TIDMPODP

RNS Number : 6425H

Pod Point Group Holdings PLC

31 July 2023

31 July 2023

Pod Point Group Holdings PLC (Symbol: PODP)

Unaudited half-year results for the six months ended 30 June

2023

New team addressing the challenges to capture long term

opportunities

Pod Point Group Holdings plc (the "Company") and its

subsidiaries (the "Group"), one of the UK's market leading

providers of Electric Vehicle ("EV") charging solutions, announces

its unaudited half-year results for the period ended 30 June 2023

and begins its transformation plan to address performance

issues.

Key Financials Six months Six months Change

to 30.06.23 to 30.06.22

Total Revenue GBP30.6m GBP41.6m -26%

Adjusted EBITDA( (1 ) GBP(6.8)m GBP(1.4)m GBP(5.4)m

EBITDA Loss GBP(9.4)m GBP(4.0)m GBP(5.4)m

Loss Before Tax GBP(32.8)m GBP(7.5)m GBP(25.3)m

Closing cash and cash GBP58.8m GBP82.1m GBP(23.3)m

equivalents

(1) See Notes below for definition of Adjusted EBITDA

Group Highlights

-- Compared to a very strong H1 2022, Revenue at GBP30.6m, down

by 26% against a very strong prior year comparison that benefitted

from pull forward demand from ending of OZEV grant.

-- Overall Gross Margin up 500bps to 30% from 25%, driven by

improved supply chain, product savings, pricing and margin mix

improvement.

-- Growth of communicating units to 212k, up by 21% across all

customers, strengthening the foundations of future recurring

revenue and leading to first Grid Load Management revenue expected

in FY2023 from UK Power Networks.

-- Continued strong growth in Owned Asset revenue up 172% and Recurring revenue up 87%.

-- Home revenue, a key focus for the transformation plan, down

54%, reflecting a more challenging market with reduced market

penetration.

-- Adjusted EBITDA loss of GBP 6.8m below expectations on lower

revenues, but with continued investment in future growth.

-- Non-cash goodwill impairment charge of GBP18.6m drives Loss Before Tax to GBP32.8m.

-- Strong balance sheet with GBP58.8m cash.

-- Following the appointment of interim CEO Andy Palmer, the

Board is focused on delivering near term operational performance

improvement and strengthening the Group's foundations to deliver

long term shareholder value creation. The Group will host a Capital

Markets Event during Q4 2023 to provide an update on its refined

strategy and transformation plan.

-- The Board has appointed a search firm to recruit a new CEO

for the Group. Updates will be provided in due course.

Strategic and Operational Summary

-- First Grid Load Management contract signed with UK Power

Networks, leading to first consumer-related recurring revenue

expected in 2023 financial year.

-- Large contract wins with three of the major UK Housebuilders

- Barratt Development, Bellway and Taylor Wimpey, opening

significant growth pipeline in this large segment.

-- Significant growth in network usage, with electricity

transferred across our network up 26% at 215 GWh, helping to avoid

163k tonnes of CO2e(1) , up 26% on 2022.

-- Excellent levels of customer service maintained with a 4.3

out of 5 rating on Trustpilot and a 4. 6 out of 5 rating on

reviews.io with a 91% recommendation rate .

-- Home charge Average Basket Spend increased by 7% to GBP800.

-- Headline Home Market Penetration (2) down by 15ppt% from 22%

to 7%, with the conclusion of OZEV grant that caused customers to

pull forward home charge purchases resulting in an overweight 2022

penetration, combined with a weaker 2023 charge point demand

market.

-- Owned Asset site expansion in Tesco deal near end of rollout:

increased to 593 sites with 1334 charging points including 140 DC

rapid units.

-- Improving of supply chain dynamics and good start to Celestica relationship.

(1) Consistent methodology with 2022 reporting

(2) Home installation units (excluding wholesale units) as a %

of reported SMMT PIV registrations in same period

Andy Palmer, Interim Chief Executive Officer of Pod Point,

said:

The first half of 2023 has been complex, and we have faced

numerous challenges, both internally and externally, including the

well documented inflationary pressures and cost of living crisis.

Pod Point has lots of reasons to be pleased with progress made

during the period, including several high-profile contract wins

with large UK housebuilders and our first grid load management

contract, significant improvements in our supply chain and a big

step-up in our recurring revenues. Our connected charging network

has increased to 212,000 and remains by far the largest in the UK.

Following my appointment as Interim CEO, we are reviewing areas of

improvement that will strengthen our foundations for long-term

future success and growth.

Financial Summary Six months Six months Period on

to 30.06.23 to 30.06.22 period change

GBP'000 GBP'000

Total revenue 30,614 41,552 -26%

Home 12,415 27,219 -54%

Commercial 12,722 12,084 5%

Owned Assets 4,052 1,489 172%

Recurring Revenue 1,425 760 87%

Gross profit 9,239 10,388 -11%

Gross margin 30% 25% +5ppt%

------------------------- ------------- ------------- ---------------

Home gross profit 3,426 6,285 -45%

Home gross margin 28% 23% +5ppt%

------------------------- ------------- ------------- ---------------

Commercial gross profit 3,746 2,776 35%

Commercial gross margin 29% 23% +6ppt%

------------------------- ------------- ------------- ---------------

Adjusted EBITDA( (1 ) (6,778) (1,414) (5,364)

EBITDA Loss (9,381) (3,992) (5,389)

Loss before tax (32,815) (7,546) (25,269)

Closing cash and cash

equivalents 58,766 82,086 (23,320)

Headline KPIs Six months Six months Period on

to to period change

30.06.23 30.06.22

Total UK new PiV(2) sales 215,120 166,512 29%

Home units installed 15,525 36,576 -58%

Commercial units installed

and shipped 9,668 8,844 9%

------------------------------------ ----------- ----------- ---------------

Home market penetration 7 % 22% -15ppt%

Total Home units installed

and able to communicate

at period end 188,158 156,398 20%

------------------------------------ ----------- ----------- ---------------

Total Commercial units

installed and able to communicate

at period end 23,771 18,732 27%

------------------------------------ ----------- ----------- ---------------

Average recurring revenue

per unit(3) GBP60 GBP41 46%

Total Owned Asset sites

at period end 593 500 19%

------------------------------------ ----------- ----------- ---------------

Total Owned Asset Charge

Points at period end 1,334 1,109 20%

------------------------------------ ----------- ----------- ---------------

Total Owned Asset Rapid/DC

Charge Points at period

end 140 101 39%

------------------------------------ ----------- ----------- ---------------

Notes

(1) Adjusted EBITDA is defined as earnings before interest, tax,

depreciation and amortisation and also excluding both amounts

charged to the income statement in respect of the Group's share

based payments arrangements and adjusting for large corporate

transaction and restructuring costs. These have been separately

identified by the Directors and adjusted to provide an underlying

measure of financial performance. The reconciliation is set out on

the income statement and N ote 5 provides a summary of the amounts

arising from the large corporate transactions and restructuring

costs.

(2) PiV defined as "Plug-in Vehicles"

(3) Average recurring revenue per unit is calculated as

recurring revenue divided by the total number of Commercial units

installed and able to communicate at a period end. Commercial units

shipped but not installed by Pod Point are not included in this

statistic.

Current trading and outlook

2023 has proven volatile during the first half, with weaker

revenue trends being partially offset by significantly higher gross

margin. Headline market data suggests strong growth in the PIV

market, but trends between private customers and fleet customers

have been divergent. While inflation has eased slightly in the most

recent data, cost of living pressures remains and are likely to

continue to weigh on consumer confidence.

Consequently, the Group has updated revenue guidance for 2023 to

be at least GBP60m. Adjusted EBITDA loss for 2023 is now expected

to be no greater than GBP17m. The updated adjusted EBITDA guidance

includes the impact of lower revenues, and an expected GBP5m of

costs related to transformation plan initiatives and growth

investments identified as part of the ongoing strategy review and

non-cash charges. We expect the improvement in gross margin seen in

H1 to continue in the second half on improved supply chain and

actions taken by the Group. Our year-end cash position is expected

to be between GBP40-45 million.

Webcast presentation

There will be a webcast presentation for investors and analysts

this morning at 09:00 am. Please contact podpoint@teneo.com if you

would like to attend.

Enquiries:

Pod Point Plc

Andy Palmer, interim Chief Executive Officer

David Wolffe, Chief Financial Officer

Phil Clark, Investor Relations phil.clark@pod-point.com

Numis (Joint Corporate Broker)

Jonathan Wilcox / Andrew Coates +44 (0)20 7260 1000

BofA Securities (Joint Corporate Broker)

Marcus Jackson / Mitchell Evans +44 (0)20 7628 1000

Media

Mark Burgess / Matt Low / Arthur Rogers (Teneo) +44 (0)20 7353

4200 podpoint@teneo.com

About Pod Point Group Holdings plc

Pod Point was founded in 2009 by entrepreneur Erik Fairbairn.

Driven by a belief that travel shouldn't damage the earth, Pod

Point has 212k smart communicating charge points on its network and

is an official charge point supplier for major car brands.

Pod Point installs a broad range of products from smart domestic

charge points to high power rapid chargers and load balancing

systems. Pod Point works with a broad range of organisations and

customers to offer home and commercial charging solutions with

customers including major retailers, hotels, restaurants and

leisure venues.

Pod Point is admitted to trading on the London Stock Exchange

under the ticker symbol "PODP."

For more information, visit https://pod-point.com/

Chief Executive's Review

The first half of 2023 has been another dynamic period for the

Group with lots of successes, lots of challenges and most recently

a period of transition with the departure of the Group's Founder

and CEO. When taking on the role of interim CEO, I promised to

provide an update on key priorities for the Group. The Board

remains extremely confident in the long-term future for Pod Point

and its core mission and plan. The Group has made a strong start in

capturing the opportunities created by the transition to electric

vehicles and our long-term shareholder value creation potential

remains huge. However, it is clear there are certain areas that we

need to improve on, particularly around operational processes and

moving towards profitability as quickly as possible.

Alongside the Executive team and the Board, I have conducted a

rapid initial review of our business. We have identified three

critical areas that need strategic and operational review.

1. Growth.

While the Group had a strong track record of delivering rapid

growth for several years, the performance in the last 12 months has

been very disappointing and we have lost market share in an

increasingly competitive market. We are acting quickly to

re-establish our market leading position on new installations,

focusing on product innovation and operational excellence. The

Board is in no doubt that the Group has significant growth

potential, and we need to reassess our strategic priorities to

ensure we fully leverage our competitive advantages of brand

awareness, existing installed base, strong OEM and Commercial

relationships and emerging recurring revenue streams.

Pod Point is positioned well to take advantage of strong

relationships with OEM partners and of the OZEV scheme to sell

charging points. However, this has been done at the detriment of

building internal sales capabilities and at this time these remain

insufficient to drive growth. With the shifts in the market and the

end of the OZEV scheme, our sales have slowed. We are therefore

re-focusing on re-establishing greater internal sales capabilities

and resources.

2. Product innovation.

Pod Point had a clear early lead in charge point technology. Our

products are reliable, robust, easy to use and offer great value.

However, while we still have a strong product set, we have failed

to maintain our leadership position and been slow to anticipate the

market evolution to open architecture technology. We are

re-establishing a clear product innovation roadmap that keeps pace

with customer requirements in a cost-effective way. The

introduction of OCPP (Open Charge Point Protocol) and OCPI (Open

Charge Point Interface) capabilities in our product is a key

priority, unlocking new growth opportunities.

3. Cost and ROI discipline.

The Group has not had a consistent and disciplined enough

approach to capital allocation and investment in our cost base.

Consequently, we have not prioritised investments into those areas

that will deliver break-even in our core charging business. We need

to ensure greater operational control across the business, and we

will implement a clearer investment criteria framework and return

on capital hurdle rates for our investment decisions. Accelerating

our path to profitability and careful deployment of our cash will

be a key focus for the Group.

A transformation programme is in development, with further

details and a strategy update in Q4 at a CMD.

Immediate priorities for H2 2023

For the balance of 2023, the Board and Executive team will focus

on refining our tactical and strategic response to each of these

areas, including the engagement of external consultants to support

a strategic and operational review of the Group. This work,

combined with core workstreams identified by the management team

will create the Group's transformation plan, Powering Up.

The intent of this work and our response to current

company-specific challenges is to ensure that Pod Point is well

placed to take advantage of our key strengths to (1) move to

break-even as quickly as possible in our core charging business and

(2) capture the long-term structural growth opportunities created

by the decarbonisation of the economy.

-- Brand . Pod Point has strong brand awareness and is well

regarded by consumers. A recent YouGov survey showed Pod Point has

the leading brand consideration in the sector.

-- Network. Our installed network of charging points is now

212,000, up 9% compared to 31 December 2022. Pod Point has the

largest home charging network in the UK.

-- Partnerships . The Group has established significant

partnerships with many of the largest OEMs in Europe as well as

being a strong partner for home electric charging points for 13 of

the largest 15 homebuilders in the UK.

-- Routes to market . Pod Point has a range of routes to market

for its charge points: Direct to Consumer, OEM referral, Leasing,

Wholesale, Housebuilders, and B2B Commercial across retail,

leisure, logistics and others. This provides us with

diversification and leverages our partnerships.

-- ESG credentials . Our mission is unchanged, to provide travel

that doesn't damage the Earth. We have a strong ESG mindset and

will provide an update of our ESG programme at our preliminary

results.

-- Balance sheet strength . Pod Point is well capitalised. Our

GBP58.8 million of cash at the end of H1 2023 means we have

sufficient financial resources to deliver on our medium-term

plan.

By doing this, we are creating a significant installed base of

connected charge points that will unlock our grid load management

potential, with its high margin and recurring revenue streams.

The Group will host a capital markets event during Q4 2023 to

provide more detail of our transformation plan, key initiatives and

updated strategic plan. We will provide more detail on the grid

management and recurring revenue opportunity for Pod Point. At the

event, financial and operational targets will be provided.

Overview of results:

Performance in H1 reflects a significant degree of challenge.

Although a key highlight is gross margin progression, revenue

growth has been disappointing.

Like many other companies, we are seeing how a poor

macroeconomic environment with low consumer confidence is currently

constraining both consumer and commercial demand.

Despite challenging conditions in 2023, we continued to invest

in our business, because we see a strong industry growth trajectory

over the next decade as the UK navigates the journey to all

vehicles being electric. We have an opportunity to cement a leading

position in the market.

In H1 2023, we shipped and installed 25,193 charge points, with

the commercial sector leading with 9% increase year on year.

During the year, we also made significant steps towards

improving our gross margin, avoiding additional supply chain costs,

having full production of our highest volume products with leading

global manufacturer, Celestica, and by growing our average basket

spend in our home charge sector from GBP746 to GBP800.

We saw exceptional growth in our small but vitally important

recurring revenue sector, specifically growing our average

recurring revenue per commercial unit from GBP41 to GBP60 and

growing our overall recurring revenue by 87% year on year.

Furthermore, we saw 172% growth in our revenues from our Owned

Assets, predominantly driven by our relationship with Tesco and

introduction of increased charging tariffs.

Overall, we ended the year with circa 212k communicating charge

points, which is a significant step toward our plans to enable grid

load management functionality across our network.

The recent announcement of the deal with UK Power Networks is a

significant marker of our progress towards the beginning of a new

stream of recurring revenues relating to consumers and the value of

our network in terms of grid load management. We expect to

recognise our first revenues in this financial year 2023.

Pod Point's mission is to enable travel that doesn't damage the

Earth, so we were also very pleased to see strong growth in the

energy transferred across our network, (215GWh HY23 vs 171GWh HY22)

and the corresponding growth in the amount of carbon avoided by our

customers (163k tonnes HY23 vs 129k tonnes HY22).

We recognise that performance in the last 6 months has been

disappointing, and we are committed to addressing the underlying

issues, and know we can build on some core strengths of the

business.

We continue to be very excited by the growth prospects for

charging underpinned by the government's 2030 internal combustion

engine ban. The opportunity from Grid services is even more

exciting.

I would like to thank the whole team at Pod Point for the hard

work of the last 6 months, the warm welcome to my new role, and the

clear commitment to the revitalisation of the business.

Sector Review

In the Home business segment:

-- Revenue of GBP12.4 million was 54% down compared to of GBP27.2 million in H1 2022.

-- New plug-in vehicle registrations increased 29% to 215,120 in

H1 2023 from 166,512 in H1 2022. This continued growth reflects

continued demand for EVs, but it is important to note that the

retail/consumer side of the market showed significant weakness. The

number of Pod Point Home units installed fell to 15,525 versus

36,576 in H1 2022.

-- Our headline market penetration of new plug-in vehicle

registrations therefore decreased to 7% from 22% in H1 2022. There

are a range of factors that we believe contributed to this

including:

o Increased consumer cost of home charge units as a result of

the end of the OZEV grant, and the cost-of-living crisis may have

reduced the average ratio of home charge units to plug-in

vehicles.

o Shifting market mix in 2023 away from private EV sales towards

fleet, with the private market showing weak demand for charge

points, and fleet sales showing increased vehicle renewals where no

charge point is required.

-- Percentage gross margin in H1 2023 increased 500 basis points

to 28% compared to H1 2022 at 23%, driven by the avoidance of

component sourcing costs, improved Average revenue per unit, and a

full period of improved Bill of Material (BoM) costs. Average

revenue per unit increased to GBP800 from GBP746 in H1 2022.

-- The lower revenue growth drove total gross margin lower in H1

2023, falling to GBP3.4 million compared to GBP6.3 million in H1

2022.

In the Commercial business segment:

-- We delivered a steady performance, with revenue of GBP12.7

million compared to H1 2022 of GBP12.1 million, an increase of 5%

on average, with higher growth in our supply only segment.

-- Number of units installed decreased to 1,890 from 2,112 in H1

2022 and the number of units sold directly to customers increased

to 7,778, compared to 6,732 in H1 2022. This represents a direct

sale increase of 16%.

-- The increased revenues helped to increase total gross margin

in H1 2023 to GBP3.7 million, compared to H1 2022 at GBP2.8

million, an increase of 35%.

-- Percentage gross margin increased by 600 basis points to 29%

in H1 2023 from 23% in H1 2022, due to a shift in the mix of

installations toward higher margin direct sale units.

In the Recurring Revenue business segment:

-- We delivered excellent growth in our recurring revenue

segment, albeit from a low base, with revenue of GBP1.4 million in

H1 2023 compared to H1 2022 of GBP0.8 million, an increase of 87%.

Network revenues in H1 2023 grew by 18% to GBP0.542 million

compared to H1 2022 of GBP0.460 million.

-- This increase in revenues helped to increase gross margin in

H1 2023 to GBP0.9 million, compared to H1 2022 of GBP0.4 million,

an increase of 108%.

-- Percentage gross margin in H1 2023 increased to 62% compared

to 56% in H1 2022, an increase of 6 percentage points, with the

average recurring revenue per commercial unit installed and able to

communicate increasing to GBP60, compared to GBP41 in H1 2022.

-- The number of Commercial units installed and able to

communicate at the period end increased to 23,771 from 21,342 at

the end of 2022. All recurring revenues in both 2023 and 2022 were

derived from these units.

-- The number of Home units installed and able to communicate at

the period end increased to 188,158 from 173,754 at the end of

2022. This growth is strategically significant as we seek to expand

our recurring revenue products across these units.

In the Owned Asset business segment:

-- We delivered a strong performance with revenue of GBP4.1

million in H1 2023 compared to H1 2022 of GBP1.5 million, an

increase of 172%.

-- The total number of sites installed at the period end

increased to 593 from 564 at the end of 2022 and 500 at June 2022.

The total number of units installed at the period end increased to

1,334 from 1,259 at the end of 2022, including 140 DC rapid units

at 30 June 2023 compared to 117 at the end of 2022.

-- This increase in revenues and units helped to increase gross

margin in H1 2023 to GBP1.2 million compared to H1 2022 at GBP0.9

million, an increase of 31%.

-- Percentage gross margin in H1 2023 decreased to 29% compared

to H1 2022 of 61%, a decrease of 32 percentage points, due to

revenue mix.

-- Gross capital deployed on assets increased to GBP6.9 million

at the end of H1 2023, compared to GBP6.3 million at the end of

2022.

Financial Performance

It was a disappointing performance by the business in H1 2023

with total revenue of GBP30.6 million (H1 2022: GBP41.6 million), a

decrease of 26%. Better growth came from our Commercial business

segment, and we also saw very high growth in Recurring Revenue and

Owned Assets.

Reduced revenue, mitigated by significant margin improvement,

moderated the decrease in total gross profit in H1 2023 of GBP9.2

million (H1 2022: GBP10.4 million) to a period on period decrease

of 11%.

Compared to H1 2022 and its additional costs of sourcing

components in the spot market, with improvements in the sales mix,

and underlying BoM improvements, as well as pricing changes,

percentage gross margin in H1 2023 increased to 30% (H1 2022: 25%),

a period-on-period increase of 5 percentage points.

The reduced revenues and gross profit combined with increased

overhead spend to invest in driving future growth, focussed on

sales and marketing, customer service and team development. This

moved the business to an adjusted EBITDA loss of GBP6.8 million in

H1 2023 (H1 2022: GBP1.4 million).

After further investment of GBP6.0 million in software and

product development and controlled investment in Owned Assets, H1

2023 period end cash and short-term investments were GBP58.8

compared to GBP74.1 million at the end of 2022.

Unadjusted losses after tax increased to GBP33.0 million in H1

2023 (H1 2022: GBP7.5 million). EBITDA losses increased in H1 2023

with losses of GBP9.4 million (H1 2022: GBP4.0 million). There were

increased depreciation and amortisation costs of GBP5.1 million in

H1 2023 (H1 2022: GBP3.5 million), while net financing income was

GBP0.3 million (H1 2022: net finance costs of GBP0.1 million).

Total administrative expenses increased to GBP43.0 million in H1

2023 (H1 2022: GBP17.9 million), an increase of 140%. This increase

was due to a goodwill impairment loss recognised in H1 2023 of

GBP18.6m (H1 2022: nil), additional staff to deliver future growth,

additional depreciation and amortisation costs as a result of

increased funds being invested in Owned Assets and intangible asset

development. Looking at these individually:

-- Administrative expenses excluding restructuring costs, share

based payments, depreciation and amortisation and goodwill

impairment costs increased to GBP16.6 million in H1 2023 (H1 2022:

GBP11.8 million) an increase of 41%. This increase was due to

additional staff and overheads to drive future growth, albeit that

growth in 2023 has been short of expectations.

-- Depreciation and amortisation costs increased in H1 2023 to

GBP5.1 million (H1 2022: GBP3.5 million) as a result of additional

funds being invested in product and software development and other

assets.

-- A goodwill impairment charge recognised in H1 2023 of GBP18.6m (H1 2022: nil).

-- Following the listing in November 2021, Pod Point incurred

share based payment charges relating to a number of share awards

that were implemented at or soon after listing, resulting in an H1

2023 charge to the P&L of GBP2 million (H1 2022: GBP2.6

million) and national insurance accrued on share based payment

charges of GBP0.3 million (H1 2022: GBP0.3 million).

-- In H1 2023, GBP0.4 million of restructuring costs were incurred (H1 2022: GBPnil).

Net finance income increased to GBP0.3 million in H1 2023 (H1

2022: net finance costs of GBP0.1 million ).

Our balance sheet remains strong. Working capital movements have

been limited across trade and other receivables, inventory and

trade and other payables. Fixed assets grew as we continue to build

the software platforms that will drive future growth.

Closing cash and cash equivalents were GBP58.8 million at 30

June 2023 (31 December 2022: GBP74.1 million). Closing net assets

were GBP152.8 million (31 December 2022: GBP184.2 million)

Cash outflow from operating activities in H1 2023 increased by

GBP0.2 million to GBP8.9 million (H1 2022: GBP8.7 million) . This

was primarily due to a larger operating loss.

Cash flow from investing activities had outflows of GBP6.3

million in H1 2023 (H1 2022: inflows of GBP44.3 million). This

swing is primarily the result of a GBP50m investment in bank

deposits in 2021 that was redeemed in 2022. Aside from this, the

business in H1 2023 invested GBP6.0 million in capitalised software

development to drive future recurring revenues.

Cash flow from financing activities were an outflow of GBP0.1

million in H1 2023 (H1 2022: inflow of GBP0.3 million).

During H1 2023, transactions with related parties included sale

of goods of GBP0.1 million (H1 2022: GBP43k) and purchase of goods

of GBP0.1 million (H1 2022: GBP0.3 million). These transactions

were undertaken with the shareholders EDF Energy Customers Limited

and its subsidiaries and related parties.

Principal Risks and Uncertainties

Effective risk management is essential to the achievement of our

strategic objectives and driving sustainable

business growth. We aim to maintain an appropriate balance

between protecting the company against specific

risks while being able to encourage appropriate and monitored

risk-taking and innovation that allows us to take advantage of

business opportunities.

The Board, as part of its half year processes, considered

reports from management reviewing the principal risks and

uncertainties and how these might evolve during the second half of

2023.

Following this review the Board is satisfied that the Group's

principal risks remain unchanged from those contained in our 2022

Annual Report to bring to your attention. These are listed

below:

1. Dependency on the continuing adoption of and demand for

EVs

2. Competition in the industry and market segment

3. Delays to Product Development

4. Ongoing and potential future disruptions to the global supply

chain

5. Government and regulatory initiatives with unknown

outcomes

6. Health and safety risks related to our products,

installation, maintenance and operation of electrical equipment

7. Potential undetected defects, errors or bugs in hardware or

software

8. Deterioration of economic conditions in the UK, the UK's

economic relationship with the EU and the possibility of a future

health pandemic

9. Disruptions to our network and IT systems

10. Ability to hire and retain key management and other skilled

employees

Further details of the Group's principal risks and uncertainties

can be found on pages 64-73 of the 2022 Annual Report, which is

available on https://investors.pod-point.com/

Director's Responsibilities Statement

We confirm that to the best of our knowledge:

a) The condensed set of financial statements has been prepared

in accordance with IAS 34 "Interim Financial Reporting"

b) The interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risk and

uncertainties for the remaining six months of the year); and

c) The interim management report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related party

transactions and changes therein).

By order of the Board

D Wolffe

Director

31 July 2023

Basis of Preparation and General Information

The condensed consolidated interim financial statements for Pod

Point Group Holdings Plc (the Company) and its subsidiaries

(together, the Group) have been prepared using accounting policies

consistent with IFRS as adopted by the UK and in accordance with

IAS 34 "Interim Financial Reporting". The same accounting policies

and methods of computation are followed in this set of condensed

consolidated interim financial statements as compared with the most

recent Annual Report. A copy of the statutory accounts for the year

ended 31 December 2022 has been delivered to the Registrar of

Companies. The auditor's report on those accounts was not

qualified, did not draw attention to any matters by way of emphasis

and did not contain statements under Section 498(2) or (3) of the

Companies Act 2006.

The condensed consolidated interim financial statements do not

constitute the full financial statements prepared in accordance

with International Financial Reporting Standards (IFRS) and have

been prepared on a going concern basis.

The condensed consolidated interim financial statements was

approved by the Board of directors on 30 July 2023.

Consolidated Income Statement

Six months Six months

ended ended

30 June 30 June Year ended

2023 2022 31 December

Notes (unaudited) (unaudited) 2022

----- ------------ ------------ ------------

GBP'000 GBP '000 GBP '000

Revenue (including OZEV

revenues) 2,3 30,614 41,552 71,409

Cost of sales (21,375) (31,164) (54,820)

------------ ------------ ------------

Gross profi t 9,239 10,388 16,589

------------ ------------ ------------

Other income 600 - 1,461

Administrative expenses (42,991) (17,857) (38,065)

------------ ------------ ------------

Operating loss (33,152) (7,469) (20,015)

Analysed as:

Adjusted EBITDA(1) (6,778) (1,414) (7, 040 )

Restructuring costs(2) 5 (359) - ( 57 )

Share-based payments 14 (2,244) (2,578) (5, 175 )

EBITDA(1) (9,381) (3,992) (12, 272 )

------------ ------------ ------------

Amortisation and depreciation (5,126) (3,477) (7,743)

Goodwill impairment 7 (18,645) - -

------------ ------------ ------------

Group operating loss (33,152) (7,469) (20,015)

------------ ------------ ------------

Finance income 6 542 75 457

Finance costs 6 (205) (152) (366)

------------ ------------ ------------

Loss before tax (32,815) (7,546) (19, 924 )

Income tax expense (138) - (287)

Loss after tax (32,953) (7,546) (20, 211 )

------------ ------------ ------------

Basic and diluted loss per

ordinary share 15 GBP(0.22) GBP(0.05) GBP(0.13)

Notes:

(1) EBITDA is defined as earnings before interest, tax,

depreciation and amortisation, and is considered by the Directors

to be a key measure of financial performance. Adjusted EBITDA is

defined as earnings before interest, tax, depreciation and

amortisation and excluding both amounts charged to the income

statement in respect of the Group's share based payments

arrangements and also adjusting for restructuring costs. These have

been separately identified by the Directors and adjusted to provide

an underlying measure of financial performance. The reconciliation

is set out on the income statement and Note 6 provides a summary of

the amounts arising from the restructuring costs.

(2) See Note 5

(3) All amounts relate to continuing activities.

( 4 ) All realised gains and losses are recognised in the

consolidated income statement and there is no other comprehensive

income.

( 5 ) The notes on pages 20 to 31 form part of the Condensed

consolidated interim financial statements.

( 6 ) There is no other comprehensive income in the years

presented and therefore no separate statement of other

comprehensive income is presented.

Consolidated Statement of Financial Position

As at As at

30 June 30 June As at

2023 2022 31 December

Notes (unaudited) (unaudited) 2022

----- ------------ -------------------- -------------

GBP'000 GBP'000 GBP'000

Non-current assets

Goodwill 7 58,994 77,639 77,639

Intangible assets 7 35,231 31,440 33, 236

Property, plant and equipment 8 5,619 5,009 5,498

Deferred tax asset 5, 471 7,309 5,670

Right of use assets 2,949 2,655 2,914

------------ -------------------- -------------

108,264 124,052 124,957

------------ -------------------- -------------

Current assets

Inventories 9 8,012 7,631 7,342

Trade and other receivables 10 28 ,572 26,381 26, 882

Cash and cash equivalents 58,766 82,086 74,103

------------ -------------------- -------------

95 ,350 116,098 108,327

------------ -------------------- -------------

Total assets 203,614 240,150 233,284

Current liabilities

Trade and other payables 11 (37,504) (30,843) (36, 419 )

Loans and borrowings 12 (1,271) (1,343) (2,842)

Lease liabilities (1,466) (1,212) (1,634)

Provisions (290) (238) (265)

------------ -------------------- -------------

(40,531) (33,636) (41, 160 )

------------ -------------------- -------------

Net current assets 54,819 82,462 67,167

------------ -------------------- -------------

Total assets less current

liabilities 163,083 206,514 192,124

------------ -------------------- -------------

Non-current liabilities

Loans and borrowings 12 (2,821) (2,657) (481)

Lease liabilities (1,700) (1,681) (1,515)

Deferred tax liability (5,471) (7,309) ( 5 ,670)

Provisions (302) (314) (301)

------------ -------------------- -------------

(10,294) (11,961) ( 7 ,967)

------------ -------------------- -------------

Total liabilities (50,825) (45,597) (49,127)

------------ -------------------- -------------

Net assets 152,789 194,553 184, 157

============ ==================== =============

Equity

Share capital 154 154 154

Share premium 140,203 140,045 140,203

Other reserves 8,236 4,540 6,651

ESOP reserve (1,318) (1,318) (1,318)

Retained earnings 5,514 51,132 38,467

------------ -------------------- -------------

152,789 194,553 184, 157

============ ==================== =============

Consolidated Statement of Changes in Equity

Share Share Other Retained Total

Capital Premium Reserves ESOP Reserve earnings equity

-------- -------- --------- ------------ --------- ---------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance As at 1 January

2022 154 140,057 2,264 (1,318) 58,678 199,835

Loss after tax - - - - (7,546) (7,546)

Share issuance costs

finalisation - (12) - - - (12)

Share based payments - - 2,276 - - 2,276

-------- -------- --------- ------------ --------- ---------

Balance As at 30 June

2022 (unaudited) 154 140,045 4,540 (1,318) 51,132 194,553

-------- -------- --------- ------------ --------- ---------

Loss after tax - - - - (12,665) (12,665)

Issue of shares - 158 (158) - - -

Share-based payments - - 2,269 - - 2,269

-------- -------- --------- ------------ --------- ---------

Balance as at 31 December

2022 154 140,203 6,651 (1,318) 38,467 184, 157

-------- -------- --------- ------------ --------- ---------

Loss after tax - - - - (32, 953) (32, 953)

Share-based payments - - 1,585 - - 1,585

Balance as at 30

June 2023 (unaudited) 154 140,203 8,236 (1,318) 5,514 152,789

======== ======== ========= ============ ========= =========

Consolidated Statement of Cash Flow

Six months Six months

ended ended

30 June 30 June

2023 2022 Year ended

31 December

Notes (unaudited) (unaudited) 2022

----- ------------ ------------ ------------

GBP'000 GBP'000 GBP'000

Cash flows from operating

activities

Operating loss (33,152) (7,469) (20,015)

Adjustment for non-cash

items:

Amortisation of intangible

assets 7 3,792 2,466 5,484

Depreciation of tangible

assets 8 656 534 1,123

Depreciation of right of

use assets 679 477 1,136

Tax (138) - (287)

Loss on impairment of intangible

assets 7 235 - 604

Loss on impairment of goodwill 7 18,645 - -

Loss on disposal of tangible

assets 8 - 4 4

Share based payment charges 1,683 2,276 4,545

------------ ------------ ------------

(7,600) (1,712) (7, 406 )

Changes in working capital

(Increase)/Decrease in inventories (670) 583 872

(Increase) in trade and

other receivables (1,689) (2,340) (2, 841 )

Increase/(Decrease) in trade

and other payables 971 (5,330) 246

Increase in provisions 25 148 162

------------ ------------ ------------

(1,363) (6,939) (1,561)

------------ ------------ ------------

Net cash flow (used in)

operating activities (8,963) (8,651) (8,967)

Cash flows from investing

activities

Purchase of tangible assets 8 (777) (1,270) (2,348)

Cost of intangible assets 7 (6,023) (4,485) (9,902)

Redemption of short-term

investments - 50,000 50,000

Interest received 542 75 458

------------ ------------ ------------

Net cash flow generated

from/(used in) investing

activities (6,258) 44,320 38,208

Cash flows from financing

activities

Proceeds from new borrowings 12 1,466 1,317 1,243

Loan repayment 12 (666) (351) (990)

Payment of principal of

lease liabilities (711) (509) (1,129)

Payment of lease interest (121) (76) (216)

Other Interest paid (84) (76) (158)

------------ ------------ ------------

Net cash flows generated

by financing activities (116) 305 (1,250)

Net increase/(decrease)

in cash and cash equivalents (15,337) 35,974 27,991

Cash and cash equivalents

at beginning of the period 74,103 46,112 46,112

Closing cash and cash equivalents 58,766 82,086 74,103

============ ============ ============

Consolidated Notes to the financial statements

1. General information

Pod Point Group Holdings plc (referred to as the "Company") is a

public limited company incorporated in the United Kingdom under the

Companies Act 2006 and registered in England. Its registration

number is 12431376. The registered address is 28-42 Banner Street,

London EC1Y 8QE.

The principal activity of the Company and its subsidiary

undertakings (the "Group") during the periods presented is that of

development and supply of equipment and systems for recharging

electric vehicles. The entire issued share capital of the Company

was admitted to trading on the Main Market of the London Stock

Exchange on 9 November 2021. All figures presented in this

unaudited preliminary announcement are in GBP sterling.

When considering the basis of Going Concern, the Directors have

made enquiries and reviewed cash flow forecasts and available

facilities for at least the next 12 months (including subsequent

events). Taking these into account the Directors have formed a

judgement, at the time of approving the unaudited preliminary

announcement, that there is a reasonable expectation that the Group

has adequate resources to continue in operational existence for the

foreseeable future. This judgement has been formed taking into

account the principal risks and uncertainties that the Group

faces.

2. Segment reporting

The Group has four operating and reportable segments which are

considered:

Reportable Segment Operations

------------------ -------------------------------------------------

Home Activities generated by the sale of charging

units to domestic customers for installation

in homes.

Commercial Activities generated by the sale and installation

of charging units in commercial settings,

such as the destination, workplace and en-route

routes to market.

Owned Assets Operating activities relating to customer

contracts, in which Pod Point owns the charging

point assets but charges end customers for

the use of these assets and, at some sites,

charges a fee for provision of media screens

on the units for advertising purposes.

Recurring Operating activities relating to the recurring

revenue generated on charging units, relating

to fees charged from the ongoing use of the

Pod Point software and information generated

from the management information system.

There are no transactions with a single external customer

amounting to 10 per cent. or more of the Group's revenues.

Work, destination and en-route revenues are routes to market

within the Commercial segment, rather than individual business

segments with the types of installations being similar in all

three.

Revenue has been further split into OZEV and non-OZEV revenues

for each segment. OZEV revenues are the portion of revenue

generated from an install, which are claimed from the DVLA by the

Group on behalf of customers who are eligible for the EVHS

government grant.

A breakdown of revenues and non-current assets by geographical

area is included in Note 3. Assets and liabilities are not reviewed

on a segmental basis and therefore have not been included in this

disclosure.

Segmental Analysis for the six months ended 30 June 2023

(unaudited):

UK UK Owned Total

Home Commercial Assets Recurring Group

------- ----------- ------- --------- --------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------- ----------- ------- --------- --------

Revenue, non-OZEV 12,342 12,496 4,052 1,425 30,315

------- ----------- ------- --------- --------

OZEV revenue 73 226 - - 299

------- ----------- ------- --------- --------

Revenue 12,415 12,722 4,052 1,425 30,614

Cost of sales (8,989) (8,976) (2,869) (541) (21,375)

------- ----------- ------- --------- --------

Gross Margin 3,426 3,746 1,183 884 9,239

------- ----------- ------- --------- --------

Other income 600

------- ----------- ------- --------- --------

Administrative

Expenses (42,991)

------- ----------- ------- --------- --------

Operating Loss (33,152)

------- ----------- ------- --------- --------

Finance income 542

------- ----------- ------- --------- --------

Finance costs (205)

------- ----------- ------- --------- --------

Loss before

tax (32,815)

------- ----------- ------- --------- --------

Segmental Analysis for the six months ended 30 June 2022

(unaudited):

UK UK Owned Total

Home Commercial Assets Recurring Group

-------- ----------- ------- --------- --------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------- ----------- ------- --------- --------

Revenue, non-OZEV 20,817 11,728 1,489 760 34,794

-------- ----------- ------- --------- --------

OZEV revenue 6,402 356 - - 6,758

-------- ----------- ------- --------- --------

Revenue 27,219 12,084 1,489 760 41,552

Cost of sales (20,934) (9,308) (587) (335) (31,164)

-------- ----------- ------- --------- --------

Gross Margin... 6,285 2,776 902 425 10,388

-------- ----------- ------- --------- --------

Administrative

Expenses (17,857)

-------- ----------- ------- --------- --------

Operating Loss (7,469)

-------- ----------- ------- --------- --------

Finance income 75

-------- ----------- ------- --------- --------

Finance costs (152)

-------- ----------- ------- --------- --------

Loss before

tax (7,546)

-------- ----------- ------- --------- --------

Segmental Analysis for the year ended 31 December 2022:

UK UK Owned Total

Home Commercial Assets Recurring Group

-------- ----------- ------- --------- --------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------- ----------- ------- --------- --------

Revenue, non-OZEV 34,891 23,257 4,233 1,896 64, 277

-------- ----------- ------- --------- --------

OZEV revenue 6,495 637 - - 7,132

-------- ----------- ------- --------- --------

Revenue 41,386 23,894 4,233 1,896 71,409

Cost of sales (33,304) (18,721) (1,992) (803) (54,820)

-------- ----------- ------- --------- --------

Gross Margin... 8,082 5,173 2,241 1,093 16,589

-------- ----------- ------- --------- --------

Other income 1,461

-------- ----------- ------- --------- --------

Administrative

Expenses (38,065)

-------- ----------- ------- --------- --------

(20, 015

Operating Loss )

-------- ----------- ------- --------- --------

Finance income 457

-------- ----------- ------- --------- --------

Finance costs (366)

-------- ----------- ------- --------- --------

Loss before (19, 924

tax )

-------- ----------- ------- --------- --------

3. Revenue and non-current assets

Revenue, analysed geographically between markets, was as

follows:

Six months Six months

ended ended

30 June 30 June Year Ended

2023 2022 31 December

(unaudited) (unaudited) 2022

------------ ------------ -------------

GBP'000 GBP'000 GBP'000

United Kingdom 30,592 41,463 71,277

Ireland 21 - -

Norway 1 89 132

------------ ------------ -------------

30,614 41,552 71,409

============ ============ =============

The geographical analysis of revenue and net revenue is on the

basis of the country of origin in which the client is invoiced.

Revenue, split between OZEV revenues and non-OZEV revenues was

as follows:

Six months Six months

ended ended

30 June 30 June Year Ended

2023 2022 31 December

(unaudited) (unaudited) 2022

------------ ------------ -------------

GBP'000 GBP'000 GBP'000

Non-OZEV revenue 30,315 34,794 64,277

OZEV revenue 299 6,758 7,132

------------ ------------ -------------

30,614 41,552 71,409

============ ============ =============

All OZEV revenue was earned in the UK. Non-current assets are

all held within the UK for all periods presented.

Other income represents grant income relating to the R&D

expenditure credit for relief on the Group's research and

development costs.

4. Directors and employees

The table below presents the staff costs of these persons,

including those in respect of the Directors, recognised in the

income statement.

Six months Six months

ended ended

30 June 30 June Year Ended

2023 2022 31 December

(unaudited) (unaudited) 2022

------------ ------------ -------------

GBP'000 GBP'000 GBP'000

Wages and salaries 15,956 9,602 20,699

Social security costs 1,843 1,086 3,118

Costs of defined contribution scheme 639 660 266

Net share-based payment expense 2,244 2,275 4,545

------------ ------------ -------------

20,682 13,623 28,628

============ ============ =============

Staff costs presented in this note reflect the total wage, tax

and pension cost relating to employees of the Group. These costs

are allocated between administrative expenses, cost of sales or

capitalised where appropriate as part of Software Development

intangible assets. The allocation between these areas is dependent

on the area of business the employee works in and the activities

they have undertaken.

During the 6 months ended 30 June 2023, GBP 4.2 million of staff

costs were capitalised (H1 2022: GBP2.8 million, year ended 31

December 2022: GBP6.7 million).

5. Restructuring costs

Restructuring costs, for the purposes of presenting non-IFRS

measure of adjusted EBITDA are as follows:

Six months Six months

ended ended

30 June 30 June Year Ended

2023 2022 31 December

(unaudited) (unaudited) 2022

------------ ------------ -------------

GBP'000 GBP'000 GBP'000

Restructuring costs 359 - 57

------------ ------------ -------------

Restructuring costs in 2023 related to changes within the senior

management team. Restructuring costs in 2022 related to the closure

of the Norway branch.

6. Finance income and finance costs

Net financing costs comprise bank interest income and interest

expense on borrowings, and interest expense on lease

liabilities.

Six months Six months

ended ended

30 June 30 June Year Ended

2023 2022 31 December

(unaudited) (unaudited) 2022

------------ ------------ --------------

GBP'000 GBP'000 GBP'000

Interest on bank deposits 542 75 457

------------ ------------ --------------

Finance Income 542 75 457

------------ ------------ --------------

Interest on loans and bonds (84) (92) (150)

Interest on lease liabilities (121) (60) (216)

------------ ------------ --------------

Finance Costs (205) (152) (366)

------------ ------------ --------------

Net finance income/(costs) recognised

in the income statement 337 (77) 91

============ ============ ==============

7. Intangible assets

Intangible assets as at 30 June 2023 (unaudited):

Customer

Development Brand Relationships Goodwill Total

----------- ------- -------------- -------- -------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost:

At 1 January 2023 20,702 13,940 13,371 77,639 125,652

Additions 6,023 - - - 6,023

----------- ------- -------------- -------- -------

At 30 June 2023 26,725 13,940 13,371 77,639 131,675

----------- ------- -------------- -------- -------

Accumulated amortisation

and impairment:

At 1 January 2023 10,146 2,033 2,599 - 14,778

Amortisation 2,997 349 446 - 3,792

Impairment 235 - - 18,645 18,880

At 30 June 2023 13,378 2,382 3,045 18,645 37,450

----------- ------- -------------- -------- -------

Carrying amounts:

At 30 June 2023 13,347 11,558 10,326 58,994 94,225

=========== ======= ============== ======== =======

Intangible assets as at 30 June 2022 (unaudited):

Customer

Development Brand Relationships Goodwill Total

----------- ------- -------------- -------- -------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost:

At 1 January 2022 10,800 13,940 13,371 77,639 115,750

Additions 4,485 - - - 4,485

At 30 June 2022 15,285 13,940 13,371 77,639 120,235

----------- ------- -------------- -------- -------

Accumulated amortisation:

At 1 January 2022 5,646 1,336 1,708 - 8,690

Amortisation 1,671 349 446 - 2,466

At 30 June 2022 7,317 1,685 2,154 - 11,156

----------- ------- -------------- -------- -------

Carrying amounts:

At 30 June 2022 7,968 12,255 11,217 77,639 109,079

=========== ======= ============== ======== =======

Intangible assets as at 31 December 2022:

Customer

Development Brand Relationships Goodwill Total

----------- ------- -------------- -------- -------

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Cost:

At 1 January 2022 10,800 13,940 13,371 77,639 115,750

Additions 9,902 - - - 9,902

----------- ------- -------------- -------- -------

At 31 December 2022 20,702 13,940 13,371 77,639 125,652

----------- ------- -------------- -------- -------

Accumulated amortisation

and impairment:

At 1 January 2022 5,646 1,336 1,708 - 8,690

Amortisation 3,896 697 891 - 5,484

Impairment 604 - - - 604

----------- ------- -------------- -------- -------

At 31 December 2022 10,146 2,033 2,599 - 14,778

----------- ------- -------------- -------- -------

Carrying amounts:

At 31 December 2022 10,556 11,907 10,772 77,639 110,874

=========== ======= ============== ======== =======

In accordance with the provisions of IAS36 'Impairment of

Assets' the allocation to the individual cash generating unit

("CGU") of the goodwill recognised on the purchase of PPH was

completed during the year ended 31st December 2021, being the end

of the first annual period beginning after the relevant acquisition

date of PPH by the Company. An impairment loss of GBP18.6m has been

recognised during H1 2023.

An impairment review has been performed comparing book values

(including goodwill) to value in use of the CGU at 30 June 2023.

The recoverable amount of the CGU was determined from value in use

calculations based on a discounted cash flow model. Key assumptions

in which management has based its determination of value in use

include the number of forecasted car registrations used to project

revenue growth and estimated market penetration for the home and

commercial markets. Car registration forecasts are based upon

external data from the Society of Motor Manufacturers and Traders

("SMMT") and the Government ban on new internal combustion cars

from 2030, while market share assumptions are determined using

historical data and experience.

Management projected cash flows to 2030, a period longer than 5

years. This was considered appropriate as it represents the period

to the Government's committed date of the ban on the sale of new

petrol and diesel cars. A weighted average cost of capital (WACC)

of 13% has been applied.

Given decreases in home market penetration in H1 2023 and other

macro-economic factors, sensitivities have been performed around

home and commercial penetration, sales price and overheads

inflation which resulted in the carrying value exceeding the value

in use by GBP18.6m and therefore an impairment loss has been

recognised. No other reasonably possible changes in assumptions

would cause the carrying amount to further exceed the recoverable

amount.

8. Property, Plant and Equipment

Property Plant and Equipment as at 30 June 2023 (unaudited):

Other Property,

Plant and Owned

Equipment Assets Total

--------------- ------- -------

GBP'000 GBP'000 GBP'000

Cost:

At 1 January 2023 1,659 6,496 8,155

Additions 183 594 777

At 30 June 2023 1,842 7,090 8,932

--------------- ------- -------

Accumulated depreciation:

At 1 January 2023 1,081 1,576 2,657

Depreciation 178 478 656

At 30 June 2023 1,259 2,054 3,313

--------------- ------- -------

Carrying amounts:

At 30 June 2023 583 5,036 5,619

=============== ======= =======

Property Plant and Equipment as at 30 June 2022 (unaudited):

Other Property,

Plant and Owned

Equipment Assets Total

--------------- ------- -------

GBP'000 GBP'000 GBP'000

Cost:

At 1 January 2022 1,116 4,698 5,814

Additions 395 875 1,270

Disposals - (7) (7)

--------------- ------- -------

At 30 June 2022 1,511 5,566 7,077

--------------- ------- -------

Accumulated depreciation:

At 1 January 2022 756 781 1,537

Depreciation 154 380 534

Disposals - (3) (3)

--------------- ------- -------

At 30 June 2022 910 1,158 2,068

--------------- ------- -------

Carrying amounts:

At 30 June 2022 601 4,408 5,009

=============== ======= =======

Property Plant and Equipment as at 31 December 2022:

Other Property,

Plant and Owned

Equipment Assets Total

--------------- ------- -------

GBP'000 GBP'000 GBP'000

Cost:

At 1 January 2022 1,116 4,698 5,814

Additions 543 1,805 2,348

Disposals - (7) (7)

--------------- ------- -------

At 31 December 2022 1,659 6,496 8,155

--------------- ------- -------

Accumulated depreciation:

At 1 January 2022 756 781 1,537

Depreciation 325 798 1,123

Disposals - (3) (3)

--------------- ------- -------

At 31 December 2022 1,081 1,576 2,657

--------------- ------- -------

Carrying amounts:

At 31 December 2022 578 4,920 5,498

=============== ======= =======

9. Inventories

As at As at

30 June 30 June As at

2023 2022 31 December

(unaudited) (unaudited) 2022

------------ ------------ -------------

GBP'000 GBP'000 GBP'000

Finished goods 6,733 5,127 5,523

Work in progress 1,279 2,504 1,819

------------ ------------ -------------

8,012 7,631 7,342

============ ============ =============

The cost of inventories recognised as an expense during H1 2023

in respect of continuing operations was GBP10.1m (H1 2022: GBP15.8

million, year ended 31 December 2022: GBP28.8m).

Included within work in progress is hardware purchased for

installation in progress but not yet complete, time spent on

installations in progress but not yet complete and invoices

received against installations in progress but not yet

complete.

10. Trade and other receivables

As at As at

30 June 30 June As at

2023 2022 31 December

(unaudited) (unaudited) 2022

------------ ------------ -------------

GBP'000 GBP'000 GBP'000

Trade receivables 18,293 17,691 18,841

Loss allowance (912) (369) (507)

------------ ------------ -------------

17,381 17,322 18,334

------------ ------------ -------------

Other receivables 1,818 447 940

R&D tax credit receivable 1,090 - 1,174

Prepayments and accrued income 8,283 8,612 6,434

------------ ------------ -------------

28,572 26,381 26,882

============ ============ =============

11. Trade and other payables

As at As at

30 June 30 June As at

2023 2022 31 December

(unaudited) (unaudited) 2022

------------ ------------ -------------

GBP'000 GBP'000 GBP'000

Trade payables 6,513 7,099 9,096

Other taxation and social security 1,575 2,212 3,098

Accruals and deferred revenue 24,320 20,012 21,163

Other payables 5,096 1,520 3,062

------------ ------------ -------------

37,504 30,843 36,419

============ ============ =============

There is no material difference between the carrying value and

fair value of trade and other payables presented.

12. Loans and borrowings

As at As at

30 June 30 June As at

2023 2022 31 December

(unaudited

(unaudited) ) 2022

------------ ----------- -------------

GBP'000 GBP'000

Current liabilities

Secured bank loan 1,271 1,343 2,842

Non-current liabilities

Secured bank loan 2,821 2,657 481

------------ ----------- -------------

Total loans and borrowings 4,092 4,000 3,323

============ =========== =============

During the 11 months ended 31 December 2020, the Group entered

into GBP3.5 million facility agreement with Triodos Bank UK Limited

for a period of 5 years, to fund charging units owned by the Group

and installed at customer sites. The facility is structured as a

construction facility while the assets are being installed, at

which point the outstanding balance will become an operating

facility. The interest rate is fixed at 3.5 per cent. The loan is

repayable in eighteen quarterly instalments starting one quarter

after the start of the operating facility.

An additional loan was entered into with Triodos Bank UK Limited

during the year ended 31 December 2022, for GBP1.25 million under

the same facility agreement. The interest rate is fixed at 4.969

per cent. The loan is repayable in eighteen quarterly instalments

starting from the first payment date.

No changes in liabilities arising from financing activities has

been identified during the period ended 30 June 2023 or are

expected in the near future

13. Financial Instruments

The Group had the following financial assets and liabilities.

The amounts below are contractual undiscounted cash flows and

include both interest and principal amounts.

Categorisation within the hierarchy, measured or disclosed at

fair value, has been determined based on the lowest level of input

that is significant to the fair value measurement as follows:

-- Level 1 - valued using quoted prices in active markets for identical assets or liabilities

-- Level 2 - valued by reference to valuation techniques using

observable inputs other than quoted prices included within Level

1

-- Level 3 - valued by reference to valuation techniques using

inputs that are not based on observable market data

As at As at

30 June 30 June As at

2023 2022 31 December

(unaudited

(unaudited) ) 2022

------------ ----------- -------------

GBP'000 GBP'000 GBP'000

Cash and cash equivalents 58,766 82,086 74,103

Trade and other receivables 19,199 17,769 19,274

Accrued Income 6,740 7,345 5,195

Total financial assets 84,705 107,200 98,572

------------ ----------- -------------

Trade and other payables 11,609 8,619 12,158

Accruals 11,081 9,076 9,210

Leases 3,166 2,893 3,149

Loans and borrowings 4,092 4,000 3,323

------------ ----------- -------------

Total financial liabilities 29,948 24,588 27,840

------------ ----------- -------------

All financial assets and financial liabilities shown above, and

loans and borrowings, are valued at carrying amount or at fair

value using Level 2 measurements. There have been no transfers

between levels in any of the years.

Financial assets

The Group classifies its financial assets into the following

categories: cash and cash equivalents, trade and other receivables

and accrued income. The classification depends on the purpose for

which the assets are held. The classification is first performed at

initial recognition and then re-evaluated at every reporting date

for financial assets other than those held at fair value through

the income statement.

Financial liabilities

The Group classifies its financial liabilities into the

following categories: trade and other payables, loans and

borrowings and other non-current liabilities.

The Directors consider that the carrying amount for all

financial assets and liabilities which are not held at fair value

through profit or loss approximates to their fair value.

14. Share based payments

Charge to the income statement:

The charge to the income statement is set out below:

Six months Six months

ended ended

30 June 30 June Year ended

2023 2022 31 December

(unaudited) (unaudited) 2022

------------ ------------ -------------

GBP'000 GBP'000 GBP'000

IPO restricted share award 448 1,457 2,238

IPO performance share award 392 468 759

Share incentive plan 191 179 360

Long-term incentive plan 553 474 611

Deferred share bonus plan 392 - 577

------------ ------------ -------------

Total share-based payment expense 1,976 2,578 4,545

============ ============ =============

National insurance on share based payment awards of GBP0.3

million (H1 2022: GBP0.3 million, year ended 31 December 2022:

GBP0.6 million) has also been charged to the income statement.

15 . Loss per share

Basic earnings per share is calculated by dividing the loss

attributable to the equity holders of the Group by the weighted

average number of shares in issue during the year.

The group has dilutive ordinary shares for H1 2023, H1 2022 and

the year ended 31 December 2022, these being share options granted

to employees. As the Group has incurred a loss in all periods, the

diluted loss per share is the same as the basic earnings per share

as the loss has an anti-dilutive effect.

Six months Six months

ended ended

30 June 30 June Year ended

2023 2022 31 December

(unaudited) (unaudited) 2022

------------- ------------ -------------

GBP GBP GBP

Loss for the period attributable

to equity holders 32,952,930 7,546,564 20,211,814

Basic and diluted weighted average

number of shares in issue 153,473,724 153,403,537 153,405,628

------------- ------------ -------------

Earnings/(Loss) per share (Basic

and Diluted) (0.22) (0.05) (0.13)

============= ============ =============

16. Related Parties

Transactions with Shareholders

During the six months ended 30 June 2023, the Group had the

following transactions with group companies part of the EDF Group

(unaudited):

Purchase of

Sales of goods goods

Group Company 'GBP000 'GBP000

----------------------------- --------------- -----------

EDF Energy Limited 138 -

EDF Energy Customers Limited - 143

During the six months ended 30 June 2022, the Group had the

following transactions with group companies part of the EDF Group

(unaudited):

Purchase of

Sales of goods goods

Group Company 'GBP000 'GBP000

----------------------------- -------------- -----------

EDF Energy Limited 43 -

EDF Energy Customers Limited - 273

During the year ending 31 December 2022, the Group had the

following transactions with group companies part of the EDF

Group:

Purchase of

Sales of goods goods

Group Company 'GBP000 'GBP000

----------------------------- -------------- -----------

EDF Energy Limited 335 -

EDF Energy Customers Limited - 390

Transactions with related parties who are not members of the

Group

During the H1 2023, the Group had the following transactions

with a related party who is not a member of the Group. Imtech

Inviron Limited is a related party by virtue of their ultimate

parent and controlling party being Électricité de France S.A. (see

note 18):

-- Sale of goods of GBP0.2 million (H1 2022: GBP0.1 million,

year ended 31 December 2022: GBP0.2 million)

17 . Post balance sheet events

On 6 July 2023, Erik Fairbairn stepped down as Chief Executive

Officer ("CEO"). Andy Palmer, who at the time was acting as Senior

Independent Director of the Group, has been appointed as interim

CEO.

18 . Ultimate parent undertaking and controlling party

The immediate parent company of the Company and its subsidiaries

is EDF Energy Customers Limited, a company registered in the United

Kingdom.

The immediate parent company of EDF Energy Customers Limited is

EDF Energy Limited, a company registered in the United Kingdom.

In all periods presented, Électricité de France SA, a company

incorporated in France, is regarded by the Directors as the

Company's ultimate parent company and controlling party. This is

the largest group for which consolidated financial statements are

prepared. Copies of that company's consolidated financial

statements may be obtained from the registered office at

Électricité de France SA, 22-30 Avenue de Wagram, 75382, Paris,

Cedex 08, France.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BCGDRDXXDGXG

(END) Dow Jones Newswires

July 31, 2023 02:00 ET (06:00 GMT)

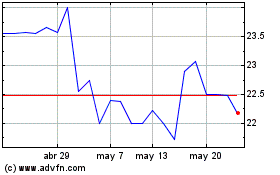

Pod Point (LSE:PODP)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Pod Point (LSE:PODP)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024