EUROPE MARKETS: European Stocks Leap Toward Best Session Since Early October

17 Noviembre 2015 - 12:14PM

Noticias Dow Jones

By Carla Mozee, MarketWatch

Euro trading at a 7-month low

European stocks finished sharply higher on Tuesday, aided by a

climb in energy and defense shares as the region's benchmark marked

its biggest rise in about six weeks.

The Stoxx Europe 600 jumped 2.9% % to close at 379.88, with all

sectors advancing. The index was led by a 3.4% rise for the

oil-and-gas group , resulting in the pan-European benchmark's best

daily gain since a 3% jump on Oct. 5, FactSet data showed.

Energy stocks pushed higher following Monday's 2.5% rally in oil

prices

(http://www.marketwatch.com/story/oil-futures-rise-on-worries-about-supply-disruptions-2015-11-16),

in part on news that output from the Organization of the Petroleum

Exporting Countries fell for a third consecutive month.

Most oil stocks held to gains although oil futures gave back a

portion of Monday's rally. In the group, Spanish oil producer

Repsol SA (REPYY) tacked on 5% and Portugal's Galp Energia SGPS

(GALP.LB) rose 3.1%. France's Total SA (TOT) stepped up 3.8% and

Tullow Oil (TLW.LN) finished 3.1% higher, after sinking nearly 2%

lower intraday.

Total's rise helped lift France's CAC 40 up 2.8% to 4,937.31,

while Galp's gain aided in a 2.2% advance in Portugal's PSI 20 . A

3.1% rise in energy producer BG Group PLC (BG.LN) helped lift the

U.K.'s FTSE 100 by 2% to finish at 6,268.76.

Meanwhile, a drive lower in the euro benefited shares of

exporters in Germany, Europe's largest economy. The DAX 30 index

gained 2.4% to 10,971.04. The euro was down 0.3% at $1.0650, its

lowest level since April.

"There is still a continually strong divergence in both monetary

and economic sentiment between the United States and Europe that is

consistently encouraging sellers to attack," the eurodollar

currency pair, said FXTM research analyst Lukman Otunuga in a

note.

The euro and European stocks were little changed after the

widely watched ZEW survey from Germany showed economic sentiment

improved in November

(http://www.marketwatch.com/story/german-economic-sentiment-picks-up-in-november-2015-11-17-54855419)

after declining for seven straight months.

Defense and travel: The European travel and leisure sector was

recovering from losses Monday spurred by the terrorist attacks in

Paris that left at least 132 people dead. Shares of travel-services

provider Thomas Cook Group PLC (TCG.LN) rose 2.5%, and French

hotels company AccorHotels SA (AC.FR) picked up 2.2%.

The Paris attacks may have accelerated downside risks to the

eurozone economy, European Central Bank chief economist Peter Praet

(http://www.marketwatch.com/story/paris-attack-may-hit-eurozone-economy-ecbs-praet-2015-11-17)

said in a Bloomberg interview published Tuesday.

French President François Hollande has reportedly indicated he's

ready to set aside European Union budget rules as he seeks to ramp

up military spending. France has launched airstrikes in Syria

against Islamic State

(http://www.marketwatch.com/story/france-bombs-islamic-state-stronghold-in-syria-2015-11-16),

which claimed responsibility for Friday's attacks.

"The fiscal boost of expansion of defence spending is likely to

be something that will play out across Europe as the war against

ISIS intensifies," and a jump in shares of BAE Systems PLC "so far

this week perfectly illustrates this," said Joshua Mahony, market

analyst at IG, in a note.

In the defense group, BAE (BA.LN) was up 2% and Airbus Group SE

(AIR.FR) gained 4.3%. Thales SA (HO.FR) climbed 3.6% and

Rolls-Royce Holdings PLC (RR.LN) finished 5.1% higher.

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 17, 2015 12:59 ET (17:59 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

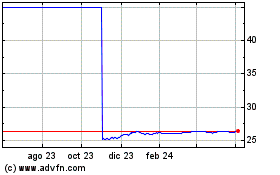

Frk Eur Igc Etf (LSE:EURO)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

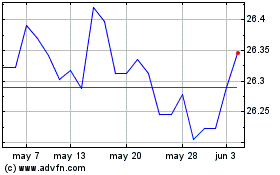

Frk Eur Igc Etf (LSE:EURO)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024