TIDMHNE

RNS Number : 9076N

Henderson Eurotrust PLC

28 September 2023

JANUS HERSON FUND MANAGEMENT UK LIMITED

HERSON EUROTRUST PLC

LEGAL ENTITY IDENTIFIER: 213800DAFFNXRBWOEF12

28 September 2023

HERSON EUROTRUST PLC

Annual Financial Results for the year ended 31 July 2023

This announcement contains regulated information

Investment objective

Henderson EuroTrust plc ("the Company") aims to achieve a

superior total return from a portfolio of European (excluding the

UK) investments where the quality of the business is deemed to be

high or significantly improving.

Performance highlights

Total return performance to 31 July 2023

1 year 3 years 5 years 10 years

% % % %

------------------- ------- -------- -------- ---------

NAV(1) 16.7 23.0 44.6 157.9

Share price(2) 19.7 21.1 38.1 144.3

Benchmark(3) 16.1 36.7 39.2 124.3

Peer group NAV(4) 14.6 31.8 41.4 146.2

Year ended Year ended

31 July 2023 31 July 2022

-------------------------------------- -------------- --------------

NAV per share at year end 161.3p 142.1p

Share price at year end 139.5p 120.5p

Dividend for year(5) 3.8p 3.8p

Dividend yield(6) 2.7% 3.2%

Ongoing charge(9) 0.79% 0.75%

Gearing at year end GBP15.6m GBP7.3m

(% of NAV) 4.6% (2.5%)

Number of investments at year end(7) 47 41

Discount at year end(8) 13.5% 15.2%

Net assets GBP342.0m GBP301.0m

1 Net asset value ("NAV") per ordinary share total return

(including dividends reinvested)

2 Share price total return (including dividends reinvested)

3 FTSE World Europe (ex UK) Index

4 Association of Investment Companies (" AIC") Europe Sector

(based on cumulative fair net asset value returns)

5 Including the 0.8p interim dividend paid on 28 April 2023 and

the 3.0p final dividend which will be put to shareholders for

approval at the Annual General Meeting ("AGM") on 15 November

2023

6 Based on the share price at the year end

7 Excluding the nil value position in OW Bunker (2022: excluding

OW Bunker)

8 Calculated using the mid-market closing price

9 Calculated using the methodology prescribed by the AIC

Sources: Morningstar Direct, Janus Henderson

CHAIRMAN'S STATEMENT

Summary:

-- Over the year, the share price and the net asset value were

ahead of the benchmark index and ahead of the AIC peer group

-- Stock selection has been the driver of the modest

outperformance, an encouraging outcome given that growth stocks on

the whole have lagged the market

-- We have increased the board size to five and our new director

will be appointed Senior Independent Director following the

conclusion of the 2023 AGM

The financial year to 31 July 2023 has seen a significant

recovery in the share price and net asset value after the

disappointment of the previous financial year. I am pleased to

report that, over the year, the share price and net asset value

were moderately ahead of the benchmark index and materially ahead

of the AIC peer group. In the latest financial year, "value" stocks

in Europe outperformed "growth" stocks by over 9 percentage points

but individual stock selection in quite a difficult environment was

strong enough to result in modest overall outperformance.

In the year to 31 July 2023, net asset value total return was

16.7%. This compared with a total return of 16.1% for the benchmark

index (FTSE World Europe (ex UK)) and 14.6% for the AIC peer group.

The discount to net asset value narrowed during the year, from

15.2% to 13.5%, and as a result, the share price total return for

the Company was 19.7%. The share price at 31 July 2023 was 139.5p,

only slightly below the all-time high of 140.5p.

Dividend

We have proposed a final dividend of 3.0p, which brings the

total dividend for the year ended 31 July 2023 to 3.8p. Subject to

shareholder approval the dividend will be paid on 22 November 2023

to shareholders on the register as at 20 October 2023. The shares

will be quoted ex-dividend on 19 October 2023. The Company's

dividend approach is broadly to pay out the level of actual income

received. In the Chairman's Statement of October 2020, I explained

that the Board committed to pay out the majority of the (then

significant) revenue reserve over three to four years. The proposed

final dividend of 3.0p for the year ended 31 July 2023 means that

commitment to shareholders will be fulfilled and, once the dividend

has been paid in November 2023, the revenue reserve will

effectively be zero.

The Board has also decided that, as only a very small part of

the Company's revenue is received in the first half of the

financial year (for example, 0.3p per share was received for the

six months ended 31 January 2023), going forward the Company will

pay a final dividend only, and no interim dividend. This is in line

with the Company's commitment that, once the revenue reserve had

been paid out, dividends would broadly reflect the level of income

received.

Board changes

During the year we implemented a number of key recommendations

following an external Board evaluation exercise undertaken in June

2022. First, we expanded the Board from four to five directors, to

broaden the diversity of skills and experience. Stephen White, who

is a former European investment manager and experienced investment

trust director, joined the Board with effect from 1 December 2022

and will seek election from shareholders at the AGM in November

2023.

Second, we are appointing a Senior Independent Director with

effect from the AGM in November 2023. Subject to his election by

shareholders, Stephen White will assume this role, thereby

providing shareholders with an alternative point of contact to

raise any concerns should they not wish to discuss these with me or

the Chairman of the Audit and Risk Committee.

In my statement last year, I indicated my intention to retire

from the Board at the AGM this year. However, the search for my

successor has taken longer than anticipated; the Directors have

therefore asked me to stay on until its completion. Consequently, I

have agreed that I will retire from the Board, at the latest, at

the AGM in November 2024 and an update on the recruitment process

will be included in our half year results' announcement in March

2024.

Annual General Meeting

Our meeting will be held on Wednesday 15 November 2023 at 2.30pm

at Janus Henderson Investors' offices at 201 Bishopsgate, London

EC2M 3AE. I hope as many shareholders as possible will be able to

attend to take the opportunity to meet the Board and to hear a

presentation from the Fund Manager. However, if you are unable to

attend in person, you can watch the meeting live by visiting

www.janushenderson.com/trustslive. Full details are set out in the

Notice which has been sent to shareholders with this report and are

also available online at www.hendersoneurotrust.com .

Outlook

We are heartened by the absolute and relative performance of the

Company over the last year. We believe that attitudes towards

investing in European shares are becoming more positive; Europe is

home to many strong global businesses on attractive valuations and

also demonstrates an above average focus on sustainability.

Inevitably, there will be headwinds at times but we remain

committed to seeking out growth companies which have the ability to

achieve consistent growth in the long run. There is a wealth of

such opportunities in this region.

Over the financial year the discount to net asset value at which

our shares trade has ranged from approximately 11.4% to 18.7%,

ending the year at 13.5% (2022: 15.2%). In the long run, strong

absolute and relative performance is a necessary - but not

sufficient - factor in reducing the discount. Therefore, we

continue to consider all other factors which might contribute to

the appeal of the Company to all types of shareholder, and retail

investors in particular. As part of this process, I extend an

invitation to any shareholders who have questions, whether specific

or general, or who would welcome a more general discussion with me

or the Senior Independent Director to get in touch via the

Corporate Secretary (itsecretariat@janushenderson.com). I also

direct current and potential shareholders to the wealth of

materials on the Janus Henderson website ( www.janushenderson.com )

including short videos and articles by our portfolio manager Jamie

Ross, and a video by Jamie on our year end results at

www.hendersoneurotrust.com .

Nicola Ralston

Chairman

27 September 2023

FUND MANAGER'S REPORT

Summary:

-- I am pleased to report a positive year for performance, both

in absolute terms (the value of your shares has increased), and in

relative terms (our net asset value per share has increased by more

than the index return).

-- This performance has been driven by the positive impact of our stock selection.

-- We have also found opportunity to increase our exposure to

some of the highest quality companies in Europe.

Key messages

I am pleased to report a positive year for performance, both in

absolute terms (the value of your shares has increased), and in

relative terms (our net asset value per share has increased by more

than the index return). This performance has been achieved in an

environment where our style of investing (buying and owning high

quality growing businesses) has been out of favour, but our stock

picking has been strong enough to outweigh this.

What has driven our performance?

The best performing sectors in the financial year tended to be

those of a cyclical, interest rate sensitive nature: consumer

discretionary, financials, industrials and technology. The sectors

that lagged tended to be less economically sensitive: consumer

staples, health care, real estate and telecommunications. As has

been usual for us, our sector allocations have had little bearing

on our relative performance. Stock picking within each sector has

been a much more important determinant of performance: we are

'stock pickers' not 'sector pickers'.

Our best performing positions were in three areas: financials,

luxury goods companies and semi-conductor equipment businesses.

Within financials, we were particularly well-rewarded for our

decision to maintain a large position in UniCredit even through the

early days of the Russia-Ukraine conflict in 2022, when investors

were concerned about UniCredit's Russian exposure. We felt that

their exposure was small enough to be manageable, even in a

worst-case scenario, and that the undervaluation of the company's

shares was far too extreme for us to sell just at the time when

higher inflation and interest rates were coming back into the

system (typically a good thing for banks, at least initially).

UniCredit shares have delivered a total return of more than 150%

over the last twelve months and have benefitted from higher

interest rates, strong control of the cost base, a benign

environment for loan losses and strong capital returns to

shareholders. Management have done an excellent job. Munich Re, a

longstanding position for us, has been another financial that has

performed well in this environment.

We have three luxury goods companies in the portfolio: Hermès

and Moncler have been longstanding positions and LVMH was added

more recently, in 2021. Luxury goods companies sell aspiration and

desirability - intangible characteristics for which people are

prepared to pay a high price. The best companies curate their brand

allure with decades of consistent investment, avoid discounting and

partner with well-known trend-setters. Within the sector, we have

taken the approach of owning brands with the strongest and most

longstanding cultural heritage. This approach has led us to owning

Hermès, Moncler and LVMH; these are three of the more expensive

companies in the sector, but we think it is worth paying up for

brands of this quality. We were pleased to see our companies

perform well in the period, in part due to short-term factors such

as recovery in China after Covid restrictions were lifted, but our

investment view takes a much longer-term perspective. We continue

to see attractive growth prospects for these high margin and high

return companies over the medium- to long-term.

The semiconductor industry encompasses businesses of highly

variable quality. The industry is exposed to attractive structural

growth drivers such as the growing ubiquity of semiconductor usage

and powerful technological themes such as machine learning,

artificial intelligence and the internet of things. However, not

all companies have a sufficiently commanding market position to

translate this growth potential into a high margin and high return

business. The three semiconductor companies that we own share one

key characteristic: they have consistently high market shares in

their core technology. ASML has a 100% market share in high end

lithography, ASM International has a commanding market share in a

packaging technology called Atomic Layer Deposition, while Besi

dominate the nascent area of Hybrid Bonding. Strong market shares

in niche technologies drive high margins and return on capital for

these companies. We have had a longstanding position in ASML and

initiated a new position in ASM International during the year and

Besi in June 2022, taking advantage of a period when investors

seemed overly concerned about a potential short-term cyclical

downswing in industry demand. These two positions rallied

particularly strongly over the year.

Finally, Novo Nordisk is worthy of mention. Novo is our largest

position and a long standing holding in the portfolio. Novo has

recently launched an obesity drug in the US and this has attracted

a huge amount of media attention. We have been following their

progress in this therapeutic area for a number of years and it is

pleasing to see the company finally able to bring an efficacious

and well-tolerated product to market. We believe that the obesity

franchise is extremely well positioned for growth and this

reinforces our positive views on the company. We continue to own a

large position in Novo even after the strong multi-year share price

performance.

Our underperformers have tended to be defensive in nature. When

investors want to buy into improving economic sentiment, they tend

to avoid steady, consistent, dependable companies such as Roche,

Cellnex and Sartorius. We ignore these short-term swings in

sentiment and continue to value the long-term compounding nature of

these businesses. In addition to this issue of style, there were a

small number of companies whose operational performance was not as

impressive as we would wish. Allfunds, DSM Firmenich and Kion have

each struggled this year.

Allfunds, a business that links up fund houses with fund

distributors, is exposed to three major drivers of growth in assets

under administration: the onboarding of new clients, inflows from

existing clients and long-term growth in market levels. Over the

past year or two, market volatility across multiple asset classes

has impacted the latter two of these drivers whilst the onboarding

of new clients, an area where they have more control, has remained

resilient. We retain faith in the ability of this high market

share, high margin business to generate significant growth over

time, but a period of more benign markets would be welcome. DSM has

struggled with a number of issues, some industry-wide and some

stockspecific. On the former, there has been some post-Covid unwind

with a number of US customers destocking their ingredients

inventory. On the latter, DSM has suffered from weakness in vitamin

pricing and have had to deal with disruption related to the

Firmenich merger and senior management changes. We have maintained

our positions in both Allfunds and DSM (now DSM Firmenich).

Finally, Kion has suffered from cost overruns in its warehouse

automation business as well as signs of slowing demand. We felt

that our long-term thesis had been sufficiently challenged to sell

out of our position in Kion.

Average portfolio Attribution Analysis

weight (%) (1)

Sector Stock

allocation selection Total

Company Index Relative effect effect effect

-------- ------------ ----------- --------

Aerospace & Defence 5.7 2.2 -3.5 0.3 0.7 1.0

-------- ------ --------- ------------ ----------- --------

Alternative Energy 0.0 0.5 0.5 0.0 0.1 0.1

-------- ------ --------- ------------ ----------- --------

Automobiles and

Parts 0.0 3.3 3.3 0.0 -0.5 -0.5

-------- ------ --------- ------------ ----------- --------

Banks 7.0 7.5 0.4 1.5 -0.4 1.1

-------- ------ --------- ------------ ----------- --------

Beverages 2.3 2.1 -0.2 0.0 -0.1 -0.1

-------- ------ --------- ------------ ----------- --------

Cash -0.7 0.0 0.7 0.0 -0.1 -0.1

-------- ------ --------- ------------ ----------- --------

Chemicals 2.3 3.5 1.2 -0.1 0.0 -0.0

-------- ------ --------- ------------ ----------- --------

Construction &

Materials 0.0 3.8 3.8 0.0 -0.1 -0.1

-------- ------ --------- ------------ ----------- --------

Consumer Services 0.7 0.2 -0.5 -0.1 -0.1 -0.1

-------- ------ --------- ------------ ----------- --------

Electricity 2.1 2.9 0.8 -1.0 0.1 -0.9

-------- ------ --------- ------------ ----------- --------

Electronic & Electrical

Equipment 2.9 2.7 -0.2 -0.1 0.0 -0.1

-------- ------ --------- ------------ ----------- --------

Finance and Credit

Services 1.5 0.0 -1.5 0.0 -0.7 -0.6

-------- ------ --------- ------------ ----------- --------

Food Producers 9.8 6.1 -3.8 -1.1 -0.8 -1.9

-------- ------ --------- ------------ ----------- --------

Gas, Water & Multiutilities 0.0 1.4 1.4 0.0 -0.1 -0.1

-------- ------ --------- ------------ ----------- --------

General Industrials 1.6 1.9 0.3 -0.5 -0.1 -0.6

-------- ------ --------- ------------ ----------- --------

Health Care Providers 0.0 0.3 0.3 0.0 -0.0 -0.0

-------- ------ --------- ------------ ----------- --------

Household Goods

and Home Construction 0.0 0.4 0.4 0.0 0.0 0.0

-------- ------ --------- ------------ ----------- --------

Industrial Engineering 3.6 2.5 -1.1 0.4 -0.1 0.2

-------- ------ --------- ------------ ----------- --------

Industrial Materials 0.0 0.5 0.5 0.0 0.1 0.1

-------- ------ --------- ------------ ----------- --------

Industrial Metals

& Mining 0.0 0.7 0.7 0.0 0.1 0.1

-------- ------ --------- ------------ ----------- --------

Industrial Support

Services 0.4 1.7 1.4 -0.1 0.5 0.5

-------- ------ --------- ------------ ----------- --------

Industrial Transportation 0.0 2.6 2.6 0.0 -0.0 -0.0

-------- ------ --------- ------------ ----------- --------

Investment Banking

and Brokerage

Services 8.9 3.4 -5.6 0.2 -0.6 -0.3

-------- ------ --------- ------------ ----------- --------

Leisure Goods 0.0 0.1 0.1 0.0 0.0 0.0

-------- ------ --------- ------------ ----------- --------

Life Insurance 0.0 0.7 0.7 0.0 0.0 0.0

-------- ------ --------- ------------ ----------- --------

Media 1.9 1.0 -0.9 -0.2 0.0 -0.2

-------- ------ --------- ------------ ----------- --------

Medical Equipment

and Services 1.7 3.1 1.4 0.1 0.3 0.4

-------- ------ --------- ------------ ----------- --------

Nonlife Insurance 3.2 5.1 1.9 1.2 0.0 1.2

-------- ------ --------- ------------ ----------- --------

Oil, Gas and Coal 5.3 4.1 -1.2 0.6 -0.2 0.3

-------- ------ --------- ------------ ----------- --------

Personal Care,

Drug and Grocery

Stores 3.2 1.3 -1.9 0.1 -0.1 -0.0

-------- ------ --------- ------------ ----------- --------

Personal Goods 9.5 7.0 -2.5 1.1 0.3 1.3

-------- ------ --------- ------------ ----------- --------

Pharmaceuticals

& Biotechnology 15.4 13.0 -2.4 0.0 -0.3 -0.2

-------- ------ --------- ------------ ----------- --------

Precious Metals

and Mining 0.0 0.0 0.0 0.0 -0.0 -0.0

-------- ------ --------- ------------ ----------- --------

Real Estate Investment

and Services 0.0 0.7 0.7 0.0 0.4 0.4

-------- ------ --------- ------------ ----------- --------

Real Estate Investment

Trusts 0.0 0.4 0.4 0.0 0.1 0.1

-------- ------ --------- ------------ ----------- --------

Retailers 0.0 0.7 0.7 0.0 -0.2 -0.2

-------- ------ --------- ------------ ----------- --------

Software & Computer

Services 2.6 4.2 1.6 0.6 0.0 0.6

-------- ------ --------- ------------ ----------- --------

Technology Hardware

& Equipment 5.8 4.6 -1.2 0.8 0.3 1.1

-------- ------ --------- ------------ ----------- --------

Telecommunications

Equipment 0.0 0.6 0.6 0.0 0.3 0.3

-------- ------ --------- ------------ ----------- --------

Telecommunications

Service Providers 3.3 2.8 -0.5 -0.5 -0.1 -0.6

-------- ------ --------- ------------ ----------- --------

Tobacco 0.0 0.1 0.1 0.0 -0.0 -0.0

-------- ------ --------- ------------ ----------- --------

Travel and Leisure 0.0 0.6 0.6 0.0 -0.1 -0.1

-------- ------ --------- ------------ ----------- --------

Total(1) 100.0 100.0 0.0 3.1 -1.2 1.9

-------- ------ --------- ------------ ----------- --------

1 Total may not sum to the value shown due to rounding

differences

Source: Factset

What changes have we made?

We have now had three years of value outperforming growth and

quality. Notwithstanding the fact that we managed to outperform

marginally over the last year, this style environment has been

tough for us. Our inclination throughout the period has been to

increase our exposure to high quality companies at a time when they

have been out of favour. Each of our purchases and sales over the

past twelve months can be seen as moving us in this direction. I

will illustrate this with two of our new positions highlighting why

we think these are high quality businesses with very attractive

long-term prospects.

In March, we initiated a new position in Alcon, the Swiss listed

manufacturer of ophthalmic equipment and contact lenses. Over the

long term, the industry has experienced healthy growth of 4-5% per

annum. Alcon, after years of underinvestment under Novartis

ownership, is playing catch up. They have been growing faster than

the overall market and expect to continue to do so. Margin

potential since the spin-out from Novartis has been clear but the

delivery has been slower than hoped for. Recently, however, margin

progress has started to come through and the outlook for further

margin gains is strong. Finally, on valuation, in MedTech,

investors tend to pay for durable growth, i.e. organic revenue

growth and the sector trades on around 25 times forward price to

earnings. Alcon has usually traded at a 0-10% premium, but when we

bought our position, it traded at a small discount. Over the next

few years, revenue growth should be faster than the sector (6%

versus 4%) and so should earnings per share growth (greater than

15% versus 11%) if they achieve margin progress as guided. We thus

see Alcon as a superior growth business capable of margin

improvement and a valuation rerating over time.

In May, we bought a position in the Swiss testing company SGS.

We have long liked the characteristics of the testing sector. The

companies provide a cheap, but essential function to a number of

businesses across a wide range of end markets. Often their work is

mandated by regulation. The industry is fragmented but is

increasingly being consolidated by the large, listed companies,

with smaller players disadvantaged in a world where customers want

broad, global services. This means that the large companies can

consistently acquire the smaller ones at inexpensive valuations,

taking advantage of inherent scale benefits to create shareholder

value over the medium term. We also believe that increasingly

stringent environmental testing regulation is resulting in a boost

to testing intensity and this should bring higher growth rates for

SGS and their peers especially in the consumer goods-facing part of

the business. SGS are the global leader in consumer testing and are

in the strongest position to benefit.

Our most notable sales during the period were Enel, CNH

International and Kion (a utility company, a tractor company and a

forklift truck company respectively).

Largest New Investments Largest Divestments

-------------------------------------- ----------------------------------

Company name Position Company name Position size

size at year at start of

end (% of year (% of

the portfolio) the portfolio)

-------------------- ---------------- ---------------- ----------------

SGS 2.62 Koninklijke KPN 3.05

ASM International 2.25 Kion 2.00

Alcon 1.91 CNH Industrial 1.87

BNP Paribas 1.85 Enel 1.29

Heineken 1.71

Schneider Electric 1.66

Euronext 1.52

Brenntag 0.95

Industrie De Nora 0.81

Zealand Pharma 0.61

Our medium term outlook

I am pleased that we have managed to outperform modestly in yet

another year of value outperformance. We have used the last few

years to increase our exposure to growth and quality and I am

confident that our companies are well-placed to deliver strong

growth, attractive margins and robust return on capital.

Classification of holdings as at 31 July 2023

Compounders(1) Average Improvers(2) Average Company Average Index Average

Market Capitalisation (GBPm) 112,902 43,178 94,024 81,677

---------------------------------- --------------------- ---------------- --------------

Price/book (x) 3.6 1.4 2.6 2.0

Trailing 12 month dividend yield

(%) 2.2 2.6 2.3 3.0

Trailing 12 month price/earnings

(x) 24.8 13.4 20.2 14.6

Forward 2024 price/earnings (x) 17.5 12.9 16.0 12.9

----------------------- --------------------- ---------------- --------------

Historical 3-year earnings per

share growth per annum (%) 11.5 16.3 12.8 23.9

Forecast next 12 months earnings

per share growth (%) 12.7 8.4 11.5 9.4

Return on equity (%) 27.4 5.7 21.5 19.6

Operating margin (%) 25.1 13.5 22.0 18.3

Long term debt to capital (%) 31.0 33.9 31.8 33.1

Number of securities 32 15 47 577

--------------------- ---------------- --------------

Weight (%)(3) 76.6 28.4

----------------------- ---------------------

Fundamentals are based on weighted averages at the stock level,

excluding net cash/borrowing

1 Compounders - high-return businesses

2 Improvers - companies whose return profile should materially

improve over time

3 The weight percentages of Compounders and Improvers are shown

including net cash/borrowing

Net cash/(borrowing) was -5.1% at 31 July 2023

OW Bunker, a nil value position, is not included in the

analysis

Source: Factset/Fundamentals in Sterling and Janus Henderson

Top ten contributors to and bottom detractors from relative

performance

Data illustrating the top ten contributors to relative

performance is set out below:

%

UniCredit 2.82

-----

Munich Re. 1.54

-----

Hermès 0.81

-----

ASM International 0.77

-----

Safran 0.70

-----

Besi 0.57

-----

Metso 0.48

-----

Novo Nordisk 0.37

-----

Moncler 0.37

-----

Alcon 0.36

-----

Data illustrating the bottom ten detractors from relative

performance is set out below:

%

Partners Group -0.31

------

Sartorius -0.40

------

Siemens -0.41

------

DSM Firmenich -0.41

------

Roche -0.49

------

Kion -0.61

------

Allfunds -0.65

------

Cellnex -0.86

------

EDP Renovaveis -0.95

------

Koninklijke DSM (prior to the merger

with Firmenich) -1.60

------

Jamie Ross

Fund Manager

27 September 2023

PRINCIPAL RISKS AND UNCERTAINTIES

Managing our risks

The Board, with the assistance of the Manager, has carried out a

robust assessment of the principal risks and uncertainties facing

the Company, including those that would threaten its business

model, future performance, solvency and liquidity.

With the assistance of the Manager, the Board has drawn up a

risk register facing the Company and has put in place a schedule of

investment limits and restrictions, appropriate to the Company's

Investment Objective and Policy, in order to mitigate these risks

as far as practicable. The Board monitors the Manager, other

suppliers and the internal and external environments in which the

Company operates to identify new and emerging risks. The Board's

policy on risk management has not materially changed from last

year. The principal risks which have been identified and the steps

taken by the Board to mitigate these are as follows:

Risk Mitigation

Investment activity and performance The Board monitors investment

An inappropriate investment performance at each Board meeting

strategy (for example, in terms and regularly reviews the extent

of stock or sector attribution of its borrowings.

or the level of gearing) may

result in underperformance against The Board receives monthly updates

the Company's benchmark index from the Fund Manager.

and the companies in its peer

group.

-------------------------------------------

Portfolio and market The Board reviews the portfolio

Although the Company invests at each meeting, regularly considers

almost entirely in securities relevant political, economic and

that are quoted on recognised environmental changes and mitigates

markets, share prices may move risk through diversification of

rapidly. The companies in which investments in the portfolio.

investments are made may operate

unsuccessfully, or fail entirely.

Significant economic, political

or environmental changes in

Europe and globally may impact

investment returns. A fall in

the market value of the Company's

portfolio would have an adverse

effect on shareholders' funds.

-------------------------------------------

Regulatory The Manager is contracted to provide

A breach of Section 1158 could investment, company secretarial,

lead to a loss of investment administration and accounting

trust status, resulting in capital services through qualified professionals.

gains realised within the portfolio The Board receives internal controls

being subject to corporation reports produced by Janus Henderson

tax. A breach of the FCA's Listing on a quarterly basis, which confirm

Rules could result in suspension regulatory compliance.

of the Company's shares, while

a breach of the Companies Act

2006 could lead to criminal

proceedings, or financial or

reputational damage.

-------------------------------------------

Operational and cyber The Board monitors the services

Disruption to, or failure of, provided by the Manager and its

the Manager's accounting, dealing other suppliers and receives reports

or payment systems or the Custodian's on the key elements in place to

records could prevent the accurate provide effective internal control.

reporting and monitoring of During the year the Board received

the Company's financial position. reports on the Manager's approach

The Company is also exposed to information security and cyber

to the operational risk that attack defence. The Board considers

one or more of its service providers the loss of the Fund Manager as

may not provide the required a risk but this is mitigated by

level of service. The Company the experience of the Equities

may also be exposed to the risk team at Janus Henderson.

of cyber attack on its service

providers.

-------------------------------------------

ESG For those companies with a MSCI

The Company is an Article 8 Laggard rating, the Board requires

company under SFDR. Decisions the Manager to formally explain

on ESG matters can be subjective the rationale for the potential

and criteria may change as knowledge, improvement of the MSCI risk rating

technology and science evolves. to a minimum of 'medium' within

There is a risk that an investment, three years. See the Annual Report

assessed as appropriate at a for more detail.

point in time, subsequently

does not meet ESG criteria, The Company's ESG criteria are

and exposes the Company to reputational considered to be sufficiently

risk. clear and measurable. These criteria

and the Company's adherence to

them are monitored and reviewed

on a regular basis. Should the

Board or the Manager consider

it appropriate to review or alter

the criteria, this would be considered

on a case by case basis against

known factors prevailing at the

time.

-------------------------------------------

Details of how the Board monitors the services provided by Janus

Henderson and its other suppliers, and the key elements designed to

provide effective internal control, are explained further in the

internal controls section of the Corporate Governance report of the

2023 Annual Report. Further details of the Company's exposure to

market risk (including market price risk, currency risk and

interest rate risk), liquidity risk and credit and counterparty

risk and how they are managed are contained in the Notes to the

Financial Statements within the Annual Report.

VIABILITY STATEMENT AND GOING CONCERN

The Company is a long-term investor. The Board believes it is

appropriate to assess the Company's viability over a five year

period in recognition of the Company's long-term horizon and what

the Board believes to be investors' horizons, taking account of the

Company's current position and the potential impact of the

principal risks and uncertainties as documented in the Strategic

Report within the Annual Report.

The Directors do not expect there to be any significant change

in the current principal risks and adequacy of the mitigating

controls in place. In addition, the Directors do not envisage any

change in strategy or objectives or any events that would prevent

the Company from continuing to operate over that period, as the

Company's assets are liquid, its commitments are limited and the

Company intends to continue to operate as an investment trust. In

coming to this conclusion, the Board has considered the potential

impact of the principal risks and uncertainties facing the Company,

in particular the impact of the rise in inflation, COVID-19, the

risks arising from the wider ramifications of the conflict between

Russia and Ukraine, investment strategy and performance against the

benchmark (whether from stock or sector attribution or the level of

gearing) and market risk, materialising in severe but plausible

scenarios, and the effectiveness of any mitigating controls in

place.

The Directors took into account the liquidity of the portfolio

and the borrowings in place when considering the viability of the

Company over the next five years and its ability to meet

liabilities as they fall due. This included consideration of the

duration of the Company's borrowing facilities and how a breach of

any covenants could impact on the Company's net asset value and

share price. Based on this assessment, the Board has a reasonable

expectation that the Company will be able to continue in operation

and meet its liabilities as they fall due over the next five year

period.

The Directors consider it appropriate to adopt the going concern

basis of accounting in preparing the Financial Statements (see note

1(b) for further details).

BORROWINGS

During the year under review, the Company had in place an

unsecured loan facility of GBP25 million (2022: GBP25 million)

which allowed it to borrow as and when appropriate. The maximum

amount drawn down in the year under review was GBP17.7 million

(2022: GBP12.8 million), with borrowing costs for the year

totalling GBP217,000 (2022: GBP84,000). GBP8.6 million of the

facility was in use at the year end (2022: GBP12.6 million). Actual

gearing at 31 July 2023 was 4.6% (2022: 2.5%) of NAV. Since the

year end the Company has put in place an unsecured loan facility of

EUR30 million to replace the previous facility. The Board has

delegated responsibility for day to day gearing levels to the Fund

Manager. The Fund Manager expects to maintain some level of gearing

in most conditions and the normal level of gearing is expected to

be between 2% and 6% of NAV, but at times it may be above or below

these levels. The Fund Manager does not use gearing in an attempt

to time prospective market moves. Instead, the Company's gearing

will increase when the Fund Manager sees attractive, stock

specific, opportunities to deploy capital and will reduce gearing

when the Fund Manager is a net seller of existing positions, again

for stock specific reasons.

RELATED PARTY TRANSACTIONS

The Company's transactions with related parties in the year were

with its Directors and the Manager. There have been no material

transactions between the Company and its Directors during the year

and the only amounts paid to them were in respect of expenses and

remuneration for which there were no outstanding amounts payable at

the year end. Directors' shareholdings are disclosed in the 2023

Annual Report.

In relation to the provision of services by the Manager, other

than fees payable by the Company in the ordinary course of business

and the facilitation of marketing activities with third parties,

there have been no material transactions with the Manager affecting

the financial position of the Company during the year under review.

More details on transactions with the Manager, including amounts

outstanding at the year end, are given in the Notes to the

Financial Statements within the Annual Report.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

In accordance with Disclosure Guidance and Transparency Rule

4.1.12, each of the Directors confirms that, to the best of his or

her knowledge:

(a) the Company's Financial Statements, which have been prepared

in accordance with UK Accounting Standards, give a true

and fair view of the assets, liabilities, financial position

and profit of the Company; and

(b) the Annual Report and Financial Statements include a fair

review of the development and performance of the business

and the position of the Company, together with a description

of the principal risks and uncertainties that it faces.

The Directors consider that the Annual Report and Financial

Statements, taken as a whole, are fair, balanced and understandable

and provide the information necessary for shareholders to assess

the Company's performance, business model and strategy.

On behalf of the Board

Nicola Ralston

Chairman

27 September 2023

TWENTY LARGEST HOLDINGS AS AT 31 JULY 2023

Market Percentage

Value 2023 of Portfolio

Company Country Sector GBP'000 2023

--- ---------------------- ------------ -------------------------- ------------ ---------------

Pharmaceuticals

1 Novo Nordisk Denmark and Biotechnology 20,336 5.69

2 Nestlé Switzerland Food Producer 17,817 4.99

3 TotalEnergies France Oil, Gas and Coal 17,261 4.83

Pharmaceuticals

4 Roche Switzerland and Biotechnology 15,766 4.41

Pharmaceuticals

5 Sanofi France and Biotechnology 14,465 4.05

Technology Hardware

6 ASML Netherlands and Equipment 13,009 3.64

7 Hermès France Luxury Goods 12,403 3.47

LVMH Moët

Hennessy Louis

8 Vuitton France Personal Goods 12,156 3.40

Aerospace and

9 Safran France Defence 10,072 2.82

Software and Computer

10 SAP Germany Services 9,968 2.79

--- ---------------------- ------------ -------------------------- ------------ ---------------

Top 10 143,253 40.09

--------------------------------------------------------------------- ------------ ---------------

11 DSM Firmenich Switzerland Food Producer 9,860 2.76

12 Cellnex Spain Mobile Telecommunications 9,762 2.73

Aerospace and

13 Airbus France Defence 9,642 2.70

Industrial Support

14 SGS Switzerland Services 9,353 2.62

Private Equity

15 Partners Group Switzerland Asset Manager 9,028 2.53

Personal Care,

Drug and Grocery

16 Beiersdorf Germany Store 8,650 2.42

17 Munich Re. Germany Insurance 8,441 2.36

18 Deutsche Börse Germany Financial Services 8,400 2.35

Technology Hardware

19 ASM International Netherlands and Equipment 8,033 2.25

20 UniCredit Italy Banks 7,913 2.21

--- -------------------- -------------- -------------------------- ------------ ---------------

Top 20 232,335 65.02

--------------------------------------------------------------------- ------------ ---------------

Market capitalisation (excluding cash) of the portfolio by

weight at 31 July 2023

Market cap % Portfolio weight % Benchmark weight

------------------- ------------------- -------------------

>EUR20bn 74.9 73.7

EUR10bn - EUR20bn 8.2 12.0

EUR5bn - EUR10bn 11.5 9.7

EUR1bn - EUR5bn 4.7 4.4

EUR0bn - EUR1bn 0.7 0.2

------------------- ------------------- -------------------

Performance drivers over the year ended 31 July 2023

%

---------------------------------------- -------

Benchmark Return 16.1

Sector Allocation(1) (2.0)

Stock Selection 3.1

Currency Movements (relative to index) 0.9

Effect of Cash and Gearing (0.1)

Effect of Ongoing Charge (0.8)

Residual (due to timing and rounding) (0.5)

---------------------------------------- -------

NAV Total Return 16.7

---------------------------------------- -------

(1) Sector allocation is the effect of asset allocation, less

the effects of gearing, share buy-backs / issues and currency.

Source: Morningstar Direct, Janus Henderson

AUDITED INCOME STATEMENT

Year ended 31 July Year ended 31 July

2023 2022

Revenue Capital Total Revenue Capital Total

return return return return return return

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Gains/(losses) on investments

held

at fair value through profit

or loss

(note 2) - 43,816 43,816 - (54,923) (54,923)

Investment income (note

3) 8,877 - 8,877 9,298 - 9,298

Other income 71 - 71 1 - 1

--------- ---------- --------- --------- ---------- ---------

Gross revenue and capital

Gains/(losses) 8,948 43,816 52,764 9,299 (54,923) (45,624)

Management fee (407) (1,628) (2,035) (410) (1,642) (2,052)

Other administrative expenses (553) - (553) (553) - (553)

--------- ---------- --------- --------- ---------- ---------

Net return/(loss) before

finance costs and taxation 7,988 42,188 50,176 8,336 (56,565) (48,229)

Finance costs (43) (174) (217) (17) (67) (84)

--------- ---------- --------- --------- ---------- ---------

Net return/(loss)before

taxation 7,945 42,014 49,959 8,319 (56,632) (48,313)

Taxation on net return (1,120) - (1,120) (69) (11) (80)

--------- ---------- --------- --------- ---------- ---------

Net return/(loss)after

taxation 6,825 42,014 48,839 8,250 (56,643) (48,393)

===== ===== ===== ===== ===== =====

Return/(loss) per ordinary

share

(basic and diluted) (note

4) 3.22p 19.83p 23.05p 3.89p (26.73p) (22.84p)

===== ===== ===== ===== ===== =====

The total return column of this statement represents the Income

Statement of the Company.

All revenue and capital items in the above statement derive from

continuing operations.

The revenue return and capital return columns are supplementary

to this and are prepared under guidance published by the AIC.

The Company had no recognised gains or losses other than those

disclosed in the Income Statement.

AUDITED STATEMENT OF CHANGES IN EQUITY

Called

up Share Capital

share premium redemption Capital Revenue Total shareholders'

Year ended 31 July capital account reserve reserves reserve funds

2023 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 August 2022 1,060 41,032 263 251,065 7,590 301,010

Net return after

taxation - - - 42,014 6,825 48,839

Final dividend paid

in respect of the

year ended 31 July

2022 (paid 23 November

2022) - - - - (6,356) (6,356)

Interim dividend paid

in respect of the

year ended 31 July

2023 (paid 28 April

2023) - - - - (1,695) (1,695)

---------- ----------- ---------- ----------- ---------- ------------

At 31 July 2023 1,060 41,032 263 293,079 6,364 341,798

====== ====== ====== ======= ====== =======

Called

up Share Capital

share premium redemption Capital Revenue Total shareholders'

Year ended 31 July capital account reserve reserves reserve funds

2022 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

At 1 August 2021 1,060 41,032 263 307,722 4,633 354,710

Net (loss)/return

after taxation - - - (56,643) 8,250 (48,393)

Costs relating to

sub-division of shares - - - (14) - (14)

Final dividend paid

in respect of the

year ended 31 July

2021 (paid 24 November

2021) - - - - (3,602) (3,602)

Interim dividend paid

in respect of the

year ended 31 July

2022 (paid 22 April

2022) - - - - (1,695) (1,695)

Refund of unclaimed

dividends over 12

years old - - - - 4 4

---------- ----------- ---------- ----------- ---------- ------------

At 31 July 2022 1,060 41,032 263 251,065 7,590 301,010

====== ====== ====== ======= ====== =======

AUDITED STATEMENT OF FINANCIAL POSITION

As at 31 As at 31

July 2023 July 2022

GBP'000 GBP'000

--------------------------------------- ------------ ----------------------

Fixed assets

Fixed asset investments held at fair

value through profit or loss

Listed at market value - overseas 357,406 308,398

---------- ----------

Current assets

Debtors 3,445 6,192

Cash at bank and in hand 2,687 2,482

---------- ----------

6,132 8,674

Creditors: amounts falling due within

one year (21,740) (16,062)

---------- ----------

Net current liabilities (15,608) (7,388)

---------- ----------

Total assets less current liabilities 341,798 301,010

---------- ----------

Net assets 341,798 301,010

====== ======

Capital and reserves

Called up share capital 1,060 1,060

Share premium account 41,032 41,032

Capital redemption reserve 263 263

Capital reserves 293,079 251,065

Revenue reserve 6,364 7,590

----------- -----------

Total shareholders' funds 341,798 301,010

====== ======

Net asset value per ordinary share

(basic and diluted) 161.3p 142.1p

====== ======

NOTES TO THE FINANCIAL STATEMENTS

1 Accounting policies

.

(a) Basis of preparation

The Company is a registered investment company as defined

in Section 833 of the Companies Act 2006 and is incorporated

in the United Kingdom. It operates in the United Kingdom

and is registered at 201 Bishopsgate, London EC2M 3AE.

The Financial Statements have been prepared in accordance

with the Companies Act 2006, FRS 102 'The Financial Reporting

Standard applicable in the UK and Republic of Ireland' and

with the Statement of Recommended Practice: Financial Statements

of Investment Trust Companies and Venture Capital Trusts

(the 'SORP') issued in July 2022 by the Association of Investment

Companies.

The principal accounting policies applied in the presentation

of these Financial Statements are set out below. These policies

have been consistently applied to all the years presented.

There have been no significant changes to the accounting

policies compared to those set out in the Company's Annual

Report for the year ended 31 July 2022.

As an investment company the Company has the option, which

it has taken, not to present a cash flow statement. A cash

flow statement is not required when an investment company

meets all the following conditions: substantially all of

the entity's investments are highly liquid, substantially

all of the entity's investments are carried at market value,

and the entity provides a statement of changes in equity.

The Directors have assessed that the Company meets all of

these conditions.

The Financial Statements have been prepared under the historical

cost basis except for the measurement at fair value of investments.

In applying FRS 102, financial instruments have been accounted

for in accordance with Section 11 and 12 of the standard.

All of the Company's operations are of a continuing nature.

The preparation of the Company's Financial Statements on

occasion requires the Directors to make judgements, estimates

and assumptions that affect the reported amounts in the

primary Financial Statements and the accompanying disclosures.

These assumptions and estimates could result in outcomes

that require a material adjustment to the carrying amount

of assets or liabilities affected in the current and future

periods, depending on circumstance.

The Directors do not believe that any accounting judgements

or estimates have been applied to this set of Financial

Statements that have a significant risk of causing a material

adjustment to the carrying amount of assets and liabilities

within the next financial year.

(b) Going concern

The assets of the Company consist of securities that are

primarily readily realisable and, accordingly, the Directors

believe that the Company has adequate resources to continue

in operational existence for at least 12 months from the

date of approval of the Financial Statements. Having assessed

these factors and the principal risks, as well as considering

the impact of the rise in inflation, COVID-19 and the risks

arising from the wider ramifications of the conflict between

Russia and Ukraine, the Directors consider it appropriate

to adopt the going concern basis of accounting in preparing

the Financial Statements.

2. Gains/(losses)on investments held at fair value through

profit or loss

2023 2022

GBP'000 GBP'000

Gains on sale of investments based on

historical cost 10,558 4,271

Less: Revaluation gains recognised in

previous years (591) (32,176)

------------ ------------

Gains/(losses)on investments sold in

the year based on carrying value at previous

statement of financial position date 9,967 (27,905)

------------ ------------

Revaluation of investments held at 31

July 34,001 (27,108)

Exchange (losses)/gains(1) (152) 90

---------- ----------

43,816 (54,923)

====== ======

(1) Includes exchange losses of GBP34,000 (2022: GBP20,000)

on bank loans

3. Investment income 2023 2022

GBP'000 GBP'000

----------------------------------------------- ------------- ---------------

Overseas dividend income 8,877 9,298

---------- ----------

8,877 9,298

===== =====

4. Return/(loss) per ordinary share (basic and diluted)

The total return per ordinary share is based on the net

gain attributable to the ordinary shares of GBP48,839,000

(2022: loss GBP48,393,000) and on 211,855,410 ordinary shares

(2022: 211,855,410), being the weighted average number of

shares in issue during the year. The total return can be

further analysed as follows:

2023 2022

GBP'000 GBP'000

----------------------------------------------- ------------- ---------------

Revenue return 6,825 8,250

Capital return/(loss) 42,014 (56,643)

---------- ----------

Total return/(loss) 48,839 (48,393)

====== ======

Weighted average number of ordinary shares 211,855,410 211,855,410

2023 2022

Pence Pence

----------------------------------------------- ------------- ---------------

Revenue return per ordinary share 3.22 3.89

Capital return/(loss) per ordinary share 19.83 (26.73)

---------- ----------

Total return/(loss) per ordinary share 23.05 (22.84)

====== ======

The Company has no securities in issue that could dilute

the return per ordinary share. Therefore the basic and diluted

return per ordinary share are the same.

5. Dividends on ordinary shares

Register date Payment date 2023 2022

GBP'000 GBP'000

------------------------------ -------------------------- ---------------------- ------------ -----------

Final dividend (1.7p)

for the year ended 31 22 October

July 2021 2021 24 November 2021 - 3,602

Interim dividend (0.8p)

for the year ended 31

July 2022 8 April 2022 22 April 2022 - 1,695

Final dividend (3.0p)

for the year ended 31 21 October

July 2022 2022 23 November 2022 6,356 -

Interim dividend (0.8p)

for the year ended 31

July 2023 11 April 2023 28 April 2023 1,695 -

Refund of unclaimed

dividends over 12 years

old - (4)

----------- ----------

8,051 5,293

======= =======

The proposed final dividend of 3.0p per share for the year ended

31 July 2023 is subject to approval by shareholders at the AGM

and has not been included as a liability in these Financial

Statements. The final dividend will be paid on 22 November 2023

to shareholders on the register of members at the close of business

on 20 October 2023. The shares will be quoted ex-dividend on

19 October 2023.

All dividends have been paid or will be paid out of revenue

profits and revenue reserves.

The total dividends payable in respect of the financial year

which form the basis of Section 1158 of the Corporation Tax

Act 2010 are set out below:

2023 2022

GBP'000 GBP'000

---------------------------------------------------------------------------------- ------------ -----------

Revenue available for distribution by way of

dividend for the year 6,825 8,250

Interim dividend of 0.8p (2022: 0.8p) paid 28

April 2023 (2022: 22 April 2022) (1,695) (1,695)

Proposed final dividend for the year ended 31

July 2023 of 3.0p (2022: 3.0p) (based on 211,855,410

ordinary shares in issue at 27 September 2023

(2022: 211,855,410)) (6,356) (6,356)

----------- ----------

Transfer (from)/to revenue reserve(1) (1,226) 199

======= =======

(1) There is no undistributed revenue in the current year (2022:

GBP199,000 of undistributed revenue).

6 Net asset value per ordinary share (basic and diluted)

.

The net asset value per ordinary share of 161.3p (2022: 142.1p)

is based on the net assets attributable to ordinary shares of

GBP341,798,000 (2022: GBP301,010,000) and 211,855,410 (2022:

211,855,410) ordinary shares in issue at the year end. There

were also 200,000 shares held in Treasury at the year end (2022:

200,000).

The movements during the year of the assets attributable to

the ordinary shares were as follows:

2023 2023

GBP'000 GBP'000

---------------------------------------------------------------------------------- ------------ -----------

Net assets attributable to the ordinary shares

at start of year 301,010 354,710

Net return/(loss) after taxation 48,839 (48,393)

Costs relating to sub-division of shares - (14)

Dividends paid on ordinary shares in the year (8,051) (5,297)

Refund of unclaimed dividends over 12 years old - 4

----------- ----------

Total net assets attributable to the ordinary

shares at 31 July 341,798 301,010

======= =======

7 Called up share capital

.

Nominal

Number of value of

shares entitled Total number shares

to dividend of shares GBP'000

------------------------------------------- --- -------------------- ------------------------ -----------

Allotted and issued ordinary

shares of 0.5p each at 31 July

2022 211,855,410 212,055,410 1,060

----------------- ---------------- ----------

At 31 July 2023 211,855,410 212,055,410 1,060

========== ========== =====

During the year the Company issued no shares (2022: none).

During the year the Company repurchased no shares (2022: none).

Shares held in treasury (2023: 200,000; 2022: 200,000) are not

entitled to receive a dividend.

There is a single class of ordinary share. Reserves that can

be distributed as a dividend are detailed in the Annual Report.

Since 31 July 2023, no shares have been repurchased or issued.

8. 2023 financial information

The figures and financial information for the year ended 31

July 2023 are extracted from the Company's Annual Financial

Statements for that period and do not constitute statutory financial

statements for that period. The Company's Annual Financial Statements

for the year ended 31 July 2023 have been audited but have not

yet been delivered to the Registrar of Companies. The Independent

Auditor's Report on the 2023 Financial Statements was unqualified,

did not include a reference to any matter to which the Auditors

drew attention without qualifying the report, and did not contain

any statements under sections 498(2) and 498(3) of the Companies

Act 2006.

9 2022 financial information

.

The figures and financial information for the year ended 31

July 2022 are extracted from the Company's Annual Financial

Statements for that period and do not constitute statutory financial

statements for that period. The Company's Annual Financial Statements

for the year ended 31 July 2022 have been audited and delivered

to the Registrar of Companies. The Independent Auditor's Report

on the 2022 Financial Statements was unqualified, did not include

a reference to any matter to which the Auditors drew attention

without qualifying the report, and did not contain any statements

under sections 498(2) and 498(3) of the Companies Act 2006.

10. Annual Report and Annual General Meeting

The Annual Report for the year ended 31 July 2023 will be posted

to shareholders in October 2023 and copies will be available

from the Corporate Secretary at the Company's Registered Office,

201 Bishopsgate, London EC2M 3AE.

The Company's Annual General Meeting ('AGM' or 'Meeting') is

currently scheduled to take place at the registered office at

2.30pm on Wednesday 15 November 2023. The Notice of the AGM

will be posted to shareholders with the Annual Report and will

be available on the Company's website.

11. Website

This document, and the Annual Report for the year ended 31 July

2023, will be available on the following website: www.hendersoneurotrust.com

.

For further information please contact:

Jamie Ross Dan Howe

Fund Manager Head of Investment Trusts

Henderson EuroTrust plc Janus Henderson Investors

Telephone: 020 7818 5260 Telephone: 020 7818 4458

Harriet Hall

Investment Trust PR Manager

Janus Henderson Investors

Tel: 020 7818 2919

Neither the contents of the Company's website nor the contents

of any website accessible from hyperlinks on the Company's website

(or any other website) is incorporated into, or forms part of, this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

FR SESFAWEDSEFU

(END) Dow Jones Newswires

September 28, 2023 02:00 ET (06:00 GMT)

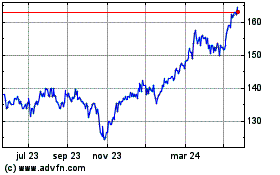

Henderson Eurotrust (LSE:HNE)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

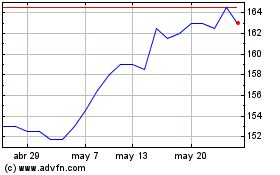

Henderson Eurotrust (LSE:HNE)

Gráfica de Acción Histórica

De May 2023 a May 2024