TIDMUPL

RNS Number : 2762H

Upland Resources Limited

27 November 2015

27(th) November 2015

UPLAND RESOURCES LIMITED

RESULTS FOR THE FINANCIAL YEAR ENDED 30 JUNE 2015

The Directors of Upland Resources Limited ("Upland" or the

"Company") are pleased to announce the results of the Company for

the financial year ended 30(th) June 2015.

The information below pertains to the financial year ended

30(th) June 2015, prior to the public listing upon the London Stock

Exchange. Since the financial year end, Upland's shares were

successfully admitted to listing on the Official List of the UK

Listing Authority ("UKLA") by way of a standard listing under

Chapter 14 of the UKLA's Listing Rules and to trading on the London

Stock Exchange's main market for listed securities on 26(th)

October 2015, accompanied by a simultaneous placing of 130,000,000

new ordinary shares of no par value which raised gross proceeds of

GBP1,300,000.

Principal activities

The Company and Group was formed for the purpose of acquiring

assets, businesses or target companies, that have operations in the

oil & gas exploration and production sector that it will then

look to develop and expand.

Business review and future developments

The past year has been an exciting one for Upland. The Company

began the year in a strong financial position with significant cash

in the bank, and with low corporate overheads.

A major fall in oil price during the reporting period has meant

that the number of opportunities available in the market has

increased as more companies seek partners for existing projects or

are forced to relinquish good assets because of financial

difficulties. Unless oil prices recover substantially, the Board

expects this trend to continue as oil price hedges, put in place by

producers before the price drop, unwind exposing them to the full

impact of markedly reduced revenues.

The Board believes that this has produced a buyers' market for

oil and gas assets which the Company intends to take full advantage

of.

New Ventures

During the year, Upland considered a number of potential

farm-ins, acquisitions and new permit applications over a range of

geographies. A number of these were in Tunisia, where good

opportunities were identified. However, the 2015 terrorist attacks

on the Bardo Museum in Tunis and on the resort of Sousse have

increased concerns about security in the country and led the

Company to not pursue these opportunities further.

In October 2014, Upland made an application for a Petroleum

Exploration and Development Licence ("PEDL") in the UK 14(th)

Onshore Oil and Gas Licensing Round. This PEDL covers the majority

of the acreage in two onshore blocks located in the East Midlands

and that we believe to have a very attractive risk/reward profile.

The majority of the hydrocarbon potential lies in conventional oil

and gas reservoirs - including a former oil field that we believe

can be rejuvenated. Upland generated the original concept but this

has been further developed with our bid partners Europa Oil &

Gas plc and Shale Petroleum (UK) Ltd. Unconventional hydrocarbon

potential also exists in the application area. As at the date of

this report, the UK Oil & Gas Authority has yet to announce the

award of the vast majority of the permits, including for those

applied for by Upland and its bid partners.

Further information extracted from the Company's audited

accounts for the financial year ended 30 June 2015 is set out

below.

Upland Resources Limited www.uplandres.com

============================ =========================================================

Steve Staley, CEO Tel: 0208 675 9685

s.staley@uplandres.com

============================ =========================================================

Optiva Securities Limited

============================ =========================================================

Jeremy King (Corporate Tel: 020 3137 1904

Finance) jeremy.king@optivasecurities.com

============================ =========================================================

Christian Dennis (Corporate Tel: 020 3411 1882 christian.dennis@optivasecurities.com

Broker)

============================ =========================================================

FlowComms Ltd www.flowcomms.com

============================ =========================================================

Sasha Sethi (Investor Tel: 0208 675 9685

Relations) sasha@flowcomms.com

============================ =========================================================

Results and dividends

The Group's loss on ordinary activities after taxation amounted

to GBP221,069 for the year (2014: loss of GBP66,474). The Directors

are unable to recommend payment of a dividend.

Key Performance Indicators ('KPIs')

The following KPIs are used by the Directors' to understand the

business:

2015 2014

GBP GBP

Operating cash

burn 216,712 41,944

Risks and uncertainties

The key risk for the Group is that no suitable investments are

identified to move the Group forward in its investment activities

and that cash burn reduces its ability to find further

opportunities in the future.

Post balance sheet events

On 26(th) October 2015, Upland's shares were admitted to listing

on the Official List of the UKLA by way of a standard listing under

Chapter 14 of the UKLA's Listing Rules and to trading on the London

Stock Exchange's main market for listed securities.

The Listing was accompanied by the issue of 130,000,000 new

ordinary shares in the Company at a price of 1 pence per share,

hence raising GBP1.3 million (before expenses). This has provided

Upland with considerable additional liquidity and access to broader

sources of capital, which will allow it to consider a wider range

of opportunities.

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

YEAR ENDED 30 JUNE 2015

Note

2015 2014

GBP GBP

Revenues - -

Administrative expenses (221,069) (66,474)

_______ _______

Operating Loss 5 (221,069) (66,474)

_______ _______

Loss before taxation (221,069) (66,474)

Taxation 7 - -

_______ _______

Loss and total Comprehensive Income

for the Period from Continuing Operations

Attributable to Equity Owners of the Parent Company

(221,069)

(66,474)

_______ _______

The Statement of Comprehensive Income has been prepared on the

basis that all operations are continuing operations.

The accompanying accounting policies and notes form an integral

part of these Financial Statements.

CONSOLIDATED STATEMENT OF FINANCIAL POSITION

AS AT 30 JUNE 2015

Note

2015 2014

GBP GBP

Assets

Non-Current Assets

Investments in Group undertakings 8 - -

Current Assets

Other debtors 9 642 777

(MORE TO FOLLOW) Dow Jones Newswires

November 27, 2015 12:48 ET (17:48 GMT)

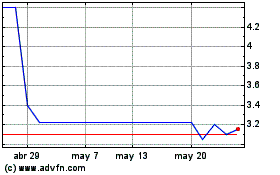

Upland Resources (LSE:UPL)

Gráfica de Acción Histórica

De Jun 2024 a Jul 2024

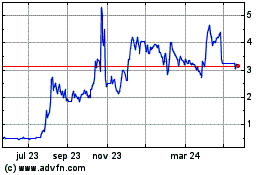

Upland Resources (LSE:UPL)

Gráfica de Acción Histórica

De Jul 2023 a Jul 2024