in this news

release.

CONTACT INFORMATION

Jack Garman

Vice President, Investor Relations

+44 203 011 2723

jack.garman@endeavourmining.com |

Brunswick Group LLP in London

Carole Cable, Partner

+44 207 404 5959

ccable@brunswickgroup.com |

ABOUT ENDEAVOUR MINING PLC

Endeavour Mining is one of the world’s

senior gold producers and the largest in West Africa, with

operating assets across Senegal, Cote d’Ivoire and Burkina Faso and

a strong portfolio of advanced development projects and exploration

assets in the highly prospective Birimian Greenstone Belt across

West Africa.

A member of the World Gold Council,

Endeavour is committed to the principles of responsible mining and

delivering sustainable value to its employees, stakeholders and the

communities where it operates. Endeavour is listed on the London

and Toronto Stock Exchanges, under the symbol EDV.

For more information, please visit

www.endeavourmining.com.

CAUTIONARY NOTE REGARDING

FORWARD-LOOKING INFORMATION

This news release contains "forward-looking

statements" within the meaning of applicable securities laws.

All statements, other than statements of historical fact, are

"forward-looking statements". Generally, these forward-looking

statements can be identified by the use of forward-looking

terminology such as "expects", "expected", "budgeted", "forecasts",

and "anticipates".

Forward-looking statements, while based on

management's best estimates and assumptions, are subject to risks

and uncertainties that may cause actual results to be materially

different from those expressed or implied by such forward-looking

statements, including but not limited to: risks related to the

successful integration of acquisitions; risks related to

international operations; risks related to general economic

conditions and credit availability, actual results of current

exploration activities, unanticipated reclamation expenses; changes

in project parameters as plans continue to be refined; fluctuations

in prices of metals including gold; fluctuations in foreign

currency exchange rates, increases in market prices of mining

consumables, possible variations in ore reserves, grade or recovery

rates; failure of plant, equipment or processes to operate as

anticipated; accidents, labour disputes, title disputes, claims and

limitations on insurance coverage and other risks of the mining

industry; delays in the completion of development or construction

activities, changes in national and local government regulation of

mining operations, tax rules and regulations, and political and

economic developments in countries in which Endeavour operates.

Although Endeavour has attempted to identify important factors that

could cause actual results to differ materially from those

contained in forward-looking statements, there may be other factors

that cause results not to be as anticipated, estimated or intended.

There can be no assurance that such statements will prove to be

accurate, as actual results and future events could differ

materially from those anticipated in such statements. Accordingly,

readers should not place undue reliance on forward-looking

statements. Please refer to Endeavour's most recent Annual

Information Form filed under its profile at www.sedarplus.ca for

further information respecting the risks affecting Endeavour and

its business.

- 240702 - NR - Lafigue First Gold

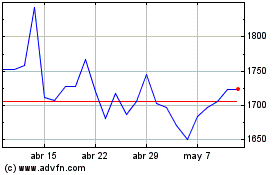

Endeavour Mining (LSE:EDV)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Endeavour Mining (LSE:EDV)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024