-- safeguard the Group's ability to continue to meet

stakeholders' expectations, in accordance with its corporate

mission, vision and values.

The Group is subject to insurance solvency regulations in all

the territories in which it issues insurance and investment

contracts, and capital is managed and evaluated on the basis of

regulatory capital.

In the UK, the Group and its UK regulated entities are required

to comply with rules issued by the Financial Conduct Authority

(FCA) and the Prudential Regulation Authority (PRA), and submit PRA

returns detailing levels of regulatory capital held. Regulatory

capital should be in excess of the higher of two amounts. The first

is an amount which is calculated by applying fixed percentages to

premiums and claims (general insurance business) or by applying

fixed percentages to insurance liabilities and applying stress

testing (long-term business). The second is an economic capital

assessment by the regulated entity, which the PRA reviews and may

amend by issuing Individual Capital Guidance. The Group sets

internal capital standards above the PRA's minimum requirement. For

overseas business the relevant capital requirement is the minimum

requirement under the local regulatory regime. Both the Group and

the regulated entities within it have complied with all externally

imposed capital requirements throughout the current and prior

year.

Regulated subsidiaries are restricted in the amount of cash

dividends they transfer to the parent entity in order for them to

meet their individual minimum capital requirements. The Group's

total available capital resources are disclosed in note 27 (b) to

the full financial statements.

Segmental information

(a) Operating segments

The Group segments its business activities on the basis of differences in the products and

services offered and, for general insurance, the underwriting territory. This reflects the

management and internal Group reporting structure. Group activities that are not reportable

operating segments on the basis of size are included within an 'Other activities' category.

The activities of each operating segment are described below.

- General business

United Kingdom

The Group's principal general insurance business operation is in the UK, where it operates

under the Ecclesiastical and Ansvar brands.

Australia

The Group has a wholly-owned subsidiary in Australia underwriting general insurance business

under the Ansvar brand.

Canada

The Group operates a general insurance Ecclesiastical branch in Canada.

Ireland

The Group operates an Ecclesiastical branch in the Republic of Ireland underwriting general

business across the whole of Ireland.

Central operations

This includes the Group's internal reinsurance function, corporate underwriting costs, adverse

development cover sold to ACS (NZ) Limited and operations that are in run-off or not reportable

due to their immateriality.

- Investment management

The Group provides investment management services both internally and to third parties through

Ecclesiastical Investment Management Limited.

- Broking and Advisory

The Group provides insurance broking through South Essex Insurance Brokers Limited and financial

advisory services through Ecclesiastical Financial Advisory Services Limited.

- Life business

Ecclesiastical Life Limited provides long-term insurance policies to support funeral planning

products. It is closed to new business.

- Other activities

This includes corporate costs relating to acquisition and disposal of businesses.

Inter-segment and inter-territory transfers or transactions are entered into under normal

commercial terms and conditions that would also be available to unrelated third parties.

Segment revenue

The Group uses gross written premiums as the measure for

turnover of the general and life insurance business segments.

Turnover of the non-insurance segments comprises fees and

commissions earned in relation to services provided by the Group to

third parties. Segment revenues do not include net investment

return or general business fee and commission income, which are

reported within revenue in the consolidated statement of profit or

loss.

2014 2013

Gross Non- Gross Non-

written insurance written insurance

premiums services Total premiums services Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

General business

United Kingdom 234,000 - 234,000 291,338 - 291,338

Australia 40,083 - 40,083 45,669 - 45,669

Canada 39,365 - 39,365 41,172 - 41,172

Ireland 11,528 - 11,528 13,606 - 13,606

Central operations 3,654 - 3,654 807 - 807

---------- ---------- --------- --------- ---------- ---------

Total 328,630 - 328,630 392,592 - 392,592

Life business 167 - 167 6,753 - 6,753

Investment management - 12,045 12,045 - 10,535 10,535

Broking and Advisory - 9,865 9,865 - 8,031 8,031

---------- ---------- --------- --------- ---------- ---------

Group revenue 328,797 21,910 350,707 399,345 18,566 417,911

---------- ---------- --------- --------- ---------- ---------

Group revenues are not materially concentrated on any single external customer.

Segment result

General business segment results comprise the insurance

underwriting profit or loss, investment activities and other

expenses of each underwriting territory. The Group uses the

industry standard net combined operating ratio (COR) as a measure

of underwriting efficiency. The COR expresses the total of net

claims costs, commission and underwriting expenses as a percentage

of net earned premiums.

The life business segment result comprises the profit or loss on

insurance contracts (including return on assets backing liabilities

in the long-term fund), shareholder investment return and other

expenses.

All other segment results consist of the profit or loss before

tax measured in accordance with IFRS.

2014 Combined

operating Insurance Investments Other Total

ratio GBP000 GBP000 GBP000 GBP000

General business

United Kingdom 94.1% 9,765 23,360 70 33,195

Australia 106.2% (1,129) 7,619 (139) 6,351

Canada 94.2% 1,662 1,598 - 3,260

Ireland 93.2% 594 288 - 882

Central operations (1,693) - - (1,693)

---------- ------------ ------- --------

95.9% 9,199 32,865 (69) 41,995

Life business (178) 1,522 (4) 1,340

Investment management - 3,164 - 3,164

Broking and Advisory - - 2,071 2,071

Other activities - - (416) (416)

---------- ------------ ------- --------

Profit before tax 9,021 37,551 1,582 48,154

---------- ------------ ------- --------

2013 Combined

operating Insurance Investments Other Total

ratio GBP000 GBP000 GBP000 GBP000

General business

United Kingdom 95.3% 9,815 59,726 (114) 69,427

Australia 114.8% (4,182) 3,913 (2) (271)

Canada 104.0% (1,142) 1,459 - 317

Ireland 186.4% (9,068) 385 - (8,683)

Central operations (3,666) - - (3,666)

---------- ------------ ------- --------

102.9% (8,243) 65,483 (116) 57,124

Life business 367 6,627 (5) 6,989

Investment management - 1,728 - 1,728

Broking and Advisory - - 1,689 1,689

Other activities - - (593) (593)

---------- ------------ ------- --------

Profit before tax (7,876) 73,838 975 66,937

---------- ------------ ------- --------

(b) Geographical information

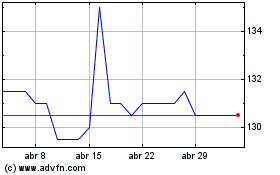

Ecclesiastl.8fe (LSE:ELLA)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Ecclesiastl.8fe (LSE:ELLA)

Gráfica de Acción Histórica

De May 2023 a May 2024