Teleperformance Announces Successful €500 Million 5-Year Bond Issuance

15 Enero 2025 - 1:31AM

Business Wire

Regulatory News:

Teleperformance (Paris:TEP), a global leader in digital business

services, announced it has successfully completed a €500 million

bond issue, maturing in 2030, with an annual coupon of 4.25%.

The net proceeds of the issue will be used to meet the company's

general financing needs. The transaction will also allow

Teleperformance to extend the maturity of its debt profile.

The success of this issue, close to 6 times oversubscribed by a

diversified, high-quality investor base, confirms the market’s

confidence in the creditworthiness of the Group.

Standard & Poor’s has recently confirmed Teleperformance’s

investment grade rating of BBB, with a stable outlook, the highest

credit rating received in the customer experience management

industry.

Citi, Deutsche Bank, JP Morgan, Standard Chartered Bank, and

Wells Fargo acted as active joint lead managers.

###

About Teleperformance Group

Teleperformance (TEP – ISIN: FR0000051807 – Reuters: TEPRF.PA

- Bloomberg: TEP FP), is a global leader in digital business

services which consistently seeks to blend the best of advanced

technology with human empathy to deliver enhanced customer care

that is simpler, faster, and safer for the world’s biggest brands

and their customers. The Group’s comprehensive, AI-powered service

portfolio ranges from front office customer care to back-office

functions, including operations consulting and high-value digital

transformation services. It also offers a range of specialized

services such as collections, interpreting and localization, visa

and consular services, and recruitment process outsourcing

services. The teams of multilingual, inspired, and passionate

experts and advisors, spread in close to 100 countries, as well as

the Group’s local presence allows it to be a force of good in

supporting communities, clients, and the environment. In 2023,

Teleperformance reported consolidated revenue of €8,345 million

(US$9 billion) and net profit of €602 million.

Teleperformance shares are traded on the Euronext Paris market,

Compartment A, and are eligible for the deferred settlement

service. They are included in the following indices: CAC 40, STOXX

600, S&P Europe 350, MSCI Global Standard and Euronext Tech

Leaders. In the area of corporate social responsibility,

Teleperformance shares are included in the CAC 40 ESG since

September 2022, the Euronext Vigeo Euro 120 index since 2015, the

MSCI Europe ESG Leaders index since 2019, the FTSE4Good index since

2018 and the S&P Global 1200 ESG index since 2017.

For more information: www.teleperformance.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20250114130061/en/

FINANCIAL ANALYSTS AND INVESTORS Investor relations and

financial communication department TELEPERFORMANCE Tel: +33 1 53 83

59 15 investor@teleperformance.com

PRESS RELATIONS Europe Karine Allouis – Laurent

Poinsot IMAGE7 Tel: +33 1 53 70 74 70 teleperformance@image7.fr

PRESS RELATIONS Americas and Asia-Pacific Nicole

Miller TELEPERFORMANCE Tel: +1 629-899-0675

tppublicaffairs@teleperformance.com

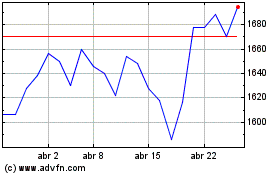

Telecom Plus (LSE:TEP)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

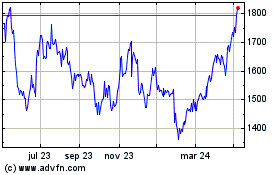

Telecom Plus (LSE:TEP)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025