M&C Saatchi PLC Divestment of South Africa Group subsidiaries

09 Abril 2024 - 10:22AM

RNS Regulatory News

RNS Number : 9107J

M&C Saatchi PLC

09 April 2024

9 April 2024

M&C SAATCHI

PLC

(the

"Company" or "M&C Saatchi")

Divestment of M&C Saatchi

South Africa Group subsidiaries

M&C Saatchi today

announces the divestment

of its shares in the M&C Saatchi South Africa

Group, comprising of M&C Saatchi

Abel, Connect, Levergy, Razor, Dalmatian and Black & White

(together the "M&C Saatchi South Africa Group").

M&C Saatchi's shares in the M&C Saatchi

South Africa Group are being acquired by the existing local

leadership teams which includes the directors and current minority

owners of the M&C Saatchi South Africa Group.

This divestment of the

M&C Saatchi South Africa Group

is in line M&C Saatchi's strategy to simplify

its operating structure while retaining its valued affiliation with

this South African group of agencies.

The cash consideration for the

shares of the M&C

Saatchi South Africa Group is

£5.6 million. The proceeds

of the disposal will be retained by M&C Saatchi. In the

year ended 31 December 2023, the

M&C Saatchi South Africa Group generated a consolidated profit after tax of £1.3

million (£0.7 million excluding minority interests).

Zillah Byng-Thorne, Executive Chair

of M&C Saatchi, said: "We look forward to

continuing our collaboration with M&C Saatchi Abel and

the South Africa Group as our trusted partners in the dynamic

African markets. They have a truly vibrant Africa network of

agencies servicing large global brands and this is an exciting

development which is very much a win-win for both M&C Saatchi

and the M&C Saatchi South Africa Group. We look forward to further

collaboration in the region and expanding our offering and services

to our clients."

Related party transaction

The divestment of shares in

the M&C Saatchi South Africa

Group is considered to be a related party

transaction for the purposes of AIM Rule 13 of the AIM Rules for

Companies due to the acquisition of the Company's interest being

made by directors of the M&C Saatchi

South Africa Group. For the purposes of the

AIM Rules for Companies, the directors of M&C Saatchi, having

consulted with the Company's Nominated Adviser, Liberum Capital

Limited, consider the terms of this divestment to be fair and

reasonable so far as its shareholders are concerned.

FURTHER INFORMATION

|

M&C Saatchi plc

|

+44

(0)20-7543-4500

|

|

Zillah Byng-Thorne, Executive

Chair

Bruce Marson, Chief Financial

Officer

Jill Sherratt, Head of Investor

Relations

|

|

|

|

|

|

Liberum, NOMAD and joint

broker

|

+44

(0)20-3100-2000

|

|

Max Jones, Edd Mansfield, Will King

|

|

|

Deutsche Numis, joint broker

|

+44

(0)20-7260-1000

|

|

Nick Westlake, Iqra Amin

|

|

|

Headland Consultancy

|

+44

(0)20-3805-4822

|

|

Charlie Twigg

|

|

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact

rns@lseg.com or visit

www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our

Privacy

Policy.

END

DISUKAVRSWUSRAR

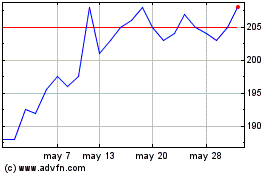

M&c Saatchi (LSE:SAA)

Gráfica de Acción Histórica

De Nov 2024 a Dic 2024

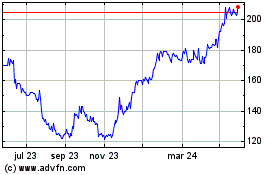

M&c Saatchi (LSE:SAA)

Gráfica de Acción Histórica

De Dic 2023 a Dic 2024