USA - Equities (7.12%, 2010:

7.90%)

Bionostics Holdings Limited 3,000,000 1,310,077 2.34

Bionostics Holdings Limited

Preference Shares 3,000,000 935,769 1.67

EOriginal Inc Series B Shares 12,513 - -

Nastor Investments Limited

Preference Shares 2,284,752 1,425,334 2.55

Tagos 500,000 311,923 0.56

----------- ---------------

3,983,103 7.12

USA - Warrants (Nil 2010: Nil)

EOriginal Inc Warrants 562 - -

ICarbon Corp Warrants 245,092 - -

----------- ---------------

- -

Total unlisted investments 9,518,017 17.03

----------- ---------------

Total investments 54,466,584 97.47

----------- -------

Cash 880,745 1.57

Other net assets 534,566 0.96

Total net assets 55,881,895 100.00

----------- -------

DIRECTORS' REPORT

The Directors are pleased to present their Report and

consolidated Financial Statements of the Company for the year ended

31 March 2011.

Business review

A review of the Company's activities is given in the Corporate

Summary on page 2, the Chairman's statement on page 4 and the

Investment Adviser's report on page 5. This includes a review of

the business of the Company and its principal activities, likely

future developments of the business, dividends policy and details

of the buyback of shares for cancellation during the year by the

Company. The Company's investment policy and its approach to

achieving the investment policy and managing the associated risks

are set out below and in note 19 to the Consolidated Financial

Statements. The Key Performance Indicators for the Company

including NAV performance, share price performance and benchmark

performance are contained within the Chairman's statement and the

Investment Adviser's report.

The current Directors, Messrs N Cayzer, S Cabessa, W Chatila, R

Evans, C Hannaway (resigned on 31(st) December 2010), C Mills, J

Radziwill and J Grace (appointed on 8(th) March 2011) were the only

Directors in office during the year.

The Company does not make political donations or expenditures

and has not made any donations for charitable purposes during the

year and in common with other investment funds, the Company has no

employees. Directors' and Officers' liability insurance cover has

been maintained throughout the year at the expense of the

Company.

Investment policy

The Company principally invests in small and mid-size quoted and

unquoted companies in the United Kingdom and United States. The

Investment Manager targets companies that have fundamentally strong

business models but where there may be specific factors which are

constraining the maximisation or realisation of shareholder value,

which may be realised through the pursuit of an activist

shareholder agenda by the Investment Manager. Dividend income is a

secondary consideration when making investment decisions.

Achieving the Investment Policy

The investment approach of the Investment Manager is

characterised by a rigorous focus on research and financial

analysis of potential investee companies so that a thorough

understanding of their business models is gained prior to

investment. Comprehensive due diligence, including one or more

meetings with management as well as site visits, are standard

procedure before shares are acquired.

Typically the portfolio will comprise of 40 to 60 holdings (but

without restricting the Company from holding a more or less

concentrated portfolio in the future).

The Company may invest in derivatives, financial instruments,

money market instruments and currencies solely for the purpose of

efficient portfolio management (i.e. solely for the purpose of

reducing, transferring or eliminating investment risk in the

Company's investments, including any technique or instrument used

to provide protection against exchange and credit risks).

The Investment Manager expects the Company's assets will

normally be fully invested. However, during periods in which

changes in economic conditions or other factors so warrant, the

Company may reduce its exposure to securities and increase its

position in cash and money market instruments.

A detailed description of the investment process and risk

controls employed by the Manager is disclosed in Note 19 to the

consolidated financial statements. A comprehensive analysis of the

Company's portfolio is disclosed on pages 5 to 9 including a

description of the ten largest equity investments. At the year end

the Company's portfolio consisted of 55 holdings. The top 10

holdings represented 59.58% of total net assets.

The Board is responsible for determining the gearing strategy

for the Company. Gearing is used selectively to leverage the

Company's portfolio in order to enhance returns where and to the

extent this is considered

appropriate to do so. Borrowings are short term and particular

care is taken to ensure that any bank covenants

permit maximum flexibility of investment policy.

The Company may only make material changes to its investment

policies with the approval of Shareholders (in the form of an

ordinary resolution).

Investment Restrictions

The Company has adopted the following policies:

(a) it will not invest in securities carrying unlimited

liability;

(b) short selling for the purpose of efficient portfolio

management will be permitted provided that the aggregate value of

the securities subject to a contract for sale that has not been

settled and which are not owned by the Company shall not exceed 20

per cent. of the Net Asset Value; in addition, the Company may

engage in uncollateralised stock lending on normal commercial terms

with counterparties whose ordinary business includes

uncollateralised stock lending provided that the aggregate exposure

of the Company to any single counterparty shall not exceed 20 per

cent. of the Net Asset Value;

(c) it will not take legal or management control of investments

in its portfolio;

(d) it will not buy or sell commodities or commodity contracts

or real estate or interests in real estate although it may purchase

and sell securities which are secured by real estate or commodities

and securities of companies which invest in or deal in real estate

commodities;

(e) it will not invest or lend more than 20 per cent of its

assets in securities of any one company or single issuer;

(f) it will not invest more than 35 per cent of its assets in

securities not listed or quoted on any

recognised stock exchange;

(g) it will not invest in any company where the investment would

result in the company holding more than 10 per cent. of the issued

share capital of that company or any class of that share capital,

unless that company constitutes a trading company (for the purposes

or the relevant United Kingdom legislation) in which case the

company may not make any investment that would result in its

holding 50 per cent. or more of the issued share capital of that

company or of any class of that share capital;

(h) it will not invest more than 5 per cent. of its assets in

units of unit trusts or shares or other forms of participation in

managed open-ended investment vehicles;

(i) the Company may use options, foreign exchange transactions

on the forward market, futures and contracts for differences for

the purpose of efficient portfolio management provided that:

(1) in the case of options, this is done on a covered basis;

(2) in the case of futures and forward foreign exchange

transactions, the face value of all such contracts does not exceed

100 per cent. of the Net Asset Value of the Company; or

(3) in the case of contracts for difference (including stock

index future or options) the face value of all such contracts does

not exceed 100 per cent. of Net Asset Value of the Company. None of

these restrictions, however, require the realisation of any assets

of the Company where any restriction is breached as a result of an

event outside the control of the Investment Manager which occurs

after the investment is made, but no further relevant assets may be

acquired by the Company until the relevant restriction can again be

complied with. In the event of any breach of these investment

restrictions, the Board will as soon as practicable make an

announcement on a Regulatory Information Service and subsequently

write to Shareholders if appropriate; and

(j) the Company will ensure gearing does not exceed 20% of net

assets.

CORPORATE GOVERNANCE

Introduction

The Board is accountable to shareholders for the governance of

the company's affairs. Paragraph 9.8.6 of the UK Listing Rules

requires all listed companies to disclose how they have applied the

principles and complied with the provisions of the 2008 Combined

Code. As an investment company, most of the Company's day-to-day

responsibilities are delegated to third parties, the Company has no

employees and the Directors are all non-executive. Therefore, not

all of the provisions of the 2008 Combined Code are directly

applicable to the Company.

The Directors believe that during the year under review they

have complied with the provisions of the Combined Code, insofar as

they apply to the Company's business.

In May 2010, the FRC published the new UK Corporate Governance

Code which applies to accounting periods commencing on or after

29(th) June 2010 and will therefore be applicable to the Company

for the year ended 31(st) March 2012.

Going Concern

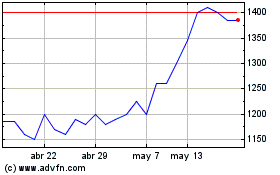

Oryx International Growth (LSE:OIG)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

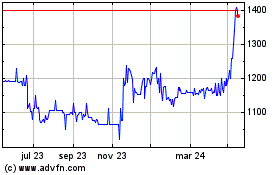

Oryx International Growth (LSE:OIG)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024