TIDMSYS1

RNS Number : 0422W

System1 Group PLC

13 April 2023

13 April 2023

System1 Group PLC (AIM: SYS1)

("System1", or "the Company", or "the Group")

Further re Requisitioned General Meeting

As previously announced on 7 March 2023, System1 received an

email from Stefan Barden (former System1 Chief Executive Officer

and Board Adviser) and James Geddes (former System1 Chief Financial

Officer) (the "Requisitioning Shareholders") seeking to requisition

a general meeting of the Company (the "Requisition") unless certain

Board changes were agreed to by the Company's Board of Directors

(the "Board").

On 24 March 2023, the Company posted a circular to Shareholders

(the "Circular") in response to the Requisition and a Notice of

General Meeting (the "Notice") convening the requisitioned General

Meeting for Shareholders which is to be held at the offices of Reed

Smith LLP at The Broadgate Tower, 20 Primrose Street, London EC2A

2RS at 10:00 a.m. on 21 April 2023.

The Board considers that all the resolutions proposed by the

Requisitioning Shareholders are NOT in the best interest of the

Company and the shareholders as a whole.

The Board will be voting against all of them and unanimously

recommends that you do the same.

On 11 April 2023, the Company received the letter included below

from the Requisitioning Shareholders. The Company have responded to

this letter, and this is also included below.

The Company is today posting to Shareholders a copy of the

letter from the Requisitioning Shareholders and a copy of the

Company response to the letter from the Requisitioning

Shareholders.

1. Letter from Requisitioning Shareholders

Dear fellow System1 Group PLC shareholder,

We have requisitioned the resolutions which are to be voted on

at the forthcoming Extraordinary General Meeting, and which we

would encourage you to consider and vote on.

In summary we believe the company has considerable potential but

has performed poorly and needs a change in board composition to ful

l its potential. With a focus on Data-Platform sales, and proving

the value of the platform, we believe the company can realistically

aim for an exit with a value in excess of ve times its current

value.

It is di cult in these scenarios to nd independent and well

thought through views to guide these decisions.

In that regard, you might nd the latest System1 Group PLC update

from Maynard Paton helpful. Maynard is an investor in the company

and also an independent investment commentator and former analyst,

who has followed the company closely over a prolonged period. You

can nd his commentary at https://maynardpaton.com .

This is an important time for the company, and we thank you for

your time considering this.

Yours faithfully,

Stefan Barden and James Geddes

2. Company response to letter from Requisitioning Shareholders

Statement from the Board of System1 Group plc ("Company")

In advance of the Company's general meeting convened for 21

April 2023 ("GM"), the Company has received a communication from

Messrs Stefan Barden and James Geddes ("requisitioning

shareholders") that we are required in accordance with the UK

Companies Act to pass on to all Company shareholders.

Rather than set out their arguments directly to shareholders,

the requisitioning shareholders have provided a hyperlink to a

3(rd) party blog site belonging to Mr Maynard Paton who claims also

to be a shareholder in the Company. The requisitioning shareholders

describe Mr Paton as an "independent investment commentator". The

Board does not think the blog post dated 9 April 2023 ("Blog Post")

can be described as "independent", firstly because Mr Paton is a

shareholder in the Company and secondly because he did not ask the

Company to verify or comment on any of Mr Barden's assertions that

are reported in the Blog Post.

Mr Paton's Blog Post to over 7,500 words and draws heavily on a

recent interview with Mr Barden. The Blog Post covers a broad range

of topics, some of which are relevant to the Resolutions at the

forthcoming GM. The Board is of the opinion that the Blog Post

reports (largely unchallenged) a number of statements made by Mr

Barden in the interview and draws some incorrect conclusions by

linking the coincidental timing of events or trends (positive and

negative) to their alleged causation.

We have summarised below selected points made in the Blog Post,

organised by subject area, alongside your Board's response. It is

not always clear in the Blog Post which points are Mr Paton's and

which are those of the requisitioning shareholders and we have not

attempted to clarify the attribution of the points made.

Disclaimer:

The hyperlink of the Blog Post is being made available at the

request of the requisitioning shareholders. The Board cannot vouch

for the accuracy of any content and is not endorsing or promoting

its commentary or any investment advice related to the Company or

other securities included in the Blog Post or any other posts

available on the website that contains the Blog Post

1. Business performance & results

The Blog Post suggests that the Company is not focussed on

growing platform revenue or delivering profit or cash. The

Company's latest trading update provides ample evidence that this

is not the case.

Blog Post statement Board response

"The company should not be The Company's 12 April 2023

losing money. I don't believe trading update announced our

System1 should be losing cash return to profitability for

and how to get to at least H2 and the full year and GBP0.6m

breakeven will be one of the cash generation in Q4. We agree

first questions I pose to James that System1 should not be

[Gregory] and Chris [Willford]." losing money, but the Company

indicated a year ago at the

"Nor did SYS1 talk about the 27 April 2022 Capital Markets

prospect of near-term profitability, Day that expenditure would

which feels like an obvious increase, and margins tighten

oversight given the recent in FY23 as we continued to

H1 loss." invest in the Platform for

Predict Your and Improve Your

products at the increased H2

FY22 run rate.

------------------------------------

"Strong scalability and operational The performance for the second

gearing" of the Data platform half of FY23 (as set out in

have never emerged within the the 12 April 2023 trading update)

financials. counter this assertion with

significant growth in Platform

revenue and margin improvement

at every level. We stand by

our original assertion that

the Company will benefit from

strong scalability and operational

gearing.

------------------------------------

"Mr Barden disclosed SYS1 enjoyed The Company's 12 April 2023

a healthy sales pipeline before trading update announced record

his departure: revenue growth of our standard

"Management are three years Predict Your and Improve Your

into their sales approach and products (Platform-based data

it is not working fast enough. and consultancy) to a point

When I stepped back there was where they represented 80%

a sales pipeline that should of revenue in Q4, growing by

have increased sales substantially. 73% on Q4 FY22 and by 38% for

Instead, System1 is flat. Something the financial year.

has clearly gone wrong."

We note that Mr Barden was

either Chief Operating Officer

("COO") or Chief Executive

Officer ("CEO") for most of

the three years he refers to

here. The Company has seen

record growth in Platform revenue

since he has left

------------------------------------

2. Strategy - where to win, participation

The review of strategic options, the findings of which were

announced on 30 November 2022, determined that pursuing a long tail

of small business with a web-only offering was not currently

attractive as it was estimated to generate poor returns and low

lifetime value/ customer acquisition cost ("LTV/CAC"). Mr Barden

disagrees. Similarly, we have learned over the past 3 years that

our most important customers (many of them tech businesses) are not

yet ready to transact online to buy market research.

Blog Post statement Board response

"Apart from mentioning they Test Your Ad is our most developed

have Innovation and Brand services, product and proposition that

you won't see anything out there grew by over 20% H2 on H1. However

where they are doing anything Brand and Idea are also important

to sell them. That's why the parts of our product suite,

sales of those areas have lagged. proposition and large growth

The advertising part has grown, opportunities for the Company.

but everything else has collapsed Following the launch of Test

far faster because there is Your Idea Pro in Q2, Innovation

nobody focusing on them. The product revenue increased by

net result is flat-to-declining 28% in H2 versus H1. Brand grew

total revenue." by 12% year on year, helped

by the first full year of Test

Your Brand.

------------------------------------------

Mr Barden believed SYS1 could The recent review of strategic

broaden its sales efforts to options carefully considered

include smaller companies, "national two propositions championed

champions" and fast-growing by Mr Barden and which the Board

start-ups, as well as the the has now chosen to deprioritise

very largest businesses: in favour of higher-yielding

"There's a pyramid of customers opportunities.

and System1 is starting at the The first is that the Company

top, which they do need to get can maximise shareholder value

to, because they need to get by pursuing an opportunity in

to every single level. At the the long tail of small & medium

very top are really competent sized enterprises, as opposed

global players, such as Unilever, to building a franchise with

P&G, Nestle... where the top the world's top 100 spenders

people have a lot of experience on advertising. The idea was

and it's really difficult for deprioritised for direct customer

you to get in there and change acquisition in the near term

their minds" following a review of the economics

(small profit pool) and the

"Imagine a three-by-three matrix. likely poor return and low LTV/CAC.

Columns are headed by product; However, we believe we can access

Advert, Innovation, and Brand. this group of customers in a

The Rows are the key channels. more cost-effective way through

Let's start with just three; our partnerships with for example

Global brand, National brand LinkedIn who already have direct

and Fast growing start-up." access to these smaller businesses.

The second is that there is

"System1 should sell its platform a demand from all customers

equally to all. But today the to purchase and transact all

board seems to focus only on their creative content pre-testing

the top left: Advert testing purely online via the Company's

for global brands. Not only Platform. The Board recognises

that, it seems to sell creative that this way of transacting

advertising support, methodologies could be attractive to the Company

and insight, rather than the as a supplier and will keep

best-in-class prediction platform, the opportunity under review.

which is more accurate, cheaper The consistent feedback from

and quicker than anyone else." our customers as well as our

staff in sales, financial and

"Filling out the matrix, adding legal roles is that most of

extra channels and focusing the customers we deal with are

on also becoming viral rather neither willing nor able currently

than just purely selling relationship to conduct their purchasing

by relationship is the key to of market research solely via

success. I would argue that a supplier's portal.

such an approach is just not "Filling out the matrix" is

in the psyche of the current a nice "white-board" idea, but

board as they have an advertising-agency if the economics do not work,

background and see the platform we will not pursue that opportunity.

only through an agency lens. The Board's approach to becoming

The proposed extra hires will viral centres on our increasingly

only exacerbate this". successful fame-building activities

on both sides of the Atlantic,

including the Ad of the Week

, Uncensored CMO , relationship-building

with marketing influencers such

as Mark Ritson, as well as our

thought leadership work such

as Wise Up! and Feeling Seen

USA .

We set out the Board's platform

and digital credentials in the

Circular , together with our

plans to recruit a team of media

tech advisers in the US

------------------------------------------

"Mr Barden believes the marketing-technology The "winner takes all" hypothesis

sector is a winner-takes-all may or may not turn out to be

opportunity, with SYS1, Zappi right. In the meantime, market

or another competitor one day research is a fragmented market

emerging as the dominant marketing-data with plenty of scope for growth

supplier. by smaller players and for consolidation

I suppose a trade-buyer could to create larger groupings.

also imagine SYS1 (or Zappi The Company is embedding its

or another competitor) becoming data into several partners (including

the Rightmove or Autotrader LinkedIn and ITV) and customers

of the marketing-technology (including adidas).

industry... and pay handsomely This is a clear part of the

for that potential." strategy that the Board set

out in the findings from the

review of strategic options

and is achieving success in

its execution. We would note

the quotations from selected

customers in the Circular .

------------------------------------------

3. Strategy - how to win, marketing

Mr Barden describes the Company as an "agency". We do not. We

want to give our chief marketing officers ("CMOs") and insights

customers confidence in their creative marketing decisions on

innovation, advertising and brand identity.

Blog Post statement Board response

System1 should be selling marketing We do not consider that Platform

predictions. What System1 should and creativity need to be mutually

not be doing is selling advertising exclusive. We are selling predictions

creativity. And this is the (product, feature) whilst at

fundamental issue, the creativity the same time selling the important

side has taken over and pushed benefit of creative confidence

the platform thinking out... to our customers.

rather than publishing books

such as Look Out. We understand that the competitor

System1 should be talking about research platform companies

its marketing predictions being that are mentioned in the Blog

the best, the cheapest and the Post also provide a combination

quickest" of data, insight through consultancy,

and thought leadership.

Note, Mr Barden was CEO at the

time of the publication of Look

Out. It is unclear why he now

regrets his marketing strategy

while he was CEO.

---------------------------------------

From what I can tell: The Board does not recognise

Mr Kearon wishes to sell SYS1's the dichotomy set out here.

creative-advertising services We wish to sell all our products

to marketing people who develop/commission to as broad a range of businesses

adverts, while; as is commercially attractive.

Mr Barden wishes to sell SYS1's In practice, we have found that

platform-prediction services ad testing is the best way to

to marketing and 'insights' initiate a new relationship

people, as well as innovation with a large business, because

and creative agencies. Everyone advertising is one of their

in fact. largest and therefore most important

annual investment. That's why

Test Your Ad is the product

we lead with, and then target

to sell in Test Your Idea and

Test Your Brand once we have

won the relationship with the

CMO and Head of Insight. We

deal with insights people every

day; the CMO relationship is

something we have developed

very successfully in the last

3 years and has often helped

us gain a foothold in customers

that we had not previously managed

to win via the insights department.

Separately, John Kearon's role

is to develop new business wherever

opportunities arise and particularly

in the US, because of the scale

and opportunity in the that

market. James Gregory as CEO

is leading the executive team

and executing the strategy agreed

by the Board.

The Company does not describe

itself as an agency and questions

why Mr Barden continues to do

so.

---------------------------------------

"System1 should be talking about This is a clear part of our

its marketing predictions being marketing messaging. E.g. the

the best, the cheapest and the Test Your Ad webpage images

quickest." below:

---------------------------------------

4. Track record/ fact check

The Board noted some comments in the Blog Post that are not

correct and where we wish to set the record straight.

Blog Post statement Board response

I was disappointed many of SYS1's The Board stands by all of the

arguments against Mr Barden arguments in the 24 March 2023

- notably his Behaviorally chairmanship, Circular , all of which were

potential pay and that 53% staff subjected to verification by

rating - did not really stand external advisers - a different

up to scrutiny. level of scrutiny than applies

to blog posts.

---------------------------------------

"This vote is not about personalities The Board agrees which is why

because a good business is greater it is unanimously recommending

than any individual." shareholders not to change 3

individuals for 1 ( Mr Barden).

---------------------------------------

This may be very simplistic, The Board is of the opinion

but a pattern seems to have that this is a grossly simplistic

emerged: and unreliable conclusion. There

* Mr Barden takes on executive is often a time lag of 6 months

board duties, and SYS1 turns or more from product launches

from loss to profit, and; or marketing activity and visible

* Mr Barden relinquishes executive sales results, which would undermine

board duties, and SYS1 turns what Mr Barden and Mr Paton

from profit to loss. claim.

"...Mr Barden's skillset looks

to be required once again to Mr Barden worked in the Company

stem the losses and return the from mid-2017, was a member

group to profit" of the senior management in

the business from early 2018,

attending Board meetings from

that time, and exerting material

influence in the business throughout.

He was eventually appointed

to the Board in June 2020, at

the end of the worst-hit quarter

in the pandemic. Profit did

indeed return immediately after

his appointment as a director,

but the bounce at that time

was not because of Mr Barden

(although he played a valuable

role helping the business mitigate

the losses at the start of the

pandemic).

Mr Barden served as CEO from

30 March 2021 until 31 January

2022. Similarly, the downturn

in profitability during 2022

was not related to Mr Barden's

departure in Q4 of FY22. Rather,

it was largely influenced by

the impact of Russian invasion

of Ukraine and the resulting

reduction in market research

budgets from a few key customers

with exposure to Russia. The

Board believes it was also a

consequence of Mr Barden's decisions

while he was CEO, to switch

off bespoke research, in favour

of email marketing initiatives,

which yielded no leads that

converted to new customer wins.

---------------------------------------

5. Shareholder value

The Board is aligned with Mr Barden's aspirations for value

accretion, including the timescales. Based on history, we do not

believe that adding Mr Barden to the Board would increase

shareholder value.

Blog Post statement Board response

The return to profit during During Mr Barden's period as

Mr Barden's boardroom tenure an adviser/employee the s hare

prompted the share price to price range d f rom GBP9.69

increase from approximately at the beginning ( end-May 2017)

100p to more than 400p: to GBP3.05 at the end (31 March

2022). The Board believes the

dip to 90p in mid-2020 was pandemic

related. Mr Barden had already

been working in the Company

for 3 years at that point.

--------------------------------------

And Mr Barden signalled a relatively The Board are open to maximising

short timescale for a potential shareholder value and are mindful

trade-sale exit: of their fiduciary obligations.

"I believe it should take up Notwithstanding that the Board

to three years to prove the believes that three years is

value." a realistic timescale to "prove

Stefan Barden: potential GBP100m-plus the value" of the Company under

valuation and $1 billion ambition its new CEO, James Gregory.

What could SYS1 be worth to

a potential acquirer? Mr Barden The Board shares Mr Barden's

suggested potential 5-bagger view of the potential future

upside from SYS1's recent GBP20m value of the Company and shares

market cap: his ambition to create shareholder

"I think this business is worth value.

GBP100m at least, GBP8 a share,

if not GBP150m, GBP12 a share." We are focused on growing the

Company profitably by becoming

an indispensable business partner

to the world's largest media

platforms, advertisers and marketing

spenders. We believe that this

route to market is the Company's

best way to scale profitably

and the principal platform for

creating shareholder value.

--------------------------------------

6. Talent and employee motivation

The Board wishes to confirm that statements in the Circular

related to employee satisfaction are based on quarterly staff

surveys which show that employee motivation has improved

consistently since Mr Barden left the Company.

Blog Post statement Board response

"I have a good track record The Board believe that none

of building strong teams. I of the Executive or Senior Management

brought in many of the current team have been contacted by

senior team. I am not looking Mr Barden recently, and it is

to exit anyone. I do however therefore unclear why this statement

know that many in the current is made. Everyone in the business

team are excited by a renewed is already delivering a Platform

platform focus, but if anyone focus, with Platform sales at

is not excited by the platform 80% of total revenue in Q4 and

opportunity then they should are looking forward to building

leave." on the successful H2 revenue

growth into FY24 and onwards,

under the existing Board.

---------------------------------------

"SYS1's statement included this During Mr Barden's tenure as

somewhat unseemly remark about CEO, the 53% staff satisfaction

53% staff-motivation levels rate for the entire business

... Mr Barden disclosed the can be attributed solely to

survey under his areas of responsibility him, not John Kearon.

had "above-average levels of It is worth noting that satisfaction

satisfaction", with "the real levels have significantly improved

issue" arising "in the sales across the Company since Mr

team that John Kearon controlled", Barden left the Company, including

in which the newly recruited in the operational areas that

platform sales team "did not were managed directly by Mr

feel properly supported". Barden.

---------------------------------------

RECOMMENDATION

The revenue trends in the trading update published by the

Company on 12 April 2023 suggest that the requisitioning

shareholders are out of touch with the Company's performance and

the growth that they are seeking is already being delivered. The

Board's recommendation for the General Meeting on 21 April 2023

remains that you should VOTE AGAINST ALL FOUR RESOLUTIONS for the

following reasons.

1. We have the right Board for the next phase of the Company's

growth

2. The US is key to success - a distinguished and tech-savvy US

advisory team, assembled by Non-Executive Chair Rupert Howell, is

ready to start work after the General Meeting

3. The Board has a clearly defined plan for the Company that is

starting to work

4. Customers support our go-to-market strategy

5. The Requisitioning Shareholders have not articulated an

alternative strategy beyond re-appointing Mr. Barden to the

Board

6. We need expertise in business-to-business sales and marketing

- a different skillset from Mr. Barden's

7. The Board does not believe having an Executive Chair would be

in the interest of all shareholders, and Mr. Barden is conflicted

by holding a Non-Executive Chair position at Behaviorally, a market

research platform business

8. We will lose our Founder and President, John Kearon, who

holds 22% of the Company's voting rights and has advised the Board

he will not remain a director on the terms proposed by the

Requisitioning Shareholders

9. Unless the proposed resolutions are defeated, there is a risk

of serious business disruption if the executive leadership and

senior team members decide not to serve under Mr. Barden

10. It is not the right time to change the leadership - we have

very recently appointed a new Non-Executive Chair and CEO. The

current Board deserves more time to deliver the growth agenda

Further information on the Company can be found at

www.system1group.com .

This announcement contains inside information for the purposes

of article 7 of the Market Abuse Regulation (EU) 596/2014 as

amended by regulation 11 of the Market Abuse (Amendment) (EU Exit)

Regulations 2019/310. With the publication of this announcement,

this information is now considered to be in the public domain.

For further information, please contact:

System1 Group PLC Tel: +44 (0)20 7043

1000

James Gregory, Chief Executive Officer

Chris Willford, Chief Financial Officer

Canaccord Genuity Limited (Nominated Adviser Tel: +44 (0)20 7523

& Broker) 8000

Simon Bridges / Andrew Potts / Harry Rees

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCGZGMDMZMGFZZ

(END) Dow Jones Newswires

April 13, 2023 02:00 ET (06:00 GMT)

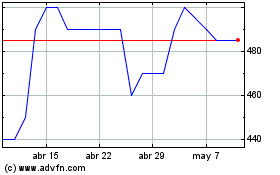

System1 (LSE:SYS1)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

System1 (LSE:SYS1)

Gráfica de Acción Histórica

De May 2023 a May 2024