TIDMBEH

RNS Number : 8215X

Bayfield Energy Holdings PLC

13 February 2013

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION IN WHOLE OR IN

PART, IN, INTO OR FROM ANY JURISDICTION WHERE TO DO SO WOULD

CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OF SUCH

JURISDICTION

This announcement is not an admission document. This

announcement does not constitute or form part of, and should not be

construed as, any offer or invitation to sell or issue, or any

solicitation of any offer to purchase or subscribe for, any shares

in the Company or securities in any other entity nor shall it, or

any part of it, or the fact of its distribution, form the basis of,

or be relied on in connection with, any contract or investment

decision in relation thereto. This announcement does not constitute

a recommendation regarding any securities.

Any investment decision must be made exclusively on the basis of

the admission document dated 25 January 2013 and published by the

Company (and any supplement thereto to be published by the Company)

(the "Admission Document").

13 February 2013

Bayfield Energy Holdings plc

("Bayfield" or the "Company"; AIM: BEH)

Result of General Meeting

Bayfield announces that the special resolution proposed at the

General Meeting of the Company held at 1 p.m. today was duly passed

without amendment on a show of hands to:

(a) approve the Merger for the purposes of Rule 14 of the AIM

Rules;

(b) authorise the Directors to allot the Consideration Shares,

the Trinity Warrant Shares and the

Placing Shares;

(c) disapply statutory pre-emption rights in relation to the

allotment of the Consideration

Shares, the Placing Shares and the Trinity Warrant Shares;

(d) change the name of the Company to "Trinity Exploration &

Production plc"; and

(e) approve the Share Consolidation.

For further information (including any defined terms used in

this announcement) please view the Admission Document, which is

available to download from the Company's website

www.bayfieldenergy.com.

A summary of proxy votes received is set out in the table

below.

Votes in Votes Discretionary

Favour Against Votes

------------ --------- --------------

134,016,549 3,000 3,585,714

------------ --------- --------------

In accordance with the Admission Document, at 8 a.m. tomorrow 14

February 2013 Admission will occur, the Merger will complete and

the Share Consolidation will take effect. The Company will be

renamed Trinity Exploration & Production plc, and there will be

a new ISIN and TIDM (ISIN: GB00B8JG4R91 / TIDM: TRIN).

-ends-

Enquiries

Bayfield Tel: +44 (0) 20 7920

Hywel John, Chief Executive Officer 2347

FirstEnergy Capital LLP (Financial Adviser Tel: +44 (0) 20 7488

& Joint Broker 0200

to Bayfield and Co-lead Manager to the

Placing)

Hugh Sanderson

David van Erp

Seymour Pierce (In administration; NOMAD Tel: +44 (0)20 7107

& Joint Broker to Bayfield) 8000

David Porter/Rick Thompson

Richard Redmayne/David Banks

M:Communications (PR Adviser to Bayfield) Tel: +44 (0) 20 7920

Patrick d'Ancona 2347/44

Andrew Benbow

Trinity Exploration & Production Limited Tel: +44 (0)20 7404

Monty Pemberton, Chief Executive Officer 5959

Robert Gair, Corporate Development Manager

RBC Capital Markets (Financial Adviser Tel: +44 (0) 20 7653

to Trinity & Joint Bookrunner to the 4000

Placing)

Tim Chapman

Matthew Coakes

Daniel Conti

Jefferies (Joint Bookrunner to the Placing) Tel: +44 (0) 20 7029

Chris Zeal / Graham Hertrich 8000

Lee Morton / Luca Erpici

Brunswick Group LLP (PR Adviser to Trinity) Tel: +44 (0) 20 7404

Patrick Handley 5959

Catriona McDermott

This announcement does not constitute an offer to sell or the

solicitation of an offer to buy shares in the Company ("Shares") in

any jurisdiction. Any such offer, if made, will be made pursuant to

the Admission Document proposed to be published in due course. In

particular, this announcement is not for distribution in or into

the United States, Canada, Republic of South Africa, Australia or

Japan or to any national resident or citizen of the United States,

Canada, Republic of South Africa, Australia or Japan. The

distribution of this announcement in other jurisdictions including

(without limitation) the United States, Canada, Republic of South

Africa, Australia and Japan (or to any resident thereof) may be

restricted by law and therefore persons into whose possession this

announcement comes should inform themselves of and observe any such

restrictions. Any failure to comply with these restrictions may

constitute a violation of the securities laws of any such

jurisdiction.

The Shares have not been nor will be registered under the United

States Securities Act of 1933, as amended (the "US Securities

Act"), or under the securities legislation of any state of the

United States of America, nor under the relevant securities laws of

Canada, Republic of South Africa, Australia or Japan, and may not

be offered or sold in the United States of America except pursuant

to an exemption from, or in a transaction not subject to, the

registration requirements of the US Securities Act and in

compliance with any applicable state securities laws. There will be

no offering of Shares in or into the United States of America,

Canada, Republic of South Africa, Australia or Japan or in any

country, territory or possession where to do so may contravene

local securities laws or regulations. This document (or any part of

it) is not to be reproduced, distributed, passed on, or the

contents otherwise divulged, directly or indirectly, in or into the

United States of America, Canada, Republic of South Africa,

Australia or Japan, or in any country, territory or possession

where to do so may contravene local securities laws or

regulations.

Seymour Pierce and FirstEnergy (the "Banks"), each of which are

authorised and regulated in the United Kingdom by the Financial

Services Authority, are acting for the Company in connection with

the proposals set out in this announcement (the "Proposals") and

will not be acting for any other person or otherwise be responsible

to any person for providing the protections afforded to customers

of the Banks or for advising any other person in respect of the

Proposals. The Banks have not authorised the contents of any part

of this announcement and neither accepts liability for the accuracy

of any information or opinions contained in this announcement nor

for the omission of any material information from this announcement

for which the Company is responsible. No representation or

warranty, express or implied, is made by the Banks as to any of the

contents of this announcement (without limiting the statutory

rights of any person to whom this announcement is issued).

RBC, which is authorised and regulated in the United Kingdom by

the Financial Services Authority, is acting as financial adviser to

Trinity Exploration & Production Limited ("Trinity") in

connection with the Proposals and joint bookrunner to the Company

in connection with the Placing and will not be acting for any other

person or otherwise be responsible to any person for providing the

protections afforded to customers of RBC or for advising any other

person in respect of the Proposals. RBC has not authorised the

contents of any part of this announcement and neither accepts

liability for the accuracy of any information or opinions contained

in this announcement nor for the omission of any material

information from this document for which the Company is

responsible. No representation or warranty, express or implied, is

made by

RBC as to any of the contents of this announcement (without

limiting the statutory rights of any person to whom this

announcement is issued).

Jefferies International Limited ("Jefferies"), which is

authorised and regulated in the United Kingdom by the Financial

Services Authority, is acting as joint bookrunner to the Company in

connection with the Placing and will not be acting for any other

person or otherwise be responsible to any person for providing the

protections afforded to customers of Jefferies or for advising any

other person in respect of the Proposals. Jefferies has not

authorised the contents of any part of this announcement and

neither accepts liability for the accuracy of any information or

opinions contained in this document nor for the omission of any

material information from this document for which the Company is

responsible. No representation or warranty, express or implied, is

made by Jefferies as to any of the contents of this announcement

(without limiting the statutory rights of any person to whom this

announcement is issued).

This announcement includes statements that are, or may be deemed

to be, "forward-looking statements". These forward-looking

statements can be identified by the use of forward-looking

terminology, including the terms "believes", "estimates",

"anticipates", "expects", "intends", "may", "will" or "should" or,

in each case, their negative or other variations or comparable

terminology. These forward-looking statements relate to matters

that are not historical facts.

By their nature, forward-looking statements involve risks and

uncertainties because they relate to events and depend on

circumstances that may or may not occur in the future.

Forward-looking statements are not guarantees of future

performance. The Company's actual investment performance, results

of operations, financial condition, liquidity, dividend policy and

the development of its financing strategies may differ materially

from the impression created by the forward-looking statements

contained in this announcement. In addition, even if the investment

performance, result of operations, financial condition, liquidity

and dividend policy of the Company and development of its financing

strategies, are consistent with the forward-looking statements

contained in this announcement, those results or developments may

not be indicative of results or developments in subsequent

periods.

These forward-looking statements speak only as at the date of

this announcement. Subject to its legal and regulatory obligations

(including under the AIM Rules), the Company expressly disclaims

any obligations to update or revise any forward-looking statement

contained herein to reflect any change in expectations with regard

thereto or any change in events, conditions or circumstances on

which any statement is based.

This information is provided by RNS

The company news service from the London Stock Exchange

END

ROMUOOSROSAUAAR

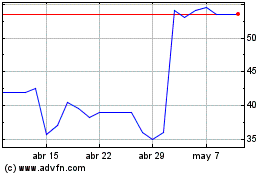

Trinity Exploration & Pr... (LSE:TRIN)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Trinity Exploration & Pr... (LSE:TRIN)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024