TIDMEZJ

RNS Number : 6762A

easyJet PLC

24 January 2024

24 January 2024

easyJet plc

('easyJet')

easyJet Trading Update for the quarter ended 31 December

2023

easyJet's performance has improved year on year, with booking

trends giving a positive outlook for the remainder of the financial

year. Underlying trends in Q1 were strong, although headline

results were impacted by the conflict in the Middle East.

-- Q1 headline loss before tax GBP126 million (Q1'23 GBP133 million loss)

o Passenger growth +14% YoY

o RPS +3% YoY

-- Load factor -1ppt YoY

-- Ticket yield +2% YoY

-- Ancillary yield +6% YoY

o CPS ex fuel reduced 3% YoY

o easyJet holidays delivered GBP30 million profit (Q1'23 GBP13

million profit)

-- Customer growth +48%

-- Winter FY24 improvement:

o Expect H1 loss to reduce YoY, despite a c.GBP40 million direct

impact(1) from the Middle East conflict

-- Expect Q2 RPS to be up by mid-single digits

-- H1 CPS ex fuel to be broadly flat YoY

-- Remain on track to deliver disciplined capacity growth of c.9% in FY24

o H1'24 c. 42m seats, +11% YoY

o H2'24 c. 59m seats(2) , +8% YoY

-- Positive outlook for summer:

o Strong turn of year bookings with seats sold and yield ahead

YoY

o H2 RPS remain well ahead YoY

-- Yields and loads both ahead in Q3 & Q4

o Expect H2 CPS ex fuel to be up low single digits YoY

o easyJet holidays continues to expect >35% customer growth

YoY in FY24

Summary

easyJet's financial performance in the first quarter showed

year-on-year improvement at a headline level, with underlying

progress stronger still. The onset of conflict in the Middle East

on 7 October had short term impacts from a pause in flights to

Israel and Jordan (which currently remains in place) and a

temporary slowdown in flight bookings for the wider industry.

Demand and bookings have recovered strongly from late November.

easyJet holidays had another strong quarter, with customer numbers

increasing by 48% compared to the same period last year, and a

profit of GBP30 million, a 131% increase year-on-year.

easyJet's seasonal winter loss for the first half of FY24 is

also expected to improve year-on-year despite a direct impact(1) of

c.GBP40 million (and further indirect impacts) from the conflict in

the Middle East. This improvement comes as a result of disciplined

capacity growth where demand is strongest, alongside productivity

benefits. easyJet expects cost per seat excluding fuel to remain

broadly flat in the first half of 2024, with fuel costs c.7%

higher.

Although still early, bookings for summer 2024 are building

well, with the turn of the year bookings period showing an increase

in both volume and pricing compared to the same period last year.

Demand for easyJet's primary airport network remains strong, with

RPS for the second half of FY24 currently well ahead year-on-year.

This positive momentum is also evident in the holidays business,

where we continue to expect customer growth to exceed 35%

year-on-year.

Johan Lundgren, CEO of easyJet, commenting on the results

said:

"We delivered an improved performance in the quarter which is

testament to the strength of demand for our brand and network. The

popularity of easyJet holidays also continues to grow, with 48%

more customers in the period.

"We see positive booking momentum for summer 2024 with travel

remaining a priority for consumers. Flight and holidays bookings

took off strongly during the traditional busy turn of year sales

period, as customers opted to secure their summer holidays to firm

favourites like Spain and Portugal alongside destinations further

afield like Greece and Turkey.

"easyJet remains focused on delivering for our customers in the

coming months, while also expecting to deliver continuing

performance gains"

Capacity

During Q1 easyJet flew 23.0 million seats. In the same period

last year easyJet flew 20.2 million seats. Load factor was 86% (Q1

FY23: 87%).

Passenger(4) numbers in the quarter increased to 19.8 million

(Q1 FY23: 17.5 million).

October November December Q1 Q1

2023 2023 2023 FY24 FY23

Number of flights 51,604 34,518 42,150 128,272 112,892

-------- --------- --------- -------- --------

Peak operating aircraft 317 266 277 317 313

-------- --------- --------- -------- --------

Passengers (4) (thousand) 8,066 5,324 6,452 19,842 17,481

-------- --------- --------- -------- --------

Seats flown (thousand) 9,210 6,199 7,585 22,994 20,159

-------- --------- --------- -------- --------

Load factor (5) 88% 86% 85% 86% 87%

-------- --------- --------- -------- --------

Fleet

On 19 December 2023, shareholders approved the purchase of 157

Airbus A320neo family aircraft, scheduled for delivery between FY29

and FY34. On 31 December 2023, easyJet finalised an agreement to

purchase engines from CFM, securing the company's long-term

strategy of fleet modernisation and disciplined growth. easyJet

expects the delivery of 16 aircraft in the current financial year

as planned.

Revenue, Cost and Liquidity

Revenue continued to benefit from strong demand for easyJet's

leading network through October where RPS was +12% year on year.

However, t he onset of the conflict in the Middle East on 7 October

had short term impacts from a pause in flights to Israel and Jordan

(which currently remains in place) and a temporary slowdown in

flight bookings for the wider industry. Demand and bookings have

recovered strongly from late November.

The airline's increased productivity and utilisation led to a 3%

year-on-year reduction in non-fuel unit costs. Rising fuel prices

resulted in a 15% (GBP2.92) per seat increase in fuel costs

compared to the same period last year.

Financing costs benefitted from a decrease in gross debt and a

rise in the interest rate on floating-rate cash. However, foreign

exchange movements over the quarter resulted in a non-operational,

non-cash FX loss of GBP4 million from balance sheet

revaluations.

In Q1 of FY24, easyJet repaid a EUR500 million Eurobond which

matured in October 2023.

Q1'24 Q1'23 Variance

Passenger revenue (GBP'm) 1,133 975 16%

-------- -------- ---------

Airline ancillary revenue (GBP'm) 486 406 20%

-------- -------- ---------

Holidays revenue(3) (GBP'm) 181 93 95%

-------- -------- ---------

Group revenue (GBP'm) 1,800 1,474 22%

-------- -------- ---------

Fuel costs (GBP'm) (516) (393) (31)%

-------- -------- ---------

Airline headline EBITDAR costs (GBP'm) (1,057) (959) (10)%

-------- -------- ---------

Holidays EBITDAR costs(3) (GBP'm) (153) (80) (91)%

-------- -------- ---------

Group headline EBITDAR costs (GBP'm) (1,726) (1,432) (21)%

-------- -------- ---------

Group headline EBITDAR (GBP'm) 74 42 76%

-------- -------- ---------

Group depreciation & amortisation

(GBP'm) (191) (164) (16)%

-------- -------- ---------

Group LBIT (GBP'm) (117) (122) 4%

-------- -------- ---------

Financing costs excluding balance

sheet revaluations (GBP'm) (5) (24) 79%

-------- -------- ---------

Balance sheet FX revaluations (GBP'm) (4) 13 (131)%

-------- -------- ---------

Group headline LBT (GBP'm) (126) (133) 5%

-------- -------- ---------

Airline passenger revenue per seat

(GBP) 49.26 48.35 2%

-------- -------- ---------

Airline ancillary revenue per seat

(GBP) 21.13 20.12 5%

-------- -------- ---------

Total airline revenue per seat (GBP) 70.39 68.47 3%

-------- -------- ---------

Airline headline cost per seat ex

fuel (GBP) (54.80) (56.21) 3%

-------- -------- ---------

Airline fuel cost per seat (GBP) (22.42) (19.50) (15)%

-------- -------- ---------

Airline headline total cost per

seat (GBP) (77.22) (75.71) (2)%

-------- -------- ---------

Cash and money market deposits (GBP'bn) 1.9 3.0 (37)%

-------- -------- ---------

Net debt (GBP'bn) 0.5 1.1 55%

-------- -------- ---------

Average Sector Length (km) 1,182 1,212 (2)%

-------- -------- ---------

Fuel & FX Hedging (as at 31 December 2023)

Jet Fuel H1'24 H2'24 H1'25 USD H1'24 H2'24 H1'25

Hedged position 80% 55% 29% Hedged position 78% 58% 32%

----- ----- ----- ----- ----- -----

Average hedged rate Average hedged rate

($/MT) 866 821 821 (USD/GBP) 1.22 1.24 1.25

----- ----- ----- ----- ----- -----

Current spot ($/MT) c.895 Current spot (USD/GBP) c.1.27

at 23.01.24 at 23.01.24

------------------- -------------------

For further details please contact easyJet plc :

Institutional investors and analysts:

Michael Barker Investor Relations +44 (0) 7985 890 939

Adrian Talbot Investor Relations +44 (0) 7971 592 373

Media:

Anna Knowles Corporate Communications +44 (0) 7985 873 313

Olivia Peters Teneo +44 (0) 20 7353 4200

Harry Cameron Teneo +44 (0) 20 7353

1) Direct impact of GBP40 million relates to the lost

contribution in H1'24 from pausing flying to Israel and Jordan

alongside the demand softness seen in Egypt following the onset of

the conflict in the Middle East on 7 October.

2) Represents on sale capacity for H2 of FY'24.

3) easyJet holidays numbers include elimination of intercompany

airline transactions

4) Represents the number of earned seats flown. Earned seats

include seats which are flown whether or not the passenger turns

up, as easyJet is a no refund airline and once a flight has

departed, a no-show customer is generally not entitled to change

flights or seek a refund. Earned seats also include seats provided

for promotional purposes and to staff for business travel.

5) Represents the number of passengers as a proportion of the

number of seats available for passengers. No weighting of the load

factor is carried out to recognise the effect of varying flight (or

"sector") lengths.

This announcement may contain statements which constitute

'forward-looking statements'. Although easyJet believes that the

expectations reflected in these forward-looking statements are

reasonable, it can give no assurance that these expectations will

prove to have been correct. Because these statements involve risks

and uncertainties, actual results may differ materially from those

expressed or implied by these forward-looking statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAXFDASALEFA

(END) Dow Jones Newswires

January 24, 2024 02:00 ET (07:00 GMT)

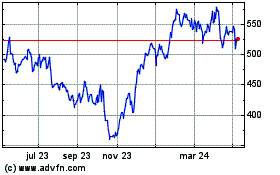

Easyjet (LSE:EZJ)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

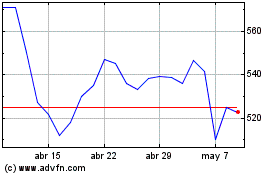

Easyjet (LSE:EZJ)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024