3,318 27,024 73,075 103,417

------- -------- -------- ---------

Liabilities

Long-term business provision 6,125 22,200 64,121 92,446

------- -------- -------- ---------

Group financial investments with variable interest rates,

including cash and cash equivalents, insurance instalment

receivables and mortgage loans are subject to cash flow interest

rate risk. This risk is not significant to the Group.

(d) Credit risk

The Group has exposure to credit risk, which is the risk of

non-payment of their obligations by counterparties and financial

markets borrowers. Areas where the Group is exposed to credit risk

are:

-- reinsurers' share of insurance liabilities (excluding

provision for unearned premiums) and amounts due from reinsurers in

respect of claims already paid;

-- deposits held with banks;

-- amounts due from insurance intermediaries and policyholders;

and

-- counterparty default on loans and debt securities.

The carrying amount of financial and reinsurance assets

represents the Group's maximum exposure to credit risk. The Group

structures the levels of credit risk it accepts by placing limits

on its exposure to a single counterparty. Limits on the level of

credit risk are regularly reviewed.

Reinsurance is used to manage insurance risk. This does not,

however, discharge the Group's liability as primary insurer. If a

reinsurer fails to pay a claim for any reason, the Group remains

liable for the payment to the policyholder. The creditworthiness of

reinsurers is considered on a regular basis through the year by

reviewing their financial strength. The Group Reinsurance Security

Committee assesses, monitors and approves the creditworthiness of

all reinsurers, reviewing relevant credit ratings provided by the

recognised credit rating agencies, as well as other publicly

available data and market information. The Committee also monitors

the balances outstanding from reinsurers and maintains an approved

list of reinsurers.

There has been no significant change in the recoverability of

the Group's reinsurance balances during the year with all

reinsurers on the 2014 reinsurance programme having a minimum

rating of 'A-' from Standard & Poor's or an equivalent agency

at the time of purchase, with the exception of MAPFRE RE whose

rating was adversely impacted by the sovereign rating of Spain.

However, MAPFRE RE was upgraded by Standard & Poor's to 'A-' in

February 2014 and then to 'A' in May 2014 with a stable

outlook.

Group cash balances are regularly reviewed to identify the

quality of the counterparty bank and to monitor and limit

concentrations of risk.

The Group's credit risk policy details prescriptive methods for

the collection of premiums and control of intermediary and

policyholder debtor balances. The level and age of debtor balances

are regularly assessed via monthly credit management reports. These

reports are scrutinised to assess exposure in more than one region

in respect of aged or outstanding balances. Any such balances are

likely to be major international brokers who are in turn monitored

via credit reference agencies and considered to pose minimal risk

of default. The Group has no material concentration of credit risk

in respect of amounts due from insurance intermediaries and

policyholders due to the well-diversified spread of such

debtors.

Collateral is held over loans secured by mortgages. The debt

securities portfolio consists of a range of mainly fixed interest

instruments including government securities, local authority

issues, corporate loans and bonds, overseas bonds, preference

shares and other interest-bearing securities. Limits are imposed on

the credit ratings of the corporate bond portfolio and exposures

regularly monitored. Group investments in unlisted securities

represent less than 1% of this category in the current and prior

year. The Group's exposure to counterparty default on debt

securities is spread across a variety of geographical and economic

territories, as follows:

2014 2013

GBP000 GBP000

UK 424,480 463,879

Australia 87,037 93,283

Canada 60,162 58,629

Europe 24,586 26,272

Total 596,265 642,063

--------- ---------

(e) Liquidity risk

Liquidity risk is the risk that funds may not be available to

pay obligations when due. The Group is exposed to daily calls on

its available cash resources mainly from claims arising from

insurance contracts. An estimate of the timing of the net cash

outflows resulting from insurance contracts is provided in note 27

to the full financial statements. The Group has robust processes in

place to manage liquidity risk and has available cash balances,

other readily marketable assets and access to funding in case of

exceptional need. This is not considered to be a significant risk

to the Group.

Non-derivative financial liabilities consist of finance leases,

which are not material to the Group, and other liabilities for

which a maturity analysis is included in note 30 to the full

financial statements.

(f) Currency risk

The Group operates internationally and its main exposures to

foreign exchange risk are noted below. The Group's foreign

operations generally invest in assets and purchase reinsurance

denominated in the same currencies as their insurance liabilities,

which mitigates the foreign currency exchange rate risk for these

operations. As a result, foreign exchange risk arises from

recognised assets and liabilities denominated in other currencies

and net investments in foreign operations. The Group mitigates this

risk through the use of derivatives from time to time.

The Group exposure to foreign currency risk within the

investment portfolios arises from purchased investments that are

denominated in currencies other than sterling.

The Group foreign operations create two sources of foreign

currency risk:

-- the operating results of the Group foreign branches and

subsidiaries in the Group financial statements are translated at

the average exchange rates prevailing during the period; and

-- the equity investment in foreign branches and subsidiaries is

translated into sterling using the exchange rate at the year end

date.

The largest currency exposures with reference to net

assets/liabilities are shown below, representing effective

diversification of resources.

2014 2013

GBP000 GBP000

Aus $ 45,571 Aus $ 43,053

Can $ 34,757 Can $ 33,044

Euro 14,625 Euro 12,828

NZ $ 10,969 US $ 1,479

Japanese Japanese

Yen 1,047 Yen 1,130

(g) Equity price risk

The Group is exposed to equity price risk because of financial

investments held by the Group which are stated at fair value

through profit or loss. The Group mitigates this risk by holding a

diversified portfolio across geographical regions and market

sectors, and through the use of derivative contracts from time to

time which would limit losses in the event of a fall in equity

markets.

The concentration of equity price risk by geographical listing,

before the mitigating effect of derivatives, to which the Group is

exposed is as follows:

2014 2013

GBP000 GBP000

UK 264,716 UK 273,650

Europe 20,442 Europe 19,393

Canada 2,583 Canada 1,909

US 1,950 US 979

Other 214 Other 389

--------- ---------

Total 289,905 Total 296,320

--------- ---------

(h) Market risk sensitivity analysis

The sensitivity of profit and other equity reserves to movements

on market risk variables (comprising interest rate, currency and

equity price risk), each considered in isolation, is shown in the

following table:

Group Potential increase / (decrease) in Potential increase / (decrease) in

profit other equity reserves

Change in

Variable variable 2014 2013 2014 2013

GBP000 GBP000 GBP000 GBP000

Interest rate risk -100 basis points (4,284) (254) (15) (121)

+100 basis points 1,243 (4,769) 18 131

Currency risk -5% 1,388 811 3,794 3,513

5% (1,318) (770) (3,605) (3,337)

Equity price risk +/- 5% 11,379 11,371 - -

The following assumptions have been made in preparing the above

sensitivity analysis:

-- the value of fixed income investments will vary inversely

with changes in interest rates, and all territories experience the

same interest rate movement;

-- currency gains and losses will arise from a change in the

value of sterling against all other currencies moving in

parallel;

-- equity prices will move by the same percentage across all

territories; and

-- change in profit is stated net of tax at the standard rate

applicable in each of the Group's territories.

(i) Capital management

The Group's primary objectives when managing capital are to:

-- comply with the regulators' capital requirements of the

markets in which the Group operates; and

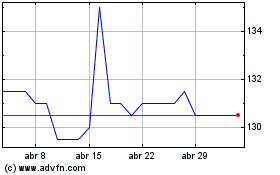

Ecclesiastl.8fe (LSE:ELLA)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Ecclesiastl.8fe (LSE:ELLA)

Gráfica de Acción Histórica

De May 2023 a May 2024