TIDMIGV

RNS Number : 6910Z

Income & Growth VCT (The) PLC

15 January 2024

THE INCOME & GROWTH VCT PLC

LEI: 213800FPC15FNM74YD92

ANNUAL FINANCIAL RESULTS OF THE COMPANY FOR THE YEARED 30 SEPTEMBER

2023

The Income & Growth VCT plc (the "Company") announces the final results

for the year ended 30 September 2023. These results were approved by

the Board of Directors on 12 January 2024.

You may, in due course, view the Annual Report & Financial Statements,

comprising the statutory accounts of the Company by visiting https://www.mobeusvcts.co.uk/

.

FINANCIAL HIGHLIGHTS

As at 30 September 2023:

Net assets: GBP122.78 million

Net asset value ("NAV") per share: 79.33 pence

- There was a positive Net asset value ("NAV") total return (including

dividends)(1) per share of 4.3%.

- Dividends paid/payable in respect of the year total 11.00 pence per

share. This brings cumulative dividends paid(1) to Shareholders in respect

of the past five years to 48.00 pence per share.

- The Company realised investments totalling GBP9.13 million of cash

proceeds and generated net realised gains in the year of GBP0.41 million.

- GBP3.34 million was invested into five new companies and two follow-on

investments.

(1) - Definitions of key terms and alternative performance measures

shown above and throughout this report are provided in the Glossary of

terms in the Annual Report & Financial Statements.

(2) - Further details on the share price total return are shown in the

Performance section of the Strategic Report within the Annual Report

& Financial Statements.

OUR INVESTMENT OBJECTIVE

The objective of the Company is to provide investors with an attractive

return by maximising the stream of

tax-free dividend distributions from the income and capital gains generated

by a diverse and carefully selected portfolio of investments, while continuing

at all times to qualify as a VCT.

INVESTMENT POLICY

The Company's Investment Policy is to invest primarily in a diverse portfolio

of UK unquoted companies. Investments are generally structured as part

loan and part equity in order to receive regular income, to generate

capital gain upon sale and to reduce the risk of high exposure to equities.

To further spread

risk, investments are made in a number of different businesses across

different industry sectors.

The Company's cash and liquid resources are held in a range of instruments

which can be of varying

maturities, subject to the overriding criterion that the risk of loss

of capital be minimised.

The Company seeks to make investments in accordance with the requirements

of VCT regulation.

The full text of the Company's Investment Policy is set out in the Annual

Report & Financial Statements.

CHAIRMAN'S STATEMENT

Overview

The Company has seen continuing challenging UK economic conditions during

this financial year. Rising inflation and high interest rates have both

impacted consumer and business confidence which caused a general softening

of trading performance. Worldwide, central banks have been assessing

the impact of their rising rates and there are early signs that inflation

is continuing, perhaps more stubbornly than anticipated. Despite this,

stock market multiples appear to have stabilised somewhat following the

material downward re-rating of growth stocks experienced over much of

2022 and a number of portfolio companies have experienced good growth

in the year. Positive NAV performance was generated over the last six

months in the year, reversing a small fall in the first six months, from

strong performance by a number of key assets and a degree of resilience

within the remainder of the portfolio. The result is that the Company's

NAV total return (including dividends paid in the year) increased by

4.3% (2022: (8.7)%).

The Company has continued to be an active investor and provided investment

finance to five new companies during the year: Connect Earth; Cognassist;

Dayrize; Mable Therapy and Branchspace. Follow-on investment activity

continued with further investments made during the year into Legatics

and Orri. It also delivered highly successful exits in both Equip Outdoor

Technologies (trading as Rab and Lowe Alpine) ("EOTH") and Tharstern

Group.

Overall, the portfolio remains well funded and diversified, however there

are three key assets which represent 46.5% of portfolio value. As is

the nature of growth assets, the risk of company failures is ever present.

The Company has strong liquidity to support the Investment Adviser's

team who are actively seeking opportunities within the existing portfolio.

Following the year-end, new investments were made into Ozone Financial

Technology Limited, Azarc and CitySwift. Additionally further follow-on

investments were made into RotaGeek, FocalPoint and MyTutor.

The Board and Investment Adviser were pleased with the Chancellor's confirmation

in the Autumn Budget held on 22 November 2023, of the intention to extend

the sunset clause to 6 April 2035 meaning that future investors will

still benefit from the tax reliefs available from VCTs, subject to EU

approval.

Company Objective and Strategy

A Venture Capital Trust ("VCT") is a company listed on the London Stock

Exchange that raises money from private investors and uses it to invest

in small, young, innovative companies with high potential for growth.

These companies are usually unquoted and often less established. As a

consequence they may be considered higher risk and some will not be successful.

However, because small company formation is an important source of growth

for the UK economy, the government has policies to help those companies

grow. The VCT scheme provides investors with generous tax reliefs to

help encourage investors for the risk they take with their investment

and there are strict guidelines on the type of company that can receive

VCT investment. Since incorporation, your Company has helped to create

jobs, reward innovation and bolster the UK economy in line with the UK

Government's VCT scheme policy.

The Company's objective is to provide investors with an attractive return

by maximising the stream of tax-free dividend distributions from the

income and capital gains generated by a diverse and carefully selected

portfolio of investments, while continuing at all times to qualify as

a VCT. The investment strategy and policy of the Company as set out in

the Annual Report & Financial Statements is to invest primarily in a

diverse portfolio of UK unquoted companies to support this objective.

Performance

The Company's NAV total return per share increased by 4.3% (2022: a fall

of (8.7)%) after adding back a total of 8.00 pence per share in dividends

paid during the year. The increase was principally the result of positive

valuation movements across three of the five largest investments by value,

in particular, Preservica, as well as higher interest income generated

on cash held awaiting investment. In addition, the successful portfolio

exits of EOTH and Tharstern Group generated a positive net realised gain

for the Company, although this was partially offset by impairments applied

to the holdings of two other companies.

At the year-end, the Company was ranked 5th out of 37 Generalist VCTs

over three years, 2nd out of 36 Generalist VCTs over five years and 9(th)

out of 31 over ten years in the Association of Investment Companies'

("AIC") analysis of NAV Cumulative Total Return. Shareholders should

note that, due to the lag in the disclosed performance figures available

each quarter, the AIC ranking figures do not fully reflect the final

NAV uplift to 30 September 2023, or those of our peers.

Dividends

To meet the Company's objective, the Investment Adviser is tasked to

provide an attractive dividend stream to Shareholders. The Board was

therefore pleased to be able to declare two interim dividends of 4.00

and 7.00 pence per share, totalling 11.00 pence per share in respect

of the year ended 30 September 2023 to reflect gains and income generated

and ensure compliance with the VCT regulations. This surpassed the Company's

annual target of 6.00 pence per share which has been achieved, and often

exceeded, in each of the last twelve financial years.

The first interim dividend was paid on 26 May 2023, to Shareholders on

the Register on 21 April 2023 and the second interim dividend was paid

after the year end on 8 November 2023 to those Shareholders on the Register

on 6 October 2023. These dividend payments have brought cumulative dividends

paid per share since inception to 159.50 pence including the second interim

dividend paid after the year-end.

It should continue to be noted that the majority of the portfolio are

now younger growth capital investments. By their nature this results

in greater risk than the historic MBO portfolio and can result in increased

volatility in performance, which may affect the return Shareholders receive

in any given year. Shareholders should also note that there may continue

to be circumstances where the Company is required to pay dividends in

order to maintain its regulatory status as a VCT, for example, to stay

above the minimum percentage of assets required to be held in qualifying

investments.

On 20 June 2023, the Board obtained Court approval to cancel the Company's

share premium reserve and capital redemption reserve. Subject to HMRC's

Return of Capital rules, this will enable additional distributable reserves

to be available for dividends and will help the Company to meet its dividend

target in

future years.

Dividend Investment Scheme

The Company's Dividend Investment Scheme ("DIS") provides Shareholders

with the opportunity to reinvest their cash dividends into new shares

in the Company at the latest published NAV per share. New VCT shares

attract the same tax reliefs as shares purchased through an Offer for

Subscription. A total of 2,674,764 (2022: 1,901,145) Ordinary shares

were allotted as a result of dividends paid during the year resulting

in GBP2.07 million (2022: GBP1.81 million) of cash being retained by

the Company.

Shareholders wishing to take advantage of the scheme for any future dividends

can join the DIS by completing a mandate form available on the Company's

website, under the 'Dividends' heading, at:

www.incomeandgrowthvct.co.uk , or alternatively, Shareholders can opt-out

by contacting City Partnership, using their details provided under Corporate

Information in the Annual Report & Financial Statements.

Investment Portfolio

The portfolio movements across the year were as follows:

GBPm

Portfolio value at 30 September

2022 73.08

New and follow-on investments 3.34

Disposal proceeds (9.13)

Net unrealised gains 5.02

Net realised gains 0.41

-----

Net investment portfolio gains 5.43

-------

Portfolio value at 30 September

2023 72.72

Notwithstanding the current challenging environment, a number of investee

companies have shown positive revenue growth over the year (e.g. Preservica,

MPB and Bella & Duke). Alongside the improvements in market multiples

used as the basis of the Company's valuations, this has driven the portfolio

value increase compared to last year. The overall value of the portfolio

increased by GBP5.43 million, or 7.4%, on a like for like basis (adjusting

new investments in the year) compared to the opening value of the portfolio

at 1 October 2022 of GBP73.08 million (2022: GBP(10.84) million, or (12.3)%).

At the year-end, the portfolio was valued at GBP72.72 million (30 September

2022: GBP73.08 million). The portfolio's value is now substantially comprised

of growth capital investments. Over 55% of the portfolio's value is comprised

of the Company's largest five assets by value, with Preservica accounting

for c. 27%.

The Investment Adviser closely monitors these higher value assets as

part of its risk mitigation measures. The VCT's portfolio valuation methodology

has continued to be applied consistently and in line with IPEV guidelines.

During the year, this was triangulated with an independent valuation,

which was commissioned for Preservica and Bella & Duke. The intention

is that the valuation of four of the largest investee companies will

be externally reviewed over the course of the next year.

During the year under review, the Company invested GBP2.72 million (2022:

GBP2.69 million) into five new investments:

Connect Earth GBP0.33 An environmental data provider

million

Cognassist GBP0.67 An education and neuro-inclusion solutions

million business

--------- ---------------------------------------------

Dayrize GBP0.63 A provider of a rapid sustainability impact

million assessment tool

--------- ---------------------------------------------

Mable Therapy GBP0.55 Therapy & counselling for children and young

million adults

--------- ---------------------------------------------

Branchspace GBP0.54 A digital retailing consultancy and software

million provider to the

aviation and travel industry

--------- ---------------------------------------------

The Company also invested a total of GBP0.62 million (2022: GBP4.64 million)

into two existing portfolio companies during the year:

Legatics GBP0.45 million A SaaS LegalTech software provider

Orri GBP0.17 million An intensive day care provider for adults

with eating disorders

---------------- ------------------------------------------

In November 2022 it was pleasing to exit the equity investment held in

EOTH receiving GBP7.34 million including preference share dividends on

completion which generated a realised a capital gain in the year of GBP0.42

million, a 6.9x multiple of cost and an IRR of 23.2%. The Company retains

its interest yielding loan stock in EOTH which will increase returns

further. The Company also received GBP2.85 million in proceeds from the

realisation of Tharstern Group, generating a realised gain of GBP0.86

million. Over the life of this investment, the Company has received total

proceeds of GBP4.00 million which equates to a multiple on cost of 2.6x

and an IRR of 15.0%.

During the year, Spanish Restaurant Group Limited (trading as Tapas Revolution)

went into administration. The company had experienced extremely challenging

conditions since COVID-19 and under the HMRC Financial Health Test (more

detail below), your Company was unable to invest further. Including Tapas

Revolution and a restructuring of RDL Corporation, a total of GBP0.87

million has been recognised as a realised loss.

I reported previously on HMRC's recent stricter interpretation of the

Financial Health Test. Additional guidance has since been published on

this matter which outlines that each potential new VCT investment will

be assessed independently based on the specific financial circumstances

of the investee company. Although it will take time to see these assessments

in action, this updated guidance and expected increased flexibility is

a welcome development. The Board, AIC and Venture Capital Trust Association

will continue to monitor this.

Revenue Account

The results for the year are set out in the Income Statement in the Annual

Report & Financial Statements and show a revenue return (after tax) of

1.11 pence per share (2022: 1.23 pence per share). The revenue return

for the year of GBP1.66 million has increased from last year's figure

of GBP1.53 million which was, primarily, due to higher income received

from the liquid balances of the immediately realisable OEIC money market

funds.

Fundraising

Following the success of the two fundraises launched in 2022, the Company

has sufficient levels of

liquidity to continue to take advantage of new investment opportunities

and fund further expansion of the businesses in its investment portfolio,

helping to further diversify the portfolio and create opportunities for

future growth. The current level of funds also allows the Company to

seek to deliver attractive returns for its Shareholders, by way of the

payment of dividends over the medium term, and buy back its shares from

those Shareholders who may wish to sell theirs. Therefore, it is not

the intention of the Board to conduct another fundraise in the 2023/2024

tax year.

Liquidity

Cash and liquidity fund balances as at 30 September 2023 amounted to

GBP50.09 million representing 40.8% of net assets. After the year-end,

following a 7.00 pence dividend payment of GBP8.89 million and investments

totalling GBP3.84 million, the level of liquidity at 11 January 2024

is GBP37.36 million or 32.8% of net assets). The majority of cash resources

are held in liquidity funds with AAA credit ratings, the returns on which

have benefitted from the increases in interest rates over the past year

which will help support future returns to Shareholders. The Board however

continues to monitor credit risk in respect of all its cash and near

cash resources and still prioritises the security and protection of the

Company's capital.

Share buy-backs

During the year to 30 September 2023, the Company bought back and cancelled

3,975,746 of its own shares (2022: 1,166,089), representing 3.1% (2022:

1.1%) of the shares in issue at the beginning of the year, at a total

cost of GBP2.98 million (2022: GBP1.03 million), inclusive of expenses.

It is the Company's policy to cancel all shares bought back in this way.

The Board regularly reviews its buyback policy, where its priority is

to act prudently and in the interest of remaining Shareholders, whilst

considering other factors, such as levels of liquidity and reserves,

market conditions and applicable law and regulations. Under this policy,

the Company seeks to maintain the discount at which the Company's shares

trade at approximately 5% below the latest published NAV.

Shareholder Communications & Annual General Meeting

May I remind you that the Company has its own website which is available

at: www.incomeandgrowthvct.co.uk.

The Investment Adviser last held a virtual Shareholder Event on behalf

of all four Mobeus VCTs in March 2023. The event was well received and

the Investment Adviser plans to hold another event on 1 March 2024. Further

details were circulated to Shareholders in December 2023 and will be

shown on the Company's website in due course. You are encouraged to register

for attendance.

Your Board is pleased to hold the next Annual General Meeting ("AGM")

of the Company at 11.00 am on Thursday, 29 February 2024 at the offices

of Shakespeare Martineau LLP, 6th Floor, 60 Gracechurch Street, London

EC3V 0HR. A webcast will also be available at the same time for those

Shareholders who cannot attend in person however, please note that you

will not be able to vote via this method and so are encouraged to return

your proxy form before the deadline of 27 February 2024. Information

setting out how to join the meeting by virtual means will be shown on

the Company's website. For further details, please see the Notice of

the Meeting which can be found at the end of the Annual Report & Financial

Statements.

Change of Registrar

On 4 December 2023, the Company, along with the three other Mobeus VCTs,

changed its Registrar to City Partnership LLP ("City") bringing all four

VCTs under one Registrar for the first time. The Board believes the move

will bring additional benefits to Shareholders including the ability

to access multiple Mobeus VCT shareholdings in one place using City's

online portal, the Hub.

Shareholders are encouraged to register their email address with City

via the Hub portal or by calling them to reduce the printing/posting

costs of the Company. Further details can be found in the Shareholder

Information section at the end of the Annual Report & Financial Statements.

Co-investment Scheme

The Board is keen to ensure that the Investment Adviser retains a motivated

and incentivised investment team which can generate attractive future

returns for the Company. To improve the alignment of interests with shareholders,

on 26 July 2023, the Boards of the four Mobeus VCTs released a joint

announcement detailing the adoption of a Co-investment incentive scheme

("the Scheme") under which members of the Investment Adviser's VCT investment

and administration team will invest their own money into a proportion

of the ordinary shares of each investment made by the Mobeus VCTs (the

co-investment under the Scheme will represent 8% of the four VCTs' overall

ordinary share investment in an investee company).

The Scheme will apply to investments made on or after 26 July 2023, such

co-investment to be at the same time and on substantially the same terms

as the investment by the Mobeus VCTs. The Board will keep the Scheme

arrangements under regular review.

Acquisition of Investment Adviser, Gresham House

Further to the announcement on 17 July 2023, on the acquisition of the

Investment Adviser by Searchlight Capital Partners, L.P., the acquisition

has now completed, and Gresham House plc delisted from the London Stock

Exchange on 20 December 2023 to become a privately owned company. The

acquisition is expected to have minimal impact on the Company and business

is continuing as usual.

For further information please visit the website link: https://greshamhouse.com/

about/.

Consumer Duty

The Financial Conduct Authority's (FCA) new Consumer Duty regulation

came into effect on 31 July 2023. The Consumer Duty is an advance on

the previous concept of 'treating customers fairly', which sets higher

and clearer standards of consumer protection across financial services

and requires all firms to put their customers' needs first.

As previously notified, the Company is not regulated by the FCA and therefore

it does not directly fall into the scope of Consumer Duty. However, Gresham

House as the Investment Adviser, and any IFAs or financial platforms

used to distribute future fundraising offers, are subject to Consumer

Duty.

The Board will ensure that the principles behind Consumer Duty are upheld

and have worked closely with the Investment Adviser on the information

now available to assist consumers and their advisers to be able to discharge

their obligations under Consumer Duty.

Environmental, Social and Governance ("ESG")

The Board and the Investment Adviser believe that the consideration of

environmental, social and corporate governance ("ESG") factors throughout

the investment cycle will contribute towards enhanced Shareholder value.

Gresham House Asset Management Limited has a team which is focused on

sustainability, the Board views this as an opportunity to enhance the

Company's existing protocols and procedures through the adoption of the

highest industry standards.

The FCA reporting requirements consistent with the Task Force on Climate-related

Financial Disclosures ("TCFD"), which commenced on 1 January 2021 do

not currently apply to the Company but are kept under review, the Board

being mindful of any recommended changes. The Board is aware of the FCA's

new Sustainability Disclosure Requirements ("SDR") and investment labels

(together the "rules") to be phased-in across the next 3 years. As the

Company is classified as a Collective Investment Undertaking, the scope

of the rules capture such UK-domiciled unauthorised funds, however given

that the shares in the Company (the "product") do not have a sustainable

investment objective, the rules only apply on a very limited basis (through

the Investment Adviser) in relation to the Company. The Gresham House

first TCFD Report can be found on its website at: TCFD report - Gresham

House .

Fraud Warning

We are aware of cases where Shareholders are being fraudulently contacted

or are being subjected to

attempts of identity fraud. Shareholders should remain vigilant of all

potential financial scams or

requests for them to disclose personal data. The Board strongly recommends

Shareholders take time

to read the Company's Fraud warning section, including details of who

to contact, contained within

the Information for Shareholders section at the end of the Annual Report

& Financial Statements.

Outlook

The geopolitical and economic outlook for the next twelve months is likely

to remain challenging.

However, the Board and Investment Adviser are confident that this can

also provide a good opportunity to make high quality investments and

build strategic stakes in businesses with good potential for the future.

Despite the successful exits of EOTH and Tharstern during the year the

exit environment is likely to be more subdued when compared to recent

years, although this is not foreseen to be a significant issue given

that the Company is not time limited. We anticipate that further stresses

will become apparent across the UK business population over the coming

year with no sectors immune from the impact. Nevertheless, the Company's

portfolio is managed by a professional and capable Investment team, to

respond to the challenges which lie ahead.

Maurice Helfgott

Chairman

12 January 2024

INVESTMENT ADVISER'S REVIEW

Porfolio Review

The current exacting economic conditions are creating challenging circumstances

for portfolio companies although some stability has been seen in market

multiples compared to the previous year. UK business has seen both demand

and operating margins come under pressure due to marked increases in

inflation and interest rates. Such macro-economic conditions have not

been faced by management teams in a generation, however Gresham House's

experienced non-executive directors and consultants continue to support

the portfolio's companies during these turbulent times.

There is now a greater focus on cash management and capital efficiency.

With ample liquidity following the fundraises in 2022, the Company is

very well placed to support portfolio companies with follow-on funding

where it is appropriate and can be structured on attractive terms. Strong

liquidity also benefits the new investment environment for the Company

which, in our view, is strong as we are seeing a number of interesting

investment propositions.

The decline in consumer confidence and business investment has been impacting

portfolio companies'

trading. Inflation has remained at an elevated level and has impacted

economic growth expectations. In contrast, there are indications that

supply chains are returning to normal, that labour shortages are easing

and this is producing an element of positive market sentiment. The direct

impact of high interest rates on the Company's portfolio is appropriately

limited because most portfolio companies do not have any significant

third-party debt. The outlook is therefore mixed, with the emphasis on

robust funding structures and preparation for all circumstances.

The portfolio movements in the year are summarised as follows: 2023 2022

GBPm GBPm

Opening portfolio value 73.08 88.15

------- --------

New and follow-on investments 3.34 7.33

------- --------

Disposal proceeds (9.13) (11.56)

------- --------

Net unrealised gains/(losses) 5.02 (13.16)

------- --------

Realised valuation gains 0.41 2.32

------- --------

Portfolio value at 30 September 72.72 73.08

------- --------

Despite concerns about the wider trading environment, the portfolio's

largest investments have experienced some strong revenue growth, which

has underpinned a positive return over the last two quarters of the Company's

financial year. Preservica continues to see strong trading and is out-performing

its budget giving a material uplift in its valuation. A strengthening

has also been seen in the quoted share price of Virgin Wines UK plc following

the release of its trading update in July 2023. There has also been some

recovery in value across other portfolio companies, such as Veritek Global.

The profitable exit of EOTH provided a 6.9x multiple of cost and an IRR

of 23.2% over the life of the investment and the Tharstern exit gave

a return of 2.6x and an IRR of 15.0%. Unless there is a change in market

dynamics, it is likely that there will be few exit prospects in the next

year and portfolio companies will be held for longer periods. By contrast

however, there were also some larger portfolio value falls such as MyTutor,

Bleach and Wetsuit Outlet which continue to experience challenging trading

conditions. The

portfolio companies are now more focussed on establishing a path to profitability.

Disappointingly, after experiencing very difficult trading conditions

as a result of the effects of COVID-19, Tapas Revolution entered administration

during the year with no expected recovery for the Company.

The Company made five new growth capital investments during the year

totalling GBP2.72 million and

two follow-on investments totalling GBP0.62 million, further details

of these investments are on the

next pages.

After the year-end, new investments were made into Ozone Financial Technology,

Azarc and CitySwift and further follow-on investments were made into

RotaGeek, FocalPoint and MyTutor.

The investment and divestment activity during the year has further increased

the proportion of the

portfolio comprised of investments made since the 2015 VCT rule change

to 80.2% by value at the

year-end (30 September 2022: 71.5%).

The portfolio's valuation changes in the year are summarised as follows:

2023 2022

GBPm GBPm

Increase in the value of unrealised

investments 11.49 7.32

------- --------

Decrease in the value of unrealised

investments (6.47) (20.48)

------- --------

Net increase/(decrease) in the value

of unrealised investments 5.02 (13.16)

------- --------

Realised gains 1.28 3.03

------- --------

Realised losses (0.87) (0.71)

------- --------

Net realised gains in the year 0.41 2.32

------- --------

Net investment portfolio movement

in the year 5.43 (10.84)

------- --------

Valuation changes of portfolio investments still held

The total valuation increases were GBP11.49 million with the main increases

being:

-- Preservica GBP6.34 million

-- MPB Group GBP2.07 million

-- Aquasium GBP0.94 million

Preservica continues to perform well and is improving recurring revenues.

MPB's revenue growth continues with its latest valuation validated by

a significant third party investor round made after the

year end. Aquasium is gaining strong pipeline demand for its products.

The main reductions within total valuation decreases of GBP(6.47) million

were:

-- MyTutor GBP(2.39) million

-- Bleach GBP(0.94) million

-- Connect Childcare GBP(0.92) million

MyTutor has been impacted by declining sector multiples combined with

slower than anticipated growth over the year. Bleach is trading behind

budget but has recently received third party funding to support its cash

position. Connect Childcare struggled to deliver product cost effectively

but has now raised additional third party investment as part of its restructuring.

The Company's investment values have been partially insulated from market

movements and lower revenue growth by the preferred investment structures

utilised in many of the portfolio companies. This acts to moderate valuation

swings and the net result can be more modest falls when portfolio values

decline.

Realised gains/losses

The Company realised its investments in EOTH and Tharstern during the

year under review, generating

gains in the period of GBP0.42 million and GBP0.86 million, respectively.

These contributed to a multiple of cost of 6.9x and 2.6x over the life

of the investments. Realised losses through impairments of companies

still held totalling GBP0.87 million were applied to two investee companies.

Net realised gains for the year as a whole were GBP0.41 million.

Investment portfolio and income yield

In the year under review, the Company received the following amounts

of income:

2023 2022

GBPm GBPm

Interest received in the year 0.58 1.41

Dividends received in the year 0.64 1.16

OEIC and bank interest received

in the year 1.97 0.24

------- -------

Total Income in the year 3.19 2.57

------- -------

Net asset Value at 30 September 122.78 108.42

------- -------

Income Yield (Income as a % of

Net asset Value at 30 September) 2.6% 2.6%

------- -------

New investments during the year

The Company made five new investments totalling GBP2.72 million, as detailed

below: Company Business Date of Investment Amount of new

investment

(GBPm)

Environmental data

Connect Earth provider March 2023 0.33

--------------------- -------------------- --------------------

Founded in 2021, Connect Earth ( https://connect.earth/ ) is a London-based

environmental data company that seeks to facilitate easy access

to sustainability data. With its carbon tracking API technology,

Connect Earth supports financial institutions in offering their

customers transparent insights into the climate impact of their

daily spending and investment decisions. Connect Earth's defensible

and scalable product platform suite has the potential to be a future

market winner in the nascent but rapidly growing carbon emission

data market, for example, by enabling banks to provide end retail

and business customers with carbon footprint insights of their spending.

This funding round is designed to facilitate the delivery of the

technology and product roadmap to broaden the commercial reach of

a proven product.

Education and

neuro-inclusion

Cognassist solutions March 2023 0.67

--------------------- -------------------- --------------------

Cognassist ( https://cognassist.com ) is an education and neuro-inclusion

solutions company that provides a Software-as-a-Service (SaaS) platform

focused on identifying and supporting individuals with hidden learning

needs. The business is underpinned by extensive scientific research

and an extensive cognitive dataset. Cognassist has scaled its underlying

business within the education market. This investment will empower

Cognassist to continue its growth within education and penetrate

the enterprise market, where demand for neuro-inclusive employee

support solutions is rapidly emerging.

A provider of a

rapid

sustainability

impact

Dayrize assessment tool May 2023 0.63

--------------------- -------------------- --------------------

Founded in 2020, Amsterdam-based Dayrize ( https://Dayrize.io )

has developed a rapid sustainability impact assessment tool that

delivers product-level insights for consumer goods brands and retailers,

enabling them to be leaders in sustainability. Its proprietary software

platform and methodology bring together an array of data sources

to provide a single holistic product-level

sustainability score that is comparable across product categories

in under two seconds. This funding round is to drive product development

and develop its market strategy to build on an opportunity to emerge

as a market leader in the industry.

Digital health

platform

for speech therapy

and counselling for

children and young

Mable Therapy adults July 2023 0.55

---------------------- -------------------- --------------------

Based in Leeds, Mable ( https://mabletherapy.com ) is the UK's leading

digital health platform for speech therapy and counselling for children

and young adults. All sessions are undertaken live with qualified

paediatric therapists, and Mable uses gamification (games, activities

and other interactive resources) to provide improved therapeutic

outcomes in a child-friendly environment. This is a significant

and growing area of need, with 1.4 million children in the UK with

long-term speech, language or communication needs - Mable has the

potential to transform the lives of children in their crucial early

stages of development. The funding will be used to accelerate growth

in existing B2C and B2B customer groups as well as capitalising

on new, potentially significant, routes to market.

Digital retail

software

provider to aviation

and

Branchspace travel industry August 2023 0.54

---------------------- -------------------- --------------------

Branchspace ( https://branchspace.com ) is a well-established specialist

digital retailing consultancy and software provider to the aviation

and travel industry. Branchspace's offering helps customers to transform

their technology architecture to unlock best-in-class digital retailing

capabilities, driving distribution efficiencies and an improved

customer experience. Across two complementary service offerings

Branchspace can effectively cover the entire airline tech stack

and has carved a defensible position as sector experts, serving

clients including IAG, Lufthansa and Etihad. This funding round

will seek to accelerate product development increasing the customer

reach of their SaaS offering to establish itself as the leading

choice for airline digital retailing solutions.

Further investments during the year

The Company made two further investments into existing portfolio companies

in the year, totalling GBP0.62 million, as detailed below:

Company Business Date of Investment Amount of new

investment (GBPm)

Legatics SaaS LegalTech software July 2023 0.45

-------------------------- --------------------- --------------------

Legatics ( https://www.legatics.com/ ) transforms legal transactions

by enabling deal teams to collaborate and close deals in an interactive

online environment. Designed by lawyers to improve legacy working

methods and solve practical transactional issues, the legal transaction

management platform increases collaboration, efficiency and transparency.

As a result, Legatics

has been used by around 1,500 companies, and has been procured

by more than half of the top global banking and finance law firms,

with collaborations having been hosted in over 60 countries. This

funding round will provide headroom to further accelerate growth

in sales via marketing as well as increasing product development.

Specialists in eating

Orri disorder support August 2023 0.17

-------------------------- --------------------- --------------------

Orri Limited ( https://orri-uk.com ) is an intensive daycare provider

for adults with eating disorders. Orri provides an alternative

to expensive residential in-patient treatment and lighter-touch

outpatient services by providing highly structured day and half

day sessions either online or in-person at its clinic on Hallam

Street, London. Orri opened its current clinic on Hallam Street,

London in February 2019 which provides a homely environment in

a converted 4-storey manor house which is operating at capacity.

The plan sees a larger site being leased nearby with Hallam Street

being used to provide a step-down outpatient service. This follow

on loan stock is to provide additional cash headroom to help drive

growth.

Portfolio Realisations during the year

The Company realised two investments, as detailed below:

Company Business Period of Investment Total cash proceeds

over the life of

the investment/

Multiple over

cost

EOTH Branded clothing October 2011 GBP9.54 million

(RAB to 6.9x cost

and Lowe Alpine) November 2022

--------------------- --------------------- --------------------

The Company realised its equity investment in EOTH for GBP7.34 million

(realised gain in the period:

GBP0.42 million) including preference dividends. Total proceeds

received over the life of the investment were GBP9.54 million compared

to an original investment cost of GBP1.38 million, representing

a multiple on cost of 6.9x and an IRR of 23.2%. The Company has

retained its interest yielding loan stock investment. Once repaid,

this should increase the multiple on cost to

7.9x.

Software based July 2014 GBP4.00 million

Tharstern management to 2.6x cost

information systems March 2023

--------------------- --------------------- --------------------

The Company realised its investment in Tharstern Group for GBP2.85

million (realised gain in period: GBP0.86 million). Total proceeds

received over the life of the investment were GBP4.00 million compared

to an original cost of GBP1.54 million, representing a multiple

on cost of 2.6x and an IRR of 15.0%.

Investments made after the year-end

The Company made three follow-on and three new investments of GBP3.84

million after the year-end, as

detailed below:

Existing:

Company Business Date of Investment Amount of new

investment (GBPm)

Provider of

cloud-based

RotaGeek enterprise software November 2023 0.23

---------------------- -------------------- -------------------

RotaGeek ( https://www.rotageek.com/ ) is a provider of cloud-based

enterprise software to help larger retail, leisure and healthcare

organisations to schedule staff effectively. RotaGeek has proven

its ability to solve the scheduling issue for large retail clients

effectively competing due to the strength of its technologically

advanced proposition. Since investment it has also diversified and

started to prove its applicability in other verticals such as healthcare

and hospitality. This investment will help the company focus on

operational delivery and continue sales and client contract win

momentum.

Focal Point GPS enhancement

Positioning software provider December 2023 0.17

---------------------- -------------------- -------------------

Focal Point Positioning Limited ( https://focalpointpositioning.com

) is a deeptech business with a growing IP and software portfolio.

Its proprietary technology applies advanced physics and machine

learning to dramatically improve the satellite-based location sensitivity,

accuracy, and security of devices such as smartphones, wearables,

and vehicles and reduce costs. The further investment was agreed

at the time of the original funding in September 2022.

Digital marketplace

MyTutor for online tutoring January 2024 0.64

---------------------- -------------------- -------------------

MyTutorweb (trading as MyTutor) ( https://mytutor.co.uk ) is a digital

marketplace that connects school age pupils who are seeking private

online tutoring with university students. The business is satisfying

a growing demand from both schools and parents to improve pupils'

exam results. This further investment, alongside other existing

shareholders and Australian strategic coinvestor, SEEK, aims to

build and reinforce its position as a UK category leader in the

online education market. This additional funding will give the business

extra headroom to support its more focused product and growth strategy.

New:

Company Business Period of Amount of further

Investment investment (GBPm)

Open banking

Ozone Financial software

Technology Limited developer December 2023 1.50

------------------- ------------------ -------------------

Ozone API ( https://ozoneapi.com ) is a software developer providing

banks and financial institutions with a low cost, out of the box

solution enabling them to deliver open APIs which comply with open

banking and finance standards globally. The software goes beyond

compliance and enables customers to monetise open banking and finance

opportunities which are growing significantly following regulatory

& market development. This funding is the first equity investment

into Ozone and enables the team to invest into their product and

go to market teams as they look to capitalise on the large and fast-growing

global market.

Cross-border

customs

automation

software

Azarc provider December 2023 0.53

------------------- ------------------ -------------------

Azarc.io ( https://azarc.io ) specialises in business process automation

using distributed ledger technology. Its Verathread(R) product has

been applied to automating cross-border customs clearances, albeit

it has wider supply chain applications. Founded in 2021, Azarc successfully

secured British Telecom as a customer and a long-term strategic

partner in the UK and aims to improve inefficiencies over traditional

paper-based customs clearances for import and export trade. This

investment will support the company's growth trajectory with BT

and expedite its expansion into international import/export hubs

through new partnerships.

Passenger

transport

data and

scheduling

CitySwift software provider December 2023 0.77

------------------- ------------------- -------------------

Huddl Mobility Limited trading as CitySwift ( https://cityswift.com

) is a software business that works with bus operators and local

authorities to aggregate, cleanse and access insight from complex

data sources from across their networks, enabling them to optimise

schedules and unlock revenue generating or cost reduction opportunities.

This investment will be used to accelerate new customer acquisition

and unlock significant opportunities within the existing customer

base - CitySwift already works with major bus operators and local

transport authorities including National Express, Stagecoach and

Transport for Wales.

Environmental, Social, Governance considerations

Gresham House is committed to sustainable investment as an integral part

of its business strategy. The Investment Adviser has formalised its approach

to sustainability and has put in place several processes to ensure environmental,

social and governance factors and stewardship responsibilities are built

into asset management across all funds and strategies, including venture

capital trusts, for example, individual members of the investment team

now have their own individual ESG objectives set which align with the

wider ESG goals of Gresham House. For further details, Gresham House

published its third Sustainable Investment Report in April 2023, which

can be found on its website at: www.greshamhouse.com .

Outlook

Whilst the year under review was marked with volatility and uncertainty

as a result of a number of factors affecting the global economy, the

portfolio has continued to trade well. The UK outlook remains challenging

but the portfolio is well diversified and Gresham House has an experienced

team working closely with the portfolio companies to help them navigate

the challenges that lie ahead. The exit environment is likely to remain

subdued, resulting in longer average investment hold times, but also

providing further portfolio follow-on investment opportunities. Previous

evidence has shown that investing throughout the economic cycle has the

potential to yield strong returns and Gresham House is seeing a number

of opportunities, both new deals and further investment into the existing

portfolio, which have the potential to drive shareholder value over the

medium term.

Gresham House Asset Management Limited

Investment Adviser

12 January 2024

Annual General Meeting

The AGM will be held at 11.00 am on Thursday, 29 February 2024 at the

offices of Shakespeare Martineau LLP, 6(th) floor, 60 Gracechurch Street,

London EC3V 0HR and will also by webcast for those Shareholders who are

unable to attend in person. Details of how to join the meeting by virtual

means will be shown on the Company's website. Shareholders joining virtually

should note you will not be able to vote at the meeting and therefore

you are encouraged to lodge your proxy form. For further details, please

see the Notice of the Meeting which can be found at the end of the Annual

Report & Financial Statements.

Further Information

The Annual Report & Financial Statements for the year ended 30 September

2023 will be available shortly on www.incomeandgrowthvct.co.uk .

It will also be submitted shortly in full unedited text to the Financial

Conduct Authority's National Storage Mechanism and will be available

for inspection at data.fca.org.uk/#/nsm/nationalstoragemechanism in accordance

with DTR 6.3.5(1A) of the Financial Conduct Authority's Disclosure Guidance

and Transparency Rules.

Contact:

Gresham House Asset Management Limited

Company Secretary

mobeusvcts@greshamhouse.com

+44 20 7382 0999

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACSQKPBKCBKKDDD

(END) Dow Jones Newswires

January 15, 2024 04:04 ET (09:04 GMT)

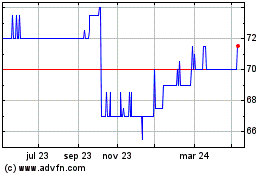

Income & Growth Vct (LSE:IGV)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Income & Growth Vct (LSE:IGV)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024