3rd Quarter Results

16 Diciembre 2024 - 10:30AM

UK Regulatory

3rd Quarter Results

16 December 2024

Oxford Technology

2 VCT Plc (the "Company")

Legal Entity Identifier:

2138002COY2EXJDHWB30

3rd Quarter Results

Oxford Technology 2 VCT Plc presents its quarterly update for

the 3 month period ending 30 November 2024. The Directors have

reviewed the valuation of its entire portfolio as at that date. The

unaudited net asset value (NAV) per share for each Class (and other

associated data) as at 30 November 2024 is shown in the table

below:

|

|

Unaudited NAV p per share 30/11/24 |

Unaudited NAV p per share 31/8/24 |

Change in NAV % |

Cumulative Dividends p per share to 31/8/24 |

Total NAV Return p per share |

Shares in Issue |

|

Share Class |

|

|

|

|

|

|

OT1 |

42.5 |

46.8 |

-9% |

55.0 |

97.5 |

5,431,655 |

|

OT2 |

17.3 |

18.9 |

-9% |

22.5 |

39.8 |

5,331,889 |

|

OT3 |

19.5 |

22.9 |

-15% |

42.0 |

61.5 |

6,254,596 |

|

OT4 |

19.9 |

21.2 |

-6% |

48.0 |

67.9 |

10,826,748 |

The primary drivers of these changes are

movements in valuations of the two principal AIM quoted investments

– Scancell Holdings Plc (“Scancell) and Arecor Therapeutics Plc

(“Arecor”) and three months of running costs. The share price of

both have decreased – Scancell from 17p at 31 August 2024 to 13p at

30 November 2024 and Arecor fell from 83p to 75p over the same

period. Both companies continue to announce exciting and

significant clinical news, but both the sector and the AIM market

are unloved. Their share prices do not seem to take account of

these developments – indeed it remains extremely disappointing that

their valuations do not yet reflect the clear potential of these

businesses. In December 2024, Scancell announced that

it had raised a further £11.3m gross, but at 10.5p per share (a 19%

discount to the share price used in our 30 November valuation) to

enable it to produce more trial data, and additional working

capital: this is despite a day earlier announcing a further

commercial partnership with Genmab, with an associated milestone

receipt. The fund raising was oversubscribed and had significant

participation from both existing and new healthcare specialist

investors, as well as retail shareholders.

During the period, we have been advised that

Novacta Holdings PLC, the company that holds the rights to a

portion of the royalties from the commercialisation of SPR206 which

was licensed to Spero Therapeutics, is to be put into

administration. The Board and Investment Manager have tried to work

with other shareholders to find an alternative solution but have

been unsuccessful to date. As a result, we have made a full

provision against this investment. The valuation of Biocote Limited

has slightly increased, reflecting an increase in sales during the

period. The other unquoted investments have been kept at their 31

August 2024 valuations.

No dividends were paid during the period under

review. No shares were bought or sold in any the portfolio

companies in any of the four Share Classes.

The Directors are not aware of any other events

or transactions which have taken place between 30 November 2024 and

the publication of this statement which have had a material effect

on the financial position of the Company.

The Board has completed its discussions with a

major shareholder who voted against the resolutions regarding

remuneration policy and the Remuneration Report included in the

2024 Financial Statements issued on 16 April 2024. Unusually, the

Company has an institutional shareholder, and they were concerned

the Board had not set out sufficiently clearly its strategy for the

portfolios and board tenure. The Directors sought to address these

with more details provided in the half year report issued on 20

September 2024: the Board was pleased to receive confirmation from

the dissenting shareholder that we had addressed their concerns and

had provided a rationale for the approach being taken.

At 30 November 2024, the Company’s issued share

capital by Share Class is shown in the table above. The Company

holds no shares in treasury and the total voting rights in the

Company are 27,844,888. This figure of 27,844,888 may be used by

shareholders as the denominator for the calculations by which they

will determine if they are required to notify their interest in, or

a change to their interest in, the Company under the Financial

Conduct Authority's Disclosure Guidance and Transparency Rules.

Enquiries: Lucius Cary Oxford Technology

Management 01865 784466

This announcement contains inside information as stipulated

under the UK version of the Market Abuse Regulation No 596/2014

which is part of English Law by virtue of the European (Withdrawal)

Act 2018, as amended. Upon the publication of this announcement via

a Regulatory Information Service, this information is now

considered to be in the public domain.

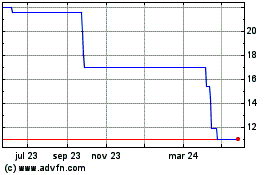

Oxford Technology 2 Vent... (LSE:OXH)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

Oxford Technology 2 Vent... (LSE:OXH)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024