TIDMVELA

RNS Number : 6851X

Vela Technologies PLC

22 December 2023

22 December 2023

Vela Technologies plc

("Vela" or " the Company")

Interim results for the six months ended 30 September 2023

Vela Technologies plc (AIM: VELA), an AIM-quoted investing

company focused on early stage and pre-IPO disruptive technology

investments, is pleased to announce its interim results for the six

months ended 30 September 2023.

Overview

The last six months have continued to be challenging for capital

markets with political unrest continuing both at home and abroad,

the continuing war in Ukraine and rising inflation and interest

rates continue to be factors impacting the small-cap marketplace in

the UK. We remain cautiously optimistic regarding the long-term

future of the Company's overall investment portfolio and we remain

committed to the Company's stated investing strategy.

Despite these negatives, post period end we were pleased to be

able to exercise the put option in the economic interest that the

Company holds in AZD 1656 into shares in Conduit Pharmaceuticals

Inc. ("Conduit"). As previously reported Vela entered into a put

option at a cost of GBP400,000. Following the exercise Vela

received 1,015,760 new shares in Conduit, valued at the date of

exercise at GBP3.75 million (the "Consideration Shares"). It is the

intention of the Board to sell these shares in due course to

augment its cash reserves. On 15 December 2023, Conduit issued a

prospectus in connection with various share issuances, including

the issue of the Consideration Shares to Vela. Following the

publication of the prospectus Vela became able to trade its

Consideration Shares on NASDAQ.

Vela made one new investment during the period, investing

GBP250,000 into Tribe Technologies PLC as part of an IPO funding

round. During the period we have continued to monitor the

investments and have made some small sales when the prices were

favourable.

Turning to the financials, I am pleased to say that Vela's

balance sheet remains strong with no debt and total assets

amounting to GBP7.542 million as at 30 September 2023 (30 September

2022: GBP7.268 million; 31 March 2023: GBP7.043 million). Cash and

cash equivalents as at 30 September 2023 were GBP31,000 (31 March

2023: GBP724,000; 30 September 2022: GBP646,000). Since 31 March

2023 the decrease in Vela's cash reserves can be attributed to

further investments in line with the Company's investing policy

(being Tribe Technology Plc and the put option for Conduit), as

well as the ongoing administrative costs associated with the

Company.

As at 30 September 2023, the investment portfolio comprises a

total of 15 investee companies. 14 of these are held as investments

and had a fair value of GBP2.789 million as at 30 September 2023

(31 March 2023 GBP3.193 million; 30 September 2022: GBP3.546

million). The remaining and largest investment, St George Street

Capital, is held as a financial asset and is held on Vela's balance

sheet at a fair value of GBP4.0 million (30 September 2022: GBP2.35

million; 31 March 2023: GBP2.35 million) with a cost of GBP2.750

million, including the previously acquired, and now exercised, put

option. Investments are held at fair value through profit and loss

using a three-level hierarchy for estimating fair value, as

detailed in the audited financial statements for the year ended 31

March 2023, and, in line with this, investments have been revalued

to reflect the fair value at 30 September 2023.

Vela has made no new investments since the period end, as we

continue to monitor cash reserves and company expenses, but the

Board continues to have meaningful dialogue with engaging parties

as a potential to enhancing the Vela offering.

The Board looks forward to the remainder of the financial year

ending 31 March 2024 with caution but ever mindful of potential new

and follow-on investments in line with its investing policy and the

strategic update announced on 2 September 2022. The Board will

continue to update shareholders, in line with regulatory

guidelines, via its quarterly investment updates and regulatory

announcements. The directors would like to thank shareholders for

their continued support.

Brent Fitzpatrick

Chairman

21 December 2023

Unaudited Statement of Comprehensive Income

for the six months ended 30 September 2023

(Unaudited) (Unaudited) (Audited)

6 months 6 months Year

ended ended Ended

30 September 30 31

September March

2023 2 022 2 023

Notes GBP'000 GBP'000 GBP'000

------ ------------- ------------ ----------

Revenue - - -

Fair value movements

- on derivatives (55) (26) 9

- on financial asset 1,250 - -

- on investments (518) 55 (26)

------------- ------------ ----------

Net surplus (deficit) arising from

fair value movements 677 29 (17)

Administrative expenses (181) (171) (401)

------------- ------------ ----------

Operating profit (loss) 496 (142) (418)

Finance income 6 15 40

Profit (loss) before tax 502 (127) (378)

Income tax - - -

-------------

Profit (loss) after tax 502 (127) (378)

Other comprehensive income for the - - -

year

Total comprehensive profit (loss) 502 (127) (378)

------------- ------------ ----------

Attributable to:

Equity holders of the company 502 (127) (378)

Profit (loss) per share

Basic and diluted profit (loss) per

share (pence) 4 0.0031 (0.0008) (0.0023)

Unaudited Balance Sheet

as at 30 September 2023

(Unaudited) (Unaudited) (Audited)

30 September 30 September 31

March

2023 2 022 2023

Notes GBP '000 GBP ' GBP'000

000

------ -------------- -------------- -----------

Non-current assets

Investments 5 2,789 3,546 3,193

Trade and other receivables 6 4,704 3,039 3,054

-------------- -------------- -----------

Total non-current assets 7,493 6,585 6,247

-------------- -------------- -----------

Current assets

Derivative financial instruments 7 18 37 72

Cash and cash equivalents 31 646 724

-------------- -------------- -----------

Total current assets 49 683 796

-------------- -------------- -----------

Total assets 7,542 7,268 7,043

-------------- -------------- -----------

Equity and liabilities

Equity

Called-up share capital 8 3,291 3,291 3,291

Share premium reserve 7,594 7,594 7,594

Share-based payment reserve 46 65 46

Retained earnings (3,424) (3,699) (3,926)

-------------- -------------- -----------

Total equity 7,507 7,251 7,005

-------------- -------------- -----------

Current liabilities

Trade and other payables 35 17 38

Total current liabilities 35 17 38

-------------- -------------- -----------

Total equity and liabilities 7,542 7,268 7,043

-------------- -------------- -----------

Unaudited Cashflow Statement

for the six months ended 30 September 2023

(Unaudited) (U naudited) (Audited)

6 months 6 months year

ended ended

ended

30 September 30 September 31

March

2023 2022 2023

GBP'000 GBP'000 GBP'000

------------- ------------- ----------

Operating activities

Proft (loss) before tax 502 (127) (378)

Share based payment - - 5

Fair value movements on investments (732) (55) 26

Fair value movements on derivative instruments 55 26 (9)

Finance income (6) (15) (40)

Decrease in receivables - - 1

Increase (decrease) in payables 2 (4) (17)

------------- ------------- ----------

Total cash flow from operating activities (179) (175) (378)

------------- ------------- ----------

Investing activities

Interest received - - 10

Proceeds from sale of investments 136 163 709

Payment for put option (400) - -

Purchase of investments (250) (300) (575)

------------- ------------- ----------

Total cash flow from investing activities (514) (137) 144

------------- ------------- ----------

Financing activities

Proceeds from exercise of warrants - - -

Proceeds from the issue of ordinary shares - - -

Total cash flow from financing activities - - -

------------- ------------- ----------

Net decrease in cash and cash equivalents (693) (312) (234)

Cash and cash equivalents at start of year/period 724 958 958

------------- ------------- ----------

Cash and cash equivalents at the end of

the year/period 31 646 724

------------- ------------- ----------

Cash and cash equivalents comprise:

Cash at bank 31 534 724

Cash held in trust - 112 -

------------- ------------- ----------

Cash and cash equivalents at end of year/period 31 646 724

------------- ------------- ----------

Unaudited Statement of Changes in Equity

for the six months ended 30 September 2023

Share Share Share Retained Total

capital Premium Option Earnings Equity

Reserve

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

--------- --------- --------- ---------- --------

Balance at 1 April 2023 3,291 7,594 46 (3,926) 7,005

Profit and total comprehensive

income for the period - - - 502 502

Balance at 30 September 2023 3,291 7,594 46 (3,424) 7,507

--------- --------- --------- ---------- --------

Balance at 1 April 2022 3,291 7,594 65 (3,572) 7,378

Loss and total comprehensive income

for the period - - - (127) (127)

Balance at 30 September 2022 3,291 7,594 65 (3,699) 7,251

Balance at 1 April 2022 3,291 7,594 65 (3,572) 7,378

Share-based payment - - 5 - 5

Lapse of options in the period - - (24) 24 -

Loss and total comprehensive income

for the period - - - (378) (378)

--------- --------- --------- ---------- --------

Balance at 31 March 2023 3,291 7,594 46 (3,926) 7,005

--------- --------- --------- ---------- --------

Notes to the Interim Accounts

for the six months ended 30 September 2023

1. General information

Vela Technologies plc is a company incorporated in the United

Kingdom.

These unaudited condensed interim financial statements for the

six months ended 30 September 2023 have been prepared in accordance

with International Financial Reporting Standards (IFRS) and IAS 34

"Interim Financial Reporting" as adopted by the European Union and

do not constitute statutory accounts as defined in Section 434 of

the Companies Act 2006. This condensed set of financial statements

has been prepared applying the accounting policies that were

applied in the preparation of the Company's published financial

statements for the year ended 31 March 2023 and are presented in

pounds sterling.

The comparative figures for the financial year ended 31 March

2023 have been extracted from the Company's statutory accounts

which have been delivered to the Registrar of Companies and

reported on by the Company's Auditors. Their report was unqualified

and contained no statement under section 298 (2) or (3) of the

Companies Act 2006.

2. Changes in accounting policy

The assessment of new standards, amendments and interpretations

issued but not effective are not anticipated to have a material

impact on the interim financial statements.

3. Going concern

The Directors have considered the Company's activities, together

with the factors likely to affect its future development and

performance, the financial position of the Company, and its cash

flows and liquidity position, taking account of the current market

conditions. This review has demonstrated that the Company shall

continue to operate within its own resources.

The Directors believe that the Company is well placed to manage

its business risks successfully and that the Company has adequate

resources to continue in operational existence for the foreseeable

future. Accordingly, they consider it appropriate to adopt the

going concern basis in preparing these condensed financial

statements.

4. Profit (loss) per share

Profit / (Loss) per share has been calculated on a profit of

GBP502,000 (six months to 30 September 2022: GBP127,000 loss; year

to 31 March 2023: GBP378,000 loss) and the weighted number of

average shares in issue for the period of 16,252,335,184 (30

September 2022: 16,252,335,184; 31 March 2023: 16,252,335,184).

6 months 6 months Year

ended ended ended

30 September 30 September 31 March

2023 2022 2023

-------------- -------------- ----------

Profit (loss) (GBP'000) 502 (127) (378)

Earnings (loss) per share (pence) 0.0031 (0.0008) (0.0023)

5. Investments

Other

Investments

GBP'000s

-------------

Fair value at 1 April 2023 3,193

Additions during the period 250

Disposals during the period (136)

Current period fair value movement charged to profit or

loss (518)

-------------

Fair value at 30 September 2023 2,789

-------------

Investment in Tribe Technology Group Limited ("Tribe Tech")

In May 2023, Vela invested GBP250,000 in Tribe Tech via an

advance subscription agreement as part of a pre-IPO funding round.

The IPO completed on 5 September 2023 and Vela was issued with

shares at a price of 8p per share which was equivalent to 80% of

the IPO issue price. Following the investment Vela is interested in

3,125,000 ordinary shares representing 1.41 per cent of Tribe

Tech's issued share capital.

Part Disposal in EnSilica Plc

Between May 2023 and September 2023 the Company disposed of a

total of 163,000 shares at an average price of 68p per share,

generating gross proceeds of GBP110,537 for the Company. Following

the disposals Vela remained interested in 946,707 ordinary shares

representing 1.9% of the issued share capital after these

disposals.

Part Disposal in Kanabo Group Plc

In May 2023 the Company disposed of a total of 500,000 shares at

a price of 3p per share, generating gross proceeds of GBP15,460 for

the Company. Following the disposals Vela remained interested in

657,692 ordinary shares.

Part Disposal in Northcoders Group Plc

In May 2023 the Company disposed of a total of 2,500 shares at a

price of GBP3.00 per share, generating gross proceeds of GBP7,189

for the Company. Following the disposals Vela remained interested

in 347,499 ordinary shares.

6. Trade and other receivables - non-current

30 30 31

September September March

2023 2022 2023

GBP'000 GBP'000 GBP'000

----------- ----------- --------

Loan due from Bixx Tech Limited 704 689 704

Other financial asset 4,000 2,350 2,350

4,704 3 , 039 3,054

----------- ----------- --------

Loan due from Bixx Tech Limited

The loan represents the consideration receivable for the

disposal of certain investment assets in August 2020. The total

consideration receivable is GBP855,000 which is receivable after

seven years. The consideration has been discounted at a market

interest rate of 4.5%.

Under the terms of the loan agreement, the Company has provided

an undertaking to distribute a sum equal to any repayment of the

loan to the holders of the Special Deferred Shares. This

distribution will be by way of a dividend declared on the Special

Deferred Shares ("the Special Dividend"). In the event that

insufficient distributable reserves exist at the end of the

seven-year loan term, the repayment of the loan will be deferred

for a further year. This deferral will continue until such a time

as the Company has sufficient distributable reserves to be able to

pay the Special Dividend.

Other financial asset - Investment in St George Street

Capital

On 20 October 2020, the Company entered into a contract with St

George Street Capital ("SGSC") for an 8% economic interest in the

potential future commercialisation of SGSC's asset to treat

individuals with diabetes who are suffering with COVID-19 ("the

Asset"). The consideration payable under the terms of the contract

was GBP2.35m which was settled by cash of GBP1.25m and the issue of

1,100,000,000 consideration shares at a price of 0.1 pence per

share. The directors consider that this represented the fair value

of the contract at the date of investment.

The contract gives the Company a right to future economic

benefits and has been classified as a financial asset measured at

fair value through profit and loss. The directors estimate that the

contract will not be realised within 12 months of the reporting

date and so the asset has been classified as non-current.

SGSC had successfully completed the Phase II trials and had

moved on to the process of investigating options for funding Phase

III clinical trials (which would involve a significantly larger

sample of patients than Phase II) and onward commercialisation of

the Asset. The development of the Asset continues to progress along

the typical drug development pipeline. However, the need for SGSC

to raise further funding in order to commence the Phase III trials,

to successfully complete those trials and achieve commercialisation

of the drug gives rise to an inherent level of risk in respect of

the ultimate realisation of the Asset, which the directors took

into consideration when estimating its fair value as at 31 March

2023. The directors considered the position at the balance sheet

date and were of the view that there had not been any major

developments (either positive or negative) or milestones achieved

in the period up to the reporting date which would give rise to a

material change in the fair value of the contract during this time.

Accordingly, the original consideration payable under the contract

represents the directors' best estimate of its fair value, as a

standalone contract, as at 31 March 2023.

In April 2023, the Company entered into a put option agreement

(the "Option") to give the Company the right, but not the

obligation, to sell its economic interest in the commercialisation

of the Covid-19 application of AZD1656 for a total consideration of

GBP4.0 million. The Option was granted by Conduit Pharmaceuticals

Limited ("Conduit") and its prospective parent company, Murphy

Canyon Acquisition Corp ("Murphy"), a Company listed on NASDAQ at

that time. On exercise of the Option by Vela, the consideration

that would be payable to Vela will be satisfied through the

issuance of new shares of authorised common stock of par value

$0.001 of Murphy. The Option is exercisable solely at the

discretion of Vela and Vela paid Conduit GBP400,000 in cash as the

premium for the Option, with the consideration settled from Vela's

existing cash resources.

On 21 September 2023 Conduit completed its merger with Murphy

and its shares were listed on NASDAQ. Following the listing on

NASDAQ the put option became exercisable. As a result, at 30

September 2023 Vela was in a position to exchange its GBP2.75

million economic interest in AZD1656 for GBP4 million worth of

Conduit shares. This is reflected in the valuation of the 'other

financial asset' at the half-year end.

Subsequent to the half-year period end (on 1 December 2023) Vela

exercised the put option to sell its economic interest for shares

in Conduit. Under the terms of the put option Vela received

1,015,760 new shares of authorised common stock of par value $0.001

in Conduit.

7. Derivative financial instruments

30 30 31

September September March

2023 2022 2023

GBP'000 GBP'000 GBP'000

----------- ----------- --------

Warrants 18 39 72

18 39 72

----------- ----------- --------

The Company holds warrants providing it with the right to

acquire additional shares in certain of its investee companies at a

fixed price in the future, should the directors decide to exercise

them. The warrants have been recognised as an asset at fair value,

which has been calculated using an appropriate option pricing

model.

8. Share capital

Allotted, called up and fully paid capital 30 30 31

September September March

2023 2 022 2023

16,252,335,184 Ordinary Shares of 0.01 pence

each 1,625 1,625 1,625

1,748,943,717 Deferred Shares of 0.08 pence

each 1,399 1,399 1,399

2,665,610,370 Special Deferred Shares of

0.01 pence each 267 267 267

3,291 3,291 3,291

----------- ----------- -------

9. Financial instruments

The Company is required to report the category of fair value

measurements used in determining the value of its investments, to

be disclosed by the source of its inputs, using a three-level

hierarchy. There have been no transfers between Levels in the fair

value hierarchy.

Quoted market prices in active markets - "Level 1"

Inputs to Level 1 fair values are quoted prices in active

markets for identical assets. An active market is one in which

transactions occur with sufficient frequency and volume to provide

pricing information on an ongoing basis. The Company has twelve (30

September 2022: ten; 31 March 2022: eleven) investments classified

in this category. The aggregate historic cost of these investments

is GBP3,393,803 (30 September 2022: GBP3,393,803; 31 March 2022:

GBP3,145,110) and the fair value as at 30 September 2023 was

GBP1,961,310 (30 September 2022: GBP2,681,046; 31 March 2022:

GBP2,364,534)

Valued using models with significant observable market

parameters - "Level 2"

Inputs to Level 2 fair values are inputs other than quoted

prices included within Level 1 that are observable for the asset,

either directly or indirectly. The Company has two (30 September

2022: two; 31 March 2023: two) unquoted investments classified in

this category. The historic cost of these investments is GBP450,000

(30 September 2022: GBP450,000; 31 March 2023: GBP450,000) and the

fair value as at 30 September 2022 was GBP828,186 (30 September

2022; GBP764,644; 31 March 2023: GBP828,186).

Valued using models with significant unobservable market

parameters - "Level 3"

The Company has two (30 September 2022: two; 31 March 2023: two)

investments that are held at cost less impairment because a

reliable estimate of fair value cannot be determined. As at 30

September 2023 the historical cost of these investments amounted to

GBP300,000 (30 September 2022: GBP300,000; 31 March 2023:

GBP300,000) and the aggregate carrying value was GBPnil (30

September 2022: GBPnil; 31 March 2023: GBPnil).

The Company also holds a non-current financial asset described

in note 9 to the financial statements at a fair value of

GBP4,000,000 (30 September 2022: GBP2,350,000; 31 March 2023:

GBP2,350,000). The historic cost of the asset is GBP2,750,000 (30

September 2022: GBP2,350,000; 31 March 2023: GBP2,350,000).

10. Related party transactions

During the period the Company entered into the following related

party transactions. All transactions were made on an arm's length

basis:

Ocean Park Developments Limited

Brent Fitzpatrick, non-executive chairman, is also a director of

Ocean Park Developments Limited. During the period the Company paid

GBP24,000 (six months ended 30 September 2022: GBP24,000; year

ended 31 March 2023: GBP62,000) in respect of his director's fees

to the Company. The balance due to Ocean Park Developments at the

period end was GBPnil (30 September 2022 GBPnil; 31 March 2023:

GBPnil).

11. Principal risks and uncertainties

Principal risks and uncertainties are set out in the annual

financial statements within the directors' report and also in note

15 to those financial statements and are reviewed on an on-going

basis.

The Board provides leadership within a framework of appropriate

and effective controls. The Board has set up, operates and monitors

the corporate governance values of the Company, and has overall

responsibility for setting the Company's strategic aims, defining

the business objective, managing the financial and operational

resources of the Company and reviewing the performance of the

officers and management of the Company's business both prior to and

following an acquisition.

There have been no significant changes in the first six months

of the financial year to the principal risks and uncertainties as

set out in the 31 March 2023 Annual Report and Accounts.

12. Board approval

These interim results were approved by the Board of Vela

Technologies plc on 21 December 2023.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKDBDOBDDPBB

(END) Dow Jones Newswires

December 22, 2023 02:00 ET (07:00 GMT)

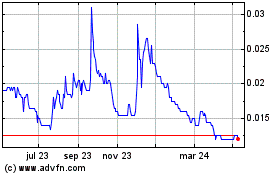

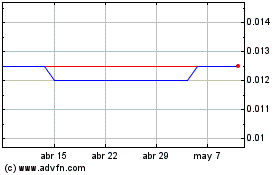

Vela Technologies (LSE:VELA)

Gráfica de Acción Histórica

De Oct 2024 a Nov 2024

Vela Technologies (LSE:VELA)

Gráfica de Acción Histórica

De Nov 2023 a Nov 2024