RNS Number : 1685J

Triple Point VCT PLC

28 November 2008

The directors of Triple Point VCT plc are pleased to announce the Reults of the Company for the six months ended 30 September

2008-11-28

Please address any queires to :

David Dick 020 7201 8989 or Graham Urquhart 020 3216 2000

Chairman's Statement

Introduction

I am pleased to be writing to you to present the unaudited interim results for Triple Point VCT plc ("the Company") for the six months

ended 30 September 2008.

Investment strategy and review

The investment strategy of the Company was to build and hold a diversified portfolio of VCT qualifying holdings.

Having achieved the threshold of being 70% invested in VCT qualifying holdings, there have been no changes in such holdings during the

period and the Company retains its VCT status. The Company's priority is now to manage the portfolio with the intention of returning value

to shareholders within the minimum time consistent with VCT rules.

Dividends and buyback

During the period the Company declared and paid a dividend of 3.13p per share in respect of the year ended 31 March 2008. The total

value of dividends paid so far is 5.43p per share. The Directors do not propose to declare a dividend in respect of the half year to 30

September 2008.

53 Shareholders accepted the buyback Tender Offer made by the Company and 3,390,537 shares were purchased at 92.0p each which is

reflected in the reduction in money market funds and uninvested funds recorded in the balance sheet.

Results

The Company continues to perform satisfactorily and made a profit after taxation of �0.271 million during the period.

The Net Asset Value (NAV) of the Company increased during the period and, following the payment of the dividend of 3.13p per share, the

NAV of the Company at 30 September was �26.64 million. The NAV per share at 30 September was 93.15p.

Risks and Uncertainties

The board confirms that the principal risks facing the Company over the remainder of the financial period are:

a) investment risk associated with investing in small and immature businesses

b) failure to maintain approval as a VCT.

The Board believe these principal risks are manageable and to expected for a company with Triple Point VCT plc's strategy. The Board

continues to work closely with the Investment Manager to endeavour to minimise either their likelihood or potential impact. A more detailed

explanation of the risks faced by the Company can be found in note 20 on page 30 of the Annual Financial Statements for the period ended 31

March 2008.

Conclusion

The financial markets have experienced unprecedented difficulties but the board is pleased to announce that your Company, thus far, has

been largely unaffected and hopes to be able to announce a substantial return of funds to shareholders in 2009.

If you have any queries or comments, please do not hesitate to telephone Triple Point Investment Management LLP on 020 7201 8989 or

email me at michael.sherry@triplepoint.co.uk.

Michael Sherry

Chairman

28 November 2008

Triple Point VCT plc

Financial Summary

Unaudited Unaudited Audited

6 Months 6 Months Year

Ended Ended Ended

30 Sep 2008 30 Sep 2007 31 Mar 2008

�'000 �'000 �'000

Net assets 26,640 30,198 30,534

Net profit before tax 364 506 978

Return per share 0.86p 1.13p 2.18p

Net asset value per share 93.15p 94.40p 95.45p

Triple Point VCT plc

Portfolio summary (unaudited)

As at 30 September 2008

Cost & Valuation Cost & Valuation

Security Activity 30-Sep-08 31-Mar-08

�'000 % �'000 %

Unquoted

Qualifying holdings 22,202 91.24 22,202 76.11

Holdings whose VCT qualifying 1,030 4.23 1,030 3.53

status has yet to be

determined

Money market funds 1,094 4.50 2,972 10.19

Uninvested funds 7 0.03 2,966 10.17

24,333 100.00 29,170 100.00

Qualifying Holdings (All

Unquoted)

Beam Carrier Trading Ltd Provision of

satellite capacity

Equity 600 2.70 600 2.70

Debt 1,350 6.08 1,350 6.08

Bereavement Facilities and Crematorium

Services Ltd maintenance

Equity 530 2.39 530 2.39

Debt 500 2.25 500 2.25

Broadsword Satellite Provision of

Communications Ltd satellite capacity

Equity 685 3.09 685 3.09

Debt 1,315 5.92 1,315 5.92

Cranmer Lawrence Engineering Ambulance

Solutions Ltd refurbishment

Equity 475 2.14 475 2.14

Debt 475 2.14 475 2.14

Furnace Management Services Crematorium

Ltd management

Equity 530 2.39 530 2.39

Debt 500 2.25 500 2.25

High Definition Broadcast Provision of

Services Ltd satellite capacity

Equity 532 2.40 532 2.40

Debt 1,343 6.05 1,343 6.05

HTI Private Patient Services Clinical care and

Ltd administration

Equity 530 2.39 530 2.39

Debt 500 2.25 500 2.25

Meaujo 732 Ltd Provision of virtual

communications

systems

Equity 302 1.36 302 1.36

Debt 1,132 5.10 1,132 5.10

Partners in Healthcare Clinical care and

Technology London Ltd administration

Equity 530 2.39 530 2.39

Debt 500 2.25 500 2.25

Per Port Services Ltd Servicing & supply

of telephony

equipment

Equity 312 1.40 312 1.40

Debt 615 2.77 615 2.77

Carried Forward 13,256 59.71 13,256 59.71

Triple Point VCT plc

Portfolio summary (unaudited)

As at 30 September 2008

Cost & Valuation Cost & Valuation

Security Activity 30-Sep-08 31-Mar-08

�'000 % �'000 %

Brought Forward 13,256 59.71 13,256 59.71

Satellite Broadband Access Provision of satellite

Solutions Ltd capacity

Equity 526 2.37 526 2.37

Debt 1,359 6.12 1,359 6.12

Simply Coffee Services Ltd Coffee shops

Equity 530 2.39 530 2.39

Debt 500 2.25 500 2.25

Telecom Network Management Ltd Provision of virtual

communications systems

Equity 530 2.39 530 2.39

Debt 500 2.25 500 2.25

WAN Solutions Ltd Provision of virtual

communications systems

Equity 352 1.59 352 1.59

Debt 1,472 6.63 1,472 6.63

Wide Area Network Services Ltd Provision of virtual

communications systems

Equity 282 1.27 282 1.27

Debt 1,186 5.34 1,186 5.34

Wide Area Network Solutions Provision of virtual

Ltd communications systems

Equity 321 1.45 321 1.45

Debt 1,388 6.24 1,388 6.24

22,202 100.00 22,202 100.00

Holdings whose VCT qualifying status has yet to be determined (All Unquoted)

Delanic Films Ltd Film distribution

Equity 530 51.46 530 51.46

Debt 500 48.54 500 48.54

1,030 100.00 1,030 100.00

Money Market Funds

(non-qualifying)

BGI Sterling Liquidity Fund 182 16.64 495 16.66

GS Stg Liquid Res Fund 182 16.64 495 16.66

HSBC Sterling Liquidity Fund 183 16.73 495 16.66

Insight Liquidity Fund 182 16.64 495 16.66

Merrill Lynch Inst Liq Fund 182 16.63 496 16.68

RBOS Global Treasury Fund 183 16.72 496 16.68

1,094 100.00 2,972 100.00

Triple Point VCT plc

Income Statement

Unaudited Unaudited Audited

6 months ended 6 months ended Year ended

30-Sep-08 30-Sep-07 31-Mar-08

Rev. Cap. Tot. Rev. Cap. Tot. Rev. Cap. Tot.

�'000 �'000 �'000 �'000 �'000 �'000 �'000 �'000 �'000

Investment income 764 - 764 934 - 934 1,814 - 1,814

Investment management fees (84) (250) (334) (90) (271) (361) (178) (534) (712)

Other expenses (66) - (66) (67) - (67) (124) - (124)

Return / (loss) on ordinary 614 (250) 364 777 (271) 506 1,512 (534) 978

activities before taxation

Taxation on return on ordinary (157) 64 (93) (223) 78 (145) (434) 153 (281)

activities

Return / (loss) on ordinary 457 (186) 271 554 (193) 361 1,078 (381) 697

activities after taxation

Return / (loss) per share, 1.46p (0.59p) 0.86p 1.73p (0.60p) 1.13p 3.37p (1.19p) 2.18p

basic and diluted

The total column of this statement is the company's profit and loss account. The supplementary revenue return and capital return columns

have been prepared under guidance published by the Association of Investment Companies.

All the items in the above statement derive from continuing operations.

There are no recognised gains or losses other that those disclosed in the income statement.

Statement of Movements in Shareholders' Funds

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30-Sep-08 30-Sep-07 31-Mar-08

�'000 �'000 �'000

Shareholders' funds at 1 April 2008

30,534

30,573

30,573

Shares bought back by company

(3,164)

-

-

Return on ordinary activities after taxation

271

361

697

Dividends paid in period

(1,001)

(736)

(736)

Shareholders' funds at 30 September 2008

26,640

30,198

30,534

Triple Point VCT plc

Balance Sheet

Unaudited Unaudited Audited

30-Sep-08 30-Sep-07 31-Mar-08

�'000 �'000 �'000

Fixed Assets:

Investments 23,232 13,061 23,232

Current assets:

Debtors 2,691 1,184 2,042

Money market funds 1,094 15,572 2,972

Cash at bank 7 812 2,966

3,792 17,568 7,980

Creditors: amounts falling due within one (384) (431) (678)

year

Net current assets 3,408 17,137 7,302

Total assets less current liabilities 26,640 30,198 30,534

Capital and reserves:

Share capital 286 320 320

Share premium - 28,799 28,799

Capital redemption reserve 1,172 1,138 1,138

Special distributable reserve 25,635 - -

Capital reserve - realised (993) (619) (807)

Revenue reserve 540 560 1,084

Shareholders' funds 26,640 30,198 30,534

Net asset value per share 93.15p 94.40p 95.45p

Triple Point VCT plc

Cash Flow Statement

Unaudited Unaudited Audited

6 months 6 months Year

ended ended ended

30-Sep-08 30-Sep-07 31-Mar-08

�'000 �'000 �'000

Net cash inflow from operating

activities

Return on ordinary activities 364 506 978

before tax

Adjusted for:

Increase in debtors (649) (366) (1,224)

(Decrease) / increase in (294) 138 386

creditors

Net cash outflow from (579) 278 140

operating activities

Taxation:

Corporation tax charge for the (93) (145) (281)

period

Financial investment:

Purchase of unquoted - (5,277) (15,448)

investments

Disposal of current asset 1,878 2,658 15,257

investments

Equity dividends paid (1,001) (736) (736)

Net cash outflow before 205 (3,222) (1,068)

financing

Financing:

Repurchase of own shares (3,164) - -

Net cash outflow from (3,164) - -

financing

Decrease in cash (2,959) (3,222) (1,068)

Reconciliation of net cash flow to movements in cash and cash equivalents

Net decrease in cash and cash (2,959) (3,222) (1,068)

equivalents

Cash and cash equivalents at 1 2,966 4,034 4,034

April 2008

Cash and cash equivalents at 30 September 7 812 2,966

2008

Triple Point VCT plc

Notes to the half yearly report for the six months ended 30 September 2008

1. The unaudited half yearly results cover the six months to 30 September 2008 and have been drawn up in accordance with the

Accounting Standard Board's (ASB) Statement on Half-yearly Financial Reports (July 2007) and adopting the accounting policies set out in the

statutory accounts for the year ended 31 March 2008 which were prepared under UK GAAP and in accordance with the Statement of Recommended

Practice for Investment Companies issued by the Association of Investment Companies in January 2003, revised December 2005.

2. The financial information set out in this report has not been audited and does not comprise full financial statements within the

meaning of Section 240 of the Companies Act 1985 and have not been delivered to the Registrar of Companies. Statutory accounts for the year

ended 31 March 2008, which were unqualified, have been lodged with the Registrar of Companies. No statutory accounts in respect of any

period after 31 March 2008 have been reported on by the Company's auditor or delivered to the Registrar of Companies.

3. Taxation has been provided for at a rate of 25.50% based on the assumption that income for the second half of the year will be

equal to that for the first half. Given that the business is not seasonal the directors regard this as a reasonable assumption.

4. Copies of the Half Yearly Report to Shareholders have been sent to shareholders and are available at the Company's Registered

Office: 4-5 Grosvenor Place, London SW1X 7HJ or from Woodside Corporate Services Limited, 4th Floor, 150-152 Fenchurch Street, London EC3M

6BB

5. During the period under review, the Company did not issue any new shares but bought back 3,390,537 shares at a cost of

�3,163,171.

6. The return per share is based on income from ordinary activities after tax of �0.271m and on 31,434,656 ordinary shares of 1p,

being the weighted average number of shares in issue during the period. The net assets per share is based on total net assets of �26.640m

and 28,599,945 ordinary shares of 1p in issue at the period end.

7. Related party transactions

Mr Michael Sherry, Chairman of the Company, is an equity Member of Triple Point LLP (TPLLP). TPLLP in turn holds a controlling

interest in Triple Point Investment Management LLP (TPIMLLP). During the period, TPIMLLP provided management and administrative services to

the Company amounting to �334,497 (2007 - �361,147).

Triple Point VCT plc

Responsibility statement of the Directors in respect of the half yearly report for the six months ended 30 September 2008

We confirm to the best of our knowledge:

* the half yearly financial statements have been prepared in accordance with the Statement Half-yearly financial reports issued by

the UK Accounting Standards Board;

* the half yearly management report includes a fair review of the information required by the Financial Services Authority Disclosure

and Transparency rules, being:

- an indication of the important events that have occurred during the first six months of the financial year and their impact on the

condensed set of financial statements; and a description of the principal risks and uncertainties for the remaining six months of the year;

and

- related party transactions that have taken place in the first six months of the current financial year and that may have materially

affected the financial position or performance of the entity during that period, and any changes in the related party transactions described

in the last annual report that could do so.

By order of the Board

Michael Sherry

Director

28 November 2008

Triple Point VCT plc

Directors

Michael Gabriel Sherry

James Chadwick Murrin

Robin David Morrison

Secretary and Registered Office

Peter William Hargreaves

10-11 Gray's Inn Square,

Gray's Inn,

London WC1R 5JD

Company Registered Number

05304481

Solicitors

Howard Kennedy

19a Cavendish Square

London W1A 2AW

Bankers

HSBC

60 Queen Victoria Street

London, EC4

Investment Manager and Administrator

Triple Point Investment Management LLP

4-5 Grosvenor Place,

London SW1X 7HJ

VCT Tax Adviser

PricewaterhouseCoopers LLP

1 Embankment Place

London WC2N 6RH

Independent Auditor

Grant Thornton UK LLP

1 Westminster Way

Oxford OX2 0PZ

Registrars

Neville Registrars Limited

Neville House

18 Laurel Lane

Halesowen

West Midlands, B63 3DA

This information is provided by RNS

The company news service from the London Stock Exchange

END

IR FVLFLVFBZFBB

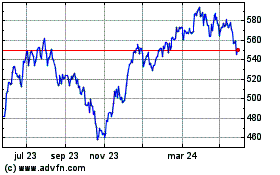

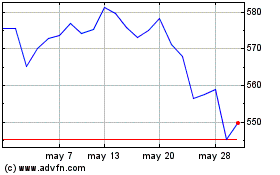

Travelusacc (LSE:TRIP)

Gráfica de Acción Histórica

De May 2024 a Jun 2024

Travelusacc (LSE:TRIP)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024