Ecofin US Renewables Infrastr.Trust Net Asset Value(s) (4133I)

07 Agosto 2023 - 1:00AM

UK Regulatory

TIDMRNEW

RNS Number : 4133I

Ecofin US Renewables Infrastr.Trust

07 August 2023

7 August 2023

ECOFIN U.S. RENEWABLES INFRASTRUCTURE TRUST PLC

(the "Company")

Quarterly Operational and Net Asset Value Update

Quarterly Operational Highlights

-- The portfolio generated 156.6 GWh of clean electricity,

equivalent to powering c.29,400 households, during the first six

months of 2023 from a fully-contracted portfolio of diversified

solar and wind assets with investment-grade equivalent off-takers

and a weighted average PPA term remaining of 14.5 years (18.8 years

excluding Whirlwind)

-- The Company amended and extended by 12 months its $65 million

revolving credit facility ("RCF") with KeyBank on competitive

terms:

o $50 million tranche extended to October 2024 at SOFR + 2.00%

to 18 October 2023 and SOFR + 2.125% thereafter

o $15 million tranche extended to October 2025 at SOFR + 2.25%

to 18 October 2023 and SOFR + 2.375% thereafter

-- Progress continues in completing construction and financing

of the Echo Solar Portfolio, a 36.0 MWdc commercial solar portfolio

in Minnesota, Virginia and Delaware, including the completion of

several tax equity milestone fundings during the quarter and

nearing completion of a back-leverage debt facility. Currently, two

projects have achieved commercial operation, and the four remaining

projects are mechanically complete and are being commissioned for

commercial operation during Q3 2023.

-- As announced on 27 July 2023, the Investment Manager

continues to work closely with Whirlwind's asset and operations

managers, AEP (the owner of the Matador substation) and The

Electric Reliability Council of Texas (ERCOT) authorities to resume

operations at its 59.8 MW Whirlwind asset which has been out of

service since a tornado on 21 June 2023 destroyed the Matador

substation through which it transmits electricity. A temporary

interconnection is expected to be established during the fourth

quarter of 2023 through an alternative route, which will allow the

project to operate at up to 50 MW of capacity during an approximate

18-month period during which AEP will rebuild the Matador

substation. The estimated impact of these arrangements has been

reflected in the Company's unaudited Net Asset Value ("NAV") as at

30 June 2023.

Quarterly NAV Drivers

The Company announces its unaudited NAV as at 30 June 2023 on a

cum-income basis was $0.9180 per Ordinary Share (31 March 2023:

$0.9394) or $126.8 million (31 March 2023: $129.7 million).

The key contributors to the changes in NAV were:

-- a $2.0 million increase ($0.0142 per Ordinary Share) due to

the transition to holding the Echo Solar portfolio at Fair Market

Value ("FMV") versus previously accounted for at cost as the

projects are completing construction and being commissioned for

commercial operation;

-- a $0.8 million increase ($0.0056 per Ordinary Share) due to a

25 bps decrease in the discount rates used to value the SED Solar

Portfolio and Delran Solar to bring the discount rates applied to

those investments in line with the broader solar portfolio, and

updates to merchant curve power prices on Beacon Solar 2 &

5;

-- a $0.6 million increase ($0.0047 per Ordinary Share) due to a

decrease in the deferred tax accrual, largely driven by the

decrease to FMV of investments;

-- a $2.1 million decrease ($0.0152 per Ordinary Share) in cash

and accrued financial assets, primarily driven by

lower-than-expected energy production principally due to

historically low wind resource during the quarter at Whirlwind, a

phenomenon that was experienced across the U.S.. This was further

compounded by the tornado at Whirlwind's substation on 21 June,

temporarily low availability due to downtime and corrective

maintenance interruptions at two solar projects, fund expenses and

interest expenses from the Company's drawn balance on its RCF;

-- a $3.1 million decrease ($0.0227 per Ordinary Share)

principally due to adjusted forecast assumptions related to

expected operational downtime at Whirlwind as announced on 27 July

2023, partially mitigated by business interruption insurance,

alongside partial downtime at one of the solar assets for extended

corrective maintenance, which is expected to be remediated during

Q3 2023; and

-- a $1.1 million decrease ($0.0081 per Ordinary Share) in FMV

of investments due in part to the expected quarterly roll-off of

distributable cash flows in the forward-looking discounted cash

flow models, partially offset by equity value build up from debt

amortisation at Beacon Solar 2 & 5.

The pre-tax discount rates, which were provided by the Company's

independent valuer and used to determine the FMV of investments,

decreased slightly this quarter, on an unlevered weighted average

basis, to 7.3% primarily due to modifications to the discount rates

applied to the SED Solar Portfolio and Delran Solar, as well as the

incorporation of the discount rates used to hold the Echo Solar

Portfolio at FMV. Based on market conditions in the U.S., the

Company's independent valuer did not recommend increasing discount

rates for any asset.

For further information, please contact:

Ecofin Advisors, LLC (Investment Manager)

Edward Russell

Eileen Fargis

Jason Benson

Michael Hart +1 913 981 1020

Peel Hunt LLP (Joint Corporate Broker)

Liz Yong

Luke Simpson

Huw Jeremy +44 20 7418 8900

Stifel (Joint Corporate Broker)

Edward Gibson-Watt

Rajpal Padam

Madison Kominski +44 20 7710 7600

Apex Listed Companies Services (UK) Limited

(Company Secretary)

Martin Darragh

Maria Matheou +44 20 3327 9720

FTI Consulting (Financial PR)

Matthew O'Keeffe

Mitch Barltrop

Vee Montebello +44 79 7607 5797

Further information on the Company can be found on its website

at

https://uk.ecofininvest.com/funds/us-renewables-infrastructure-trust-plc/

.

The Company's LEI is 2138004JUQUL9VKQWD21.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NAVUPUAPRUPWGQC

(END) Dow Jones Newswires

August 07, 2023 02:00 ET (06:00 GMT)

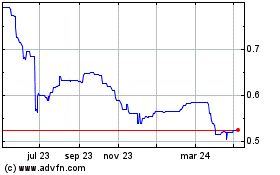

Ecofin U.s. Renewables I... (LSE:RNEW)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

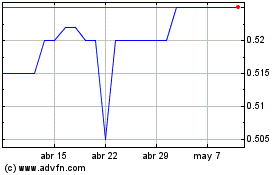

Ecofin U.s. Renewables I... (LSE:RNEW)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025