TIDMTFIF

TWENTYFOUR INCOME FUND LIMITED

INTERIM MANAGEMENT REPORT AND UNAUDITED CONDENSED

INTERIM FINANCIAL STATEMENTS

For the period from 1 April 2023 to 30 September 2023

LEI: 549300CCEV00IH2SU369

(Classified Regulated Information, under DTR 6 Annex 1 section 1.2)

The Company has today, in accordance with DTR 6.3.5, released its Interim

Management Report and Unaudited Condensed Financial Statements for the period

ended 30 September 2023. The Report will shortly be available via the

Company'sPortfolio Manager's website www.twentyfouram.com and will shortly be

available for inspectiononline at www.morningstar.co.uk/uk/NSM website.

FINANCIAL AND OPERATIONAL HIGHLIGHTS

·NAV per share of 102.71 pence (FYE 31/03/23: 100.97 pence)

·Total Net Assets of £768.12 million (FYE 31/03/23: £724.98 million)

·Dividends declared for the 6-month period of 4 pence per share (12 months to

FYE 31/03/23: 9.46 pence per share) and remain on track to deliver the Company's

target dividend for the year

·Dividends paid in the 6-month period were 6.46 pence per share (12 months to

FYE 31/3/2023: 7.27 pence per share)

·Total Return of 8.50% (FYE 31/03/23: -3.54%)

·The Company continues to perform strongly, with no defaults or credit concerns

within the portfolio

Aza Teeuwen, Partner & Portfolio Manager at TwentyFour Asset Management, said:

"The rising rate environment coupled with a strong supply and active primary

market has enabled us to position TwentyFour Income Fund Limited positively over

the period. The rise in portfolio coupon rates as base rate hikes were seen,

combined with accretive additions to the portfolio have contributed to the

Company's income levels, while maintaining the credit profile."

Bronwyn Curtis OBE, Chair of TwentyFour Income Fund, said: "We are very pleased

to present the interim financial statements for the Company, which demonstrate

how TwentyFour Income Fund Limited continues to deliver an excellent income

story. The Company's strong NAV performance sits alongside its stand-out share

activity for the period, having traded at or around NAV, while the bulk of the

investment company market saw significant discounts."

SUMMARY INFORMATION

The Company

TwentyFour Income Fund Limited (the "Company" and "TFIF") is a closed-ended

investment company whose shares("Ordinary Shares", being the sole share class)

have a Premium Listing on the Official List of the UK Listing Authority. The

Company was incorporated in Guernsey on 11 January 2013.The Company has been

included in the London Stock Exchange's FTSE 250 Index since 16 September 2022.

Investment Objective and Investment Policy

The Company's investment objective is to generate attractive risk adjusted

returns principally through income distributions. The Company's investment

policy is to invest in a diversified portfolio ("Portfolio") of predominantly UK

and European Asset Backed Securities ("ABS"). The Company maintains a Portfolio

largely diversified by the issuer, it being anticipated that the Portfolio will

comprise at least 50 ABS at all times.

Target Returns*

The Company has a target annual net total return on the Company's NAV of between

6% and 9% per annum, which since 24 February 2023 has included quarterly

dividends with an annual target each financial year of 8% of the Issue Price

(the equivalent of 8 pence per year, per Ordinary Share), effective from the

dividend declared in respect of the 3-month period ended 31 March 2023. Between

21 September 2022 and 23 February 2023 the annual target dividend was 7% and

prior to that was 6%. Total return per Ordinary Share is calculated by adding

the increase or decrease in NAV per share with the dividend per share and

dividing it by the NAV per share at the start of the period/year.

The increases in the annual target dividend are intended to increase the rate of

return to investors following increases in global interest base-rates.

Ongoing Charges

Ongoing charges for the period ended 30 September 2023 have been calculated in

accordance with the Association of Investment Companies (the "AIC") recommended

methodology. The ongoing charges for the period ended 30 September 2023 were

0.99% (30 September 2022: 0.95%).

Discount

As at 23 November 2023, the discount to NAV had moved to 2.49%. The estimated

NAV per share and mid-market share price stood at 102.25p and 99.70p,

respectively.

Published NAV

Northern Trust International Fund Administration Services (Guernsey) Limited

(the "Administrator") is responsible for calculating the NAV per share of the

Company. The unaudited NAV per Ordinary Share will be calculated as at the close

of business on the last business day of every week and the last business day of

every month by the Administrator and will be announced by a Regulatory News

Service the following business day. The basis for determining the Net Asset

Value per share can be found in Note 5.

* The Issue Price being £1.00. This is a target only and not a profit forecast.

There can be no assurance that this target will be met or that the Company shall

pay any dividends at all. This target return should not be taken as an

indication of the Company's expected or actual current or future results. The

Company's actual return will depend upon a number of factors, including the

number of Ordinary Shares outstanding and the Company's total expense ratio, as

defined by the AIC's ongoing charges methodology. Potential investors should

decide for themselves whether or not the return is reasonable and achievable in

deciding whether to invest in or retain or increase their investment in the

Company. Further details on the Company's financial risk management can be found

in note 16.

Financial Highlights

NAV per share

As at 30 September 2023 As at 31 March 2023

102.71p 100.97p

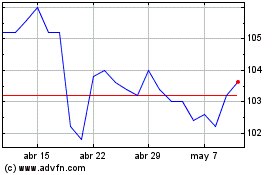

Share price

As at 30 September 2023 As at 31 March 2023

97.80p 100.50p

Total Net Assets

As at 30 September 2023 As at 31 March 2023

£768.12 million £724.98 million

Total return

For the six-month period For the year ended 31 March 2023

ended 30 September 2023

8.50% -3.54%

Dividends declared

For the six-month period For the year ended 31 March 2023

ended 30 September 2023

4p 9.46p

Average premium /

(discount)

For the six-month period For the year ended 31 March 2023

ended 30 September 2023

-0.82% 0.55%

Shares in issue

As at 30 September 2023 As at 31 March 2023

747.84 million 718.04 million

Portfolio performance

For the six-month period For the year ended 31 March 2023

ended 30 September 2023

7.39% -1.17%

Repurchase Agreement

Borrowing

As at 30 September 2023 As at 31 March 2023

0.78% 6.74%

Number of positions in

portfolio

As at 30 September 2023 As at 31 March 2023

197 183

Please see the 'Glossary of Terms and Alternative Performance Measures' for

definitions how the above financial highlights are calculated.

CHAIR'S STATEMENT

for the period from 1 April 2023 to 30 September 2023

Bronwyn Curtis OBE

In my capacity as Chair of the Board of Directors of TwentyFour Income Fund

Limited (the "Company"), I am pleased to present my report on the Company's

progress for the six-month period ended 30 September 2023 (the "reporting

period").

Investment Performance

In May 2023, the Company distributed the final quarterly dividend of its

financial year at 4.46p per share, increasing the overall annual dividend to

9.46p per share. This represented a 40% increase over 2022 and the highest

distribution since inception, an excellent result particularly considering the

wider market backdrop.

During the reporting period, the NAV per share saw an increase from 100.97 to

102.71, a rise of 1.72%. The Company's net assets increased from £725m to £768m

and the NAV per share total return for the reporting period was 8.50%.

Market Overview

The start of the reporting period saw wider financial markets sailing into

calmer waters, following the regional US regional banking turmoil, which gave

the market the necessary stability and favourable backdrop to support primary

issuance in a meaningful way.

Fundamentals have played their part in the overall performance of the sector.

While traditional fixed income markets have been dominated by discussions around

central bank policy and peak rates, with multiple increases in key rates by the

Bank of England and the European Central Bank, the floating rate Asset Backed

Securities ("ABS") and Collateralised Loan Obligations ("CLOs") markets have

benefitted from the anticipated higher for longer rate environment.

In the UK, headline inflation is moderating - although core inflation remains

challenging. House prices have been steadily falling over the reporting period

and the Nationwide House Price Index fell 5.3% year on year to September 2023.

Housing market activity remains weak with just 45,400 mortgage approvals in

August, which is around 30% below the monthly average prevailing in 2019 prior

to the pandemic. This subdued picture is not surprising given rising mortgage

rates and the challenging picture for housing affordability, however, swap rates

stabilised over the reporting period and some lenders started to reduce mortgage

lending rates.

The unemployment rate over the reporting period continued to be very low. As job

losses are generally the biggest driver of mortgage arrears, the actual losses

remain minimal. However, the job market is weakening and while wage growth

continues to be strong; cracks are starting to appear and mortgage arrears have

increased this year. TwentyFour Asset Management LLP (the "Portfolio Manager")

highlighted this development in previous reports to you, so it isn't a surprise

and they have positioned the portfolio for this. The levels of arrears are low,

and the portfolio has seen no defaults. Most of the asset class's

underperformance has been seen in legacy (pre-Global Financial Crisis) non

-conforming mortgage portfolios. None of these are held by the Company.

The debate around rates has shifted from how high rates might go, to how long

rates might remain elevated. Deutsche Bank analysis recently noted that from a

UK RMBS perspective one thing is clear: that the vast majority of borrowers who

reverted from a fixed rate to a floating mortgage in 2023 (the cohort that in

theory, should be most exposed to affordability stress), have so far, weathered

the shock. Actual losses remain almost non-existent within UK and European RMBS

and ABS securitisation pools and the 12-month trailing leveraged loan default

rate remains low at 1.5%, which is well below the levels that had been forecast.

There have been no losses in any tranches of any deals which the Company holds.

Dividend

The Company aims to distribute all its investment income to ordinary

shareholders. The Company is currently targeting quarterly payments equivalent

to an annual dividend of at least 8p per year. The fourth interim dividend is

used to distribute residual income (if any), generated in the year. Dividends

paid by the Company for the reporting period totalled 6.46p per ordinary share.

The increase in dividends for the financial year ending March 2023 was driven by

two main factors; the increase in the Bank of England Rate (which rose by 1%

from 4.25% to 5.25% in the six-month period to 30 September 2023), and the

deployment of available capital from bond amortisations in the portfolio of the

Company, along with share issuance by the Company. This enabled the Portfolio

Manager to invest at the then prevailing higher yields; which was accretive to

the income of the Company.

Premium/Discount and Share Capital Management

In contrast to the wider investment company market, which saw trading at large

discounts across the board, the Company traded close to NAV for the majority of

the reporting period, at an average of only a -0.82% discount.

Due to shareholder demand coupled with the ability to purchase accretive

assets, the Company was able to issue £29.8m of new shares between April and the

end of June 2023.

Annual General Meeting

The Company's 2023 Annual General Meeting was held on 14 September 2023, with

all resolutions being passed.

Board Composition

Richard Burwood retired as Non-Executive Director of the Company and as the

Chair of the Management Engagement Committee, effective from 14 September 2023.

I would like to thank Richard for all his hard work and valued contribution to

the Board and to the Company during his tenure.

With effect from 14 September 2023, Paul Le Page was appointed as Chair of the

Management Engagement Committee.

Outlook

The market consensus is that we are close to terminal rates in the UK and Europe

and the market is pointing towards a soft-landing next year. In this scenario,

the economic conditions for European ABS remains favourable as unemployment and

corporate defaults are expected to remain low. This in turn could mean that we

see central banks keeping interest rates at higher levels for longer, further

supporting the return profile of the Company's asset class.

Bronwyn Curtis OBE

Chair

23 November 2023

PORTFOLIO MANAGER'S REPORT

for the period from 1 April 2023 to 30 September 2023

TwentyFour Asset Management LLP

TwentyFour Asset Management LLP, in our capacity as Portfolio Manager to the

TwentyFour Income Fund Limited, are pleased to present our report on the

Company's progress for the six-month period ended 30 September 2023 ("the

reporting period").

Market Environment

The reporting period has seen around ?47bn of gross issuance in ABS markets,

including CLOs, which culminated in September being the busiest single month for

ABS, since the onset of the Global Financial Crisis ("GFC"). This included ?16bn

of Residential Mortgage-Backed Securities ("RMBS"), ?17bn of auto and consumer

ABS and ?11.5bn of CLOs. Issuance was from a very geographically diverse sector

across the UK and Europe and saw debut deals from new borrowers together with

repeat issuers and from platforms that have not been seen in the market for a

number of years.

One noted feature in the RMBS market was the welcome return of many bank

lenders, which was clearly due to the rolling off, of Central Bank funding

schemes.

It is becoming clear that banks are focussed on not only diversification of

funding but also on diversification of capital sources, following the Credit

Suisse AT1 write down. The market saw an increasing number of significant risk

transfer ("SRT") transactions (which gives banks a way of deleveraging their

balance sheets by transferring the risk of a tranche of a loan portfolio to an

investor in such a way that they obtain regulatory capital relief) and full

capital structures (which allows banks to sell whole loan portfolios rather than

adopt alternative strategies that can obtain capital relief) being issued;

mainly by European banks. We welcome this supply, as the collateral generally

includes the core business (and best performing collateral) of the issuing bank,

which should offer the Company the opportunity to further diversify its

portfolio, in the coming months.

The European CLO market was active, seeing issuance during the reporting period

of ?11.5bn, which took the CLO issuance for the full year-to-date to around

?18bn by the end of September. This was despite the challenges that the market

has endured for most of the year, mainly based on the weighted average cost of

capital as AAA spreads have remained stubbornly wide; but also due to a lack of

underlying leveraged loan supply.

We continue to see value in BB rated securities, which at the end of the

reporting period yielded around 13% (in GBP). Commercial Mortgage-Backed

Security ("CMBS") activity remains, understandably, near non-existent over the

reporting period, with just one deal (with low levels of leverage) from Last

Mile Logistic being pre-placed into the market.

However, the over-riding theme for the whole year to date, has really been the

very strong supply-demand technical that has been in play, evidenced by the

oversubscription levels seen across all deals, in particular mezzanine tranches,

which were generally oversubscribed multiple times.

Performance

The Company returned 8.50% in the reporting period, on a total return basis, a

strong performance mainly driven by CLO and RMBS returns.

Portfolio Events

The fundamentals of CLOs and European ABS have been in focus for quite some time

as the market has dealt with multiple headwinds. As spreads have gradually

tightened during this volatile period we have gradually reduced leverage from

5.4% to just under 1% in the Company as we continue to value liquidity and

flexibility in the portfolio.

One further aspect to consider is the rating performance of the ABS transactions

themselves. Since the GFC, securitisation structures have been robust and rating

performance has reflected this with upgrades being significantly higher than

downgrades. There have been no defaults or underlying issues with the assets in

the portfolio of the Company and the core focus has remained on western

European, secured assets (mortgages and leveraged loans). Wider market

volatility is likely to remain elevated and a deterioration of fundamental

performance is expected, and we have taken the opportunity in certain instances

to improve the credit profile in certain sectors. This has been achieved through

selling lower rated bonds and in their stead purchasing other bonds with a

higher rating or by reducing exposure to assets where our deal monitoring has

shown that the performance of those assets is has reduced. We have also pared

back the portfolio's exposure to UK RMBS equity through refinancing in the

region of £32m during the reporting period.

Portfolio Strategy

Our focus during the reporting period, has been and will continue to be on

investing in higher-yielding floating-rate ABS, which, in an environment of

higher-for-longer rates, should continue to deliver ongoing, attractive levels

of income; this should enable the Company to deliver on its annual target

dividend. At the end of the reporting period, the Company had a very healthy

gross purchase yield of 11.3% and a mark-to-market yield of 13.8%. While the

overall performance of UK and European mortgage market is understandably

deteriorating, the levels of losses observed within RMBS and ABS transactions

currently do not give us any cause for concern. The robust nature of the ABS

structures and our internal stress tests indicate that the performance of the

underlying assets would need to deteriorate by many multiples of the levels that

were seen in the GFC before significant losses would be seen on the

transactions.

The issues in the commercial real estate sector are well documented and will

take a long time to be resolved, this suggests that refinancing in the sector

will become more challenging and most CMBS deals are likely to extend in the

near term. As a result, we have re-underwritten all the CMBS holdings and

reduced the CMBS allocation, in the portfolio, to just 3.8%.

Spreads have generally tightened during the reporting period, whilst senior

issuance spreads have been mostly range-bound, without strong moves in either

direction, as the market expects further issuance in the last quarter. Most of

the spread performance has been in mezzanine and sub-investment grade bonds.

Given the elevated volumes of primary and secondary trading were well absorbed,

the market is well positioned in a good technical situation. The liquidity which

the Company has available could be deployed in the event of elevated market

stress to take advantage of any investment opportunities. We currently expect to

increase the allocation to SRT investments instead of future RMBS equity and

junior non-prime transactions.

Key Risks:

We believe the key risks currently perceived by the market are:

· The risk of the central bank rate increases having a lagged impact on

economic fundamentals.

· The risk that central banks overly extend monetary tightening in their fight

against high inflation, resulting in a greater economic slowdown than intended.

· The escalation of geopolitical risk due to the ongoing Ukraine-Russia

conflict and Middle East conflict.

Market Outlook:

· A soft economic landing remains our base case expectation, but a recession

in the EU, UK and/or US cannot be ruled out. We have therefore focussed on

keeping the credit spread duration and leverage of the portfolio relatively low.

· While corporate and consumer fundamentals are likely to deteriorate, we do

not expect this to be problematic for bond holders.

· We expect short term rates to remain elevated for longer. Market sentiment

has already priced in rate cuts in the fixed rate market and floating rate bonds

should benefit in the medium term from higher income due to elevated base rates.

· Protection from broader market volatility is very strong, supported by

relatively short maturities and high income.

· Given the current uncertainty in the global economy, we believe that

flexibility and liquidity remain important and remain of the view that raising

the credit quality of the portfolio seems prudent at this time.

TwentyFour Asset Management LLP

23 November 2023

TOP TWENTY HOLDINGS

as at 30 September 2023

Nominal/ Asset Fair Percentage of

Backed Value Net Asset

Security Value

Security Shares Sector* £

UK MORTGAGES CORP?FDG DAC 20,056,444 RMBS 21,621,569 2.81

KPF1 A 0.0% 31/07/2070

UK MORTGAGES CORPORATE F 24,273,696 RMBS 20,627,326 2.69

'KPF4 A' 0.00% 30/11/2070

SYON SECURITIES 19-1 B 17,508,622 RMBS 16,912,787 2.20

CLO FLT 19/07/2026

TULPENHUIS 0.0% 19,538,092 RMBS 16,674,636 2.17

18/04/2051

UKDAC MTGE 'KPF3 A' 0.0% 18,386,135 RMBS 14,647,940 1.91

31/7/2070

EQTY. RELEASE FNDG. NO 5 16,500,000 RMBS 13,447,500 1.75

'5 B' FRN 14/07/2050

CASTELL 2022-1 PLC '1 D' 13,299,000 RMBS 13,370,311 1.74

FRN 25/4/2054

VSK HOLDINGS LTD VAR 2,058,000 RMBS 13,160,874 1.71

31/7/2061

CHARLES ST CONDUIT ABS 2 12,500,000 RMBS 12,182,500 1.59

LIMITED CABS 2- CL B MEZZ

CHARLES STREET CONDUIT 12,000,000 RMBS 11,548,800 1.50

FRN 0.00% 12/04/2067

SYON SECS. 2020-2 DAC '2 10,441,446 RMBS 10,435,735 1.36

B' FRN 17/12/2027

HABANERO LTD '6W B' VAR 10,200,000 RMBS 10,200,000 1.33

5/4/2024

RRME 8X D '8X D' FRN 13,000,000 CLO 10,171,845 1.32

15/10/2036

VSK HLDGS. '1 C4-1' VAR 1,443,000 RMBS 9,244,830 1.20

01/10/2058

HOPS HILL NO2 PLC '2 E' 9,262,000 RMBS 8,692,280 1.13

FRN 27/11/2054

FONDO DE TITULIZACION 10,000,000 SME 8,674,368 1.13

PYME '7 NOTE' FRN

23/12/2042

UK MORTGAGES CORP FDG DAC 15,965,581 RMBS 8,257,654 1.08

KPF2 A 0.0% 31/07/2070

UK MORTGAGES CORP?FDG DAC 7,686,024 RMBS 8,195,377 1.07

CHL1 A 0.0% 31/07/2070

SYON SECURITIES 2020-2 8,338,258 RMBS 7,859,134 1.02

DESIGNATED A FLTG

17/12/2027

TAURUS 2020-1 NL DAC 10,421,518 CMBS 7,647,846 1.00

'NL1X E' FRN 20/02/2030

The full listing of the Portfolio as at 30 September 2023 can be obtained from

the Administrator on request.

* Definition of Terms

`ABS' - Asset Backed Securities

`CLO' - Collateralised Loan Obligations

`CMBS' - Commercial Mortgage-Backed Securities

`RMBS'- Residential Mortgage-Backed Securities

`SME' - Small and Medium Enterprises

BOARD MEMBERS

Biographical details of the Directors are as follows:

Bronwyn Curtis OBE - (Non-Executive Director and Chair)

Ms Curtis is a resident of the United Kingdom, an experienced Chair, Non

-Executive Director and Senior Executive across banking, media, commodities and

consulting, with global or European wide leadership responsibilities for 20

years at HSBC Bank plc, Bloomberg LP, Nomura International and Deutsche Bank

Group. She is presently a Non-Executive member of the Oversight Board at the UK

Office for Budget Responsibility and Non-Executive Director at Pershing Square

Holdings, The Scottish American Investment Company plc and BH Macro Limited. She

is also a regular commentator in the media on markets and economics. Ms. Curtis

was appointed to the Board on 12 July 2022 and was appointed Chair on 14 October

2022.

Joanne Fintzen - (Non-Executive Director and Senior Independent Director)

Ms Fintzen is a resident of the United Kingdom, with extensive experience of the

finance sector and the investment industry. She trained as a Solicitor with

Clifford Chance and worked in the Banking, Fixed Income and Securitisation

areas. She joined Citigroup in 1999 providing legal coverage to an asset

management division. She was subsequently appointed as European General Counsel

for Citigroup Alternative Investments where she was responsible for the

provision of legal and structuring support for vehicles which invested $100bn in

Asset Backed Securities as well as hedge funds investing in various different

strategies in addition to private equity and venture capital funds. Ms Fintzen

is currently Non-Executive Director of JPMorgan Claverhouse Investment Trust

plc. Ms Fintzen was appointed to the Board on 7 January 2019 and was appointed

Senior Independent Director on 14 October 2022.

John de Garis - (Non-Executive Director and Chair of the Nomination and

Remuneration Committee)

Mr de Garis is a resident of Guernsey with over 30 years of experience in

investment management. He is Managing Director and Chief Investment Officer of

Rocq Capital founded in July 2016 following the management buyout of Edmond de

Rothschild (C.I.) Ltd. He joined Edmond de Rothschild in 2008 as Chief

Investment Officer following 17 years at Credit Suisse Asset Management in

London, where his last role was Head of European and Sterling Fixed Income. He

began his career in the City of London in 1987 at Provident Mutual before

joining MAP Fund Managers where he gained experience managing passive equity

portfolios. He is a Non-Executive Director of VinaCapital Investment Management

Limited in Guernsey. Mr de Garis is a Chartered Fellow of the Chartered

Institute for Securities and Investment and holds the Certificate in Private

Client Investment Advice and Management. Mr de Garis was appointed to the Board

on 9 July 2021.

Paul Le Page (Non-Executive Director and Chair of the Management Engagement

Committee)

Paul Le Page is a resident of Guernsey and has over 24 years' experience in

investment and risk management. He was formerly an Executive Director and

Senior Portfolio Manager of FRM Investment Management Limited, a subsidiary of

the UK's largest listed alternatives manager, Man Group. In this capacity, he

managed alternative funds and institutional client portfolios, worth in excess

of $5bn and was a director of a number of group funds and structures. Prior to

joining FRM, he was employed by Collins Stewart Asset Management (now Canaccord

Genuity) where he was Head of Fund Research responsible for reviewing both

traditional and alternative fund managers and managing the firm's alternative

fund portfolios. He joined Collins Stewart in January 1999 where he completed

his MBA in July 1999. Mr Le Page is currently a Non-Executive Director of

NextEnergy Solar Fund Limited and RTW Biotech Opportunities Limited. Mr Le Page

was appointed to the Board on 16 March 2023.

John Le Poidevin - (Non-Executive Director and Chair of the Audit Committee)

Mr Le Poidevin is a resident of Guernsey and a Fellow of the Institute of

Chartered Accountants in England and Wales. He was formerly an audit partner at

BDO LLP in London where he developed an extensive breadth of experience and

knowledge across a broad range of business sectors in the UK, European and

global markets during over twenty years in practice, including in corporate

governance, audit, risk management and financial reporting. Since 2013 he has

acted as a Non-Executive, including as audit committee chair, on the boards of a

number of listed and private groups. Mr Le Poidevin is currently a Non-Executive

Director of International Public Partnerships Limited, BH Macro Limited, Super

Group (SGHC) Limited, and several other private companies and investment funds.

Mr Le Poidevin was appointed to the Board on 9 July 2021 and was appointed Chair

of the Audit Committee on 14 October 2022.

Board Member who retired during the period

Richard Burwood - (Non-Executive Director)

Mr Burwood is a resident of Guernsey with over 30 years' experience in banking

and investment management. During 18 years with Citibank London, Mr Burwood

spent 11 years as a fixed income portfolio manager spanning both banks/finance

investments and Asset Backed Securities. Mr Burwood has lived in Guernsey since

2010, initially working as a portfolio manager for EFG Financial Products,

managing the treasury department's ALCO Fixed Income portfolio. From 2011 to

2013, Mr Burwood worked as the Business and Investment Manager for Man

Investments, Guernsey. In January 2014, Mr Burwood joined the board of

RoundShield Fund, a Guernsey private equity fund, focused on European small to

mid-cap opportunities. In August 2015, he became a Board Member of SME Credit

Realisation Fund Limited, which provides investors access to a diversified pool

of SME loans originated through Funding Circle's marketplaces in the UK, US and

Europe. Mr Burwood also serves on the boards of Habrok, a hedge fund

specialising in Indian equities, and EFG International Finance, a structured

note issuance company based in Guernsey. Mr Burwood was appointed to the Board

on 17 January 2013 and retired from the Board effective 14 September 2023.

DISCLOSURE OF DIRECTORSHIPS IN PUBLIC COMPANIES LISTED ON RECOGNISED STOCK

EXCHANGES

Company Name Stock Exchange

Bronwyn Curtis

BH Macro Limited London

Pershing Square Holdings Limited London and Euronext Amsterdam

The Scottish American Investment Company Plc London

Joanne Fintzen

JPMorgan Claverhouse Investment Trust plc London

Paul Le Page

NextEnergy Solar Fund Limited London

RTW Biotech Opportunities Limited London

John Le Poidevin

BH Macro Limited London

International Public Partnerships Limited London

Super Group (SGHC) Limited New York

STATEMENT OF PRINCIPAL RISKS AND UNCERTAINTIES

The Company's assets are mainly comprised of ABS carrying exposure to risks

related to the underlying assets backing the security or the originator of the

security. The Company's principal risks are therefore market or economic in

nature.

The principal risks disclosed can be divided into the various areas as follows:

· Market Risk and Investment Valuations

Market risk is the risk associated with changes in market factors including

spreads, interest rates, economic uncertainty, changes in laws and political

circumstances.

Due to inflation concerns and existing geo-political tensions, both the UK and

Europe could go into a prolonged recessionary period, therefore, risk premiums

demanded by the market could continue to rise as risk sentiment deteriorates and

wider spreads could result in lower cash prices.

· Liquidity Risk

Liquidity risk is the risk that the portfolios may not be able to sell

securities at a given price and/or over the desired timeframe. Investments made

by the Company may be relatively illiquid. Some investments held by the Company

may take longer to realise than others and this may limit the ability of the

Company to realise its investments and meet its target dividend payments in the

scenario where the Company has insufficient income arising from its underlying

investments.

· Credit Risk and Investment Performance

Credit risk arises when the issuer of a settled security held by the Company

experiences financing difficulties or defaults on its payment obligations

resulting in an impact to the security market price.

The Company holds Asset Backed Securities which comprises debt securities issued

by companies, trusts or other investment vehicles which, compared to bonds

issued or guaranteed by governments, are generally exposed to greater risk of

default in the repayment of the capital provided to the issuer or interest

payments due to the Company. The amount of credit risk is indicated by the

issuer's credit rating which is assigned by one or more internationally

recognised rating agencies. This does not amount to a guarantee of the issuer's

creditworthiness but generally provides a strong indicator of the likelihood of

default. Securities which have a lower credit rating are generally considered to

have a higher credit risk and a greater possibility of default than more highly

rated securities. There is a risk that an internationally recognised rating

agency may assign incorrect or inappropriate credit ratings to issuers. Issuers

often issue securities which are ranked in order of seniority which, in the

event of default, would be reflected in the priority in which investors might be

paid back. Whilst they have been historically low since the inception of the

Company, the level of defaults in the portfolio and the losses suffered on such

defaults may increase in the event of adverse financial or credit market

conditions.

In the event of a default under an Asset Backed Security, the Company's right to

financial recovery will depend on its ability to exercise any rights that it has

against the borrower under the insolvency legislation of the jurisdiction in

which the borrower is incorporated. As a creditor, the Company's level of

protection and rights of enforcement may therefore vary significantly from one

country to another, may change over time and may be subject to rights and

protections which the relevant borrower or its other creditors might be entitled

to exercise. Information regarding investment restrictions that are currently in

place in order to manage credit risk can be found in the note 16.

· Foreign Currency Risk

The Company is exposed to foreign currency risk through its investments in

predominantly Euro-denominated assets. The Company's share capital is

denominated in Sterling and its expenses are incurred in Sterling. The Company's

financial statements are presented in Sterling. Amongst other factors affecting

the foreign exchange markets, events in the Eurozone may impact upon the value

of the Euro which in turn will impact the value of the Company's Euro

-denominated investments. The Company manages its exposure to currency movements

by using spot and forward foreign exchange contracts, which are rolled forward

periodically.

· Counterparty Credit Risk

Where a market counterparty to an Over the Counter (OTC) derivative transaction

fails, any unrealised positive mark to market profit may be lost. The Company

mitigates this risk by only trading derivatives against approved counterparties

which meet minimum creditworthiness criteria and by employing central clearing

and margining where applicable.

· Settlement Risk

Settlement risk is the risk of loss associated with any security price movements

between trade date and eventual settlement date should a trade fail to settle on

time (or at all). The Company mitigates the risk of total loss by trading on a

delivery versus payment (DVP) basis for all non-derivative transactions and

central clearing helps to ensure that trades settle on a timely basis.

· Reinvestment Risk

The Portfolio Manager is conscious of the challenge to reinvest any monies that

result from principal and income payments and to minimise reinvestment risk.

Cash flow analysis is conducted on an ongoing basis and is an important part of

the Portfolio Management process, ensuring such proceeds can be invested

efficiently and in the best interests of the Company.

The Portfolio Manager expects £61.7m of assets to have a Weighted Average Life

of under 1 year. While market conditions are always subject to change, the

Portfolio Manager does not currently foresee reinvestment risk significantly

impacting the yield nor affecting each quarter's minimum dividend and recognises

the need to be opportunistic as and when market conditions are particularly

favourable in order to reinvest any proceeds or in order to take advantage of

rapidly evolving pricing during periods of market volatility.

· Operational Risks

The Company is exposed to the risk arising from any failures of systems and

controls in the operations of the Portfolio Manager, Administrator, AIFM,

Independent Valuer, Custodian and the Depositary amongst others. The Board and

its Audit Committee regularly review reports from key service providers on their

internal controls, in particular, focussing on changes in working practices. The

Administrator, Custodian and Depositary report to the Portfolio Manager any

operational issues for final approval of the Board as required.

· Accounting, Legal and Regulatory Risks

The Company is exposed to the risk that it may fail to maintain accurate

accounting records or fail to comply with requirements of its Admission document

and fail to meet listing obligations. The accounting records prepared by the

Administrator are reviewed by the Portfolio Manager. The Portfolio Manager,

Administrator, AIFM, Custodian, Depositary and Corporate Broker provide regular

updates to the Board on compliance with the Admission document and changes in

regulation. Changes in the legal or the regulatory environment can have a major

impact on some classes of debt. The Portfolio Manager monitors this and takes

appropriate action.

· Income Recognition Risk

The Board considers income recognition to be a principal risk and uncertainty.

The Portfolio Manager estimates the remaining expected life of the security and

its likely terminal value, which has an impact on the effective interest rate of

the Asset Backed Securities which in turn impacts the calculation of interest

income. This risk is considered on behalf of the Board by the Audit Committee as

discussed in the Annual Report for the year ended 31 March 2023 and is therefore

satisfied that income is appropriately stated in all material aspects in the

Financial Statements.

· Cyber Security Risks

The Company is exposed to risk arising from a successful cyber-attack through

its service providers. The Company requests of its service providers that they

have appropriate safeguards in place to mitigate the risk of cyber-attacks

(including minimising the adverse consequences arising from any such attack),

that they provide regular updates to the Board on cyber security, and conduct

ongoing monitoring of industry developments in this area. The Board is satisfied

that the Company's service providers have the relevant controls in place to

mitigate this risk.

· Geopolitical Risk and Economic Disruption

The Company is exposed to the risk of geopolitical and economic events impacting

on the Company, Portfolio Manager and Shareholders, including elevated levels of

global inflation, recessionary risks and the current conflicts in Ukraine and

the Middle East. The Company does not hold any assets in Ukraine, Belarus,

Russia, or the Middle East, however, the situation in the impacted regions and

wider geopolitical consequences remain volatile and the Board and Portfolio

Manager continue to monitor the situation carefully and will take whatever steps

are necessary and in the best interests of the Company's Shareholders. The

Company's key suppliers do not have operations in Ukraine, Russia, Belarus, or

the Middle East and there is not expected to be any adverse impact from military

operations on the activity (including processes and procedures) of the Company.

· Climate Change Risk

Climate change risk is the risk of the Company not responding sufficiently to

pressure from stakeholders to assess and disclose the impact of climate change

on investment portfolios and address concerns on what impact the Company and its

portfolio has on the environment.

Regular contact is maintained by the Portfolio Manager and Broker with major

stakeholders and the Board receives regular updates from the Portfolio Manager

on emerging policy and best practice within this area and can take action

accordingly.

Environmental, Social, and Governance ("ESG") factors are assessed by the

Portfolio Manager for every transaction as part of the investment process.

Specifically for ABS, for every transaction an ESG assessment is produced by the

Portfolio Manager and an ESG score is assigned. External ESG factors are factors

related to the debt issuers of ABS transactions and they are assessed through a

combination of internal and third-party data. Climate risks are incorporated in

the ESG analysis under environmental factors and taken into consideration in the

final investment decision. CO2 emissions are tracked at issuer and deal level

where information is available. Given the bankruptcy-remoteness feature of

securitisation transactions the climate risks which the manager considers more

relevant and that are able to potentially impact the value of the investment are

the ones related to the underlying collateral which include physical and

transitional risks. Those risks are also assessed and considered as

environmental factors in the ESG analysis.

The Board and Portfolio Manager do not consider these risks to have changed

materially and these risks are considered to remain relevant for the remaining

six months of the financial year.

The Board's process of identifying and responding to emerging risks is disclosed

under the Statement of Principal Risks and Uncertainties in the Annual Report

for the year ended 31 March 2023.

Going Concern

The Directors believe that it is appropriate to adopt the going concern basis in

preparing the Unaudited Condensed Interim Financial Statements in view of the

Company's holdings in cash and cash equivalents and the liquidity of investments

and the income deriving from those investments, meaning the Company has adequate

financial resources and suitable management arrangements in place to continue as

a going concern for at least twelve months from the date of approval of the

Unaudited Condensed Interim Financial Statements.

The Company's articles provide for a realisation opportunity ("Realisation

Opportunity") under which Shareholders may elect to realise some or all of their

holdings of Ordinary Shares at each third Annual General Meeting, with the next

Realisation Opportunity being in September 2025.

The Company's continuing ability to continue as a going concern, in light of the

external geo-political and macro factors, the increased risk of default due to

rising inflation, increasing global interest rates and the next Realisation

Opportunity has been considered by the Directors and no material doubts to going

concern have been identified.

STATEMENT OF DIRECTORS' RESPONSIBILITIES

We confirm that to the best of our knowledge:

· these Unaudited Condensed Interim Financial Statements have been prepared in

accordance with International Accounting Standard 34, "Interim Financial

Reporting" and give a true and fair view of the assets, liabilities, equity and

profit or loss of the Company as required by DTR 4.2.4R.

· the interim management report includes a fair review of the information

required by:

(a) DTR 4.2.7R of the Disclosure and Transparency Rules, being an indication of

important events that have occurred during the period from 1 April 2023 to 30

September 2023 and their impact on the Unaudited Condensed Interim Financial

Statements; and a description of the principal risks and uncertainties for the

remaining six months of the year; and

(b) DTR 4.2.8R of the Disclosure and Transparency Rules, being related party

transactions that have taken place during the period from 1 April 2023 to 30

September 2023 and that have materially affected the financial position or

performance of the Company during that period as included in note 14.

By order of the Board

Bronwyn CurtisJohn Le Poidevin

ChairDirector

23 November 2023

The directors are responsible for the maintenance and integrity of the corporate

and financial information included on the Company's website, and for the

preparation and dissemination of financial statements. Legislation in Guernsey

governing the preparation and dissemination of financial statements may differ

from legislation in other jurisdictions.

INDEPENT REVIEW REPORT

TO TWENTYFOUR INCOME FUND LIMITED

Conclusion

We have been engaged by TwentyFour Income Fund Limited (the "Company") to review

the condensed set offinancial statements in the half-yearly financial report for

the six months ended 30 September 2023 of the Company, which comprises the

statement of financial position, the statement of comprehensive income, the

statement of changes in equity, the statement of cash flows and the related

explanatory notes.

Based on our review, nothing has come to our attention that causes us to believe

that the condensed set offinancial statements in the half-yearly financial

report for the six months ended 30 September 2023 is not prepared, in all

material respects, in accordance with IAS 34 Interim Financial Reporting and the

Disclosure Guidance and Transparency Rules ("the DTR") of the UK's Financial

Conduct Authority ("the UK FCA").

Scope of review

We conducted our review in accordance with International Standard on Review

Engagements (UK) 2410 Review of Interim Financial Information Performed by the

Independent Auditor of the Entity ("ISRE (UK) 2410") issued by the Financial

Reporting Council for use in the UK. A review of interim financial information

consists of making enquiries, primarily of persons responsible for financial and

accounting matters, and applying analytical and other review procedures. We read

the other information contained in the half-yearly financial report and consider

whether it contains any apparent misstatements or material inconsistencies with

the information in the condensed set of financial statements.

A review is substantially less in scope than an audit conducted in accordance

with International Standards on Auditing (UK) and consequently does not enable

us to obtain assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not express an audit

opinion.

Conclusions relating to going concern

Based on our review procedures, which are less extensive than those performed in

an audit as described in the Scope of review section of this report, nothing has

come to our attention to suggest that the directors have inappropriately adopted

the going concern basis of accounting or that the directors have identified

material uncertainties relating to going concern that are not appropriately

disclosed.

This conclusion is based on the review procedures performed in accordance with

ISRE (UK) 2410. However future events or conditions may cause the Company to

cease to continue as a going concern, and the above conclusions are not a

guarantee that the Company will continue in operation.

Directors' responsibilities

The half-yearly financial report is the responsibility of, and has been approved

by, the directors. The directors are responsible for preparing the interim

financial report in accordance with the DTR of the UK FCA.

As disclosed in note 2, the annualfinancial statements of theCompany are

prepared in accordance with International Financial Reporting Standards. The

directors are responsible for preparing the condensed set offinancial statements

included in the half-yearly financial report in accordance with IAS 34 Interim

Financial Reporting.

In preparing the half-yearly financial report, the directors are responsible for

assessing the Company's ability to continue as a going concern, disclosing, as

applicable, matters related to going concern and using the going concern basis

of accounting unless they either intend to liquidate the Company or to cease

operations, or have no realistic alternative but to do so.

Our responsibility

Our responsibility is to express to the Company a conclusion on thecondensed set

of financial statements in the half-yearly financial report based on our

review.Our conclusion, including our conclusions relating to going concern, are

based on procedures that are less extensive than audit procedures, as described

in the scope of review paragraph of this report.

The purpose of our review work and to whom we owe our responsibilities

This report is made solely to the Company in accordance with the terms of our

engagement letter to assist the Company in meeting the requirements of the DTR

of the UK FCA. Our review has been undertaken so that we might state to the

Company those matters we are required to state to it in this report and for no

other purpose. To the fullest extent permitted by law, we do not accept or

assume responsibility to anyone other than the Company for our review work, for

this report, or for the conclusions we have reached.

Rachid Frihmat

For and on behalf of KPMG Channel Islands Limited

Chartered Accountants

Guernsey

23 November 2023

CONDENSED STATEMENT OF COMPREHENSIVE INCOME

for the period from 1 April 2023 to 30 September 2023

For the For the

period period

from from

01.04.23 to 01.04.22 to

30.09.23 30.09.22

Notes £ £

(Unaudited) (Unaudited)

Income

Interest income on financial assets 39,617,803 27,159,169

at fair value through profit or loss

Net foreign currency gains/(losses) 7 6,714,557 (11,081,941)

Net gains/(losses) on financial

assets

at fair value through profit or loss 8 18,179,471 (95,521,570)

Total income/(loss) 64,511,831 (79,444,342)

Operating expenses

Portfolio management fees 14 (2,785,136) (2,516,061)

Directors' fees 14 (136,245) (149,846)

Administration and secretarial fees 15 (175,947) (161,765)

Audit fees (78,000) (65,000)

Custody fees 15 (37,139) (33,548)

Broker fees (24,939) (25,057)

AIFM management fees 15 (126,343) (115,684)

Depositary fees 15 (50,155) (45,695)

Legal and professional fees (28,635) (31,216)

Listing fees (12,500) (14,105)

Registration fees (44,030) (19,783)

Other expenses 56,041 (152,697)

Total operating expenses (3,443,028) (3,330,457)

Total operating profit/(loss) 61,068,803 (82,774,799)

Finance costs on repurchase 11 (383,505) (255,413)

agreements

Total comprehensive income/(loss) 60,685,298 (83,030,212)

for the period*

Earning/(loss) per Ordinary Share 3 0.0817 (0.1299)

All items in the above statement derive from continuing operations.

The Company's income and expenses are not affected by seasonality or cyclicity.

The notes below form an integral part of these Unaudited Condensed Interim

Financial Statements.

*There was no other comprehensive income during the current and prior periods.

CONDENSED STATEMENT OF FINANCIAL POSITION

as at 30 September 2023

30.09.23 31.03.23

Notes £ £

Assets (Unaudited) (Audited)

Non-current assets

Financial assets at fair

value through profit or loss

- Investments1 8 757,872,773 739,385,970

Current assets

Financial assets at fair

value through profit or loss

- Derivative assets: Forward 17 28,274 2,281,253

currency contracts

Other receivables 9 8,319,864 6,976,028

Cash and cash equivalents 15,024,303 27,235,318

Total assets 781,245,214 775,878,569

Liabilities

Current liabilities

Financial liabilities at fair

value through profit or loss

- Derivative liabilities: 17 3,763,080 1,509

Forward currency contracts

Amounts payable under 11 5,921,313 49,827,700

repurchase agreements

Amounts due to broker 2,342,079 -

Share issue costs payable - 5,219

Other payables 10 1,094,157 1,061,379

Total liabilities 13,120,629 50,895,807

Net assets 768,124,585 724,982,762

Equity

Share capital account 12 780,213,410 750,558,986

(Accumulated losses) (12,088,825) (25,576,224)

Total equity 768,124,585 724,982,762

Ordinary Shares in issue 12 747,836,661 718,036,661

Net Asset Value per Ordinary 5 102.71 100.97

Share (pence)

1 The entire balance of investments in Financial assets at fair value through

profit or loss was reclassified from current assets to non-current assets. For

more information please see Note 8 - Investments.

The Unaudited Condensed Interim Financial Statements were approved by the Board

of Directors on 23 November 2023 and signed on its behalf by:

Bronwyn CurtisJohn Le Poidevin

DirectorDirector

The notes below form an integral part of these Unaudited Condensed Interim

Financial Statements.

CONDENSED STATEMENT OF CHANGES IN EQUITY

for the period from 1 April 2023 to 30 September 2023

Share

capital

account (Accumulated Total

losses)

Notes £ £ £

Balances at 1 750,558,986 (25,576,224) 724,982,762

April 2023

Issue of 12 30,244,890 - 30,244,890

shares

Share issue 12 (347,817) - (347,817)

costs

Dividends - (47,440,548) (47,440,548)

paid

Income 4 (242,649) 242,649 -

equalisation

on new issues

Total - 60,685,298 60,685,298

comprehensive

income for

the period

Balances at 780,213,410 (12,088,825) 768,124,585

30 September

2023

(Unaudited)

Share Retained

capital earnings/

account (Accumulated Total

losses)

£ £ £

Balances at 1 675,350,674 43,126,544 718,477,218

April 2022

Issue of 1,054,500 - 1,054,500

shares

Share issue (12,127) - (12,127)

costs

Release of 803,803 803,803

UKML share

issue costs

payable

Dividends - (24,088,138) (24,088,138)

paid

Income 4 (16,079) 16,079 -

equalisation

on new issues

Total - (83,030,212) (83,030,212)

comprehensive

loss for the

period

Balances at 677,180,771 (63,975,727) 613,205,044

30 September

2022

(Unaudited)

The notes on below form an integral part of these Unaudited Condensed Interim

Financial Statements.

CONDENSED STATEMENT OF CASH FLOWS

for the period from 1 April 2023 to 30 September 2023

For the For the

period period

Notes from 01.04.23 from 01.04.22

to 30.09.23 to 30.09.22

£ £

(Unaudited) (Unaudited)

Cash flows from operating

activities

Total comprehensive 60,685,298 (83,030,212)

gain/(loss) for the period

Less:

Interest income on financial (39,617,803) (27,159,169)

assets at fair value through

profit or loss

Movement in interest income 1,400,933 (1,525,481)

receivable

Adjustments for non-cash

transactions:

Net (gains)/losses on 8 (18,179,471) 95,521,570

investments

Amortisation adjustment under 8 (7,931,404) (7,226,952)

effective interest rate method

Unrealised losses on forward 7 6,014,551 4,310,247

currency contracts

Exchange losses/(gains) on 2,812 (26,446)

cash and cash equivalents

Investment income 37,793,736 25,366,644

Bank interest income 423,134 267,044

Increase in other receivables (1,343,836) (1,498,828)

Increase/(decrease) in other 32,778 (698,449)

payables

Finance costs on repurchase 383,505 255,413

agreements

Purchase of investments (141,096,823) (129,995,550)

Sale of investments/principal 151,062,974 87,130,635

repayments

Net cash generated from/(used 49,630,384 (38,309,534)

in) operating activities

Cash flows from financing

activities

Proceeds from issue of 30,244,890 1,054,500

Ordinary Redeemable Shares

Share issue costs (353,037) (2,406,742)

Dividend paid (47,440,548) (24,088,138)

Finance costs (383,505) (255,413)

(Decrease)/increase in amounts (43,906,387) 24,270,170

payable under repurchase

agreements

Net cash used in financing (61,838,587) (1,425,623)

activities

Decrease in cash and cash (12,208,203) (39,735,157)

equivalents

Cash and cash equivalents at 27,235,318 59,706,062

beginning of the period

Exchange (losses)/gains on (2,812) 26,446

cash and cash equivalents

Cash and cash equivalents at 15,024,303 19,997,351

end of the period

The notes below form an integral part of these Unaudited Condensed Interim

Financial Statements.

NOTES TO THE UNAUDITED CONDENSED INTERIM FINANCIAL STATEMENTS

for the period from 1 April 2023 to 30 September 2023

1.General Information

TwentyFour Income Fund Limited (the "Company") is a closed-ended investment

company whose shares ("Ordinary Shares", being the sole share class) have a

Premium Listing on the Official List of the UK Listing Authority and trade on

the Main Market of the London Stock Exchange. The Company was incorporated in

Guernsey on 11 January 2013.

Since 16 September 2022, the Company has been included on the London Stock

Exchange's FTSE 250 Index.

The Company's investment objective and policy is set out in the Summary

Information.

The Portfolio Manager of the Company is TwentyFour Asset Management LLP (the

"Portfolio Manager").

2.Principal Accounting Policies

a) Statement of Compliance

The Unaudited Condensed Interim Financial Statements for the period 1 April 2023

to 30 September 2023 have been prepared on a going concern basis in accordance

with IAS 34 "Interim Financial Reporting", the Disclosure Guidance and

Transparency Rules Sourcebook of the United Kingdom's Financial Conduct

Authority ("FCA") and applicable legal and regulatory requirements.

The Unaudited Condensed Interim Financial Statements should be read in

conjunction with the annual audited financial statements for the year ended 31

March 2023, which were prepared in accordance with International Financial

Reporting Standards ("IFRS") and were in compliance with The Companies

(Guernsey) Law, 2008 and which received an unqualified Auditor's report.

b) Presentation of Information

In the current financial period, there have been no changes to the accounting

policies from those applied in the most recent audited annual financial

statements.

c) Significant Judgements and Estimates

There have been no changes to the significant accounting judgements, estimates

and assumptions from those applied in the most recent audited annual financial

statements.

d) Standards, Amendments and Interpretations Effective during the Period

At the reporting date of these Financial Statements, the following standards,

interpretations and amendments, were adopted for the period ended 30 September

2023 and the year ending 31 March 2024:

- Insurance Contracts (IFRS 17) (applicable to accounting periods beginning

on or after 1 January 2023);

- Disclosure of Accounting Policies (Amendments to IAS 1 and IFRS Practice

Statement 2) (applicable to accounting periods beginning on or after 1 January

2023);

- Definition of Accounting Estimates (Amendments to IAS 8) (applicable to

accounting periods beginning on or after 1 January 2023); and

- Deferred Tax related to Assets and Liabilities arising from a Single

Transaction (Amendments to IAS 12) (applicable to accounting periods beginning

on or after 1 January 2023).

The Directors ("Directors") of the Company (the "Board") believe that the

adoption of the above standards does not have a material impact on the Company's

Unaudited Condensed Interim Financial Statements for the period ended 30

September 2023 and for the Annual Audited Financial Statements for the year

ending 31 March 2024.

e) Standards, Amendments and Interpretations Issued but not yet Effective

The following standards, interpretations and amendments, which have not been

applied in these Unaudited Condensed Interim Financial Statements, were in issue

but not yet effective:

- Non-current Liabilities with Covenants and Classification of Liabilities as

Current or Non-Current (Amendments to IAS 1) (applicable to accounting periods

beginning on or after 1 January 2024);

- Lease (https://www.ifrs.org/content/ifrs/home/projects/completed

-projects/2020/classification-of-liabilities.html) Liability in a Sale or

Leaseback (Amendments to IFRS 16) (applicable to accounting periods beginning on

or after 1 January 2024);

- Supplier Finance Arrangements (Amendments to IAS 7 and IFRS 7) (applicable

to accounting periods beginning on or after 1 January 2024);

- Lack of Exchangeability (Amendments to IAS 21) (applicable to accounting

periods beginning on or after 1 January 2025);

The Directors anticipate that the adoption of the above standards, effective in

future periods, will not have a material impact on the financial statements of

the Company.

3.Earnings/(Loss) per Ordinary Share - Basic & Diluted

The earnings per Ordinary Share - Basic is calculated by dividing a company's

income or profit by the number of shares outstanding. Diluted earnings per

Ordinary Share takes into account all potential dilution that would occur if

convertible securities were exercised or options were converted to stocks.

As the Company has not issued options, only the Basic Earnings per Share has

been calculated.

Basic earnings per Ordinary Share has been calculated based on the weighted

average number of Ordinary Shares of 742,733,383 (30 September 2022:

638,959,048) and a net gain of £60,685,298 (30 September 2022: net loss of

£83,030,212).

4.Income Equalisation on New Issues

In order to ensure there are no dilutive effects on earnings per share for

current holders of shares ("Ordinary Shares") issued by the Company

("Shareholders") when issuing new Ordinary Shares earnings are calculated in

respect of accrued income at the time of purchase and a transfer is made from

share capital to income to reflect this. The transfer for the period is £242,649

(30 September 2022: £16,079).

5.Net Asset Value per Ordinary Share

The net asset value ("NAV") of each Ordinary Share of £1.03 (31 March 2023:

£1.01) is determined by dividing the value of the net assets of the Company

attributed to the Ordinary Shares of £768,124,585 (31 March 2023: £724,982,762)

by the number of Ordinary Shares in issue at 30 September 2023 of 747,836,661

(31 March 2023: 718,036,661).

6. Taxation

The Company has been granted Exempt Status under the terms of The Income Tax

(Exempt Bodies) (Guernsey) Ordinance, 1989 to income tax in Guernsey. Its

liability for Guernsey taxation is limited to an annual fee of £1,200 (2022:

£1,200).

7.Net Foreign Currency Gains/(Losses)

For the For the

period period

from from

01.04.23 to 01.04.22 to

30.09.23 30.09.22

£ £

(Unaudited) (Unaudited)

Movement on (6,014,551) (4,310,247)

unrealised

loss on

forward

currency

contracts

Realised 12,705,591 (7,171,088)

gains/(losse

s) on

foreign

currency

contracts

Unrealised 4,063 219,025

foreign

currency

gain on

receivables/

payables

Unrealised 19,454 180,369

foreign

currency

exchange

gain on

interest

receivable

6,714,557 (11,081,941)

8.Investments

For the For the year

period

01.04.23 to 01.04.22 to

30.09.23 31.03.23

Financial £ £

assets at

fair value

through

profit or

loss:

(Unaudited) (Audited)

Opening book 832,506,047 693,217,802

cost

Purchases at 143,438,902 390,806,347

cost

Proceeds on (151,062,974) (297,663,729)

sale/principa

l repayment

Amortisation 7,931,404 19,931,829

adjustment

under

effective

interest

rate method

Realised 3,173,775 57,193,656

gains on

sale/principa

l repayment

Realised (43,700,421) (30,979,858)

losses on

sale/principa

l repayment

Closing book 792,286,733 832,506,047

cost

Unrealised 14,553,298 3,919,689

gains on

investments

Unrealised (48,967,258) (97,039,766)

losses on

investments

Fair value 757,872,773 739,385,970

For the For the

period period

from 01.04.23 from 01.04.22

to 30.09.23 to 30.09.22

£ £

(Unaudited) (Unaudited)

Realised 3,173,775 46,974,421

gains on

sales/princip

al repayment

Realised (43,700,421) (38,404,969)

losses on

sales/princip

al repayment

Movement in 10,633,609 (35,448,173)

unrealised

gains

Movement in 48,072,508 (68,642,849)

unrealised

losses

Net 18,179,471 (95,521,570)

gains/(losses

) on

financial

assets at

fair value

through

profit or

loss

In the six-month period ended 30 September 2023, investments have been

reclassified as 'non-current assets' from 'current assets'. This is to more

accurately reflect the Company's intention not to hold the majority of

investments in the portfolio for sale in any given period.

The reclassification has no impact on the Company's NAV.

9.Other Receivables

As at As at

30.09.23 31.03.23

£ £

(Unaudited) (Audited)

Coupon interest receivable 8,149,957 6,808,822

Bank interest receivable 121,388 61,590

Prepaid expenses 48,519 105,616

8,319,864 6,976,028

There are no material expected credit losses for coupon interest receivable as

at 30 September 2023.

10.Other Payables

As at As at

30.09.23 31.03.23

£ £

(Unaudited) (Audited)

Portfolio management fees payable 759,976 738,231

Custody fees payable 12,642 6,974

Administration and secretarial fees payable 175,211 83,039

Directors' fee payable 1,375 12,629

Audit fees payable 71,939 136,389

AIFM management fees payable 113,236 47,885

Depositary fees payable 25,326 16,792

General expenses payable (65,548) 19,440

1,094,157 1,061,379

A summary of the expected payment dates of payables can be found in the

`Liquidity Risk' section of Note 16.

11.Amounts payable under repurchase agreements

The Company, as part of its investment strategy, may enter into repurchase

agreements. A repurchase agreement is a short-term loan where both parties agree

to the sale and future repurchase of assets within a specified contract period.

Repurchase agreements may be entered into in respect of securities owned by the

Company which are sold to and repurchased from counterparties on contractually

agreed dates and the cash generated from this arrangement can be used to

purchase new securities, effectively creating leverage. The Company still

benefits from any income received, attributable to the security. Under the

Company's Global Master Repurchase Agreement it may from time to time enter into

transactions with a buyer or seller under the terms and conditions as governed

by the agreement.

Finance costs on repurchase agreements have been presented separately from

interest income for the period end 30 September 2023.

Finance costs on repurchase agreements amounted to £383,505 (30 September 2022:

£255,413). As at 30 September 2023, finance cost liabilities on open repurchase

agreements amounted to £120,196 (31 March 2023: £157,335).

At the end of the period, amounts repayable under open repurchase agreements

were £5,921,313 (31 March 2023: £49,827,700). 2 securities were designated as

collateral against the repurchase agreements (31 March 2023: 9 securities), with

a total fair value of £7,855,797 (31 March 2023: £50,574,587), all of which were

investment grade residential mortgage backed securities. The total exposure was

-0.77% (31 March 2023: -6.87%) of the Company's NAV. The contracts were across

one counterparty and were all rolling agreements with a maturity of 3 months.

12.Share Capital

Authorised Share Capital

Unlimited number of Ordinary Shares at no par value.

Issued Share Capital

For the For the year

period

01.04.23 to 01.04.22 to 31.03.23

30.09.23

Ordinary Shares £ £

Ordinary Redeemable (Unaudited) (Audited)

Shares

Share Capital at the 750,558,986 675,350,674

beginning of the

period/year

Issued Share Capital 30,244,890 76,631,101

Share issue costs (347,817) (773,112)

Release of UKML share - 798,176

issue costs payable1

Income equalisation (242,649) (1,447,853)

on new issues

Total Share Capital 780,213,410 750,558,986

at the end of the

period/year

1.The release of UKML share issue costs payable was as a result of an over

-accrual of estimated costs at 31 March 2022 attributed to the issue of new

shares from the acquisition of UKML assets.

For the For the year

period

01.04.23 to 01.04.22 to 31.03.23

30.09.23

Shares Shares

(Unaudited) (Audited)

Ordinary Shares

Shares at the 718,036,661 638,942,655

beginning of the

period/year

Issue of Shares 29,800,000 79,094,006

Total Shares in 747,836,661 718,036,661

issue at the end of

the period/year

For the For the year

period

01.04.23 to 01.04.22 to 31.03.23

30.09.23

£ £

(Unaudited) (Audited)

Treasury Shares

Treasury Share - 43,083,300

capital at the

beginning of the

period/year

Issue of Ordinary - (43,083,300)

Shares from

Treasury

Total Treasury - -

Share capital at

the end of the

period/year

For the For the year

period

01.04.23 to 01.04.22 to 31.03.23

30.09.23

Shares Shares

(Unaudited) (Audited)

Treasury Shares

Treasury Shares at - 39,000,000

the beginning of

the period/year

Issue of Ordinary - (39,000,000)

Shares from

Treasury

Total Shares at the - -

end of the

period/year

The Share Capital of the Company consists of an unlimited number of Ordinary

Shares at no par value which, upon issue, the Directors may designate as:

Ordinary Shares; Realisation Shares or such other class as the Board shall

determine and denominated in such currencies as shall be determined at the

discretion of the Board.

As at 30 September 2023, one share class has been issued, being the Ordinary

Shares of the Company.

The Ordinary Shares carry the following rights:

a) The Ordinary Shares carry the right to receive all income of the Company

attributable to the Ordinary Shares.

b) The Shareholders present in person or by proxy or present by a duly

authorised representative at a general meeting has, on a show of hands, one vote

and, on a poll, one vote for each Share held.

c) 56 days before the annual general meeting date of the Company in each

third year ("Reorganisation Date"), the Shareholders are entitled to serve a

written notice ("Realisation Election") requesting that all or a part of the

Ordinary Shares held by them be redesignated to Realisation Shares, subject to

the aggregate NAV of the continuing Ordinary Shares on the last business day

before the Reorganisation Date being not less than £100 million. A Realisation

Notice, once given is irrevocable unless the Board agrees otherwise. If one or

more Realisation Elections be duly made and the aggregate NAV of the continuing

Ordinary Shares on the last business day before the Reorganisation Date is less

than £100 million, the Realisation Opportunity will not take place. Shareholders

do not have a right to have their shares redeemed and shares are redeemable at

the discretion of the Board. The most recent Realisation Election took place in

October 2022. The next Realisation Opportunity is due to occur at the end of the

next three-year term, at the date of the AGM in September 2025.

The Company has the right to issue and purchase up to 14.99% of the total number

of its own shares at £0.01 each, to be classed as Treasury Shares and may cancel

those Shares or hold any such Shares as Treasury Shares, provided that the

number of Shares held as Treasury Shares shall not at any time exceed 10% of the

total number of Shares of that class in issue at that time or such amount as

provided in the Companies (Guernsey) Law, 2008.

The Company has the right to re-issue Treasury Shares at a later date.

£2,396,197 of share issue costs paid in the Condensed Statement of Cash Flows

for the period from 1 April 2022 to 30 September 2022 related to issue costs

incurred during the period ended 30 September 2022 in relation to the

acquisition of UKML assets. During the year ended 31 March 2023, £798,176 of the

original costs capitalised were released back to the NAV of the Company.

13.Analysis of Financial Assets and Liabilities by Measurement Basis

Assets at

fair

value Amortised

through

profit or cost Total

loss

£ £ £

30 September

2023

Financial

Assets as

per

Condensed

Statement of

Financial

Position

(Unaudited)

Financial

assets at

fair value

through

profit or

loss:

- Investments 757,872,773 - 757,872,773

- Derivative 28,274 - 28,274

assets:

Forward

currency

contracts

Other - 8,271,345 8,271,345

receivables

(excluding

prepayments)

Cash and - 15,024,303 15,024,303

cash

equivalents

757,901,047 23,295,648 781,196,695

Liabilities

at fair

value Amortised

through

profit or cost Total

loss

£ £ £

Financial

Liabilities

as per

Condensed

Statement of

Financial

Position

(Unaudited)

Financial

liabilities

at fair

value

through

profit or

loss:

- Derivative 3,763,080 - 3,763,080

liabilities:

Forward

currency

contracts

Amounts - 5,921,313 5,921,313

payable

under

repurchase

agreements

Amounts due - 2,342,079 2,342,079

to brokers

Other - 1,094,157 1,094,157

payables

3,763,080 9,357,549 13,120,629

Assets at

fair

value Amortised

through