TIDMTIG

RNS Number : 1633T

Team Internet Group PLC

13 November 2023

13 November 2023

TEAM INTERNET GROUP PLC

("Team Internet" or the "Company" or the "Group")

UNAUDITED FINANCIAL RESULTS FOR THE NINE MONTHSED 30 SEPTEMBER

2023

Continued delivery with 16% year-on-year increase in Revenue,

11% rise in Adjusted EBITDA,

and a confident outlook for FY23

Team Internet Group Plc (AIM: TIG), the global internet company

that generates recurring revenue from creating meaningful and

successful connections: businesses to domains, brands to consumers,

publishers to advertisers, is pleased to announce its unaudited

financial results for the nine months ended 30 September 2023

("September 2023 YTD").

September 2023 YTD Financial Summary:

-- Gross revenue increased by 16% to USD 611.7m (nine months

ended September 2022 ("September 2022 YTD"): USD 526.7m)

-- Organic revenue growth(*) for the trailing twelve months

ended 30 September 2023 ("TTM 2023") of approximately 19%

-- Net revenue (Gross profit) increased by 8% to USD 138.5m (September 2022 YTD: USD 128.3m)

-- Adjusted EBITDA(**) increased by 11% to USD 68.8m (September 2022 YTD: USD 62.0m)

-- Adjusted EPS increased by 28% to USD 17.56 cents (September 2022 YTD: USD 13.68 cents)

-- Net debt(***) of USD 81.7m (31 December 2022: USD 56.6m) and

Leverage(****) of 1.1x pro forma EBITDA TTM 2023, following

non-operating cash outflows in respect of the Group acquiring its

own shares USD 30.2m (Share buyback: USD 24.9m, Employee Benefit

Trust: USD 5.3m), dividend of USD 3.6m, reflecting the Group's

choice to return cash to shareholders, and non-recurring settlement

of deferred consideration of USD 17.9m

-- Adjusted operating cash conversion of 95% (FY2022: 110%) . We

expect this to continue to normalise nearer to 100% over the

remainder of the year

Q3 highlights:

-- On 4 September 2023, the Group announced its rebranding from

CentralNic Group to Team Internet Group and effective that same

day, the Group's shares commenced trading under the ticker "TIG".

At a general meeting held on 28 September 2023, a resolution was

passed to change the Company's name from CentralNic Group Plc to

Team Internet Group Plc, a change which has now been confirmed by

Companies House

-- The Group continued to trade at least in line with current

market expectations during the period, driven by ongoing market

share gains of its proprietary privacy-safe, AI-based customer

journeys which address a multi-billion-dollar opportunity

-- In the Online Marketing segment, the number of visitor

sessions increased by 36% to 5.6 billion for TTM 2023 from 4.1

billion for the trailing twelve-month period ended 30 September

2022 ("TTM 2022"). Revenue per thousand sessions ("RPM") decreased

by 7% from USD 104 to USD 97, continuing to outperform the

market

-- The Online Presence segment again posted its highest ever

organic revenue growth, 17% TTM 2023 compared to 4% for TTM

2022

-- Adjusted EBITDA as a percentage of Net revenue has increased

to 50% for September 2023 YTD from 48% for September 2022 YTD,

demonstrating that Team Internet's growth continues to translate

into operating leverage

-- Zeropark, Team Internet's Commerce Media Tech business,

announced three strategic partnerships: First, becoming a Tier 1

Demand Partner of Sovrn, a leading publisher technology platform.

Second, a significant deal with booking.com, the global online

travel agency. Third, Klarna, the Buy Now Pay Later platform has

become a direct publisher on the Zeropark network

-- Voluum, Team Internet's flagship ad tracker, announced the

launch of a new integration with popular e-commerce platform

Shopify, allowing customers to directly feed conversion data from

their Shopify stores into Voluum, bolstering their ad, product, and

page performance

-- On 31 August 2023, Adrenalads LLC was acquired for an initial

consideration of USD 2.1m. The acquisition included deferred

consideration of USD 0.2m payable in February 2025. This business

has a rich history of collaboration with Zeropark

-- One of the Group's largest Retail brands OnlyDomains entered

into a partnership with business email provider Titan to offer new

and existing customers premium business email with every domain

name

Post period end highlights:

-- Launch of Team Internet AG's Adsolutely product, seamlessly

integrating tailored ad feeds into the digital space, discarding

the intrusive nature of native ads. Adsolutely's state-of-the-art

technology resonates with the target audience's interests through

advanced keyword pairing, offering users total control over

contextual ads and related terms, while handling the intricacies of

optimisation

-- The Group's performance marketing business Codewise has been

rebranded to "Commerce Media Tech", reflecting our mission to help

advertisers connect with their ideal customers

-- Simon McCalla joined Team Internet as the new CEO of our

Online Presence division. Simon's experience as a senior leader at

blue chip companies both within and beyond the domain name industry

make him a great fit to lead Online Presence into the future

-- Team Internet initiated an ESG alliance between leading

partners along the domain name value chain at ICANN78 in Hamburg in

October 2023

Outlook:

Team Internet delivered another strong performance during

September 2023 YTD across both its Online Marketing and Online

Presence segments, delivering organic revenue growth of 19% on a

TTM 2023 pro forma basis. The Group has maintained its strong

operating leverage, as demonstrated by Adjusted EBITDA as a

percentage of Net revenue being 50% for September 2023 YTD (48%

September 2022 YTD).

The material expansion of the Company's share buyback programme

announced on 3 July 2023, alongside the cash flow waterfall model

as described on page 14 in the 2022 Annual Report, is primarily

being funded by continued strong operating cash generation. To

date, the Company has bought back 16.7m shares under its programme

at a cumulative cost of GBP 20.7m. GBP 13.3m remains available for

the remainder of the programme.

The Group looks ahead with confidence to Q4, which is typically

its strongest quarter, and the Directors expect that the Group will

continue to deliver results at least in line with current market

expectations for the full year.(*****)

Results presentation:

There will be a webinar/conference call for equity analysts at

09.30am GMT today, and for private client investment managers at

11am GMT. Both events will be hosted by CEO Michael Riedl and CFO

William Green.

Anybody wishing to register should contact

teaminternet@secnewgate.co.uk , where further details will be

provided.

Further, an Investor Meet Company session will be held at 1pm

GMT today: https://investormeetcompany.com/Team

Internet-group-plc/register-investor

Michael Riedl, CEO of Team Internet, commented: " I am pleased

to report that the Group has continued its strong organic revenue

growth in Q3 2023, building on the record results achieved in 2022.

This growth was driven by both operating segments, reflecting the

strength of our product portfolio. Leveraging this position, the

Group is primed for a strong finish in Q4, traditionally our

highest revenue quarter of the year.

The Group's new brand launched in the quarter goes beyond

aesthetics. It's a manifestation of our purpose: to forge

meaningful and successful connections. We aim to connect domains

with businesses, businesses with consumers, and publishers with

advertisers, propelling them towards their digital aspirations.

Our aspirations for Team Internet are clear: diversification,

global outreach, deeper vertical integration, and an unyielding

allegiance to our core values."

(*) Pro forma revenue, adjusted for; acquired revenue, constant

currency foreign exchange impact and non-recurring revenues is USD

817m for TTM 2023 and at USD 687m for TTM 2022

(**) Earnings before interest, tax, depreciation, amortisation,

impairment, non-cash charges and non-core operating expenses

(***) Includes gross cash, bank debt and prepaid finance costs

as of 30 September 2023 (cash of USD 83.7m and bank debt and

prepaid finance costs of USD 166.7m); includes gross cash, bank

debt, prepaid finance costs and hedging assets of USD 1.4m (31

December 2022 cash of 94.8m, bond debt, bank debt and prepaid

finance costs of USD 151.2m and hedging liabilities of USD

0.2m)

(****) Includes Net Debt as defined under (***) (i) excluding

prepaid finance costs, (ii) plus guarantee obligations, and (iii)

plus the best estimate of any crystallised deferred consideration

payable in cash, all divided by pro forma EBITDA, i.e. last twelve

months' EBITDA including acquired entities' EBITDA on a pro forma

basis, and adjusted for rental expense capitalized under IFRS 16

and non-core expenses

(*****) Latest analyst forecasts are within a range of USD 783m

and USD 834m for FY23 revenue and USD 91m and USD 98m for FY23

Adjusted EBITDA

For further information:

Team Internet Group Plc +44 (0) 203 388 0600

Michael Riedl, Chief Executive Officer

William Green, Chief Financial Officer

Zeus Capital Limited (NOMAD and Joint

Broker)

Nick Cowles / Jamie Peel / James Edis

(Investment Banking) +44 (0) 161 831 1512

Dominic King (Corporate Broking) +44 (0) 203 829 5000

Berenberg (Joint Broker) +44 (0) 203 207 7800

Mark Whitmore / Richard Andrews / Alix

Mecklenburg-Solodkoff

SEC Newgate (for Media) teami nterne t@secnewgate.co.uk

Bob Huxford / Alice Cho / Harry Handyside

/ Tom Carnegie +44 (0) 203 757 6880

Forward-Looking Statements

This document includes forward-looking statements. Whilst these

forward-looking statements are made in good faith, they are based

upon the information available to Team Internet at the date of this

document and upon current expectations, projections, market

conditions and assumptions about future events. These

forward-looking statements are subject to risks, uncertainties and

assumptions about the Group and should be treated with an

appropriate degree of caution.

About Team Internet Group Plc

Team Internet (AIM: TIG) creates meaningful and successful

connections from businesses to domains, brands to consumers,

publishers to advertisers, enabling everyone to realise their

digital ambitions. The Company is a leading global internet

solutions company that operates in two highly attractive markets:

high-growth digital advertising (Online Marketing segment) and

domain name management solutions (Online Presence segment). The

company's Online Marketing segment creates privacy-safe and

AI-generated online consumer journeys that convert general interest

online media users into confident high conviction consumers through

advertorial and review websites. The Online Presence segment is a

critical constituent of the global online presence and productivity

tool ecosystem, where Team Internet serves as the primary

distribution channel for a wide range of digital products. The

company's high-quality earnings come from subscription recurring

revenues in the Online Presence segment and revenue share on

rolling utility-style contracts in the Online Marketing

segment.

For more information please visit: www.teaminternet.com

MANAGEMENT COMMENTARY ON PERFORMANCE

Introduction

Team Internet's organic growth, combined with the acquisition

strategy pursued through the end of 2022, substantially increased

the scale and capabilities of the Group. The effect of this is

demonstrated in our unaudited September 2023 YTD results which show

increases in both Revenue and Adjusted EBITDA of 16% and 11%

respectively, compared to September 2022 YTD.

Performance Overview

The Group has performed strongly during the period with the key

financial metrics listed below:

Nine months Nine months

ended ended

30 September 30 September

2023 2022 Change

USD m USD m %

-------------- -------------- ---------

Revenue 611.7 526.7 16%

-------------- -------------- ---------

Net revenue/gross profit 138.5 128.3 8%

-------------- -------------- ---------

Adjusted EBITDA 68.8 62.0 11%

-------------- -------------- ---------

Operating profit 29.8 35.1 (15%)

-------------- -------------- ---------

Adjusted operating cash

conversion (note 8) 95% 105% (9%)

-------------- -------------- ---------

Profit after tax 13.8 6.5 112%

-------------- -------------- ---------

EPS - Basic (cents) 5.10 2.48 106%

-------------- -------------- ---------

EPS - Adjusted earnings

- Basic (cents) (note 7) 17.56 13.68 28%

-------------- -------------- ---------

Segmental analysis

Organic growth rates quoted below are calculated on a pro forma

basis including all the Group's constituents as of the last balance

sheet dates and adjusted for non-recurring or non-cash revenues and

on a constant currency basis.

Online Marketing segment

The Online Marketing segment continued to outperform the market,

with revenues increasing by USD 62.1m, or 15%, from USD 412.6m to

USD 474.7m. Organic revenue grew at a rate of 20% for TTM 2023,

predominantly driven by Team Internet's TONIC platform. Inorganic

growth was a result of the full period impact of the VGL

acquisition, which was acquired in March 2022, and Adrenalads in

August 2023.

The number of visitor sessions increased by 36% from 4.1 billion

for TTM 2022 to 5.6 billion for TTM 2023 and the RPM decreased by

7% from USD 104 to USD 97(1) .

The Online Marketing segment creates privacy-safe and

AI-generated online consumer journeys that convert general interest

online media users into confident high conviction consumers through

advertorial and review websites, generating utility-style referral

and commission income through partnerships with Google, Amazon and

a multitude of other partners. Our long-term vision aims to harness

the Group's expertise in two critical areas: first, to transform

social media and other low-intent traffic into qualified leads for

search ad campaigns; and second, to effectively turn search ad

campaigns into successful e-commerce transactions. By integrating

these capabilities, we aspire to establish a robust social commerce

channel. This sector is expected to reach a value of USD 80

billion(2) by 2025 in the US alone.

Online Presence segment

Reported revenue in this segment increased by 20% from USD

114.1m in September 2022 YTD to USD 137.0m in September 2023 YTD.

Organic growth for the Online Presence segment was 17% for TTM

2023, the highest growth rate since the segment's establishment,

driven by the structural shift in demand towards Top Level Domains

where Team Internet has a competitive edge.

The number of processed domain registration years increased by

11% from 12.7m for TTM 2022 to 14.1m for TTM 2023 and the average

revenue per domain year increased by 8% from USD 10.03 to USD

10.81. The share of Value-Added Service revenue TTM 2023 was

11.2%(3) .

The Online Presence segment is a critical constituent of the

global online presence and productivity tool ecosystem, where Team

Internet serves as the primary distribution channel for a wide

range of digital products.

Michael Riedl

Chief Executive Officer

(1) Based on analysis of c.85% of the search segment which can

be adequately and reliably described by this KPI

(2) Source: "Social commerce: The future of how customers

interact with brands", McKinsey & Company, October 19, 2022

(3) Based on analysis of c.86% of this segment which can be

adequately and reliably described by this KPI

CONSOLIDATED STATEMENT OF Unaudited Unaudited

COMPREHENSIVE INCOME Nine months Nine months Audited

ended ended Year ended

30 September 30 September 31 December

2023 2022 2022

Note USD m USD m USD m

-------------- -------------- --------------

Revenue 4 611.7 526.7 728.2

Cost of sales (473.2) (398.4) (550.5)

Net revenue/gross profit 138.5 128.3 177.7

Operating expenses (105.2) (89.4) (138.4)

Share-based payments expense (3.5) (3.8) (5.7)

Operating profit 29.8 35.1 33.6

Adjusted EBITDA (a) 68.8 62.0 86.0

Depreciation of property, plant

and equipment (2.3) (2.1) (3.0)

Amortisation and impairment

of intangible assets (28.1) (21.1) (36.4)

Non-core operating expenses(b) 5 (5.0) (6.0) (8.2)

Foreign exchange (loss)/gain (0.1) 6.1 0.9

Share-based payment expenses (3.5) (3.8) (5.7)

-------------- -------------- --------------

Operating profit 29.8 35.1 33.6

--------------------------------------- ----- -------------- -------------- --------------

Finance income less finance

costs 6 (8.8) (9.4) (13.2)

Foreign exchange loss on borrowings - (4.7) (5.6)

Net finance costs (8.8) (14.1) (18.8)

Profit before taxation 21.0 21.0 14.8

Income tax expense (7.2) (14.5) (16.9)

-------------- -------------- --------------

Profit/(loss) after taxation 13.8 6.5 (2.1)

Items that may be reclassified

subsequently to profit and

loss

Exchange difference on translation

of foreign operations (4.2) (30.5) (13.7)

Movement arising on changes

in fair value of hedging instruments 1.6 6.4 6.2

-------------- -------------- --------------

Total comprehensive income/(loss)

for the period/year 11.2 (17.6) (9.6)

Profit/(loss) is attributable

to:

Owners of Team Internet Group

Plc 13.8 6.5 (2.1)

-------------- -------------- --------------

Total comprehensive income/(loss)

is attributable to:

Owners of Team Internet Group

Plc 11.2 (17.6) (9.6)

-------------- -------------- --------------

Earnings per share:

Basic (cents) 5.10 2.48 (0.78)

Diluted (cents) 5.07 2.41 (0.78)

Adjusted earnings - Basic (cents) 17.56 13.68 20.01

Adjusted earnings - Diluted

(cents) 17.45 13.29 19.81

All amounts relate to continuing activities

(a) E arnings before interest, tax, depreciation, amortisation and

impairment , non-cash charges and non-core operating expenses.

(b) Non-core operating expenses include items related primarily to

acquisition, integration and other related costs, which are not incurred

as part of the underlying trading performance of the Group, and which

are therefore adjusted for, in line with Group policy.

CONSOLIDATED STATEMENT OF Unaudited Unaudited

FINANCIAL POSITION Nine months Nine months Audited

ended ended Year ended

30 September 30 September 31 December

2023 2022 2022

USD m USD m USD m

-------------- -------------- -------------

ASSETS

NON-CURRENT ASSETS

Property, plant and equipment 2.7 1.8 1.8

Right-of-use assets 4.7 5.6 5.5

Intangible assets 327.0 314.1 347.9

Deferred receivables 0.2 0.4 0.3

Deferred tax assets 9.7 7.9 9.5

Derivative financial instruments 1.4 - -

-------------- -------------- -------------

345.7 329.8 365.0

CURRENT ASSETS

Inventory 0.5 0.8 0.6

Trade and other receivables 99.8 93.4 98.2

Cash and bank balances 83.7 83.8 94.8

184.0 178.0 193.6

TOTAL ASSETS 529.7 507.8 558.6

EQUITY AND LIABILITIES

EQUITY

Share capital 0.3 0.3 0.3

Share premium 98.3 98.3 98.3

Merger relief reserve 5.3 5.3 5.3

Share-based payments reserve 27.4 22.1 24.1

Cash flow hedging reserve 1.4 - (0.2)

Foreign exchange translation

reserve (15.0) (27.6) (10.8)

Retained earnings 30.0 59.1 50.0

-------------- -------------- -------------

TOTAL EQUITY 147.7 157.5 167.0

NON-CURRENT LIABILITIES

Other payables 5.7 11.5 13.9

Lease liabilities 3.1 1.9 3.8

Deferred tax liabilities 26.5 26.8 30.2

Borrowings 147.7 0.5 145.9

Derivative financial instruments - - 0.2

-------------- -------------- -------------

183.0 40.7 194.0

CURRENT LIABILITIES

Trade and other payables and

accruals 178.2 159.0 190.3

Lease liabilities 1.7 3.9 1.9

Borrowings 19.1 141.7 5.3

Derivative financial instruments - 5.0 0.1

-------------- -------------- -------------

199.0 309.6 197.6

-------------- -------------- -------------

TOTAL LIABILITIES 382.0 350.3 391.6

TOTAL EQUITY AND LIABILITIES 529.7 507.8 558.6

-------------- -------------- -------------

Equity

CONSOLIDATED Share- Foreign attributable

STATEMENT OF Merger based Cash exchange to owners

CHANGES IN Share Share relief payments flow translation Retained of the

EQUITY capitalUSD premium reserve reserve hedging reserve earnings Parent

m USD m USD m USD m Reserve USD m USD m Company

USD m USD m

Balance as at

1 January

2022 0.3 39.8 5.3 19.5 (6.4) 2.9 52.6 114.0

Profit for the

period - - - - - - 6.5 6.5

Translation of

foreign

operations - - - - - (30.5) - (30.5)

Other

comprehensive

income -

changes in

fair value of

hedging

instruments - - - - 6.4 - - 6.4

Total

comprehensive

income for

the period - - - - 6.4 (30.5) 6.5 (17.6)

Issue of share

capital - 59.6 - - - - - 59.6

Share issue

costs - (1.1) - - - - - (1.1)

Share-based

payments - - - 3.8 - - - 3.8

Share-based

payments -

deferred tax

asset - - - (0.4) - - - (0.4)

Share-based

payments -

exercised and

lapsed - - - (0.8) - - - (0.8)

Balance as at

30 September

2022 0.3 98.3 5.3 22.1 - (27.6) 59.1 157.5

Loss for the

period - - - - - - (8.6) (8.6)

Translation of

foreign

operations - - - - - 16.8 - 16.8

Other

comprehensive

income -

changes in

fair value of

hedging

instruments - - - - (0.2) - - (0.2)

Total

comprehensive

income for

the period - - - - (0.2) 16.8 (8.6) 8.0

Repurchase of

shares - - - - - - (0.5) (0.5)

Share-based

payments - - - 4.3 - - - 4.3

Share-based

payments -

deferred tax

asset - - - 0.5 - - - 0.5

Share-based

payments -

exercised and

lapsed - - - (2.8) - - - (2.8)

------------ ---------- --------- ---------- ---------- ------------- ---------- -------------

Balance as at

31 December

2022 0.3 98.3 5.3 24.1 (0.2) (10.8) 50.0 167.0

------------ ---------- --------- ---------- ---------- ------------- ---------- -------------

Profit for the

period - - - - - - 13.8 13.8

Translation of

foreign

operations - - - - - (4.2) - (4.2)

Other

comprehensive

income -

changes in

fair value of

hedging

instruments - - - - 1.6 - - 1.6

Total

comprehensive

income for

the period - - - - 1.6 (4.2) 13.8 11.2

Dividends paid

on equity

shares - - - - - - (3.6) (3.6)

Repurchase of

shares - - - - - - (30.2) (30.2)

Share-based

payments - - - 7.3 - - - 7.3

Share-based

payments -

deferred tax

asset - - - 1.2 - - - 1.2

Share-based

payments -

exercised and

lapsed - - - (5.2) - - - (5.2)

Balance as at

30 September

2023 0.3 98.3 5.3 27.4 1.4 (15.0) 30.0 147.7

-- Share capital represents the nominal value of the Company's

cumulative issued share capital.

-- Share premium represents the cumulative excess of the fair

value of consideration received for the issue of shares in excess

of their nominal value less attributable share issue costs and

other permitted reductions.

-- Merger relief reserve represents the cumulative excess of the

fair value of consideration received for the issue of shares in

excess of their nominal value less attributable shares issue costs

and other permitted reductions.

-- Retained earnings represents the cumulative value of the

profits not distributed to Shareholders but retained to finance the

future capital requirements of the Group.

-- Share-based payments reserve represents the cumulative value

of share-based payments recognised through equity and deferred tax

assets arising thereon, net of exercised and lapsed options.

-- Cash flow hedging reserve represents the effective portion of

changes in the fair value of derivatives.

-- Foreign exchange translation reserve represents the

cumulative exchange differences arising on Group consolidation.

Unaudited Unaudited

Nine months Nine months Audited

ended ended Year ended

CONSOLIDATED STATEMENT OF CASH 31 September 30 September 31 December

FLOWS 2023 2022 2022

USD m USD m USD m

-------------- -------------- -------------

Cash flow from operating activities

Profit before taxation 21.0 21.0 14.8

Adjustments for:

Depreciation of property, plant

and equipment 2.3 2.1 3.0

Amortisation and impairment of

intangible assets 28.1 21.1 36.4

Finance cost (net) 8.8 14.0 18.8

Share-based payments 3.5 3.8 5.7

Increase in trade and other receivables (1.1) (5.3) (9.8)

Increase/(decrease) in trade and

other payables (8.3) 1.7 16.9

Decrease in inventories 0.2 - 0.2

Cash flow generated from operations 54.5 58.4 86.0

-------------- -------------- -------------

Income tax paid (4.3) (4.4) (8.4)

-------------- -------------- -------------

Net cash flow generated from

operating activities 50.2 54.0 77.6

Cash flow used in investing activities

Purchase of property, plant and

equipment (1.7) (0.6) (1.3)

Purchase of intangible assets (6.7) (3.6) (5.2)

Payment of deferred consideration (17.9) (2.5) (2.7)

Proceeds from disposals of investments - 0.1 0.1

Acquisition of subsidiaries and

related assets, net of cash acquired (5.6) (66.9) (81.5)

Net cash flow used in investing

activities (31.9) (73.5) (90.6)

Cash flow generated from/(used

in) financing activities

Proceeds from borrowings 15.0 30.5 185.5

Settlement of forward foreign

exchange contracts - (21.0) (25.5)

Repayment of bond financing - - (128.6)

Repayment of revolving credit

facility - - (18.8)

Bank finance arrangement fees (0.2) - (3.4)

Accrued interest on bond tap - 0.4 0.4

Bond arrangement fees - (0.8) (0.8)

Proceeds from issuance of ordinary

shares (net) - 58.5 58.6

Repurchase of ordinary shares (30.2) - (0.4)

Dividends paid on equity shares (3.6) - -

Payment of lease liability (1.1) (1.6) (2.2)

Bank loan capital repayments (0.2) - -

Interest paid (9.0) (7.0) (7.8)

Net cash flow generated from/(used

in) financing activities (29.3) 59.0 57.0

-------------- -------------- -------------

Net increase/(decrease) in cash

and cash equivalents (11.0) 39.5 44.0

Cash and cash equivalents at beginning

of the period/year 94.8 56.1 56.1

Exchange losses on cash and cash

equivalents (0.1) (11.8) (5.3)

-------------- -------------- -------------

Cash and cash equivalents at

end of the period/year 83.7 83.8 94.8

NOTES TO THE UNAUDITED FINANCIAL RESULTS

1. General information

Team Internet Group Plc is the UK holding company of a group of

companies which operate a global internet platform that derives

recurring revenue from Online Marketing and Online Presence

services. The Company is registered in England and Wales. Its

registered office and principal place of business is 4th Floor,

Saddlers House, 44 Gutter Lane, London EC2V 6BR.

2. Basis of preparation

The financial results for the nine months ended 30 September

2023 are unaudited and have been prepared on the basis of the

accounting policies set out in the Group's 2022 statutory accounts

and, for all periods presented, in line with the principal

disclosure requirements of IAS 34: Interim Financial Reporting.

The unaudited financial results are condensed and do not

represent statutory accounts within the meaning of section 435 of

the Companies Act 2016. The statutory accounts for the year ended

31 December 2022, upon which the auditors issued an unqualified

opinion, are available on the Group's website and did not contain

statements under section 498(2) or (3) of the Companies Act

2006.

3. Segment analysis

Team Internet is an independent global service provider building

and managing platforms that sell Online Marketing and Online

Presence services. Operating segments are organised around the

products and services of the business and are prepared in a manner

consistent with the internal reporting used by the chief operating

decision maker to determine allocation of resources to segments and

to assess segmental performance. The Directors do not rely on

analyses of segment assets and liabilities, nor on segmental cash

flows arising from the operating, investing and financing

activities for each reportable segment, for their decision making

and therefore have not included them.

The Online Marketing segment creates privacy-safe, AI-generated

online customer journeys that convert general interest online media

users into confident high conviction consumers through advertorial

and review websites. The Online Presence segment is a critical

constituent of the global online presence and productivity tool

ecosystem, where Team Internet serves as the primary distribution

channel for the wide range of digital products.

Management reviews the activities of the Team Internet Group in

the segments disclosed below up to a Net revenue/gross profit level

only:

Unaudited Unaudited

Nine months Nine months Audited

ended ended Year ended

30 September 30 September 31 December

2023 2022 2022

USD m USD m USD m

-------------- -------------- ----------------

Online Marketing

Revenue 474.7 412.6 574.7

Cost of sales (380.4) (323.7) (449.6)

-------------- ----------------

Net revenue/gross profit 94.3 88.9 125.1

-------------- ----------------

Online Presence

Revenue 137.0 114.1 153.5

Cost of sales (92.8) (74.7) (100.9)

-------------- -------------- ----------------

Net revenue/gross profit 44.2 39.4 52.6

----------------

Total revenue 611.7 526.7 728.2

Total cost of sales (473.2) (398.4) (550.5)

-------------- ----------------

Net revenue/gross profit 138.5 128.3 177.7

-------------- -------------- ----------------

NOTES TO THE UNAUDITED FINANCIAL RESULTS (continued)

4. Revenue

The Group's revenue is generated indirectly from consumers

located in the following geographical areas:

Unaudited Unaudited

Nine months Nine months Audited

ended ended Year

30 September 30 September ended

2023 2022 31 December

USD m % USD m % 2022 %

USD m

-------------- -------------- --------------

Americas 314.6 51% 279.2 53% 389.0 53%

APAC 53.8 9% 55.8 11% 73.5 10%

EMEA 210.9 35% 169.9 32% 234.5 33%

UK 32.4 5% 21.8 4% 31.2 4%

-------------- -------------- --------------

611.7 100% 526.7 100% 728.2 100%

-------------- -------------- --------------

The Group's revenue is invoiced directly to the following

geographical areas:

Unaudited Unaudited

Nine months Nine months Audited

ended ended Year

30 September 30 September ended

2023 2022 31 December

USD m % USD m % 2022 %

USD m

-------------- -------------- --------------

Online Marketing

Americas 14.4 3% 14.0 3% 19.5 3%

APAC 7.9 1% 5.4 1% 7.8 1%

EMEA 449.3 73% 391.5 74% 544.5 75%

UK 3.1 1% 1.7 - 2.9 -

-------------- -------------- --------------

474.7 78% 412.6 78% 574.7 79%

-------------- -------------- --------------

Online Presence

Americas 51.4 8% 33.4 6% 51.7 7%

APAC 17.4 3% 16.2 3% 22.3 3%

EMEA 62.5 10% 61.6 12% 75.4 10%

UK 5.7 1% 2.9 1% 4.1 1%

--------------

137.0 22% 114.1 22% 153.5 21%

-------------- -------------- --------------

Total revenue 611.7 100% 526.7 100% 728.2 100%

-------------- -------------- --------------

5. Non-core operating expenses

Unaudited Unaudited

Nine months Nine months Audited

ended ended Year ended

30 September 30 September 31 December

2023 2022 2022

USD m USD m USD m

-------------- -------------- -------------

Acquisition related costs 0.7 3.1 3.5

Integration and streamlining

costs 2.6 2.8 4.0

Other costs (1) 1.7 0.1 0.7

5.0 6.0 8.2

-------------- -------------- -------------

(1) Other costs include items related primarily to business

reviews and restructuring expenses.

NOTES TO THE UNAUDITED FINANCIAL RESULTS (continued)

6. Net finance costs

Unaudited Unaudited

Nine months Nine months Audited

ended ended Year ended

30 September 30 September 31 December

2023 2022 2022

USD m USD m USD m

-------------- -------------- -------------

Finance income (0.3) - -

Impact of unwinding of discount

on net present value of deferred

consideration 1.1 0.4 1.0

Reappraisal of deferred consideration (2.8) (1.4) (1.3)

Arrangement fees on borrowings 1.0 2.9 3.0

Interest on bank borrowings

and bond interest 9.9 7.4 10.2

Interest expense on leases 0.1 0.1 0.2

(Gain)/loss arising on derivatives

classified

as fair value hedges (0.2) - 0.1

Foreign exchange loss on borrowings - 4.7 5.6

Net finance costs 8.8 14.1 18.8

-------------- -------------- -------------

7. Earnings per share

Earnings per share has been calculated by dividing the

consolidated profit/(loss) after taxation attributable to ordinary

shareholders by the weighted average number of ordinary shares in

issue during the year. Diluted earnings per share have been

calculated on the same basis as above, except that the weighted

average number of ordinary shares that would be issued on the

conversion of all the dilutive potential ordinary shares (arising

from the Group's share option scheme and warrants) into ordinary

shares has been added to the denominator. In 2022, there is no

change to the loss numerator of the dilutive calculation. Due to

the loss made in the year, the impact of the potential shares to be

issued on exercise of share options and warrants would be

anti-dilutive and therefore diluted earnings per share is reported

on the same basis on earnings per share.

Unaudited Unaudited

Nine months Nine months Audited

ended ended Year ended

30 September 30 September 31 December

2023 2022 2022

USD m USD m USD m

-------------- -------------- -------------

Profit/(loss) after tax attributable

to owners 13.8 6.5 (2.1)

-------------- -------------- -------------

Operating profit 29.8 35.1 33.6

Depreciation of property, plant

and equipment 2.3 2.1 3.0

Amortisation and impairment of

intangible assets 28.1 21.1 36.4

Non-core operating expenses 5.0 6.0 8.2

Foreign exchange loss/(gain) 0.1 (6.1) (0.9)

Share-based payment expenses 3.5 3.8 5.7

-------------- -------------- -------------

Adjusted EBITDA 68.8 62.0 86.0

Depreciation (2.3) (2.1) (3.0)

Net finance costs (excluding deferred

consideration amounts, foreign

exchange loss on borrowings and

write off of arrangement fees on

borrowing - note 7) (11.8) (9.5) (13.1)

Taxation (7.2) (14.5) (16.9)

-------------- -------------- -------------

Adjusted earnings 47.5 35.9 53.0

Weighted average number

of shares:

Basic 270,543,200 262,399,797 265,623,278

Effect of dilutive potential

ordinary shares 1,600,095 7,708,732 2,584,385

-------------- -------------- -------------

Diluted average number

of shares 272,143,295 270,108,529 268,207,663

-------------- -------------- -------------

Earnings per share:

Basic (cents) 5.10 2.48 (0.78)

Diluted (cents) 5.07 2.41 (0.78)

-------------- -------------- -------------

Adjusted earnings - Basic

(cents) 17.56 13.68 20.01

Adjusted earnings - Diluted

(cents) 17.45 13.29 19.81

-------------- -------------- -------------

Basic and diluted earnings per share of 5.10 and 5.07 cents

(2022: 2.48 and 2.41 cents) have been impacted by depreciation,

amortisation, impairment, non-core operating expenses, foreign

exchange gains and losses and share-based payment expenses.

NOTES TO THE UNAUDITED FINANCIAL RESULTS (continued)

8. Financial instruments

The Team Internet Group is exposed to market risk, credit risk

and liquidity risk arising from financial instruments. The Group's

overall financial risk management policy focusses on the

unpredictability of financial markets and seeks to minimise

potential adverse effects on the Group's financial performance. The

Group does not trade in financial instruments.

Cash conversion for the nine-month periods ended 30 September

2023, 30 September 2022 and for the year ended 31 December 2022 was

as follows:

Unaudited Unaudited

Nine months Nine months Audited

ended ended Year ended

30 September 30 September 31 December

2023 2022 2022

USD m USD m USD m

-------------- -------------- --------------

Cash conversion

Cash flow from operations 54.5 58.4 86.0

Exceptional costs incurred and

paid during the year 5.1 5.4 7.8

Settlement of one-off working capital

items from the prior year 6.0 1.2 1.2

-------------- -------------- --------------

Adjusted cash flow from operations 65.6 65.0 95.0

Adjusted EBITDA 68.8 62.0 86.0

Conversion % 95% 105% 110%

Net debt as at 30 September 2023 and 31 December 2022 is shown

in the table below.

Bank debt Cash Financial Net debt

instruments

USD m USD m USD m USD m

----------- ------- ------------- ----------

At 31 December 2022 (151.2) 94.8 (0.2) (56.6)

Drawdown (15.0) 15.0 - -

Capital repayments 0.2 (0.2) - -

Prepaid finance costs 0.2 (0.2) - -

Amortisation of prepaid finance

costs (1.0) - - (1.0)

Mark-to-market revaluation - - 1.6 1.6

Other cash movements - (25.6) - (25.6)

Foreign exchange differences - (0.1) - (0.1)

----------- ------- ------------- ----------

At 30 September 2023 (166.8) 83.7 1.4 (81.7)

----------- ------- ------------- ----------

Financial instruments included in net debt represent the

mark-to-market valuation of interest rate swaps, which fix the

variable interest component of USD 75.0m of the bank debt.

8. Business combinations

Acquisition of Adrenalads LLC

On 31 August 2023, Team Internet acquired Adrenalads LLC, a Los

Angeles based online marketing company that has a rich history of

collaboration with Zeropark. Consideration included initial

consideration USD 2.1m and deferred consideration of USD 0.2m

payable in February 2025. The acquisition will be immediately

earnings accretive. The acquisition aims to seamlessly integrate

Adrenalads into the Zeropark ecosystem. This move is anticipated to

strengthen Zeropark's ties with ecommerce stakeholders, improve

efficiency of internal media-buying processes, open new supply

channels for Zeropark and establish a presence in strategic Pacific

time zone.

In FY2022, Adrenalads generated unaudited revenue of USD 2.7m,

unaudited Net revenue/gross profit of USD 1.1m and unaudited EBITDA

of USD 0.7m.

The purchase price allocation exercise for the acquisition of

Adrenalads has not yet been completed as at the date of signing

this report, and it is therefore not possible to provide further

details of the fair value estimates of the assets and liabilities

at the acquisition date.

Deferred consideration payments

During the nine month period ended 30 September 2023 the

following deferred consideration payments were made:

-- Deferred contingent consideration payments for the

acquisition of VGL Publishing AG was settled in cash for EUR 13.7

(USD 14.9m), which includes EUR 12.4m (USD 13.6m) in respect of

performance in 2022

-- The first deferred contingent consideration payment for the

acquisition of M.A Aporia was cash settled for USD 2.3m in two

instalments USD 0.8m paid on 13 July 2023 and USD 1.5m paid on 24

August 2023

-- On 27 July 2023 , the final deferred contingent consideration

payment for the acquisition of InterNexum GmbH was settled in cash

for EUR 0.6m (USD 0.6m)

NOTES TO THE UNAUDITED FINANCIAL RESULTS (continued)

9. Share buyback programme and Employee Benefit Trust

During the period the Company repurchased 15,878,125 shares

under its share buyback programme at an average share price of

GBP1.28 (FY2022: 220,000 shares at a share price of GBP1.54). These

shares are held in treasury by the Company.

During the period the Group's Employee Benefit Trust purchased

3,648,587 shares at an average share price of GBP1.16. At 30

September 2023 the Employee Benefit Trust held 9,199,521 shares (31

December 2022: 11,232,599 shares, 30 September 2022: 16,519,280

shares).

The total share repurchase in the period is USD 30.9m of which

USD 30.2m was settled in cash in the period, with USD 0.7m settled

in cash after the period end.

The number of shares held and outstanding share options is as

follows:

Unaudited Unaudited Audited

30 September 30 September 31 December

2023 2022 2022

Number Number Number

-------------- -------------- -------------

Issued share capital 288,660,084 288,660,084 288,660,084

Shares held by the Employee Benefit

Trust (9,199,521) (16,519,280) (11,232,599)

Shares held in Treasury (16,098,125) - (220,000)

Share capital 263,362,438 272,140,804 277,207,485

Outstanding share options 11,525,831 18,372,001 12,985,926

-------------- -------------- -------------

Share capital plus outstanding

share options 274,888,269 290,512,805 290,193,411

-------------- -------------- -------------

10. Events occurring after the period end

The following significant event occurred after the Group's

period end date of 30 September 2023 and before the signing of

these Unaudited Financial Results on 13 November 2023:

-- On 19 October 2023, a deferred consideration payment in

relation to the acquisition of M.A Aporia was made for USD 2.8m

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

QRTEAFFAFEADFAA

(END) Dow Jones Newswires

November 13, 2023 02:00 ET (07:00 GMT)

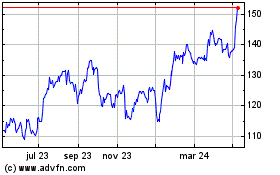

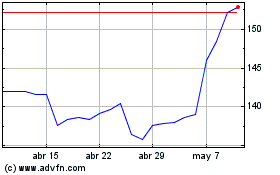

Team Internet (LSE:TIG)

Gráfica de Acción Histórica

De Abr 2024 a May 2024

Team Internet (LSE:TIG)

Gráfica de Acción Histórica

De May 2023 a May 2024