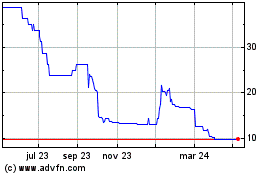

TIDMRDT

RNS Number : 8365R

Rosslyn Data Technologies PLC

31 October 2023

31 October 2023

Rosslyn Data Technologies plc

("Rosslyn", the "Company" or the "Group")

Final Results

Publication of Annual Report

and Notice of AGM

Rosslyn (AIM: RDT), the provider of a leading cloud-based

enterprise data analytics platform, announces its final results and

publication of its annual report for the year ended 30 April 2023

and gives notice of its annual general meeting ("AGM").

Financial Highlights*

-- Revenue increased 11% to GBP3.0m (2022: GBP2.7m)

-- Gross margin improved to 34.7% (2022: 16.6%)

-- Administrative expenses reduced to GBP3.4m (2022: GBP4.3m)

-- Adj. EBITDA** loss reduced to GBP2.0m (2022: GBP3.6m loss)

-- Loss before tax reduced to GBP2.8m (2022: GBP4.1m loss)

-- Cash burn rate reduced to GBP205k per month (2022: GBP266k)

-- Cash and cash equivalents of GBP767k as at 30 April 2023*** (30 April 2022: GBP2.4m)

* Integritie and Langdon Systems are classified as discontinued

operations for the purpose of the statutory accounts. See note 6 to

the financial statements for details on the discontinued

operations

** Adjustments made for exceptional items and share-based

payments

*** Post year end, Rosslyn raised GBP3.3m through the issue of

new ordinary shares and convertible loan notes

Operational and Strategic Highlights

-- Improvement in all key performance indicators ("KPIs"):

o Annual recurring revenue ("ARR") growth of 8% (2022: -9%),

with ARR of GBP2.4m (2022: GBP2.2m)

o Net revenue retention ("NRR") rate increased to 90% (2022:

83%)

o Total pipeline as at 30 April 2023 was GBP3.6m (30 April 2022:

GBP2.7m) and weighted pipeline was GBP1.1m (30 April 2022:

GBP0.87m)

o Customer acquisition cost ("CAC") payback was 65 months (2022:

122 months)

-- Launched a new and improved Rosslyn platform

-- Rebrand completed to reflect Rosslyn's strategic focus on a

single product comprising a best-in-class SaaS solution

-- Won six new contracts during the year and a further two post year end

-- Successful proof of concept ("POC") conducted to incorporate

next generation artificial intelligence ("AI") into the Rosslyn

platform, with full module development now underway

-- Value-accretive disposal of non-core subsidiaries, Langdon

Systems ("Langdon") and Integritie, generating a profit of

GBP2.3m

Paul Watts, CEO of Rosslyn, said: "It has been an incredibly

busy year for Rosslyn. We have transformed our business, launched a

new platform, renewed our strategy and established the foundations

for sustainable growth. While it is still early days, we achieved

improvement in all of our KPIs in 2023 compared with the previous

year and we are making good progress in our transition to a

partner-led go-to-market approach. At the same time, we have

continued our development activities - in particular, exploring the

opportunities offered by generative AI, which is poised to disrupt

the marketplace. We have taken significant steps towards embedding

this technology into our platform and we are very excited about its

potential as are our customers. As a result, alongside our recent

fundraising that has further strengthened our position, the Board

continues to look to the future with confidence."

Enquiries

Rosslyn

Paul Watts, Chief Executive Officer

James Appleby, Chairman +44 (0)20 3285 8008

--------------------

Cavendish Securities (Nominated

adviser and Broker)

--------------------

Stephen Keys/Camilla Hume/George

Lawson +44 (0)20 7220 0500

--------------------

Gracechurch Group (Financial PR)

--------------------

Claire Norbury/Anysia Virdi +44 (0)20 4582 3500

--------------------

About Rosslyn

Rosslyn (AIM: RDT) provides an award-winning spend analytics and

predictive analytics platform. The Rosslyn Platform helps

organizations with diverse supply chains mitigate risk and make

informed strategic decisions. It leverages automated workflows,

artificial intelligence and machine learning to extract and

consolidate procurement data providing visibility of complex

supplier data, enabling supplier spend savings and delivering

rapid ROI. For more information visit www.rosslyn.ai

Operational Review

During FY 2023, Rosslyn launched a new platform and migrated its

customers; re-branded to reflect a strategic focus on a single

product comprising a best-in-class SaaS solution; divested two

businesses that were not core to this vision; strengthened the

customer success function; and increased business development

activities, resulting in securing six new contracts during the year

and a further two post year end. As testament to the strength of

Rosslyn's offer, these new contracts are to serve multinational,

blue-chip companies with complex data requirements and operating in

mission-critical industries. The Company's success during the year

is reflected in the improvement in all of its KPIs. A further key

development that commenced during the year, and which has continued

subsequently, is Rosslyn's exploration of the opportunities offered

by next-generation AI, namely generative AI.

Rosslyn platform

In the first half of the year, the Company launched the new,

upgraded Rosslyn platform, which has been designed to ensure that

customers are able to extract maximum value from the Rosslyn

solution. The new platform delivers a simplified, more intuitive

interface and streamlined navigation, making it easier for users to

quickly gather the insights they need. The collaboration functions

have been improved to facilitate the sharing of dashboards and

reports with key stakeholders across a business. There is also a

closer integration between data and visualisation, including

features such as enabling specialist teams within customer

organisations to have their own tailored view of procurement

data.

The migration of customers to the new platform was substantially

complete by mid-year and Rosslyn has received strong customer - as

well as partner and industry analyst - endorsement. The Company's

data suggests that users are spending more time on the platform and

that customers are growing the number of internal users.

Innovation opportunity

Alongside launching its new platform, Rosslyn continued its

broader development activities. A key focus is incorporating data

sets that relate to ESG to enable customers to take such factors

into account in procurement decisions - from both a risk management

and ethical business perspective. Customers are already utilising

the Rosslyn platform for this purpose and the Company is continuing

to improve its aggregation and analytical capabilities in this

respect to support greater sales of this module.

A further key area of development work undertaken during the

year was exploring the potential offered by the technological

advances in AI - namely, generative AI. By harnessing the

capabilities of generative AI, process automation can be

transformed which is crucial for addressing the increasing demand

for real-time procurement insight. Previously, procurement

analytics was largely regarded as a one-off or occasional

standalone project focused on identifying cost savings in the

supply chain. Today, customers want real-time insight to enable

dynamic decision making and risk mitigation - a trend that has been

accelerated by the global supply chain challenges during the

COVID-19 pandemic and resulting from the Russia-Ukraine

conflict.

The Rosslyn platform has been built with automation at its core,

and the strength of its automated extraction capabilities is one of

its competitive differentiators. The Company is now building on

this by embedding generative AI into the platform. Rosslyn is

working on utilising AI to generate the categorisations and

classifications of extracted data, which must be done before it can

be analysed, thereby automating the process. This significantly

increases accuracy, shortens the time to insight and expands the

volume of data that can be incorporated.

During the year, Rosslyn commenced a POC of this technology with

four of its largest customers from different industries and who

procure internationally. The results of the POC, which concluded

post year end, exceeded management's expectations. The Company is

now further developing and refining this technology and expects the

module to go live with the first customer within the new financial

year. While this opportunity will likely endure longer sales

cycles, Rosslyn is well placed to establish a leadership position

in this new market thanks to the depth of its technology stack,

which has been built on an automation-first basis; its vast

experience from operating in the industry for over 15 years; and

from being custodians of a large volume of complex supply chain

data.

Partner-led go-to-market approach

The Company continued to make progress in its renewed

go-to-market approach centred on a partner model, with half of the

new contracts won during the year being via partners as well as

accounting for a significant proportion of the pipeline.

Rosslyn is actively seeking to increase its number of Business

Process Outsourcing ("BPO") partners. Two of these BPO partners

currently are Genpact, which has more than 320 global clients and

manages spend of $78bn, and Chain IQ, which has more than 60

clients in over 49 countries. Both Genpact and Chain IQ offer

significant potential for growth. The Company is also enhancing

partnerships with procurement advisers and other large, global

consulting partners with complex enterprise requirements.

Customer success

A key focus during the year was strengthening the customer

success function. Over the last 18 months, the team has been

expanded and new processes have been introduced to allow Rosslyn to

gain a better understanding of customers' businesses and ongoing

procurement requirements. This enables Rosslyn to anticipate

customer demands and make recommendations to ensure that they

extract maximum value from the platform. This improves customer

retention as well as allowing the Company to cross-sell or up-sell

additional modules, where relevant.

Rosslyn brand

During the year, Rosslyn launched its new brand, following a

major rebranding initiative that commenced in the previous year.

The project aimed to refresh Rosslyn's appearance, making it more

engaging for today's market and aligning it with the new direction

of the business. In particular, the Company is now branded simply

as 'Rosslyn' to reflect the strategic focus on a core SaaS

platform.

The rebrand has brought great results both in terms of

interaction with the Rosslyn brand, as measured by metrics such as

web traffic, and also the generation of new opportunities.

Divestment

As part of the strategy to refocus on Rosslyn's core product

offering, the Company decided to divest all non-core businesses -

namely, Integritie, which is a content management platform, and

Langdon, which specialises in bulk handling of supply chain data

associated with import and export duty management systems.

Accordingly, Integritie was sold for a total maximum consideration

of GBP3.0m, comprising an initial cash consideration of GBP1.6m and

a GBP1.4m conditional deferred payment based on achieving certain

revenue and growth targets (with management estimating the fair

value of the deferred payment to be GBPnil based on currently

available information), and Langdon was sold for GBP100k. These

divestments enable greater strategic and operational focus on the

Rosslyn platform along with reducing cash burn.

Financial Review

The Company achieved improvement in all financial metrics in

2023 over the previous year with the exception of the cash

position, which was significantly strengthened post year end with

the completion of a GBP3.3m fundraising. The Company also

significantly reduced its cash burn rate during the year.

Discontinued operations

Integritie and Langdon have been classed as discontinued

operations for the year and historical comparisons have been

restated on that basis. These financial statements comprise the

results for continuing operations only. See note 6 to the financial

statements for detail on the discontinued operations.

Revenue

Revenue for the year increased to GBP3.0m (2022: GBP2.7m) as the

Company began to rebuild its business following a period of

restructuring. Of the total revenue, GBP2.4m was ARR, representing

growth of 9% over the GBP2.2m of ARR in 2022.

Revenue comprises the annual licence fee - software revenue -

that customers are charged for having access to the Rosslyn

platform and professional services fees for work undertaken to

tailor the Company's solution to align with customers'

infrastructure or meet specific additional solution requirements.

Software revenue continued to be the main contributor to total

revenue, accounting for 80% in FY 2023. However, this was lower

than the previous year of 88%, reflecting an increase in

professional services revenue to GBP0.6m (2022: GBP0.3m) and

software revenue remaining flat at GBP2.4m (2022: GBP2.4m). The

growth in professional services revenue reflects the Company

increasing its pricing to appropriate market levels for such

services as well as greater activity in this area as the Company

supported the onboarding of new customers.

In total, the NRR rate grew to 90% (2022: 83%), reflecting the

launch of the new Rosslyn platform and the improvements to the

Customer Success function during the year.

Gross profit

Gross margin improved significantly to 34.7% (2022: 16.6%),

reflecting a reduction in cost of sales as a result of increased

efficiencies within a leaner team.

In particular, software gross margin was stable due to the fixed

cost base for hosting and platform costs. However, the Company will

benefit from economies of scale as software revenue grows.

Professional services margin improved as a result of the increase

in pricing and having a leaner team.

As a result of the improved gross margin, combined with the

higher revenue, gross profit more than doubled to GBP1.0m compared

with GBP0.5m for 2022.

Operating expenses

Operating costs were reduced to GBP3.8m (2022: GBP4.5m). This

primarily reflects administrative expenses being lower at GBP3.4m

(2022: GBP4.3m), as the Company placed a strong focus on cost

reduction. This was partly offset by an increase in depreciation

and amortisation to GBP366k (2022: GBP40k) due to the

capitalisation of development costs relating to the new

platform.

Profitability measures

As a result of the lower expenses, operating loss was reduced to

GBP2.8m (2022: GBP4.0m loss) and adjusted EBITDA loss was reduced

to GBP2.0m (2022: GBP3.6m loss).

The loss before tax for the year was reduced to GBP2.8m (2022:

GBP4.1m loss). The Company received GBP664k (2022: GBP391k) in

R&D tax credits. As a result, net loss for the year for

continuing operations was reduced to GBP2.1m (2022: GBP3.7m

loss).

In addition, the Company generated profit of GBP2.5m (2022:

GBP297k) from discontinued operations, which included profit of

GBP2.3m from the disposals (with a further payment expected to be

received based on the 12-month post-disposal performance of

Integritie). Accordingly, total comprehensive income (based on

continuing and discontinued operations) was GBP400k (2022: GBP3.3m

loss).

Cash flow and liquidity

Net cash used in operating activities was GBP2.7m (2022:

GBP2.1m), which reflects an increase in cash used in operations to

GBP2.7m (2022: GBP2.2m) as a result of the timing of payables and

receivables at the year end.

The Company generated net cash of GBP971k from investing

activities compared with GBP1.1m of cash being used in investing

activities for the previous year. This reflects GBP1.5m of cash

being generated from the disposals as well as an investment of

GBP1.1m in software in the previous year.

Net cash generated from financing activities was GBP27k (2022:

GBP1.0m outflow). This primarily reflects Rosslyn entering an

unsecured loan during the year of GBP160k, of which GBP64k was

repaid during the year, and the repayment in 2022 of its secured

loan of GBP890k.

Monthly cash burn during the year was GBP205k compared with

GBP266k in 2022, reflecting the reduction in administrative

expenses and increase in professional services revenue.

Accordingly, there was a net decrease in cash and cash

equivalents of GBP1.7m compared with a net decrease of GBP4.3m in

2022.

Cash and cash equivalents at 30 April 2023 were GBP767k (2022:

GBP2.4m). The cash position was significantly strengthened post

year end with the raising of GBP3.3m via the issue of new ordinary

shares (GBP2.7m) and convertible loan notes (GBP0.6m). The Company

has also received, post year end, an R&D tax credit of

GBP612k.

Balance sheet

As at 30 April 2023, the Company had net assets and total equity

of GBP1.9m compared with GBP1.4m at 30 April 2022. The main

movements in the balance sheet during the year were:

-- the decrease in cash and cash equivalents, as described

above, partly offset by an increase in corporation tax receivable,

resulting in current assets of GBP2.6m (30 April 2022:

GBP3.4m);

-- assets held for sale of GBPnil (30 April 2022: GBP0.7m);

-- total assets reducing to GBP4.1m (30 April 2022: GBP5.4m) due to the above; and

-- liabilities directly associated with assets held for sale of

GBPnil compared with GBP1.5m at 30 April 2022, resulting in total

liabilities being reduced to GBP2.2m (30 April 2022: GBP4.0m).

Material uncertainty

As discussed in note 2 to the financial statements, the Board

considers the Company to be a going concern. However, if the

Company is unable to deliver upon its proposed revenue projections,

there is limited headroom in the current forecasts and as such

there is considered to be a material uncertainty relating to going

concern. The independent auditors' report is not modified in

respect of this matter. The financial statements do not include any

adjustments that would result if the Company were unable to

continue as a going concern. For further details, refer to the

Going Concern section in note 2 to the financial statements.

Current Trading and Outlook

Rosslyn entered the 2024 financial year in a stronger position

than at the same point in the previous year, having completed the

restructuring and rebranding of the business along with the launch

of the new platform and execution on the new go-to-market strategy.

Accordingly, the weighted and total pipeline were significantly

higher at GBP1.1m and GBP3.6m, respectively (30 April 2022: GBP0.9m

and GBP2.7m).

During the first half of FY 2024, the Company has secured two

new contract wins worth GBP422k in aggregate over a multi-year

period representing an additional GBP120k of ARR. Rosslyn is in

advanced negotiation with several other customers within the

weighted pipeline while the total pipeline has grown substantially

during H1 2024, which primarily reflects increasing business

through partnerships. In addition, the Company's position has been

further strengthened by the recent fundraising, which has

established the foundations for Rosslyn to accelerate growth.

The Company remains on track to report results for 2024 in line

with management expectations. This reflects strong revenue and ARR

growth driven by new customers won via partnerships as well as

expansion with existing customers through the launch of new

modules, including its eagerly anticipated generative AI solution.

As a result, the Board is excited about the year ahead and

continues to look to the future with confidence.

Publication of Annual Report

The Company announces that its annual report and accounts for

the year ended 30 April 2023 has, today, been published on its

website on the Reports and Corporate Documents page of the

Investors section at

https://www.rosslyn.ai/investors/reports-corporate-documents, and

has been posted to shareholders.

Notice of AGM

The Company gives notice that its AGM will be held at 10.00am on

Thursday 23 November 2023 at the offices of Gracechurch Group, 48

Gracechurch Street, London, EC3V 0EJ.

The Notice of AGM has been posted to shareholders and published

on the Reports and Corporate Documents page in the Investors

section of the Company website:

https://www.rosslyn.ai/investors/reports-corporate-documents.

Consolidated statement of comprehensive income

For the year ended 30 April 2023

Year Year ended

ended 30 April

30 April 30 April 30 April 2022

2023 2023 2022 GBP'000

Note GBP'000 GBP'000 GBP'000

----------------------------------------- ----- --------- --------- ---------------------------- --------------

Continuing operations

Revenue 3 3,012 2,731

Cost of sales (1,968) (2,278)

========================================= ===== ========= ========= ==============================================

Gross profit 1,044 453

========================================= ===== ========= ========= ==============================================

Operating expenses (3,807) (4,464)

Analysed as

Administrative expenses (3,352) (4,287)

Depreciation and amortisation (366) ( 40 )

Share-based payments (89) (137)

========================================= ===== ========= ========= ============================ ================

(3,807) (4,464)

========================================= ===== ========= ========= ============================ ======= =======

Operating loss (2,763) (4,011)

Finance income 3 5

Finance costs - (44)

========================================= ===== ========= ========= ==============================================

Loss before income tax (2,760) (4,050)

Income tax 664 391

========================================= ===== ========= ========= ==============================================

Loss for the year for continued ( 2,

operations 096) (3,659)

========================================= ===== ========= ========= ==============================================

Profit for the year from discontinued

operations 6 2,468 297

========================================= ===== ========= ========= ==============================================

Profit/(loss) for the year 372 (3,362)

----------------------------------------- ----- --------- --------- ----------------------------------------------

Other comprehensive income - translation

differences 28 19

========================================= ===== ========= ========= ==============================================

Total comprehensive income/(loss) 400 (3,343)

========================================= ===== ========= ========= ==============================================

Profit/(loss) per share Pence Pence

----------------------------------------- ----- --------- --------- ----------------------------------------------

Basic and diluted loss per share:

ordinary shareholders - 4 (30.6) (53.7)

Continued

Basic profit/( loss) per share:

ordinary shareholders -

Total 4 5.9 (49.2)

Diluted profit/(loss) per share:

ordinary shareholders - Total 4 5.7 (49.2)

========================================= ===== ========= ========= ==============================================

The accompanying notes form part of these financial

statements.

Consolidated statement of financial position

As at 30 April 2023

30 April 30 April

2023 2022

Note GBP'000 GBP'000

--------------------------------------- ----------------- --------

Assets

Non-current assets

Intangible assets 1,372 1,105

Property, plant and equipment - 16

Right-of-use assets 162 236

=================================== ================= ========

1,534 1,357

======================================= ================= ========

Current assets

Trade and other receivables 969 820

Corporation tax receivable 852 161

Cash and cash equivalents 767 2,433

=================================== ================= ========

Total current assets 2,588 3,414

======================================= ================= ========

4,122 4,771

======================================= ================= ========

Disposal group assets 6 - 650

=================================== ================= ========

Total assets 4,122 5,421

======================================= ================= ========

Liabilities

Non-current liabilities

( 114

Trade and other payables ) (168)

Deferred tax - -

=================================== ================= ========

( 114

) (168)

======================================= ================= ========

Current liabilities

(2, 284

Trade and other payables (2,001) )

Financial liabilities - borrowings (96) -

=================================== ================= ========

(2, 284

Total current liabilities (2,097) )

======================================= ================= ========

Disposal group liabilities 6 - (1,547)

=================================== ================= ========

(2, 211

Total liabilities ) (3,999)

======================================= ================= ========

Net assets 1,911 1,422

======================================= ================= ========

Equity

Called up share capital 1,699 1,699

Share premium 18,923 18,923

Share-based payment reserve 320 255

Accumulated loss (24,089) (24,485)

Translation reserve (75) (103)

Merger reserve 5,133 5,133

=================================== ================= ========

Total equity 1,911 1,422

======================================= ================= ========

The accompanying notes form part of these financial

statements.

Consolidated statement of changes in equity

For the year ended 30 April 2023

Share-

Called Accumulated Translation based Share Merger Total

up loss reserve payment premium reserve equity

share reserve

capital

--------------

Note GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

-------------- ----- ------------ ------------- ------------- --------------- ----------- --------- ----------

Balance at 1 May

2021 1,699 (21,662) (122) 657 18,923 5,133 4,628

===================== ============ ============= ============= =============== =========== ========= ==========

Loss for the year - (3,362) - - - - (3,362)

Other comprehensive

income - - 19 - - - 19

Lapsed options - 539 - (539) - - -

Share-based payment

transaction - - - 137 - - 137

===================== ============ ============= ============= =============== =========== ========= ==========

Balance at 30 April

2022 1,699 (24,485) (103) 255 18,923 5,133 1,422

===================== ============ ============= ============= =============== =========== ========= ==========

Balance at 1 May

2022 1,699 (24,485) (103) 255 18,923 5,133 1,422

Profit for the year - 372 - - - - 372

Other comprehensive

income - - 28 - - - 28

Lapsed options - 24 - (24) - -

Share-based payment

transaction - - - 89 - - 89

===================== ============ ============= ============= =============== =========== ========= ==========

Balance at 30 April

2023 1,699 (24,089) (75) 320 18,923 5,133 1,911

===================== ============ ============= ============= =============== =========== ========= ==========

The merger reserve arises from the Group reorganisation that

occurred on 23 April 2014. Rosslyn Data Technologies plc acquired

Rosslyn Analytics Limited in a share-for-share transaction. There

was no change in rights or proportions of control in the Group as a

result of this transaction. As common control exists IFRS 3 was

deemed to not apply and this has been accounted for as a capital

reorganisation. The difference between the share capital and share

premium of the Company and the share capital and share premium of

Rosslyn Analytics Limited at 23 April 2014 is recognised in the

merger reserve.

The translation reserve comprises translation differences

arising from the translation of financial statements of the Group's

foreign entities (Rosslyn Analytics, Inc.) into sterling (GBP).

The accumulated loss reserve includes all current and prior

period retained profits and losses.

The share-based payment reserve comprises the fair value of

options granted under the Group's Enterprise Management Incentive

Scheme, less reductions for those options that lapsed during the

year.

The accompanying notes form part of these financial

statements.

Consolidated statement of cash flows

For the year ended 30 April 2023

Year ended Year ended

30 April 30 April

2023 2022

Note GBP'000 GBP'000

-------------------------------------------------- ---------- ---------- ----------

Cash flows used in operating activities

Cash used in operations See below (2,668) (2,156)

Finance income 3 5

Finance costs - (44)

Corporation tax (paid)/received (27) 75

============================================================== ========== ==========

Net cash used in operating activities (2,692) (2,120)

============================================================== ========== ==========

Cash flows generated from/(used in) investing

activities

Purchase of property, plant and equipment (6) (28)

( 535

Acquisition of software ) (1,105)

Cash received on disposal of operation 1,512 -

============================================================== ========== ==========

Net cash generated from/(used in) investing

activities 971 (1,133)

============================================================== ========== ==========

Cash flows generated from/(used in) financing

activities

New loans in year 160 -

Repayment of borrowings ( 64 ) (890)

Repayment of capital element of obligations under

leases ( 69 ) (122)

Net cash generated from/(used in) financing

activities 27 (1,012)

============================================================== ========== ==========

Net decrease in cash and cash equivalents (1,694) (4,265)

Cash and cash equivalents at beginning of year 2,433 6,681

============================================================== ========== ==========

Foreign exchange gains 28 17

============================================================== ========== ==========

Cash and cash equivalents at end of year 767 2,433

============================================================== ========== ==========

Reconciliation of loss before income tax to cash used in

operations

Year ended Year ended

30 April 30 April

2023 2022

GBP'000 GBP'000

--------------------------------------------------- ---------- -----------------

Loss before income tax (292) (3, 753)

Depreciation, amortisation and impairment charges 366 40

Share-based payment transactions 89 137

Finance income (3) (5)

Gain on disposal of operations (2,468) -

Disposal of leases (5) -

Finance costs - 44

=================================================== ========== =================

(2,313) (3,537)

(Increase)/decrease in trade and other receivables (149) 875

( 206

(Decrease)/increase in trade and other payables ) 506

=================================================== ========== =================

Cash used in operations (2,668) (2,156)

=================================================== ========== =================

The accompanying notes form part of these financial

statements.

Notes to the unaudited interim statements

For the year ended 30 April 2023

1. General information

Rosslyn Data Technologies plc (the "Company") is a company

incorporated and domiciled in the UK. It is quoted on AIM, a market

of the London Stock Exchange. The address of the registered office

is 1000 Lakeside North Harbour, Western Road, Portsmouth,

Hampshire, PO6 3EN. The Company is the ultimate parent company of

Rosslyn Analytics Limited and Rosslyn Data Management Limited,

companies incorporated in the UK, and the ultimate parent company

of Rosslyn Analytics, Inc., a company incorporated in the USA

(collectively, the "Group"). The Group's principal activity is the

provision of procurement data analytics using a proprietary form,

data capture, data mining and workflow management.

The financial statements are presented in British Pounds

Sterling (GBP), the currency of the primary economic environment in

which the Group's activities are operated in and reported in

GBP'000. The financial statements are for the year ended 30 April

2023.

2. Accounting policies

Basis of preparation

The principal accounting policies adopted in the preparation of

the financial statements are set out below. The policies have been

consistently applied to all the years presented, unless otherwise

stated.

The Group financial statements have been prepared under the

historical cost convention subject to fair valuing certain

financial instruments and in accordance with UK adopted

international accounting standards.

Going concern

Information on the business environment and the factors

underpinning the Group's future prospects and product portfolio are

included in the CEO's statement. The cash balance at 30 April 2023

was GBP0.8m and on 18 September the Group successfully completed an

equity fundraising round, raising GBP3.3m of gross proceeds. The

Group has performed prudent scenario analysis on revenue and cost

performance. These demonstrate that the Group can meet its

liabilities as they fall due.

After making appropriate enquiries, the Directors consider that

it is appropriate to adopt the going concern basis in preparing the

consolidated financial statements. Accordingly, the financial

statements do not include any adjustments that would be required if

the going concern basis of preparation was deemed to be

inappropriate. However, if the Group is unable to deliver its

proposed revenue projections, there is limited headroom in the

current forecasts and as such there is considered to be a material

uncertainty which may cast significant doubt on the Group's ability

to continue as a going concern.

Basis of consolidation

On 23 April 2014 the Company acquired the Group's previous

parent company, Rosslyn Analytics Limited, via a share-for-share

exchange whereby every ordinary share and A preference share in

Rosslyn Analytics Limited was exchanged for eight ordinary shares

and eight A preference shares respectively in Rosslyn Data

Technologies Limited (prior to the conversion to a plc on 24 April

2014). On 24 April 2014 the A preference shares were converted into

ordinary shares on a one-for one basis. On 29 April 2014, Rosslyn

Data Technologies plc's shares were admitted to trading on AIM.

Accordingly, these financial statements are presented in the

name of the new legal parent, Rosslyn Data Technologies plc, but

are a continuation of the financial statements of Rosslyn Analytics

Limited.

During the year, the Group disposed of the Langon Systems and

Integritie parts of the Group. The Langdon Systems sale was

completed on 30 September 2022 and the Integritie sale completed on

1 November 2022.

The consolidated statement of comprehensive income and statement

of financial position include the financial statements of the

Company and its subsidiary undertakings as of 30 April 2023.

Where the Company has control over an investee, it is classified

as a subsidiary. The Company controls an investee if all three of

the following elements are present: power over the investee,

exposure to variable returns from the investee, and the ability of

the investor to use its power to affect those variable returns.

Control is reassessed whenever facts and circumstances indicate

that there may be a change in any of these elements of control.

De facto control exists in situations where the Company has the

practical ability to direct the relevant activities of the investee

without holding the majority of the voting rights. In determining

whether de facto control exists the Company considers all relevant

facts and circumstances, including:

-- the size of the Company's voting rights relative to both the

size and dispersion of other parties which hold voting rights or

substantive potential voting rights held by the Company and by

other parties;

-- other contractual arrangements; and

-- historical patterns in voting attendance.

The consolidated financial statements present the results of the

Company and its subsidiaries (the "Group") as if they formed a

single entity. Intercompany transactions and balances between Group

companies are therefore eliminated in full.

The consolidated financial statements incorporate the results of

business combinations using the acquisition method.

In the consolidated balance sheet, the acquiree's identifiable

assets, liabilities and contingent liabilities are initially

recognised at their fair values at the acquisition date. The

results of acquired operations are included in the consolidated

statement of comprehensive income from the date on which control is

obtained.

Subsidiaries

Subsidiaries are entities controlled by the Company. Control

exists where an investor, regardless of the nature of its

involvement with an entity (the investee), shall determine whether

it is a parent by assessing whether it controls the investee. An

investor controls an investee when it is exposed, or has rights, to

variable returns from its involvement in the investee and has the

ability to affect those returns through its power over the

investee. The financial information of subsidiaries is included in

the consolidated financial information from the date that control

commences until the date that control ceases.

Transactions eliminated on consolidation

Intragroup balances, and any gains and losses or income and

expenses arising from intragroup transactions, are eliminated in

preparing the consolidated financial information.

Judgements and estimates

The preparation of the financial statements requires management

to exercise judgement in applying the Group's accounting policies.

It also requires the use of estimates and assumptions that affect

the reported amounts of assets, liabilities, income and expenses.

Actual results may differ from these estimates.

Judgements

-- Conditional deferred payment on the sale of Integritie -

Based on current and available information the conditional deferred

payment of up to GBP1.4m has been fair valued at GBPnil.

-- Development costs capitalised as intangible assets -

Management exercises judgement in determining whether the costs can

be capitalised. Management look for costs that can be directly

attributable, and also measurable, to a particular project when

deciding on capitalisation. During the year, the Group has

capitalised intangible assets development costs of GBP535,000

(2022: GBP1,105,000 ), which relate specifically to the Rosslyn

Platform redevelopment.

-- Impairment of intangible assets - The Directors will use

their judgement to determine if indicators of impairment of

intangible assets have arisen.

Estimates

-- Valuation of share-based payments - The Directors base their

judgement on the Black Scholes model.

-- Recognition of professional services revenue - For projects

that are in progress, management assesses how far through to

completion then recognise revenue using time management records and

expectation of total time required based on prior projects.

-- Impairment of intangible assets - Management have carried out

an impairment review based on the recoverable amount using a

discounted cash flow model. No impairment is considered necessary,

but this is dependent upon future cash flows generated by the

continuing subsidiary operations, which themselves are dependent on

the successful commercialisation, value and timing of product

sales.

-- Amortisation of development costs - The amortisation of

development costs is spread in a straight-line basis over its

estimated useful economic life at the outset of the project. The

life of the asset will be reassessed as time progresses to ensure

the estimation of its life is correct and any impairment will be

taken into account at that time.

Revenue recognition

Revenue is measured at the fair value of consideration received

or receivable and represents amounts for services provided to third

parties in the normal course of business during the year, net of

value added tax, and results from the principal activities of the

Group.

Each element of revenue (described below) is recognised only

when:

-- provision of the services has occurred;

-- the consideration receivable is fixed or determinable; and

-- collection of the amount due from the customer is reasonably assured.

i) Initial data processing and analysis in connection with the

deployment and customisation of the Group's proprietary solutions

are recognised over the corresponding period of the related

customer contract.

ii) Annual licence fees are recognised on a straight-line basis

over the period of the contractual term.

iii) Any revenue arising from consultancy or professional

services work is recognised as such services are delivered.

Services that have been delivered at the end of a financial

period but which have not been invoiced at that time are recognised

as revenue and shown within accrued revenue in the statement of

financial position.

Advance payments from customers are included within deferred

income in the statement of financial position. Such amounts are

recognised as the services are provided to the customer in

accordance with points (i) to (iii) as set out above.

Cost of sales

Cost of sales includes utilised data storage costs proportionate

to the amount utilised to service customers, together with

third-party costs for software licences supplied to customers.

Other intangible assets

Customer lists, internally developed software and software

licences have been acquired in a business combination; they qualify

for separate recognition and are recognised as intangible assets at

their fair value.

Goodwill represents the excess of the cost of a business

combination over the total fair value of the identifiable assets,

liabilities and contingent liabilities acquired as at the

acquisition date. Goodwill is capitalised as an intangible asset

with any impairment in carrying value being charged to the

consolidated statement of comprehensive income. Where the fair

value of identifiable assets, liabilities and contingent

liabilities exceeds the fair value of consideration paid, the

excess is credited in full to profit or loss.

All finite-lived intangible assets are accounted for using the

cost model whereby capitalised costs are amortised on a

straight-line basis over their estimated useful lives. Residual

values and useful lives are reviewed at each reporting date. The

following useful lives are applied:

-- Software licences - five years straight line

-- Internally developed software - five years straight line

-- Customer relationships - five years straight line

Amortisation has been included within depreciation, amortisation

and impairment of non-financial assets.

Property, plant and equipment

Items of property, plant and equipment are stated at cost less

accumulated depreciation and impairment losses. Cost includes the

original purchase price of the asset and the costs attributable to

bringing the asset to its working condition for its intended use.

When parts of an item of property, plant and equipment have

different useful lives, those components are accounted for as

separate items of property, plant and equipment.

Subsequent costs are included in the asset's carrying amount or

recognised as a separate asset, as appropriate, only when it is

probable that future economic benefits associated with the item

will flow to the Group and the cost of the item can be measured

reliably.

Gains and losses on disposals are determined by comparing the

proceeds with the carrying amount and are recognised in the income

statement.

Depreciation

Depreciation is provided at the following annual rates in order

to write off each asset over its estimated useful life:

-- Fixtures, fittings, and equipment - 18 to 36 months straight line

Impairment review of intangible assets

The intangible assets, with the exception of g oodwill, are

being amortised over their useful economic lives, however

management still tests intangible assets for impairment if and when

indicators of impairment arise. Where such an indication exists,

management estimates the fair value less costs to sell of the

assets based on the net present value of future cash flows. The

Directors have considered whether there are any indicators of

impairment to the carrying amount of intangible assets of

GBP1,372,000 (2022: GBP1,105,000), and there is considered to be no

requirement for impairment in this financial year.

Taxation

Current taxes are based on the results shown in the financial

statements and are calculated according to local tax rules, using

tax rates enacted or substantively enacted by the statement of

financial position date.

Deferred tax is provided using the statement of financial

position liability method, providing for temporary differences

between the carrying amounts of assets and liabilities for

financial reporting purposes and the amounts used for taxation

purposes.

Temporary differences are not provided for the initial

recognition of other assets or liabilities that affect neither

accounting nor taxable profit. The amount of deferred tax provided

is based on the expected manner of realisation or settlement of the

carrying amount of assets and liabilities, using tax rates enacted

or substantively enacted at the statement of financial position

date.

A deferred tax asset is recognised only to the extent that it is

probable that future taxable profits will be available against

which the asset can be utilised. Deferred tax assets are reduced to

the extent that it is no longer probable that the related tax

benefit will be realised.

Deferred income tax assets and liabilities are offset when there

is a legally enforceable right to offset current tax assets against

current tax liabilities and when the deferred income tax assets and

liabilities relate to income taxes levied by the same taxation

authority on either the taxable entity or different taxable

entities where there is an intention to settle the balances on a

net basis.

Deferred income tax is provided on temporary differences arising

on investments in subsidiaries, except for deferred income tax

liability where the timing of the reversal of the temporary

difference is controlled by the Group and it is probable that the

temporary difference will not reverse in the foreseeable

future.

Research and development

Expenditure on research activities is recognised as an expense

in the period in which it is incurred. An intangible asset arising

from development or the development phase of an internal project is

recognised if the Group can demonstrate:

a. the technical feasibility of completing the intangible asset

so that it will be available for sale or use;

b. the intention to complete the development;

c. the ability to use or sell the intangible asset;

d. how the intangible asset will generate probable future

economic benefits (for example, the existence of a market for the

output of the intangible asset or for the intangible asset

itself);

e. the availability of resources to complete the development;

and

f. the ability to measure the attributable expenditure

reliably.

This financial year the development costs of the new Rosslyn

Platform have been able to be identified meeting the tests above

and have therefore been capitalised.

Foreign currencies

The functional currency of the Company is pounds sterling

because that is the currency of the primary economic environment in

which the Company operates. The Company's presentation currency is

pounds sterling.

Assets and liabilities in foreign currencies are translated into

sterling at the rates of exchange ruling at the statement of

financial position date. Transactions in foreign currencies are

translated into sterling at the rate of exchange ruling at the date

of transaction. Exchange differences are taken into account in

arriving at the operating result and are recognised in

administrative expenses.

Group companies

The results and financial position of all the Group entities

(none of which have the currency of a hyperinflation economy) that

have a functional currency different from the presentation currency

are translated into the presentation currency as follows:

-- assets and liabilities for each statement of financial

position presented are translated at the closing rate at the date

of that statement of financial position;

-- income and expenses for each income statement presented are

translated at average exchange rates (unless this average is not a

reasonable approximation of the cumulative effect of the rates

prevailing on the transaction dates, in which case income and

expenses are translated at the rate on the dates of the

transactions); and

-- all resulting exchange differences are recognised in other

comprehensive income. The following exchange rates were applied for

GBP1 at each year end:

2023 2022

----------- ---- ----

US dollars 1.26 1.26

Euros 1.14 1.19

=========== ==== ====

Retirement benefits

The Group operates a defined contribution scheme. Contributions

payable to the Group's pension scheme are charged to the income

statement in the period to which they relate.

Leases

All leases are accounted for by recognising a right-of-use asset

and a lease liability except for:

-- leases of low value assets, which are defined as leases under GBP4,500 per annum; and

-- leases with a duration of 12 months or less.

Lease liabilities are measured at the present value of the

contractual payments due to the lessor over the lease term, with

the discount rate determined by reference to the rate inherent in

the lease unless (as is typically the case) this is not readily

determinable, in which case the Group's incremental borrowing rate

on commencement of the lease is used. Variable lease payments are

only included in the measurement of the lease liability if they

depend on an index or rate. In such cases, the initial measurement

of the lease liability assumes the variable element will remain

unchanged throughout the lease term. Other variable lease payments

are expensed in the period to which they relate.

On initial recognition, the carrying value of the lease

liability also includes:

-- amounts expected to be payable under any residual value guarantee;

-- the exercise price of any purchase option granted in favour

of the Group if it is reasonably certain to assess that option;

and

-- any penalties payable for terminating the lease, if the term

of the lease has been estimated on the basis of a termination

option being exercised.

Right-of-use assets are initially measured at the amount of the

lease liability, reduced for any lease incentives received, and

increased for:

-- lease payments made at or before commencement of the lease;

-- initial direct costs incurred; and

-- the amount of any provision recognised where the Group is

contractually required to dismantle, remove or restore the leased

asset.

Subsequent to initial measurement, lease liabilities increase as

a result of interest charged at a constant rate on the balance

outstanding and are reduced for lease payments made. Right-of-use

assets are amortised on a straight-line basis over the remaining

term of the lease or over the remaining economic life of the asset

if, rarely, this is judged to be shorter than the lease term.

When the Group revises its estimate of the term of any lease

(because, for example, it reassesses the probability of a lessee

extension or termination option being exercised), it adjusts the

carrying amount of the lease liability to reflect the payments to

make over the revised term, which are discounted at the same

discount rate that applied on lease commencement. The carrying

value of lease liabilities is similarly revised when the variable

element of future lease payments dependent on a rate or index is

revised. In both cases an equivalent adjustment is made to the

carrying value of the right-of-use asset, with the revised carrying

amount being amortised over the remaining (revised) lease term.

When the Group renegotiates the contractual terms of a lease

with the lessor, the accounting depends on the nature of the

modification:

-- if the renegotiation results in one or more additional assets

being leased for an amount commensurate with the standalone price

for the additional rights of use obtained, the modification is

accounted for as a separate lease in accordance with the above

policy;

-- in all other cases where the renegotiation increases the

scope of the lease (whether that is an extension to the lease term,

or one or more additional assets being leased), the lease liability

is remeasured using the discount rate applicable on the

modification date, with the right-of-use asset being adjusted by

the same amount; and

-- if the renegotiation results in a decrease in the scope of

the lease, both the carrying amount of the lease liability and

right-of-use asset are reduced by the same proportion to reflect

the partial or full termination of the lease with any difference

recognised in profit or loss. The lease liability is then further

adjusted to ensure its carrying amount reflects the amount of the

renegotiated payments over the renegotiated term, with the modified

lease payments discounted at the rate applicable on the

modification date. The right-of-use asset is adjusted by the same

amount.

The Group leases a number of properties on fixed rents. None of

these leases have inflation clauses or break clauses.

Financial instruments

Financial instruments are classified and accounted for,

according to the substance of the contractual agreement, as either

financial assets, financial liabilities or equity instruments. An

equity instrument is any contract that evidences a residual

interest in the assets of the Group after deducting all of its

liabilities.

Trade and other payables

Trade payables are stated at their original invoiced value, as

the interest that would be recognised from discounting future cash

payments over the expected payment period is not considered to be

material.

Financial assets

Classification

Financial assets and financial liabilities are recognised in the

statement of financial position when the Group becomes a party to

the contractual provisions of the instrument. Investments other

than investments in subsidiaries are classified as either

held-for-trading or not at initial recognition. At the year end

date all investments are classified as not held for trading.

Trade receivables

Trade receivables are held in order to collect the contractual

cash flows and are initially measured at the transaction price as

defined in IFRS 15, as the contracts of the Group do not contain

significant financing components.

Impairment losses are recognised based on lifetime expected

credit losses in profit or loss.

Other receivables

Other receivables are held in order to collect the contractual

cash flows and accordingly are measured at initial recognition at

fair value, which ordinarily equates to cost and are subsequently

measured at cost less impairment due to their short-term

nature.

A provision for impairment is established based on 12-month

expected credit losses unless there has been a significant increase

in credit risk when lifetime expected credit losses are recognised.

The amount of any provision is recognised in profit or loss.

Cash and cash equivalents

Cash and cash equivalents comprise cash balances held by the

Group and overnight call deposits. Financial liability and equity

instruments issued by the Group are classified in accordance with

the substance of the contractual arrangements entered into and the

definitions of a financial liability and an equity instrument. An

equity instrument is any contract that evidences a residual

interest in the assets of the Group after deducting all of its

liabilities. Equity instruments issued by the Company are recorded

at the proceeds received, net of direct issue costs.

Share capital and share premium

Ordinary shares are classified as equity. Share premium is the

amount subscribed for share capital in excess of nominal value less

any costs directly attributable to the issue of new shares.

Incremental costs directly attributable to the issue of new shares

are shown in share premium as a deduction from the proceeds.

Share-based payments

The Group operates an equity-settled, share-based compensation

plan, the Enterprise Management Incentive (EMI) Scheme.

The fair value of the employee services received in exchange for

the grant of the options is recognised as an expense. The total

amount to be expensed over the vesting period is determined by

reference to the fair value of the options granted calculated using

an appropriate option pricing model. Non-market vesting conditions

are included in assumptions about the number of options that are

expected to vest. At each statement of financial position date, the

entity revises its estimates of the number of options that are

expected to vest. Options issued under the scheme to Non-Executive

Directors and other individuals who are not employees of the UK

Company follow the EMI rules but are considered non-qualifying EMI

options for tax purposes.

Borrowings

Borrowings are recognised initially at fair value, net of

transaction costs incurred. Borrowings are subsequently carried at

amortised cost; any difference between the proceeds (net of

transaction costs) and the redemption value is recognised in the

income statement over the period of the borrowings using the

effective interest method.

Provisions

A provision is recognised in the statement of financial position

when the Group has a present legal or constructive obligation as a

result of a past event, and it is probable that an outflow of

economic benefits will be required to settle the obligation.

If the effect is material, provisions are discounted at a rate

that reflects current market assessments of the time value of money

and, when appropriate, the risks specific to the liability. The

increase in the provision due to passage of time is recognised in

finance costs.

Net finance costs

Finance costs

Finance costs comprise interest payable on borrowings and direct

issue costs.

Finance income

Finance income comprises interest receivable on funds invested.

Interest income is recognised in the income statement as it accrues

using the effective interest method.

Standards, amendments and interpretations

There were no new IFRSs, endorsed standards and amendments,

improvements and interpretations of published standards applicable

for accounting periods beginning 1 May 2022 that had a material

impact on the financial statements.

Standards not yet effective

There are a number of standards, amendments to standards, and

interpretations which have been issued by the IASB that are

effective in future accounting periods that the Group has decided

not to adopt early.

-- Classification of liabilities as current or non-current (Amendments to IAS 1)

-- Deferred tax related to Assets and Liabilities arising from a

Single Transaction (Amendments to IAS 12)

-- Narrow scope amendments to IAS 1 'Presentation of Financial

Statements, Practice statement 2 and IAS 8 'Accounting Policies,

Changes in Accounting Estimates and Errors'

The Group does not expect any other standards issued by the

IASB, but not yet effective, to have a material impact on the

Group.

3. Segmental reporting

Management has determined the operating segments based on the

operating reports reviewed by the Directors that are used to assess

both performance and strategic decisions. Management has identified

that the Directors are the Chief Operating Decision Maker in

accordance with the requirements of IFRS 8 Operating segments.

The determination is that the Group operates as a single

segment, as no internal reporting is produced either by geography

or division. The Group views performance on the basis of the type

of revenue, and the end destination of the client as shown

below.

Year ended Year ended

30 April 30 April

2023 2022

GBP'000 GBP'000

---------------------- ---------- ----------

Annual licence fees 2,406 2,414

Professional services 606 317

====================== ========== ==========

Total revenue 3,012 2,731

====================== ========== ==========

Year ended Year ended

30 April 30 April

2023 2022

Analysis of revenue by country GBP'000 GBP'000

--------------------------------- ---------- ----------

United Kingdom 1,528 1,643

Europe 520 414

North America 964 674

================================= ========== ==========

Total revenue 3,012 2,731

================================= ========== ==========

Included in Europe is the Netherlands, which had revenues of

GBP208,000 in the year ended 30 April 2023 (2022: GBP158,000).

Included in North America is the USA, which had revenues of

GBP964,000 in the year ended 30 April 2023 (2022: GBP674,000).

Year ended Year ended

30 April 30 April

2023 2022

Analysis of future obligations: GBP'000 GBP'000

------------------------------------------------------- ---------- ----------

Performance obligations to be satisfied in the next

year 1,725 1,763

Performance obligations to be satisfied after 30 April

2024 125 1,426

======================================================= ========== ==========

Total future performance obligations 1,850 3,189

======================================================= ========== ==========

There were two (2022: nil) significant customers who made up

greater than 10% of total revenue in the year. The following

revenue arose from the Group's largest customer in each year:

Year ended Year ended

30 April 30 April

2023 2022

GBP'000 GBP'000

---------------------- ---------- ----------

Annual licence fees 178 199

Professional services 167 8

====================== ========== ==========

Total revenue 345 207

====================== ========== ==========

4. Profit/(loss) per share

Basic earnings per share is calculated by dividing the net

profit/(loss) for the year attributable to ordinary shareholders by

the weighted average number of ordinary shares outstanding during

the year.

Diluted earnings per share is calculated by dividing the net

profit/(loss) for the year attributable to ordinary shareholders by

the weighted average number of ordinary shares outstanding during

the year plus the weighted average number of ordinary shares that

would be issued on the conversion of all dilutive potential

ordinary shares into ordinary shares.

Year ended Year ended

30 April 30 April

2023 2022

--------------------------------------------------------------- ---------- --------------

Profit/(loss) for the year attributable to the owners GBP400,000 (GBP3,434,000)

of the parent

--------------------------------------------------------------- ---------- --------------

2023 2022

Number Number

--------------------------------------------------------------- ---------- --------------

Weighted average number of shares

Weighted average number of shares in issue during the 339, 862

year ,521 339,862,521

6,797,

Weighted average number of shares post consolidation* 250 6,797,250

Dilutive effect of share options** 12,021,429 -

Number of dilutive effect of share options post consolidation* 240,429 -

--------------------------------------------------------------- ---------- --------------

Total number of dilutive effect of share options 7,037,679 -

--------------------------------------------------------------- ---------- --------------

Pence Pence

------------------------------------------------------------- ------ ------

Basic and diluted loss per share: ordinary shareholders

- continued (30.6) (53.7)

Basic profit per share: ordinary shareholders - discontinued 36.5 4.5

============================================================= ====== ======

Basic profit/(loss) per share: ordinary shareholders 5.9 (49.2)

Diluted profit/(loss) per share: ordinary shareholders 5.7 (49.2)

------------------------------------------------------------- ------ ------

* Ordinary shares and share options have been reinstated to

reflect the share consolidation of a ratio of 50:1 which took place

on 19 September 2023

** At 30 April 2023 there were 30,675,638 share options

outstanding, of these 13,675,638 were not included in the

calculation of diluted earnings per share as these are anti

dilutive in terms of IAS 33. As at 30 April 2022 all 14,564,527

share options were not included in the calculation of diluted

earnings per share as these are anti dilutive in terms of IAS

33

5. Related party disclosures

During the year, the Group received invoices from a family

member of a director for the provision of consultancy services for

the sum of GBP16,025 (2022: GBP10,850).

6. Discontinued operations and business disposals

In order to deliver the Group's emphasis on the Rosslyn product,

a decision was taken to dispose of the Langdon Systems and

Integritie parts of the Group. The Langdon Systems sale was

completed on 30 September 2022 and the Integritie sale completed on

1 November 2022, and are therefore the trading and profit on

disposal are presented on one line as discontinued operations for

the current and prior period in the consolidated statement of

comprehensive income. As part of the sale of Integritie there is a

conditional deferred payment of up to GBP1.4m based on achieving

certain revenue and growth targets. Based on current and available

information, this conditional deferred payment has been fair valued

at GBPnil. The above transactions have been treated as disposals

from the dates the sales were completed.

The associated assets and liabilities were consequently

presented as held for sale in the 2022 consolidated statement of

financial position. Financial information relating to the

discontinued operation for the Group is set out below.

Statement of comprehensive income

Year ended Year ended

30 April 30 April 30 April 30 April

2023 2023 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------------------- ------------------ ------------------

Discontinued operations

Revenue Cost of sales 1,510 3,140

(539) (958)

============================================ ================== ==================

Gross p rofit 971 2,184

============================================ ================== ==================

Admin expenses (830) (1,885)

Analysed as

Administrative expenses (830) (943)

Depreciation and amortisation - (942)

Share-based payment - -

============================================ ================== ==================

- (1,885)

============================================ ================== ==================

Operating profit 141 297

Profit on disposal of operations 2,309 -

Finance costs (9) -

============================================ ================== ==================

Profit before income tax 2,441 297

Income tax 27 -

============================================ ================== ==================

Total comprehensive income for discontinued

operations 2,468 297

============================================ ================== ==================

Statement of financial position

The major classes of asset and liabilities held for sale at 30

April 2022 were, as follows:

30 April

2022

GBP'000

---------------------------------------------------------------- --------------------

Assets

Non-current assets

Intangible assets 62

Property, plant and equipment Right-of-use assets 17

60

================================================================ ====================

139

================================================================ ====================

Current assets

Trade and other receivables Corporation tax receivable Cash 511 -

and cash equivalents -

================================================================ ====================

511

================================================================ ====================

Disposal of Group assets 650

================================================================ ====================

Liabilities (195)

Non-current liabilities Trade and other payables Deferred tax -

Financial liabilities - borrowings -

================================================================ ====================

195

================================================================ ====================

Current liabilities

Discontinued operations held for sale Trade and other payables (1,352)

================================================================ ====================

Financial liabilities - borrowings -

================================================================ ====================

(1.352)

================================================================ ====================

Disposal of Group liabilities (1,547)

================================================================ ====================

Net liabilities directly associated with disposal (897)

================================================================ ====================

Before the classification of Langdon Systems and Integritie as

discontinued operations, the recoverable amount was estimated for

the assets and no impairment loss has been identified.

Profit on disposal of operations

Year ended Year ended

30 April 30 April 30 April 30 April

2023 2023 2022 2022

GBP'000 GBP'000 GBP'000 GBP'000

----------------------------------------- --------------------- ----------------------------------

Cash proceeds 1,700 -

Selling fees paid out of consideration (188) -

========================================= ===================== ==================================

Net cash consideration 1,512 -

========================================= ===================== ==================================

Net assets disposed of

Intangible fixed assets 62

Tangible assets 20 -

Debtors 342 -

Creditors (1,449) -

========================================= ===================== ==================================

(1,025) -

========================================= ===================== ==================================

Post-completion costs (228) -

Profit on disposal before tax 2,309 -

========================================= ===================== ==================================

The cash flows from the discontinued operations were as

follows:

2023 2022

GBP'000 GBP'000

------------------------------------------------------- ------------------- -------------------

Net cash (used in)/generated from operating activities (716) 805

Net cash generated from investing activities 1,512 -

Net cash generated from financing activities 96 -

======================================================= =================== ===================

7. Post balance sheet events

After the reporting date, the Company successfully underwent an

equity fundraising round, raising GBP3m of gross proceeds.

On 19 September 2023, 882,963,721 existing ordinary shares were

consolidated into 17,659,275 new consolidated ordinary shares at a

conversion ratio of 50:1.

After the year end, on 29 September 2023, the Directors

determined that some of its share option schemes would be

cancelled. As a result of the cancellation, some of the outstanding

options under the schemes were forfeited and are no longer eligible

for exercise by the option holders. The value of the forfeited

share options at the date of the cancellation was determined to be

GBP59,874. This amount represents the total expense that would have

been recognised over the vesting period if the share options had

not been cancelled.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information