Trinity Exploration & Production Long Term Incentive Plan (6029S)

10 Julio 2020 - 1:00AM

UK Regulatory

TIDMTRIN

RNS Number : 6029S

Trinity Exploration & Production

10 July 2020

Trinity Exploration & Production plc

('Trinity' or the 'Company' or the 'Group')

Partial Vesting of the 2017 Awards under the Long Term Incentive

Plan

Trinity Exploration & Production plc (AIM: TRIN), the

independent E&P company focused on Trinidad and Tobago,

announces the partial vesting of the one off awards made under the

Long Term Incentive Plan ("LTIP") on 25 August 2017.

Further to the announcement of 25 August 2017, informing the

Market that the Company had issued certain awards under its LTIP to

the Executive Directors and other key employees ("Management"), the

Company announces the partial vesting of these awards as a result

of satisfying a portion of the performance criteria established at

the time of the grant.

The Options are due to vest on 30 June 2022, subject to meeting

a series of predetermined performance criteria. However, the

Options can also vest in whole or in part on 30 June 2020 or 30

June 2021, to the extent that the relevant performance conditions

have been met. Subject to meeting these conditions and continued

employment with the Company, the Options are exercisable at nil

cost by the participants. Participants have until 24.08.2027 to

exercise any Options vesting under this tranche of the LTIP

scheme.

The Company has satisfied certain performance criteria (the

detail of which is set out below) and as a result 34.59% per cent

of the awards made to Management vested on 30 June 2020.

Performance Criteria Percent of options Performance criteria

Set available to vest achieved

Share price growth 70 per cent The 3-month VWAP at

from the 2017 placing the first testing

price of 4.98 pence date of 30 June 2020

per share . If the was 6.95p. Therefore,

3- month volume-weighted 6.56 per cent of this

price (VWAP) at the performance criterion

testing date is 35 has been met.

pence per share or

more this element

of the award vests

in full. If the 3-month

VWAP at the testing

date is between 4.98

pence and 35 pence

per share, this component

of the award will

vest on a pro-rated

straight line basis.

------------------- ------------------------

Repayment of the amount 20 per cent Performance criterion

due to the Board of achieved and the full

Inland Revenue of 20 per cent of options

Trinidad and Tobago vest.

in accordance with

the terms of the Creditors

Proposal approved

in 2017, with repayment

due by 30 September

2019.

------------------- ------------------------

Redemption of all 10 per cent Performance criteria

the Convertible Loan achieved and the full

Notes issued in January 10 per cent of options

2017 before the second vest.

anniversary of their

issue.

------------------- ------------------------

The total number of Options vested on 30 June was 8,916,631

including those vested to the Executives detailed in the table

below. A further 16,858,744 options will be re-tested under the

Share Price Growth criterion on 30 June 2021 and 30 June 2022.

Name Position NUMBER OF ORDINARY SHARES

VESTING

Bruce Dingwall Executive Chairman 3,121,080

==================== ==========================

Managing Director

& Chief Financial

Jeremy Bridglalsingh Officer 1,788,912

==================== ==========================

Whilst these Options have vested, as yet, none of the vested

Options have been exercised by any of the Executives. These vested

Options remain available to be exercised until 24.08.2027. The

Company intends to apply for a single block admission to trading on

AIM for awards exercised under the LTIP. A further announcement

will be made as appropriate.

The Remuneration Committee believes that the Company's LTIP

continues to be an important tool for aligning the interests of the

Trinity management team, including the Executives, with those of

shareholders. The Share Price Performance criterion means that

future grants will only take place when the Company's share price

appreciates in absolute terms and the total pool of Options issued

in this tranche will only vest, in full, if the 3-month VWAP

exceeds 35 pence at one of the future testing dates.

Enquiries:

Trinity Exploration & Production Tel: +44 (0)131 240

Bruce Dingwall CBE, Executive Chairman 3860

Jeremy Bridglalsingh, Managing Director

& Chief Financial Officer

Tracy Mackenzie, Corporate Development Manager

SPARK Advisory Partners Limited ( Nominated Tel: +44 (0)20 3368

Adviser and Financial Adviser) 3550

Mark Brady

Cenkos Securities PLC (Broker) Tel: +44 (0)20 7397

Joe Nally (Corporate Broking) 8900

Neil McDonald +44(0)131 220 6939

Derrick Lee

Walbrook PR Limited Tel: +44 (0)20 7933

Nick Rome 8780

trinityexploration@walbrookpr.com

About Trinity

Trinity is an independent oil and gas exploration and production

company focused solely on Trinidad and Tobago. Trinity operates

producing and development assets both onshore and offshore, in the

shallow water West and East Coasts of Trinidad. Trinity's portfolio

includes current production, significant near-term production

growth opportunities from low risk developments and multiple

exploration prospects with the potential to deliver meaningful

reserves/resources growth. The Company operates all of its nine

licences and, across all of the Group's assets, management's

estimate of 2P reserves as at the end of 2019 was 20.9 mmbbls.

Group 2C contingent resources are estimated to be 20.1 mmbbls. The

Group's overall 2P plus 2C volumes are therefore 41.1 mmbbls.

Trinity is quoted on the AIM market of the London Stock Exchange

under the ticker TRIN.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

MSCFFFIIDLIAIII

(END) Dow Jones Newswires

July 10, 2020 02:00 ET (06:00 GMT)

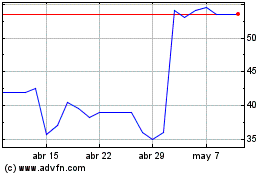

Trinity Exploration & Pr... (LSE:TRIN)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

Trinity Exploration & Pr... (LSE:TRIN)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024