TIDMHDD

RNS Number : 6246Z

Hardide PLC

17 May 2023

The information communicated in this announcement is inside

information for the purposes of Article 7 of the Market Abuse

Regulation 596/2014 as it forms part of UK domestic law by virtue

of the European Union (Withdrawal) Act 2018 ("MAR") .

17 May 2023

Hardide plc

("Hardide, the "Group" or the "Company")

Interim Results for the six months ended 31 March 2023

EBITDA breakeven performance driven by continuing revenue growth

and improving gross margin

Hardide plc (AIM: HDD), the developer and provider of advanced

surface coating technology , announces its results for the

six-month period ended 31 March 2023.

Highlights

Financial

-- Revenue of GBP2.9m (H1 FY22: GBP2.7m), a 9% increase

over H1 FY22

-- Gross profit of GBP1.3m (H1 FY22: GBP1.1m)

-- Gross margin improved to 47% (H1 FY22: 41%)

-- EBITDA breakeven achieved (H1 FY22: GBP0.2m EBITDA loss)

-- Available cash resources at 31 March 2023 were GBP0.7m

(30 September 2022: GBP0.7m)

-- Selling price increases successful in mitigating input

cost inflation

-- Profit and working capital improvement actions announced

in December 2022 are running ahead of expectations and

are now expected to yield GBP0.5m of benefit for the

full financial year

Commercial

* Energy (representing 64% of H1 FY23 sales): total

energy sales increased by 29%

* Industrial (representing 33% of H1 FY23 sales):

revenue fell 17% mainly due to the timing of orders

* Aerospace (representing 3% of H1 FY23 sales): sales

to the aerospace sector increased by 10% as

production orders are now regularly being received

Commenting on the results, Philip Kirkham, CEO of Hardide plc,

said:

"The Group performed well in the first half, with revenues up 9%

from H1 FY22 and 22% higher than H2 FY22. This reflected improving

market conditions in the oil & gas sector, new project wins and

the recovery of input cost inflation in selling prices. We were

pleased to deliver an EBITDA breakeven performance for the period,

bringing us closer to achieving our strategic milestone of becoming

EBITDA and operating cash flow positive.

"The Board expects the positive sales growth to continue into

the second half year. Therefore, whilst mindful of ongoing external

economic uncertainties and headwinds, including further cost

inflation, the Board anticipates performance for the full financial

year to be in line with its expectations.

"More broadly, the Board believes that the Group will continue

to benefit from significant growth potential over the short, medium

and longer term from increasing market adoption of our unique

patented coatings technology, which helps customers to improve

operational efficiency, lower life cycle costs and reduce their

carbon footprint."

Enquiries:

Hardide plc

Philip Kirkham, CEO Tel: +44 (0) 1869 353

Jackie Heddle, Communications Manager 830

IFC Advisory Tel: +44 (0) 20 3934

Graham Herring 6630

Tim Metcalfe

Florence Chandler

finnCap - Nominated Adviser and Joint Tel: +44 (0) 2072 200

Broker 500

Henrik Persson/ Abigail Kelly (Corporate

Finance)

Barney Hayward (ECM/Broking)

Allenby Capital - Joint Broker Tel: +44 (0) 20 3328

Tony Quirke/ Joscelin Pinnington - Sales 5656

and Corporate Broking

Jeremy Porter/ Dan Dearden-Williams - Corporate

Finance

Notes to editors:

www.hardide.com

Hardide develops, manufactures and applies advanced technology

tungsten carbide/tungsten metal matrix coatings to a wide range of

engineering components. Its patented technology is unique in

combining in one material, a mix of toughness and resistance to

abrasion, erosion and corrosion; together with the ability to coat

accurately interior surfaces and complex geometries. The material

is proven to offer dramatic improvements in component life,

particularly when applied to components that operate in very

aggressive environments. This results in cost savings through

reduced downtime and increased operational efficiency as well as a

reduced carbon footprint. Customers include leading companies

operating in the energy sectors, valve and pump manufacturing,

industrial gas turbine, precision engineering and aerospace

industries.

OVERVIEW

I am pleased to report that good progress is being made towards

achieving the strategic milestone of the Group becoming EBITDA and

operating cash flow positive.

Revenues in H1 FY23 grew by 9% to GBP2.9m (H1 FY22: GBP2.7m).

The growth rate was softened by the delay of an expected large

project order for the coating of turbine blades. This is now

expected later in this calendar year. Revenue in H1 FY22 had

benefited from an order of similar value; and excluding that order

from H1 FY22 sales, H1 FY23 revenues would be 21% ahead of H1

FY22.

The increase in revenues allowed the Group to improve capacity

utilisation and better leverage fixed costs which, together with

good recovery of input cost inflation in selling prices, enabled a

significant improvement in gross margin to 47% (H1 FY22: 41%).

The combination of revenue growth and higher gross margin

enabled us to deliver an EBITDA breakeven performance for the

period (H1 FY22: EBITDA loss of GBP0.2m).

EBITDA benefited from a net non-recurring property gain of

GBP0.1m described further below. EBITDA in H1 FY22 benefited from

GBP0.2m of Covid support.

The Group balanced its cash flows overall for the period, with

GBP0.7m of available cash resources on the balance sheet at 31

March 2023 (30 September 2022: GBP0.7m). The cash balance has been

relatively stable in recent months, reflecting the EBITDA breakeven

performance. The Group is well invested and, in general, has

sufficient operational capacity to support approximately double the

current annualised revenue, depending on product mix, over the

short to medium term without further major capital investment.

Nonetheless, the Board continues to explore opportunities to

further strengthen the balance sheet to build additional headroom

and resilience.

The Group is making strong progress in commercialising new

applications that have been subject to long and/or delayed test and

development programmes. It is pleasing to note several first new

orders, resulting from these programmes, from customers in the

power generation, oil & gas drilling and aerospace sectors.

Revenue growth is expected to continue into the second half

year, and performance for the full financial year is expected to be

in line with the Board's expectations.

STRATEGIC DEVELOPMENT

The Group is on track to achieve its initial strategic objective

of becoming consistently EBITDA and operating cash flow positive,

enabling us then to drive towards full profitability.

Good progress is being made on technical co-operation with other

large coatings companies to develop mutually beneficial commercial

opportunities; technical and co-operation agreements have been

signed with two global companies.

COMMERCIAL AND OPERATIONAL OVERVIEW

Customers and Markets

In H1 FY23, end use market segmentation was:

-- Energy (including oil & gas, power generation and alternative

energy): 64% (H1 FY22: 54%)

-- Industrial: 33% (H1 FY22: 43%)

-- Aerospace: 3% (H1 FY22: 3%)

Energy

Sales to energy customers increased by 29%.

Recovery from the oil & gas sector was strong with revenue

increasing by 54% compared with H1 FY22. Nonetheless, recovery has

been slower than expected due to ongoing material supply and labour

shortages in the oil & gas supply chain. Indications from

customers are that the situation is improving. We expect revenue

growth from this sector to continue in H2 FY23. The first major

order was received from a new customer for well stimulation

components, and successful trials and developments are underway

with customers in sand control systems, downhole drilling tools and

other oil & gas components.

The delayed order from the existing power generation customer is

now expected later in calendar year 2023. Following extensive

testing, it is expected that our first order will be received in H2

FY23 from the second largest global industrial gas turbine (IGT)

producer, for sets of gas turbine vanes. The coating is also in

trials for coated blades and vanes with other large IGT

manufacturers.

Testing of the coating for both EV battery and hydrogen

applications continues to progress and all tests have been

successful and productive. Customer testing by a major European

company in the hydrogen production and distribution sector is

underway. The Henry-Royce Institute's grant-supported project with

Cranfield University to investigate 'green' hydrogen production

produced very promising results. Further grant applications are

being made to take the project to the next stage.

Industrial

Revenue from our industrial customers fell by 17% primarily due

to phasing of demand. We expect this revenue to recover this in the

second half of the year.

Aerospace

Sales revenue from aerospace customers increased by 10%.

Momentum is building as production orders are now being received

regularly for the coating of wing components for the Airbus A320,

A330, A380 and A400M aircraft with other parts for these aircraft

currently in test. Of particular significance is a new approval

received for high volume components for the Airbus A320 where the

Hardide coating is replacing a competitor's coating. Orders are due

to commence in H2 FY23. Further orders were received for parts for

Lockheed Martin's F35 Joint Strike Fighter. Following Leonardo

Helicopters' approval, orders are now being received for the

coating of transmission system components.

Profit and cash improvement plan

In December 2022 we announced an initiative to improve profit

and cash flow by GBP0.3-0.4m by summer 2023. We are pleased to

report that this initiative is now anticipated to exceed initial

expectations and bring an overall benefit of c.GBP0.5m for the full

financial year, comprising:

-- Cost savings of GBP0.2m

-- Grants to offset development and testing costs of GBP0.1m

-- Selling price increase / cost inflation recovery of

GBP0.1m

-- Working capital improvements of GBP0.1m.

FINANCIAL REVIEW

Income statement

Revenues for H1 FY23 were GBP2.9m, an increase of 9% from H1

FY22 and 22% higher than the prior half year of H2 FY22. This

reflects improving market demand, particularly in the oil and gas

sector, increasing customer adoption of our unique coatings

technology, and price increases to offset input cost inflation.

This revenue growth enabled us to improve capacity utilisation

and better leverage fixed costs, driving a 6 percentage point

increase in gross margin to 47% (H1 FY22: 41%). Together with good

control of overheads, the increase in revenues and improvement in

gross margin enabled us to deliver an EBITDA breakeven performance

for the period (H1 FY22: GBP0.2m EBITDA loss).

The EBITDA breakeven result benefited from a net GBP0.1m

non-recurring gain relating mainly to the purchase, sale and

leaseback of our facility in Martinsville, USA, in December 2022.

The EBITDA loss in H1 FY22 benefited from GBP0.2m of COVID-19 US

Government support.

There were no significant changes in depreciation or financing

costs compared to previous periods. The loss before taxation was

GBP0.6m (H1 22: loss of GBP0.8m).

Cash Flow, Going Concern and Financing

Overall, the Group balanced its cash flows in H1 FY23, with

available cash resources at both the beginning and end of the

period of GBP0.7m. Excluding the one-off cash flow benefit of

GBP0.5m from the new Martinsville leasing arrangements and

adjusting for period-end timing differences relating to supplier

payments, the underlying net cash outflow in the half year was

circa GBP0.2m.

The Group's cash balance has been reasonably stable for the last

few months. This illustrates, alongside the EBITDA breakeven

result, that the Group is now very close to achieving its key

strategic milestone of becoming operating cash flow

self-sufficient. The Group is very well invested, has sufficient

spare operational capacity to support significant revenue growth

and therefore we do not currently anticipate any need for further

large amounts of capital expenditure.

Gross debt at 31 March 2023, comprising Coronavirus Business

Interruption Loan Schemes ("CBILS") and asset finance arrangements,

but excluding lease obligations reported under IFRS 16, was GBP1.0m

(H1 FY22: GBP1.2m). Of the amount outstanding at 31 March 2022,

GBP0.3m is repayable within one year. Net debt at both 31 March

2023 and 2022 was GBP0.3m.

Lease obligations reported under IFRS 16 at 31 March 2023 were

GBP2.3m (31 March 2022: GBP2.0m), the increase being due to the new

10-year property lease agreement entered into in Martinsville in

December 2022.

Therefore, having reviewed cash flow forecasts and associated

sensitivity analysis, the Board has concluded that the Group has

sufficient financial resources to meet its needs for the

foreseeable future and accordingly has prepared the interim

financial statements on a going concern basis.

RISK REVIEW

The Board confirms that the risk assessment disclosed in our

2022 annual report remains relevant for the remainder of the

current financial year. The risks and uncertainties relating to

macroeconomic and geopolitical factors, and the precise timing of

customer orders on revenue realisation are those currently judged

by the Board as being the most relevant to delivery of current

financial year performance expectations.

BUSINESS DEVELOPMENT

Our operational capacity is sufficient to produce a sales

revenue of approximately GBP10m (depending on product mix). With

average current utilisation of this capacity running at around 60%,

there are adequate resources available to achieve our aim of

maximising utilisation of this spare capacity over the next few

years. We aim to do this by new developments including c. GBP1m in

the oil & gas sector, more than GBP1m in power generation and

up to GBP1m in aerospace. We should achieve EPS positive results at

approximately GBP7.5m-GBP8.0m revenue.

OUTLOOK

The Board expects the positive sales growth seen in H1 FY23 to

continue in H2 FY23. Therefore, whilst mindful of ongoing external

economic uncertainties and headwinds, including further cost

inflation, the Board anticipates performance for the full financial

year to be in line with its expectations.

More broadly, the Board believes that the Group should continue

to benefit from significant growth potential over the short, medium

and longer term from increasing market adoption of our unique

patented coatings technology, which helps customers to improve

operational efficiency, lower life cycle costs and reduce their

carbon footprint.

Philip Kirkham

Chief Executive Officer

17 May 2023

Income Statement

GBP 000 Year to

6 months 6 months 30 September

to to 2022

31 March 31 March (audited)

2023 2022

(unaudited) (unaudited)

Revenue 2,886 2,658 5,015

Cost of Sales (1,539) (1,556) (3,135)

Gross profit 1,347 1,102 1,880

----------------------------- --------------- --------------- -------------------

Administrative expenses (1,338) (1,323) (2,821)

Depreciation - owned assets (440) (433) (890)

Depreciation - right of use

assets (98) (64) (318)

Operating loss (529) (718) (2,149)

----------------------------- --------------- --------------- -------------------

Finance income 1 1 4

Finance costs (32) (14) (49)

Finance costs on right of

use assets (48) (40) (80)

Loss on ordinary activities

before tax (608) (771) (2,274)

----------------------------- --------------- --------------- -------------------

Tax (6) 15 86

Loss on ordinary activities

after tax (614) (756) (2,188)

----------------------------- --------------- --------------- -------------------

Consolidated Statement of Changes in Equity

GBP 000 Year to

6 months 6 months 30 September

to to 2022

31 March 31 March (audited)

2023 2022

(unaudited) (unaudited)

Total equity at start of

period 5,530 6,914 6,914

------------------------------------- --------------- --------------- -------------------

Loss for the period (614) (756) (2,188)

Issue of new shares - - 509

Exchange differences on translation

of foreign operation (94) 38 304

Share options - - (9)

Total equity at end of period 4,822 6,196 5,530

------------------------------------- --------------- --------------- -------------------

Consolidated Statement of Financial Position

GBP 000 30 September

2022

31 March 31 March (audited)

2023 2022

(unaudited) (unaudited)

Assets

Non-current assets

Goodwill 69 69 69

Intangible assets 13 27 19

Property, plant & equipment 4,837 5,490 5,402

Right of Use Assets 1,813 1,821 1,660

-------------------------------- --------------- --------------- --------------

Total non-current assets 6,732 7,407 7,150

-------------------------------- --------------- --------------- --------------

Current assets

Inventories 214 362 487

Trade and other receivables 1,013 1,146 955

Other current financial assets 232 357 450

Cash and cash equivalents 701 864 693

Total current assets 2,160 2,729 2,585

-------------------------------- --------------- --------------- --------------

Total assets 8,892 10,136 9,735

-------------------------------- --------------- --------------- --------------

Liabilities

Current liabilities

Trade and other payables 710 665 1,077

Financial liabilities - loans

and deferred income 256 258 257

Financial liabilities - leases 171 199 201

Provision for dilapidations - 12 -

Total current liabilities 1,137 1,134 1,535

-------------------------------- --------------- --------------- --------------

Net current assets 1,023 1,595 1,050

-------------------------------- --------------- --------------- --------------

Non-current liabilities

Financial liabilities - loans

and deferred income 708 941 878

Financial liabilities - leases 2,175 1,815 1,742

Provision for dilapidations 50 50 50

Total non-current liabilities 2,933 2,806 2,670

-------------------------------- --------------- --------------- --------------

Total liabilities 4,070 3,940 4,205

-------------------------------- --------------- --------------- --------------

Net assets 4,822 6,196 5,530

-------------------------------- --------------- --------------- --------------

Equity attributable to equity

holders of the parent

Share capital 4,063 3,942 4,063

Share premium 19,242 18,854 19,242

Retained earnings (18,814) (16,766) (18,200)

Share-based payment reserve 553 562 553

Translation reserve (222) (396) (128)

-------------------------------- --------------- --------------- --------------

Total equity 4,822 6,196 5,530

-------------------------------- --------------- --------------- --------------

Consolidated Statement of Cash Flows

GBP 000 Year to

6 months 6 months 30 September

to to 2022

31 March 31 March (audited)

2023 2022

(unaudited) (unaudited)

Cash flows from operating

activities

Operating (loss) (529) (718) (2,149)

Depreciation - owned assets 440 433 890

Depreciation - right of use

assets 98 64 318

Gain on sale and leaseback (157) - -

Share option charge - - (9)

Decrease in inventories 273 142 17

Decrease / (increase) in

receivables 73 (544) (372)

(Decrease) / increase in

payables (286) (42) 372

(Decrease) in provisions - (22) (34)

Cash generated from operations (88) (687) (967)

-------------------------------------- --------------- --------------- ------------

Finance income 1 1 4

Finance costs (32) (14) (49)

Interest on right of use

assets (48) (40) (80)

Tax received 82 80 78

Net cash generated from

operating activities (85) (660) (1,014)

-------------------------------------- --------------- --------------- ------------

Cash flows from investing

activities

Proceeds from sale and leaseback 477 - -

Proceeds from sales of property,

plant, equipment

Purchase of intangibles - - 7

Purchase of property, plant,

equipment - - (1)

(105) (185) (298)

Net cash used in investing

activities 182 (185) (292)

-------------------------------------- --------------- --------------- ------------

Cash flows from financing

activities

Net proceeds from issue of

ordinary share capital - - 509

Loans raised - 333 325

Loans repaid (147) (75) (261)

Lease principal repayments (135) (98) (251)

-------------------------------------- --------------- --------------- ------------

Net cash used in financing

activities (282) 160 322

-------------------------------------- --------------- --------------- ------------

Effect of exchange rate fluctuations 3 6 134

-------------------------------------- --------------- --------------- ------------

Net decrease in cash and

cash equivalents 8 (679) (850)

-------------------------------------- --------------- --------------- ------------

Cash and cash equivalents

at the beginning of the period 693 1,543 1,543

-------------------------------------- --------------- --------------- ------------

Cash and cash equivalents

at the end of the period 701 864 693

-------------------------------------- --------------- --------------- ------------

Notes

1. Basis of preparation of financial information

While the financial information included in these interim

financial results for the half year ended 31 March 2023 have been

prepared in accordance with the recognition and measurement

principles of international accounting standards in conformity with

the requirements of Companies Act 2006 , this announcement does not

contain sufficient information to comply with IFRS's.

These condensed consolidated financial statements should be read

in conjunction with the consolidated financial statements for the

year ended 30 September 2022, which have been prepared in

accordance with UK adopted international accounting standards and

with the requirements of the Companies Act 2006 as applicable to

companies reporting under these standards.

The financial information set out above does not constitute the

Company's statutory accounts as defined by section 434 of the UK

Companies Act 2006. A copy of the statutory accounts for Hardide

plc for the year ended 30 September 2022 has been delivered to the

Registrar of Companies. The auditors have reported on those

accounts; their reports were unqualified and did not include

references to any matters to which the auditors drew attention by

way of emphasis without qualifying their reports. Their reports for

the year ended 30 September 2022 did not contain statements under

section 498 (2) or (3) of the Companies Act 2006.

The consolidated financial statements present the results of the

Company and its subsidiaries ("the Group") as if they formed a

single entity. Intercompany transactions and balances between Group

companies are therefore eliminated in full. Subsidiaries are fully

consolidated from the date on which control is transferred to the

Group and cease to be consolidated from the date on which control

is transferred out of the Group.

2. Segmental information

Under IFRS8, operating segments are defined as a component of

the entity (a) that engages in business activities from which it

may earn revenues and incur expenses (b) whose operating results

are regularly reviewed and (c) for which discrete financial

information is available. The Group management is organised in to

UK and USA operation and Corporate central functions, and this

factor identifies the Group's reportable segments.

6 months ended UK operation US operation Corporate Total

31 March 2023 GBP000 GBP000 GBP000 GBP000

External revenue 1,518 1,368 - 2,886

Reportable segment

profit / (loss) (395) 442 (661) (614)

--------------------- ------------- ------------- ---------- --------

Segment assets 6,466 2,299 127 8,892

Segment liabilities 2,522 1,216 332 4,070

6 months ended UK operation US operation Corporate Total

31 March 2022 GBP000 GBP000 GBP000 GBP000

External revenue

1,532 1,126 - 2,658

Reportable segment

profit / (loss) (475) 319 (600) (756)

--------------------- ------------- ------------- ---------- --------

Segment assets 7,119 2,724 293 10,136

Segment liabilities 2,897 707 336 3,940

12 months ended UK operation US operation Corporate Total

30 September GBP000 GBP000 GBP000 GBP000

2022

External revenue 3,076 1,939 - 5,015

Reportable segment

profit / (loss) (1,650) 186 (724) (2,188)

--------------------- ------------- ------------- ---------- --------

Segment assets 6,855 2,323 557 9,735

Segment liabilities 2,962 893 350 4,205

The Group currently has a single business product, so no

secondary analysis is presented. Revenue from external customers is

attributed according to their country of domicile. Turnover by

geographical destination is as follows:

UK Europe N America Rest of Total

GBP000 GBP000 GBP000 World GBP000

External sales GBP000

31 March 2023 767 79 2,023 17 2,886

31 March 2022 646 267 1,744 1 2,658

30 September

2022 1,314 666 3,007 28 5,015

3. Earnings per share

31 March 31 March 30 September

2023 2022 2022

GBP000 GBP000 GBP000

(Loss) on ordinary activities after

tax (614) (756) (2,188)

Basic earnings per ordinary share:

Weighted average number of ordinary

shares in issue 58,901,959 55,875,645 56,058,053

Earnings per share (1.0)p (1.4)p (3.9)p

As net losses were recorded in each of the respective periods,

the potentially dilutive share options are anti-dilutive for the

purposes of the loss per share calculation and their effect is

therefore not considered.

4. Going concern

The directors have adopted the going concern basis in preparing

the interim financial statements after assessing the principal

risks and having considered the impact of various downside

scenarios compared to the Group's base case financial plans, the

pace of sales growth and the level of profit margins for a period

of at least 12 months from the date of releasing the interim

results. Whilst the macro-economic position continues to be

uncertain, the directors have considered various impacts on sales,

profitability and cash flows and believe that the Group will have

adequate resources to continue in operational existence for the

foreseeable future.

5. Debt maturity

Loans

31 March 31 March 30 September

2023 2022 2022

GBP000 GBP000 GBP000

Total loans 868 1,092 1,018

Maturity analysis:

Within 1 year 239 242 238

1 to 2 years 251 236 250

2 to 3 years 170 248 217

3 to 4 years 105 167 149

4 to 5 years 55 102 81

5+ years 48 97 83

Deferred income

31 March 31 March 30 September

2023 2022 2022

GBP000 GBP000 GBP000

Total deferred income 96 107 117

Maturity analysis:

Within 1 year 17 16 19

1 to 2 years 17 16 19

2 to 3 years 17 16 19

3 to 4 years 17 16 19

4 to 5 years 17 16 19

5+ years 11 27 22

Right of use lease liabilities

31 March 31 March 30 September

2023 2022 2022

GBP000 GBP000 GBP000

Total lease liabilities 2,346 2,014 1,943

Maturity analysis:

Within 1 year 171 199 201

1 to 2 years 180 182 196

2 to 3 years 187 190 174

3 to 4 years 195 138 133

4 to 5 years 202 136 139

5+ years 1,411 1,169 1,100

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR KZGMKKVRGFZM

(END) Dow Jones Newswires

May 17, 2023 02:00 ET (06:00 GMT)

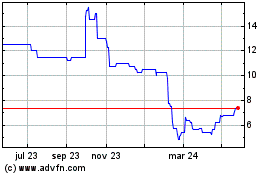

Hardide (LSE:HDD)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

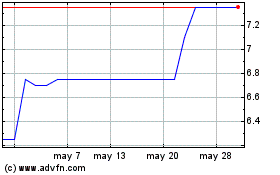

Hardide (LSE:HDD)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025