Final Results

FORESIGHT VCT PLC

LEI: 213800GNTY699WHACF46

15 April 2024

Final results

31 December 2023

Foresight VCT plc, managed by Foresight Group LLP, today

announces the final results for the year ended 31 December

2023.

These results were approved by the Board of Directors on 15 April

2024.

The Annual Report will shortly be available in full at

www.foresightgroup.eu. All other statutory information can also be

found there.

Financial Highlights

- Total net assets £219.1 million.

- A final dividend of 4.4p per share was paid on 30 June 2023,

costing £10.7 million.

- A special interim dividend of 4.0p per share was paid on 18

August 2023, costing £9.8 million.

- Net Asset Value per share decreased by 1.8% from 87.5p at 31

December 2022 to 85.9p at 31 December 2023. After adding

back the payments of a 4.4p dividend made on 30 June 2023 and a

4.0p dividend made on 18 August 2023, NAV Total Return per

share was 94.3p, bringing the total return in the year to

7.8%.

- Nine new investments costing £11.5 million and nine follow-on

investments costing £8.8 million were made during the year.

- The value of the investment portfolio rose by £1.6 million in

the year to 31 December 2023. This was driven by an

increase of £14.8 million in the valuation of investments,

plus £20.3 million of new and follow-on investments

offset by sales of investments totalling £33.2 million and loan

repayments totalling £0.3 million.

- The offer for subscription launched in November 2023 was closed

to further applications on 26 January 2024 and raised a

total of £23.9 million after expenses.

- The Board is recommending a final dividend for the year ended

31 December 2023 of 4.4p per share, to be paid on 28 June

2024.

Chair's Statement

I am pleased to present the Company’s audited Annual Report and

Accounts for the year ended 31 December 2023 and to report a Net

Asset Value Total Return of 7.8% for the year and a dividend yield

of 10.7% including a special dividend.

Overview of 2023

The Net Asset Value (“NAV”) Total Return per share of 7.8% for 2023

represents another good investment performance by the Company

despite the continuing challenges of the current macroeconomic

environment.

The UK’s economy fell into a recession in the second half of

2023, with GDP contracting in the two last quarters. At the

start of the year inflation remained stubbornly high but gradually

fell to 4% by year end, closer to the Bank of England's inflation

target of 2%. Nonetheless the Bank of England, still wary of

embedded inflation, maintained interest rates at 5.25% from August

onwards and there is still uncertainty over the timing of future

interest rate cuts, despite a further fall in reported inflation to

3.4% in February. On a global level, the continuing war in Ukraine

and the more recent conflict in the Middle East have increased

geopolitical concerns and heightened nervousness in the financial

markets. Against this backdrop, understandably consumer and

business confidence in the UK remains fragile.

Nevertheless, the performance of the Company’s portfolio in

aggregate throughout the year has remained healthy against this

unpromising background.

The Manager has continued to work closely with the individual

investee companies and developed a good understanding of their

changing business requirements. Many of the portfolio companies

successfully adapted to the new economic landscape, with some

performing extremely well and demonstrating the strength of their

management teams. A minority struggled as a result of a fall in

consumer demand, inflationary pressures, surging energy prices,

labour shortages and more limited fundraising opportunities. The

overall solid performance of the Company through 2023, however,

demonstrates the advantages of a well-constructed and diversified

portfolio.

Strategy

The Board and the Manager continue to pursue a strategy for the

Company which includes the following four key objectives:

- Growth in Net Asset Value Total Return above a 5% target

- Payment of annual ordinary dividends of at least 5% of the NAV

per share per annum (based on the latest announced NAV per

share)

- The implementation of a significant number of new and follow-on

qualifying investments every year, exceeding deployment

requirements to maintain VCT status

- Maintaining a programme of regular share buybacks at a discount

of no less than 7.5% (2022: 10.0%) to the prevailing NAV per

share

The Board and the Manager believe that these key objectives

remain appropriate and the Company’s performance in relation to

each of them over the past year is reviewed in more detail

below.

Net Asset Value and dividends

The NAV of the Company grew over the financial year from £191.7

million to £219.1 million at 31 December 2023. At the end of

2023, nearly four-fifths of the Company’s assets were already

invested, and the Board believed it would be in the Company’s best

interest to raise further funds to provide liquidity for its

activities in 2024 and beyond. On 15 November 2023, the Company

launched an offer for subscription to raise up to £20 million, with

an over‑allotment facility to raise up to a further £5 million,

through the issue of new shares. The offer was closed to

applications on 26 January 2024 having raised gross proceeds

of £25.0 million, £23.9 million after expenses.

During the year, the previous offer was closed to applications

on 13 April 2023 and raised gross funds of £24.1 million. We would

like to thank those existing shareholders who supported these

offers and welcome all new shareholders to the Company.

The Company paid two dividends during the year: an ordinary

dividend of 4.4p per share paid on 30 June 2023 which represented

5% of the NAV per share as at 31 December 2022 and a special

dividend of 4.0p per share paid on 18 August 2023, following the

successful sales of Mowgli, Innovation Consulting Group and

Datapath. The distribution of both these dividends reduced the NAV

per share to 85.9p at 31 December 2023, a reduction of 1.6p from

87.5p at 31 December 2022. After adding back both dividends,

the NAV per share for the year was 94.3p, representing a total

return of 7.8%.

The total return per share from an investment in the Company’s

shares made five years ago is 47.0%, which is well above the

minimum target return set by the Board of 5% per annum. Exceeding

this target is at the centre of the Company’s current and future

portfolio management objectives.

The Board is recommending a final dividend for the year ended 31

December 2023 of 4.4p per share, to be paid on 28 June 2024 based

on an ex-dividend date of 13 June 2024, with a record date of 14

June 2024. At the year end, distributable reserves totalled

£52,046,000 (2022: £64,303,000).

The Company continues to achieve its target dividend yield of 5%

of NAV, which was set in 2019 in light of the change in portfolio

towards earlier-stage, higher-risk companies, as required by the

VCT rules. This level may be supplemented in future by payment of

additional special dividends as and when particularly successful

portfolio disposals are achieved.

Investment performance and portfolio

activity

A detailed analysis of the investment portfolio performance over

the year is given in the Manager’s Review.

The value of the investment portfolio rose by £1.6 million in

the year to 31 December 2023. This was driven by an increase of

£14.8 million in the valuation of investments, plus £20.3 million

of new and follow-on investments, offset by sales of investments

totalling £33.2 million and loan repayments totalling £0.3

million.

In brief, during the year under review, the Manager completed

nine new investments, in a range of sectors, and nine follow‑on

investments deploying £11.5 million and £8.8 million respectively.

The Board and the Manager believe that a similar number of new and

follow-on investments can be achieved in 2024. The Company also

exited six investments, generating proceeds of £33.2 million with a

further £1.7 million of deferred consideration included within

debtors at the year end. These sales produced net gains in

valuation of £4.5 million in the year and represented in total a

combined return multiple of 3.4 times over the life of the

investments. Of particular note was the successful sale of Datapath

Group Limited in September 2023, which generated a multiple of over

11.6 times the original cost of £1.0 million. Further details of

these particular investments and realisations can be found in the

Manager's Review.

After the year end, the Company made three new and two follow-on

investments totalling £8.2 million. Furthermore, in March 2024, the

Company realised its holding in Specac International Limited. The

exit generated proceeds of £11.2 million at completion. When added

to £1.5 million of cash returned to date, this implies a total

cash‑on-cash return of 10.3 times the initial investment,

equivalent to an IRR of 34%.

The Company and Foresight Enterprise VCT plc have the same

Manager and share similar investment policies. The Board closely

monitors the extent and nature of the pipeline of investment

opportunities and is reassured by the Manager’s confidence in being

able to deploy funds without compromising quality and to satisfy

the investment needs of both companies.

Responsible investing

The analysis of environmental, social and governance (“ESG”) issues

is embedded in the Manager’s investment process and these factors

are considered key in determining the quality of a business and its

long-term success. Central to the Manager’s responsible investment

approach are five ESG principles that are applied to evaluate

investee companies, acquired since May 2018, throughout the

lifecycle of their investment, from their initial review and

acquisition to their final sale. Every year, these portfolio

companies are assessed and progress is measured against these

principles. More detailed information about the process can be

found on pages 46 to 49 of the Manager’s Review of the Annual

Report.

Buybacks

During the year the Company repurchased 6,784,285 shares for

cancellation at an average discount of 7.5%, achieving its revised

objective of maintaining regular share buybacks at a discount of

7.5%. As noted above and in the November 2023 Prospectus, the Board

now has a current objective of maintaining a programme of regular

share buybacks at a discount of no less than 7.5% to the prevailing

NAV per share. The Board and the Manager consider that the ability

to offer to buy back shares at no less than 7.5% is fair to both

continuing and selling shareholders, and continues to help underpin

the discount to NAV at which the shares trade.

Share buybacks are timed to avoid the Company’s closed periods.

Buybacks will generally take place, subject to demand, during the

following times of the year:

- April, after the Annual Report has been published

- June, prior to the half-yearly reporting date of 30 June

- September, after the Half-Yearly Report has been published

- December, prior to the end of the financial year

Management charges, co-investment and performance

incentive

The annual management fee is an amount equal to 2% of net assets,

excluding cash balances above £20 million, which are charged at a

reduced rate of 1%. This has resulted in ongoing charges for the

period ended 31 December 2023 of 2.2%, which is at the lower end of

the range when compared to competitor VCTs.

Since March 2017, co-investments made by the Manager and

individual members of the Manager’s private equity team have

totalled £1.3 million alongside the Company’s investments of £101.3

million. The co-investment scheme requires that the individual

members of the private equity team invest in all of the Company’s

investments from that date onwards and prohibits selective “cherry

picking” of co‑investments. If any individual team member opts out

of co-investment, they cannot invest in anything during that year.

The Board believes that the co-investment scheme aligns the

interests of the Manager's team with those of shareholders and has

contributed to the improvement in the Company’s investment

performance.

A new performance incentive scheme was formally approved by

shareholders at a general meeting of the Company held on 15 June

2023 and has now replaced the original scheme which was approved on

8 March 2017. The revised arrangements were designed to be simpler

to implement and understand and to cap the maximum annual payment

under the scheme, whilst continuing to incentivise the Manager’s

performance and align with the interests of shareholders. The new

arrangements will be subject to continual review by the Board to

ensure they meet these objectives. The new arrangements have

superseded the previous scheme and any potential outstanding

liabilities relating to it have ended. The Manager will now be able

to earn an annual performance fee as summarised below.

A performance incentive fee will be payable in respect of each

financial year commencing on or after 1 January 2023, where the

Company achieves an average annual NAV Total Return per share, over

a rolling five-year period, in excess of an average annual hurdle

of 5% (simple not compounded). If this hurdle is met, the Manager

would be entitled to an amount equal to 20% of the excess over the

hurdle, subject to a cap of 1% of the closing Net Asset Value for

the relevant financial year. No fee will become due in excess of

this cap. 75% of the performance incentive fees are payable to the

private equity team and the balance of 25% to the Manager.

Where there is a negative annual return in the last year of the

rolling five-year period, no fee shall be payable, even if the

five-year average hurdle is exceeded. However, in such

circumstances the potential fee will be carried forward and may

become due at the end of the next financial year if certain

criteria are met. Any such catch-up fees shall be paid alongside

any fee payable for the next financial year, subject to the 1% cap

applying to both fees in aggregate.

Any such catch-up fees cannot be rolled further forward to

subsequent financial years.

More information on the current performance incentive

arrangements (including an explanation of terms used above) can be

found in note 13 of the Annual Report.

A performance fee of £1.5 million is due in respect of the 2023

financial year, based on the outperformance of the average

five-year annual NAV Total Return per share as described above.

Over the last five years the NAV Total Return per share has

increased by 37.2p (47.6%), representing an average of 7.4p each

year. This exceeds the average annual 5% hurdle by 3.5p per share

and represents a period of strong performance by the Company.

Board composition

The Board continues to review its own performance and undertakes

succession planning to maintain an appropriate level of

independence, experience, diversity and skills in order to be in a

position to discharge its responsibilities.

2023 has seen some planned changes to the composition of the

Board. The Board was delighted to appoint David Ford and Dan Sandhu

as Non-Executive Directors in January 2023. After over 16

years as a Non-Executive Director, including nearly 12 years as

Chair of the Audit Committee, Gordon Humphries did not stand for

re-election at the AGM on 15 June 2023. On behalf of the

Company, I would like to thank Gordon for his significant

contribution and dedication to the Company over many years. We are

very pleased to remain in contact with him in his new role as Chair

of the AIC where his VCT experience will continue to benefit the

VCT sector.

Gordon has been succeeded as Chair of the Audit Committee by

Patricia Dimond, who has already served on the Board for over three

years.

Jocelin Harris, who has served on the Board since December 2015,

will be retiring from the Board at this year’s AGM. Jocelin’s

commercial and investment experience, combined with his legal

training, have been of enormous benefit to the Company. On behalf

of the Board and shareholders, I would like to thank Jocelin for

his valuable contribution to Board discussions and his wise counsel

during his many years of service. He will be greatly missed and we

wish him the very best for the future.

Shareholder communication

We were delighted to meet with some shareholders in person at the

AGM last year. We hope many of you will be available to attend this

year’s AGM on 4 June 2024, as detailed below.

Annual General Meeting

The Company’s Annual General Meeting will take place at the

Company's registered office on 4 June 2024 at 2:00pm and we look

forward to meeting as many of you as possible in person. Please

refer to the formal notice on page 107 of the Annual Report for

further details in relation to the format of this year’s meeting.

We would encourage you to submit your votes by proxy ahead of the

deadline of 2:00pm on 31 May 2024 and to forward any questions by

email to InvestorRelations@foresightgroup.eu in advance of the

meeting.

VCT Sunset clause

A condition of the European Commission’s State Aid approval of the

UK’s VCT scheme in 2015 was the introduction of a retirement date

for the current scheme at midnight on 5 April 2025, known as the

“Sunset clause”. This "Sunset clause" for VCT reliefs therefore

needs to be extended or cancelled by the government before this

expiry date or the income tax relief given to VCT subscriptions

made after this date would no longer be available to investors. I

am pleased to report that during the Autumn Statement delivered by

the government in November 2023, Chancellor Jeremy Hunt announced

the extension of the "Sunset clause" applying to VCTs for another

ten years to April 2035. The UK should be able to extend the scheme

through secondary legislation without European Commission approval,

clarified by the Northern Ireland Protocol, the Windsor Framework

announced during the year.

Outlook

Experience has taught us that it is not possible to predict

outcomes in an uncertain world, particularly in a year when nearly

half the population will have the opportunity to vote in elections

and potentially introduce radical political change. However, it is

not unreasonable to expect that growth in the UK is likely to

continue to be weak in 2024 against a background of macroeconomic

and political uncertainty: ongoing inflationary pressures, tight

monetary policies and supply chain issues, labour shortages and a

lack of bank lending appetite may all continue to dampen economic

recovery. We are conscious that such conditions could prove

challenging for our investee companies which are unquoted, small,

early-growth businesses and, by their nature, entail higher risk

and lower liquidity levels than larger listed companies.

On the other hand, these younger companies may prove more agile

and creative in their approach and better able to adapt their

operations and develop new products and services in response to the

uncertain circumstances. A difficult funding environment can

create good opportunity for smart deployment.

The Manager understands well the management and business

requirements of each of the companies within the investment

portfolio and is working closely with them to help them adapt to,

and grow within, this changing environment. The Company’s current

portfolio of investments is well diversified by number, business

sector, size and stage of development and overall has already

demonstrated its relative resilience in the face of economic and

geopolitical difficulties. We are confident that this approach will

continue to provide some protection in volatile market

conditions.

The Manager is continuing to see a promising pipeline of

potential investments, both new and follow-on. The fundraising

referred to earlier will provide additional resources to make

selective investments and enable the Company to continue to take

advantage of the increasing numbers of opportunities that are now

emerging out of the recent disruption. Although we anticipate there

will be considerable economic headwinds in the year ahead, we

believe the Company’s generalist, diversified portfolio is well

positioned to continue to generate long-term value for

shareholders.

Margaret Littlejohns

Chair

15 April 2024

Manager's Review

“The Board has appointed Foresight Group LLP (“the Manager”) to

provide investment management and administration services.”

Portfolio summary

As at 31 December 2023, the Company’s portfolio comprised 53

investments with a total cost of £103.9 million and a valuation of

£171.3 million. The portfolio is diversified by sector, transaction

type and maturity profile. Details of the ten largest investments

by valuation, including an update on their performance, are

provided on pages 30 to 34 of the Annual Report.

In the year to 31 December 2023, the value of the investment

portfolio rose by £1.6 million as a result of an increase of £14.8

million in the valuation of investments, plus £20.3 million of

new and follow-on investments offset by strong sales of several

investments realising £33.5 million. Overall, the portfolio has

performed well despite uncertainty in the market with significant

geopolitical issues and continued domestic price inflation, coupled

with high interest rates.

In line with the Board’s strategic objectives, the Manager

remains focused on growing the Company through further development

of Net Asset Value Total Return. In the year, Net Asset Value Total

Return was 7.8% and net assets increased by 14.3% to

£219.1 million after the payment of dividends, meaning that

the Company has successfully met this objective in the period under

review.

New investments

2023 was characterised by higher interest rates and cost inflation,

although this began to stabilise during the latter part of the year

leading into 2024. Many investee management teams have successfully

steered their businesses through the uncertainty of the year,

whilst developing clearer medium and longer-term growth plans.

The Manager has continued to invest in its deal origination

capabilities and identified a large number of potentially

attractive investment opportunities during the year.

Over the course of 2023, nine new investments were completed,

investing a total of £11.5 million. New investments were across

recruitment software, industrials, financial planning, health

services, communications and technology. Behind these, there

continues to be a strong pipeline of opportunities that the Manager

expects to convert during the next 12 months. Follow-on investments

totalling £8.8 million were also made in nine existing

investee companies.

Sprintroom Limited

In January 2023, the Company invested £1.0 million of growth

capital in Sprintroom, which trades as Sprint Electric. The

business designs and manufactures drives for controlling electric

motors in light and heavy industrial applications, as well as

recovering and reusing otherwise lost energy. The investment will

be used to further develop and commercialise novel alternating

current variable speed drive technology.

Red Flag Alert Technology

Group Limited

In March 2023, the Company invested £1.7 million in Reg Flag Alert

Technology Group, a Manchester based proprietary SaaS intelligence

platform with modular capabilities spanning compliance,

prospecting, risk management and financial health assessments. The

growth capital will be used to support further product development

and expand its commercial capabilities.

Firefish Software Ltd.

In March 2023, the Company invested £1.5 million in Firefish

Software, a Glasgow-based customer relationship management and

marketing software platform targeting the recruitment sector. The

funding will be used to support the company in its growth

plans.

The KSL Clinic Limited

In April 2023, the Company invested £1.0 million in the KSL Clinic,

a leading provider of hair replacement treatments, with clinics in

Manchester and Kent. The investment will enable the company to grow

its medical team and expand its geographic presence.

Five Wealth Limited

In March 2023, the Company invested £0.7 million in Five Wealth, an

established boutique financial planning business operating across

the North West of England. Five Wealth’s service offering is

focused on the provision of independent private client financial

advice and wealth planning. This growth capital investment will be

used to accelerate Five Wealth’s ambition to help more people reach

their financial planning goals.

Loopr Ltd

In September 2023, the Company invested £1.7 million in Loopr Ltd,

trading as Looper Insights, a fast-growing, London‑based technology

business providing data analytics to digital content distributors

and streaming services. The investment will enable Looper to

increase the solution’s automation and customer integration and

accelerate rollout of its products internationally.

Live Group Limited

In December 2023, the Company invested £1.4 million in Live Group,

a global events and communications agency selling digital and live

communications and events services. The company has developed a

proprietary delegate management platform to collect attendee data,

share content and enhance engagement with delegates. The investment

will be used to enhance and further develop the platform whilst

supporting growth plans, including international growth.

Kognitiv Spark Inc

In December 2023, the Company invested £1.0 million in Kognitiv

Spark, a developer of augmented reality software that enables the

remote sharing of critical data to on-site employees. Developed

specifically for industrial communications, the company’s core

product offers superior performance in terms of data compression

and visualisation. The funding will be used to expand the

management team and explore new commercial opportunities.

Navitas Digital Safety

Limited

In December 2023, the Company invested £1.5 million in Navitas

Digital Safety, a digital food safety management business. The

company uses a combination of hardware and software to provide a

complete food safety management solution to hospitality sector

customers. The investment will support the company’s effort to

expand its commercial capabilities and further develop the

platform.

Follow-on investments

Given the expansion of the portfolio, there has been an increase in

follow-on investments during the year. These follow-on investments

are to support further growth initiatives within the portfolio. The

Manager is pleased to report that despite continuing macroeconomic

uncertainty and stubbornly high interest rates and inflation, the

portfolio remains resilient overall.

The Manager has made follow-on investments in nine companies

during 2023, totalling £8.8 million. Further details of each of

these are provided below.

The additional equity injections in the year were used to

support further growth plans, such as launching new products or

opening new sites and providing cash headroom for further growth.

In view of the economic outlook, which remains challenging, the

Manager continued to be vigilant about the health of the rest of

the portfolio and the need for follow-on funding over the coming

months.

Mizaic Ltd (formerly IMMJ Systems

Limited)

In February 2023, £0.6 million was invested in Mizaic, a clinical

electronic document management solution for the NHS. The investment

was used to back the new leadership team and enhance the product

roadmap, bolstering the business’ ability to support digitising

patient records. Mizaic’s principal product, MediViewer, saves time

and costs for the NHS and improves the outcomes for the

clinician-patient experience.

NorthWest EHealth Limited (“NWEH”)

In March 2023 and October 2023, the Company invested a further £2.5

million total in aggregate in NWEH, which provides software and

services to the clinical trials market, allowing pharmaceutical

companies and contract research organisations to conduct

feasibility studies, recruit patients and run trials. The

investment provided support to the delivery of a number of new

real-world trials, while also enabling the company to complete its

ConneXon platform.

Ten Health & Fitness Limited

In March 2023, Ten Health & Fitness, a multi-site operator in

the boutique health, wellbeing and fitness market, received an

additional investment of £0.6 million. The funding enabled the

company to complete its new flagship Kings Cross site and support

the company’s growth strategy.

Additive Manufacturing Technologies Ltd

(“AMT”)

In April 2023, the Company invested £0.1 million in AMT, which

manufactures systems that automate the post-processing of 3D

printed parts. See the Key valuation changes in the period section

below for further details.

Ollie Quinn Limited

In April 2023, the Company invested £1.0 million in Ollie Quinn, a

branded retailer of prescription glasses, sunglasses and

non-prescription polarised sunglasses based in the UK and Canada.

The investment provided the cash headroom and time to explore

longer-term financing initiatives in its continuing search for

growth opportunities.

viO HealthTech Limited

In September 2023, the Company invested £35k in viO HealthTech

Limited, a developer of innovative medical devices that allow women

to predict and detect ovulation with a high degree of accuracy. The

funding will support the business in the next stage of market

testing.

Weduc Holdings Limited

In October 2023, the Company invested £0.6 million in Weduc

Limited, a communication platform enabling smoother communication

between parents, teachers and students, alleviating the

administrative burden for teachers and improving parent and student

engagement. The investment will be used to support the continued

growth of the platform.

Callen-Lenz Associates Limited

In December 2023, the Company invested £2.5 million in Callen‑Lenz

Associates Limited. Callen-Lenz develops, designs and manufactures

air vehicles, vehicle components and navigation and communication

software for high performance unmanned aerial vehicles ("UAVs")

globally. The investment will support the continued rapid growth of

the business.

Clubspark Group Ltd

In October 2023, the Company invested £0.9 million in Clubspark

Group Ltd, a sports club management and reporting platform for

local organisations and national governing bodies. The funding will

provide further cash headroom to support Clubspark’s continued

growth.

Realisations

The M&A climate has proved more challenging than in recent

years in light of the macroeconomic conditions of high interest

rates and geopolitical uncertainty. Despite this, the Manager was

pleased to report some particularly strong realisations, as well as

the disposal of one challenged business within the portfolio. The

Manager continues to engage with a range of potential acquirers of

several portfolio companies and to carefully consider the timing of

exit for each. Demand remains for high-quality, high-growth

businesses from both private equity and trade buyers.

Mowgli Street Food Group Limited

In January 2023, the Company announced the successful exit of

casual Indian food chain Mowgli to TriSpan, a global private equity

firm with extensive restaurant expertise. The Manager invested in

2017, when the business had three restaurant sites. It has since

grown to 15 sites nationally. The Manager introduced Dame Karen

Jones, co-founder of Café Rouge and the Pelican Group, as Chair.

The Manager also introduced Matt Peck as Finance Director and

helped recruit Lucy Worth as Operations Director and, together with

this team, built a market-leading hospitality brand. The business

also shared the Manager’s commitment to sustainability, creating

more than 500 jobs and ranking 16th best UK company to work for in

2022, owing to its focus on employee welfare, local charity support

and sustainable sourcing.

The exit resulted in proceeds of £5.2 million, including

£0.8 million which was received in July 2023 and £0.8 million

which was received in February 2024. When added to the £0.1m cash

returned pre-exit, this implied a total cash-on-cash return of 3.5x

on the original investment, equivalent to an IRR of 25% since the

initial investment.

Datapath Group Limited

In March 2023, the Company exited Datapath, a global leader in the

provision of hardware and software solutions for multi‑screen

displays. The transaction generated proceeds of £5.1 million at

completion and a further £0.3 million was received in November

2023. An additional £0.9 million is payable over 24 months

following exit.

The investment in Datapath was initially held by Foresight 2 VCT

plc (“F2”) and was transferred to the Company on the merger with F2

on 17 December 2015. F2 initially invested £1.0 million into

the business in 2007. The accounting cost of £7.6 million refers to

the value at which F2's holding was transferred to the Company.

When added to £5.4 million of cash returned pre-exit, this

implies a total cash-on-cash return of 11.6x the original

investment of £1.0 million, equivalent to an IRR of 37% since the

initial investment in 2007.

Since the original investment, the Manager had supported

Datapath through a period of material growth with revenues growing

from approximately £7.0 million to £25.0 million. Datapath has

developed a market-leading hardware and software product suite for

the delivery of multi-screen displays and video walls which are

sold globally to a diverse customer base across a range of

sectors.

Innovation Consulting Group Limited

(“GovGrant”)

In March 2023, the Company announced the exit of GovGrant to Source

Advisors, a US corporate buyer backed by BV Investment Partners.

GovGrant is one of the UK’s leading providers of R&D tax

relief, patent box relief and other innovation services.

The transaction generated proceeds of £6.8 million at

completion. When added to £0.5 million of cash returned to date,

this implies a total cash-on-cash return of 4.4x the capital

of £1.65 million invested in October 2015, equivalent to an IRR of

24%.

Since the original investment in 2015, the Manager had helped

GovGrant through a period of material growth during which it

supported the R&D activities of a growing number of customers.

GovGrant’s high levels of service and innovative products, such as

the growing patent box offering, have contributed to driving

innovation in the UK economy. The Manager had taken a proactive

approach to supporting the exceptional senior management team, all

of whom were introduced to the business during the investment

period.

Protean Software Limited

In July 2023, the Company achieved a successful exit of its holding

in Protean Software to Joblogic, a UK-based direct provider of

Field Service Management software to SMEs, and Protean’s direct

competitor. The Company invested in Protean in July 2015 as one of

the last buyouts prior to the changes in VCT legislation. Over the

holding period, the Manager helped Protean transition its highly

featured legacy product into modern software sold on a SaaS basis.

The transaction generated proceeds of £5.9 million on completion.

When added to the £0.2 million cash returned pre-exit, this implies

a total cash-on-cash return of 2.4x on the original investment,

equivalent to an IRR of 12% since the initial investment.

Fresh Relevance Ltd

In September 2023, the Company announced the successful exit of

Fresh Relevance, an email marketing and e-commerce personalisation

platform which provides online retailers with tools to improve

customer retention and acquisition. The transaction generated

proceeds of £10.6 million at completion. When added to £0.2 million

of cash returned pre-exit, this implies a total cash-on-cash return

of 3.8x, equivalent to an IRR of 27%.

The sale to Dotdigital Group PLC follows the growth of the

business since the original investment in 2017, with follow-on

investment provided in 2021. With the Company's investment, Fresh

Relevance tripled revenues and created close to 40 high-quality,

sustainable jobs, positively impacting the local economy in

Southampton.

Luminet Networks

Limited

In October 2023, the Company announced the exit of Luminet,

London’s largest fixed wireless network operator and leading

business-to-business internet provider. The transaction generated

proceeds of £4.7 million at completion. This implies a total

cash-on-cash return of 1.2x the original investment, equivalent to

an IRR of 5%.

The Company's investment helped the company to scale up by adding

additional base stations to the existing infrastructure, as well as

navigate through the challenging period of COVID-19 related

uncertainty.

Realisations in the year ended 31 December

2023

|

Company |

Detail |

Accounting cost at date of disposal (£) |

Proceeds3 (£) |

Realised gain/(loss) (£)

|

Valuation at 31 December 2022 (£) |

|

Fresh Relevance Ltd |

Full disposal |

2,860,324 |

10,226,288 |

7,365,964 |

5,935,427 |

|

Innovation Consulting Group Limited |

Full disposal |

1,605,000 |

6,138,615 |

4,533,615 |

5,474,353 |

|

Protean Software Limited |

Full disposal |

2,500,000 |

5,291,070 |

2,791,070 |

4,382,049 |

|

Datapath Group Limited¹ |

Full disposal |

7,563,365 |

5,049,691 |

(2,513,674) |

5,245,695 |

|

Luminet Networks Limited |

Full disposal |

3,783,251 |

3,433,268 |

(349,983) |

2,472,529 |

|

Mowgli Street Food Group Limited² |

Full disposal |

1,526,750 |

3,101,743 |

1,574,993 |

5,183,006 |

|

200 Degrees Holdings Limited |

Loan repayment |

225,000 |

225,000 |

— |

225,000 |

|

Positive Response Corporation Ltd |

Loan repayment |

100,000 |

100,000 |

— |

100,000 |

|

Total disposals |

|

20,163,690 |

33,565,675 |

13,401,985 |

29,018,059 |

- Excludes £292,000 of deferred consideration which was received

in November 2023. A further £875,000 of deferred consideration has

been recognised within debtors. The accounting cost of £7.6

million includes the valuation of the F2 investment at the point it

was transferred to the Company.

- Excludes £824,000 of deferred consideration which was received

in July 2023. A further £824,000 of deferred consideration has been

recognised within debtors.

- Proceeds on exit excluding interest, dividends and exit fees

where applicable.

Pipeline

At 31 December 2023, the Company had cash reserves of £46.2

million, which will be used to fund new and follow‑on investments,

buybacks, dividends and corporate expenditure. The Manager is

seeing a strong pipeline of new opportunities, with several

opportunities in due diligence or in exclusivity, with further deal

completions expected to be announced in the months to follow.

Stubbornly high interest rates and inflation have created

challenging trading conditions for many companies, with inflation

of wages and input prices of particular concern. Interest on bank

debt remains at a significantly higher level than 18 months ago;

however, the Manager notes that the cautious approach to leveraging

portfolio companies provides some protection here. Continuing

geopolitical concern surrounding conflicts in Ukraine and the

Middle East have also caused supply chain disruption. These

challenges create opportunities to source attractive investments,

however, with many companies seeking to strengthen their balance

sheets.

The Manager continues to see an attractive pipeline of

opportunities and does not see this changing in the medium term.

The Company is able to access these opportunities through its wide

and proprietary network across the country, supported to a greater

extent by its network of regional offices. The Manager considers

the Company’s strategy to be well-suited to market volatility, due

to its balanced mix of companies across sectors and stages,

experienced investment team and network of high‑quality

non-executives.

Post year end activity

Family Adventures Group Limited

In January 2024, the Company invested £2.5 million of growth

capital in Family Adventures Group Limited, a provider of daycare

nurseries and children’s leisure sites that combines soft play

areas with role play facilities. All inspected sites have been

rated “Good” by Ofsted and have an average score of 9.9/10 on

daynurseries.co.uk; whilst the leisure sites have market leading

Net Promoter Scores ("NPS") and high repeat visits. The investment

will be used to aid the business with a continued rollout of

nursery and leisure sites across the South West and Midlands.

Ollie Quinn Limited

In January 2024, following a period of challenging trading, the

Manager exited the UK division of Ollie Quinn, a branded retailer

of prescription glasses, sunglasses and non‑prescription polarised

sunglasses based in the UK and Canada. The exit returned £0.2

million on completion. A sale of the majority of the remaining

Canadian business was completed by the management team in February

2024, unlocking the necessary third-party funding to take the

business forward whilst retaining the potential for future

upside for the Company.

Lepide Group Holding Company Ltd

In March 2024, the Company invested £1.9 million in Lepide, a cyber

security software solution that helps organisations to protect

their unstructured data. Lepide actively monitors event logs within

Windows Active Directory in order to detect suspicious activity and

help organisations to manage over‑exposure of data. The investment

will help scale the business and accelerate growth initiatives.

Evolve Dynamics Limited

In March 2024, the Manager completed a £2.0 million investment in

Evolve Dynamics Limited. Founded in 2016, the company designs and

manufactures smaller Unmanned Aerial Systems (“UAS”) with

capabilities for Intelligence, Surveillance, Target Acquisition and

Reconnaissance (“ISTAR”). The investment will help scale the

business and aid in new product launches.

Homelink Healthcare Limited

In March 2024, the Company completed a £1.0 million follow‑on

investment in Homelink Healthcare Limited. Foresight first invested

into HomeLink in March 2022. Contracting with the NHS, the business

provides patients with wound care, physiotherapy and intravenous

therapies in their own home. HomeLink is also a leader in remote

monitoring practice and offers a virtual ward solution. The

investment will support the organic expansion of the company.

Sprintroom Limited

In March 2024, the Company completed a £0.8 million follow-on

investment in Sprintroom Limited, which trades as Sprint Electric.

The business designs and manufactures drives for controlling

electric motors in light and heavy industrial applications, as well

as recovering and reusing otherwise lost energy. The investment

will be used to drive continued revenue growth.

Specac International Limited

In March 2024, the Manager announced the sale of Specac

International, a leading manufacturer of high specification sample

analysis and preparation equipment used in testing and research

laboratories worldwide, primarily supporting infrared spectroscopy.

The transaction generated proceeds of £11.2 million at completion.

When added to £1.5 million of cash returned pre-exit, this implies

a total cash-on-cash return of 9.4x. equivalent to an IRR of 33%.

Since investment, the business has grown to sell globally through

both original equipment manufacturers (“OEMs”) and distributors.

The Manager also engaged with the team to support management team

changes, improvements in governance, headcount and numerous product

launches. The exit will facilitate the continued growth of the

business.

Key portfolio developments

Material changes in valuation, defined as increasing or decreasing

by £1.0 million or more since 31 December 2022, are detailed

below. Updates on these companies are included below, in the Post

year end activity section on pages 24 and 25, or in the Top Ten

Investments section on pages 30 to 34 of the Annual Report.

Key valuation changes in the year

|

Company |

Valuation methodology |

Net movement (£) |

|

Callen-Lenz Associates Limited |

Discounted offer received |

9,512,985 |

|

Aquasium Technology Limited |

Discounted earnings multiple |

4,836,061 |

|

Hospital Services Group Limited |

Discounted earnings multiple |

1,790,599 |

|

Fourth Wall Creative Limited |

Discounted revenue multiple |

1,452,191 |

|

TLS Management Limited |

Net assets |

1,274,590 |

|

Copptech UK Limited |

Discounted revenue multiple |

(1,013,332) |

|

Crosstown Dough Ltd |

Discounted revenue multiple |

(1,145,347) |

|

Nano Interactive Group Limited |

Discounted revenue multiple |

(1,211,595) |

|

Aerospace Tooling Corporation Limited |

Discounted earnings multiple |

(1,340,079) |

|

So-Sure Limited |

Nil value |

(1,584,158) |

|

Additive Manufacturing Technologies Ltd |

Price of last funding round |

(1,779,015) |

|

Ollie Quinn Limited |

Discounted offer received |

(4,028,399) |

Copptech UK Limited

Copptech has developed a series of antimicrobial technologies using

copper, zinc and organic active ingredients. The active ingredient

is added to polymers, plastics or dispersions such as varnish and

kills bacteria, fungi and viruses on contact.

31 December 2023 update

Sales in the 12 months to 31 December 2023 were in line with the

prior year but behind plan. The company’s EBITDA loss was driven by

investment in overhead and a drop in gross margin as finished goods

sales were prioritised to build strategic relationships. The

management team continues to review costs and the level of

R&D.

Crosstown Dough Ltd

Crosstown began trading in 2014 and has a portfolio of 31 sites,

including a mix of bricks and mortar, food trucks and market

stalls. Crosstown’s core product are fresh sourdough doughnuts made

at its central production unit in Battersea. Crosstown has also

developed an online presence, via its website and other delivery

providers, as well as a wholesale offering.

31 December 2023 update

Crosstown participated in The Mother of the Nation Festival in Abu

Dhabi in December, helping to build the brand internationally and

presenting future growth opportunities. Management continues to

focus on improvements to the existing retail network to return to

like-for-like growth, as well as selective new site opportunities.

Crosstown continues to invest in its digital business, following

the recruitment of a new Head of E-commerce.

So-Sure Limited

So-Sure is an insurance technology company acting as "Managing

General Agent" for insurers, offering a more trusted proposition,

greater pricing transparency and improved customer experience

through its customer-centric digital platform.

31 December 2023 update

So-Sure has not performed in line with the management plan

presented to the Manager's Investment Committee at the time of the

initial investment and was fully written off in the quarter.

Aerospace Tooling Corporation

Limited

ATL provides specialist inspection, maintenance, repair and

overhaul ("MRO") services for components in high-specification

aerospace and turbine engines.

31 December 2023 update

Sales were in line with the prior year. ATL has implemented

improvements in its processes and internal systems which have led

to improvements in gross margin. There remains a focus on the

delivery of a growing order book, which is expected to result in an

uplift in sales for 2024. Some challenges remain over equipment

reliability issues and the Board has implemented a plan to resolve

these.

Additive Manufacturing Technologies

Limited

AMT is developing machines for post-production of 3D printed parts:

removal of excess polymer ("depowdering"), surface

smoothing/polishing, colouring and inspection. AMT’s goal is to

provide a fully automated end-to-end post-production system, the

“DMS”, with robots linking each stage.

31 December 2023 update

A significant cost reduction exercise has been implemented, with

the full impact continuing to be realised in the business. The

Manager continues to support the business with its restructuring

plan and progress towards a break-even position. The business

recently released a smaller version of its machine to market which

has been well received, with strong order intake received in the

first few months.

Outlook

Global economies demonstrated some recovery in 2023 with signs of

stability returning; however, the UK is proving slower to recover.

The FTSE 100 grew by just 4%, whilst the MCSI World Index grew by

c.20% during the year and many global indexes surpassed this,

including the S&P 500 and NASDAQ – the latter seeing 45%

growth.

Consumer confidence has remained relatively weak in the face of

inflation, which fell steadily throughout 2023 to 4% but remained

high by recent standards. To combat this, interest rates increased

from 3% to 5.25% throughout the year, eroding consumer spending

power and putting leveraged businesses under financial pressure. At

a global level, the ongoing conflict in Ukraine and emerging

conflict in the Middle East have led to continuing supply chain

uncertainty and volatility in oil and gas prices. Overall, the UK

economy experienced stagnation during 2023 and entered a technical

recession in the latter half of the year, although many

commentators expected this to be shallow by historic standards. As

a result of these factors, M&A volumes dropped noticeably in

2023.

Despite this challenging backdrop, the Company has performed

well in the year, achieving a 7.8% NAV Total Return for

shareholders. Strong exits were achieved, to both trade and PE

buyers and across various sectors, demonstrating that demand

remains for high-quality assets that are well prepared for sale.

The exits of Datapath, GovGrant, Fresh Relevance and Mowgli from

across a range of sectors, significantly contributed to the

Company’s total dividends of 8.4p per share for the year,

delivering an attractive dividend yield of 10.7% and exceeding the

Company’s target. The Company retains a portfolio that is well

balanced across sectors and stages, with some companies delivering

strong profitability whilst other earlier-stage investments

continue to display strong growth. The Manager’s cautious approach

to taking on leverage has protected many portfolio companies from

concerns surrounding rising interest rates.

Looking forward to 2024, considerable uncertainty remains in the

UK economy. The UK’s economic activity was subdued during 2023.

This had an effect on lenders’ confidence which had also been

challenged by high interest rates and inflation. Interest rates are

set to remain above recent norms for the foreseeable future,

impacting consumer spending power. The forthcoming general

election, which will be announced at some point this year, will

only add to the sense of uncertainty, although it seems likely the

government will seek to reduce the tax burden to the degree

possible in the run up to an election.

More broadly there is cause for optimism, however.

The UK continues to be a global leader in key sectors

such as technology, life sciences and financial services. There is

a strong and established network of support for growing young

companies and world-class universities continue to nurture exciting

spin-outs. Multinationals continue to see the UK as an attractive

place to invest and grow their businesses. The strength of the US

technology and finance sectors in recent years has made UK

valuations seem relatively cheap by comparison, offering attractive

opportunities for sale to international buyers.

The Manager is pleased with the performance in the year,

especially against the backdrop of a challenging macroeconomic

picture. Looking forward, with the economy returning to some growth

and interest rates and inflation having likely peaked, there is

potential for continued good performance over the medium term. The

Company’s strong performance has improved its position in the VCT

market, which is an increasingly attractive and visible source of

capital for the UK’s ambitious entrepreneurs. The portfolio remains

diversified and resilient to macroeconomic headwinds, supported by

a collaborative, hands-on approach from the Manager.

James Livingston

on behalf of Foresight Group LLP

Co-Head of Private Equity

15 April 2024

Income Statement

For the year ended 31 December 2023

|

|

Year ended 31 December 2023 |

Year ended 31 December 2022 |

|

Revenue |

Capital |

Total |

Revenue |

Capital |

Total |

|

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

£’000 |

| Realised gains on

investments |

|

— |

14,573 |

14,573 |

— |

13,207 |

13,207 |

| Investment holding gains |

|

— |

2,833 |

2,833 |

— |

2,138 |

2,138 |

| Income |

|

5,372 |

— |

5,372 |

1,536 |

— |

1,536 |

| Investment management fees |

|

(1,004) |

(4,481) |

(5,485) |

(949) |

(2,550) |

(3,499) |

|

Other expenses |

|

(817) |

— |

(817) |

(680) |

— |

(680) |

| Return/(loss) on ordinary

activities before taxation |

|

3,551 |

12,925 |

16,476 |

(93) |

12,795 |

12,702 |

|

Taxation |

|

(476) |

476 |

— |

— |

— |

— |

|

Return/(loss) on ordinary activities after

taxation |

|

3,075 |

13,401 |

16,476 |

(93) |

12,795 |

12,702 |

|

Return/(loss) per share |

|

1.3p |

5.6p |

6.9p |

(0.1)p |

5.9p |

5.8p |

The total columns of this statement are the profit and loss

account of the Company and the revenue and capital columns

represent supplementary information.

All revenue and capital items in the above Income Statement are

derived from continuing operations. No operations were acquired or

discontinued in the year.

The Company has no recognised gains or losses other than those

shown above, therefore no separate statement of total comprehensive

income has been presented.

The Company has only one class of business and one reportable

segment, the results of which are set out in the Income Statement

and Balance Sheet.

There are no potentially dilutive capital instruments in issue

and, therefore, no diluted earnings per share figures are relevant.

The basic and diluted earnings per share are, therefore,

identical.

The notes on pages 89 to 106 of the Annual Report form part of

these financial statements.

Reconciliation of Movements in Shareholders’

Funds

|

Year ended 31 December 2023 |

|

Called-up

share capital

£’000 |

Share

premium account

£’000 |

Capital redemption reserve

£’000 |

Distributable reserve1

£’000 |

Capital reserve1

£’000 |

Revaluation reserve

£’000 |

Total

£’000 |

| As at 1 January 2023 |

|

2,192 |

56,380 |

1,195 |

47,701 |

16,602 |

67,659 |

191,729 |

| Share issues in the

year2 |

|

428 |

37,827 |

— |

— |

— |

— |

38,255 |

| Expenses in relation to share

issues3 |

|

— |

(1,441) |

— |

— |

— |

— |

(1,441) |

| Repurchase of shares |

|

(68) |

— |

68 |

(5,369) |

— |

— |

(5,369) |

| Realised gains on disposal of

investments |

|

— |

— |

— |

— |

14,573 |

— |

14,573 |

| Investment holding gains |

|

— |

— |

— |

— |

— |

2,833 |

2,833 |

| Dividends paid |

|

— |

— |

— |

(20,531) |

— |

— |

(20,531) |

| Management fees charged to

capital |

|

— |

— |

— |

— |

(4,481) |

— |

(4,481) |

| Revenue return before taxation

for the year |

|

— |

— |

— |

3,551 |

— |

— |

3,551 |

|

Taxation for the year |

|

— |

— |

— |

(476) |

476 |

— |

— |

|

As at 31 December 2023 |

|

2,552 |

92,766 |

1,263 |

24,876 |

27,170 |

70,492 |

219,119 |

- Reserve is available for distribution; total distributable

reserves at 31 December 2023 total £52,046,000 (2022:

£64,303,000).

- Includes the dividend reinvestment scheme.

- Expenses in relation to share issues includes trail commission

for prior years’ fundraising.

The notes on pages 89 to 106 of the Annual Report form part of

these financial statements

| Year

ended 31 December 2022 |

|

Called-up share capital

£’000 |

Share premium account

£’000 |

Capital redemption reserve

£’000 |

Distributable reserve1

£’000 |

Capital reserve1

£’000 |

Revaluation reserve

£’000 |

Total

£’000 |

| As at 1 January 2022 |

|

2,056 |

34,954 |

1,081 |

75,591 |

5,945 |

65,521 |

185,148 |

| Share issues in the

year2 |

|

250 |

22,084 |

— |

— |

— |

— |

22,334 |

| Expenses in relation to share

issues3 |

|

— |

(658) |

— |

— |

— |

— |

(658) |

| Repurchase of shares |

|

(114) |

— |

114 |

(8,980) |

— |

— |

(8,980) |

| Realised gains on disposal of

investments |

|

— |

— |

— |

— |

13,207 |

— |

13,207 |

| Investment holding gains |

|

— |

— |

— |

— |

— |

2,138 |

2,138 |

| Dividends paid |

|

— |

— |

— |

(18,817) |

— |

— |

(18,817) |

| Management fees charged to

capital |

|

— |

— |

— |

— |

(2,550) |

— |

(2,550) |

| Revenue

loss for the year |

|

— |

— |

— |

(93) |

— |

— |

(93) |

| As at

31 December 2022 |

|

2,192 |

56,380 |

1,195 |

47,701 |

16,602 |

67,659 |

191,729 |

- Reserve is available for distribution; total distributable

reserves at 31 December 2023 total £52,046,000 (2022:

£64,303,000).

- Includes the dividend reinvestment scheme.

- Expenses in relation to share issues includes trail commission

for prior years’ fundraising.

The notes on pages 89 to 106 of the Annual Report form part of

these financial statements.

Balance Sheet

At 31 December 2023

|

|

|

As at

31 December

2023

£’000 |

As at

31 December

2022

£’000 |

| Fixed

assets |

|

|

|

|

Investments held at fair value through profit or loss |

|

171,348 |

169,775 |

| Current

assets |

|

|

|

| Debtors |

|

3,510 |

3,037 |

|

Cash and cash equivalents |

|

46,200 |

19,525 |

| |

|

49,710 |

22,562 |

| Creditors |

|

|

|

|

Amounts falling due within one year |

|

(1,939) |

(608) |

| Net current assets |

|

47,771 |

21,954 |

|

Net assets |

|

219,119 |

191,729 |

| Capital and

reserves |

|

|

|

| Called-up share capital |

|

2,552 |

2,192 |

| Share premium account |

|

92,766 |

56,380 |

| Capital redemption reserve |

|

1,263 |

1,195 |

| Distributable reserve |

|

24,876 |

47,701 |

| Capital reserve |

|

27,170 |

16,602 |

|

Revaluation reserve |

|

70,492 |

67,659 |

| Equity shareholders’

funds |

|

219,119 |

191,729 |

|

Net Asset Value per share |

|

85.9p |

87.5p |

The financial statements were approved by the Board of Directors

and authorised for issue on 15 April 2024 and were signed on its

behalf by:

Margaret Littlejohns

Chair

15 April 2024

Registered number: 03421340

The notes on pages 89 to 106 of the Annual Report form part of

these financial statements.

Cash Flow Statement

For the year ended 31 December 2023

|

|

|

Year ended

31 December

2023

£’000

|

Year ended

31 December

2022

£’000 |

|

Cash flow from operating activities |

|

|

|

| Loan interest received from

investments |

|

2,212 |

1,249 |

| Dividends received from

investments |

|

1,525 |

132 |

| Other income received from

investments |

|

284 |

— |

| Deposit and similar interest

received |

|

1,326 |

220 |

| Investment management fees

paid |

|

(4,014) |

(3,789) |

| Secretarial fees paid |

|

(130) |

(130) |

|

Other cash payments |

|

(631) |

(457) |

|

Net cash inflow/(outflow) from operating

activities |

|

572 |

(2,775) |

| Cash flow from investing

activities |

|

|

|

| Purchase of investments |

|

(19,352) |

(11,051) |

| Proceeds on sale of

investments |

|

33,566 |

21,922 |

|

Proceeds on deferred consideration |

|

1,171 |

266 |

|

Net cash inflow from investing activities |

|

15,385 |

11,137 |

| Cash flow from financing

activities |

|

|

|

| Proceeds of fundraising |

|

33,547 |

18,531 |

| Expenses of fundraising |

|

(599) |

(473) |

| Repurchase of own shares |

|

(5,755) |

(9,234) |

|

Equity dividends paid |

|

(16,475) |

(15,182) |

|

Net cash inflow/(outflow) from financing

activities |

|

10,718 |

(6,358) |

|

Net inflow of cash in the year |

|

26,675 |

2,004 |

| Reconciliation of net cash flow

to movement in net funds |

|

|

|

| Increase in cash and cash

equivalents for the year |

|

26,675 |

2,004 |

|

Net cash and cash equivalents at start of year |

|

19,525 |

17,521 |

|

Net cash and cash equivalents at end of year |

|

46,200 |

19,525 |

Analysis of changes in net debt

|

|

At

1 January

2023

£’000 |

Cash flow

£’000 |

At

31 December 2023

£’000 |

|

Cash and cash equivalents |

19,525 |

26,675 |

46,200 |

The notes on pages 89 to 106 of the Annual Report form part of

these financial statements.

Notes

1. These are not statutory accounts in accordance with S436 of

the Companies Act 2006. The full audited accounts for the year

ended 31 December 2023, which were unqualified and did not contain

statements under S498(2) of the Companies Act 2006 or S498(3) of

the Companies Act 2006, will be lodged with the Registrar of

Companies. Statutory accounts for the year ended 31 December 2023

including an unqualified audit report and containing no statements

under the Companies Act 2006 will be delivered to the Registrar of

Companies in due course.

2. The audited Annual Financial Report has been prepared on the

basis of accounting policies set out in the statutory accounts of

the Company for the year ended 31 December 2023. All investments

held by the Company are classified as ‘fair value through the

profit and loss’. Unquoted investments have been valued in

accordance with IPEV guidelines. Quoted investments are stated at

bid prices in accordance with the IPEV guidelines and Generally

Accepted Accounting Practice.

3. Copies of the Annual Report will be sent to shareholders and

can be accessed on the following website: www.foresightvct.com.

4. Net Asset Value per share

The Net Asset Value per share is based on net assets at the end of

the year and on the number of shares in issue at that date.

|

|

31 December |

31 December |

|

|

2023 |

2022 |

|

Net assets |

£219,119,000 |

£191,729,000 |

|

No. of shares at year end |

255,218,477 |

219,151,944 |

|

Net Asset Value per share |

85.9p |

87.5p |

5. Return per share

|

|

Year ended |

Year ended |

|

|

31 December |

31 December |

|

|

2023 |

2022 |

|

|

£’000 |

£’000 |

|

|

|

|

|

Total return after taxation |

16,476 |

12,702 |

|

Total return per share (note a) |

6.9p |

5.8p |

|

Revenue return/(loss) from ordinary activities after taxation |

3,075 |

(93) |

|

Revenue return/(loss) per share (note b) |

1.3p |

(0.1)p |

|

Capital return from ordinary activities after taxation |

13,401 |

12,795 |

|

Capital return per share (note c) |

5.6p |

5.9p |

|

Weighted average number of shares in |

|

|

|

issue in the year (note d) |

240,044,732 |

218,519,391 |

Notes:

a) Total return per share is total return after taxation divided by

the weighted average number of shares in issue during the year.

b) Revenue return/(loss) per share is revenue loss after taxation

divided by the weighted average number of shares in issue during

the year.

c) Capital return per share is capital return after taxation

divided by the weighted average number of shares in issue during

the year.

d) The weighted average number of shares is calculated by taking

the number of shares issued and bought back during the year,

multiplying each by the percentage of the year for which that share

number applies and then totalling with the number of shares in

issue at the beginning of the year.

6. Annual General Meeting

The Annual General Meeting of the Company will be held at the

offices of Foresight Group LLP, The Shard, 32 London Bridge Street,

SE1 9SG on 4 June 2024 at 2.00pm. Details will be published on both

the Company’s and the Manager’s website at

www.foresightvct.com.

7. Income

|

|

Year ended |

Year ended |

|

|

31 December |

31 December |

|

|

2023 |

2022 |

|

|

£’000 |

£’000 |

|

Loan stock interest |

2,237 |

1,184 |

|

Dividends receivable |

1,525 |

132 |

|

Deposit and similar interest received |

1,326 |

220 |

|

Other income |

284 |

— |

|

|

5,372 |

1,536 |

8 Investments held at fair value through profit or

loss

|

|

31 December |

31 December |

|

|

2023 |

2022 |

|

|

£’000 |

£’000 |

|

Unquoted investments |

171,348 |

169,775 |

|

|

|

|

|

|

|

£’000 |

|

Book cost as at 1 January 2023 |

|

103,766 |

|

Investment holding gains |

|

66,009 |

|

Valuation at 1 January 2023 |

|

169,775 |

|

Movements in the year: |

|

|

|

Purchases at cost |

|

20,342 |

|

Disposal proceeds1 |

|

(33,566) |

|

Realised gains² |

|

13,402 |

|

Investment holding gains3 |

|

1,395 |

|

Valuation at 31 December 2023 |

|

171,348 |

|

Book cost at 31 December 2023 |

|

103,944 |

|

Investment holding gains |

|

67,404 |

|

Valuation at 31 December 2023 |

|

171,348 |

- The Company received £33,566,000 (2022: £21,922,000) from the

disposal of investments during the year. The book cost of these

investments when they were purchased was £20,164,000 (2022:

£8,981,000). These investments have been revalued over time and

until they were sold, any unrealised gains or losses were included

in the fair value of the investments.

- Realised gains in the Income Statement include deferred

consideration receipts from Accrosoft Limited (£13,000), Datapath

Group Limited (£292,000) and Mowgli Street Food Group Limited

(£824,000), and completion proceeds received from Datapath Group

Limited (£39,000) and Protean Software Limited (£3,000).

- Investment holding gains in the Income Statement include the

deferred consideration debtor increase of £1,438,000. The debtor

movement reflects the recognition of amounts receivable from

Datapath Group Limited (£1,170,000) and Mowgli Street Food Group

Limited (£1,647,000), offset by receipts from Accrosoft Limited

(£13,000), Datapath Group Limited (£292,000) and Mowgli Street Food

Group Limited (£824,000). The Codeplay Software Limited debtor

increased due to its foreign exchange movements (£100,000), and

provisions have been made against balances potentially due from

Ixaris Systems Ltd (£40,000), FFX Group Limited (£70,000) and

Mologic Ltd (£240,000).

9. Related party transactions

No Director has an interest in any contract to which the Company is

a party other than their appointment and remuneration as

Directors.

10.Transactions with the Manager

Foresight Group LLP was appointed as Manager on 27 January 2020 and

earned fees of £4,018,000 during the year (2022: £3,499,000). A

performance incentive fee of £1,467,000 was also accrued at 31

December 2023. Further details are included in note 13 of the

Annual Report.

Foresight Group LLP is the Company Secretary (appointed in

November 2017) and received accounting and company secretarial

services fees of £130,000 (2022: £130,000) during the year. At 31

December 2023, the amount due to Foresight Group LLP was £4,000

(2022: £nil).

No amounts have been written off in the year in respect of debts

due to or from the Manager.

END

For further information please contact:

Gary Fraser, Foresight Group: 020 3667 8181

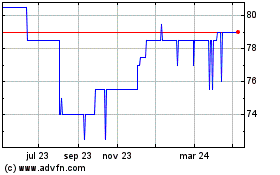

Foresight Vct (LSE:FTV)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

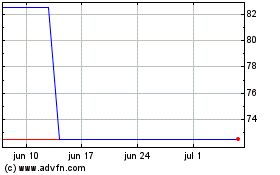

Foresight Vct (LSE:FTV)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024