Net other - - - - (646,046) (646,046)

------------- ---------- --------------- -------------- -------------- -------------

Total 938,383 158 236,563 (31,571) (649,390) 494,143

------------- ---------- --------------- -------------- -------------- -------------

* Cash and cash equivalents have been presented with loans and receivables.

** Financial liabilities are held at amortised cost.

*** In the prior year financial investments included mortgages secured

on residential property which are classified as held for sale in

the current year.

(b) Fair value hierarchy

The fair value measurement basis used to value those financial

assets and financial liabilities held at fair value is categorised

into a fair value hierarchy as follows:

Level 1: fair values measured using quoted bid prices

(unadjusted) in active markets for identical assets or liabilities.

This category includes listed equities in active markets, listed

debt securities in active markets and exchange-traded

derivatives.

Level 2: fair values measured using inputs other than quoted

prices included within level 1 that are observable for the asset or

liability, either directly (i.e. as prices) or indirectly (i.e.

derived from prices). This category includes listed debt or equity

securities in a market that is not active and derivatives that are

not exchange-traded.

Level 3: fair values measured using inputs for the asset or

liability that are not based on observable market data

(unobservable inputs). This category includes unlisted debt and

equities, including investments in venture capital, and suspended

securities. Where a look-through valuation approach is applied,

underlying net asset values are sourced from the investee and

adjusted to reflect illiquidity where appropriate, with the fair

values disclosed being directly sensitive to this input.

There have been no transfers between investment categories in

the current year.

Analysis of fair value measurement bases Fair value measurement

at the

end of the reporting

period based on

-----------------------------

Level Level Level Total

1 2 3

GBP000 GBP000 GBP000 GBP000

At 31 December 2014

Financial assets at fair value through

profit or loss

Financial investments

Equity securities 269,347 209 20,349 289,905

Debt securities 591,542 4,485 238 596,265

Total financial assets at fair value through

profit or loss 860,889 4,694 20,587 886,170

--------- ------- --------- ---------

At 31 December 2013

Financial assets at fair value through

profit or loss

Financial investments

Equity securities 276,660 270 19,390 296,320

Debt securities 636,330 5,416 317 642,063

Derivatives - 158 - 158

--------- ------- --------- ---------

Total financial assets at fair value through

profit or loss 912,990 5,844 19,707 938,541

--------- ------- --------- ---------

Fair value measurements based on level 3

Fair value measurements in level 3 for the Group consist of

financial assets, analysed as follows:

Financial assets at fair

value

through profit and loss

----------------------------------

Equity Debt

securities securities Total

GBP000 GBP000 GBP000

At 31 December 2014

Opening balance 19,390 317 19,707

Total gains/(losses) recognised in profit or

loss 959 (79) 880

Closing balance 20,349 238 20,587

----------- ----------- --------

Total gains/(losses) for the period included

in profit or loss for assets

held at the end of the reporting period 959 (79) 880

----------- ----------- --------

At 31 December 2013

Opening balance 18,558 6,176 24,734

Total gains/(losses) recognised in profit or

loss 832 (5,782) (4,950)

Disposal proceeds - (77) (77)

----------- ----------- --------

Closing balance 19,390 317 19,707

----------- ----------- --------

Total gains/(losses) for the period included

in profit or loss for assets

held at the end of the reporting period 832 (5,782) (4,950)

----------- ----------- --------

All the above gains or losses included in profit or loss for the period

are presented in net investment return within the statement of profit

or loss.

(c) Interest rate risk

The Group's exposure to interest rate risk arises primarily from

movements on financial investments that are measured at fair value

and have fixed interest rates, which represent a significant

proportion of the Group's assets, and from those insurance

liabilities for which discounting is applied at a market interest

rate. Investment strategy is set in order to control the impact of

interest rate risk on anticipated Group cash flows and asset and

liability values. The fair value of the Group's investment

portfolio of fixed income securities reduces as market interest

rates rise as does the present value of discounted insurance

liabilities, and vice versa.

Interest rate risk concentration is reduced by adopting

asset-liability duration matching principles where appropriate.

Excluding assets held to back the long-term business, the average

duration of the Group's fixed income portfolio is two years (2013:

two years), reflecting the relatively short-term average duration

of its general insurance liabilities. The mean term of discounted

general insurance liabilities is disclosed in note 27 (a) part (iv)

to the full financial statements.

For the Group's long-term insurance funeral plan business,

benefits payable to policyholders are independent of the returns

generated by interest-bearing assets. Therefore the interest rate

risk on the invested assets supporting these liabilities is borne

by the Group. This risk can be mitigated by purchasing fixed

interest investments with durations that precisely match the

profile of the liabilities. For funeral plan policies, benefits are

linked to the Retail Prices Index (RPI). Assets backing these

liabilities are also linked to the RPI, and include index-linked

gilts and corporate bonds. For practical purposes it is not

possible to exactly match the durations due to the uncertain

profile of liabilities (e.g. mortality risk) and the availability

of suitable assets, therefore some interest rate risk will persist.

The Group monitors its exposure by comparing projected cash flows

for these assets and liabilities and making appropriate adjustments

to its investment portfolio.

The table below summarises the maturities of long-term business

assets and liabilities that are exposed to interest rate risk.

Maturity

---------------------------

Within Between After

1 year 1 & 5 5 years Total

Group long-term business years

GBP000 GBP000 GBP000 GBP000

At 31 December 2014

Assets

Debt securities 1,053 24,311 79,490 104,854

Cash and cash equivalents 1,924 - - 1,924

------- -------- -------- ---------

2,977 24,311 79,490 106,778

------- -------- -------- ---------

Liabilities

Long-term business provision 6,014 21,816 66,494 94,324

------- -------- -------- ---------

At 31 December 2013

Assets

Debt securities 1,104 27,024 73,075 101,203

Cash and cash equivalents 2,214 - - 2,214

------- -------- -------- ---------

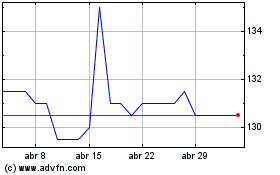

Ecclesiastl.8fe (LSE:ELLA)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

Ecclesiastl.8fe (LSE:ELLA)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025