TIDMSDP

RNS Number : 2453A

Schroder AsiaPacific Fund PLC

23 May 2023

Schroder AsiaPacific Fund plc

Half Year Report and Accounts

Schroder AsiaPacific Fund plc hereby submits its Half Year

Report for the period ended 31 March 2023 as required by the

Financial Conduct Authority's Disclosure Guidance and Transparency

Rule 4.2.

The Half Year Report is also being published in hard copy format

and an electronic copy of that document will shortly be available

at the link below:

http://www.rns-pdf.londonstockexchange.com/rns/2453A_1-2023-5-22.pdf

This is also available to download from the Company's

website

https://www.schroders.co.uk/asiapacific

The Company has submitted its Half Year Report to the National

Storage Mechanism and it will shortly be available in unedited full

text at

https://data.fca.org.uk/#/nsm/nationalstoragemechanism .

Enquiries:

Kerry Higgins

Schroder Investment Management Limited

Tel: 020 7658 6189

Chairman's Statement

Performance

Over the six months ended 31 March 2023, the Company's NAV

produced a total return of 8.1%, outperforming the 4.9% total

return from the Company's Benchmark Index, the MSCI All Countries

Asia (excluding Japan). The Company's share price produced a total

return of 8.7% over the period.

Performance over the period was helped by strong stock selection

across a number of markets including India, Hong Kong, Taiwan and

China, which more than offset the negative attribution to

performance from the underweight to China and allocation to

Vietnam.

Further analysis of performance may be found in the Investment

Manager's Review.

Investment Management

I am pleased to announce that Abbas Barkhordar, who previously

had been Assistant Manager, will co-manage the portfolio alongside

Richard Sennitt from 1 June 2023. Richard will remain as lead

manager. The team draw upon Schroders' deep resources in Asia and

the research team based across the region continue to play an

integral role.

Discount management

The Company continued to be active in buying back its shares

during the period and a total of 3,240,000 shares were purchased

for cancellation over that time at a cost of GBP16,050,000. Since

the end of the period, the Company has bought back an additional

990,000 shares. The discount narrowed slightly from 10.8% at the

start of the period to 10.6% as at 31 March 2023.

The Board continues to monitor the Company's discount levels and

regularly reviews the Company's share buy- back policy.

Gearing

The Company was 0.2% geared at the start of the period and at 31

March 2023 held a net cash position. The Board continues to keep

gearing under consideration and the Manager has access to a GBP75m

revolving credit facility, and an overdraft facility, which will be

utilised when the Manager believes that the use of borrowing will

be accretive to returns.

Board succession

As part of its succession plans, the Board welcomed Rupert Hogg

as an additional independent non-executive Director with effect

from 1 May 2023. Rupert has over 30 years international business

experience gained through senior executive level positions in

various organisations, including a number of large Asian based

companies. He joined John Swire & Sons Limited, part of the

Swire conglomerate of businesses, in 1986 and worked with the group

in Hong Kong, Southeast Asia, India, Korea, Australia and the

United Kingdom. Between May 2017 and August 2019, Rupert was Chief

Executive Officer of Cathay Pacific Airways Limited and Chairman of

Hong Kong Dragon Airlines Limited, Rupert has also served as Chief

Operating Officer of Cathay Pacific Airways Limited, a Director of

Cathay Pacific and John Swire & Sons (H.K.) Limited, Chairman

of AHK Air Hong Kong Limited and a Director and Chairman of the

executive committee of Cathay Dragon.

The Board welcomes Rupert's depth of expertise and knowledge and

he will be standing for election at our next annual general

meeting.

Outlook

After a difficult period to September 2022 it has been good to

see performance, both in relative and absolute terms, rebound over

the period.

China's reopening after Zero COVID and a general expectation

that inflation and therefore interest rates are peaking has aided

markets. However, geopolitical issues remain, not least increased

tensions between the USA and China, as does the uncertainty about

the medium term consequences of higher interest rates on the global

economy and financial system.

However, our Investment Manager believes that overall aggregate

valuations in Asia are trading at or below long term averages and

that this does potentially set up a constructive backdrop for Asian

markets in the coming months.

James Williams

Chairman

22 May 2023

Investment Manager's Review

The NAV per share of the Company recorded a total return of 8.1%

over the six months ended 31 March 2023. This was ahead of the

performance of the Benchmark, which rose by 4.9% over the same

period. (Source: Morningstar, net of fees, cum income NAV

return).

Asian markets experienced huge swings in sentiment over the six

months to the end of March 2023, seeing steep falls in China and

Hong Kong during October 2022 in the run up to, and post, the

Communist Party Congress before seeing a dramatic recovery driven

by the Chinese authorities' move away from Zero COVID. This move

took the market, and us, by surprise given the speed and extent of

the reversal. We had expected a slower, more staggered, shift given

the sizeable cohort of the elderly that were still not fully

vaccinated and the political capital that had been invested in the

policy.

In addition to this policy reversal, there were a number of

positive developments including a stabilisation in

US-China relations following the G-20 meeting in Bali, where

presidents Xi and Biden met face-to-face. With the party congress

and US mid-term elections out of the way, there was hope that we

could see increased cooperation between the two countries. In this

vein, there was a positive development from the US Public Company

Accounting Oversight Board ("PCAOB") inspection of Chinese accounts

where, for now at least, the US seem happy with the access they had

been given, thus likely deferring any forced de-listings of Chinese

companies in the US. Unsurprisingly, Chinese American Depositary

Receipts ("ADRs") responded very positively to this. Furthermore,

in China, there was a shift in tone around regulation towards the

internet companies, together with the approval of a number of games

by leading developers and further announcements of government

support for the troubled residential property market. All this led

to a very rapid rise in the market and the China index outperformed

over the period. At one point it was up by nearly 50% from its

end-October 2022 lows, before selling off as some of the re-opening

euphoria died back along with renewed geopolitics concerns.

Elsewhere, there was also a change of fortune among a number of

the major markets - Korea and Taiwan outperformed, with Indonesia

and India the main laggards as investors took profits following

their strong performance throughout 2022. In part, this rotation

into the North East Asian markets was driven by an expectation that

the information technology ("IT") cycle was starting to bottom,

after a sell off in the sector due to a slowing demand outlook that

had seen valuations start to trade near cyclical lows for a number

of names. Leading companies in the sector performed well -

semiconductor manufacturer Samsung Electronics and foundry company

Taiwan Semiconductor Manufacturing Company ("TSMC") were both up by

around 20% over the period for instance. The Indian market had also

started to look expensive and was seen as a source of cash for

investors looking to fund increased exposure to North Asian

markets.

Despite the deteriorating outlook for global growth, inflation

pressures remained elevated which disappointed investors, as US

interest rates would likely remain a headwind for longer. Towards

the end of the period global markets were impacted by the collapse

of Silicon Valley Bank and Credit Suisse and the potential wider

impacts on the financial system. Although we believe that there are

relatively few parallels between these specific cases and the Asian

banks, which we discuss later on, this did see financials

underperform over the period despite banks' earnings benefitting

from rising interest rates. Defensive sectors generally

underperformed over the period, with utilities particularly weak

following a short seller's report on the Adani group in India which

saw those group companies under pressure. As described above, the

IT sector performed particularly well as did the communication

services sector where some of the more growth-orientated internet

platform names, such as Tencent and SEA, performed strongly.

Performance and portfolio activity

Absolute and relative performance over the period was helped by

strong stock selection across a number of markets including India,

Hong Kong, Taiwan and China which more than offset the negative

contributions to performance from the underweight to China and

allocation to Vietnam. Stock selection in Hong Kong and China was

boosted by non-bank financials, including insurance names AIA and

Ping An Insurance, that were beneficiaries of the end to the Zero

COVID policy in China which should see a pick up in policy sales.

AIA in particular will benefit from the return of mainland Chinese

visitors to Hong Kong, who historically have been significant

purchasers of insurance there. Infrastructure spend beneficiaries,

such as supplier of construction equipment Sany Heavy Industry,

also performed well as did Prada, the luxury consumer goods

company, where a recovery in demand has become apparent.

Our stock picks in Taiwan performed well, including IT names

such as fabless integrated circuit design houses Novatek and

Mediatek and foundry TSMC, as did window shutter manufacturer Nien

Made. Vietnam performed poorly due to a combination of a slowing

export sector outlook on global growth concerns, as well as

uncertainties over banks' exposure to the property sector following

a government tightening of regulations and an anti-corruption

campaign.

From a sector perspective, our overweight to, and stock

selection in, IT was the biggest contributor, due to both our names

in Taiwan (as above) and in Korea where Samsung Electronics and

electric vehicle ("EV") battery manufacturer Samsung SDI performed

particularly strongly. Our overweight to financials was a negative,

impacted by the global retracement of banks following the Silicon

Valley Bank and Credit Suisse collapses, but this was more than

offset by the underweights to some of the more defensive areas

including consumer staples and utilities. Our holdings in Hong Kong

property names also added value as the move away from Zero COVID

was expected to lead to a return of shoppers and workers to the

malls and offices.

The geographic exposure in the Company's portfolio continues to

be mainly spread between China, Taiwan, Hong Kong, India, Korea and

Singapore. Over the period, we added to positions in Hong Kong,

including Hong Kong Exchange, insurance company AIA and Bank of

China (Hong Kong) and remain overweight there. China remains a

substantial underweight but is, in part, offset by this overweight

to Hong Kong. The Hong Kong market, in general, looks more

attractive from a valuation perspective with a number of names set

to benefit from the opening of the border with the mainland.

Elsewhere, we reduced our exposure to the Indian market earlier in

the period, as valuations, particularly amongst some of the

domestic names, looked relatively expensive. Here, sales included

auto company Maruti Suzuki and logistics provider Container

Corporation of India. Towards the end of the period valuations were

starting to look more reasonable and we initiated new positions in

Oberoi Realty, a Mumbai based property company, and Mphasis, an IT

services name that had been sold down to attractive levels.

Sectorwise, our largest exposure is to the IT sector, where we

continue to like the Korean and Taiwanese names, followed by the

financials where we have a broad exposure to not only the banks but

also the exchanges and insurers. Although near term earnings in the

IT sector have been seeing downward revisions, we continue to see

some strong long-term drivers for growth around digitisation, the

roll-out of 5G and 'Internet of Things' and Artificial Intelligence

("AI"). We added to our exposure to communications services

companies, where the internet related names have underperformed,

including The Association of Southeast Asian Nations ("ASEAN")

focussed e-commerce and mobile gaming company SEA that is executing

on a plan to bring forward profitability. Reductions in the

consumer discretionary and industrials sectors centred on the

Indian sales mentioned above.

Top three contributors and top three detractors at a market

level, six months to 31 March 2023 (% points)

Total contribution

---------- ------------------

India 1.0

---------- ------------------

Hong Kong 0.9

---------- ------------------

Taiwan 0.8

---------- ------------------

Singapore 0.0

---------- ------------------

Thailand -0.2

---------- ------------------

Vietnam -0.5

---------- ------------------

Outlook and policy

We entered the Year of the Rabbit with the hope that China's

re-opening and the potential for a softer US dollar and peaking US

rate hike cycle should provide a more supportive backdrop for Asian

markets, although slowing global growth would inevitably be a

headwind given Asia's position as manufacturer to the world. More

recently the collapse of several regional banks in the US and the

proposed takeover of Credit Suisse have added to concerns over

financial sector risk globally, as well as the potential knock-on

impact on growth. Geopolitics remains a risk with US-China

relations, Taiwan and the Ukraine all areas of tension.

Looking first at the U-turn in China's Zero COVID policy - which

unsurprisingly saw the Chinese market rally hard off its lows,

rising some 50% before pulling back. Clearly the move away from

Zero COVID is a positive from an economic perspective and, when

combined with the stimulus measures that have been announced,

particularly towards the property sector, this should help remove

the tail risk of a hard landing in China centred on the property

market. We remain very underweight China and, from a reopening

standpoint, it feels as though much of the upside has already been

priced in.

Notwithstanding the recent pullback, valuations of many of the

'reopening plays' pre the U-turn on COVID were not particularly

attractive, as there was already an expectation that 2023 would see

a move away from Zero COVID - albeit very few, including ourselves,

expected it to happen as rapidly as it has. Following the rally,

valuations in a lot of these names rose well above historic levels,

even factoring in a large recovery in profits.

Other areas have in part also benefitted from this change in

policy, together with a perceived lowering of risk from a

regulatory perspective. Statements at the Central Economic Work

Conference ("CEWC") in December 2022 around equal support for state

owned and private owned enterprises, as well as support for the

internet platform companies, helped here. This, along with a

diminished ADR-delisting risk, saw the likes of Alibaba rally

strongly from their lows. Whilst things have improved from a

regulatory perspective, we remain sceptical that risks around

'national service' have entirely gone away, as highlighted by the

recent use of "golden shares", and thus think that long term

returns in a number of areas in the market have likely come

down.

Lastly, although the domestic demand outlook has improved in

China, the external side is moving in the opposite direction, with

net exports likely to continue to be under pressure through 2023.

Given its importance in employment (nearly a quarter of the

workforce), this slowdown will have obvious ramifications for

growth.

All this means we remain meaningfully underweight China,

although we are still looking for opportunities to add to stocks

that have lagged in areas which are less obvious beneficiaries, but

where we think the long term opportunity remains attractive. We

are, however, more positive on Hong Kong, where valuations are

lower and the special administrative region ("SAR") will see a

recovery as the border with the mainland opens and tourists come

back. Given this, and as mentioned above, we did add to some of our

names there including AIA, Bank of China (Hong Kong) and HK

Exchange.

If we look further afield, we think the stabilisation of China's

economy and rebound in consumption, albeit most evident in services

rather than goods, will also help a number of regional names

including some of the IT companies in Korea and Taiwan, resource

names in Australia and other companies that will benefit from an

increased level of travel by Chinese for example in Thailand and

Vietnam. The portfolio holdings in these areas should benefit from

any pick up in China and improved mobility.

Elsewhere, as mentioned earlier, India and Indonesia (as well as

other ASEAN markets) appear to be being used as a funding source

after strong performance last year. Valuations on average in India

are still elevated but are now starting to get more interesting

following the market's pullback, given the strong longer term

growth story there. So whilst we did reduce our exposure at the

start of the period, with sales including some of the more

expensive domestic names, towards the end of the period we started

to add back to names where value had started to emerge.

Markets globally have been more recently impacted by the

collapse of several regional banks in the US and Credit Suisse and

the potential wider impacts on the financial system. The Asian

financial sector has few direct parallels for the problems faced in

these cases. In particular, the Asian banks tend to have strong

deposit franchises, smaller investment portfolios and different

regulatory requirements with regard to adjusting the value of their

fixed income positions to reflect current market conditions. They

have been seeing improved profitability and are generally well

capitalised. Most banks we own are more domestically focussed

retail names and in general trade at attractive valuations and

decent dividend yields. Still, we are mindful of the global

tightening in liquidity that we are seeing and the potential

contagion risks, and will continue to monitor our positions

carefully. Elsewhere, our preference for IT continues. The IT names

remain sensitive to the global slowdown and the Korean names, such

as Samsung Electronics, despite a recent rally are still trading at

relatively attractive levels from a valuation perspective. Although

the demand slowdown has been worse than we expected, there are

signs that an adjustment on the supply side is starting to take

place as announcements on production and capital expenditure cuts

have started to be seen.

Underweights remain in the more defensive areas of the market,

including consumer staples and utilities, where valuations in our

view still remain relatively full.

Near term, it is likely that we will see further downward

revisions to earnings as global growth slows and an ongoing period

of inventory adjustment amongst companies to reflect this slower

growth, which will hopefully put them in a position to start to

grow earnings once more. Given overall aggregate valuations for the

region are now trading at or below long-term averages, this does

set up a more constructive backdrop for Asian markets in the coming

year, barring a global hard landing or a more extreme geopolitical

risk event.

To conclude, it is worth remembering that as investors we buy

companies not countries. We are mindful of the impact political and

macroeconomic factors can have on equities and returns, but we are

bottom-up stock-pickers first and foremost, focusing on the

company's return prospects and valuation. We do not try to pick

companies which will do well based purely on a particular macro

environment which we have forecast; rather we try to pick

well-managed companies which have sustainable structural

advantages. Therefore, a focus on attractive bottom up ideas, in

our view, remains essential.

Market Weights - Company vs. Benchmark Index

Net Asset

Value Weight (%)

31 Mar 30 Sep

Benchmark

Index

Weight

(%)

31 Mar

2023 2022 2023

Mainland China 18.2 18.7 36.8

---------------- --------- -------- ---------

Taiwan 16.2 15.0 17.1

---------------- --------- -------- ---------

India 15.0 17.0 14.6

---------------- --------- -------- ---------

Hong Kong (SAR) 14.4 12.9 7.2

---------------- --------- -------- ---------

South Korea 12.6 12.4 13.4

---------------- --------- -------- ---------

Singapore 8.2 8.4 4.0

---------------- --------- -------- ---------

Australia 3.7 3.8 -

---------------- --------- -------- ---------

Vietnam 2.6 3.1 -

---------------- --------- -------- ---------

Indonesia 2.3 2.6 2.1

---------------- --------- -------- ---------

Thailand 1.8 2.2 2.4

---------------- --------- -------- ---------

Philippines 1.1 0.9 0.8

---------------- --------- -------- ---------

Malaysia - - 1.6

---------------- --------- -------- ---------

Other equities* 3.9 3.2 -

---------------- --------- -------- ---------

Gearing** - (0.2) -

---------------- --------- -------- ---------

Total 100.0 100.0 100.0

---------------- --------- -------- ---------

* UK (including a Unit Trust) and Italy.

** Cash less borrowings used for investment purposes.

Source: Schroders, MSCI, 31 March 2023.

Schroder Investment Management Limited

22 May 2023

Half Year Report

Principal risks and uncertainties

The principal risks and uncertainties associated with the

Company's business fall into the following categories: strategic

risk; investment management and performance risk; financial and

currency risk; political risk; custody risk; gearing and leverage

risk; accounting, legal and regulatory change risk; service

provider risk; cyber and climate change risk. A detailed

explanation of the risks and uncertainties in each of these

categories can be found on pages 21 and 22 of the Company's

published annual report and accounts for the year ended 30

September 2022.

These risks and uncertainties have not materially changed during

the six months ended 31 March 2023. However, the Board undertook a

review of principal and emerging risks for the Company while

reviewing these accounts. The Directors noted that geopolitical

risk and climate change risk in particular continue to develop.

These matters will continue to be monitored and reported on in the

next annual report as appropriate.

Going concern

Having assessed the principal risks and uncertainties, and the

other matters discussed in connection with the viability statement

as set out on page 23 of the published annual report and accounts

for the year ended 30 September 2022, the Directors consider it

appropriate to adopt the going concern basis in preparing the

accounts.

Related party transactions

There have been no transactions with related parties that have

materially affected the financial position or the performance of

the Company during the six months ended 31 March 2023.

Directors' responsibility statement

The Directors confirm that, to the best of their knowledge, this

set of condensed financial statements has been prepared in

accordance with United Kingdom Generally Accepted Accounting

Practice, in particular with Financial Reporting Standard 104

"Interim Financial Reporting" and with the Statement of Recommended

Practice, "Financial Statements of Investment Companies and Venture

Capital Trusts" issued in July 2022, and that this half year report

includes a fair review of the information required by 4.2.7R and

4.2.8R of the FCA's Disclosure Guidance and Transparency Rules.

Investment Portfolio as at 31 March 2023

Investments are classified by the Manager in the region or

country of their main business operations or listing. Stocks in

bold are the 20 largest investments, which by value account for

65.1% (30 September 2022: 60.5% and 31 March 2022: 62.5%) of total

investments.

GBP'000 %

-------------------------------------------------- ------- -----

Mainland China

-------------------------------------------------- ------- -----

Tencent Holdings(1) 49,606 5.4

-------------------------------------------------- ------- -----

Alibaba(1) 30,233 3.3

-------------------------------------------------- ------- -----

Midea (including A shares and LEPO) 18,283 2.0

-------------------------------------------------- ------- -----

Yum China(1,2) 11,456 1.3

-------------------------------------------------- ------- -----

Sany Heavy Industry A 11,068 1.2

-------------------------------------------------- ------- -----

Ping An Insurance H(1) 11,066 1.2

-------------------------------------------------- ------- -----

JD.com(1) 11,043 1.2

-------------------------------------------------- ------- -----

Shenzhou International(1) 9,633 1.1

-------------------------------------------------- ------- -----

Hongfa Technology A 7,768 0.8

-------------------------------------------------- ------- -----

LONGi Green Energy Technology A 4,198 0.5

-------------------------------------------------- ------- -----

Meituan(1) 1,844 0.2

-------------------------------------------------- ------- -----

Total Mainland China 166,198 18.2

-------------------------------------------------- ------- -----

Taiwan

-------------------------------------------------- ------- -----

Taiwan Semiconductor Manufacturing 88,298 9.7

-------------------------------------------------- ------- -----

MediaTek 19,083 2.1

-------------------------------------------------- ------- -----

Delta Electronics 11,462 1.3

-------------------------------------------------- ------- -----

Nien Made Enterprise 9,989 1.1

-------------------------------------------------- ------- -----

Giant Manufacturing 8,512 0.9

-------------------------------------------------- ------- -----

Hon Hai Precision Industries 6,339 0.7

-------------------------------------------------- ------- -----

Novatek Microelectronics 3,393 0.4

-------------------------------------------------- ------- -----

Total Taiwan 147,076 16.2

-------------------------------------------------- ------- -----

India

-------------------------------------------------- ------- -----

HDFC Bank 34,989 3.8

-------------------------------------------------- ------- -----

ICICI Bank (including ADR(2) ) 28,980 3.2

-------------------------------------------------- ------- -----

Infosys 15,487 1.7

-------------------------------------------------- ------- -----

Apollo Hospitals Enterprise 14,810 1.6

-------------------------------------------------- ------- -----

Tata Consultancy Services 11,921 1.3

-------------------------------------------------- ------- -----

Reliance Industries 9,836 1.1

-------------------------------------------------- ------- -----

Oberoi Realty 9,062 1.0

-------------------------------------------------- ------- -----

Mphasis 7,996 0.9

-------------------------------------------------- ------- -----

Delhivery 3,337 0.4

-------------------------------------------------- ------- -----

Total India 136,418 15.0

-------------------------------------------------- ------- -----

Hong Kong (SAR)

-------------------------------------------------- ------- -----

AIA 34,667 3.8

-------------------------------------------------- ------- -----

Hong Kong Exchanges and Clearing 22,877 2.5

-------------------------------------------------- ------- -----

BOC Hong Kong 19,617 2.1

-------------------------------------------------- ------- -----

Techtronic Industries 16,303 1.8

-------------------------------------------------- ------- -----

Kerry Properties 11,836 1.3

-------------------------------------------------- ------- -----

Hang Lung Properties 11,451 1.2

-------------------------------------------------- ------- -----

Swire Properties 9,507 1.0

-------------------------------------------------- ------- -----

ASM Pacific Technology 6,437 0.7

-------------------------------------------------- ------- -----

Total Hong Kong (SAR) 132,695 14.4

-------------------------------------------------- ------- -----

South Korea

-------------------------------------------------- ------- -----

Samsung Electronics (including preference shares) 86,648 9.5

-------------------------------------------------- ------- -----

Samsung SDI 21,933 2.4

-------------------------------------------------- ------- -----

LG H&H 6,258 0.7

-------------------------------------------------- ------- -----

Total South Korea 114,839 12.6

-------------------------------------------------- ------- -----

Singapore

-------------------------------------------------- ------- -----

Oversea-Chinese Banking 21,324 2.3

-------------------------------------------------- ------- -----

Singapore Telecommunications 15,873 1.7

-------------------------------------------------- ------- -----

Singapore Exchange 14,471 1.6

-------------------------------------------------- ------- -----

Sea ADR(2) 11,616 1.3

-------------------------------------------------- ------- -----

DBS Bank 11,561 1.3

-------------------------------------------------- ------- -----

Total Singapore 74,845 8.2

-------------------------------------------------- ------- -----

Australia

-------------------------------------------------- ------- -----

BHP Group(3) 10,599 1.2

-------------------------------------------------- ------- -----

Rio Tinto(3) 10,417 1.1

-------------------------------------------------- ------- -----

Orica 9,107 1.0

-------------------------------------------------- ------- -----

Woodside Energy(3) 3,577 0.4

-------------------------------------------------- ------- -----

Total Australia 33,700 3.7

-------------------------------------------------- ------- -----

Vietnam

-------------------------------------------------- ------- -----

Dragon Capital Vietnam Enterprise Investments(4) 17,016 1.9

-------------------------------------------------- ------- -----

Vietnam Dairy Products 5,834 0.6

-------------------------------------------------- ------- -----

Mobile World Investement 1,200 0.1

-------------------------------------------------- ------- -----

Total Vietnam 24,050 2.6

-------------------------------------------------- ------- -----

United Kingdom

-------------------------------------------------- ------- -----

Schroder Asian Discovery Fund Z Acc(4) 17,864 2.0

-------------------------------------------------- ------- -----

Standard Chartered 4,683 0.5

-------------------------------------------------- ------- -----

Total United Kingdom 22,547 2.5

-------------------------------------------------- ------- -----

Indonesia

-------------------------------------------------- ------- -----

Bank Mandiri 20,611 2.3

-------------------------------------------------- ------- -----

Total Indonesia 20,611 2.3

-------------------------------------------------- ------- -----

Thailand

-------------------------------------------------- ------- -----

Kasikornbank NVDR 11,790 1.3

-------------------------------------------------- ------- -----

Bangkok Dusit Medical Services NVDR 4,946 0.5

-------------------------------------------------- ------- -----

Total Thailand 16,736 1.8

-------------------------------------------------- ------- -----

Italy

-------------------------------------------------- ------- -----

Prada(1) 13,194 1.4

-------------------------------------------------- ------- -----

Total Italy 13,194 1.4

-------------------------------------------------- ------- -----

Philippines

-------------------------------------------------- ------- -----

International Container Terminal Services 10,057 1.1

-------------------------------------------------- ------- -----

Total Philippines 10,057 1.1

-------------------------------------------------- ------- -----

Total Investments(5) 912,966 100.0

-------------------------------------------------- ------- -----

(1) Listed in Hong Kong.

(2) Listed in the USA.

(3) Listed in the United Kingdom.

(4) Predominantly invested in Asia

(5) Total investments comprises the following:

GBP'000 %

------------------------------------------ ------- -----

Equities, including ADRs, LEPOs and NVDRs 863,028 94.5

------------------------------------------ ------- -----

Collective investment funds 34,880 3.9

------------------------------------------ ------- -----

Preference shares 15,058 1.6

------------------------------------------ ------- -----

Total investments 912,966 100.0

------------------------------------------ ------- -----

The following abbreviations have been used above:

ADR: American Depositary Receipt

LEPO: Low Exercise Price Option

NVDR: Non Voting Depositary Receipt

Income Statement

for the six months ended 31 March 2023 (unaudited)

(Audited)

(Unaudited) (Unaudited) For the year

For the six months For the six months Ended 30 September

ended 31 March 2023 ended 31 March 2022 2022

Revenue Capital Total Revenue Capital Total Revenue Capital Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------- -------- -------- -------- -------- --------- --------- -------- ---------- ----------

Gains/(losses)

on investments

held at fair

value through

profit or loss - 65,764 65,764 - (44,814) (44,814) - (154,731) (154,731)

Net foreign currency

gains/(losses) - 858 858 - (381) (381) - (2,936) (2,936)

Income from

investments 6,017 142 6,159 5,804 - 5,804 24,673 - 24,673

Other interest

receivable and

similar income 66 - 66 1 - 1 12 - 12

---------------------- -------- -------- -------- -------- --------- --------- -------- ---------- ----------

Gross return/(loss) 6,083 66,764 72,847 5,805 (45,195) (39,390) 24,685 (157,667) (132,982)

Investment management

fee (807) (2,420) (3,227) (911) (2,732) (3,643) (1,728) (5,185) (6,913)

Administrative

expenses (677) - (677) (787) - (787) (1,437) - (1,437)

---------------------- -------- -------- -------- -------- --------- --------- -------- ---------- ----------

Net return/(loss)

before finance

costs and taxation 4,599 64,344 68,943 4,107 (47,927) (43,820) 21,520 (162,852) (141,332)

Finance costs (77) (231) (308) (12) (37) (49) (48) (145) (193)

---------------------- -------- -------- -------- -------- --------- --------- -------- ---------- ----------

Net return/(loss)

before taxation 4,522 64,113 68,635 4,095 (47,964) (43,869) 21,472 (162,997) (141,525)

Taxation (note

3) (624) (175) (799) (539) 208 (331) (1,799) 1,145 (654)

---------------------- -------- -------- -------- -------- --------- --------- -------- ---------- ----------

Net return/(loss)

after taxation 3,898 63,938 67,836 3,556 (47,756) (44,200) 19,673 (161,852) (142,179)

---------------------- -------- -------- -------- -------- --------- --------- -------- ---------- ----------

Return/(loss)

per share (note

4) 2.45p 40.24p 42.69p 2.17p (29.08)p (26.91)p 12.04p (99.08)p (87.04)p

---------------------- -------- -------- -------- -------- --------- --------- -------- ---------- ----------

The "Total" column of this statement is the profit and loss

account of the Company. The "Revenue" and "Capital" columns

represent supplementary information prepared under guidance issued

by The Association of Investment Companies. The Company has no

other items of other comprehensive income, and therefore the net

return/(loss) after taxation is also the total comprehensive

income/(loss) for the period.

All revenue and capital items in the above statement derive from

continuing operations. No operations were acquired or discontinued

in the period.

Statement of Changes in Equity

For the six months ended 31 March 2023 (unaudited)

Called-up Capital Warrant Share

share Share redemption exercise purchase Capital Revenue

capital premium reserve reserve reserve reserves reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- ---------- -------- ----------- --------- --------- --------- -------- --------

At 30 September 2022 16,080 100,956 4,064 8,704 - 726,968 21,415 878,187

Repurchase and cancellation

of the Company's own

shares (324) - 324 - - (16,050) - (16,050)

Net return after

taxation - - - - - 63,938 3,898 67,836

Dividend paid in

the period (note 5) - - - - - - (19,030) (19,030)

---------------------------- ---------- -------- ----------- --------- --------- --------- -------- --------

At 31 March 2023 15,756 100,956 4,388 8,704 - 774,856 6,283 910,943

---------------------------- ---------- -------- ----------- --------- --------- --------- -------- --------

For the six months ended 31 March 2022 (unaudited)

Called-up Capital Warrant Share

share Share redemption exercise purchase Capital Revenue

capital premium reserve reserve reserve reserves reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- ---------- -------- ----------- --------- --------- --------- -------- ---------

At 30 September 2021 16,486 100,956 3,658 8,704 16,110 894,363 17,664 1,057,941

Repurchase and cancellation

of the Company's own

shares (132) - 132 - (7,433) - - (7,433)

Net (loss)/return

after taxation - - - - - (47,756) 3,556 (44,200)

Dividend paid in

the period (note 5) - - - - - - (15,922) (15,922)

---------------------------- ---------- -------- ----------- --------- --------- --------- -------- ---------

At 31 March 2022 16,354 100,956 3,790 8,704 8,677 846,607 5,298 990,386

---------------------------- ---------- -------- ----------- --------- --------- --------- -------- ---------

For the year ended 30 September 2022 (audited)

Called-up Capital Warrant Share

share Share redemption exercise purchase Capital Revenue

capital premium reserve reserve reserve reserves reserve Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

---------------------------- ---------- -------- ----------- --------- --------- --------- -------- ---------

At 30 September 2021 16,486 100,956 3,658 8,704 16,110 894,363 17,664 1,057,941

Repurchase and cancellation

of the Company's own

shares (406) - 406 - (16,110) (5,543) - (21,653)

Net (loss)/return

after taxation - - - - - (161,852) 19,673 (142,179)

Dividend paid in

the year (note 5) - - - - - - (15,922) (15,922)

---------------------------- ---------- -------- ----------- --------- --------- --------- -------- ---------

At 30 September 2022 16,080 100,956 4,064 8,704 - 726,968 21,415 878,187

---------------------------- ---------- -------- ----------- --------- --------- --------- -------- ---------

Statement of Financial Position

at 31 March 2023 (unaudited)

(Unaudited) (Unaudited) (Audited)

31 March 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

---------------------------------------- ----------- ----------- ------------

Fixed assets

Investments held at fair value through

profit or loss 912,966 993,162 882,801

---------------------------------------- ----------- ----------- ------------

Current assets

Debtors 3,188 5,234 7,920

Cash at bank and in hand 12,317 14,076 11,343

---------------------------------------- ----------- ----------- ------------

15,505 19,310 19,263

---------------------------------------- ----------- ----------- ------------

Current liabilities

Creditors: amounts falling due within

one year (14,464) (17,556) (19,964)

---------------------------------------- ----------- ----------- ------------

Net current assets/(liabilities) 1,041 1,754 (701)

---------------------------------------- ----------- ----------- ------------

Total assets less current liabilities 914,007 994,916 882,100

---------------------------------------- ----------- ----------- ------------

Non current liabilities

---------------------------------------- ----------- ----------- ------------

Deferred taxation (3,064) (4,530) (3,913)

---------------------------------------- ----------- ----------- ------------

Net assets 910,943 990,386 878,187

---------------------------------------- ----------- ----------- ------------

Capital and reserves

Called-up share capital (note 6) 15,756 16,354 16,080

Share premium 100,956 100,956 100,956

Capital redemption reserve 4,388 3,790 4,064

Warrant exercise reserve 8,704 8,704 8,704

Share purchase reserve - 8,677 -

Capital reserves 774,856 846,607 726,968

Revenue reserve 6,283 5,298 21,415

---------------------------------------- ----------- ----------- ------------

Total equity shareholders' funds 910,943 990,386 878,187

---------------------------------------- ----------- ----------- ------------

Net asset value per share (note 7) 578.15p 605.59p 546.13p

---------------------------------------- ----------- ----------- ------------

Notes to the Accounts

1. Financial Statements

The information contained within the accounts in this half year

report has not been audited or reviewed by the Company's

independent auditor.

The figures and financial information for the year ended 30

September 2022 are extracted from the latest published accounts of

the Company and do not constitute statutory accounts for that year.

Those accounts have been delivered to the Registrar of Companies

and included the report of the auditor which was unqualified and

did not contain a statement under either section 498(2) or 498(3)

of the Companies Act 2006.

2. Accounting policies

Basis of accounting

The accounts have been prepared in accordance with United

Kingdom Generally Accepted Accounting Practice, in particular with

Financial Reporting Standard 104 "Interim Financial Reporting" and

with the Statement of Recommended Practice "Financial Statements of

Investment Trust Companies and Venture Capital Trusts" issued by

the Association of Investment Companies in July 2022.

All of the Company's operations are of a continuing nature.

The accounting policies applied to these accounts are consistent

with those applied in the accounts for the year ended 30 September

2022.

3. Taxation

The Company's effective corporation tax rate is nil, as

deductible expenses exceed taxable income. The taxation charge

comprises irrecoverable overseas withholding tax on dividends

receivable, and overseas capital gains tax.

4. Return/(loss) per share

(Unaudited) (Unaudited)

Six months Six months (Audited)

ended ended Year ended

31 March 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

-------------------------------------- ------------ ------------ ------------

Revenue return 3,898 3,556 19,673

Capital return/(loss) 63,938 (47,756) (161,852)

-------------------------------------- ------------ ------------ ------------

Total return/(loss) 67,836 (44,200) (142,179)

-------------------------------------- ------------ ------------ ------------

Weighted average number of shares in

issue during the period 158,887,090 164,224,700 163,346,606

Revenue return per share 2.45p 2.17p 12.04p

Capital return/ (loss) per share 40.24p (29.08)p (99.08)p

-------------------------------------- ------------ ------------ ------------

Total return/(loss) per share 42.69p (26.91)p (87.04)p

-------------------------------------- ------------ ------------ ------------

5. Dividends paid

(Unaudited) (Unaudited)

Six months Six months (Audited)

ended ended Year ended

31 March 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

----------------------------------- ----------- ----------- ------------

2022 final dividend paid of 12.0p

(2021: 9.7p) 19,030 15,922 15,922

----------------------------------- ----------- ----------- ------------

No interim dividend has been declared in respect of the six

months ended 31 March 2023 (2022: nil).

6. Called-up share capital

(Unaudited) (Unaudited)

Six months Six months (Audited)

ended ended Year ended

31 March 31 March 30 September

2023 2022 2022

---------------------------------------- ------------ ------------ ------------

Ordinary shares of 10p each, allotted,

called-up and fully paid:

Opening balance of shares in issue 160,800,716 164,860,716 164,860,716

Shares repurchased and cancelled (3,240,000) (1,320,000) (4,060,000)

---------------------------------------- ------------ ------------ ------------

Closing balance of shares in issue 157,560,716 163,540,716 160,800,716

---------------------------------------- ------------ ------------ ------------

7. Net asset value per share

Net asset value per share is calculated by dividing

shareholders' funds by the number of shares in issue at 31 March

2023 of 157,560,716 (31 March 2022: 163,540,716 and 30 September

2022: 160,800,716).

8. Financial instruments measured at fair value

The Company's financial instruments within the scope of FRS 102

that are held at fair value comprise its investment portfolio.

FRS 102 requires that financial instruments held at fair value

are categorised into a hierarchy consisting of the three levels

below. A fair value measurement is categorised in its entirety on

the basis of the lowest level input that is significant to the fair

value measurement.

Level 1 - valued using unadjusted quoted prices in active

markets for identical assets.

Level 2 - valued using observable inputs other than quoted

prices included within Level 1.

Level 3 - valued using inputs that are unobservable.

The Company's investment portfolio was categorised as

follows:

(Unaudited) (Unaudited) (Audited)

31 March 31 March 30 September

2023 2022 2022

GBP'000 GBP'000 GBP'000

--------- ----------- ----------- ------------

Level 1 912,966 993,162 882,801

Level 2 - - -

Level 3 - - -

--------- ----------- ----------- ------------

Total 912,966 993,162 882,801

--------- ----------- ----------- ------------

There have been no transfers between Levels 1, 2 or 3 during the

period (period ended 31 March 2022 and year ended 30 September

2022: nil).

9 . Events after the interim period that have not been reflected

in the financial statements for the interim period

The Directors have evaluated the period since the interim date

and have not noted any significant events which have not been

reflected in the financial statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR BUGDUXSDDGXD

(END) Dow Jones Newswires

May 23, 2023 02:00 ET (06:00 GMT)

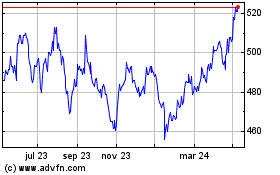

Schroder Asiapacific (LSE:SDP)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

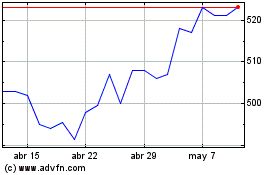

Schroder Asiapacific (LSE:SDP)

Gráfica de Acción Histórica

De May 2023 a May 2024