TIDMEQLS

RNS Number : 5125Y

Equals Group PLC

07 September 2022

7 September 2022

Equals Group plc

('Equals' or the 'Group')

Interim Results

'Significant revenue growth, record Adjusted EBITDA, return to

statutory profit and strong balance sheet'

Equals (AIM: EQLS) , the fintech payments group focused on the

SME marketplace, announces its interim results for the six months

ended 30 June 2022 (the 'period' or 'H1-2022') and an update on

trading for the period from 1 July 2022 to 5 September 2022

('Q3-2022').

H1-2022: Financial Summary

H1-2022 H1-2021 Change

GBP millions GBP millions % (***)

Underlying transaction values 4,169 2,434 +71%

Revenue 31.4 16.9 +86%

Gross profit 14.9 10.3 +44%

Contribution 14.1 9.9 +42%

Adjusted EBITDA* 4.9 1.6 +203%

Operating Profit /(Loss) 1.1 (2.2)

Profit / (loss) after Taxation

and R&D credits 0.8 (1.2)

EPS (Basic, in pence) 0.38 (0.70)

Operational** cash in/(out) flows 4.7 0.8

Cash at bank 16.5 10.1 +63%

Notes

* Adjusted EBITDA is defined as operating profit before:

depreciation, amortisation, impairment charges and share option

charges and items of an exceptional nature. EBITDA is defined as

operating profit before depreciation and amortisation.

** Operational cashflows are before earn-outs and R&D

credits.

***Percentages are calculated based on underlying rather than

rounded figures.

H1-2022: Financial Highlights

-- Record revenue performance with an 86% increase to GBP31.4

million (H1-2021: GBP16.9 million) with GBP6.3 million derived

from the Solutions platform (H1-2021: GBP0.3 million)

-- 44% increase in Gross profit to GBP14.9 million (H1-2021:

GBP10.3 million)

-- 203% increase in Adjusted EBITDA* to GBP4.9 million (H1-2021:

GBP1.6 million) with GBP1.8 million contribution from Q1-2022

and GBP3.1 million in Q2-2022 (Q1-2021: GBP1.4 million; Q2-2021:

GBP0.2 million)

-- Statutory profit achieved with statutory PBT at GBP0.9 million

(H1-2021: loss of GBP2.2 million)

-- Basic EPS at 0.38 pence against a loss per share of 0.70 pence

in H1-2021

-- Cash per share increased 62.5% to 9.1 pence (30 June 2021:

5.6 pence)

H1-2022: Operational and Product Highlights

-- Continued focus on sales and marketing to corporate (B2B/SME) customers driving growth

-- Hiring of highly experienced Chief Commercial Officer ('CCO')

plus expansion of revenue generating headcount in sales and

marketing teams

-- Direct integration into SEPA enabling rapid transactional capability in Euros

-- Equals Money cards live on new platform supporting physical

and virtual cards with 21-currency capabilities

-- More investment into compliance via automation and hiring experienced staff

-- Progressed people agenda with 360 appraisals and staff

retention measures in difficult labour market

Q3-2022 Trading (1 July 2022 to 5 September 2022) and

Outlook

-- Strong performance continued with revenues of GBP13.3 million

in the period, an increase of 55% over the same period in

2021

-- Year-to-date revenue of GBP44.7 million, which already exceeds

full-year performance in 2021

-- Revenues per day of GBP289k, compared to GBP187k in the same

period in 2021

-- Continued growth in Solutions revenues at GBP3.1 million compared

to GBP1.1 million in same period in 2021

-- Positive distributable reserves allowing the Board to consider

a future dividend policy

-- Cash generation allowed the CBILS loan of GBP1.8 million to

be repaid in full in August 2022

-- Strong cash position permits further working capital to drive

the card business, platform investments, and strategic acquisitions

Commenting on the Interim Results, Ian Strafford-Taylor, CEO of

Equals Group plc, said:

"This is an outstanding set of results with record revenue and

EBITDA cementing our extremely successful transition into cash

generation and, ultimately, a return to the first statutory profit

since 2018.

"It also reflects the three-year investment cycle into platform,

connectivity and compliance which, alongside our operational pivot

towards corporate customers, has enabled the business to go from

strength to strength. Our performance has of course been delivered

by the hard work and dedication of every Equals team member who I

am immensely proud of and, on behalf of the Board, would like to

thank for their continued support and exceptional work ethic.

"Trading in Q3-2022 has continued to be robust, despite global

economic uncertainty and inflationary pressures, with strong growth

over the same period last year. We continue to see an increase in

fee-based revenues to complement our transactional and FX revenues,

which is part of our overall strategy for diversifying and

de-risking our earnings streams. Based on these strong results and

our current trading performance, we look to the future with

increased confidence and remain in line with expectations for the

full year."

Analyst meeting

A conference call for analysts hosted by Ian Strafford-Taylor

(CEO) and Richard Cooper (CFO) will be held today at 9.30am. A copy

of the Interim Results presentation is available at the Group's

website: http://www.equalsplc.com .

For retail investors, a n audio webcast of the conference call

with analysts will be available after 12pm today at:

https://webcasting.buchanan.uk.com/broadcast/62c3e636fb4bba516c453314.

In addition, as previously announced, the Company will also be

presenting the Interim Results via the Investor Meet Company

platform at 6pm today. Please register at

https://www.investormeetcompany.com/equals-group-plc/register-investor.

- Ends -

For more information, please contact:

Equals Group plc

Ian Strafford-Taylor, CEO Tel: +44 (0) 20 7778

Richard Cooper, CFO 9308

www.equalsplc.com

Canaccord Genuity (Nominated Adviser

& Broker)

Max Hartley / Georgina McCooke Tel: +44 (0) 20 7523

8150

Buchanan (Financial Communications)

Henry Harrison-Topham / Steph Whitmore Tel: +44 (0) 20 7466

/ Toto Berger 5000

equals@buchanan.uk.com www.buchanan.uk.com

Chief Executive Officer's Report

SUMMARY

The Group has delivered record-breaking revenue and Adjusted

EBITDA performance in H1-2022, leading to a first reported

statutory profit and positive EPS. The quantum of underlying

transactions through the Group's platforms increased by 71%. In

addition, the value of 'deposits', meaning loads on cards and

deposits through the banking platform, rose by 55%.

GBP millions

Q1-2021 Q2-2021 Q3-2021 Q4-2021 Q1-2022 Q2-2022

Transaction

value* 1,091 1,343 1,878 2,135 1,980 2,189

Deposit/Load

value 292 430 495 509 515 607

*Q4-2021shown here excludes the GBP114 million from the one-off

material trade announced on 28 October 2021.

Revenues rose by 86% in H1-2022 to GBP31.4 million (H1-2021:

GBP16.9 million). This growth was broad-based with all product

lines performing well. The Group continues to focus on corporate

(B2B/SME) customers and saw very strong revenue growth in this

sector in H1-2022.

Revenues from travel products, despite recovering strongly from

the impact of Covid-19, represented a modest 10.4% of overall

revenues in Q2-2022 and 8.9% for the whole of H1-2022.

Revenue from Solutions, the Group's platform that targets larger

corporates, led the way with strong growth and a healthy pipeline

of new customers. Additionally, the Group's corporate expenses

product, Equals Spend, reported strong growth along with Equals

Connect, the Group's white-label business. Further detail on the

revenue mix is included in the CFO's Report.

Revenue* by quarter, in GBP millions

Q1-2021 Q2-2021 Q3-2021 Q4-2021 Q1-2022 Q2-2022

Solutions - 0.3 1.5 1.8 2.8 3.5

White-Label 0.8 1.6 2.2 3.2 3.3 3.8

Other 6.1 6.4 7.2 7.8 7.1 8.1

-------- -------- -------- -------- -------- --------

Total Non-Travel 6.9 8.3 10.9 12.8 13.2 15.4

Travel 1.2 0.6 0.9 0.9 1.0 1.8

-------- -------- -------- -------- -------- --------

8.1 8.8 11.9 13.8 14.2 17.2

Material Trade - - - 1.5 - -

-------- -------- -------- -------- -------- --------

Total 8.1 8.8 11.9 15.3 14.2 17.2

-------- -------- -------- -------- -------- --------

Adjusted EBITDA (before share option charges) in H1-2022

increased to GBP4.9 million from GBP1.8 million, with GBP3.1

million being earned in Q2-2022.

The confidence in Equals' performance and ability to generate

cash led the Group to repay, in full, the outstanding balance

(totalling GBP1.8 million) of the CBILS loan in August 2022. With

interest rates continuing to rise, this action is immediately

accretive for EPS.

OPERATING REVIEW

Focus on growth

Given the product innovations Equals has achieved, the Group's

priority is to now overlay its platform developments with an

enhanced Sales and Marketing approach to drive further growth. The

essential building blocks to achieve this are:

-- a single CRM system across the Group, so all customer interaction

is captured in one place;

-- up-skilling the sales and marketing teams through training

and selected hiring; and,

-- a data science and AI team focusing on sales and customer data

to further assist the sales and marketing teams.

Equals' CRM solution, HubSpot, was initiated in 2021 and in

H1-2022 it has seen further refinement of how it is used. Further

work on extracting maximum value from HubSpot will continue

throughout 2022 and beyond utilising dedicated internal 'power

users' and providing training and facilitation.

The Group's data science team is now fully staffed and has been

concentrating on putting in place the data warehouse infrastructure

needed to provide both repetitive and bespoke data reporting. The

benefits of this are now flowing through with strong measurement of

key KPIs and more insights into customer acquisition and

retention.

In keeping with the overall strategy of the Group, the focus for

growth is on the B2B customer base. B2B customer acquisition is

heavily reliant on the outbound sales function augmented by and

integrated with a coherent digital marketing strategy and content

production. This contrasts with B2C customer acquisition, where

above-the-line ('ATL') marketing such as TV and billboard

advertisements augmented by digital marketing is the driving force.

Hence our growth strategy is directed towards improving our sales

capabilities with support from advanced data science and targeted

marketing.

One sales challenge for Equals is managing the transition from

being a product-led business to a platform-led business.

Previously, the Group has sold its products: International

Payments, Cards and Current Accounts, using largely separate sales

teams and marketing strategies. As Equals moves forward, it will be

selling:

-- Equals Money to the SME customer base, and

-- Equals Solutions to the larger B2B customers.

The transition from product to platform differentiates Equals

from traditional FX businesses, as the Group can compete not just

on FX rates, but also on platform capabilities and service.

Equals strengthened its sales and marketing leadership by the

appointment, announced on 17 May 2022, of Tom Kiddle as Chief

Commercial Officer. Tom, who started at the end of H1-2022, has a

strong background in the B2B payments industry having previously

held key positions at Travelex, Western Union and most recently at

World First. Since Tom's arrival, and utilising Equals' enhanced

data capabilities, the Group has already refined many aspects of

its go-to-market strategy and has more changes planned for the

balance of 2022 whilst planning its targets and strategy for

2023.

Focus on product development

Unified platform

H1-2022 focused on the further development of the Equals Money

platform for B2B customers.

The platform incorporates the payments and cards products of the

Group underpinned by an 'own-name multi-currency IBAN' allowing a

business to run one account supporting multiple currencies and

balances whilst being payment agnostic between bank transfer and

cards. This is the key strategic vision for the Group to simplify

money movement for business customers.

The Equals platform is built to be 'evergreen' in utilisation of

technology and has been assembled with scalability at its core,

placing the Group in a strong position for the future.

Payment infrastructure, 'Boxes' operating system

The Equals platform can provide each B2B customer with an 'own

name multi-currency IBAN', an account in their own name denoted by

a unique IBAN ('International Bank Account Number') which supports

multiple currencies.

This is a key differentiator from Banks who provide one account

per currency, each with a unique IBAN. As the account is in the

name of the customer, a so-called 'first party' account, this

allows more use-cases than payments into a 'pooled account' from a

compliance perspective. Furthermore, having one IBAN for all

currencies enables a customer to provide one single account

identifier to all its customers and suppliers, thereby simplifying

both sales and procurement processes.

Providing own-name multi-currency accounts required a

combination of third-party integrations to partner Banks and SWIFT

overlaid with smart technology. The in-house operating system used

by Equals to support the platform is referred to as 'Boxes'. This

proprietary technology allows Equals to offer a highly flexible

platform supporting multiple accounts and sub-accounts bespoke to

the customer.

The Boxes infrastructure was developed further in H1-2022 to

provide key functionality including:

-- real-time running balances;

-- statements; and,

-- enhanced reporting for customers.

In addition, Equals directly integrated into the SEPA (Single

European Payments Area) network, providing instant movement of

Euros in and out of the Equals payment infrastructure. Further

enhancements will be rolled out in H2-2022 including enhanced bulk

payments capabilities and the capability to offer IBAN and Boxes

functionality via API, thereby allowing more sophisticated

customers to directly integrate with the Equals platform and

support white-label opportunities.

Card Products

B2B customers increasingly need the flexibility to pay suppliers

via cards as well as traditional 'wire-transfer', particularly in

the e-commerce space where providers such as Google and Amazon will

only accept payments via a card. The Equals Money platform was

conceived recognising this need and therefore excellence in card

issuance, processing and technology is core to the platform.

Development of the Group's card infrastructure has continued in

H1-2022 to replace legacy platforms with a single platform built to

power the Equals card products for the medium term.

This platform provides the base from which a strong pipeline of

customer-facing features will deployed in H2-2022 including the

launch of the new Equals Money card which is multi-currency, can be

both virtual and physical, can be prepaid or debit, are live in

Apple Pay and have many more features and capabilities.

Focus on Compliance

The Group has a strong compliance culture and views its

capabilities as a strategic asset and competitive advantage.

Efficient compliance is essential to optimisation of revenues as

any delays to new business onboarding can lead to increased

customer frustration and possibly abandonment. Ensuring the process

of becoming a customer is as efficient as possible whilst

maintaining high standards of compliance requires the levels of

investment made in H1-2022. This investment is targeted at both

automation where possible, of the compliance processes combined

with adding skilled headcount to process the non-standard and

exceptional items.

Compliance requires strong control at the onboarding stage

augmented by ongoing monitoring and hence the Group's systems

investment is targeted at onboarding processes and transaction

monitoring.

Equals hired a Head of Compliance in mid-2021, and since then,

the Group has been consistently upgrading its staff and increasing

the headcount as the business expands. Equals has recruited a new,

highly experienced MLRO ('Money Laundering Reporting Officer')

joining the business in H2-2022, which will further bolster its

relationships with the Group's regulators and banks. These hires

supplemented an already an exceptionally skilled and commercially

focused team.

Focus on Employees

The labour market in the UK continues to be challenging both for

hiring talent and for staff retention. The Group introduced various

measures in 2021 to tackle these issues including share ownership

and LTIP schemes and plans to repeat this process in 2022. In

addition, the Group paid a mid-year cost of living award and other

bonuses to staff in July 2022 totalling GBP0.3 million, which is

fully accrued in the Group's interim financial statements.

Whilst the Group is growing rapidly, it retains a strong

cost-control culture, and it balances efficiency gains it yields

from its engineering investments with the priority to achieve

strong growth. The Group therefore expects overall staff numbers to

continue to rise slowly with most increases coming in direct

revenue generation roles or compliance. Given the strong

operational gearing of Equals, any increase in headcount and

overall cost-base is expected to be at a much lower rate than

growth in transactions and revenues.

Focus on ESG

Equals wholeheartedly embraces ESG initiatives and takes

Equality, Diversity, and Inclusivity ('EDI') extremely seriously.

The Group's EDI strategy, which covers not only employees but also

customers, includes an internal EDI network populated with elected

representatives and regular employee surveys. This is a key

objective for all Executive Committee members and forms part of

their appraisal.

FUTURE PLANS AND OPPORTUNITIES

The key strategic vision for the Group continues to be the

simplification of money movement for business customers. Equals

achieves this through its B2B platforms - Equals Money being

targeted at the SME base and Equals Solutions at larger corporate

opportunities. The Group's growth potential is extremely strong

given that the core building blocks of its platforms, namely

own-name multi-currency IBANs and bank-grade connectivity and

clearance, are highly complex and time consuming to replicate. This

'first mover' advantage will be enhanced further by the

developments planned in the Group's technical roadmap.

Equals will continue to look for external growth opportunities

and can do so with a strong balance sheet and cash position. The

Group is examining overseas expansion beyond its current

predominantly UK-centric customer base given the portability of its

platforms and will also take a considered strategic approach to

acquisitions.

Global Macro-Economic environment

The global economy faces serious challenges stemming from the

conflict in Ukraine and rising inflation and interest rates in

major economies. To date, Equals has performed resiliently despite

these conditions and continues to grow strongly as can be seen from

today's H1-2022 results and Q3-2022 trading update. However, the

Board continues to monitor the situation closely.

Q3-2022 trading and Outlook

Q3-2022 has continued the strong revenue generation seen in

H1-2022 with revenue for the period from 1 July 2022 to 5 September

2022 being GBP13.3 million, representing a 55% increase on the same

period in 2021.

Equals has a strong outlook resulting from the investments it

has made to create a payments platform. Further investments made in

compliance, onboarding and user experience means that the rich

functionality of the platform is made easily accessible to current

and potential customers. Finally, advances made in sales, marketing

and data mean that Equals now sells its products and platform more

efficiently. Accordingly, the Board looks forward to the future

with increased confidence and the Group remains in line with

expectations for the full year.

Ian Strafford-Taylor

Chief Executive Officer

7 September 2022

REVIEW OF THE CFO

Taking the financial information disclosed in the CEO's Report

one step further, I am pleased to present record Interim Results

for the six months ended 30 June 2022.

Totals may not sum due to rounding. Percentages are calculating

on underlying figures before rounding. Where costs cannot be

accurately attributed to each segment, they have been allocated on

the basis of revenue.

A: Income and Expenditure account and notes

Table 1 - Income and Expenditure account

GBP000's H1-2022 H1-2021 Change

Revenue 31,373 16,905 14,468

Gross profit 14,866 10,317 4,549

Marketing costs (790) (410) (380)

Contribution 14,076 9,907 4,169

-------- -------- -------

Net staff costs (6,620) (6,104) (516)

Net property & office costs (430) (490) 60

Net IT & telephone costs (925) (817) (108)

Professional fees (560) (594) 34

Compliance costs (358) (251) (107)

Travel and other expenses (331) (52) (279)

Operating costs (9,224) (8,308) (916)

-------- -------- -------

Adjusted EBITDA* 4,852 1,599 3,253

-------- -------- -------

Separately reported items - (616) 616

Share option charges (290) (217) (73)

EBITDA 4,562 766 3796

------ ------ -----

Memo: Adjusted EBITDA after

rent 4,497 1,034 3,463

------ ------ ------

Group revenues rose by 86%, Gross profits by 44%, Contribution

by 42%, whilst Operating costs increased by 11% leading to Adjusted

EBITDA increasing by 203% and EBITDA by 495%.

Ongoing growth is witnessed by comparing revenues in H1-2022 at

GBP31.4 million with GBP25.7 million in H2-2021 (excluding the

one-off revenue of GBP1.5 million earned from the material trade

reported in October 2021), thus a 22% half-on half increase.

To continue the theme of comparing the last two half years, I

present below a bridge from the Adjusted EBITDA in H2-2021 to

H1-2022, which shows a 13% increase on the like-for-like

position:

Table 2 - Adjusted EBITDA bridge from H2-2021 to H1-2022

H2-2021 Adjusted EBITDA 5,174

Gross profits from material

Less: trade (812)

Property rates rebate (80)

--------

Like-for-like H2-2021

Adjusted EBITDA 4,282

15% uplift in contribution

Add: H1-2022 1,868

15% increase in staff costs,

reflecting higher planned

headcount along with pay

Less: adjustments averaging 8% (885)

46% increase in professional

and compliance costs, much

of which is attributable

to onboarding more clients (290)

Increase in travel and

exhibition costs (80)

Increase in property utility

costs and rates (44)

--------

H1-2022 Adjusted EBITDA 4,852

--------

Uplift over like-for-like

H2-2021 570

--------

% uplift over like-for-like

H2-2021 13%

--------

Revenue

A split of revenues by both customer group and platform, clearly

shows both the strong and growing emergence of Solutions and very

significant migration away from the legacy travel products.

Table 3, H1-2022

Revenue in Consumer Corporates Large Sub-total White-label TOTAL

GBP millions and small enterprises H1-2022

business

---------------- ----------- ----------- ----------

International

payments 2.0 7.1 - 9.1 7.1 16.2

Cards 2.3 3.3 - 5.6 - 5.6

Banking 2.8 - - 2.8 - 2.8

Solutions - - 6.3 6.3 - 6.3

Travel cash 0.5 - - 0.5 - 0.5

---------------- ----------- ----------- ------------- ---------- ------------ ---------

Total, H1-2022 7.6 10.4 6.3 24.3 7.1 31.4

---------------- ----------- ----------- ------------- ---------- ------------ ---------

% Change*

H1-22 vs H1-21 +29% +24% >2010% +67% +202% +86%

*based on underlying figures

Table 3a - H1-2021

Consumer Corporates Large Sub-total White-label TOTAL

Revenue and small enterprises H1-2021

in GBP millions business

------------------- ----------- ----------- ----------

International

payments 1.3 6.1 - 7.4 2.4 9.8

Cards 1.7 2.2 - 3.9 - 3.9

Banking 2.8 - - 2.8 - 2.8

Solutions - - 0.3 0.3 - 0.3

Travel cash 0.1 - - 0.1 - 0.1

------------------- ----------- ----------- ------------- ---------- ------------ ---------

Total, H1-2021 5.9 8.3 0.3 14.5 2.4 16.9

------------------- ----------- ----------- ------------- ---------- ------------ ---------

Taking a further look at International Payments, Table 4 below,

shows the composition of transaction values and revenue across spot

and forward contracts.

Table 4. White Label Other

------------ ------

H1-2022 Spot Fwd Total Spot Fwd Total

Transaction values 648.9 98.3 747.2 976.9 281.8 1,258.7

% mix 87% 13% 100% 78% 22% 100%

Revenue 5.7 1.4 7.1 6.7 2.3 9.0

% mix 81% 19% 100% 75% 25% 100%

H1-2021

Transaction values 337.8 50.0 387.8 862.0 357.3 1219.3

% mix 87% 13% 100% 71% 29% 100%

Revenue 2.0 0.4 2.4 5.4 2.1 7.5

% mix 83% 17% 100% 72% 28% 100%

The move towards offering more forward contracts has evolved

over time and reflecting on 2019 as the last "pre-covid" year,

forward contracts only represented 10% of turnover.

Around 80% of the revenues were earned from three core currency

parings (GBP:EUR; GBP:USD; and EUR:USD).

Solutions Revenues have been analysed below between

transaction-based and fee-based. This shows the evolution of the

platform and its ability to secure long-term revenue streams.

Table 4a Fee based revenue Transaction based Total

In GBP millions revenue revenues

H1-2022 1.7 4.6 6.3

H2-2021 0.9 2.4 3.3

H1-2021 0.1 0.2 0.3

Variable costs and gross profits

The elements of variable costs are shown in the table below,

along with the gross profits and gross profit margins.

Table 5

Consumer Corporates Large enterprises Sub-total White-label TOTAL

and small H1-2022

In GBP millions business

------------------- ----------- ----------- ----------

Transaction

costs 1.3 2.7 - 4.0 0.1 4.1

Staff commissions 0.6 0.9 0.1 1.6 0.1 1.7

Affiliate costs 0.6 0.8 3.2 4.6 6.1 10.7

Total, H1-2022 2.5 4.4 3.3 10.2 6.3 16.5

Gross profit 5.2 5.9 2.9 14.0 0.8 14.9

Gross profit

% 67% 58% 47% 58% 12% 47%

------------------- ----------- ----------- ------------------ ---------- ------------ ---------

Table 5a

Consumer Corporates Large enterprises Sub-total White-label TOTAL

and small H1-2021

In GBP millions business

------------------- ----------- ----------- ----------

Transaction

costs 0.6 1.7 - 2.3 0.1 2.4

Staff commissions 0.5 0.6 - 1.1 0.1 1.2

Affiliate costs 0.4 0.6 0.2 1.2 1.8 3.0

Total, H1-2021 1.5 2.9 0.2 4.6 2.0 6.6

Gross profit 4.5 5.3 0.1 9.9 0.4 10.3

Gross profit

% 75% 64% 37% 68% 18% 61%

------------------- ----------- ----------- ------------------ ---------- ------------ ---------

H1-2022 witnessed Solutions and White-label contributing 43% of

revenues (H1-2021: 16%) and 25% of Gross profits (H1-2021: 5%).

Marketing, branding and contribution

The Group has accelerated its marketing plans after pausing this

during FY20 and FY21 when Covid posed greater uncertainties. Cash

costs include ad campaigns, pay-per-click and exhibition and

similar events including those in the USA where the Group noticed

considerable interest in particularly the Spend platform and the

Group's ability to sell this through its partnership with

Metropolitan Commercial Bank.

Table 6 H1-2022 H1-2021

Marketing expenses (GBP

millions) 0.8 0.4

-------- --------

Contribution 14.1 9.9

Contribution margin 45% 59%

-------- --------

Staff costs

Staff costs, gross of capitalisation, were GBP8.8 million in

H1-2022 against GBP7.3 million in H1-2021, and GBP7.7 million in

H2-2021. These costs were offset by:

- Capitalised software: GBP2.0 million in total (H1-2021: GBP1.2

million, H2-2021: GBP1.8 million), with GBP0.6 million on

contractors.

Amounts capitalised represent 19% of gross staff costs,

consistent with FY21. The Group investment strategy continues to

accelerate and focus on new and enhanced product design as has been

commented on in the CEO's Report.

Headcount numbers have moved from 258 as at 30 June 2021 to 266

as at 30 June 2022, below the rate of increase in revenue for the

period, and at 31 August 2022 they stood at 274.

The average number of engineering contractors per month in

H1-2022 was 14 (H1-2021: 7). As previously reported, Equals is

accelerating product development as fast as resource access allows

the Group to do in a tight labour market.

Professional fees and Compliance costs

Owing to an increasing cross-industry compliance burden, the

Group has chosen to report compliance and similar costs separately

from other professional fees. Compliance costs, including

onboarding systems, have risen due to a combination of greater

business activity and the Group's desire to fast-track business

applications but not at the expense of quality. Professional fees

have risen in line with trends widely reported in the national

press.

Property, insurance and office costs

Renegotiation of office leases has led to lower passing rents

which benefit the Group's cashflows but not the EBITDA as such

rents are accounted for under IFRS-16. Utilities, rates, and

insurance charges have however risen by an aggregate of 19% over

H2-2021, although there are 13% lower than in H1-2021.

Separately reported items

Separately Reported Items are large, non-recurring items

identified by management. There were no Separately Reported Items

in the period.

Amortisation and depreciation

Amortisation and depreciation for the period were GBP2.9 million

(H1-2021: GBP2.1 million) and GBP0.6 million (H1-2021: GBP0.7

million) respectively.

Operating result

The Group made a profit before taxation of GBP0.9 million for

the period, compared to a loss of GBP2.2 million for the period

H1-2021.

Taxation, incorporating R&D credits

The Group's taxation charge includes both corporation tax,

deferred tax, and R&D credits. The Group has recognised a net

tax charge of GBP37k (H1-2021: GBP1,075k net tax credit) of which

GBP40k (H1-2021: GBP319k) relates to an estimated R&D tax

credit repayment claim for the six months to 30 June 2022.

Result after taxation

The result after taxation was a profit of GBP848k against a loss

in H1-2021 of GBP1,172k and a full year loss in 2021 of

GBP2,262k.

Earnings per share

Both basic and diluted EPS went into the positive, with basic

EPS rising to 0.38pence (H1-2021: negative, 0.70pence) and diluted

EPS rising to 0.36pence (H1-2021: negative, 0.70pence).

B: Balance sheet

At 30 June 2022, the Group considers some of the key items on

the balance sheet to be:

-- GBP16.5 million of cash at bank (30 June 2021: GBP10.1 million)

-- GBP1.8 million CBILS loan (repaid in full in August 2022)

-- GBP0.3 million deferred consideration payable but settled after the period end.

Table 7 - Balance sheet

As at As at As at

30 Jun 2022 30 Jun 31 Dec

2021 2021

GBP'000s GBP'000s GBP'000s

IFRS 16 assets, less IFRS 16 liabilities (976) (364) (388)

Other non-current assets (other

than deferred tax) 31,618 35,519 32,217

------------- --------- ---------

30,642 35,155 31,829

------------- --------- ---------

Liquidity (per Table 9) 12,825 7,316 10,739

Trade debtors and accrued income 4,244 3,508 3,638

R&D rebates 438 1,687 398

Prepayments 1,411 1,076 998

Deposits and sundry debtors 190 396 329

Inventory of card stock 148 217 168

Accounts payable (2,315) (2,051) (1,549)

Affiliate commissions (2,905) (1,303) (1,945)

PAYE, staff commissions etc. (1,824) (1,808) (1,884)

Other accruals and other creditors (1,412) (1,151) (1,349)

------------- --------- ---------

10,800 7,887 9,543

------------- --------- ---------

Earn-out balances due (Table 16) (304) (1,835) (1,683)

Implied interest thereon 1 350 63

------------- --------- ---------

(303) (1,485) (1,620)

Net corporation and deferred tax 1,148 208 888

Net value of forward contracts 511 (31) 511

------------- --------- ---------

1,356 (1,308) (221)

------------- --------- ---------

NET SHAREHOLDER FUNDS 42,798 41,734 41,151

------------- --------- ---------

Retained earnings at 1 January (24,590) (22,259) (22,259)

Earnings for the year 675 (1,251) (2,424)

Amount attributable to the exercise

of share options - - 93

------------- --------- ---------

Retained earnings at 31 December (23,915) (23,510) (24,590)

------------- --------- ---------

Non-Controlling interest at 1 January 263 101 101

Earnings for year 173 79 162

------------- --------- ---------

Non-Controlling interest at 31

December 436 180 263

------------- --------- ---------

Share capital, share premium 55,212 54,836 55,011

Other reserves 11,065 10,228 10,467

------------- --------- ---------

66,277 65,064 65,478

--------- ---------

CAPITAL AND RESERVES 42,798 41,734 41,151

------------- --------- ---------

Non-controlling Interest

The profit for H1-2022 includes GBP173k profit in respect of the

Non-Controlling Interest of the Equals Connect business acquired in

2019 (H1-2021: GBP79k).

Off balance sheet items: client monies

As at 30 June 2022 the Group held client monies of GBP272.0

million in off balance sheet bank accounts (H1-2021: GBP170.4

million). The increase year-on-year arises from the acquisition of

new clients, and a further general increase consistent with the

uptake in B2B revenue in H1-2022.

Earn-outs

The table below shows the financial position relating to

acquisitions in and after FY19.

Table 8 - EARNOUTS

Hermex Casco Effective Total

Acquisition date 09.08.2019 19.11.2019 15.10.2020

GBP'000s GBP'000s GBP'000s GBP'000s

Acquisition price booked

at acquisition 2,000 2,236 1,575 5,811

Earn outs paid by 31.12.2020 (2,000) (1,733) (125) (3,858)

Revaluation of asset based

on performance - 793 - 793

----------- ----------- ----------- -----------

Gross outstanding at 31.12.2020 - 1,296 1,450 2,746

Paid during H1-2021 - (741) (62) (803)

Paid during H2-2021 - - (306) (306)

----------- ----------- ----------- ---------

Further change in consideration - 46 - 46

----------- ----------- ----------- -----------

Gross Outstanding at 31.12.2021 - 601 1,082 1,683

Paid during H1 - 2022 - (601) (779) (1,380)

----------- ----------- ----------- -----------

Gross Outstanding at 30.06.2022 - - 303 303

----------- ----------- ----------- -----------

Paid during Q3-2022 - - (303) (303)

Maximum consideration 2,000 3,725 1,575 7,300

Total consideration 2,000 3,075 1,575 6,650

----------- ----------- ----------- -----------

CASH FLOW

Table 9 - Cash flow

GBP000's H1-2022 H1-2021

Adjusted EBITDA after rent 4,497 1,034

- Cash incurred separately reported

items - (616)

- Internally capitalised staff

costs (2,051) (1,191)

Internally capitalised IT costs (164) (148)

- Purchase of other intangibles (307) (27)

- Purchase of property, plant,

equipment (122) (40)

Add: Working capital movement 2,875 1,795

"Operational" cashflows 4,728 807

Cash for acquisitions/ earn-outs (1,380) (803)

External funding

Repayment of CBILS loan (200) -

Cash raised from issue of equity 200 46

NET CASH FLOWS 3,348 50

Balance at start of period 13,104 10,032

Balance at end of period 16,452 10,082

=========== ===========

Number of shares in issue 180,712,473 180,045,807

Cash per share (in pence) 9.1 5.6

Table 10 - LIQUIDITY H1-2022 H1-2021 FY-2021

GBP000'S GBP000'S GBP000'S

Cash at bank 16,452 10,083 13,104

Balances with liquidity providers 1,499 2,553 1,675

Pre-funded balances with

card provider 884 1,435 1,615

--------- --------- ---------

Gross liquid resources 18,835 14,071 16,394

--------- --------- ---------

Customer balances not subject

to safeguarding (4,210) (4,755) (3,655)

CBILS loan (1,800) (2,000) (2,000)

--------- --------- ---------

(6,010) (6,755) (5,655)

--------- --------- ---------

Net position 12,825 7,316 10,739

--------- --------- ---------

Richard Cooper

Chief Financial Officer

7 September 2022

INTERIM CONSOLIDATED statement OF COMPREHENSIVE INCOME

FOR THE six month periodED 30 june 2022

Period Year end

end Period end 31

30 June 30 June December

2022 2021 2021

Unaudited Unaudited Audited

Note GBP000 GBP000 GBP000

Revenue on currency transactions 28,505 14,046 38,424

Banking revenue 2,868 2,859 5,667

----------- ----------- ----------

Revenue 2 31,373 16,905 44,091

Direct costs 2 (16,507) (6,589) (19,855)

----------- ----------- ----------

Gross profit 14,866 10,316 24,236

Administrative expenses 3 (10,314) (9,602) (18,715)

Depreciation (632) (733) (1,398)

Amortisation charge (2,858) (2,135) (5,812)

Impairment charge 4 - - (1,638)

Total operating expenses (13,804) (12,470) (27,563)

Operating profit / (loss) 1,062 (2,154) (3,327)

Finance costs 8 (177) (93) (490)

----------- ----------- ----------

Profit / loss before tax 885 (2,247) (3,817)

Tax (charge)/credit 5 (37) 1,075 1,555

----------- ----------- ----------

Profit / loss after tax 848 (1,172) (2,262)

=========== =========== ==========

Memo: Profit / loss is attributable

to:

----------- ----------- ----------

Owners of Equals Group Plc 675 (1,251) (2,424)

Non-controlling interest 173 79 162

----------- ----------- ----------

Other comprehensive income:

Exchange differences arising 1 - -

on translation of foreign

operations

849 (1,172) (2,262)

=========== =========== ==========

Profit / loss per share

Basic 0.38p (0.70)p (1.35)p

Diluted 0.36p (0.70)p (1.35)p

=========== =========== ==========

All income and expenses arise from continuing operations.

INTERIM CONSOLIDATED statement OF FINANCIAL POSITION

FOR THE six month periodED 30 june 2022

As at As at As at

30 June 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

Note GBP000 GBP000 GBP000

ASSETS

Non-current assets

Property, plant and equipment 1,193 1,439 1,257

Right of use assets 4,067 5,247 4,874

Intangible assets and goodwill 30,425 34,082 30,960

Deferred tax assets 1,287 230 949

36,972 40,998 38,040

----------- ----------- -------------

Current assets

Inventories 148 217 168

Trade and other receivables 8,228 9,096 8,256

Current tax assets 439 1,687 397

Derivative financial assets 2,593 3,019 2,593

Cash and cash equivalents 16,452 10,082 13,104

----------- ----------- -------------

27,860 24,101 24,518

----------- ----------- -------------

TOTAL ASSETS 64,832 65,099 62,558

=========== =========== =============

EQUITY AND LIABILITIES

Equity attributable to

equity holders

Share capital 6 1,807 1,787 1,793

Share premium 6 53,405 53,049 53,218

Share based payment reserve 2,455 1,619 1,858

Other reserves 8,610 8,609 8,609

Retained deficit (23,915) (23,510) (24,590)

----------- ----------- -------------

Equity attributable to owners

of Equals Group Plc 42,362 41,554 40,888

Non-controlling interest 436 180 263

----------- ----------- -------------

42,798 41,734 41,151

----------- ----------- -------------

Non-current liabilities

Borrowings 7 1,600 1,800 1,600

Lease liabilities 4,224 5,164 4,484

Deferred tax liabilities - - -

----------- ----------- -------------

5,824 6,964 6,084

----------- ----------- -------------

Current liabilities

Borrowings 7 200 200 400

Trade and other payables 12,970 12,704 12,002

Current tax liabilities 139 - 61

Lease liabilities 819 447 778

Derivative financial liabilities 2,082 3,050 2,082

----------- ----------- -------------

16,210 16,401 15,323

----------- ----------- -------------

TOTAL EQUITY AND LIABILITIES 64,832 65,099 62,558

=========== =========== =============

INTERIM CONSOLIDATEd STATEMENT OF changes in equity

For the SIX MONTH period ended 30 june 2022

Group Total

attributable

Share to owners

Share Share based Retained Other of Equals Non-controlling

capital premium payment deficit reserves Group Plc interest Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 1 January 2021 1,786 53,003 1,402 (22,259) 8,609 42,541 101 42,642

(Loss) / income for

the period - - - (1,251) - (1,251) 79 (1,172)

Other comprehensive

income:

Items that will not

be reclassified

subsequently

to profit or loss:

Exchange differences - - - - - - - -

arising on translation

of foreign operations

Other items

Share based payment

charge - - 217 - - 217 - 217

Movement in deferred - - - - - - - -

tax on share-based

payment charge

New shares issued 1 46 - - - 47 - 47

At 30 June 2021 1,787 53,049 1,619 (23,510) 8,609 41,554 180 41,734

(Loss) / income for

the period - - - (1,173) - (1,173) 83 (1,090)

Other comprehensive

income:

Items that will not

be reclassified

subsequently

to profit or loss:

Exchange differences - - - - - - - -

arising on translation

of foreign operations

Other items

Share based payment

charge - - 54 - - 54 - 54

Movement in deferred

tax on share-based

payment charge - - 278 - - 278 - 278

Share options exercised

in year - - (93) 93 - - - -

New shares issued 6 169 - - - 175 - 175

-------- -------- -------- -------- --------- ------------- --------------- -------

At 31 December 2021 1,793 53,218 1,858 (24,590) 8,609 40,888 263 41,151

Income for the period

and total comprehensive

(loss) / income - - - 675 - 675 173 848

Other comprehensive

income:

Items that will not

be reclassified

subsequently

to profit or loss:

Exchange differences

arising on translation

of foreign operations - - - - 1 1 - 1

Other items

Share based payment

charge - - 259 - - 259 - 259

Movement in deferred

tax on share-based

payment charge - - 338 - - 338 - 338

New shares issued 14 187 - - - 201 - 201

-------- -------- -------- -------- --------- ------------- --------------- -------

At 30 June 2022 1,807 53,405 2,455 (23,915) 8,610 42,362 436 42,798

======== ======== ======== ======== ========= ============= =============== =======

Other reserves comprise:

Merger reserve Arising on reverse acquisition from Group

reorganisation.

Contingent consideration Arising on equity based contingent consideration

reserve on acquisition of subsidiaries.

Foreign currency reserve Arising on translation of foreign operations

INTERIM Consolidated statement of cash flows

FOR THE SIX MONTH PERIODED 30 JUNE 2022

Six month Six month Six month

period ended period ended period ended

30 June 30 June 31 December

2022 2021 2021

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Operating Activities

Profit / loss for the period 885 (2,247) (1,570)

Adjustments for:

Depreciation 632 733 665

Amortisation 2,858 2,135 3,677

Impairment - - 1,638

Share based payment charge 259 217 55

(Increase) / decrease in trade

and other receivables (188) (351) 3,965

Decrease /in net derivative financial

assets / liabilities - - (4,898)

Increase / (decrease) in trade

and other payables 1,561 2,210 426

Increase / decrease in derivative

financial liabilities - - (968)

Decrease in inventories 20 (23) 49

Finance costs 177 93 397

-------------- -------------- --------------

Net cash inflow 6,204 2,767 3,436

Tax receipts - - 1,367

-------------- -------------- --------------

Net cash inflow from operating

activities 6,204 2,767 4,803

Cash flows from investing activities

Acquisition of property, plant

and equipment (122) (40) (38)

Acquisition of intangibles (2,323) (1,367) (2,193)

Deferred consideration on acquisition

of subsidiary - (803) 803

Acquisition of subsidiary, net - - -

of cash acquired

Net cash used in investing activities (2,445) (2,210) (1,428)

Cash flows from financing activities

Principal elements of lease payments (297) (446) (426)

Interest paid on finance lease (82) (97) (97)

Interest paid (33) (10) (4)

Repayment of borrowings (200) - -

Proceeds from issuance of ordinary

shares 201 46 174

Net cash used in financing activities (411) (507) (353)

Net increase in cash and cash

equivalents 3,348 50 3,022

Cash and cash equivalents at

the beginning of the period 13,104 10,032 10,082

-------------- -------------- --------------

Cash and cash equivalents at

end of the period 16,452 10,082 13,104

============== ============== ==============

CONSOLIDATED NOTES TO THE INTERIM FINANCIAL STATEMENTS

FOR THE SIX MONTH PERIODED 30 JUNE 2022

1. Basis of preparation

The principal accounting policies applied in the preparation of

the Group and Interim Consolidated financial statements are set out

below. These policies have been consistently applied to all the

years presented, unless otherwise stated. The financial statements

have been prepared on a historical cost basis with the exception of

derivative financial instruments which are measured at fair value

through profit or loss.

These financial statements are prepared in accordance with

UK-adopted International Accounting Standards in conformity with

the requirements of the Companies Act 2006. The financial

statements are presented in sterling, the Group's presentational

currency.

The unaudited consolidated Interim financial statements have

been prepared in accordance with the AIM rules and consistently

with the basis of preparation and accounting policies set out in

the accounts of the Group for the year ended 31 December 2021. The

information set out herein is abbreviated and does not constitute

statutory accounts within the meaning of Section 434 of the

Companies Act 2006. These interim consolidated financial statements

do not include all disclosures which would be required in a

complete set of financial statements and should be read in

conjunction with the 2021 Annual Report.

The Company is a limited liability company incorporated and

domiciled in England and Wales and whose shares are quoted on AIM,

a market operated by The London Stock Exchange.

a) Critical judgements and estimates

IFRS requires management to make estimates, judgements and

assumptions that affect the application of the Group's accounting

policies and the reported amounts of assets, liabilities, income

and expenses. These estimates are based on the Directors best

knowledge and past experience. The existing critical judgements and

estimates set out in note 3.26 of the Group's annual report for the

year ended 31 December 2021 have been reviewed in preparing these

Interim consolidated financial statements, and surrounding the

ongoing Covid-19 situation, and the Directors believe they remain

relevant.

b) Going concern

The Board continues to closely monitor its performance and

considers a range of risks that could affect the future performance

and position of the Group, including the on-going risks to the

business arising from the Covid-19 pandemic. The Board considers it

has a reasonable expectation that it has adequate resources to

continue to operate for the foreseeable future and therefore the

financial statements are prepared on a going concern basis.

2. Segmental Analysis

The segmental results were as follows:

Unaudited International Currency Travel Banking Central Total

Payments Cards Cash

6 months ended 30 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

June 2022

Segment revenue 22,382 5,645 478 2,868 - 31,373

Direct costs (13,526) (2,059) (239) (683) - (16,507)

-------------- --------- ------- -------- --------- ---------

Gross profit 8,856 3,586 239 2,185 - 14,866

Administrative expenses - - - - (10,314) (10,314)

Depreciation - - - - (632) (632)

Amortisation - - - - (2,858) (2,858)

Impairment charge - - - - - -

Finance costs - - - - (177) (177)

-------------- --------- ------- -------- --------- ---------

Profit / (loss) before

tax 8,856 3,586 239 2,185 (13,981) 885

============== ========= ======= ======== ========= =========

Current assets - - - 2,634 25,226 27,860

Non-current assets - - - 2,434 34,538 36,972

Total liabilities - - - (1,952) (20,082) (22,034)

-------------- --------- ------- -------- --------- ---------

Total net assets - - - 3,116 39,682 42,798

============== ========= ======= ======== ========= =========

Unaudited International Currency Travel Banking Central Total

Payments Cards Cash

6 months ended 30 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

June 2021

Segment revenue 10,124 3,853 69 2,859 - 16,905

Direct costs (5,837) (27) (21) (704) - (6,589)

-------------- --------- ------- -------- --------- ---------

Gross profit 4,287 3,826 48 2,155 - 10,316

Administrative expenses - - - - (9,602) (9,602)

Depreciation - - - - (733) (733)

Amortisation - - - - (2,135) (2,135)

Impairment charge - - - - - -

Finance costs - - - - (93) (93)

-------------- --------- ------- -------- --------- ---------

Profit / (loss) before

tax 4,287 3,826 48 2,155 (12,563) (2,247)

============== ========= ======= ======== ========= =========

Current assets - - - 2,294 21,807 24,101

Non-current assets - - - 2,682 38,316 40,998

Total liabilities - - - (1,996) (21,369) (23,365)

-------------- --------- ------- -------- --------- ---------

Total net assets - - - 2,980 38,754 41,734

============== ========= ======= ======== ========= =========

Audited International Currency Travel Banking Central Total

Payments Cards Cash

6 months ended 31 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

December 2021

Segment revenue 19,312 4,789 277 2,808 - 27,186

Direct costs (9,962) (2,589) (80) (635) - (13,266)

-------------- --------- -------- -------- --------- ---------

Gross profit 9,350 2,200 197 2,173 - 13,920

Administrative expenses - - - - (9,113) (9,113)

Depreciation - - - - (665) (665)

Amortisation - - - - (3,677) (3,677)

Impairment charge - - (1,638) - - (1,638)

Finance costs - - - - (397) (397)

-------------- --------- -------- -------- --------- ---------

Profit / (loss) before

tax 9,350 2,200 (1,441) 2,173 (13,852) (1,570)

============== ========= ======== ======== ========= =========

Current assets - - - - 24,518 24,518

Non-current assets 6,602 18,258 600 11,631 949 38,040

Total liabilities - - - (1,744) (19,663) (21,407)

-------------- --------- -------- -------- --------- ---------

Total net assets 6,602 18,258 600 9,887 5,804 41,151

============== ========= ======== ======== ========= =========

3. Operating profit / (loss)

Operating profit / (loss) is stated after charging the following

operating expenses:

6 months 6 months 12 months

ended 30 ended 30 ended 31

June 2022 June 2021 December

2021

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Marketing costs 790 410 1,171

Staff costs 6,620 6,718 12,550

Property and office costs 430 490 822

Audit fees 180 188 303

Compliance costs 358 251 449

Other professional fees 380 408 876

IT and telephone cost 925 817 1,720

Travel and similar 329 50 300

Foreign exchange loss 10 52 119

Share option charge 291 217 356

Contingent consideration - - 46

Other costs 1 1 3

----------- ----------- ----------

Administrative costs 10,314 9,602 18,715

Depreciation of right of use assets 445 486 931

Depreciation of property, plant

and equipment 187 247 467

Amortisation charge 2,858 2,135 5,812

Impairment charge - - 1,638

Total operating expenses 13,804 12,470 27,563

=========== =========== ==========

4. Credit impairment charge

The Credit impairment charge of GBP1,638k in H2-2021 represented

the movement for the period in expected credit loss under IFRS 9

Financial Instruments.

5. Taxation

6 months 6 months 12 months ended

ended ended 30 June 31 December

30 June 2022 2021 2021

Unaudited Unaudited Audited

GBP000 GBP000 GBP000

Current year R&D credit (40) (319) (398)

Change in R&D credit estimates - - -

relating to prior years

Current year corporation tax

charge 78 20 61

-------------- --------------- ----------------

Current tax charge /(credit) 38 (299) (337)

-------------- --------------- ----------------

Origination and reversal of

temporary differences (8) (762) (997)

Recognition of previously

unrecognised deductible temporary

differences 7 (14) (221)

-------------- --------------- ----------------

Deferred tax credit (1) (776) (1,218)

-------------- --------------- ----------------

Total tax charge / (credit) 37 (1,075) (1,555)

============== =============== ================

6. Earnings per share

Basic earnings per share is calculated based on the GBP675k

profit attributable to owners of Equals Group plc (H1-2021:

GBP1,251k loss) divided by the weighted average number of shares of

179,768,562 in the period (H1-2021: 178,629,499), giving a result

of 0.38 pence per share (H1-2021, loss, 0.70 pence per share).

7. Share capital

6 months 6 months 6 months 12 months

ended 30 ended 30 ended 30 ended 31 December

June 2022 June 2022 June 2021 2021

Unaudited Unaudited Unaudited Audited

No. GBP000 GBP000 GBP000

Authorised, issued and

fully paid-up ordinary

shares of GBP0.01 each

As at start of period 179,341,807 1,793 1,786 1,786

Issued during the period

under share options 666,666 7 1 7

Issued during the period

under the SIP 704,000 7 - -

As at end of period 180,712,473 1,807 1,787 1,793

----------- ---------- ---------- ------------------

On 18 May 2022, Equals Group Plc issued 666,666 1p ordinary

shares for total consideration of GBP193,333, of which GBP186,667

was allocated to the share premium reserve, in order to satisfy the

exercise of share options by a Director of the Group. Those shares

have been retained by the Director. As part of the longer-term

incentive plans for members of staff, on 11 March 2022, 704,000

shares were issued under a Share Incentive Plan and placed into

trust for 176 eligible employees. The shares will remain in trust

until the vesting conditions are met at the end of the holding

period on 18 October 2024.

8. Borrowings

2022 2021

GBP000 GBP000

Loan debenture 1,800 2,000

======= =======

Under the Coronavirus Business Interruption Loan Scheme (CBILS)

to further support working capital, on 23 December 2020, the main

trading subsidiary of the Company, FairFX plc, entered into a

GBP2.0 million loan agreement with the Royal Bank of Scotland

('RBS').

The loan was repaid in full on 8 August 2022 and the interest

due was GBP9,932.

9. Finance costs

Finance costs comprise the unwind of discount on the lease

liability under IFRS 16; the unwind of discount on deferred

consideration in respect of business and company acquisitions made

by the Group and other financing interest costs.

-S -

, the news service of the London Stock Exchange. RNS is approved by

the Financial Conduct Authority to act as a Primary Information

Provider in the United Kingdom. Terms and conditions relating to

the use and distribution of this information may apply. For further

information, please contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR UNOWRURUKRAR

(END) Dow Jones Newswires

September 07, 2022 02:00 ET (06:00 GMT)

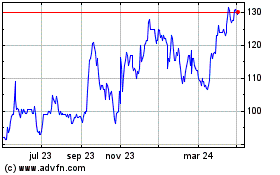

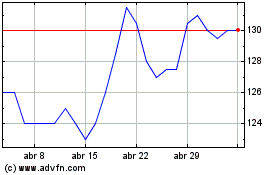

Equals (LSE:EQLS)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Equals (LSE:EQLS)

Gráfica de Acción Histórica

De May 2023 a May 2024