RNS Number : 3765Z

Oryx International Growth Fund Ld

18 July 2008

ORYX INTERNATIONAL GROWTH FUND LIMITED

PRELIMINARY RESULTS FOR THE YEAR ENDED 31 MARCH 2008

CHAIRMAN*S STATEMENT

As you will see from the report of the Investment Manager, the second half of the year saw some substantial falls in shares prices,

particularly in the smaller company sector. This did not seem to discriminate between the good and the bad. The consequence was a fall in

the Net Asset Value by 23% which was marginally better than the comparable index which fell by 24%.

The investment policy pursued by your Company is to invest in companies where our Investment Adviser, Christopher Mills of North Atlantic,

can see an opportunity to enhance value by active management. While it would be foolhardy to make any kind of prediction in the current

market, it is interesting to note his comment that 25% of the portfolio is subject to some kind of corporate action. We would therefore hope

to see a better result emerging as these actions begin to flow into the share prices of the companies concerned. We can also draw some

considerable comfort from the fact that, even in these difficult markets, where transactions have taken place, they have been done at prices

that have shown good returns to your Company.

In line with our stated policy, your Board do not propose paying a dividend. However, we will be seeking a Rule 9 whitewash at the AGM so

that we can continue with our policy of buying back shares when discounts allow. We will also be seeking to reduce the number of

shareholders on the register who, through legacy holdings in Baltimore hold a tiny number, by proposing a 100 for 1 consolidation followed

immediately by a sub-division. This will reduce administrative costs to the benefit of the remaining shareholders.

We continue to believe that the investment policy pursued by the Company will prove resilient in the medium term but until the current

uncertainty ends, the short term future is difficult to predict.

Nigel Cayzer

Chairman

18 July 2008

INVESTMENT ADVISER*S REPORT

During the twelve month period under review the Net Asset Value of the fund fell by 23%. This compares with a fall in the FTSE Small Cap

Index of 24% over the same period.

Results for the period amounted to a loss of �18,251,555 (2007: gain of �5,750,614). Consistent with past practice no dividend has been

declared.

The debt led boom in the British economy came to a shuddering halt in the fourth quarter of 2007, with the collapse of Northern Rock. This

in turn resulted in a crisis of confidence in the whole banking system leading to a liquidity crisis which is paralysing the economy. Higher

energy and food prices have seen a resurgence in inflation, squeezed disposable income which in turn has led to falling house prices, the

lowest level of new housing starts since 1948 and falling retail sales. Although interest rates have been reduced there is little scope for

further reductions due to rising inflation. Consequently it is almost certain that the economy will weaken further over the next few

months.

The quoted portfolio suffered despite its lack of exposure to Bank and Property companies which have led the market down. Particularly

disappointing was BBA Aviation, which was downrated despite meeting profit targets and Georgica and Inspired Gaming which both fell

following failed takeover offers. Cardpoint, which is now known as Payzone, was also disappointing following its merger with Alphyra.

The unquoted portfolio however performed well. Carwash and Primesco were taken over while DM Technical Services went public at a substantial

uplift. Motherwell Bridge was written up following excellent results (and following the year end, was recently sold at an even higher

price).

Outlook

Markets are likely to remain extremely difficult in the current year as the economy continues to deteriorate. However, approximately 25% of

the portfolio is either in discussions to be acquired or has announced a strategic review. In addition the Company had, at the end of June,

approximately 8% of its assets in cash. It is therefore expected that the Company will resume its growth in Net Asset Value over the coming

year.

North Atlantic Value LLP

18 July 2008

TEN LARGEST EQUITY HOLDINGS

as at 31 March 2008

Telecom plus plc - Cost �3,131,582 (1,900,000 shares)

The Company is the UK*s leading bill aggregate for the utility industry offering its clients all of the major utilities through a simple

monthly payment. The Company has substantial cash balances and no debt. Telecom plus plc is engaged in the supply of fixed and mobile

telephony, gas, electricity and internet services to residential and small business customers, who are acquired through a network of

independent distributors. The Company is organised into two operating divisions: Customer Management and Customer Acquisition. During the

fiscal year ended 31 March 2008, the Company supplied a total of 591,981 services and reported an increase in profits of 39% to

�11.95million. The Company also owns 100% of Telecommunications Management Limited (TML). TML is involved in the supply of fixed wire and

mobile telecommunications services to business and public sector customers.

Market value �4,693,000 representing 7.41% of Net Asset Value.

Gleeson (MJ) Group plc - Cost �4,779,136 (1,400,000 shares)

Gleeson (MJ) Group plc is a construction operations company. The Group builds houses and private purchases housing associations and local

authorities, in addition to providing electrical / mechanical engineering contracting, property investment, and residential and commercial

development services.

The Company has recently announced a number of measures it intends to take to protect shareholder*s interests in the current difficult

climate for house builders. This will focus on the reduction of operational costs and generation of additional cash to further strengthen

its balance sheet.

Market value �3,290,000 representing 5.20% of Net Asset Value.

AssetCo plc - Cost �2,710,774 (1,590,000 shares)

AssetCo is a leading provider of total managed services to UK fire and rescue authorities. The Company designs, builds and converts

specialist vehicles and equipment for emergency and mission critical service clients. AssetCo employ around 500 people in 8 locations.

The business is organised into two distinct operating divisions:

The Emergency Service Division brings together the combination of operational management expertise and strength of Vehicles and Equipment

within the emergency services supply chain to deliver a range of fully managed services. The Emergency Equipment Division was established to

ensure that clients have access to an extensive range of specialist vehicles and equipment all from under one roof.

The Company has released a strong set of results for the year ended 31 March 2008 with EPS up by 80%. The Chairman also stated that trading

in the first two months of the new financial year is in line with the Board's expectations.

Market Value �2,782,500 representing 4.40% of Net Asset Value.

Georgica PLC - Cost �4,683,710 (6,000,000 shares)

Georgica is the UK*s largest operator of ten pin bowling alleys and operates under the Tenpin brand name. Georgica is well funded and

profitable and we believe the fall is overdone and the Company represents very compelling value. The Board has announced it is in

preliminary talks which may or may not lead to an offer being made for the Company. We await a further announcement in due course.

Market value �2,505,000 representing 3.96% of Net Asset Value.

BBA Aviation plc - Cost �4,262,785 (1,650,000 shares)

BBA Aviation serves two primary markets * Flight Support and Aftermarket Services and Systems. Flight Support services include refuelling,

cargo handling, ground handling and other services to the business and commercial aviation market. Aftermarket Services and Systems

activities include overhaul of jet engines, supply of aircraft parts, design, manufacture and overhaul of landing gear, aircraft hydraulics

and other aircraft equipment. These are attractive niches in a $250 billion market with clear barriers to entry, where BBA has leading

positions, well-known and reputable brands and a proven track record of organic and acquisition-led growth.

Market value �2,479,125 representing 3.92% on Net Asset Value.

Bavaria Industriekapital AG - Cost �2,431,238 (270,000 shares)

Bavaria Industriekap AG is an industrial holding company with more than 3,000 employees. The Company invests in European businesses that

match one or more of the following criteria:

i) Industrial manufacturing or services businesses with a minimum turnover of EUR 50 million;

ii) Strong market position with a good reputation and stable customer base; and or

iii) Special situations / businesses in a state of upheaval (e.g. change in management or strategy required, unresolved succession

issues, low profitability).

They usually acquire the majority of the equity in the portfolio companies and actively manage investments to increase the return on

investment and to ensure the long-term success of the business. On the back of strong results and a strong balance sheet the Company has

paid a special dividend to shareholders in the form of a return of capital in the amount of EUR3.00 per share compared to the

pre-announcement share price of EUR12.00 per share.

Market value �2,389,508 representing 3.77% of Net Asset Value.

Castle Support Services plc - Cost �1,069,173 (3,118,175 shares)

Castle Support Services was formed following the de-merger of Castle Acquisitions from Lonhro Africa in 2006, at which time its major asset

was a statutory pension surplus of approximately �23m. The Company announced its results for the ten month period ended 30 June 2007 on 27

September 2007 and reported a significant improvement in trading at Dowding & Mills Technical Services, the business acquired in a reverse

merger transaction in June 2007, with operating profit rising 106% before the settlement of the pension surplus. The Company achieved a

�3.5m gain on the pension settlement as well as a �5.6m profit on the disposal of fixed assets and a net benefit of �1.7m relating to the

waiver on acquisition of interest payable to the preference shareholders of DMTS. The Board has recently announced a strategic review of the

business to consider how growth may be accelerated and value enhanced to shareholders. The strategic review will consider all alternatives,

including alliances, joint ventures or mergers and acquisitions and may lead to an offer being made for the Company.

Market value �2,338,631 representing 3.69% of Net Asset Value.

Communisis plc - Cost �2,764,166 (3,500,000 shares)

Communisis is a leading provider of print and marketing communication services. The Company instigated a recovery strategy in 2007, and the

Board have recently stated that both trading and progress with the Company's strategy have continued well during the period and the long

term prospects look good.

Market value �2,213,750 representing 3.50% of Net Asset Value.

Electronic Data Processing PLC (*EDP*) - Cost �2,561,049 (4,164,587 shares)

EDP is a computer services company. The Company supplies Software Solutions, sells and maintains computer equipment, and provides data

processing, advising, consulting, and technical services. EDP operates in the United Kingdom, the United States, and Canada. Turnover was

up 5% at �3.47 million, adjusted operating profit was �505,000. Hosting revenues represent 19% of total revenues and contracted recurring

revenues represent 67% of total revenues. Cash balances of �8.0 million reflected strong operating cash flows and property disposal. The

Company has significant property assets which could be disposed, which would further strengthen the cash position. The Company*s recent

market capitalisation was �13 million and they have no debt. Following press speculation, EDP confirmed it is in early stage discussions

regarding a possible offer for the Company from its management which may or may not lead to an offer being made.

Market value �2,207,231 representing 3.49% of Net Asset Value.

Payzone plc - Cost �3,713,035 (4,450,000 shares)

Payzone was formed from the merger of Cardpoint Plc and Alphyra in December 2007. The merged entity is a European market leader in payment

systems, mobile-phone top up cards and ATMs, operating in several different countries including the UK. Payzone has a particularly strong

presence in Germany and a key benefit of the merger will be the upside to be gained from the roll-out of Cardpoint*s ATM product in that

market as well as an estimated EUR6.5m of cost synergies. In addition, the combined companies have a strong position in a number of Eastern

European markets such as Romania, Greece and Poland, including important contacts with local government agencies that should be an important

source of revenue going forward.

Market value �2,136,000 representing 3.37% of Net Asset Value.

INVESTMENT POLICY

The Company principally invests in small and mid-size quoted and unquoted companies in the United Kingdom and United States. The Investment

Manager targets companies that have fundamentally strong business models but where there may be specific factors which are constraining the

maximisation or realisation of shareholder value, which may be realised through the pursuit of an activist shareholder agenda by the

Investment Manager. Dividend income is a secondary consideration when making investment decisions.

Achieving the Investment Policy

The investment approach of the Investment Manager is characterised by a rigorous focus on research and financial analysis of potential

investee companies so that a thorough understanding of their business models is gained prior to investment. Comprehensive due diligence,

including one or more meetings with management as well as site visits, are standard procedure before shares are acquired.

Typically the portfolio will comprise of 50 to 80 holdings (but without restricting the Company from holding a more or less concentrated

portfolio in the future).

The Company may invest in derivatives, financial instruments, money market instruments and currencies solely for the purpose of efficient

portfolio management (i.e. solely for the purpose of reducing, transferring or eliminating investment risk in the Company*s investments,

including any technique or instrument used to provide protection against exchange and credit risks).

The Investment Manager expects the Company*s assets will normally be fully invested. However, during periods in which changes in economic

conditions or other factors so warrant, the Company may reduce its exposure to securities and increase its position in cash and money market

instruments.

A detailed description of the investment process and risk controls employed by the Manager is disclosed in the financial statements. A

comprehensive analysis of the Company*s portfolio is also disclosed in the financial statements including a description of the ten largest

investments. At the year end the Company*s portfolio consisted of 68 holdings. The top 10 holdings represented 42.71% of total net assets.

The Board is responsible for determining the gearing strategy for the Company. Gearing is used selectively to leverage the Company*s

portfolio in order to enhance returns where and to the extent this is considered appropriate to do so. The Company currently has a �7.5

million multi-currency loan facility with Allied Irish Bank, which matures in March 2009. At the year end �750,000 had been drawn down.

Borrowings are short term and particular care is taken to ensure that any bank covenants permit maximum flexibility of investment policy.

The Company may only make material changes to its investment policies with the approval of Shareholders (in the form of an ordinary

resolution).

INVESTMENT RESTRICTIONS

The Company has adopted the following policies:

(a) it will not invest in securities carrying unlimited liability;

(b) short selling for the purpose of efficient portfolio management will be permitted provided that the aggregate value of the securities

subject to a contract for sale that has not been settled and which are not owned by the Company shall not exceed 20 per cent. of the Net

Asset Value; in addition, the Company may engage in uncollateralised stock lending on normal commercial terms with counterparties whose

ordinary business includes uncollateralised stock lending provided that the aggregate exposure of the Company to any single counterparty

shall not exceed 20 per cent. of the Net Asset Value;

(c) it will not take legal or management control of investments in its portfolio;

(d) it will not buy or sell commodities or commodity contracts or real estate or interests in real estatealthough it may purchase and sell

securities which are secured by real estate or commodities andsecurities of companies which invest in or deal in real estate commodities;

(e) it will not invest or lend more than 20 per cent. of its assets in securities of any one company or single issuer;

(f) it will not invest more than 35 per cent. of its assets in securities not listed or quoted on any

recognised stock exchange;

(g) it will not invest in any company where the investment would result in the company holding more than 10 per cent. of the issued share

capital of that company or any class of that share capital, unless that company constitutes a trading company (for the purposes or the

relevant United Kingdom legislation) in which case the company may not make any investment that would result in its holding 50 per cent. or

more of the issued share capital of that company or of any class of that share capital;

(h) it will not invest more than 5 per cent. of its assets in units of unit trusts or shares or other forms of participation in managed

open-ended investment vehicles; or

(i) the Company may use options, foreign exchange transactions on the forward market, futures and contracts for differences for the purpose

of efficient portfolio management provided that:

(i) in the case of options, this is done on a covered basis;

(ii) in the case of futures and forward foreign exchange transactions, the face value of all such contracts does not exceed 100 per cent. of

the Net Asset Value of the Company; or

(iii) in the case of contracts for difference (including stock index future or options) the face value of all such contracts does not exceed

100 per cent. of Net Asset Value of the Company. None of these restrictions, however, require the realisation of any assets of the Company

where any restriction is breached as a result of an event outside the control of the Investment Manager which occurs after the investment is

made, but no further relevant assets may be acquired by the Company until the relevant restriction can again be complied with. In the event

of any breach of these investment restrictions, the Board will as soon as practicable make an announcement on a Regulatory Information

Service and subsequently write to Shareholders if appropriate.

(j) the Company will ensure gearing does not exceed 20% of net assets.

DIRECTORS* RESPONSIBILITIES

The Directors are responsible for preparing the Annual Report and Financial Statements for each financial year which give a true and fair

view of the state of affairs of the Group and Company as at the end of the financial year and of the net income or loss for that year in

accordance with International Financial Reporting Standards and are in accordance with applicable laws.

The Directors confirm, to the best of their knowledge, that

(a) this Annual Report and Financial Statements, prepared in accordance with International Financial Reporting Standards, give a true and

fair view of the assets, liabilities, financial position and loss of the Company and the undertakings included in the consolidation taken as

a whole; and

(b) this Annual Report and Financial Statements includes information detailed in the Directors' Report, the Investment Adviser's Report and

Notes to the Financial Statements, which provide a fair review of the development and performance of the business and the position of the

Company and the undertakings included in the consolidation as a whole, together with a description of the principal risks and uncertainties

that they face.

In accordance with The Companies (Guernsey) Law, 2008 each Director confirms that so far as they are aware, there in no relevant audit

information of which the Company*s Auditor is unaware. Each Director also confirms that they have taken all steps they ought to have taken

as a Director to make themselves aware of any relevant audit information and to establish that the Company*s Auditor is aware of that

information.

Directors are also required to:

* properly select and apply accounting standards;

* present information, including accounting policies, in a manner that provides relevant, reliable, comparable and understandable

information; and

* provide additional disclosures when compliance with the specific requirements of IFRSs is insufficient to enable users to understand the

impact of particular transactions, other events and conditions on the Company*s financial position and financial performance.

The Directors are responsible for keeping proper accounting records which disclose with reasonable accuracy at any time the financial

position of the Group and Company and to enable them to ensure that the Financial Statements comply with The Companies (Guernsey) Law, 2008.

They are also responsible for safeguarding the assets of the Company and hence for taking reasonable steps for the prevention and detection

of fraud and other irregularities.

The Directors are also responsible for the maintenance and integrity of the Company*s website. Legislation in the United Kingdom and in

Guernsey governing the preparation and dissemination of financial statements differs from legislation in other jurisdictions.

CONSOLIDATED INCOME STATEMENT

for the year ended 31 March 2008

(Expressed in pounds sterling)

2008 2007

� �

Income

Interest 800,130 744,706

Dividends and investment income 1,529,522 1,823,920

2,329,652 2,568,626

Realised gains on investments 869,064 5,626,070

Movement in unrealised (loss)/gain on (19,781,604) 878,445

revaluation of investments

Transaction costs (244,042) (693,472)

Gain/(loss) on foreign currency translation 25,943 (139,228)

Income and (loss)/gain from investments (16,800,987) 8,240,441

Expenses

Management and investment adviser*s fee 537,491 610,796

Custodian fees 55,922 33,649

Administration fees 90,908 99,009

Registrar and transfer agent fees 49,434 76,554

Directors* fees and expenses 129,565 184,488

Audit fees 58,589 21,410

Insurance 10,549 9,651

Legal and professional fees 567,065 823,668

Performance fee - 100,000

Setting up costs - 423,228

Write back of excessive accruals in Baltimore (668,000) (717,000)

Plc

Other expenses 434,561 725,629

Total expenses 1,266,084 2,391,082

Net (loss) income for the year before (18,067,071) 5,849,359

taxation

Withholding tax on dividends 184,484 98,745

Net (loss)/income for the year (18,251,555) 5,750,614

Earnings per share * basic and diluted:

Ordinary �(0.89) �0.26

C Share �(0.05) �0.20

All items in the above statement are derived from continuing operations.

CONSOLIDATED BALANCE SHEET

as at 31 March 2008

(Expressed in pounds sterling)

2008 2007

� �

Non-current assets

Listed investments at fair value through profit 54,131,520 74,520,353

or loss

(Cost - �70,035,781: 2007 - �69,053,959)

Unlisted investments at fair value through 9,490,445 4,207,724

profit or loss

(Cost - �7,352,353: 2007 - �3,658,683)

63,621,965 78,728,077

Current assets

Other receivables 797,602 1,581,039

Dividends and interest receivable 296,296 405,259

Amounts due from brokers 248,428 -

Cash and cash equivalents 792,292 5,593,509

2,134,618 7,579,807

Total assets 65,756,583 86,307,884

Current liabilities

Amounts due to brokers 957,828 2,671,986

Interest bearing loans 750,000 -

Creditors and accrued expenses 740,603 1,731,531

2,448,431 4,403,517

Net assets 63,308,152 81,904,367

Shareholders* equity

Called up share capital 12,393,708 20,638,610

Share premium 42,894,039 34,993,797

Capital redemption reserve 1,246,500 1,246,500

Other reserves 6,773,905 25,025,460

Total equity shareholders* funds 63,308,152 81,904,367

Net Asset Value per Share * basic and diluted

Ordinary �2.55 �3.27

C Share - �1.15

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

for the year ended 31 March 2008

(Expressed in pounds sterling)

2008 2007

� �

Equity at beginning of year 81,904,367 31,532,800

(Loss)/profit for the year (18,251,555) 5,750,614

Total recognised income and expenses (18,251,555) 5,750,614

Issued share capital during year

- Ordinary shares 25,683,185 18,682,994

- C Shares - 25,937,959

25,683,185 44,620,953

Cancelled / converted share capital during

year

- Ordinary shares (89,886) -

- C Shares (25,937,959) -

(26,027,845) -

Equity at end of year 63,308,152 81,904,367

CONSOLIDATED STATEMENT OF CASH FLOWS

for the year ended 31 March 2008

(Expressed in pounds sterling)

2008 2007

� �

Net cash (outflow)/inflow from operating (5,232,501) 331,348

activities

Financing Activities

Costs associated with issue of shares - (1,315,318)

Cancellation of shares (344,659) -

Proceeds of borrowings 750,000 -

Cash flow from financing activities 405,341 (1,315,318)

Net (decrease)/increase in cash and cash (4,827,160) (983,970)

equivalents

Cash and cash equivalents at beginning of 5,593,509 6,716,707

year

Exchange movements 25,943 (139,228)

Cash and cash equivalents at end of year 792,292 5,593,509

NOTES

1. General

Oryx International Growth Fund Limited (the *Company*) was incorporated in Guernsey on 2 December 1994 and commenced activities on 3 March

1995.

The above results comprise an abridged version of the Company*s full accounts for the year ended 31 March 2008. Copies of the accounts will

be sent to shareholders by 31 July 2008 and will be available on the Company*s website www.oryxinternationalgrowthfund.co.uk and from the

Company*s registered office at BNP Paribas House, 1 St Julian*s Avenue, St Peter Port, Guernsey GY1 1WA.

2. Accounting Policies

Basis of Accounting

The financial statements of the Group have been prepared in accordance with International Financial Reporting Standards (*IFRS*), which

comprise standards and interpretations approved by the International Accounting Standards Board (the *IASB*), and International Accounting

Standards and Standing Interpretations Committee interpretations approved by the International Accounting Standards Committee (*IASC*) that

remain in effect in effect, together with applicable legal and regulatory requirements of Guernsey Law. These are the Group*s first results

prepared in conformity with IFRS and IFRS 1: First Time Adoption has been applied with 1 April 2006 as the transition date. All accounting

policies are consistent with the policies used in previous UK Generally Accepted Accounting Principles (*GAAP*) financial statements.

The transition from UK GAAP to IFRS had no effect on the reported financial position and financial performance of the Group.

IFRS 8 Operating Segments will come into force for periods commencing 1 January 2009. The Directors anticipate that the adoption of this

standard in future years will not have a material impact on the financial statements of the Group.

The Directors believe that other pronouncements which are in issue but not yet operative or adopted by the Group will not have a material

impact on the financial statements of the Group.

The financial statements have been prepared on the historical cost basis except for the measurement at fair value of certain financial

instruments. The principal accounting policies are set out below. The preparation of financial statements in conformity with International

Financial Reporting Standards requires the Group to make estimates and assumptions that affect the reported amounts of assets and

liabilities at the date of the financial statements and the reported amounts of revenues and expenses during the reporting year.

a) Income Recognition

Dividends arising on the Group*s listed and unlisted investments have been accounted for on an ex-dividend basis. Deposit interest is

accrued on a day-to-day basis. Loan interest is accounted for using the effective interest method. All income is shown gross of any

applicable withholding tax.

b) Investments

Classification

All investments of the Group are designated into the financial assets at fair value through profit or loss category. The investments are

purchased mainly for their capital growth and the portfolio is managed, and performance evaluated, on a fair value basis in accordance with

the Group*s documented investment strategy. Therefore the Directors consider that this is the most appropriate classification.

This category comprises financial instruments designated at fair value though profit or loss upon initial recognition * these include

financial assets that are not held for trading purposes and which may be sold. These are principally investments in listed and unlisted

equities.

Measurement

Financial instruments are measured initially at fair value being the transaction price. Subsequent to initial recognition, all instruments

classified as fair value through profit or loss are measured at fair value with changes in their fair value recognised in the Income

Statement. Transaction costs are separately disclosed in the Income Statement.

Fair value measurement principles

Listed investments have been valued at the bid market price ruling at the balance sheet date. In the absence of the bid market price, the

closing price has been taken, or, in either case, if the market is closed on the Balance Sheet date, the bid market or closing price on the

preceding business day.

Unlisted investments traded on AIM have been valued at their published bid prices at the Balance Sheet date. Unlisted investments where

there is not an active market are valued using an appropriate valuation technique so as to establish fair value at the Balance Sheet date.

Cost is considered appropriate for early stage investments. The relevance of this methodology can be eroded over time and in these cases the

carrying values will be reduced to reflect fair value. Estimates are based on the best information at the time but actual results may vary

from these estimates.

Gains and losses arising from changes in the fair value of investments are included in the income statement in the year in which they

arise.

For certain of the Group*s financial instruments, including cash and cash equivalents, interest and other receivables and accrued expenses,

the carrying amounts approximate fair value due to their immediate or short-term maturity.

Derecognition of financial assets occur when the rights to receive cash flows from financial instruments expire or are transferred and

substantially all of the risks and rewards of ownership have been transferred.

Transaction costs applicable to investment transactions have been recognised in the Income Statement.

c) Other receivables

Other receivables do not carry any interest and are short term in nature and are accordingly stated at their nominal value as reduced by

appropriate allowances for estimated irrecoverable amounts.

d) Cash and cash equivalents

Cash and cash equivalents are defined as cash in hand and short term deposits in banks.

e) Other Accruals and Payables

Other accruals and payables are not interest bearing and are stated at their nominal value.

f) Foreign Currency Translation

Items included in the Group*s financial statements are measured using the currencyof the primary economic environment in which it operates

(the *functional currency*). This is the pound sterling which reflects the Group*s primary activity of investing in sterling securities. The

Group*s shares are also issued in sterling.

Foreign currency assets and liabilities have been translated at the exchange rates ruling at the Balance Sheet date. Transactions in foreign

currency during the period have been translated into pounds sterling at the spot exchange rate in effect at the date of the transaction.

Realised and unrealised gains and losses on currency translation are recognised in the Income Statement.

g) Realised and Unrealised Gains and Losses

Realised gains and losses arising on the disposal of investments are calculated by reference to the cost attributable to those investments

and the sales proceeds, and are included in the Income Statement. Unrealised gains and losses arising on investments held at the Balance

Sheet date are also included in the Income Statement.

h) Financial Liabilities

All bank loans and borrowings are initially recognised at cost, being the fair value of the consideration received, less issue costs where

applicable. After initial recognition, all interest bearing loans and borrowings are subsequently measured at amortised cost. Any difference

between cost and redemption value has been recognised in the Income Statement over the period of the borrowings on an effective interest

basis.

Financial liabilities are derecognised from the balance sheet only when the obligations are extinguished either through discharge,

cancellation or expiration.

i) Equity

Share Capital represents the nominal value of equity shares.

Share Premium Account represents the excess over nominal value of the fair value of consideration received for equity shares, net of

expenses of the share issue.

Reserves include all current and prior results as disclosed in the income statement.

j) Expenses

Expenses are recognised in the Income Statement upon utilisation of the service or at the date they are incurred. Expenses in relation to

the placing of C Shares were borne by the subscribers of the C Shares and have been written off against share premium.

k) Consolidation

These consolidated financial statements comprise the financial statements of the Company and its wholly owned subsidiary undertakings,

Baltimore plc and American Opportunity Trust PLC. The results of the subsidiary undertakings and the businesses acquired are included in the

Consolidated Income Statement. The investments in the wholly owned subsidiaries are included in the accounts of the parent company at cost

less any provisions for impairment.

3. Share Capital and Share Premium

a) Authorised Share Capital

Number of Shares �

Authorised:

Ordinary shares of 50p each 90,000,000 45,000,000

b) Ordinary Shares Issued * 1 April 2007 to 31 March 2008

Ordinary Shares of 50p each Number of Shares Share Share

and Management Shares of 50p Capital� Premium�

each

At 1 April 2007 16,252,774 8,126,387 21,568,061

Conversion of C shares 8,567,328 4,283,664 21,399,521

Cancellation of shares (32,686) (16,343) (73,543)

At 31 March 2008 24,787,416 12,393,708 42,894,039

C Shares of 50p each Number of Shares Share Share

Capital� Premium�

At 1 April 2007 25,024,445 12,512,223 13,425,736

Conversion of C shares (24,774,668) (12,387,334) (13,295,852)

Cancellation of shares (249,777) (124,889) (129,884)

At 31 March 2008 - - -

Ordinary Shares Issued * 1 April 2006 to 31 March 2007

Ordinary Shares of 50p each Number of Shares Share Share

and Management Shares of 50p Capital� Premium�

each

At 1 April 2006 10,666,088 5,333,044 5,678,410

Issued during the year 5,586,686 2,793,343 15,889,651

At 31 March 2007 16,252,774 8,126,387 21,568,061

C Shares of 50p each Number of Shares Share Share

Capital� Premium�

At 1 April 2006 - - -

Issued during the year 25,024,445 12,512,223 13,425,736

At 31 March 2007 25,024,445 12,512,223 13,425,736

4. Earnings per Share and Net Asset Value per Share

The calculation of basic earnings per share for the Ordinary Share is based on a deficit of �18,251,555 (2007 * surplus �2,905,680) and the

weighted average number of shares in issue during the year of 20,529,829 shares (2007 * 11,176,184 shares). In accordance with IAS 33 *

Earnings Per Share, the diluted earnings per share is also disclosed. At 31 March 2008 there was no difference in the diluted earnings per

share calculation for the Ordinary Shares.

The calculation of Net Asset Value per Ordinary Share is based on a Net Asset Value of �63,308,152 (2007 - �53,121,474) and the number of

shares in issue at the year end of 24,787,416 shares (2007 * 16,257,772 shares). The diluted Net Asset Value per share is also disclosed. At

31 March 2008 there was no difference in the diluted Net Asset Value per share calculation for the Ordinary Shares.

Enquiries:

Sara Radford

BNP Paribas Fund Services (Guernsey) Limited Tel: 01481 750858

Alastair Moreton

Richard Tulloch

Arbuthnot Securities Limited Tel: 020 7012 2000

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR GIGDRRSBGGII

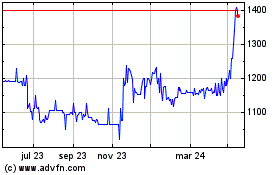

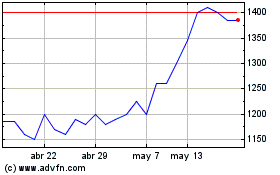

Oryx International Growth (LSE:OIG)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Oryx International Growth (LSE:OIG)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024