TIDMEGL

RNS Number : 7817Z

Ecofin Global Utilities Inf Tst PLC

18 May 2023

ECOFIN GLOBAL UTILITIES AND INFRASTRUCTURE TRUST PLC

Interim Financial Results for the six months ended 31 March

2023

Announcement of Unaudited Results

LEI: 2138005JQTYKU92QOF30

This announcement contains regulated information.

Ecofin Global Utilities and Infrastructure Trust plc (the

"Company" or "EGL") is an authorised UK investment trust whose

objectives are to achieve a high, secure dividend yield on a

portfolio invested primarily in the equities of utility and

infrastructure companies in developed countries and long-term

growth in the capital value of the portfolio while preserving

shareholders' capital in adverse market conditions.

-- During the half-year ended 31 March 2023, the Company's net

asset value ("NAV") per share increased by 3.7% on a total return

basis. The Company's share price decreased by 0.6% on a total

return basis over the 6 months

-- Two quarterly dividends were paid during the period totalling

3.80p per share. With effect from the dividend paid in February

2023, the quarterly dividend was increased to 1.95p per share (7.8p

per share per annum)

-- NAV total return has matched the total return of the MSCI

World Index since inception and outpaced it over five years, three

years and one year

Financial Highlights

as at 31 March 2023

As at or six months

to As at or year to

Summary 31 March 2023 30 September 2022

----------------------------------------- -------------------- -------------------

Net assets attributable to shareholders

(GBP000) 242,560 233,052

Net asset value ("NAV") per share(1) 212.07p 208.14p

----------------------------------------- -------------------- -------------------

Share price (mid-market) 213.00p 218.00p

Premium to NAV(1) 0.4% 4.7%

----------------------------------------- -------------------- -------------------

Revenue return per share 2.02p 6.42p

Dividends paid per share 3.80p 7.20p

Dividend yield(1,2) 3.5% 3.3%

Gearing on net assets(1,3) 11.0% 11.0%

Ongoing charges ratio(1,4) 1.33% 1.35%

----------------------------------------- -------------------- -------------------

1. Please refer to Alternative Performance Measures in the

Interim Report.

2. Dividends paid (annualised) as a percentage of share

price.

3. Gearing is the Company's borrowings (including the net

amounts due from/to brokers) less cash divided by net assets

attributable to shareholders.

4. The ongoing charges figure is calculated in accordance with

guidance issued by the Association of Investment Companies ("AIC")

as the

operating costs (annualised) divided by the average NAV (with

income) throughout the period.

3 years 5 years Since

admission(5) Since admission

Performance for % % %

periods to 31 March

2023 6 months 1 year % per annum

(all total return

in GBP) % % %

--------------------------- ---------- ------- -------- -------- -------------- ----------------

NAV per share(6) 3.7 0.7 61.8 95.6 96.1 10.9

Share price(6) -0.6 -0.7 67.8 129.7 149.6 15.1

--------------------------- ---------- ------- -------- -------- -------------- ----------------

Indices(6, 7) :

S&P Global Infrastructure

Index 3.8 2.0 51.3 44.6 42.8 5.6

MSCI World Utilities

Index 0.6 0.6 28.5 59.3 55.9 7.0

MSCI World Index 6.8 -0.6 60.6 71.3 96.1 10.9

FTSE All-Share

Index 12.2 2.8 47.7 27.6 39.5 5.2

FTSE ASX Utilities

Index 21.0 1.5 47.5 74.9 38.6 5.1

Source: Bloomberg, Ecofin

5. The Company was incorporated on 27 June 2016 and its

investment activities began on 13 September 2016 when the liquid

assets of Ecofin Water & Power Opportunities plc ("EWPO") were

transferred to it. The formal inception date for the measurement of

the Company's performance is 26 September 2016, the date its shares

were listed on the London Stock Exchange.

6. Total return includes dividends paid and reinvested

immediately. Please also refer to the Alternative Performance

Measures in the Annual Report.

7. The S&P Global Infrastructure Index and MSCI World

Utilities Index are the global sector indices deemed the most

appropriate for performance comparison purposes. The Company does

not have a formal benchmark index. The other indices are provided

for general interest.

Chairman's Statement

Performance

Your Company performed well in a difficult six months during

which economic and market expectations fluctuated. The net asset

value (NAV) total return was 3.7% over the six months to 31 March,

including the reinvestment of dividends, and the share price total

return was -0.6%. The MSCI World Utilities Index and the S&P

Global Infrastructure Index produced total returns of 0.6% and 3.8%

respectively in sterling terms. In comparison, global equities,

measured by the MSCI World Index, returned 6.8%.

The fundamental investment case for our universe of clean energy

development and infrastructure renewal companies continued to

strengthen during the period. The outlook for earnings and growth

held up well while there was no further bad news about windfall tax

and government policies. The benefits of a balanced portfolio

showed through: good performance in continental Europe outweighed

dual headwinds of share price weakness in North America and the

strengthening of the pound against the dollar. More details on

performance are to be found in the Investment Manager's report.

Since EGL launched in September 2016, the NAV total return and

the share price total return have averaged 10.9% and 15.1% per

annum respectively . NAV total return has matched the total return

of the MSCI World Index since inception and outpaced it over five

years, three years and one year.

Dividends

We announced in December an increase in the quarterly dividend

to 1.95p per share (7.8p per annum) with effect from the dividend

paid in February 2023, helped by the growth in income from the

Company's portfolio despite higher finance costs: your Company has

a conservative level of borrowings, the price of which is tied to

market interest rates.

Share price and share issuance

During the half-year, the Company's share price traded on

average at a 1.3% discount to NAV. Market demand pushed the share

price to trade at a premium to NAV sufficiently often for EGL to

issue a total of 2,411,000 shares, raising GBP5.2 million during

the period. Another 1,920,577 shares have been issued since the end

of March. This continues a pattern of new share issuance which

began in April 2020, responding to daily demand and helping to

reduce cost ratios and improve liquidity in the shares.

Outlook

Since 31 March (to 12 May), the Company's NAV has increased by

1.6% and the share price by 2.3% (both on a total return

basis).

EGL's portfolio companies derive most of their revenues and cash

flows from businesses which benefit from structural growth

opportunities including the move to renewable energy generation and

the upgrades of water, waste and transportation infrastructure.

These companies combine reliable growth with very resilient

business models, providing reassurance in the current economic

environment.

Our Investment Manager is confident that portfolio investment

income will continue to grow this year, more than covering the

extra costs of EGL's modest level of borrowings. Your Company is

well placed to continue to achieve its performance objectives.

David Simpson

Chairman

18 May 2023

Investment Manager's Report

Markets and our sectors

After several quarters of declines and with the geopolitical and

economic headlines continuing to be bleak, a strong equity market

rally took hold as this half-year period began. Bond yields were

still increasing quickly, interest rates and inflation were rising

almost everywhere and the US dollar was hitting 20 year peaks but

equity markets were, as usual, ahead of events. Utilities, even

though they had performed very well for the previous year,

participated in the recovery rally and so did the more cyclical

stocks in the infrastructure universe. Before long, bond yields

started to decline, inflation forecasts moderated and sterling was

recovering. The much-anticipated recession failed to arrive.

Sterling's strong bounce against the US dollar during the fourth

quarter of 2022 (+8.2%) masked the extent of the global equity

market rally for UK based investors: the MSCI World Index increased

by almost 10% in local currency terms but by only 1.1% in sterling

terms. The S&P Global Infrastructure Index's 10.8% gain was

trimmed to 2.9% when expressed in sterling terms.

In early 2023, China's much anticipated post-COVID reopening

boosted the outlook for the global economy but also inflation and,

thereby, expectations for central bank rate hikes. However, energy

prices started a steep decline in late December and US natural gas

prices returned to levels not seen since 2021. European natural gas

prices also fell significantly from 2022 averages, helped by

conservation, but remained much higher than prior year levels.

Lower gas and electricity prices improved the outlook for

inflation, economic activity and corporate profitability,

particularly in Europe where the energy crisis of 2022 presented

the biggest threat. This backdrop sustained the rally for equities,

which notably excluded utilities.

March's banking turmoil had little sustained effect on equity

markets or bond yields but attention did turn back to more

defensive equities which had been trailing year-to-date. Global

equities rose in March resulting in a 5.7% advance in sterling

terms over the first calendar quarter.

During the half-year, earnings reports were strong for most of

EGL's utility, water and waste management and transportation

infrastructure companies, guidance ranges moved higher in several

cases, and companies' growth outlooks were almost all reaffirmed.

Windfall tax uncertainty for power utilities began to lift across

Europe too; by and large, measures that were settled appeared fair

and would not discourage the vast investment in renewables capacity

expansion required.

From a policy perspective, we saw developments in Europe's

response to the US Inflation Reduction Act (IRA) via the Net Zero

Industry Act (NZIA). So far, the NZIA doesn't deliver enough

certainty to offer a meaningful counterpunch to the IRA and

persuade corporates to arrive at investment decisions. Details will

come though and it is likely that decisions taken at sovereign

state level will provide more material incentives for large scale

investment and domestic manufacturing. Regarding the longer term

project of power market reform, the drafts suggest evolution not

revolution, which somewhat de-risks potential policy curveballs for

utilities and renewables developers in Europe.

Performance summary

Over the 6 months, EGL's NAV increased by 3.7%, in line with the

global listed infrastructure index (+3.8%) and better than the

sub-set of global utilities (+0.6%). Global equities rose by 6.8%.

Sterling's strong appreciation against the US dollar reduced

portfolio performance by 5.1 percentage points (and it impacted the

US dollar-heavy global indices by even more).

The dispersion of returns across regions was remarkable: whether

looking at the local sector indices or the portfolio's regional

performances, pan-European stocks provided strongly positive

returns whereas US utilities, sometimes treated like bond proxies,

fell, lagging by about 15% over the 6 months. The contribution to

NAV was equally lop-sided: The fifteen best contributors were

European and spanned utilities (led by Enel, Endesa, E.ON, SSE and

Engie), environmental services (Veolia) and transportation

infrastructure (Vinci, Ferrovial), while the poorest performers

during the period were North American clean energy specialists

(NextEra Energy, Dominion Energy, NextEra Energy Partners,

Constellation, TransAlta Renewables), Chinese holdings (China

Longyuan Power and China Water Affairs) and Drax. Drax gave back

some of its 2022 stock price gains, given uncertainty around UK

government approval of its Carbon Capture and Sequestration project

and declining power prices.

Last year's clean energy 'winners', propelled by higher power

prices and the structural growth catalysts inherent in the energy

transition and the IRA, suffered harsh profit taking in early 2023.

Elevated interest rates were a source of concern for businesses

which 'borrow to grow', as were higher equipment costs, trade

policy issues, permitting delays, and transmission and

interconnection constraints. Falling electricity prices, even

though they remained above pre-2022 levels, will have reduced the

sub-sector's appeal too, even if many companies now have limited

exposure to merchant prices.

Conversely, shares such as Enel, E.ON and Veolia, which had

performed poorly in the previous year, recovered very swiftly when

interest rates pulled back, the severe pressures on power retailing

were alleviated, and economic growth prospects in Europe

improved.

NextEra Energy's shares and those of its yieldco NextEra Energy

Partners were a drag on the NAV (together -1.4% over 6 months). We

believe this is attributable to the factors mentioned above,

compounded by the unexpected retirement of the CEO of NextEra's

Florida utility and an investigation into its lobbying activities

in Florida which rumbles on. This overshadowed good earnings

reports which included NextEra extending its growth outlook to 2026

for EPS (6-8% p.a.) and dividends per share (10% p.a.).

Purchases and sales

We made adjustments in the portfolio, considering the

opportunities presented by volatility and our strategy to increase

the portfolio's exposure to environmental services and

transportation infrastructure while reducing power price

sensitivity. In this respect the largest purchases were of China

Water Affairs and ENAV.

China Water Affairs is a large Chinese integrated water operator

providing raw water, tap water, sewage treatment and related

services. The company's direct drinking water business should

deliver mid-double digit growth as single-use plastic bottle

regulations become more stringent, and the regulated water supply

business will benefit from structural asset base growth driven by

greater urbanisation and population growth. The stock has yet to

perform but we expect it will, given the low valuation, 5% dividend

yield and even higher dividend per share growth.

ENAV is a long-standing portfolio holding that was promoted into

the top 10 during the period. The company is the monopoly supplier

of Italian air traffic control and air navigation services (for

civilian aircraft and drones), and the only air navigation service

provider in the world listed on a stock exchange. Revenues are

highly regulated and growing (based on the number of flights rather

than each plane's occupancy), and cash flow generation is

strong.

We also increased the portfolio's holdings in Drax (after profit

taking last year), DTE Energy and National Grid. National Grid's

almost fully regulated business presents an attractive combination

of defensiveness, inflation protection and superior growth as the

company invests heavily in electricity networks. After considerable

share price weakness, we also added to AES, China Suntien Green

Energy and Enel.

Holdings in Acciona Energias and Redes Energeticas Nacionais

were sold; the positions had been profitable and we saw better

value elsewhere. Another material source of cash (and profit) was

the completion of the nationalisation of EDF in Januar y.

In the portfolio analysis in the Interim Report, you may notice

a new sector category named 'Environmental services'. This is to

better cater for and illustrate the portfolio's holdings in this

area which have grown with the additions of Veolia and China Water

Affairs over the last year (American Water Works and Essential

Utilities have been long-standing holdings).

Income and gearing

Gearing averaged 12% over the half-year (in line with fiscal

2022's average) and was 11% at 31 March. Our models indicate

another solid year for portfolio investment income growth. We

expect the increase in income will be more than sufficient to cover

the significantly higher cost of borrowings.

Strategy

EGL's diversified portfolio of infrastructure equities has

performed satisfactorily through the significant stress tests of

the last year. We are now seeing a welcome stabilisation in

interest rates with bond yields discounting significant reductions

in inflation and rates in the next few years. Gas and power prices

are back to pre-crisis levels, providing an attractive pricing

environment for utilities and the potential for good returns for

renewables developers. For the next two years, most generators are

broadly hedged so sensitivity to power prices will be limited.

Lower natural gas prices will translate into lower customer bills,

lessening the risk of clawback from power producers by governments

seeking to reduce customer bills.

We believe that earnings guidance for utilities is conservative,

being based on normalised power price assumptions but higher

interest and capital expenditure related costs. Earnings per share

growth targets are generally in the region of 6-8% per annum.

Transportation infrastructure businesses are growing and investing

to accomplish necessary renewal. This segment of EGL's essential

assets investment universe may be less recession- resistant but

companies have the benefit of inflation-linkage in their contracts

and regulated returns. We expect that the valuations in the listed

segment will continue to be attractive to private equity. In EGL's

sectors we can find an appealing combination of growth and

defensiveness, often in the same company. Our focus on quality of

earnings and balance sheet strength is not new but worth

reiterating.

We remain optimistic that the favourable policy support for

decarbonisation and electrification, the relative competitiveness

of renewables, and the ever-rising demand for energy price

stability will continue to provide strong tailwinds for this

strategy. Our focus on essential assets and asset-backed services

should continue to do well in most market environments while

undemanding share valuations lend downside protection.

Ecofin Advisors Limited

Investment Manager

18 May 2023

Condensed Statement of Comprehensive Income

Six months ended Six months Year ended

ended 30 September 2022

31 March 2023 (unaudited) 31 (audited)

March 2022 (unaudited)

-------------------- ----- ----------------------------------------------------------- ----------------------------

Revenue Capital Total Revenue Capital Total Revenue Capital Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------------- ----- --------- -------- ------------------ -------- -------- -------- -------- --------

Gains on investments

held at

fair value through

profit or loss - 5,961 5,961 - 25,233 25,233 - 16,129 16,129

Foreign exchange

gains/(losses) - 1,397 1,397 - (281) (281) - (3,076) (3,076)

Income 2 3,799 - 3,799 3,408 - 3,408 9,835 - 9,835

Investment

management

fees (466) (698) (1,164) (534) (534) (1,068) (1,089) (1,089) (2,178)

Administration

expenses (464) - (464) (374) - (374) (885) - (885)

-------------------- ----- --------- -------- ---------- ------ -------- -------- -------- -------- --------

Net return before

finance

costs and taxation 2,869 6,660 9,529 2,500 24,418 26,918 7,861 11,964 19,825

Finance costs (200) (300) (500) (26) (26) (52) (118) (118) (236)

-------------------- ----- --------- -------- ---------- ------ -------- -------- -------- -------- --------

Net return before

taxation 2,669 6,360 9,029 2,474 24,392 26,866 7,743 11,846 19,589

Taxation 3 (392) - (392) (205) - (205) (1,104) - (1,104)

-------------------- ----- --------- -------- ---------- ------ -------- -------- -------- -------- --------

Net return before

taxation 2,277 6,360 8,637 2,269 24,392 26,661 6,639 11,846 18,485

-------------------- ----- --------- -------- ---------- ------ -------- -------- -------- -------- --------

Return per ordinary

share (pence) 4 2.02 5.63 7.65 2.24 24.13 26.37 6.42 11.46 17.88

-------------------- ----- --------- -------- ---------- ------ -------- -------- -------- -------- --------

The total column of the Condensed Statement of Comprehensive

Income is the profit and loss account of the Company.

The revenue and capital columns are supplementary to this and

are published under guidance from the AIC.

All revenue and capital returns in the above statement derive

from continuing operations. No operations were acquired or

discontinued during the six months ended 31 March 2023.

The Company has no other comprehensive income and therefore the

net return on ordinary activities after taxation is also the total

comprehensive income for the period.

Condensed Statement of Financial Position

As at As at As at

31 March 2023 30 September

31 March 2022 2022 (audited)

(unaudited) GBP'000

(unaudited)

Notes GBP'000

GBP'000

-------------------------------- --------------------------------------------------------------------- ---------------

Non-current assets

Equity securities valued at

fair

value through profit or loss 268,709 250,226 258,334

-------------------------------- ----- -------------------------------- ---------------------------- ---------------

Current assets

Debtors and prepayments 2,388 1,132 1,409

2,388 1,132 1.409

-------------------------------- ----- -------------------------------- ---------------------------- ---------------

Creditors: amounts falling due

within

one year

Prime brokerage borrowings (24,419) (29,484) (25,613)

Other creditors (4,118) (937) (1,078)

-------------------------------- ----- -------------------------------- ---------------------------- ---------------

(28,537) (30,421) (26,691)

-------------------------------- ----- -------------------------------- ---------------------------- ---------------

Net current liabilities (26,149) (29,289) (25,282)

-------------------------------- ----- -------------------------------- ---------------------------- ---------------

Net assets 242,560 220,937 233,052

-------------------------------- ----- -------------------------------- ---------------------------- ---------------

Share capital and reserves

Called-up share capital 5 1,143 1,013 1,119

Share premium 45,930 16,763 40,801

Special reserve 114,971 116,459 116,976

Capital reserve 6 80,516 86,702 74,156

Revenue reserve - - -

-------------------------------- ----- -------------------------------- ---------------------------- ---------------

Total shareholders' funds 242,560 220,937 233,052

-------------------------------- ----- -------------------------------- ---------------------------- ---------------

NAV per ordinary share (pence) 7 212.07 217.97 208.14

-------------------------------- ----- -------------------------------- ---------------------------- ---------------

Condensed Statement of Changes in Equity

Six months ended 31 March 2023 (unaudited)

-----------------------------------------------------------------------------------------------------------

Share

Share premium Special Capital Revenue

capital account reserve(1) reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------------------------------------------------------ ------------ ----------- -------- -------- --------

Balance at 1 October

2022 1,119 40,801 116,976 74,156 - 233,052

Return after taxation - - - 6,360 2,277 8,637

Issue of ordinary shares 24 5,129 - - - 5,153

Dividends paid (see note

8) - - (2,005) - (2,277) (4,282)

----------------------------- ----------------------------------------------- ------------ ----------- -------- -------- --------

Balance at 31 March

2023 1,143 45,930 114,971 80,516 - 242,560

--- ----------------------------- ----------------------------------------------- ------------ ----------- -------- -------- --------

Six months ended 31 March 2022 (unaudited)

-----------------------------------------------------------------------------------------------------------

Share Special

premium reserve Capital Revenue

Share capital account (1) reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- ----------------------------------------------- ------------ ----------- -------- -------- --------

Balance at 1 October

2021 1,007 15,500 117,730 62,310 - 196,547

Return after taxation - - - 24,392 2,269 26,661

Issue of ordinary shares 6 1,263 - - - 1,269

Dividends paid (see

note 8) - - (1,271) - (2,269) (3,540)

--------------------------------- ----------------------------------------------- ------------ ----------- -------- -------- --------

Balance at 31 March

2022 1,013 16,763 116,459 86,702 - 220,937

--------------------------------- ----------------------------------------------- ------------ ----------- -------- -------- --------

Year ended 30 September 2022 (audited)

-----------------------------------------------------------------------------------------------------------

Share Special

premium reserve Capital Revenue

Share capital account (1) reserve reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------------- ----------------------------------------------- ------------ ----------- -------- -------- --------

Balance at 1 October

2021 1,007 15,500 117,730 62,310 - 196,547

Return after taxation - - - 11,846 6,639 18,485

Issue of ordinary shares 112 25,301 - - - 25,413

Dividends paid (see

note 8) - - (754) - (6,639) (7,393)

--------------------------------- ----------------------------------------------- ------------ ----------- -------- -------- --------

Balance at 30 September

2022 1,119 40,801 116,976 74,156 - 233,052

--------------------------------- ----------------------------------------------- ------------ ----------- -------- -------- --------

1. The special reserve may be used, where the board considers it

appropriate, by the Company for the purposes of paying dividends

to

shareholders and, in particular, smoothing payments of dividends

to shareholders.

Condensed Statement of Cash Flows

Six months Six

months Year

ended

ended ended 30

September

Notes 31 March

2023 31 March

2022 2022

(unaudited)

(unaudited)

(audited)

GBP'000 GBP'000

GBP'000

----------------------------------------------------------------------------------------------------------------------------------------------------------------------------

Net return before finance costs and taxation 9,529 26,918 19,825

(Decrease)/increase in accrued expenses (29) 87 228

Overseas withholding tax (489) (315) (786)

Deposit interest income (3) (13) (37)

Dividend income (3,796) (3,395) (9,798)

Foreign exchange (gains)/losses 12 (1,397) 281 3,076

Dividends received 3,589 3,309 9,462

Deposit interest received 3 13 37

Interest paid (500) (52) (236)

Gains on investments (5,961) (25,233) (16,129)

Increase/(decrease) in other debtors 1 (5) 1

---------------------------------------------------------------------------- ----------------------------------------- ---------------------------------------------------

Net cash flow from operating activities 947 1,595 5,643

Investing activities

Purchases of investments (46,338) (39,921) (76,989)

Sales of investments 44,317 36,181 56,277

---------------------------------------------------------------------------- ----------------------------------------- ---------------------------------------------------

Net cash generated from/(used in) investing

activities (2,021) (3,740) (20,712)

Financing activities

Movement in prime brokerage borrowings 203 (6,389) (10,260)

Dividends paid 8 (4,282) (3,540) (7,393)

Share issue proceeds 5,153 1,104 25,413

---------------------------------------------------------------------------- ----------------------------------------- ---------------------------------------------------

Net cash generated from/(used in)

financing activities 1,074 (8,825) 7,760

---------------------------------------------------------------------------- ----------------------------------------- ---------------------------------------------------

Decrease in cash - (10,970) (7,309)

---------------------------------------------------------------------------- ----------------------------------------- ---------------------------------------------------

Analysis of changes in cash during

the period 12

Opening balance - 11,251 11,251

Foreign exchange movement - (281) (3,942)

Decrease in cash - (10.970) (7,309)

---------------------------------------------------------------------------- ----------------------------------------- ---------------------------------------------------

Closing balances - - -

---------------------------------------------------------------------------- ----------------------------------------- ---------------------------------------------------

Foreign exchange gains for the period to 31 March 2023 are

associated with the Company's prime brokerage borrowings.

Notes to the Condensed Financial Statements

for the six months ended 31 March 2023

1. Accounting policies

(a) Basis of preparation

The Condensed Financial Statements have been prepared in

accordance with Financial Reporting Standard ("FRS") 104 Interim

Financial Reporting and with the Statement of Recommended Practice

'Financial Statements of Investment Trust Companies and Venture

Capital Trusts' issued in July 2022. The Condensed Financial

Statements are prepared in Sterling which is the functional

currency of the Company and rounded to the nearest GBP'000. They

have also been prepared on a going concern basis and approval as an

investment trust has been granted by HMRC.

The Condensed Financial Statements have been prepared using the

same accounting policies as the preceding Financial Statements

which were prepared in accordance with Financial Reporting Standard

102.

The financial information contained in this Interim Report does

not constitute statutory accounts as defined in Sections 434-436 of

the Companies Act 2006. The financial information for the periods

ended 31 March 2023 and 31 March 2022 has not been audited.

The information for the year ended 30 September 2022 has been

extracted from the latest published audited Financial Statements

which have been filed with the Registrar of Companies. The report

of the Auditor on those accounts contained no qualification or

statement under Section 498 of the Companies Act 2006.

(b) Income

Income from investments, including taxes deducted at source, is

included in revenue by reference to the date on which the

investment is quoted ex-dividend. Special dividends are credited to

capital or revenue, according to the circumstances. The fixed

returns on debt securities are recognised on a time apportionment

basis so as to reflect the effective yield on the debt securities.

Interest receivable from cash and short-term deposits is treated on

an accruals basis.

(c) Expenses

All expenses are accounted for on an accruals basis. Expenses

are charged to the revenue account except where they directly

relate to the acquisition or disposal of an investment, in which

case they are charged to the capital account; in addition, expenses

are charged to the capital account where a connection with the

maintenance or enhancement of the value of the investments can be

demonstrated. In this respect , since 1 October 2022 the management

fee and overdraft interest have been allocated 60% to the capital

account and 40% to the revenue account (previously 50% to the

capital account and 50% to the revenue account).

(d) Taxation

The charge for taxation is based on the profit for the year to

date and takes into account, if applicable, taxation deferred

because of timing differences between the treatment of certain

items for taxation and accounting purposes. Deferred taxation is

provided using the liability method on all timing differences,

calculated at the rate at which it is anticipated the timing

differences will reverse. Deferred tax assets are recognised only

when, on the basis of available evidence, it is more likely than

not that there will be taxable profits in future against which the

deferred tax asset can be offset.

Due to the Company's status as an investment trust company and

the intention to continue meeting the conditions required to obtain

approval in the foreseeable future, the Company has not provided

deferred tax on any capital gains and losses arising on the

revaluation or disposal of investments.

The tax effect of different items of income/gain and

expenditure/loss is allocated between capital and revenue within

the Condensed Statement of Comprehensive Income on the same basis

as the particular item to which it relates using the Company's

effective rate of tax for the year, based on the marginal

basis.

(e) Valuation of investments

For the purposes of preparing the Condensed Financial

Statements, the Company has applied Sections 11 and 12 of FRS 102

in respect of financial instruments. All investments are measured

initially and subsequently at fair value and transaction costs are

expensed immediately. Investment transactions are accounted for on

a trade date basis. The fair value of the financial instruments in

the Condensed Statement of Financial Position is based on their

quoted bid price at the reporting date, without deduction of the

estimated future selling costs. Changes in the fair value of

investments held at fair value through profit or loss and gains and

losses on disposal are recognised in the Condensed Statement of

Comprehensive Income as "Gains on investments held at fair value

through profit or loss". Also included within this caption are

transaction costs in relation to the purchase or sale of

investments, including the difference between the purchase price of

an investment and its bid price at the date of purchase.

(f) Cash and cash equivalents

Cash comprises cash in hand and demand deposits. Cash

equivalents are short-term, highly liquid investments that are

readily convertible to known amounts of cash and that are subject

to insignificant risk of change in value.

(g) Borrowings

Short-term borrowings, which comprise of prime brokerage

borrowings, are recognised initially at the fair value of the

consideration received, net of any issue expenses, and subsequently

at amortised cost using the effective interest method. The finance

costs, being the difference between the net proceeds of borrowings

and the total amount of payments required to be made in respect of

those borrowings, accrue evenly over the life of the borrowings and

are allocated 40% to revenue and 60% to capital.

(h) Segmental reporting

The directors are of the opinion that the Company is engaged in

a single segment of business activity, being investment

business.

Consequently, no business segmental analysis is provided.

(i) Nature and purpose of reserves

Share premium account

The balance classified as share premium includes the premium

above nominal value received by the Company on issuing shares

net

of issue costs.

Special reserve

The special reserve arose following court approval in November

2016 to transfer GBP123,609,000 from the share premium account.

This reserve is distributable and may be used, where the board

considers it appropriate, by the Company for the purposes of paying

dividends to shareholders and, in particular, augmenting or

smoothing payments of dividends to shareholders. There is no

guarantee that the board will in fact make use of this reserve for

the purpose of the payment of dividends to shareholders. The

special reserve can also be used to fund the cost of share

buy-backs.

Capital reserve

Gains and losses on disposal of investments and changes in fair

values of investments are transferred to the capital account.

Foreign exchange differences of a capital nature are also

transferred to the capital account. The capital element of the

management fee and relevant finance costs are charged to this

account. Any associated tax relief is also credited to this

account.

Revenue reserve

This reserve reflects all income and costs which are recognised

in the revenue column of the Statement of Comprehensive Income.

The Company's special reserve, capital reserve and revenue

reserve may be distributed by way of dividend.

(j) Foreign currency

Monetary assets and liabilities and non-monetary assets held at

fair value in foreign currencies are translated into sterling at

the rates of exchange ruling at the Condensed Statement of

Financial Position date. Transactions involving foreign currencies

are converted at the rate ruling on the date of the transaction.

Gains and losses on the translation of foreign currencies are

recognised in the revenue or capital account of the Condensed

Statement of Comprehensive Income depending on the nature of the

underlying item.

(k) Dividends payable

Dividends are recognised in the period in which they are

paid.

2. Income

Six months

ended Six

months ended

Year ended

31 March 2023

31 March 2022

30 September

2022

GBP'000

GBP'000

GBP'000

---------------------------------------------------------------------------------------------------------------------------------------------------

Income from investments (revenue account)

UK dividends 470 332 1,254

Overseas dividends 3,214 2,726 7,966

Stock dividends 112 337 578

----------------------------------------------------------------------------- ----------------- -------------------------------------------------

3,796 3,395 9,798

----------------------------------------------------------------------------- ----------------- -------------------------------------------------

Other income (revenue account)

Deposit interest 3 13 37

----------------------------------------------------------------------------- ----------------- -------------------------------------------------

Total income 3,799 3,408 9,835

----------------------------------------------------------------------------- ----------------- -------------------------------------------------

During the six months ended 31 March 2022, the Company received

no special dividends (31 March 2022: GBPnil and 30 September 2022:

GBP416,000).

3. Taxation

The taxation charge for the period, and the comparative periods,

represents withholding tax suffered on overseas dividend

income.

4. Return per ordinary share

Six months Year ended

Six months ended ended 30 September

31 March 2023 31 March 2022 2022

p p p

--------------------------------------- ----------------- --------------- --------------

Revenue return 2.02 2.24 6.42

Capital return 5.63 24.13 11.46

--------------------------------------- ----------------- --------------- --------------

Total return 7.65 26.37 17.88

--------------------------------------- ----------------- --------------- --------------

The returns per share are based

on the following:

Six months Year ended

Six months ended ended 30 September

31 March 2023 31 March 2022 2022

GBP'000 GBP'000 GBP'000

--------------------------------------- ----------------- --------------- --------------

Revenue return 2,277 2,269 6,639

Capital return 6,360 24,392 11,846

--------------------------------------- ----------------- --------------- --------------

Total return 8,637 26,661 18,485

--------------------------------------- ----------------- --------------- --------------

Weighted average number of ordinary

shares in issue 112,886,269 101,121,775 103,375,349

5. Ordinary share capital

31 March 2023 31 March 2022 30 September

2022

------------- ---------------------- ------- ------------ -------

Number GBP'000 Number GBP'000 Number GBP'000

----------------------------- ------------- ---------------------- ------- ------------ -------

Issued and fully paid

Ordinary shares of 1p each 111,968,423 1,119 100,738,423 1,007 100,738,423 1,007

Issue of new ordinary shares 2,411,000 24 625,000 6 11,230,000 112

Ordinary shares of 1p each 114,379,423 1,143 101,363,423 1,013 111,968,423 1,119

----------------------------- ------------- ----- --------------- ------- ------------ -------

The Company was admitted to the Main Market of the London Stock

Exchange on 26 September, 2016. The total number of ordinary shares

in the Company in issue immediately following admission was

91,872,247, each with equal voting rights. During the period, the

Company issued 2,411,000 (31 March 2022: 625,000 and 30 September

2022: 11,230,000) ordinary shares with net proceeds of GBP5,153,000

(31 March 2022: GBP5,269,000 and 30 September 2022:

25,413,000).

Since 31 March 2023 the Company has issued 1,920,577 ordinary

shares for net proceeds of GBP4,109,791.

6. Capital reserve

31 March 2023

31 March 2022

30 September

2022

GBP'000

GBP'000

GBP'000

----------------------------------------------------------------------------------------------------------------------------------------------------

Opening balance 74,156 62,310 62,310

Movement in investment holding gains (1,518) 17,051 3,073

Gains on realisation of investments at

fair value 7,479 8,182 13,056

Currency gains/(losses) 1,397 (281) (3,076)

Investment management fees (698) (534) (1,089)

Finance costs (300) (26) (118)

---------------------------------------------------------------------- ---------------------- ----------------------------------------------------

80,516 86,702 74,156

---------------------------------------------------------------------- ---------------------- ----------------------------------------------------

The capital reserve reflected in the Condensed Statement of

Financial Position at 31 March 2023 includes gains of GBP37,832,000

(31 March 2022: gains of GBP53,328,000 and 30 September 2022: gain

of GBP39,349,000) which relate to the revaluation of investments

held at the reporting date.

7. NAV per ordinary share

As at As at As at

31 March 2023 31 March 30 September

2022 2022

------------------------------ --------------- ------------ --------------

Net asset value attributable

(GBP'000) 242,560 220,937 233,052

Number of ordinary shares in

issue 114,379,423 101,363,423 111,968,423

------------------------------ --------------- ------------ --------------

NAV per share 212.07p 217.97p 208.14p

------------------------------ --------------- ------------ --------------

8. Dividends on ordinary shares

Six months Six months Year ended

ended ended 30 September

31 March 31 March 2022

2023 2022 GBP'000

GBP'000 GBP'000

---------------------------------------- ----------- ----------- --------------

Fourth interim for 2021 of 1.65p (paid

30 November 2021) - 1,666 1,666

First interim for 2022 of 1.65p (paid

26 February 2022) - 1,874 1,874

Second interim for 2022 of 1.85p (paid

31 May 2022) - - 1,893

Third interim for 2022 of 1.85p (paid

31 August 2022) - - 1,960

Fourth interim dividend for 2022 of 2,082 - -

1.85p (paid on 30 November 2022)

First interim dividend for 2023 of 2,200 - -

1.95p (paid on 28 February 2023)

---------------------------------------- ----------- ----------- --------------

4,282 3,540 7,393

---------------------------------------- ----------- ----------- --------------

A second interim dividend for 2023 of 1.95p will be paid on 31

May 2023 to shareholders on the register on 28 April 2023. The

ex-dividend date was 27 April 2023.

9. Transaction costs

During the period expenses were incurred in acquiring or

disposing of investments classified as fair value through profit or

loss. These have been expensed through capital and are included

within gains on investments in the Condensed Statement of

Comprehensive Income. The total costs were as follows:

Six months ended Six months Year ended

31 March 2023 ended 30 September

GBP'000 31 March 2022

2022 GBP'000

GBP'000

----------- ----------------- ----------- --------------

Purchases 104 69 138

Sales 18 13 25

----------- ----------------- ----------- --------------

122 82 163

----------- ----------------- ----------- --------------

The above transaction costs are calculated in line with AIC's

Statement of Recommended Practice (SORP). The transaction costs in

the Company's Key Information Document are calculated on a

different basis and in line with the EU's Packaged Retail

Investment and Insurance-based Products (PRIIPs) regulations.

10. Fair value hierarchy

FRS 102 requires an entity to classify fair value measurements

using a fair value hierarchy that reflects the significance of the

inputs used in making the measurements. The fair value hierarchy

shall have the following levels:

Level 1: unadjusted quoted prices in an active market for

identical assets or liabilities that the entity can access at the

measurement date;

Level 2: inputs other than quoted prices included within Level 1

that are observable (i.e. developed using market data) for the

asset or liability, either directly or indirectly; and

Level 3: inputs are unobservable (i.e. for which market data is

unavailable) for the asset or liability.

The financial assets and liabilities measured at fair value in

the Condensed Statement of Financial Position are grouped into the

fair value hierarchy at the reporting date as follows:

Level

Level 1 Level 2 3 Total

As at 31 March 2023 Notes GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- ------- --------- --------- --------- ---------

Financial assets at fair

value through profit or loss

Quoted equities a) 246,316 4,393 - 268,709

Total 246,316 4,393 - 268,709

---------------------------------------- --------- --------- --------- ---------

Level 1 Level 2 Level 3 Total

As at 31 March 2022 Notes GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- ------- --------- --------- --------- ---------

Financial assets at fair

value through profit or loss

Quoted equities a) 246,051 4,175 - 250,226

Total 246,051 4,175 - 250,226

---------------------------------------- --------- --------- --------- ---------

Level 1 Level 2 Level 3 Total

As at 30 September 2022 Notes GBP'000 GBP'000 GBP'000 GBP'000

------------------------------- ------- --------- --------- --------- ---------

Financial assets at fair

value through profit or loss

Quoted equities a) 258,334 - - 258,334

Total 258,334 - - 258,334

---------------------------------------- --------- --------- --------- ---------

a) Equities and preference shares

The fair value of the Company's investments in equities and

preference shares has been determined by reference to their quoted

bid prices at the reporting date. Equities and preference shares

included in Fair Value Level 1 are actively traded on recognised

stock exchanges. Investments categorised as Level 2 are not

considered to trade in active markets.

11. Related party transactions and transactions with the

Investment Manager

Fees payable to the directors and their interests in shares of

the Company are considered to be related party transactions and are

disclosed within the Directors' Remuneration Report on pages 30 and

32 of the 2022 Report and Accounts. The balance of fees due to

directors at the period end was GBPnil (31 March 2022: GBPnil and

30 September 2022: GBPnil).

The Company has an agreement with Ecofin Advisors Limited for

the provision of investment management services.

The investment management fee is calculated at 1.00% per annum

of the Company's NAV on the first GBP200 million and 0.75% per

annum of NAV thereafter, payable quarterly in arrears. The

management fee was chargeable 50% to revenue and 50% to capital

until 30 September 2022. With effect from 1 October 2022 the

management fee is chargeable 40% to revenue and 60% to capital.

During the period GBP1,164,000 (31 March 2022: GBP1,068,000 and

30 September 2022: GBP2,178,000) of investment management fees were

earned by Ecofin Advisors Limited, with a balance of GBP580,000 (31

March 2022: GBP539,000 and 30 September 2022: GBP562,000) being

payable to Ecofin Advisors Limited at the period end.

12. Analysis of changes in net debt

As at Currency As at

30 September Differences Cash flows 31 March

2022 2023

GBP'000 GBP'000 GBP'000 GBP'000

----------------------------- ------------ ----------- ------------------------------------

Cash and short term deposits - - - -

Debt due within one year (25,613) 1,397 (203) (24,419)

----------------------------- ------------ ----------- -------------- --------------------

(25,613) 1,397 (203) (24,419)

----------------------------- ------------ ----------- -------------- --------------------

As at Currency As at

30 September 2021 differences 31 March

GBP'000 GBP'000 Cash flows 2022

GBP'000 GBP'000

-------------------- ------------------ ------------ ---------- ---------

Cash and short term

deposits 11,251 (281) (10,970) -

Debt due within one

year (35,873) - 6,389 (29,484)

-------------------- ------------------ ------------ ---------- ---------

(24,622) (281) (4,581) (29,484)

-------------------- ------------------ ------------ ---------- ---------

A statement reconciling the movement in net funds to the net

cash flow has not been presented as there are no differences from

the above analysis.

Interim Management Report

The principal and emerging risks and uncertainties that could

have a material impact on the Company's performance have not

changed from those set out on pages 16 to 18 of the Company's

Annual Report for the year ended 30 September 2022.

The directors consider that the Chairman's Statement and the

Investment Manager's Report set out herein, the above disclosure on

related party transactions and the Directors' Responsibility

Statement below, together constitute the Interim Management Report

of the Company for the six months ended 31 March 2023 and satisfy

the requirements of Disclosure Guidance and Transparency Rules

4.2.3 to 4.2.11 of the Financial Conduct Authority.

The Interim Report has not been reviewed or audited by the

Company's Auditor.

Directors' Responsibility Statement

The directors listed in the Interim Report confirm that to the

best of their knowledge:

(i) the condensed set of Financial Statements has been prepared

in accordance with FRS 104 (Interim Financial Reporting) and

give

a true and fair review of the assets, liabilities, financial

position and profit and loss of the Company as required by

Disclosure Guidance and Transparency Rule 4.2.4 R;

(ii) the Interim Management Report includes a fair review, as

required by Disclosure Guidance and Transparency Rule 4.2.7 R, of

important events that occurred during the six months ended 31 March

2023 and their impact on the condensed set of Financial Statements,

and a description of the principal risks and uncertainties for the

remaining six months of the financial year; and

(iii) the Interim Management Report includes a fair review of

the information concerning related party transactions as required

by Disclosure Guidance and Transparency Rule 4.2.8 R.

This Interim Report was approved by the board on 18 May 2023 and

the Directors' Responsibility Statement was signed on its behalf

by:

Susannah Nicklin

Director

18 May 2023

Interim Report 2023

The Interim Report will be available on the Investment Manager's

website www.ecofininvest.com/eg l . A copy of the Interim Report

for the six months ended 31 March 2023 will be submitted to the

National Storage Mechanism of the FCA and will shortly be available

for inspection at:

https://data.fca.org.uk/#/nsm/nationalstoragemechanism . The

financial information for the period ending 31 March 2023 comprises

non-statutory accounts within the meaning of Sections 434 - 436 of

the Companies Act 2006.

For further information, please contact:

Faith Pengelly

For and on behalf of

Maitland Administration Services Limited

Company Secretary

Tel: 01245 950 317

18 May 2023

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BLGDUGGBDGXR

(END) Dow Jones Newswires

May 18, 2023 02:00 ET (06:00 GMT)

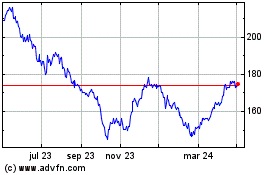

Ecofin Global Utilities ... (LSE:EGL)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

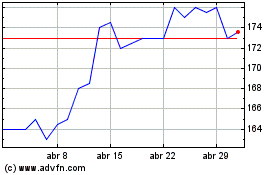

Ecofin Global Utilities ... (LSE:EGL)

Gráfica de Acción Histórica

De May 2023 a May 2024