Tetragon Financial Group Ltd Notification of a Tender Offer

03 Noviembre 2023 - 11:06AM

UK Regulatory

TIDMTFG

Tetragon Financial Group Limited Announcement of Tender Offer to Purchase

$35,000,000 of Tetragon Non-Voting Shares

LONDON, Nov. 3, 2023 /PRNewswire/ -- Tetragon today announces the commencement

of a tender offer to purchase a portion of its outstanding non-voting shares for

a maximum aggregate payment of $35,000,000 in cash. The tender offer, which was

initially announced by Tetragon on 25 October 2023, will be conducted as a

"modified Dutch auction" with shareholders able to tender their Tetragon non

-voting shares at prices ranging from and including $8.75 up to and including

$10.50 per share. The tender offer is expected to expire at 11:59 p.m. (ET) on 6

December 2023, unless extended or terminated earlier. J.P. Morgan Securities plc

(which conducts its U.K. investment banking business as J.P. Morgan Cazenove)

will act as dealer manager for the tender offer and Computershare Investor

Services PLC will act as tender agent for the tender offer.

Eligible shareholders will be able to indicate how many Tetragon non-voting

shares and at what price or prices within the specified range they wish to

tender. Based on the number of shares tendered and the prices specified by the

tendering shareholders, J.P. Morgan, as dealer manager, will determine the

lowest price per share within the range that will enable Tetragon to purchase

$35,000,000 in value of Tetragon non-voting shares, or a lower amount if the

tender offer is not fully subscribed. All shares purchased by Tetragon in the

tender offer will be purchased at the same price. If, based on the determined

purchase price, more than $35,000,000 in value of shares are properly tendered

and not properly withdrawn, valid tenders made below the determined purchase

price are expected to be accepted in full, except in the limited circumstances

described below, while valid tenders made at the determined purchase price will

be subject to proration. However, if the pro rata reduction of the number of

shares eligible to be purchased at the determined purchase price is insufficient

to reduce the value of the shares to be purchased to $35,000,000, then none of

the shares tendered at the determined purchase price will be purchased, and

instead there will be a pro rata reduction in the purchase of shares tendered at

the next highest price below the determined purchase price to the extent

necessary to reduce the value of shares purchased to $35,000,000. The determined

purchase price, as well as the proration factor (if applicable), is expected to

be announced on or 7 December 2023, and Tetragon expects the purchase of shares

in the tender offer would be settled promptly thereafter.

The tender offer is not conditioned upon the receipt of any minimum number of

shares being tendered.

This release is for informational purposes only and is neither an offer to buy

nor the solicitation of an offer to sell any shares of Tetragon. The full

details of the tender offer, including complete instructions on how to tender

shares, are included in the offer to purchase which is available on Tetragon's

website at the following URL:

https://www.tetragoninv.com/shareholders/share

-repurchases (https://c212.net/c/link/?t=0&l=en&o=4015949

-1&h=431285273&u=https%3A%2F%2Fwww.tetragoninv.com%2Fshareholders%2Fshare

-repurchases%3Fshare-repurchase

-year%3D&a=https%3A%2F%2Fwww.tetragoninv.com%2Fshareholders%2Fshare-repurchases)

Shareholders should read carefully the offer to purchase because it contains

important information. Shareholders may obtain electronic copies of this

document free of charge by calling Computershare at +44 37 0707 4040.

Shareholders are urged to read these materials carefully prior to making any

decision with respect to the tender offer.

Contacts:

Computershare: +44 37 0707 4040

About Tetragon:

Tetragon is a Guernsey closed-ended investment company. Its non-voting shares

are listed on Euronext in Amsterdam, a regulated market of Euronext Amsterdam

N.V., and also traded on the Specialist Fund Segment of the Main Market of the

London Stock Exchange. Our investment manager is Tetragon Financial Management

LP. Find out more at www.tetragoninv.com.

Tetragon: Press Inquiries:

Yuko Thomas Prosek Partners

Investor Relations Pro-tetragon@prosek.com

ir@tetragoninv.com +44 20 3890 9193

+1 212 279 3115

Forward-Looking Statements:

This press release contains forward-looking statements. These forward-looking

statements include all matters that are not historical facts. These forward

-looking statements are made based upon Tetragon's expectations and beliefs

concerning future events impacting Tetragon and therefore involve a number of

risks and uncertainties. Forward-looking statements are not guarantees of future

performance, and Tetragon's actual results of operations, financial condition

and liquidity may differ materially and adversely from the forward-looking

statements contained in this press release. Forward-looking statements speak

only as of the day they are made and Tetragon does not undertake to update its

forward-looking statements unless required by law.

This release contains inside information within the meaning of Article 7(1) of

the EU Market Abuse Regulation (2014/596/EU), or EU MAR, and of the UK version

of EU MAR as it forms part of UK law by virtue of the European Union

(Withdrawal) Act (as amended).

This release does not contain or constitute an offer to sell or a solicitation

of an offer to purchase securities in the United States or any other

jurisdiction. The securities of Tetragon have not been and will not be

registered under the U.S. Securities Act of 1933, as amended, and may not be

offered or sold in the United States or to U.S. persons unless they are

registered under applicable law or exempt from registration. Tetragon does not

intend to register any portion of its securities in the United States or to

conduct a public offer of securities in the United States. In addition, Tetragon

has not been and will not be registered under the U.S. Investment Company Act of

1940, as amended, and investors will not be entitled to the benefits of such

Act. Tetragon is registered in the public register of the Netherlands Authority

for the Financial Markets (Autoriteit Financiële Markten) under Section 1:107 of

the Dutch Financial Markets Supervision Act as an alternative investment fund

from a designated state.

ANY DECISION TO PARTICIPATE IN THE TENDER OFFER SHOULD ONLY BE MADE ON THE BASIS

OF AN INDEPENDENT REVIEW BY AN ELIGIBLE SHAREHOLDER OF TETRAGON'S PUBLICLY

AVAILABLE INFORMATION. NEITHER J.P. MORGAN SECURITIES PLC NOR ANY OF ITS

AFFILIATES ACCEPT ANY LIABILITY ARISING FROM THE USE OF, OR MAKE ANY

REPRESENTATION AS TO THE ACCURACY OR COMPLETENESS OF, THIS ANNOUNCEMENT OR

TETRAGON'S PUBLICLY AVAILABLE INFORMATION. THE INFORMATION CONTAINED IN THIS

ANNOUNCEMENT IS SUBJECT TO CHANGE IN ITS ENTIRETY WITHOUT NOTICE UP TO THE

CLOSING DATE.

In the United Kingdom, this announcement is being distributed to, and is

directed at, only (a) persons who have professional experience in matters

relating to investments who fall within the definition of "investment

professionals" in Article 19(5) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005, as amended; (b) high net worth companies, and

other persons to whom it may otherwise lawfully be communicated, falling within

Article 49(2)(a) to (d) of the Financial Services and Markets Act 2000

(Financial Promotion) Order 2005; or (c) persons to whom an invitation or

inducement to engage in an investment activity (within the meaning of Section 21

of the Financial Services and Markets Act 2000) in connection with the tender

offer may otherwise lawfully be communicated or caused to be communicated (all

such persons together being referred to as "relevant persons"). The tender offer

is available only to relevant persons. Any person who is not a relevant person

should not act or rely on this announcement or any of its contents. Persons

distributing this announcement must satisfy themselves that it is lawful to do

so.

J.P. Morgan Securities plc, which is authorised by the UK Prudential Regulation

Authority and regulated by the UK Financial Conduct Authority and the Prudential

Regulation Authority in the United Kingdom, is acting exclusively for Tetragon

and for no one else in connection with the tender offer and will not be

responsible to anyone (whether or not recipient of the tender offer) other than

Tetragon for providing the protections afforded to the clients of J.P. Morgan

Securities plc or for providing advice in relation to the tender offer.

This information was brought to you by Cision http://news.cision.com

END

(END) Dow Jones Newswires

November 03, 2023 13:06 ET (17:06 GMT)

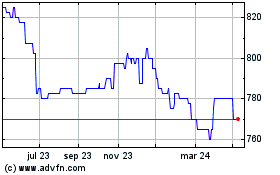

Tetragon Financial (LSE:TFGS)

Gráfica de Acción Histórica

De Ene 2025 a Feb 2025

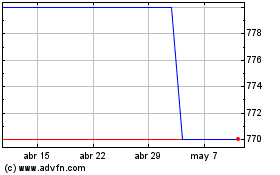

Tetragon Financial (LSE:TFGS)

Gráfica de Acción Histórica

De Feb 2024 a Feb 2025