RNS Number:4611A

Oryx International Growth Fund Ld

02 July 2004

FOR IMMEDIATE RELEASE

RELEASED BY MANAGEMENT INTERNATIONAL (GUERNSEY) LIMITED

ORYX INTERNATIONAL GROWTH FUND LIMITED

PRELIMINARY ANNOUNCEMENT

THE BOARD OF DIRECTORS OF ORYX INTERNATIONAL GROWTH FUND LIMITED ANNOUNCE

RESULTS FOR THE YEAR ENDED 31 MARCH 2004:

UNAUDITED BALANCE SHEET

As at 31 March 2004

(Expressed in pounds sterling)

2004 2003

# #

INVESNTS

Listed investments at market value 11,549,574 9,836,877

(cost #10,672,174; 2003 - #13,426,553)

Unlisted investments 6,354,026 5,385,454

(cost #3,724,591; 2003 - #3,642,490)

17,903,600 15,222,331

CURRENT ASSETS

Dividends and interest receivable 266,718 68,868

Amounts due from brokers 187,653 223,746

Bank balances 3,250,789 342,697

3,705,160 635,311

CURRENT LIABILITIES

Amounts due to brokers 132,851 49,001

Creditors and accrued expenses 61,202 62,742

194,053 111,743

NET CURRENT ASSETS 3,511,107 523,568

TOTAL ASSETS LESS CURRENT LIABILITIES 21,414,707 15,745,899

LONG TERM LIABILITIES

Convertible loan stock 2,414,522 2,504,928

TOTAL NET ASSETS #19,000,185 #13,240,971

EQUITY SHARE CAPITAL 3,941,616 4,049,116

RESERVES

Share premium 4,279,077 4,247,457

Reserve relating to warrants - 32,288

Capital redemption reserve 1,239,000 1,099,000

Other reserves 9,540,492 3,813,110

15,058,569 9,191,855

EQUITY SHAREHOLDERS' FUNDS #19,000,185 #13,240,971

Net Asset Value per Share #2.41 #1.64

Fully Diluted Net Asset Value per Share #2.00 #1.44

UNAUDITED STATEMENT OF OPERATIONS

For the year ended 31 March 2004

(Expressed in pounds sterling)

2004 2003

# #

INCOME

Deposit interest 57,738 33,707

Dividends and investment income 777,862 321,020

835,600 354,727

EXPENDITURE

Management and investment adviser's fee 228,161 219,876

Finance charge 23,152 25,723

Custodian fees 15,680 13,980

Administration fees 20,050 15,740

Registrar and transfer agent fees 3,644 4,396

Directors' fees and expenses 119,136 91,087

Audit fee 12,516 9,498

Insurance 9,500 6,750

Legal and professional fees 47,434 7,791

Printing and advertising expenses 6,425 10,601

Miscellaneous expenses 25,345 11,278

511,043 416,720

NET INCOME / (EXPENSE)

BEFORE TAXATION 324,557 (61,993)

Taxation (96,548) (27,295)

NET INCOME / (EXPENSE) FOR THE YEAR AFTER TAXATION 228,009 (89,288)

Realised gain/ (loss) on investments 703,397 (1,557,611)

Loss on foreign currency translation (79,012) (122,370)

Movement in unrealised gain/ (loss) on revaluation of investments 5,353,186 (624,988)

TOTAL SURPLUS/ (DEFICIT) ATTRIBUTABLE TO SHAREHOLDERS FOR THE YEAR #6,205,580 #(2,394,257)

EARNINGS PER SHARE FOR THE YEAR #0.77 #(0.28)

FULLY DILUTED EARNINGS PER SHARE FOR THE YEAR #0.57 #(0.20)

UNAUDITED STATEMENT OF CASH FLOWS

For the year ended 31 March 2004

(Expressed in pounds sterling)

2004 2003

# #

Net cash inflow/ (outflow) from operating activities 51,771 (108,082)

INVESTING ACTIVITIES

Purchase of investments (13,647,072) (18,202,781)

Sale of investments 17,142,329 15,377,676

Net cash inflow/ (outflow) from investing activities 3,495,257 (2,825,105)

FINANCING ACTIVITIES

Payment to holders of warrants (70,946) (6,012)

Shares issued on exercise of warrants - 4,500

Payment to shareholders (413,828) (1,203,001)

Payment to holders of convertible stock (75,150) (110,221)

Net cash outflow from financing activities (559,924) (1,314,734)

Net cash inflow/ (outflow) 2,987,104 (4,247,921)

RECONCILIATION OF NET CASH FLOW TO MOVEMENT IN NET FUNDS

Net cash inflow/ (outflow) 2,987,104 (4,247,921)

Exchange movements (79,012) (122,370)

Net cash at beginning of year 342,697 4,712,988

Net cash at end of year #3,250,789 #342,697

CHAIRMAN'S STATEMENT

The year under review saw a substantial recovery in equities across the world.

During the year the net asset value rose by 43.5%. While this was disappointing

in relation to our benchmark, the FTSE small cap index, it represents a very

credible performance as 33% of the portfolio is in unquoted investments, where

your board takes a very conservative view on valuation. In addition, a further

17% was held in cash awaiting investment.

In line with our stated policy, your Board do not propose paying a dividend,

however we will be continuing with our policy of buying back shares when

discounts allow. Consistent with this commitment, we purchased 280,000 ordinary

shares, 50,000 convertible loan notes and 242,375 warrants for cancellation.

This was modestly accretive to the NAV.

During the course of the coming year, the Board will be formulating proposals to

put to shareholders as the Fund will reach the end of its initial ten year term.

With confidence in markets overshadowed by threats of terrorism, our policy of

investing in situations where we believe value can be realised should continue

to provide us with opportunities.

Nigel Cayzer

Chairman

INVESTMENT ADVISER'S REPORT

During the year under review, the net asset value rose by 43.5%. This compares

with a rise in the FTSE 100 Index of 21.4% and a rise in the FTSE Small Cap of

59.8%. The performance was adversely impacted by the weakness of the Dollar,

which fell by 16.6% over the year, and lack of activity in the unquoted

portfolio.

I am however pleased to note that the quoted portfolio maintained the excellent

momentum of the first half. Since September 30th, Mentmore, our largest holding,

rose 30%, Quarto 20%, Whatman approximately 50%, Simon Group 15%, Charter 75%,

Paramount over 100% and Harstone Pref nearly 75%. Only two shares performed

poorly, Dowding & Mills and Lonrho Africa although the overall impact on the

portfolio was negligible.

The current year has started reasonably well with an offer to acquire Mentmore

at a premium to the value at 31st March. We are also optimistic that the

unquoted portfolio will perform well over the current year. Santa Maria is in

advanced discussions to be acquired. Waterbury has also appointed an investment

banker to sell the company and this should also result in a significant uplift

to the current holding price and Executive Air Support is subject to an offer,

which has been accepted at a 132% premium to book value.

The overall prospects for equity markets are increasingly uncertain. Interest

rates are certain to rise over the next twelve months whilst debt fed economic

growth is unlikely in the long run to be sustainable or healthy for the economy.

In the circumstances, we continue to adopt a conservative investment policy so

as to at least preserve shareholder value in the coming twelve months.

North Atlantic Value LLP

This information is provided by RNS

The company news service from the London Stock Exchange

END

FR SSMFMESLSEDW

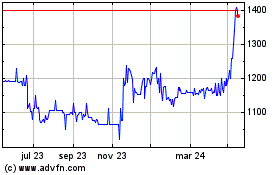

Oryx International Growth (LSE:OIG)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

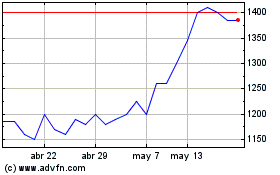

Oryx International Growth (LSE:OIG)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024