TIDMUSA

RNS Number : 5242A

Baillie Gifford US Growth Trust PLC

23 January 2024

RNS Announcement

Baillie Gifford US Growth Trust plc

Legal Entity Identifier: 213800UM1OUWXZPKE539

Regulated Information Classification: Half Yearly Financial

Report

Results for six months to 30 November 2023

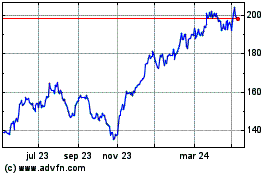

During the six months to 30 November 2023, the Company's share

price and NAV (after deducting borrowings at fair value) returned

12.3% and 4.1% respectively. This compares with a total return of

7.9% for the S&P 500 Index* (in sterling terms). We have a

long-term approach and would ask shareholders to judge performance

over periods of five years or more.

- During the period from 23 March 2018, launch date and first

trade date, to 30 November 2023, the Company's share price and NAV

(after deducting borrowings at fair value) returned 61.8% and 98.2%

respectively. This compares with a total return of 117.8% for the

S&P 500 Index* (in sterling terms).

- At the end of November, we held positions in 24 private

companies which comprised 31.7% of total assets.

- We made three new purchases over the last six months, Meta

Platforms, Samsara and Sprout Social. In addit ion, we made five

complete sales during the period: Illumina, MarketAxess, Novocure,

Redfin and Snap.

- It has been a better year. The storm is easing. We know we

cannot assume that the sun will always shine, but we take comfort

from the fact that the companies held in your portfolio are

executing, and executing well. When fundamentals will be better

reflected in share prices is nigh on impossible to predict. Trying

to predict the mood of the multitude of market participants is a

fool's game for the long-term stock picker. Instead, we must double

down on what differentiates us - long-term, active, growth,

bottom-up stock pickers focused on fundamentals.

- British physicist David Deutsch said, "We have a duty to be

optimistic. Because the future is open, not predetermined and

therefore cannot just be accepted: we are all responsible for what

it holds". We take that responsibility seriously. US Growth holds

companies which are determining that future. But it will take time.

Navigating storms is part of the process. We believe the portfolio

is well-positioned to navigate and realise its potential. That

feels like a dream opportunity.

* Source: LSEG and relevant underlying index providers. See

disclaimer at the end of this announcement.

Past performance is not a guide to future performance.

Baillie Gifford US Growth Trust plc seeks to invest

predominantly in listed and unlisted US companies which the Company

believes have the potential to grow substantially faster than the

average company, and to hold onto them for long periods of time, in

order to produce long term capital growth. The Company has total

assets of GBP631.4 million (before deduction of loans of GBP39.5

million) as at 30 November 2023.

Baillie Gifford US Growth Trust plc is managed by Baillie

Gifford & Co, the Edinburgh based fund management group with

approximately GBP218.4 billion under management and advice in

active equity and bond portfolios for clients in the UK and

throughout the world (as at 22 January 2024).

The following is the unaudited Interim Financial Report for the

six months to 30 November 2023 which was approved by the Board on

22 January 2024 .

Responsibility statement

We confirm that to the best of our knowledge:

a. the condensed set of Financial Statements has been prepared

in accordance with FRS 104 'Interim Financial Reporting';

b. the Interim Management Report includes a fair review of the

information required by Disclosure Guidance and Transparency Rule

4.2.7R (being an indication of important events that have occurred

during the first six months of the financial year, their impact on

the condensed set of Financial Statements and a description of the

principal risks and uncertainties for the remaining six months of

the financial year); and

c. the Interim Financial Report includes a fair review of the

information required by Disclosure Guidance and Transparency Rule

4.2.8R (disclosure of related party transactions and changes

therein).

On behalf of the Board

Tom Burnet

Chair

22 January 2024

Chair's interim update

Performance

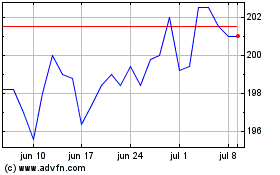

During the first half of the financial year, the Company's share

price and net asset value (after deducting borrowings at fair

value) ('NAV') total return* were 12.3% and 4.1% respectively. This

compares with a total return of 7.9% for the S&P 500 Index (in

sterling terms). The discount tightened during the period from

22.4% to 16.2%.

Further information about the Company's portfolio performance is

covered by our portfolio managers, Gary Robinson and Kirsty Gibson,

in their Interim management report.

Discount management

The Board acknowledges the discount is a challenge to many

shareholders and the investment trust sector has been trading at

discounts last seen during the financial crisis reaching an average

sector low for the year of 16.9% at the end of October 2023. As at

1 June 2023 the Company was trading at a discount of 22.4%. This

discount tightened to 16.2% as at 30 November 2023, being the end

of the interim period.

The Board regularly reviews the Company's liquidity policy and

it is a key discussion point at our Board meetings. We understand

that repurchasing shares provides NAV accretion and can reduce

share price volatility but we are also cognisant that buying back

will result in the sale of public companies to fund the buy back

and as such the portfolio will be skewed further towards the

private company investments. Importantly if the exposure to private

companies is a key driver behind the discount any such buy back

could result in the discount widening rather than tightening.

Following extensive Board discussions, a decision was reached

during the period that the Company should undertake buy backs. The

Company bought back 200,000 shares for a total consideration of

GBP319,000. The Board will continue to monitor the discount and the

application of the liquidity policy.

Gearing

During the period, the US$25 million five year revolving credit

facility was refinanced with a US$25 million three year revolving

credit facility from ING Bank N.V., London Branch, and the US$25

million three year fixed rate facility was refinanced with a US$25

million three ear revolving credit facility from The Royal Bank of

Scotland International Limited.

Gearing* remained stable over the course of the period at 6% (6%

as at 31 May 2023).

Outlook

Historically, periods of high inflation have led to

underperformance in equity markets. As interest rates are used to

control the inflation, growth equity valuations are often

particularly hard hit and elements of your portfolio have borne the

brunt of this over the last couple of years. As inflation drops and

with interest rates potentially peaking, perhaps we can allow

ourselves some optimism that valuations might begin to recover over

the coming months. In any case, the Board remains supportive of the

Managers' long-term approach to investing and we continue to

encourage Gary and Kirsty to concentrate on identifying and buying

into some of North America's most exciting companies. In that

regard, the Board is pleased with your Company's progress and

remains confident in the future.

Tom Burnet

Chair

22 January 2024

* Alternative performance measure, see Glossary of terms and

Alternative Performance Measures at the end of this

announcement.

Interim management report

During the period from 23 March 2018, launch date and first

trade date, to 30 November 2023, the Company's share price and NAV

(after deducting borrowings at fair value) returned 61.8% and 98.2%

respectively. This compares with a total return of 117.8% for the

S&P 500 Index* (in sterling terms).

This has not been a smooth journey. From launch until the end of

Q3 2023, the top 15 listed holdings of the current portfolio

experienced 59 drawdowns of greater than 20%. The largest single

peak to trough hit was 82% for Shopify from November 2021 to

October 2022. It has delivered a 347% share price rise since we

first invested in it for the Company. The average share price rise

of the top 15 since our first investment is 305% with Tesla topping

the list with a 1,351% return. This is asymmetry in action.

During the six months to 30 November 2023, the Company's share

price and NAV (after deducting borrowings at fair value) returned

12.3% and 4.1% respectively. This compares with a total return of

7.9% for the S&P 500 Index* (in sterling terms). We have a

long-term approach and would ask shareholders to judge performance

over periods of five years or more.

Portfolio

"The big money is not in the buying and the selling, but in the

waiting", Charlie Munger.

It feels only fitting to begin this Interim Report with a

Mungerism. In part to mark the passing of a legendary investor but

also to highlight its timeless relevance. The waiting, or a

willingness to be patient, is an underappreciated skill set in

investing. However, patience is different to inaction. In

investing, patience is a willingness to ride out share price

underperformance, given your conviction in the underlying strength

of the company's business model and culture, even if the

fundamentals are showing short-term weakness. To be effective it

also requires a corresponding willingness to accept your mistakes

and move on. Inaction, on the other hand, is about hope, not

conviction. The hope that share prices recover, and a better exit

opportunity presents itself.

We hypothesised that 2022 would be a year of reorientation, and

2023 would be a year of execution. Our portfolio companies

experienced a valuation re-set following the pandemic. Faced with a

higher interest rate environment and demand volatility, many spent

much of 2022 reorientating their business models whilst

endeavouring to execute on their long-term opportunities. As 2023

came to a close, the evidence for our hypothesis that it would be a

year of execution has been building.

For some, the reorientation, and subsequent execution, has been

easier given the greater levels of resilience in their business

models. They were already profitable or generating free cash flow

('FCF') . Examples would be CoStar, the US commercial and

residential property data and marketplaces business, or Tesla, the

electric vehicle manufacturer.

For others, it was a case of trimming some of the low interest

rate environment excesses whilst maintaining the necessary

investments for future growth. These companies removed teams or

mothballed projects which no longer made economic sense, enabling

them to transition to profitability. Examples include Shopify, the

merchant-focused e-commerce platform, and Amazon, the online

retailer.

Some remained less resilient from a cash flow or profitability

perspective but had significant war chests of cash, providing them

time to make the transition to self-sustainability whilst

continuing to invest. An example would be Ginkgo Bioworks, the

organism design company, whose current burn rate means it has two

and a half years of cash remaining.

The final group of companies was lacking resilience. Some, like

Wayfair, the online home furnishing business, and Affirm, the

buy-now-pay-later company, made significant changes to shore up the

resilience of their business models and are in far stronger

positions than when the downturn began. For others, like Carvana,

the online second-hand car marketplace, or Redfin, the real estate

brokerage, we lost conviction in their ability to emerge from this

environment stronger than when they went in. We consequently sold

these holdings.

What we are seeing in the fundamentals at many of the businesses

the Company holds only adds to our excitement about the future

value of these companies. Wayfair has returned to revenue growth

against a declining home market. CoStar is counter-cyclically

investing its more than US$5 billion cash pile into future growth

opportunities. Shopify launched ShopifyMagic, integrating

artificial intelligence across its entire offering whilst

delivering a 16% FCF margin, up from negative one year earlier.

Duolingo, the gamified language learning app, is growing users at

over 60% year-on-year despite spending just 16% of revenues on

marketing. DoorDash, the food delivery app, has seen strong cohort

dynamics and delivered close to US$900 million in FCF over the last

twelve months.

It has not been plain sailing for all. Moderna continues to work

through the uncertainty of Covid-19 vaccine demand, as the market

moves from a pandemic to an endemic phase. Whilst we continue to

believe in the opportunity for RNA as a treatment platform, and the

data for future treatments is positive, the journey to steady state

Covid revenues has been painful. Convoy, a marketplace for shippers

and truckers and one of the Company's private investments, fell

victim to the macro-economic environment. Despite the best efforts

of its management team, Convoy had yet to reach the necessary scale

to withstand the freight market's decline and could not cut its way

to profitability. Convoy has gone out of business.

While share prices have shown strength over the past year, we

continue to see opportunity in the dislocations between stock

prices and the underlying valuations of companies. Future cash

flows and earnings drive value, and a fundamental pillar of our

investment philosophy is that price reflects value in the long run.

However, price is driven by mood, momentum and broader sentiment in

the short term, creating opportunity.

We bought a position in Meta (formerly named Facebook). Several

years ago, we sold out of Meta on concerns around three Rs:

regulation, relevance and recruitment. We have seen progress on all

three fronts. The regulatory environment feels more benign. Reels

is battling TikTok effectively, ramping toward a US$10 billion

revenue run rate and helping Meta to remain relevant. We have a

hypothesis as to why the best engineers want to come to Meta:

artificial intelligence ('AI'). The greatest opportunity in AI

comes from proprietary datasets, and Meta has a considerable

advantage here. AI can be a significant revenue and returns driver

for the company. These reasons, combined with a shift in attitude

internally around allocating resources, led us to re-take a

holding.

We took a new holding in Sprout Social, the social media

management company. The proliferation of social media channels has

made managing a brand online increasingly complex, while its

importance has risen. Sprout's platform provides a single control

centre that enables effective analysis and management across social

media. The market has consolidated significantly over the past few

years, and the resulting potential for substantial revenue growth

with margin expansion is underappreciated.

We added to Pinterest, the visual discovery platform;

Sweetgreen, the salad chain; and Amazon, the online retailer, as

these companies have continued to execute against their long-term

opportunity sets, yet their valuations have remained undemanding.

Oddity, a cosmetics and skincare holding company, and one of our

private investments, listed in the period.

During the period we sold our holdings in Novocure, Snap,

Redfin, MarketAxess and Illumina. Redfin, the online brokerage, and

Snap, the social media company, have made changes to their business

models. We question whether they will emerge from this environment

stronger than they went in. Novocure, the tumour-treating fields

company, has faced challenges expanding its offering beyond the

treatment of brain cancer. Both MarketAxess, the bond trading

platform, and Illumina, the gene sequencing business, continue to

dominate within their respective niches, however they have not

delivered the levels of growth that we hoped for.

Outlook

It has been a better year. The storm is easing. We know we

cannot assume that the sun will always shine, but we take comfort

from the fact that the companies held in your portfolio are

executing, and executing well. When fundamentals will be better

reflected in share prices is nigh on impossible to predict. Trying

to predict the mood of the multitude of market participants is a

fool's game for the long-term stock picker. Instead, we must double

down on what differentiates us - long-term, active, growth,

bottom-up stock pickers focused on fundamentals.

British physicist David Deutsch said, "We have a duty to be

optimistic. Because the future is open, not predetermined and

therefore cannot just be accepted: we are all responsible for what

it holds". We take that responsibility seriously. US Growth holds

companies which are determining that future. But it will take time.

Navigating storms is part of the process. We believe the portfolio

is well-positioned to navigate and realise its potential. That

feels like a dream opportunity.

The principal risks and uncertainties facing the Company are set

out below.

Baillie Gifford & Co

Managers and Secretaries

22 January 2024

* S&P 500 Index total return (in sterling terms). Source:

LSEG and relevant underlying index providers. See disclaimer at the

end of this announcement.

Free cash flow is the cash a company generates after taking into

consideration cash outflows that support its operations and

maintain its capital assets.

Valuing private companies

We aim to hold our private company investments at 'fair value',

i.e. the price that would be paid in an open-market transaction.

Valuations are adjusted both during regular valuation cycles and on

an ad hoc basis in response to 'trigger events'. Our valuation

process ensures that private companies are valued in both a fair

and timely manner.

The valuation process is overseen by a valuations group at

Baillie Gifford, which takes advice from an independent third party

(S&P Global). The valuations group is independent from the

investment team, as well as Baillie Gifford's Private Companies

Specialist team, with all voting members being from different

operational areas of the firm, and the investment team only

receives final valuation notifications once they have been

applied.

We revalue the private holdings on a three-month rolling cycle,

with one-third of the holdings reassessed each month. During stable

market conditions, and assuming all else is equal, each investment

would be valued two times in a six month period. For Baillie

Gifford US Growth, and our other investment trusts, the prices are

also reviewed twice per year by the respective boards and are

subject to the scrutiny of external auditors in the annual audit

process.

Beyond the regular cycle, the valuations team also monitors the

portfolio for certain 'trigger events'. These may include: changes

in fundamentals; a takeover approach; an intention to carry out an

Initial Public Offering ('IPO'); company news which is identified

by the valuation team or by the investment team; or meaningful

changes to the valuation of comparable public companies. Any ad hoc

change to the fair valuation of any holding is implemented swiftly

and reflected in the next published net asset value. There is no

delay.

The valuations team also monitors relevant market indices on a

weekly basis and updates valuations in a manner consistent with our

external valuer's (S&P Global) most recent valuation report

where appropriate. Continued market volatility has meant that

recent pricing has moved much more frequently than would have been

the case with the quarterly valuations cycle.

Baillie Gifford US Growth

Trust *

---------------------------------- ------

Instruments (lines of stock

reviewed) 57

---------------------------------- ------

Revaluations performed 150

---------------------------------- ------

Percentage of portfolio revalued

up to 2 times 64.9%

---------------------------------- ------

Percentage of portfolio revalued

up to 4 times 94.7%

---------------------------------- ------

Percentage of portfolio revalued

at least 5 times 5.3%

---------------------------------- ------

For the six months to 30 November 2023, most revaluations have

been decreases, however we have seen some recovery within the

portfolio. In the period, we have seen one portfolio company raise

capital at an increased valuation reflecting the continued robust

performance of the underlying investment and the changing market

backdrop in specific sectors at the time of the raise. The average

movement in both company valuation and share price for those that

have decreased in value is shown below.

Average movement Average movement

in investee company in investee

valuation share price

--------------------------- --------------------- -----------------

Baillie Gifford US Growth

Trust* -6.2% 2.1%

--------------------------- --------------------- -----------------

Share prices have increased compared to the decrease in headline

valuations. This is a result of holding classes of stock with

preferential liquidation rights and therefore providing down side

protection.

The share price movement reflects a probability- weighted

average of both the regular valuation, which would be realised in

an IPO, and the downside protected valuation, which would normally

be triggered in the event of a corporate sale or liquidation.

*Data reflecting period 1 June 2023 to 30 November 2023 to align

with the Company's reporting period end.

Baillie Gifford's stewardship principles

Baillie Gifford's overarching ethos is that we are 'Actual'

investors. That means we seek to invest for the long term. Our role

as an engaged owner is core to our mission to be effective stewards

for our clients. As an active manager, we invest in companies at

different stages of their evolution across many industries and

geographies, and focus on their unique circumstances and

opportunities. Our approach favours a small number of simple

principles rather than overly prescriptive policies. This helps

shape our interactions with holdings and ensures our investment

teams have the freedom and retain the responsibility to act in

clients' best interests.

Long-term value creation

We believe that companies that are run for the long term are

more likely to be better investments over our clients' time

horizons. We encourage our holdings to be ambitious, focusing on

long-term value creation and capital deployment for growth. We know

events will not always run according to plan. In these instances we

expect management to act deliberately and to provide appropriate

transparency. We think helping management to resist short-term

demands from shareholders often protects returns. We regard it as

our responsibility to encourage holdings away from destructive

financial engineering towards activities that create genuine value

over the long run. Our value will often be in supporting management

when others don't.

Alignment in vision and practice

Alignment is at the heart of our stewardship approach. We seek

the fair and equitable treatment of all shareholders alongside the

interests of management. While assessing alignment with management

often comes down to intangible factors and an understanding built

over time, we look for clear evidence of alignment in everything

from capital allocation decisions in moments of stress to the

details of executive remuneration plans and committed share

ownership. We expect companies to deepen alignment with us, rather

than weaken it, where the opportunity presents itself.

Governance fit for purpose

Corporate governance is a combination of structures and

behaviours; a careful balance between systems, processes and

people. Good governance is the essential foundation for long-term

company success. We firmly believe that there is no single

governance model that delivers the best long-term outcomes. We

therefore strive to push back against one-dimensional global

governance principles in favour of a deep understanding of each

company we invest in. We look, very simply, for structures, people

and processes which we think can maximise the likelihood of

long-term success. We expect to trust the boards and management

teams of the companies we select, but demand accountability if that

trust is broken.

Sustainable business practices

A company's ability to grow and generate value for our clients

relies on a network of interdependencies between the company and

the economy, society and environment in which it operates. We

expect holdings to consider how their actions impact and rely on

these relationships. We believe long-term success depends on

maintaining a social licence to operate and look for holdings to

work within the spirit and not just the letter of the laws and

regulations that govern them. Material factors should be addressed

at the board level as appropriate.

List of Investments

as at 30 November 2023 (unaudited)

2023 2023

Value % of total

Name Business GBP'000 assets *

----------------------------------- ---------------------------------------------- -------- -----------------------

Space Exploration Technologies

Series J Preferred (U) Rocket and spacecraft company 20,640 3.3

----------------------------------- ---------------------------------------------- -------- -----------------------

Space Exploration Technologies

Series N Preferred (U) Rocket and spacecraft company 11,848 1.9

----------------------------------- ---------------------------------------------- -------- -----------------------

Space Exploration Technologies

Series K Preferred (U) Rocket and spacecraft company 4,704 0.7

----------------------------------- ---------------------------------------------- -------- -----------------------

Space Exploration Technologies

Class A Common (U) Rocket and spacecraft company 2,445 0.4

----------------------------------- ---------------------------------------------- -------- -----------------------

Space Exploration Technologies

Class C Common (U) Rocket and spacecraft company 754 0.1

----------------------------------- ---------------------------------------------- -------- -----------------------

40,391 6.4

---------------------------------------------------------------------------------- -------- -----------------------

Shopify Class A Cloud-based commerce platform provider 36,477 5.8

----------------------------------- ---------------------------------------------- -------- -----------------------

The Trade Desk Advertising technology company 31,210 4.9

----------------------------------- ---------------------------------------------- -------- -----------------------

Amazon Online retailer and cloud computing provider 30,664 4.9

----------------------------------- ---------------------------------------------- -------- -----------------------

NVIDIA Graphics chips 28,765 4.6

----------------------------------- ---------------------------------------------- -------- -----------------------

Stripe Series G Preferred

(U) Online payment platform 12,037 1.9

----------------------------------- ---------------------------------------------- -------- -----------------------

Stripe Series I Preferred

(U) Online payment platform 11,729 1.9

----------------------------------- ---------------------------------------------- -------- -----------------------

Stripe Class B Common (U) Online payment platform 2,472 0.4

----------------------------------- ---------------------------------------------- -------- -----------------------

Stripe Series H Preferred

(U) Online payment platform 1,450 0.2

----------------------------------- ---------------------------------------------- -------- -----------------------

27,688 4.4

---------------------------------------------------------------------------------- -------- -----------------------

Electric cars, autonomous driving and

Tesla solar energy 24,089 3.8

----------------------------------- ---------------------------------------------- -------- -----------------------

Subscription service for TV shows and

Netflix movies 17,962 2.8

----------------------------------- ---------------------------------------------- -------- -----------------------

Workday Enterprise information technology 16,545 2.6

----------------------------------- ---------------------------------------------- -------- -----------------------

Duolingo Mobile learning platform 16,229 2.6

----------------------------------- ---------------------------------------------- -------- -----------------------

Brex Class B Common (U) Corporate credit cards for start-ups 8,283 1.3

----------------------------------- ---------------------------------------------- -------- -----------------------

Brex Series D Preferred (U) Corporate credit cards for start-ups 7,793 1.3

----------------------------------- ---------------------------------------------- -------- -----------------------

16,076 2.6

---------------------------------------------------------------------------------- -------- -----------------------

CoStar Group Commercial property information provider 15,811 2.5

----------------------------------- ---------------------------------------------- -------- -----------------------

Doordash Online local delivery 15,797 2.5

----------------------------------- ---------------------------------------------- -------- -----------------------

Zipline International Series

C Preferred (U) Drone-based medical delivery 8,587 1.4

----------------------------------- ---------------------------------------------- -------- -----------------------

Zipline International Series

E Preferred (U) Drone-based medical delivery 4,866 0.8

----------------------------------- ---------------------------------------------- -------- -----------------------

Zipline International Series

F Preferred (U) Drone-based medical delivery 790 0.1

----------------------------------- ---------------------------------------------- -------- -----------------------

14,243 2.3

---------------------------------------------------------------------------------- -------- -----------------------

Meta Platforms Social networking website 13,535 2.1

----------------------------------- ---------------------------------------------- -------- -----------------------

Cloudflare Cloud-based provider of network services 13,406 2.1

----------------------------------- ---------------------------------------------- -------- -----------------------

Faire Wholesale Series F Preferred

(U) Online wholesale marketplace 4,942 0.8

----------------------------------- ---------------------------------------------- -------- -----------------------

Faire Wholesale (U) Online wholesale marketplace 4,338 0.7

----------------------------------- ---------------------------------------------- -------- -----------------------

Faire Wholesale Series G Preferred

(U) Online wholesale marketplace 3,674 0.6

----------------------------------- ---------------------------------------------- -------- -----------------------

12,954 2.1

---------------------------------------------------------------------------------- -------- -----------------------

Air conditioning, heating and refrigeration

Watsco equipment distributor 12,481 2.0

----------------------------------- ---------------------------------------------- -------- -----------------------

Moderna Therapeutic messenger RNA 12,225 1.9

----------------------------------- ---------------------------------------------- -------- -----------------------

Discord Series I Preferred

(U) Communication software 11,044 1.8

----------------------------------- ---------------------------------------------- -------- -----------------------

Databricks Series H Preferred

(U) Data and AI platform 10,587 1.6

----------------------------------- ---------------------------------------------- -------- -----------------------

Databricks Series I Preferred

(U) Data and AI platform 395 0.1

----------------------------------- ---------------------------------------------- -------- -----------------------

10,982 1.7

---------------------------------------------------------------------------------- -------- -----------------------

Affirm Class B (P) Consumer finance 5,368 0.9

----------------------------------- ---------------------------------------------- -------- -----------------------

Affirm (P) Consumer finance 4,413 0.7

----------------------------------- ---------------------------------------------- -------- -----------------------

9,781 1.6

---------------------------------------------------------------------------------- -------- -----------------------

Datadog IT monitoring and analytics platform 9,622 1.5

----------------------------------- ---------------------------------------------- -------- -----------------------

Alnylam Pharmaceuticals Therapeutic gene silencing 9,618 1.5

----------------------------------- ---------------------------------------------- -------- -----------------------

Pinterest Image sharing and social media company 9,191 1.5

----------------------------------- ---------------------------------------------- -------- -----------------------

Snyk Series F Preferred (U) Developer security software 5,357 0.8

----------------------------------- ---------------------------------------------- -------- -----------------------

Snyk Ordinary Shares (U) Developer security software 3,197 0.5

----------------------------------- ---------------------------------------------- -------- -----------------------

8,554 1.3

---------------------------------------------------------------------------------- -------- -----------------------

Solugen Series C-1 Preferred Combines enzymes and metal catalysts

(U) to make chemicals 5,720 0.9

----------------------------------- ---------------------------------------------- -------- -----------------------

Solugen Series D Preferred Combines enzymes and metal catalysts

(U) to make chemicals 2,783 0.4

----------------------------------- ---------------------------------------------- -------- -----------------------

8,503 1.3

---------------------------------------------------------------------------------- -------- -----------------------

Roku Online media player 8,376 1.3

----------------------------------- ---------------------------------------------- -------- -----------------------

Developer of a SaaS-based cloud data

Snowflake (P) warehousing platform 8,242 1.3

----------------------------------- ---------------------------------------------- -------- -----------------------

Lyra Health Series E Preferred

(U) Digital mental health platform for enterprises 6,449 1.0

----------------------------------- ---------------------------------------------- -------- -----------------------

Lyra Health Series F Preferred

(U) Digital mental health platform for enterprises 1,546 0.2

----------------------------------- ---------------------------------------------- -------- -----------------------

7,995 1.2

---------------------------------------------------------------------------------- -------- -----------------------

Coursera Online educational services provider 7,660 1.2

----------------------------------- ---------------------------------------------- -------- -----------------------

Roblox User Generated Content game company 7,288 1.2

----------------------------------- ---------------------------------------------- -------- -----------------------

Oddity (P) Online cosmetics and skincare company 6,794 1.1

----------------------------------- ---------------------------------------------- -------- -----------------------

Twilio Cloud-based communications platform 6,571 1.0

----------------------------------- ---------------------------------------------- -------- -----------------------

Wayfair Online furniture and homeware retailer 6,367 1.0

----------------------------------- ---------------------------------------------- -------- -----------------------

Workrise Technologies Series

E Preferred (U) Jobs marketplace for the energy sector 2,501 0.4

----------------------------------- ---------------------------------------------- -------- -----------------------

Workrise Technologies Series

D Preferred (U) Jobs marketplace for the energy sector 2,400 0.4

----------------------------------- ---------------------------------------------- -------- -----------------------

Workrise Technologies Series

D-1 Preferred (U) Jobs marketplace for the energy sector 533 0.1

----------------------------------- ---------------------------------------------- -------- -----------------------

5,434 0.9

---------------------------------------------------------------------------------- -------- -----------------------

Epic Games (U) Video game platform and software developer 5,349 0.8

----------------------------------- ---------------------------------------------- -------- -----------------------

Sprout Social Social media management firm 5,015 0.8

----------------------------------- ---------------------------------------------- -------- -----------------------

BillionToOne Series C Preferred

(U) Molecular diagnostics technology platform 3,281 0.5

----------------------------------- ---------------------------------------------- -------- -----------------------

BillionToOne Promissory Note

(U) Molecular diagnostics technology platform 1,605 0.3

----------------------------------- ---------------------------------------------- -------- -----------------------

4,886 0.8

---------------------------------------------------------------------------------- -------- -----------------------

Away (JRSK) Series D Preferred

(U) Travel and lifestyle brand 1,518 0.2

----------------------------------- ---------------------------------------------- -------- -----------------------

Away (JRSK) Convertible Promissory

Note (U) Travel and lifestyle brand 1,019 0.2

----------------------------------- ---------------------------------------------- -------- -----------------------

Away (JRSK) Convertible Promissory

Note 2021 (U) Travel and lifestyle brand 1,019 0.2

----------------------------------- ---------------------------------------------- -------- -----------------------

Away (JRSK) Series Seed Preferred

(U) Travel and lifestyle brand 918 0.1

----------------------------------- ---------------------------------------------- -------- -----------------------

4,474 0.7

---------------------------------------------------------------------------------- -------- -----------------------

Tanium Class B Common (U) Online security management 4,341 0.7

----------------------------------- ---------------------------------------------- -------- -----------------------

Zoom Video Communications Remote conferencing service provider 3,950 0.6

----------------------------------- ---------------------------------------------- -------- -----------------------

Penumbra Medical tools to treat vascular diseases 3,860 0.6

----------------------------------- ---------------------------------------------- -------- -----------------------

Nuro Series C Preferred (U) Self-driving vehicles for local delivery 2,072 0.3

----------------------------------- ---------------------------------------------- -------- -----------------------

Nuro Series D Preferred (U) Self-driving vehicles for local delivery 1,667 0.3

----------------------------------- ---------------------------------------------- -------- -----------------------

3,739 0.6

---------------------------------------------------------------------------------- -------- -----------------------

PsiQuantum Series D Preferred

(U) Silicon photonic quantum computing 3,510 0.6

----------------------------------- ---------------------------------------------- -------- -----------------------

Chewy Online pet supplies retailer 3,471 0.5

----------------------------------- ---------------------------------------------- -------- -----------------------

10X Genomics Single cell sequencing company 3,449 0.5

----------------------------------- ---------------------------------------------- -------- -----------------------

Denali Therapeutics Clinical stage neurodegeneration company 3,400 0.5

----------------------------------- ---------------------------------------------- -------- -----------------------

Samsara Connected operations cloud software company 3,137 0.5

----------------------------------- ---------------------------------------------- -------- -----------------------

Airbnb Class B Common (P) Online market place for travel accommodation 3,070 0.5

----------------------------------- ---------------------------------------------- -------- -----------------------

Thumbtack Class A Common (U) Online directory service for local businesses 1,700 0.3

----------------------------------- ---------------------------------------------- -------- -----------------------

Thumbtack Series I Preferred

(U) Online directory service for local businesses 1,202 0.2

----------------------------------- ---------------------------------------------- -------- -----------------------

Thumbtack Series A Preferred Online directory service for local businesses 121 <0.1

(U)

----------------------------------- ---------------------------------------------- -------- -----------------------

Thumbtack Series C Preferred Online directory service for local businesses 35 <0.1

(U)

----------------------------------- ---------------------------------------------- -------- -----------------------

Thumbtack Series B Preferred Online directory service for local businesses 8 <0.1

(U)

----------------------------------- ---------------------------------------------- -------- -----------------------

3,066 0.5

---------------------------------------------------------------------------------- -------- -----------------------

Sweetgreen Salad fast food chain 2,974 0.5

----------------------------------- ---------------------------------------------- -------- -----------------------

HashiCorp Open source infrastructure software 2,856 0.5

----------------------------------- ---------------------------------------------- -------- -----------------------

Niantic Series C Preferred

(U) Augmented reality games 2,775 0.4

----------------------------------- ---------------------------------------------- -------- -----------------------

Social network and digital workflow tools

for

Doximity medical professionals 2,725 0.4

----------------------------------- ---------------------------------------------- -------- -----------------------

Bioengineering company developing micro

Ginkgo Bioworks (P) organisms that produce various proteins 2,347 0.4

----------------------------------- ---------------------------------------------- -------- -----------------------

Lemonade Insurance company 2,269 0.4

----------------------------------- ---------------------------------------------- -------- -----------------------

Warby Parker (P) Online and physical glasses retailer 2,204 0.3

----------------------------------- ---------------------------------------------- -------- -----------------------

Aurora Innovation Class B

Common (P) Self-driving technology 1,214 0.2

----------------------------------- ---------------------------------------------- -------- -----------------------

Aurora (P) Self-driving technology 888 0.1

----------------------------------- ---------------------------------------------- -------- -----------------------

2,102 0.3

---------------------------------------------------------------------------------- -------- -----------------------

Chegg Online education company 1,924 0.3

----------------------------------- ---------------------------------------------- -------- -----------------------

Rivian Automotive Developer security platform 1,736 0.3

----------------------------------- ---------------------------------------------- -------- -----------------------

Recursion Pharmaceuticals Drug discovery platform 1,606 0.3

----------------------------------- ---------------------------------------------- -------- -----------------------

Honor Technology Series D

Preferred (U) Home care provider 855 0.1

----------------------------------- ---------------------------------------------- -------- -----------------------

Honor Technology Series E

Preferred (U) Home care provider 370 0.1

----------------------------------- ---------------------------------------------- -------- -----------------------

Honor Technology Subordinated Home care provider 99 <0.1

Convertible Promissory Note

(U)

----------------------------------- ---------------------------------------------- -------- -----------------------

1,324 0.2

---------------------------------------------------------------------------------- -------- -----------------------

Capsule Series 1-D Preferred

(U) Digital pharmacy 724 0.1

----------------------------------- ---------------------------------------------- -------- -----------------------

Capsule Series E Preferred

(U) Digital pharmacy 447 0.1

----------------------------------- ---------------------------------------------- -------- -----------------------

1,171 0.2

---------------------------------------------------------------------------------- -------- -----------------------

Blockstream Series B-1 Preferred

(U) Bitcoin and digital asset infrastructure 1,151 0.2

----------------------------------- ---------------------------------------------- -------- -----------------------

Sana Biotechnology Gene editing technology 612 0.1

----------------------------------- ---------------------------------------------- -------- -----------------------

Indigo Agriculture Class A Agricultural technology company 131 <0.1

Common (U)

----------------------------------- ---------------------------------------------- -------- -----------------------

Convoy Common# (U) Marketplace for truckers and shippers - -

----------------------------------- ---------------------------------------------- -------- -----------------------

Convoy Convertible Loan Note# Marketplace for truckers and shippers - -

(U)

----------------------------------- ---------------------------------------------- -------- -----------------------

Convoy Series D Preferred# Marketplace for truckers and shippers - -

(U)

----------------------------------- ---------------------------------------------- -------- -----------------------

Convoy Series E Preferred# Marketplace for truckers and shippers - -

(U)

----------------------------------- ---------------------------------------------- -------- -----------------------

Total investments 627,194 99.3

----------------------------------------------------------------------------------- -------- -----------------------

Net liquid assets* 4,234 0.7

----------------------------------------------------------------------------------- -------- -----------------------

Total assets * 631,428 100.0

----------------------------------------------------------------------------------- -------- -----------------------

Private Total

Listed company Net liquid assets*

equities investments assets * *

% % % %

----------------- --------- ------------------------------- -------------------- -------------------

30 November 2023 67.6 31.7 0.7 100.0

----------------- --------- ------------------------------- -------------------- -------------------

31 May 2023 65.0 34.5 0.5 100.0

----------------- --------- ------------------------------- -------------------- -------------------

* See Glossary of terms and Alternative Performance Measures at

the end of this announcement.

(P) Denotes listed investment previously held in portfolio as a

private company (unlisted) investment.

(U) Denotes private company (unlisted) investment.

Includes holdings in ordinary shares, preference shares and

promissory notes.

# The Convoy holdings were valued at nil at 30 November 2023

subsequent to the company ceasing operations. More information can

be found in the Interim management report above.

Figures represent percentage of total assets.

Distribution of total assets* (unaudited)

Sectoral Analysis as at 30 November 2023

As at 30 November 2023 As at 31 May 2023

% %

----------------------- ---------------------- -----------------

Information technology 34.0 31.3

----------------------- ---------------------- -----------------

Consumer discretionary 21.2 18.8

----------------------- ---------------------- -----------------

Communication services 13.8 11.7

----------------------- ---------------------- -----------------

Industrials 12.2 16.2

----------------------- ---------------------- -----------------

Healthcare 8.2 13.7

----------------------- ---------------------- -----------------

Financials 4.6 3.9

----------------------- ---------------------- -----------------

Real estate 2.5 0.3

----------------------- ---------------------- -----------------

Materials 1.7 2.3

----------------------- ---------------------- -----------------

Consumer staples 1.1 1.3

----------------------- ---------------------- -----------------

Net liquid assets 0.7 0.5

----------------------- ---------------------- -----------------

Private company exposure as at 30 November 2023

As at 30 November 2023 As at 31 May 2023

% %

------------------------------- ---------------------- -----------------

Space Exploration Technologies 6.4 6.5

------------------------------- ---------------------- -----------------

Stripe 4.4 4.2

------------------------------- ---------------------- -----------------

Brex 2.6 2.6

------------------------------- ---------------------- -----------------

Zipline 2.3 2.3

------------------------------- ---------------------- -----------------

Faire Wholesale 2.1 2.2

------------------------------- ---------------------- -----------------

Other 13.9 16.7

------------------------------- ---------------------- -----------------

* See Glossary of terms and Alternative Performance Measures at

the end this announcement.

Income statement (unaudited)

For the six months ended For the six months ended For the year ended

30 November 2023 30 November 2022 31 May 2023 (audited)

Revenue Capital Total Revenue Capital Total Revenue Capital Total

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------- ----- -------- -------- -------- -------- -------- -------- -------- -------- --------

Gains/(losses) on

investments - 25,868 25,868 - (8,235) (8,235) - (10,169) (10,169)

--------------------- ----- -------- -------- -------- -------- -------- -------- -------- -------- --------

Currency

gains/(losses) - 697 697 - (2,100) (2,100) - (700) (700)

--------------------- ----- -------- -------- -------- -------- -------- -------- -------- -------- --------

Income 305 - 305 363 - 363 850 - 850

--------------------- ----- -------- -------- -------- -------- -------- -------- -------- -------- --------

Investment management

fee 3 (1,707) - (1,707) (1,719) - (1,719) (3,345) - (3,345)

--------------------- ----- -------- -------- -------- -------- -------- -------- -------- -------- --------

Other administrative

expenses (341) - (341) (331) - (331) (670) - (670)

--------------------- ----- -------- -------- -------- -------- -------- -------- -------- -------- --------

Net return before

finance

costs and taxation (1,743) 26,565 24,822 (1,687) (10,335) (12,022) (3,165) (10,869) (14,034)

--------------------- ----- -------- -------- -------- -------- -------- -------- -------- -------- --------

Finance cost of

borrowings (1,144) - (1,144) (621) - (621) (1,482) - (1,482)

--------------------- ----- -------- -------- -------- -------- -------- -------- -------- -------- --------

Net return before

taxation (2,887) 26,565 23,678 (2,308) (10,335) (12,643) (4,647) (10,869) (15,516)

--------------------- ----- -------- -------- -------- -------- -------- -------- -------- -------- --------

Tax (27) - (27) (37) - (37) (71) - (71)

--------------------- ----- -------- -------- -------- -------- -------- -------- -------- -------- --------

Net return after

taxation (2,914) 26,565 23,651 (2,345) (10,335) (12,680) (4,718) (10,869) (15,587)

--------------------- ----- -------- -------- -------- -------- -------- -------- -------- -------- --------

Net return per

ordinary

share 4 (0.96p) 8.71p 7.75p (0.77p) (3.39p) (4.16p) (1.55p) (3.56p) (5.11p)

The accompanying notes below are an integral part of the

Financial Statements.

The total column of this Statement represents the profit and

loss account of the Company. The supplementary revenue and capital

columns are prepared under guidance published by the Association of

Investment Companies.

All revenue and capital items in this Statement derive from

continuing operations.

A Statement of Comprehensive Income is not required as the

Company does not have any other comprehensive income and the net

return after taxation is both the profit and comprehensive income

for the period.

Balance sheet (unaudited)

At 31 May

2023

At 30 November

2023 (audited)

Notes GBP'000 GBP'000

---------------------------------------------- ----- -------------- -----------

Fixed assets

---------------------------------------------- ----- -------------- -----------

Investments held at fair value through profit

or loss 6 627,194 605,908

---------------------------------------------- ----- -------------- -----------

Current assets

---------------------------------------------- ----- -------------- -----------

Debtors 895 657

---------------------------------------------- ----- -------------- -----------

Cash at bank 4,959 3,440

---------------------------------------------- ----- -------------- -----------

5,854 4,097

---------------------------------------------- ----- -------------- -----------

Creditors

---------------------------------------------- ----- -------------- -----------

Amounts falling due within one year 7 (41,117) (41,406)

---------------------------------------------- ----- -------------- -----------

Net current liabilities (35,263) (37,309)

---------------------------------------------- ----- -------------- -----------

Total assets less current liabilities 591,931 568,599

---------------------------------------------- ----- -------------- -----------

Creditors

---------------------------------------------- ----- -------------- -----------

Amounts falling due after more than one year 7 - -

---------------------------------------------- ----- -------------- -----------

Net assets 591,931 568,599

---------------------------------------------- ----- -------------- -----------

Capital and reserves

---------------------------------------------- ----- -------------- -----------

Share capital 3,073 3,073

---------------------------------------------- ----- -------------- -----------

Share premium account 250,827 250,827

---------------------------------------------- ----- -------------- -----------

Special distributable reserve 168,942 168,942

---------------------------------------------- ----- -------------- -----------

Capital reserve 192,177 165,931

---------------------------------------------- ----- -------------- -----------

Revenue reserve (23,088) (20,174)

---------------------------------------------- ----- -------------- -----------

Shareholders' funds 591,931 568,599

---------------------------------------------- ----- -------------- -----------

Net asset value per ordinary share

(after deducting borrowings at book value) 194.11p 186.33p

---------------------------------------------- ----- -------------- -----------

Ordinary shares in issue 8 304,953,700 305,153,700

---------------------------------------------- ----- -------------- -----------

The accompanying notes below are an integral part of the

Financial Statements.

Statement of changes in equity (unaudited)

For the six months to 30 November 2023

Share Special Capital

Share premium distributable reserve Revenue Shareholders'

capital account reserve * reserve funds

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------------------------- -------- -------- -------------- ------------- -------- -------------

Shareholders' funds at

1 June 2023 3,073 250,827 168,942 165,931 (20,174) 568,599

-------------------------- -------- -------- -------------- ------------- -------- -------------

Ordinary shares bought

back into treasury 8 - - - (319) - (319)

-------------------------- -------- -------- -------------- ------------- -------- -------------

Net return after taxation - - - 26,565 (2,914) 23,651

-------------------------- -------- -------- -------------- ------------- -------- -------------

Shareholders' funds at

30 November 2023 3,073 250,827 168,942 192,177 (23,088) 591,931

-------------------------- -------- -------- -------------- ------------- -------- -------------

For the six months to 30 November 2022

Share Special Capital

Share premium distributable reserve Revenue Shareholders'

capital account reserve * reserve funds

Notes GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

------------------------------ -------- -------- -------------- ------------- -------- -------------

Shareholders' funds at

1 June 2022 3,073 250,827 168,942 176,800 (15,456) 584,186

------------------------------ -------- -------- -------------- ------------- -------- -------------

Ordinary shares bought 8 - - - - - -

back into treasury

-------------------------- -------- -------- -------------- ------------- -------- -------------

Net return after taxation - - - (10,335) (2,345) (12,680)

------------------------------ -------- -------- -------------- ------------- -------- -------------

Shareholders' funds at

30 November 2022 3,073 250,827 168,942 166,465 (17,801) 571,506

------------------------------ -------- -------- -------------- ------------- -------- -------------

* The capital reserve as at 30 November 2023 includes investment

holding gains of GBP70,038,000 (30 November 2022 - gains of

GBP14,173,000).

The accompanying notes on below are an integral part of the

Financial Statements.

Cash flow statement (unaudited)

For the six months to 30 November

2023 2022

GBP'000 GBP'000

--------------------------------------------- -------- --------

Cash flows from operating activities

--------------------------------------------- -------- --------

Net return before taxation 23,678 (12,643)

--------------------------------------------- -------- --------

Net (gains)/losses on investments (25,868) 8,235

--------------------------------------------- -------- --------

Currency (gains)/losses (697) 2,100

--------------------------------------------- -------- --------

Finance costs of borrowings 1,144 621

--------------------------------------------- -------- --------

Overseas withholding tax incurred (27) (36)

--------------------------------------------- -------- --------

Changes in debtors and creditors 40 (226)

--------------------------------------------- -------- --------

Cash from operations * (1,730) (1,949)

--------------------------------------------- -------- --------

Finance costs paid (865) (619)

--------------------------------------------- -------- --------

Net cash outflow from operating activities (2,595) (2,568)

--------------------------------------------- -------- --------

Cash flows from investing activities

--------------------------------------------- -------- --------

Acquisitions of investments (31,575) (19,787)

--------------------------------------------- -------- --------

Disposals of investments 36,157 23,905

--------------------------------------------- -------- --------

Net cash inflow from investing activities 4,582 4,118

--------------------------------------------- -------- --------

Cash flows from financing activities

--------------------------------------------- -------- --------

Ordinary shares bought back into treasury (319) -

--------------------------------------------- -------- --------

Bank loans drawn down - -

--------------------------------------------- -------- --------

Bank loans repaid - -

--------------------------------------------- -------- --------

Net cash outflow from financing activities (319 ) -

--------------------------------------------- -------- --------

Increase in cash and cash equivalents 1,668 1,550

--------------------------------------------- -------- --------

Exchange movements (149) 211

--------------------------------------------- -------- --------

Cash and cash equivalents at start of period 3,440 3,007

--------------------------------------------- -------- --------

Cash and cash equivalents at 30 November 4,959 4,768

--------------------------------------------- -------- --------

* Cash from operations includes dividends received in the period

of GBP182,000 (30 November 2022 - GBP246,000) and interest paid of

GBP24,000 (30 November 2022 - interest received of GBP13,000).

Cash movements in bank loans are shown on a net basis. Prior

year balances have been updated to reflect this.

The accompanying notes below are an integral part of the

Financial Statements.

Notes to the Financial Statements (unaudited)

1. Basis of accounting

The condensed Financial Statements for the six months to 30

November 2023 comprise the statements set out above together with

the related notes below. They have been prepared in accordance with

FRS 104 'Interim Financial Reporting' and the AIC's Statement of

Recommended Practice issued in November 2014, updated in October

2019, April 2021 and July 2022 with consequential amendments, and

have not been audited or reviewed by the Auditor pursuant to the

Auditing Practices Board Guidance on 'Review of Interim Financial

Information'. The Financial Statements for the six months to 30

November 2023 have been prepared on the basis of the same

accounting policies as set out in the Company's Annual Report and

Financial Statements for the year ended 31 May 2023.

Going concern

Having considered the nature of the Company's principal risks

and uncertainties, as set out below, together with its current

position, investment objective and policy, assets and liabilities,

projected income and expenditure and the Company's dividend policy,

it is the Directors' opinion that the Company has adequate

resources to continue in operational existence for the foreseeable

future. The Board has, in particular, considered the impact of

heightened market volatility due to macroeconomic and geopolitical

concerns, but does not believe the Company's going concern status

is affected. The Company's assets, the majority of which are

investments in quoted securities which are readily realisable,

exceed its liabilities significantly. All borrowings require the

prior approval of the Board. Gearing levels and compliance with

borrowing covenants are reviewed by the Board on a regular basis.

As at 30 November 2023, the Company had a net current liability of

GBP35 million primarily as a result of the US$25 million three year

revolving credit facility with ING Bank N.V., London Branch, and

the US$25 million three year revolving credit facility with The

Royal Bank of Scotland International, which are due to mature on 26

July 2026 and 18 October 2026 respectively but which are rolled

forward on a three monthly basis. The Company has continued to

comply with the investment trust status requirements of section

1158 of the Corporation Tax Act 2010 and the Investment Trust

(Approved Company) (Tax) Regulations 2011. Accordingly, the

Directors consider it appropriate to adopt the going concern basis

of accounting in preparing these Financial Statements and confirm

that they are not aware of any material uncertainties which may

affect the Company's ability to continue to do so over a period of

at least twelve months from the date of approval of these Financial

Statements.

2. Financial information

The financial information contained within this Interim

Financial Report does not constitute statutory accounts as defined

in sections 434 to 436 of the Companies Act 2006. The financial

information for the year to 31 May 2023 has been extracted from the

statutory accounts which have been filed with the Registrar of

Companies. The Auditor's Report on those accounts was not

qualified, did not include a reference to any matters to which the

Auditor drew attention by way of emphasis without qualifying the

report and did not contain a statement under sections 498(2) or (3)

of the Companies Act 2006.

3. Investment manager

The Company has appointed Baillie Gifford & Co Limited, a

wholly owned subsidiary of Baillie Gifford & Co, as its

Alternative Investment Fund Manager and Company Secretaries.

Baillie Gifford & Co Limited has delegated portfolio management

services to Baillie Gifford & Co. Dealing activity and

transaction reporting have been further sub-delegated to Baillie

Gifford Overseas Limited and Baillie Gifford Asia (Hong Kong)

Limited. The Management Agreement can be terminated on six months'

notice.

The annual management fee is 0.70% on the first GBP100 million

of net assets, 0.55% on the next GBP900 million of net assets and

0.50% on the remaining net assets.

4. Net return per ordinary share

For the year

For the For the ended

six months six months

to to 31 May 2023

30 November 30 November

2023 2022 (audited)

------------------------------------ ----------------

GBP'000 p GBP'000 p GBP'000 p

------------------------------------ ------- ------ -------- ------ -------- ------

Revenue return after taxation (2,914) (0.96) (2,345) (0.77) (4,718) (1.55)

------------------------------------ ------- ------ -------- ------ -------- ------

Capital return after taxation 26,565 8.71 (10,335) (3.39) (10,869) (3.56)

------------------------------------ ------- ------ -------- ------ -------- ------

Net return 23,651 7.75 (12,680) (4.16) (15,587) (5.11)

------------------------------------ ------- ------ -------- ------ -------- ------

Weighted average number of ordinary

shares in issue 305,143,317 305,153,700 305,153,700

------------------------------------ --------------- ---------------- ----------------

Net return per ordinary share is based on the above totals of

revenue and capital and the weighted average number of ordinary

shares in issue during each period. There are no dilutive or

potentially dilutive shares in issue.

5. Dividends

No interim dividend has been declared. The Company's objective

is to produce capital growth and the policy is only to distribute,

by way of a final dividend, the minimum required to maintain

investment trust status. It is not currently envisaged that any

dividend will be paid in the foreseeable future.

6. Fixed assets - investments

The fair value hierarchy used to analyse the fair values of

financial assets is described below. The levels are determined by

the lowest (that is the least reliable or least independently

observable) level of input that is significant to the fair value

measurement for the individual investment in its entirety as

follows:

Level 1 - using unadjusted quoted prices for identical

instruments in an active market;

Level 2 - using inputs, other than quoted prices included within

Level 1, that are directly or indirectly observable (based on

market data); and

Level 3 - using inputs that are unobservable (for which market

data is unavailable).

The Company's investments are financial assets held at fair

value through profit or loss. In accordance with FRS 102, an

analysis of the Company's financial asset investments based on the

fair value hierarchy described above is shown below.

Level Level Level

1 2 3 Total

As at 30 November 2023 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------------- -------- -------- -------- --------

Listed equities 427,413 - - 427,413

-------------------------------------- -------- -------- -------- --------

Unlisted ordinary shares - - 33,010 33,010

-------------------------------------- -------- -------- -------- --------

Unlisted preference shares* - - 163,029 163,029

-------------------------------------- -------- -------- -------- --------

Unlisted convertible promissory notes - - 3,742 3,742

-------------------------------------- -------- -------- -------- --------

Total financial asset investments 427,413 - 199,781 627,194

-------------------------------------- -------- -------- -------- --------

Level Level Level

1 2 3 Total

As at 31 May 2023 GBP'000 GBP'000 GBP'000 GBP'000

-------------------------------------- -------- -------- -------- --------

Listed equities 396,272 - - 396,272

-------------------------------------- -------- -------- -------- --------

Unlisted ordinary shares - - 37,307 37,307

-------------------------------------- -------- -------- -------- --------

Unlisted preference shares* - - 168,162 168,162

-------------------------------------- -------- -------- -------- --------

Unlisted convertible promissory notes - - 4,167 4,167

-------------------------------------- -------- -------- -------- --------

Total financial asset investments 396,272 - 209,636 605,908

-------------------------------------- -------- -------- -------- --------

* The investments in preference shares are not classified as

equity holdings as they include liquidation preference rights that

determine the repayment (or multiple thereof) of the original

investment in the event of a liquidation event such as a

takeover.

The valuation techniques used by the Company are explained in

the accounting policies on page 55 of the Annual Report and

Financial Statements for the year ended 31 May 2023. Listed

investments are categorised as Level 1 if they are valued using

unadjusted quoted prices for identical instruments in an active

market and as Level 2 if they do not meet all these criteria but

are, nonetheless, valued using market data. The Company's holdings

in private company investments are categorised as Level 3 as

unobservable data is a significant input to their fair value

measurements.

Private company investments are valued at fair value by the

Directors following a detailed review and appropriate challenge of

the valuations proposed by the Managers. The Managers' private

company valuation policy applies methodologies consistent with the

International Private Equity and Venture Capital Valuation

guidelines 2022 ('IPEV'). These methodologies can be categorised as

follows: (a) market approach (multiples, industry valuation

benchmarks and available market prices); (b) income approach

(discounted cash flows); and (c) replacement cost approach (net

assets). The techniques applied are predominantly market-based

approaches.

During the period investments with a book value of GBP5,725,000

(31 May 2023 - none) were transferred from Level 3 to Level 1 on

becoming listed.

7. Bank loans

The Company has a US$25,000,000 three year revolving credit

facility with ING Bank N.V., London Branch, which expires on 26

July 2026 and a US$25,000,000 three year revolving credit facility

with The Royal Bank of Scotland International Limited which expires

on 18 October 2026. At 30 November 2023, creditors falling due

within one year include US$50,000,000 (sterling value

GBP39,496,000) drawn down under the two three year revolving credit

facilities. At 30 November 2023, there were no creditors falling

due after more than one year. At 31 May 2023, creditors falling due

within one year included US$50,000,000 (sterling value

GBP40,342,000) drawn under the five year revolving credit facility

and the three year fixed rate facility.

The fair value of borrowings as at 30 November 2023 was

GBP39,496,000 (31 May 2023 - GBP39,904,000).

8. Share capital

30 November 30 November 31 May 31 May

2023 2023 2023 2023

Number GBP'000 Number GBP'000

-------------------------------------------- ----------- ----------- ----------- --------

Allotted, called up and fully paid ordinary

shares of 1p each 304,953,700 3,049 305,153,700 3,051

-------------------------------------------- ----------- ----------- ----------- --------

Treasury shares of 1p each 2,406,300 24 2,206,300 22

-------------------------------------------- ----------- ----------- ----------- --------

307,360,000 3,073 307,360,000 3,073

-------------------------------------------- ----------- ----------- ----------- --------

The Company has authority to allot shares under section 551 of

the Companies Act 2006. The Board has authorised use of this

authority to issue new shares at a premium to net asset value in

order to enhance the net asset value per share for existing

shareholders and improve the liquidity of the Company's shares. In

the six months to 30 November 2023, the Company issued no ordinary

shares (in the year to 31 May 2023, the Company issued no

shares).

Over the period from 30 November 2023 to 22 January 2024 the

Company issued no shares.

The Company's authority to buy back shares up to a maximum of

14.99% of the Company's issued share capital was renewed at the