TIDMSHIP TIDMSHPP

RNS Number : 2797T

Tufton Oceanic Assets Ltd.

17 March 2023

Tufton Oceanic Assets Limited

("Tufton Oceanic Assets" or the "Company")

Interim Results for the six month period ended 31 December

2022

Tufton Oceanic Assets announces its interim results for the six

month period ended 31 December 2022. A copy of the Interim Report

and Unaudited Financial Statements will shortly be available on the

Company's website in the Investor Relations section at

www.tuftonoceanicassets.com.

For further information, please contact:

Tufton Investment Management Ltd (Investment

Manager)

Andrew Hampson

Paulo Almeida +44 (0) 20 7518 6700

N+1 Singer

James Maxwell, Alex Bond (Corporate Finance)

Alan Geeves, James Waterlow, Sam Greatrex

(Sales) +44 (0) 20 7496 3000

Hudnall Capital LLP

Andrew Cade +44 (0) 20 7520 9085

Highlights

-- Portfolio Operating Profit was strong at US$27.0m (vs.

US$17.4m in the financial period ending 31 December 2021) but NAV

Total Return over the financial period was negatively impacted by

unrealised losses in bulkers and the remaining containership,

Riposte.

-- NAV Total Return was -0.6% during the financial period, 7.7%

in 2022 and 91.1% since inception.

-- The 31 December 2022 NAV was US$431.6m (GBP358.8m) or US$1.402 (GBP1.165) per share.

-- The Investment Manager expects the bulker market to improve

from 2Q23, aided by the easing of Covid-related restrictions in

China and strong supply-side fundamentals.

-- After the end of the financial period, the Company agreed to

divest Riposte with realised net IRR exceeding 12%. The aggregate

realised net IRR on the Company's containerships over the past five

years is c.27%.

-- The Company agreed to acquire two product tankers, Mindful

and Courteous, below DRC, financed primarily by a new US$60m loan

which is secured on Mindful, Courteous, Marvelous and

Exceptional.

-- The Company is well positioned to benefit from the ongoing

strength in the product tanker and chemical tanker markets and the

expected improvement in the bulker market.

-- Encouraged by strong visible cash flows from increased

charter cover, diversification and continued supply-side recovery,

the Company raised its target annual dividend from $0.080 to $0.085

per share, which commenced from 4Q22.

-- The Company is forecast to have a dividend cover of c.1.8x

over the next 18 months (through the end of 2Q24) after reinvesting

the proceeds from the divestment of Riposte.

-- The Company's operating emissions intensity improved by c.34%

YoY in 2022 primarily because of capital re-allocation. We expect

further improvement as Energy Saving Device ("ESD") retrofits on

eight vessels are fully completed by mid 2023 and on another three

vessels by the end of the year.

-- We prioritise crew welfare and have especially taken action

to improve the welfare of the Ukrainian crew members on board the

Company's vessels.

-- The Investment Manager's principals acquired an additional

613,000 ordinary shares during the financial period such that

Investment Manager-related shareholders owned 3.2% of the issued

share capital at 31 December 2022.

Chairman's Statement

Introduction

On behalf of the Board, I present the Interim Financial

Statements of the Company for the period ended 31 December

2022.

During the financial period, the Company acquired two product

tankers and agreed to divest its last containership, Riposte, after

the end of the financial period. The fleet as at 31 December 2022

consisted of eight handysize bulkers, an ultramax bulker, one

containership and thirteen tankers. Full details of the investment

portfolio are set out in the Investment Manager's Report.

Performance

As at 31 December 2022, the Company's NAV was US$431.6m, being

US$1.402 per share (US$447.5m and US$1.450 per share as at 30 June

2022). NAV Total Return over the period was -0.6%. Despite a strong

operating profit, performance was impacted by unrealised capital

value losses. The bulker and containership markets weakened over

the financial period. The Investment Manager expects the bulker

market to improve from 2Q23, aided by the easing of Covid-related

restrictions in China and strong supply-side fundamentals.

The Company is well positioned to benefit from the ongoing

strength in the product tanker and chemical tanker markets and the

expected improvement in the bulker market.

The Average Charter Length on the Company's product tankers at

31 December 2022 was 2.3 years. Encouraged by the strong charter

coverage, the Company raised its target annual dividend from

US$0.08 to US$0.085 per share, commencing from 4Q22. The Company is

forecast to have a dividend cover of c.1.8x over the next 18 months

(through the end of 2Q24) after reinvesting the proceeds from the

divestment of Riposte.

During the year, the Company's share price decreased from

US$1.230 per share as at the close of business 30 June 2022 to

US$1.150 per share as at the close of business 31 December

2022.

Discount Management

On average, the Company's shares traded at an 18% discount to

NAV over the financial period. As at 10 March 2023, the Company's

shares traded at a 18% discount to the ex-dividend 31 December 2022

NAV. In November and December 2022, the Company (in accordance with

the authority granted to it by Shareholders) repurchased 850,000

shares at a cost of US$969,451. Refer to Note 5 for more details.

At the end of the financial period, there were 850,000 Shares held

in Treasury and 307,778,541 Shares outstanding.

From the period end the Company has bought back an additional

710,000 shares with 1,560,000 Shares held in Treasury and

307,068,541 Shares outstanding as at 15 March 2023.

Dividends

During the period the Company declared and paid dividends to

shareholders as follows:

Period end Dividend Announce Ex div Record Paid date

per share date date date

(US$)

Ordinary shareholders

30.06.22 0.02000 19.07.22 28.07.22 29.07.22 12.08.22

30.09.22 0.02000 18.10.22 27.10.22 28.10.22 11.11.22

A further dividend of US$0.02125 per share was declared on 17

January 2023 for the quarter ending 31 December 2022. The dividend

was paid on 10 February 2023 to holders of shares on record date 27

January 2023 with an ex-dividend date of 26 January 2023.

Russian Invasion of Ukraine

None of the Company's vessels were directly impacted by the war

in Ukraine and all remain fully insured against war perils. The

Investment Manager has formally requested all our charterers and

vessel managers to desist from trade with Russia wherever legally

possible except for humanitarian purposes. Additionally, the

Investment Manager monitors compliance through regular inspection

of vessel logs and satellite data. The Company and its vessels will

remain compliant with all international sanctions imposed by the

US, UK, EU and UN. We have had no issues to date with any vessels

being damaged or blocked. The Board and the Investment Manager

remain watchful in monitoring the war and its consequences for

shipping and the Company.

Covid-19

The global economy has largely recovered from the negative

impact of Covid. The delays to crew rotation caused by national

restrictions put in place to contain the spread of Covid were

largely resolved by 4Q22. The introduction of Covid-related

restrictions in China over the summer of 2022 impacted the bulker

market and increased planned capex and off-hire for some of the

Company's vessels. There is a growing consensus that the easing of

Covid-related restrictions in China from January will lead to

improvement in the bulker market.

Corporate Governance

The Company is a member of the Association of Investment

Companies ("AIC") and complies with the provisions of the current

AIC Code of Corporate Governance which sets out a framework of best

practice in respect of governance of investment companies (the "AIC

Code"). The AIC Code has been endorsed by the Financial Reporting

Council and the Guernsey Financial Services Commission (the "GFSC")

as an alternative means for AIC members to meet their obligations

in relation to the UK Corporate Governance Code.

The Company established a Management Engagement Committee during

the period which is chaired by Paul Barnes and includes all of the

members of the Board. The purpose of the committee is to formulate

the reviews undertaken of the Investment Manager and the other key

service providers. The annual reviews were undertaken during 4Q22

and 1Q23. Further information of the findings of the reviews will

be included in the Audited Financial Statements each year.

Where the Company's stakeholders, including shareholders and

their appointed agents, have matters they wish to raise with the

Board in respect to the Company, I would encourage them to contact

us.

Environmental, Social, Governance ("ESG")

Our Investment Manager continues to integrate ESG factors into

its investment recommendations and asset ownership practices. As

you will see in the Investment Manager's Report on pages 20 to 26

there is significant focus given to the ESG aspects of the

Company's operations.

Crew welfare continued to be a significant area of focus with

the Investment Manager paying special attention to the Ukrainian

crew members on the Company's vessels. Where requested, we will

assist in the repatriation of crew members or extension of crew

contracts.

The Board has reviewed and approved the Investment Manager's

Responsible Investment Policy and Implementation Report for the

Company. Shareholders can view the policy and the implementation

report on the Company's website. Being a closed-end investment

company listed on the Specialist Funds Segment of the London Stock

Exchange, the Company is not required to have disclosure aligned

with the Task Force on Climate-related Financial Disclosures

("TCFD") framework. Nevertheless, the Investment Manager supports

the framework and will publish a separate sustainability report

later this year based on TCFD guidelines.

Annual General Meeting

The Annual General Meeting ("AGM") of the Company was held on 27

October 2022. I am pleased to report that all the resolutions were

duly passed.

Outlook

The Investment Manager expects:

-- the bulker market to improve from 2Q23;

-- the Company's chemical tankers to benefit from strong

supply-side fundamentals and the tight product tanker market;

and

-- further upside in secondhand values of bulkers and tankers

due to limited shipyard capacity for new deliveries and tighter

environmental regulations which increase newbuild prices.

The Investment Manager continues to seek good investment

opportunities across the segments.

...........................

Rob King

Non-executive Chairman

Board Members

The Company's Board of Directors comprises four independent

non-executive Directors. The Board's role is to manage and monitor

the Company in accordance with its objectives. The Board monitors

the Company's adherence to its investment policy, its operational

and financial performance and its underlying assets, as well as the

performance of the Investment Manager and other key service

providers. In addition, the Board has overall responsibility for

the review and approval of the Company's NAV calculations and

financial statements. It also maintains the Company's risk

register, which it monitors and updates on a regular basis.

The Directors of the Company who served during the period

are:

Robert King

Stephen Le Page

Paul Barnes

Christine Rødsæther

They also served during the year ended 30 June 2022, and their

brief biographies are available in the annual report as at that

date.

Investment Manager's Report

Highlights of the Financial Period

The Company continued to re-allocate capital, in line with its

investment strategy and commitment to ESG. During the financial

period, the Company acquired two fuel-efficient product tankers and

after the end of the financial period agreed to divest its last

containership. The capital re-allocation has better positioned the

Company to benefit from the ongoing strength in the product tanker

and chemical tanker markets and the expected improvement in the

bulker market from 2Q23.

During the financial period, the product and chemical tanker

markets strengthened while the bulker and containership markets

weakened. We expect the product and chemical tanker markets to

remain strong in the medium term, the bulker market to improve from

2Q23 and the containership market to remain relatively weak in

2023. Please see the Shipping Market section of this report for

details.

This section utilises alternative measures, applied on an

unconsolidated basis, to analyse performance. Please see the

Definitions on pages 51 to 55 for details of the measures. NAV

Total Return was -0.6% during the financial period, 7.7% for 2022

and 91.1% since inception. The effectiveness of our strategy of

diversification across the major segments, conservative leverage

and strong charter cover is evidenced by the portfolio performance

and growing dividend through a variety of market conditions since

the Company's listing in December 2017.

Portfolio Operating Profit was strong at US$27.0m (vs. US$17.4m

in the financial period ending 31 December 2021) mainly as the

Company benefited from a larger bulker fleet and higher bulker time

charter rates. While the bulker market weakened over the financial

period, we expect it to improve from 2Q23, aided by the easing of

Covid-related restrictions in China and strong supply-side

fundamentals. At 31 December 2022, the Average Charter Length on

the Company's bulkers was 0.3 years. We expect the improving bulker

market will offer opportunities to employ our bulkers on charters

at higher rates than at the end of the financial period.

There was a loss of US$16.5m in charter-free value as the bulker

and containership markets weakened during the financial period. The

fall in bulker and containership charter-free values outweighed the

rise in product tanker and chemical tanker charter-free values. We

expect the bulker market and charter-free values to improve from

2Q23. The Company started divesting containerships from mid 2021 in

anticipation of a weaker market and agreed to divest its last

containership, Riposte, just after the end of the financial period.

The realised net IRR on Riposte exceeds 12% and the aggregate

realised net IRR on the Company's containerships over the past five

years is c.27%.

There was a loss of US$17.1m in charter value mainly due to

rising product tanker time charter rates. The Company did not

benefit significantly from higher charter values on bulkers, which

had only 0.3 years of Average Charter Length at the end of the

financial period. At the end of the financial period, the portfolio

had a total negative charter value of US$43.3m. This will trend to

zero (i.e. increase NAV) in the medium term. Ceteris paribus, the

negative charter value will unwind by c.US$18m in 2023. During the

financial period, the rise in product tanker charter-free values

slightly lagged the rise in time charter rates as the market

strengthened. Product tanker charter-free values should rise

further as confidence builds in the duration of the market strength

- or, if rates were to moderate, negative charter value should

unwind more than charter-free values drop.

Both tankers and bulkers benefit from strong supply-side

fundamentals. The low orderbook in both segments will result in

slowing fleet growth. We expect further upside in secondhand values

of bulkers and tankers due to limited shipyard capacity and tighter

environmental regulations which increase newbuild prices.

Highlights of the financial period also include:

-- The Company acquired two product tankers, Mindful and

Courteous, below Depreciated Replacement Cost ("DRC"). The

acquisitions were financed primarily by a new US$60m loan with a

SOFR cap of 3.5% for the first three years which is secured on

Mindful, Courteous, Marvelous and Exceptional.

-- The Company agreed to divest its last containership, Riposte,

after the end of the financial period.

-- Our investment activity continues to demonstrate our

commitment to capital re-allocation and ESG. With these

transactions, we have re-allocated capital to position the

portfolio for the greater upside potential in fuel-efficient

tankers.

-- The Dividend Cover for the financial period was c.0.5x. This

was lower than our long-run expectation because of high planned

capex and off-hire. Capex and off-hire were higher than previously

expected due to the impact of Covid-related restrictions in

China.

-- At 31 December 2022, the Company forecast much lower planned

capex and off-hire in the next 18 months.

-- At 31 December 2022, the Company's Consolidated Gearing Ratio was 13.7%.

-- The Company's fleet had no unplanned commercial idle time

(voids) during the financial period.

-- The Company's operating emissions intensity, as measured by

the Energy Efficiency Operating Index ("EEOI"), improved by c.34%

YoY in 2022 primarily because of capital re-allocation. We expect

further improvement in emissions intensity with ESD retrofits.

-- ESD retrofits are substantially complete on seven of the

Company's vessels. We expect ESD retrofits on eight vessels will be

fully completed by mid 2023 and another three vessels by the end of

the year.

-- We prioritise crew welfare and have especially taken action

to improve the welfare of the Ukrainian crew members on board the

Company's vessels.

-- We aim to minimise coal carriage on the Company's vessels

without negative financial impact. During 2022, only one of the

Company's bulkers, Masterful, carried coal, accounting for <2%

of the total cargo carried by the Company's bulkers.

The Assets

As at 31 December 2022, the Company owned twenty-three

vessels.

Containership

At the end of the financial period, Riposte was on a fixed-rate

time charter to a major investment-grade container shipping group.

The Company agreed to divest Riposte after the end of the financial

period.

Tankers

Employment for vessels owned by the Company at the end of the

financial period:

-- Octane and Sierra were on time charters to an investment grade oil major.

-- Pollock, Dachshund, Cocoa and Daffodil were on time charters

to a major commodity trading and logistics company which exercised

its optional periods on Dachshund and Pollock until mid 2024.

-- Marvelous, Mindful and Courteous were on time charters to the

same major commodity trading and logistics company.

-- Exceptional was on a time charter to a leading tanker shipping company.

-- At 31 December 2022, the Average Charter Length of the product tankers was 2.3 years.

-- The gas carrier Neon operated on a bareboat charter, under

which the Company provides only the vessel to the charterer, who is

responsible for crewing, maintaining, insuring, and operating

it.

-- Two chemical tankers, Orson and Golding, were employed in a

leading chemical tanker pool. As described in the Company's

Prospectus, a pool is a revenue sharing structure run by a

specialist third party or another ship owner.

Acquisitions:

The Company agreed to acquire:

-- Two product tankers, Mindful and Courteous, for US$73.0m in

September 2022. The vessels were delivered to the Company in

December 2022. The acquisitions were financed primarily by a new

US$60m loan which is secured on Mindful, Courteous, Marvelous and

Exceptional.

Mindful, Courteous, Marvelous and Exceptional are in the top

quartile of fuel efficiency in their market segment.

Bulkers

Employment for vessels owned by the Company at the end of the

financial period:

-- Awesome and Auspicious were on time charters to a leading operator of bulkers.

-- Charming was on a time charter to a leading dry bulk shipping

company. Charming's time charter was extended by 5-8 months from

October 2022.

-- Laurel was on a time charter to a leading owner and operator of bulkers.

-- Idaho and Mayflower were on time charters to a leading owner and operator of bulkers.

-- Mayflower's time charter was extended by 5-7 months from December 2022.

-- Rocky IV, Anvil and Masterful were on time charters to a

leading merchant and processor of agricultural goods.

Awesome, Auspicious, Masterful and Charming are in the top

quartile of fuel efficiency in their market segment. Average

Charter Length on our bulkers was 0.3 years at the end of the

financial period. We expect the improving bulker market from 2Q23

will offer opportunities to employ our bulkers on charters at

higher rates than at the end of the financial period.

The Company's fleet across all segments is well maintained and

performed well, though certain vessels had minor Covid-related

disruptions or suffered supply chain issues and inflationary

pressures.

As at 31 December 2022:

SPV(+) Vessel Type Acquisition Earliest end Latest Expected

and Year of Date of charter end of end of charter

Build period charter period**

period

Riposte 2500-TEU containership March February July February

built 2009 2018 2023 2023 2023

------------------------- -------------- ----------------- -----------

Neon Mid-sized LPG July August August August

carrier built 2018 2025 2025 2025

2009

------------------------- -------------- ----------------- ----------- ----------------

Sierra Medium-range December June July July

("MR") 2018 2024 2025 2025

product tanker

built 2010

------------------------- -------------- ----------------- ----------- ----------------

Octane MR December May June June

product tanker 2018 2024 2025 2025

built 2010

------------------------- -------------- ----------------- ----------- ----------------

Cocoa Handysize October October January January

product tanker 2020 2023 2026 2025

built 2008

------------------------- -------------- ----------------- ----------- ----------------

Pollock Handysize December April

product tanker 2018 2024

built 2008

------------------------- -------------- ------------------------------------------------

Daffodil Handysize October October March March

product tanker 2020 2023 2026 2025

built 2008

------------------------- -------------- ----------------- ----------- ----------------

Dachshund Handysize February May

product tanker 2020 2024

built 2008

------------------------- -------------- ------------------------------------------------

Golding 25,600 DWT stainless April NA - vessel is employed in a pool

steel chemical 2021

tanker

built 2008

------------------------- -------------- ------------------------------------------------

Mayflower Handysize bulker June May July July

built 2011 2021 2023 2023 2023

------------------------- -------------- ----------------- ---------

Laurel Handysize bulker July June October June

built 2011 2021 2023 2023 2023

------------------------- -------------- ----------------- ---------

Orson 20,000 DWT stainless July NA - vessel is employed in a pool

steel chemical 2021

tanker

built 2007

------------------------- -------------- ----------------------------------------------

Idaho Ultramax bulker July February July February

built 2011 2021 2023 2023 2023

------------------------- -------------- ------------- ----------- ------------------

Anvil Handysize bulker September February May February

built 2013 2021 2023 2023 2023

------------------------- -------------- ------------- ----------- ------------------

Rocky IV Handysize bulker September October January January

built 2013 2021 2022 2023 2023

------------------------- -------------- ------------- ----------- ------------------

Exceptional MR April April April April

product tanker 2022 2023 2024 2024

built 2015

------------------------- -------------- ------------- ----------- ------------------

Awesome Handysize bulker January September March September

built 2015 2022 2023 2024 2023

------------------------- -------------- ------------- ----------- ------------------

Auspicious Handysize bulker February September March September

built 2015 2022 2023 2024 2023

------------------------- -------------- ------------- ----------- ------------------

Masterful Handysize bulker April January April January

built 2015 2022 2023 2023 2023

------------------------- -------------- ------------- ----------- ------------------

Charming Handysize bulker June March June March

built 2015 2022 2023 2023 2023

------------------------- -------------- ------------- ----------- ------------------

Marvelous MR July November November November

product tanker 2022 2025 2027 2025

built 2014

------------------------- -------------- ------------- ----------- ------------------

Mindful MR December December November December

product tanker 2022 2025 2027 2025

built 2016

------------------------- -------------- ------------- ----------- ------------------

Courteous MR December December November December

product tanker 2022 2025 2027 2025

built 2016

------------------------- -------------- ------------- ----------- ------------------

Notes:

+ SPV that owns the vessel.

** Based on our assessment of the prevailing market conditions

as at 31 December 2022.

Riposte, the last containership in the portfolio, was divested

in February 2023.

Investment Performance

NAV per share was US$1.402 at 31 December 2022. US$ NAV Total

Return for the financial period was -0.6% and for calendar year

2022 was 7.7%. During the financial period, Portfolio Operating

Profit contributed US$27m (vs. US$17.4m in the financial period

ending 31 December 2021) mainly as the Company benefited from a

larger bulker fleet and higher bulker time charter rates.

There was a Loss in Capital Value of US$33.6m or US$0.109 per

share mainly due to the fall in bulker and containership values as

those markets weakened over the financial period. We expect the

bulker market and charter-free values to improve from 2Q23. After

the end of the financial period, the Company agreed to divest

Riposte.

From 1

From 1 Jul Jul 2021

Figures below are in US$m unless otherwise 2022 to 31 to 31 Dec

stated Dec 2022 2021

Total ship-days 3,908 3,947

Revenue 57.0 48.5

Operating Expense (26.0) (28.1)

------------ -----------

Gross Operating Profit 31.0 20.4

Gross Operating Profit / Time-Weighted

Capital Employed 15.0% 13.6%

Loan interest and fees (1.6) (0.8)

Gain/(loss) in Capital Values (33.6) 57.2

------------ -----------

Portfolio (loss) / profit (4.2) 76.8

Interest income 0.0 0.0

Fund Level Fees and Expenses (2.4) (2.2)

Performance fee accrual 4.0 (2.4)

(Loss) / Profit for the period (2.6) 72.2

------------ -----------

Portfolio Operating Profit 27.0 17.4

------------ -----------

Loan interest and fees were higher compared to 2H21 as a new

US$60m loan was committed and drawn for the acquisitions of two

product tankers, Mindful and Courteous, during the financial

period. The new loan is secured on Mindful, Courteous, Marvelous

and Exceptional. The accrued performance fee was unwound because

the Total Return per Share was slightly lower than the High

Watermark per Share at the end of the financial period.

The Company benefited from a significant improvement in the

market for chemical tankers as tankers which can trade both

chemicals and products shifted to the tightening product tanker

market. The chemical tanker market benefits from strong supply-side

fundamentals with a low orderbook (c.4% of fleet for stainless

steel tankers) and a strong demand growth forecast of c.6% CAGR

(2022-2024). Gross operating profit for chemical tankers during the

financial period was negatively impacted by the planned off-hire of

Orson and Golding, which are operating in a chemical tanker

pool.

Segment Performance Product Chemical Gas Tanker Containership Bulkers Total

During the Financial Tankers Tankers

Period

US$m unless otherwise

stated

Gross Operating Profit 8.3 1.4 2.1 1.2 18.0 31.0

Loan interest & fees (1.6) - - - - (1.6)

Gain/(loss) in charter-free

values 55.7 5.1 (0.6) (23.4) (53.3) (16.5)

Gain/(loss) in charter

values (32.8) - - 10.9 4.8 (17.1)

Portfolio profit 29.6 6.5 1.5 (11.3) (30.5) (4.2)

------------------------------ --------- --------- ----------- -------------- -------- -------

Segment Exposure and Product Chemical Gas Tanker Containership Bulkers Total

Forecast Yields* Tankers Tankers

% of NAV 42.9% 9.0% 5.9% - 37.6% 95.5%

Forecast Net Yields* 9.0% 23.8% 15.8% NA 15.7% 12.0%

----------------------- --------- --------- ----------- -------------- -------- ------

(*) Based on the pro forma fleet and market values at 31

December 2022

At 31 December 2022, the Company's vessels had an average age of

c.11 years and were chartered to ten different counterparties. The

forecast net yield on the product tankers slightly fell to 9.0% at

the end of December 2022 from 10.6% at the end of June largely due

to the rise in asset values during the financial period.

The Shipping Market

The Company focuses on three main shipping segments: tankers,

bulkers and containerships. The Clarksea Index, a broad vessel

earnings indicator from Clarksons Research, ended the financial

period at US$29,657/day, c.29% lower than at the end of June 2022

and c.15% lower than at the end of December 2021, because of

weakness in the containership and bulker markets. In January 2023,

the IMF forecast 2.9% world GDP growth in 2023, 0.2 percentage

points higher than its forecast of October 2022. The easing of

Covid-related restrictions in China has paved the way for a

faster-than-expected recovery. Global seaborne trade is expected to

grow by 1.5% in 2023. In comparison, seaborne trade grew by c.3%

CAGR in the two decades leading up to 2021.

We believe the shipping market is in a multi-year upcycle

because of the relative lack of investment in new capacity

(supply). The combination of commodity price inflation and reduced

shipyard capacity has increased newbuild prices. This led to higher

values for secondhand vessels. The Clarksons Research Newbuilding

Price Index has risen c.29% since the end of 2020 while the

Clarksons Research Secondhand Price Index has risen c.57% over the

same period. We expect further upside in secondhand values of

bulkers and tankers due to limited shipyard capacity and tighter

environmental regulations which increase newbuild prices. Clarksons

Research estimates that global shipbuilding capacity is 40% lower

compared to a decade ago.

This section utilises data from our Tufton Real-Time Activity

Capture System ("TRACS") which analyses satellite data to track the

international shipping fleet by the major segments. TRACS utilises

the draught of each vessel as a proxy for its utilisation and

thereby enables us to have a close to real-time measure of shipping

demand. Other research data used in this section is from Clarksons

Research, unless specified otherwise.

Tankers

According to the US Energy Information Administration, world

petroleum liquids demand is expected to grow 1.1% in 2023 and 1.7%

in 2024 after growing by more than 2% in 2022. We had expected

improvement in tanker demand in 2022 along with the recovery in

global oil demand. The improvement in tanker demand was accelerated

as the war in Ukraine partially replaced some demand for short-haul

product tanker cargoes with demand for long-haul: increasing

Russian exports to Asia, notably India, and higher European imports

from non-Russian suppliers including the Middle East, the US and

Asia. 1-year time charter rates for MR product tankers rose 48% to

c.US$30,000/day at the end of the financial period, the highest

since 2005. Beyond the current market strength, supply-side

dynamics are supportive for product and chemical tankers with the

orderbook at only c.5% of fleet. The easing of Covid-related

lockdowns in China, refinery expansions in the Middle East and Asia

as well as slowing fleet growth suggest the product tanker market

will remain strong in the medium term. The Company acquired four MR

product tankers in 2022: Exceptional, Marvelous, Courteous and

Mindful.

25-30% of MR product tankers are capable of engaging in the

chemicals/veg oil trade. The chemical tanker market benefits from

the strength in product tankers as MR product tankers shift to the

tightening product tanker market. The chemical tanker market also

benefits from strong supply-side fundamentals with a low orderbook

(c.4% of fleet for stainless steel tankers) and strong demand

growth forecast of c.6% CAGR (2022-2024). The Company's chemical

tankers benefit from this trend as they are employed in a

revenue-sharing pool and have spot market exposure.

At the end of the financial period, the Company had 10 product

tankers on fixed-rate charters with Average Charter Length of 2.3

years and two chemical tankers that operate in a pool . We believe

the product and chemical tanker markets, well supported by strong

supply-side fundamentals, offer potential for strong operating

profit and capital appreciation.

Bulkers

Over the financial period, the bulker market weakened due to the

impact of Covid-related restrictions in China, a slowdown in global

industrial production and the easing of port congestion. 1-year

time charter rates for Handysize bulkers fell c.41% to

US$12,375/day. We expect the bulker market to improve from 2Q23,

aided by the easing of Covid-related restrictions in China, as the

market has strong supply-side fundamentals. The bulker orderbook is

only c.7% of fleet compared to c.80% of fleet in 2008 when the

increase in rates resulted in an ordering boom. Further, c.14% of

the Handysize bulker fleet is >=20 years old compared to the

orderbook of c.7% of fleet which suggests negative net supply

growth as the oldest and least efficient vessels are recycled. As

at the end of the financial period , the Company had 9 bulkers on

fixed-rate charters with Average Charter Length of 0.3 years.

Containerships

The containership market weakened over the financial period.

Consumer demand weakened due to the impact of inflationary pressure

on consumers, Covid-related lockdowns in China and the war in

Ukraine. The effect of weak demand was exacerbated by easing port

congestion. Over the financial period, 1-year time charter rates

for small (2500-TEU) containerships fell 75% to US$18,750/day. The

containership orderbook was c.29% of fleet at the end of the

financial period. Fleet growth is expected to accelerate to c.7% in

2023. We expect the containership market to remain relatively weak

and have re-allocated capital by divesting containerships to

reinvest in fuel-efficient tankers and bulkers. After the end of

the financial period, the Company agreed to divest its last

containership. The orderbook for small containerships remains

relatively low at c.14% of fleet compared to c.24% of fleet which

is at least 20 years old and will continue to seek opportunities as

they arise.

Across the main segments, asset values and time charter rates

reflect our thesis of supply-side adjustment to varying degrees. In

bulkers and tankers, the combination of tightening environmental

regulations and lower shipyard capacity suggest newbuild prices

will remain high thereby also supporting secondhand prices.

Clarksons Research estimates that global shipbuilding capacity is

40% lower compared to a decade ago. Many newbuild designs

incorporate more flexible machinery and storage systems to handle

multiple fuel types to reduce emissions. These further increase

newbuild prices.

The shipping industry has a history of being resilient during

periods of disruption. Despite the negative impact of the war in

Ukraine, the product tanker market strengthened to record highs at

the end of the financial period as demand for long-haul cargoes

outpaced demand for short-haul cargoes and the supply side remains

supportive with slowing fleet growth. New environmental regulations

from the International Maritime Organisation ("IMO") to measure and

improve vessel carbon emission intensity incentivise lower speeds

resulting in reduced shipping capacity, aiding the supply-side

adjustment. Fuel-efficient vessels such as the Company's recent

acquisitions are likely to be favoured.

Environmental, Social and Governance ("ESG")

We emphasise the principles of Responsible Investment in the

management of clients' assets through awareness and integration of

ESG factors into our investment process in the belief that these

factors have a positive impact on long-term financial performance.

We recognise that our first duty is to act in the best financial

interests of the Company's shareholders and to achieve good

financial returns against acceptable levels of risk, in accordance

with the objectives of the Company. Since December 2018, we are a

signatory of the United Nations Principles of Responsible

Investment ("UN PRI") and have a Responsible Investment policy

statement (most recently revised in June 2022) which is available

on the Company's website. Current areas of ESG focus include:

1. Assessment of the fuel efficiency and environmental impact of potential acquisitions

2. Regular review of our fleet to identify opportunities for improving fuel efficiency

3. Reducing environmental impact across the asset life cycle

4. Responsible vessel recycling

5. Health and safety of the crew on our vessels

6. Enhanced security to lower risk of contraband

7. Compliance with all international sanctions imposed by the US, UK, EU and UN

8. Promoting acceptance and implementation of ESG principles with our business partners

We are committed to reducing greenhouse gas emissions and

aligning our funds to the temperature goals of the Paris Agreement

by fully transitioning to zero carbon energy sources by 2050 and

investing in zero carbon capable vessels before 2030. In September,

we appointed a Senior Adviser for Decarbonisation.

In SHIP, we aim to achieve greenhouse gas reduction and

participate in the energy transition by:

-- investing in ESDs;

-- deploying digital tools to measure and optimise fuel consumption;

-- increasing the use of zero-emission fuels by 2030; and

-- favouring long-term charters that minimise coal carriage without negative financial impact

Being a closed-end investment company listed on the Specialist

Fund Segment of the London Stock Exchange, the Company is not

required to report against the TCFD framework. Nevertheless, we

believe the TCFD recommendations provide a useful framework to

increase transparency on climate-related risks and opportunities

within financial markets and intend to publish a sustainability

report later this year on that basis. As a member of the AIC, the

Company reports against the AIC Code of Corporate Governance on a

comply or explain basis. Our Senior Management (i.e. the CEO and

the CIO) is committed to Responsible Investment and oversees the

implementation of our Responsible Investment policy statement. We

devote more than 4 full time employee equivalents to ESG

integration-related analysis and implementation in aggregate. The

policy statement is reviewed at least annually and approved by the

Company's Board. The Company's Board does not have a separate ESG

committee but collectively reviews implementation progress against

the policy statement and issues an implementation review report

which is also publicly available on the Company's website.

The Board recognises that climate change and related risks will

have an impact on the Company's business and considers

climate-related risks and opportunities when approving investment

decisions. The Board maintains ultimate responsibility for the

policy and its implementation and is committed to upholding high

standards of corporate governance.

We are a signatory of the UN PRI since 2018. In the 2021 UN PRI

signatory assessment, we received a 5-star rating in the

Infrastructure category, the highest rating in that category and

above the median rating of our peer group. We received a 4-star

rating in the Investment and Stewardship Policy category which was

also above the median rating of our peer group. Please see the for

details. We are a member of the Getting to Zero Coalition, an

alliance of more than 200 organisations including 160 companies

within the maritime, energy, infrastructure and finance sectors.

The Coalition is committed to getting commercially viable deep sea

zero-emission vessels into operation by 2030, towards full

decarbonisation by 2050. In February 2022, we became a Mission

Ambassador to the Maersk Mc-Kinney Møller Center for Zero Carbon

Shipping ("MMCZCS"), a not-for-profit research and development

organisation. We expect to benefit from the Center's extensive work

in fuel transition and technologies.

Environmental

We are reducing emissions from the Company's vessels through

investment in ESDs and promoting best operational practices such as

regular hull/propeller cleaning and optimal use of auxiliary

engines. We have invested in digital technologies for performance

monitoring and emissions reduction, which provide data and insights

for further emissions reduction and efficiency gains. Sustainable

biofuels are expected to be part of the long-term fuel mix on the

path to decarbonisation. We aim to increase the use of sustainable

biofuels following successful trials.

The potential for ESDs often depends on how efficient a vessel

design is already (the more modern the vessel the smaller the

impact of ESDs). The choice of ESDs also depends on whether a

vessel is operating near its original design parameters or not. The

selection of ESDs, the investment required, retrofit timing,

commercial arrangements for fuel savings and returns will vary from

vessel to vessel depending upon the results of energy efficiency

studies, prevailing market conditions and commercial

considerations. We have engaged a consulting firm of naval

architects to conduct energy efficiency studies on the Company's

vessels and select the appropriate ESDs for retrofit. Energy

efficiency studies will be carried out on all the Company's

acquisitions.

We have invested c.US$0.5m per vessel on ESDs such as propeller

boss cap fins, Mewis or Schneekluth ducts and variable frequency

drives. The expected return from the ESD investments is c.20% based

on the expected increased hire rate (premium) to reflect fuel

savings, from all the ESDs, of c.10% on each vessel. We expect

further upside on ESD retrofits as we better capture savings from

rising fuel prices and carbon prices. We also assess the

suitability of advanced ESDs like wind-assisted propulsion or air

lubrication for the Company's vessels and have invested in rotor

sails for a vessel in another fund that we manage.

Although we have experienced some supply chain delays in the

procurement and retrofit of ESDs, we expect ESD retrofits on eight

vessels will be fully completed by mid 2023 and on another three

vessels by the end of the year. Where possible, the ESD retrofits

are planned to coincide with each vessel's scheduled special survey

to minimise installation cost. ESD retrofit studies are in progress

on four other vessels. The other six Company vessels are already

fuel-efficient relative to their peers but will nevertheless be

evaluated for further improvement including the retrofit of

ESDs.

We have started receiving the hire rate premium for the ESD

retrofits on Laurel and Idaho. Golding and Orson operate in a pool

and will benefit directly from the fuel savings based on the

prevalent fuel prices. We are in discussion with the charterer of

Cocoa, Daffodil, Pollock and Dachshund for the hire rate premium to

reflect the fuel savings from the retrofits.

Total CO2 emissions from the Company's fleet in 2022 was 315,708

tonnes. With a growing portfolio of vessels, this measure is less

relevant to the Company than normalised measures of emissions

intensity. Total CO2 emissions from the portfolio are calculated

from the fuel consumption of the Company's vessels for propulsion

and onboard power generation. The majority of the Company's vessels

are on time charter or operate in a pool wherein the Company does

not have full operating control of the vessels but is responsible

for the regular surveys and maintenance of the vessels. Data from

one vessel (Neon) on long-term bareboat charter is excluded as the

Company does not have operating control of the vessel and is not

responsible for the regular surveys or maintenance of the

vessel.

From 2023, the IMO requires the reporting of vessel carbon

intensity using the Carbon Intensity Indicator ("CII"). The CII

measures how efficiently a vessel transports goods and is given in

grams of CO2 emitted per cargo-carrying capacity and nautical mile.

All else equal, a lower CII is indicative of a more efficiently

operated asset. The Portfolio CII improved by c.24% in 2022 mainly

because of the capital re-allocation.

Environmental Metrics 2022 2021

Total CO2 emissions (tonnes) 315,708 401,348

-------- --------

CII (g CO2/dwt-nautical mile) 7.7 10.1

-------- --------

EEOI (g CO2/tonne-nautical mile) 13.9 21.1

-------- --------

Oil spills None None

-------- --------

Of the three major segments, containerships tend to have the

highest emissions intensity due to higher operating speeds. The

Company started divesting containerships from mid 2021 to

re-allocate capital into fuel-efficient tankers and bulkers.

The EEOI is a measure of operational emissions intensity defined

as the mass of CO2 emitted per unit of transport work. The EEOI

measures a ship's fuel efficiency. Like the CII, a lower EEOI is

indicative of a more efficiently operated asset. We have utilised

the EU MRV (Monitoring, Reporting and Verification) methodology for

calculating the EEOI using data on total CO2 emissions and total

cargo transported by the Company's fleet for the 2022 calendar

year. The emissions intensity of the Company's vessels as measured

by the EEOI for 2022 improved by c.34% YoY. We expect further

reduction in emissions intensity from ESD retrofits as they are

completed in 2023. Since the Company's vessels operate on time

charters or within a pool, we are typically not involved in

determining specific voyage parameters and are therefore not able

to influence the geographic and cargo carriage metrics of the

fleet. We can only directly influence CII and EEOI metrics from the

vessel's technical parameters (such as by retrofitting ESDs) and

fleet composition.

We are committed to the deployment of new technologies to reduce

emissions and have invested in the retrofit of rotor sails on a

large bulker owned in another fund that we manage. The Company will

benefit from our knowledge and experience as we continue to

evaluate the suitability of such new technologies for the Company's

vessels. The Company's vessels utilise compliant fuel (Very Low

Sulphur Fuel Oil and Marine Gas Oil). Only one vessel, Marvelous,

is capable of utilising Heavy Fuel Oil as it has an open-loop

scrubber. According to DNV research, c.5,000 vessels in the global

fleet are scrubber-equipped with 81% having open-loop scrubbers.

The scrubber on Marvelous is compliant with current regulations and

enables the vessel to earn a premium rate for utilising cheaper

Heavy Fuel Oil.

We have proactively implemented a policy to favour long-term

charters that minimise coal carriage without negative financial

impact. Over 2022, only one of the Company's bulkers (Masterful)

carried coal, accounting for <2% of the total cargo carried by

the Company's bulkers over the year.

All of the Company's vessels have Ballast Water Treatment

Systems ("BWTS") installed except for the gas carrier Neon (on a

bareboat charter) where the charterer is responsible for BWTS

installation and compliance. BWTS prevent the translocation of

marine organisms from one region to another and help preserve

biodiversity. While BWTS installation will be mandatory from late

2024, we have expedited the installation of BWTS on Company vessels

in line with our commitment to be ahead of regulatory

requirements.

Biodiversity can also be impacted by waste generated from

shipping, particularly plastic waste. We are installing water

purification systems on all vessels to replace drinking water in

plastic bottles. The crew on each vessel are being provided with

complimentary, refillable, metal drinking water bottles.

Environmental benefits include an estimated annual reduction in the

supply of plastic-packaged water by 11,000 (1 Litre) bottles per

vessel and an annual reduction of CO2 by 2 tonnes per vessel.

The average age of the Company's vessels is c.11 years. Based on

the current portfolio and target segments, we do not expect the

Company to have recycling candidates in its portfolio in the near

future. When recycling situations do arise, the Company will follow

industry best practices in adopting the Hong Kong International

Convention for the Safe and Environmentally Sound Recycling of

Ships.

For investment and divestment decisions, we consider the

historic environmental performance and energy efficiency metrics of

candidate vessels as well as other important information on

potential environmental impact including the status of BWTS and

history of compliance to environmental and safety regulations. We

also consider the candidate track record and capability (in

addition to commercial terms) before recommending the appointment

of the technical manager for each vessel.

Social

The Company has no employees. The crew on board the Company's

vessels are employed by our technical managers. We consider crew

health and safety to be a priority and work closely with our

technical managers to promote best practices and establish a strong

safety culture, exceeding regulatory standards. The technical

managers have implemented a collection of comprehensive safety

procedures, policies, and protocols on board vessels that conform

to our guidelines. Safety performance is monitored by collecting

and tracking a comprehensive list of industry Key Performance

Indicators ("KPIs") every quarter, ensuring that any significant

incidents are reported upon with follow-up actions taken.

We are a signatory to:

-- Maritime UK's Mental Health in Maritime pledge to promote

quality of mental health and well-being in the industry.

We have engaged Mental Health Support Solutions GmbH ("MHSS") to

provide a free counselling service for crew members to help them

handle concerns of stress, anxiety, and personal issues while on

board.

-- Maritime UK's Women in Maritime pledge to build an employment

culture that actively supports and celebrates gender diversity at

all levels in the industry.

The Company has no employees. As an Investment Manager, we have

made a conscious effort to build a supportive employment culture.

As at the end of the financial period, we had c.38% female

employees and 17% female employees at the Senior Management

level.

-- The Neptune Declaration since January 2021, supporting

measures to ensure timely relief of crew and putting measures in

place to manage any pandemic-related travel restrictions.

As a result of Covid-related restrictions, crew rotation was

significantly delayed between mid 2020 and the end of the financial

period. We monitored and facilitated (sometimes at additional cost)

the prompt rotation of overdue crew members. The number of overdue

crew members was also reported to the Board on a quarterly basis.

As a result of our proactive approach to ensure timely relief, the

Company's vessels had fewer crew members overdue for rotation

compared to peers. We are pleased to note that the issue of overdue

crew members is substantially resolved in the industry as of early

2023. We remain prepared to swiftly act should new disruptions to

crew rotations arise in the future.

We are specifically monitoring the safety and well-being of the

Ukrainian crew members on board the Company's vessels. The war

could increase stress on crew members and may exacerbate challenges

to crew rotation due to the closure of airports. We have engaged

with all our technical managers to address these issues. Where

requested, we will assist in the repatriation of crew members or

extension of crew contracts. We are concerned about potential

conflict between Ukrainian and Russian crew members. Whilst no

problems have arisen to date, we have instructed our technical

managers to closely monitor the environment on board the Company's

vessels for potential conflicts.

We are committed to the deployment of new technologies towards

improving crew health and safety and are deploying ShipIN

FleetVision on all the Company's vessels. ShipIN Fleetvision

leverages machine learning camera vision technology to enhance the

safety and security of crew and cargo as well as prevent pollution,

while improving real-time, ship-to-shore collaboration.

Governance

We aim to promote acceptance and implementation of ESG

principles by business partners through an annual survey and

feedback and conduct an annual survey of all the Company's

technical managers which includes KPIs to assess their performance

on numerous metrics including ESG. The results of the survey are

communicated to the technical managers to ensure best practices are

shared.

We have a strict reporting policy for our technical managers. We

employ a third party to conduct independent inspections of the

Company's vessels on a regular basis to assist in evaluating the

performance of the technical managers. These independent

inspections include assessment of key aspects of vessel condition

as well as regulatory compliance and crew health and safety. We

update the Board on the progress of the Company's investments every

quarter with additional updates where significant events have

occurred.

We continue to closely monitor adherence to sanctions regimes

from the US, UK, EU and UN. The employment contracts for the

Company's vessels are structured to exclude trading in sanctioned

regions. Additionally, we monitor compliance through regular

inspection of vessel logs and satellite data to monitor the

movements of all the Company's vessels. Through regular contact

with our charterers, legal counsel and insurers, we are ensuring

that all vessels continue to trade in full compliance with all

relevant sanctions laws. All vessels remain insured against

war-like events. We have had no issues to date with any vessels

being damaged or blocked. We continue to monitor the consequences

of the war for shipping and the Company.

We have formally requested all our charterers and vessel

managers to desist from trade with Russia wherever legally possible

except for humanitarian purposes. The Master of each vessel may

refuse to allow the vessel to trade in areas assessed as "perilous"

where there is heightened physical risk to the vessel or its crew.

The Master of the vessel will always have the last say on the

safety of the vessel and crew and we will always support the

position of the Master in a dispute with charterers or other

interested parties.

We have a zero-tolerance policy towards bribery and adhere to

the UK Bribery Act with the following policies in place:

-- payment controls requiring dual sign-off/authorisation of all payments;

-- gifts and entertainment policies that restrict staff from giving and receiving gifts;

-- recruitment policies and ongoing monitoring of the fitness

and propriety of staff including their honesty, integrity, and

financial soundness; and

-- FCA Conduct rules and a Code of Ethics which require staff to

conduct themselves appropriately.

We are also a member of the Maritime Anti-Corruption Network

("MACN").

Principal Risks and Uncertainties

The Directors have reconsidered the principal risks and

uncertainties effecting the Company. The directors consider that

the principal risks and uncertainties have not significantly

changed since the publication of the Annual Report for the year

ended 30 June 2022. The risks and associated risk management

processes, including financial risks, can be found in the Annual

Report for the financial year ending 30 June 2022.

The risks referred to and which could have a material impact on

the Company's performance for the remainder of the current

financial year relate to:

-- Shipping and financial markets;

-- Commercial risks around charter payments;

-- Damage to the Company's assets;

-- Cost overruns;

-- Regulatory and legislative compliance;

-- Safety, health and environment;

-- Service quality of the Investment Manager and other Service Providers;

-- Liquidity.

Interim Report of the Directors

The Directors present their Interim Report and the Condensed

Interim Financial Statements of the Company for the six-month

period ended 31 December 2022.

The Company was registered in Guernsey on 6 February 2017 and is

a registered closed-ended investment scheme under the POI Law. The

Company's Shares were listed on the Specialist Funds Segment of the

Main Market of the London Stock Exchange on 20 December 2017 under

the ticker SHIP.

Investment Objective

The Company's investment objective is to provide investors with

an attractive level of regular and growing income and capital

returns through investing in secondhand commercial sea-going

vessels. The Board monitors the Investment Manager's activities

through strategy meetings and discussions as appropriate. The

Company has established a wholly owned subsidiary that acts as a

Guernsey holding company for all its investments, LS Assets

Limited, which is governed by the same Directors as the

Company.

All vessels acquired, vessel-related contracts and costs are

held in SPVs domiciled in the Isle of Man or other jurisdictions

considered appropriate by the Company's advisers. The Company

conducts its business in a manner that results in it qualifying as

an investment entity (as set out in IFRS 10: Consolidated Financial

Statements) for accounting purposes and as a result applies the

investment entity exemption to consolidation. The Company therefore

reports its financial results on a non-consolidated basis.

Subject to the solvency requirements of the Companies Law, the

Company intends to pay dividends on a quarterly basis. The

Directors expect the dividend to grow, in absolute terms, modestly

over the long term. In July 2021 the Company raised its target

annual dividend to US$0.08 per share (previously US$0.075 per

share). Encouraged by strong visible cash flows from increased

charter cover, diversification and continued supply-side recovery,

the Company again raised its target annual dividend from US$0.080

to US$0.085 per share, which commenced from 4Q22.

The Company aims to achieve a NAV Total Return of 12% or above

(net of expenses and fees) on the Issue Price over the long

term.

Results and dividends

The Company's performance during the period is discussed in the

Chairman's Statement on pages 3 - 6. The results for the year are

set out in the Condensed Statement of Comprehensive Income on page

32.

Related Parties

Details of related party transactions that have taken place

during the period and of any material changes are set out in Note

13 of the Condensed Interim Financial Statements.

Directors

The Directors of the Company who served during the period and to

date are set out on page 7.

Directors' interests

The Directors held the following interests in the share capital

of the Company either directly or beneficially as of 31 December

2022, and as of the date of signing these Financial Statements:

31 December 30 June 2022

2022

Shares Shares

R King 60,000 45,000

S Le Page 40,000 40,000

P Barnes 5,000 5,000

C Rødsæther 30,000 20,000

The Directors fees are disclosed below:

Payable from Paid from Paid from

1 January 2023 1 July 2022 1 July 2021

To To to

30 June 2023 31 December 30 June

2022 2022

Director GBP GBP GBP

R King 21,000 19,000 36,610

S Le Page 19,250 17,500 34,000

P Barnes 17,750 16,250 31,550

C Rødsæther 17,750 16,250 31,550

Other Interests

Tufton Investment Management Holding Limited group ("Tufton

Group") shareholders, employees, non-executive directors and former

shareholders held the following interests in the share capital of

the Company either directly or beneficially.

As at 31 December 2022

% of issued

Name Ordinary Shares Share Capital

Tufton Shareholders 5,988,133 1.90

Tufton Staff 466,261 0.15

Tufton Non-Executive Directors 403,279 0.13

Former Tufton Shareholders 3,041,740 0.99

As at 30 June 2022

% of issued

Name Ordinary Shares Share Capital

Tufton Group Shareholders 5,375,133 1.74

Tufton Group Staff 466,261 0.15

Tufton Group Non-Executive

Directors 403,279 0.13

Former Tufton Group Shareholders 3,041,740 0.99

Share buybacks and discount management

Subject to working capital requirements, and at the absolute

discretion of the Board, excess cash may be used to repurchase

Shares. The Directors may implement Share buyback at any time

before the 90-day guideline set out in the Prospectus where they

feel it is in the best interest of the Company and all

Shareholders.

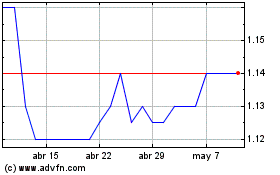

The Company purchased 850,000 of its own Shares at an average

price of US$1.14 per Share during November and December 2022. Refer

to Note 5 for more details. There were 850,000 Shares held in

Treasury and 307,778,541 Shares outstanding as at the end of the

financial period. The Company bought back a further 710,000

ordinary shares, between the end of the financial period and 15

March 2023, at an average price of US$1.14. The purchased shares

will be held in treasury. The Company had 307,068,541 Shares

outstanding as at the date of approval of these accounts.

Going concern

In assessing the going concern basis of accounting the Directors

have, together with discussions and analysis provided by Tufton,

had regard to the guidance issued by the Financial Reporting

Council. They have considered recent market volatility, the Russian

invasion of Ukraine, and the potential impact of Covid restrictions

in China on the current and future operations of the Company and

its investments. Cash reserves are held at the LS Assets Limited

and SPV levels and rolled up to the Company as required to enable

expenses to be settled as they fall due.

Based on these activities and bearing in mind the nature of the

Company's business and assets, the Directors consider that the

Company has adequate resources to continue in operational existence

for at least twelve months from the date of approval of the Interim

Report and the Condensed Interim Financial Statements. For this

reason, they continue to adopt the going concern basis in preparing

the Interim Report and the Condensed Interim Financial

Statements.

Responsibility Statement

For the period from 1 July 2022 to 31 December 2022

The Directors are responsible for preparing the Interim Report

and Condensed Interim Financial Statements, which have not been

audited or reviewed by an independent auditor, and confirm that to

the best of their knowledge:

-- the Condensed Interim Financial Statements have been prepared

in accordance with International Accounting Standard (IAS) 34,

Interim Financial Reporting;

-- the Interim Report includes a fair review of the information required by:

-- DTR 4.2.7R of the Disclosure and Transparency Rules, being an

indication of important events that have occurred during the first

six months of the financial year and their impact on the Condensed

Interim Financial Statements; and a description of the principal

risks and uncertainties for the remaining six months of the year;

and

-- DTR 4.2.8R of the Disclosure and Transparency Rules, being

related party transactions that have taken place in the first six

months of the current financial year and that have materially

affected the financial position or performance of the entity during

that period; and any changes in the related party transactions

described in the last annual report that could do so.

Approved by the Board of Directors on 16 March 2023 and signed

on behalf of the Board by:

.............................. ..............................

Rob King Stephen Le Page

Non-executive Chairman Director

Condensed Statement of Comprehensive Income

For the 6-month period ended 31 December 2022

31 December 31 December

2022 2021

Notes US$ US$

Income (Unaudited) (Unaudited)

Net changes in fair value

of financial assets at fair

value through profit or

loss 4 (4,314,159) 76,730,838

Foreign exchange gain - 1,008

Total net (loss) / income (4,314,159) 76,731,846

Expenditure

Administration fees (85,547) (83,577)

Audit fees (119,636) (79,757)

Corporate Broker fees (75,000) (75,000)

Directors' fees 15 (80,996) (88,055)

Directors' expenses (3,892) (238)

Foreign exchange loss (10,144) -

Insurance fee (4,925) (3,025)

Investment management fee 11 (1,815,843) (1,645,783)

Legal fees - (26,287)

Performance fees 12 3,980,432 (2,419,323)

Professional fees (66,096) (109,239)

Sundry expenses (13,716) (21,486)

Total credit / (expenses) 1,704,637 (4,551,770)

------------ ------------

Operating (loss) / profit (2,609,522) 72,180,076

Finance income 1,246 4,348

(Loss) / Profit and comprehensive

income for the period (2,608,276) 72,184,424

============ ============

IFRS Earnings per ordinary

share (cents) 6 (0.85) 25.34

============ ============

There were no potentially dilutive instruments in issue at 31

December 2022.

All activities are derived from continuing operations.

There is no other comprehensive income or expense apart from

those disclosed above and consequently a Statement of Other

Comprehensive Income has not been prepared. The accompanying notes

are an integral part of these condensed interim financial

statements.

Condensed Statement of Financial Position

At 31 December 2022

31 December 30 June

2022 2022

Notes US$ US$

Non-current assets (Unaudited) (Audited)

Financial assets designated

at fair value

through profit or loss 4 442,578,561 446,892,720

Total non-current assets 442,578,561 446,892,720

------------ ------------

Current assets

Trade and other receivables 18,800 5,740,385

Cash and cash equivalents 11,018 8,823

Total current assets 29,818 5,749,208

------------ ------------

Total assets 442,608,379 452,641,928

------------ ------------

Current liabilities

Trade and other payables 11,001,541 5,098,219

Total current liabilities 11,001,541 5,098,219

------------ ------------

Net assets 431,606,838 447,543,709

============ ============

Equity

Ordinary share capital 5 309,289,530 310,272,983

Retained reserves 5 122,317,308 137,270,726

Total equity attributable

to ordinary shareholders 431,606,838 447,543,709

============ ============

Net assets per ordinary

share (cents) 8 140.23 145.01

============ ============

The accompanying notes are an integral part of these condensed

interim financial statements.

The financial statements were approved and authorised for issue

by the Board of Directors on

16 March 2023 and signed on its behalf by:

________________________________

_____________________________

Rob King Stephen Le Page

Non-executive Chairman Director

Condensed Statement of Changes in Equity

For the 6-month period ended 31 December 2022

Ordinary Retained

share capital earnings Total

Notes US$ US$ US$

For the six months

ended

31 December 2022 (Unaudited)

Shareholders' equity

at 1 July 2022 310,272,983 137,270,726 447,543,709

Loss and comprehensive

income for the period - (2,608,276) (2,608,276)

Share buybacks 5 (969,451) - (969,451)

Share issue costs 5 (14,002) - (14,002)

Dividends paid 7 - (12,345,142) (12,345,142)

Shareholders' equity

at 31 December 2022 309,289,530 122,317,308 431,606,838

=============== ============= =============

Ordinary Retained

share capital earnings Total

US$ US$ US$

For the six months

ended

31 December 2021 (Unaudited)

Shareholders' equity

at 1 July 2021 259,657,871 52,988,084 312,645,955

Profit and comprehensive

income for the period - 72,184,424 72,184,424

Share issue 51,429,265 - 51,429,265

Share issue costs (827,640) - (827,640)

Dividends paid 7 - (10,674,634) (10,674,634)

Shareholders' equity

at 31 December 2021 310,259,496 114,497,874 424,757,370

=============== ============= =============

The accompanying notes are an integral part of these condensed

interim financial statements.

Condensed Statement of Cash Flows

For the 6-month period ended 31 December 2022

31 December 31 December

2022 2021

Notes US$ US$

(Unaudited) (Unaudited)

Cash flows from operating

activities

(Loss) / profit and comprehensive

income for the period (2,608,276) 72,184,424

Adjustments for:

Purchase of investments 4 - (49,560,001)

Change in fair value on investments 4 4,314,159 (76,730,838)

Operating cash flows before

movements in working capital 1,705,883 (54,106,415)

Changes in working capital:

Movement in trade and other

receivables 5,721,585 5,740,147

Movement in trade and other

payables 5,903,322 8,663,489

Net cash generated from

/ (used in) operating activities 13,330,790 (39,702,779)

------------- -------------

Cash flows from financing

activities

Share issue costs 5 (14,002) 50,601,625

Net cost from share buybacks 5 (969,451) -

Dividends paid to Ordinary

shareholders 7 (12,345,142) (10,674,634)

Net cash (utilised in) /

generated from financing

activities (13,328,595) 39,926,991

------------- -------------

Net movement in cash and

cash equivalents during the

period 2,195 224,212

Cash and cash equivalents

at the beginning of the period 8,823 29,989

Cash and cash equivalents

at the end of the period 11,018 254,201

============= =============

The accompanying notes are an integral part of these condensed

interim financial statements.

Notes to the Condensed Interim Financial Statements

For the 6-month period ended 31 December 2022

1. General information

The Company was incorporated with limited liability in Guernsey

under the Companies (Guernsey) Law, 2008, as amended, on 6 February

2017 with registered number 63061, and is regulated by the GFSC as

a registered closed-ended investment company. The registered office

and principal place of business of the Company is 1 Le Truchot, St

Peter Port, Guernsey, Channel Islands, GY1 1WD.

The Company had 308,628,541 ordinary shares in issue on 1 July

2022 all of which were listed on the Specialist Funds Segment of

the Main Market of the London Stock Exchange.

During the current period, the Company bought a total of 850,000

of its own ordinary shares at an average price of US$1.14 per

Share. Further details are noted in Note 5. The total number of

Company's shares in issue was 307,778,541 at the end of the

financial period.

2. Significant accounting policies

(a) Basis of Preparation

The Condensed Interim Financial Statements have been prepared on

a going concern basis in accordance with IAS 34 Interim Financial

Reporting, and applicable Guernsey law. These Condensed Interim

Financial Statements do not comprise statutory Financial Statements

within the meaning of the Companies (Guernsey) Law, 2008, and

should be read in conjunction with the Financial Statements of the

Company as of and for the year ended 30 June 2022, which were

prepared in accordance with International Financial Reporting

Standards. The statutory Financial Statements for the year ended 30

June 2022 were approved by the Board of Directors on 23 September

2022. The opinion of the auditors on those Financial Statements was

not qualified. The accounting policies adopted in these Condensed

Interim Financial Statements are consistent with those of the

previous financial year and the corresponding interim reporting

period can be found in the Annual Report for the financial year

ending 30 June 2022 , except for the adoption of new and amended

standards as set out below.

Compliance with IFRS

The financial statements have been prepared on a going concern

basis in accordance with International Financial Reporting

Standards ("IFRS"), which comprise standards and interpretations

approved by the International Accounting Standards Board ("IASB")

and International Financial Reporting Interpretations Committee