Vector Capital PLC Half Year Trading Update and Loan Book Summary (2762G)

18 Julio 2023 - 1:00AM

UK Regulatory

TIDMVCAP

RNS Number : 2762G

Vector Capital PLC

18 July 2023

18 July 2023

Vector Capital Plc

("Vector Capital", the "Company" or the "Group")

Half Year Trading Update and Loan Book Summary

"Trading in line with expectations utilising Vector Capital's

strong capital base"

Vector Capital Plc (AIM: VCAP), a commercial lending group that

offers secured loans to property developers and investors in

England & Wales, is pleased to provide a half-year trading

update for the period ended 30 June 2023 and a loan book summary as

at the same date.

Trading update

As indicated in our 2022 Annual Report, 2023 is a year of

consolidation where the Company plans to strengthen its position in

a lending market which continues to be impacted by increasing

interest rates, soft property prices and persistent inflation.

Vector Capital's strong capital base, with share capital and

reserves as at 31 December 2022 of GBP25.1m, representing 55.4

pence per share, together with competitively priced borrowings of

GBP4m advanced from its parent, Vector Holdings Limited, means that

the Company is very well placed to withstand these challenging

market conditions. This financial stability is reinforced by the

Company's excellent relationships with its introducer broker

network and the continued appetite to provide funding from its

wholesale and specialist lender contacts. Overall, the Board is

pleased to announce that at the half year the Company is trading in

line with market expectations.

Given market conditions, the Company remains cautious in

assessing new lending opportunities. However, new business enquiry

levels and the pipeline remain strong, despite higher interest

rates impacting borrower affordability. Redemptions continue to be

applied in new customer advances on a regular basis.

Loan book summary

As summarised below, the Company's loan book at 30 June 2023 was

GBP49.0m, reflecting aggregate planned redemptions of GBP11.8m and

new loans advanced of GBP7.6m during the six-month period. The

overall average loan to value at the period end was 58.3%.

As at 30/06/23 As at 31/03/23 As at 31/12/22

Loan book GBP49.0m GBP48.4m GBP53.2m

Number of live

loans 103 102 107

Average loan size GBP476,000 GBP475,000 GBP499,000

Average loan to

value 58.3% 57.1% 59.0%

The Company announced on 12(th) June that its wholesale bank

debt providers increased debt facilities by GBP5.0m, bringing the

total wholesale bank facilities available to GBP45.0m. Furthermore,

that within these facilities, the Group now has the capacity to

drawdown GBP2.5m toward loans secured by second charges, allowing

the flexibility for cautious and selective expansion of the Group's

loan book into higher margin loan agreements. The Group has

substantial unutilised bank facilities that can be accessed when

opportune.

Agam Jain, CEO of Vector Capital, commented: "We are very

pleased with the Group's trading performance in the first six

months of the year, further details of which will be presented in

the interim results in the first week of September. Our strong

capital base differentiates us from many of our competitors, while

the extension and broadening of our debt facilities provides

valuable flexibility in the way that we can assess new lending

opportunities. High interest rates are now likely to be with us for

a continued period, during which time we can seek to maximise

return on our own capital and, on a selective basis, borrowed funds

from our debt providers."

This announcement contains inside information for the purposes

of Article 7 of the UK version of Regulation (EU) No 596/2014 which

is part of UK law by virtue of the European Union (Withdrawal) Act

2018, as amended ("MAR"). Upon the publication of this announcement

via a Regulatory Information Service, this inside information is

now considered to be in the public domain.

For further information please contact:

Vector Capital plc c/o IFC Advisory

Robin Stevens (Chairman)

Agam Jain ( CEO)

WH Ireland Limited 020 7220 1666

Hugh Morgan, Chris Hardie, Darshan Patel

IFC Advisory Limited 020 3934 6630

Graham Herring, Florence Chandler, Zach Cohen

About Vector Capital:

Vector Capital provides secured, business-to-business loans to

SMEs based in England and Wales. Loans are typically secured by a

first legal charge against real estate. The Company's customers

typically borrow for general working capital purposes, bridging

ahead of refinancing, land development and property acquisition.

The loans provided by the Company are typically for renewable

12-month terms with fixed interest rates.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTFLFSEDAIDLIV

(END) Dow Jones Newswires

July 18, 2023 02:00 ET (06:00 GMT)

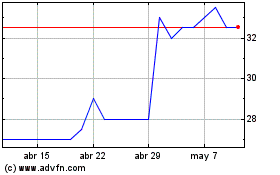

Vector Capital (LSE:VCAP)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Vector Capital (LSE:VCAP)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024