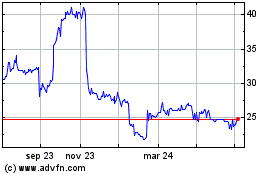

TIDMWRKS

RNS Number : 0751A

TheWorks.co.uk PLC

18 January 2024

18 January 2024

TheWorks.co.uk plc

("The Works", the "Company" or the "Group")

Interim results for the 26 weeks ended 29 October 2023 and

trading update for the 11 weeks ended 14 January 2024.

Pressures on sales and profitability seen in H1 FY24 continued

into H2. Short-term focus is on margin growth and cost reduction.

Guidance for FY24 maintained.

The Works, the family-friendly value retailer of books, arts and

crafts, stationery, toys and games, announces its interim results

for the 26 weeks ended 29 October 2023 (the "Period" or "H1 FY24")

and an update on current trading for the 11 weeks ended 14 January

2024.

H1 FY24 Financial summary

-- Delivered total revenue growth of 3.1% to GBP122.6m (H1 FY23: GBP118.9m) and total LFL sales

growth of 1.6% against a challenging backdrop with softened consumer demand.

o Maintained store sales growth, with LFL sales up 3.5%. Strong sales delivered in the early

summer months after which the rate of growth slowed, primarily due to sector-wide reduced

footfall.

o Online sales declined by 12.2%, echoing broader retail trends. Performance improved throughout

the Period, reflecting website improvements and increased demand driven by promotional activity.

-- Pre-IFRS 16 Adjusted EBITDA loss of GBP8.5m (H1 FY23: loss of GBP6.4m) and Adjusted loss before

tax of GBP7.8m (H1 FY23: loss of GBP7.3m).(1)

o Faced tough cost headwinds due to inflation and increase in National Living and Minimum Wages.

o Product gross margin increased to 57.2% (H1 FY23: 56.3%), albeit less than anticipated, with

lower freight costs partially offset by product mix and market-driven promotional activity

towards the end of the Period.

-- The Group had net bank borrowings of GBP2.5m at the Period end, reflecting the build-up of

stock prior to the peak trading season, and the corresponding low point in cash levels.

-- Given pressures on sales and profitability and uncertain trading outlook, focus is now on

cost reduction and margin growth in the short-term, with decisive action already underway.

-- The Board's expectation for the full year (pre IFRS 16 Adjusted EBITDA of approximately GBP6.0m),

currently remains unchanged.

-- The Board is not proposing a dividend or share buyback in the short-term.

H1 FY24 H1 FY23

(Restated)(2)

---------------------------------------------------------------- ----------------------- --------------------------

Revenue GBP122.6m GBP118.9m

Revenue growth 3.1% 2.4%

LFL sales growth(3) 1.6% 0.6%

Pre-IFRS 16 Adjusted EBITDA (GBP8.5m) (GBP6.4m)

Loss before tax (GBP14.8m)(4) (GBP7.3m)

Adjusted(5) loss before tax (GBP7.8m) (GBP7.3m)

Basic loss per share (17.6p) (8.4p)

Net (debt)/ cash at bank(6) (GBP2.5m) GBP7.0m

H1 FY24 Operational summary

-- Improved customer proposition through new toys and games ranges, which saw double digit growth,

as well as strong performance of summer and extended Halloween seasonal ranges.

-- Delivered website improvements to enhance the customer experience, which have resulted in

an improvement in key site-performance metrics.

-- Optimised store estate with 5 new store openings, 19 refits, 3 relocations and 10 closures.

Delivered annual rent savings of GBP0.5m on lease renewals completed in the Period.

-- Operational investments in merchandising team and a new picking process at the Distribution

Centre, have been slower than expected in delivering benefits and efficiencies.

-- Piloted new EPOS solution, replacing existing end-of-life solution, with rollout to the wider

estate planned for the first half of 2024.

-- Strengthened leadership team with the appointment of new Commercial Director and Marketing

Director in H1, as well as CFO succession early in H2.

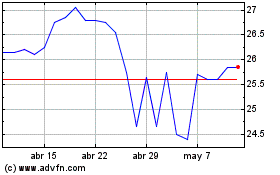

Trading update

Overall, LFL sales declined by 4.9% in the 11 weeks ended

Sunday, 14 January 2024. This was lower than anticipated and was

primarily a result of the challenging consumer environment and

subdued demand over the festive period. Family finances were under

pressure, meaning many customers prioritised spend on food and

essentials, whilst cutting back on gifting. The extended period of

discounting seen across the sector continued throughout November

and December, resulting in a highly competitive market and pressure

to maintain promotional activity.

In addition to the external challenges faced, some ranges, such

as kids' books, did not deliver as expected. We also experienced

some teething problems at our Distribution Centre following the

implementation of a new pick-process (expected to deliver

significant savings in the long-term), which intermittently

disrupted the flow of stock. Trading has improved post-Christmas in

part reflecting a more impactful January sale, and the operational

challenges in the DC have eased.

Outlook

We entered the new calendar year with stock levels in line with

our original plans, having taken action to reduce planned intake

and with seasonal stock selling through as expected. Our cash

position improved following Christmas, with GBP18.4m of cash as of

14 January 2024 and we expect to end the financial year

debt-free.

Pressure on profitability from lower sales and margins has

increased since our last trading update and we have pivoted to

focus on resetting our cost base, growing our gross margin and

scaling back non-essential investments and spend in the short-term.

The action undertaken is already having the desired impact, albeit

with most of the cost savings to be realised in the next financial

year.

Given the more positive sales trajectory in recent weeks,

coupled with expected benefits from cost action and new ranges, the

Board's expectation for FY24 pre IFRS 16 Adjusted EBITDA of

approximately GBP6.0m currently remains unchanged. We remain

mindful that the outlook for consumer spend remains unpredictable

and of uncertainty relating to external factors such as stock

delays and increased freight costs as a result of supply chain

disruption in the Red Sea.

Gavin Peck, Chief Executive Officer of The Works, commented:

"Market conditions have been persistently challenging, putting

pressure on our sales and profit performance in the first half and

throughout the festive period. It is clear that many families

celebrated Christmas on tighter budgets this year, and whilst we

offered excellent value, we were not immune to this reduced spend.

I am proud of the way that our colleagues have rallied together to

deliver for customers during these challenging times.

"We have started the new calendar year on an improved sales

trajectory, with a strengthened leadership team to drive forward

our strategy and exciting Easter and summer toy ranges due to land

later this year. However, we are also mindful of external

challenges, including recent supply chain disruption in the Red

Sea.

"Our focus for the remainder of the year will be on cost

reduction, rebuilding margin and profitability, and conserving

cash. It is necessary to take this action now to stabilise the

profitability of the business during this challenging period,

however we remain confident that our "Better, not just Bigger"

strategy is the right direction for the business and will enable a

return to sustainable growth in the long term."

Interim results presentation

A presentation for sell-side analysts will be held today at

9.30am via video conference call. A copy of the presentation will

shortly be made available on the Company's website

(www.corporate.theworks.co.uk/investors).

Enquiries:

TheWorks.co.uk plc

Gavin Peck, CEO via Sanctuary Counsel

Rosie Fordham, CFO

Sanctuary Counsel

Ben Ullmann (0)20 7340 0395

Rachel Miller theworks@sanctuarycounsel.com

Kitty Ryder

Footnotes:

(1) Refer to Note 4 of the attached condensed unaudited financial statements.

(2) Refer to Note 13 of the attached condensed unaudited financial statements.

(3) The like for like (LFL) sales increase has been calculated with reference to the FY23 comparative

sales figures.

(4) HY24 loss before tax includes a GBP6.9m net impairment charge. See Financial Report for more

details.

(5) Adjusted profit figures exclude Adjusting items. See Note 5 of the attached condensed unaudited

financial statements for details of Adjusting items.

(6) Net (debt) / cash at bank, excluding lease liabilities.

Notes for editors:

The Works is one of the UK's leading family-friendly value

retailers of books, arts and crafts, stationery, toys and games,

offering customers a differentiated proposition as a value

alternative to full price specialist retailers. The Group trades

from over 520 stores in the UK & Ireland and online.

Chief Executive's Report

Trading performance

The first half of FY24 was characterised by a challenging

consumer retail environment, with high inflation and cost of living

pressures resulting in softened consumer demand. Against this

backdrop The Works delivered total revenue growth of 3.1% and a

total LFL sales increase of 1.6%.

Stores delivered a LFL sales increase of 3.5%. We saw stronger

sales during the early summer months, driven by soft comparatives

with H1 FY23 (due to the impact of the cyber security incident) and

a good performance of new toys and games and summer "Out to Play"

ranges. Key product categories struggled in late summer and the

market became increasingly difficult from mid-late September

onwards, resulting in more competition and extensive discounting

across the sector, which we responded to with increased levels of

promotional activity. Reduced footfall caused by unseasonable

weather towards the end of the period further impacted sales,

although our extended Halloween range performed well, with further

opportunity to grow and refine our offering for this increasingly

significant seasonal event in 2024.

Online sales declined by 12.2%. Although weaker than stores

overall, consistent with the broader trend seen across the

sector,(1) our online performance gradually improved throughout the

Period. This was a result of improvements made to the customer

experience of the website and the strong performance of online

promotional activity implemented in October. The poor weather seen

towards the end of the period also saw some customers shift from

shopping in store to online, which provided a temporary boost.

Profitability was constrained in the first half with a pre-IFRS

16 Adjusted EBITDA loss of GBP8.5m (H1 FY23: GBP6.4m loss) and

Adjusted loss before tax of GBP7.8m (H1 FY23: GBP7.3m loss).(2) The

main impacts on profitability were higher business costs due to

inflation and the significant increase in the National Living and

Minimum Wages. Profitability was further constrained by operational

investments in our merchandising team and a new way of picking at

the Distribution Centre being slower than expected to deliver

benefits and efficiencies. Product gross margin increased to 57.2%

from 56.3% in H1 FY23 but was lower than expected, reflecting the

benefit of lower freight rates throughout the Period being

partially offset by the product mix (strong sales of lower margin

toys, games and fiction books) and elevated levels of market-driven

promotional activity towards the end of the Period.

Given the persistent pressure on our sales and profitability,

towards the end of the Period we took decisive action to reduce

costs across the business. This includes reducing the number of

labour hours in stores, reassessing marketing spend and keeping

other discretionary costs to a minimum. We are targeting further

rent reductions, particularly on low-profit stores, and have

strengthened middle-management in the Distribution Centre to drive

the expected efficiency savings from the new ways of working. At

the same time we have identified opportunities to accelerate margin

growth through cost reduction and supplier rationalisation. We are

pleased with the action already taken, with some positive impact

over the remainder of the current year, but given the lead time for

these measures to fully bed in we expect that most of the cost

savings will materialise in FY25.

The Group had net bank borrowings of GBP2.5m at the Period end

(H1 FY23: GBP7m net cash), reflecting the build of stock prior to

peak trading season, and the corresponding low point in cash

levels. There was GBP17.5m of headroom within our GBP20.0m bank

facility.

Strategy

Our "better, not just bigger" strategy provides The Works with a

clearer purpose and a more focussed brand identity and customer

proposition to drive a step-change in sales growth, as well as

enabling us to improve the operations of the business. Although the

aims of this strategy, to make The Works a more customer-focussed

and efficient retailer, are relatively straightforward, the extent

of change required across our business to deliver it has always

been extensive and complex in nature.

Since launching the strategy we have made good progress in key

areas, but did not anticipate facing such a persistently

challenging external environment, which has hindered our ability to

deliver as expected in recent years. We still believe this is the

right strategic direction for the business and are confident that

we have made the right investments. However, the combination of an

adverse trading environment, significant cost headwinds and slower

than expected progress have meant we have now entered an unforeseen

and temporary interim period between investment and return. Our

present focus is on delivering returns on those investments and

cutting costs where we can, which will see us scaling back

non-essential investments. This is a short-term, corrective course

to stabilise the profitability of the business to see us through a

difficult period.

Updates on our strategic pillars in H1 FY24 include:

-- Develop our brand and increase customer engagement: We hired a new Commercial Director to

improve our product proposition and key categories where we believe there is scope to deliver

growth, as well as a new Marketing Director, who will drive our plan to bring our purpose

to life and improve customer engagement. New toys and games ranges delivered strong, double-digit,

growth despite the broader YoY decline of the toy market. Conversely, changes to our core

art, craft and stationery ranges have not delivered the expected sales uplift and books have

struggled, partially reflecting the challenging market segment, but also the underperformance

of our adult non-fiction and kids' ranges. In spring 2024, we will replan and refocus our

kids' book offering alongside further refinement of our adult non-fiction range.

-- Enhance our online proposition: We delivered improvements to the website to enhance the customer

experience, supported by new analytical tools, including revamping our homepage, optimising

product pages and improving navigation across the site. These changes have seen an improvement

on all key metrics, including conversion. Whilst our online channel is important, representing

c.10% of sales, we are a predominantly store-based retailer and will continue to be for the

foreseeable future. A review of online priorities for the next 12 to 18 months will be complete

by the end of Q1 2024, balancing any investment with necessary cost reductions across the

business.

-- Optimise our store estate: We continued to optimise our store estate with 5 new openings,

19 refits, 3 relocations and 10 closures, meaning we traded from 521 stores at the end of

the period. We continue to aggressively target rent reductions on low-profit stores which

has seen us deliver rent savings on our existing estate, saving c.GBP0.5m in annual rent on

the 36 lease renewals in H1 (an average saving of 22% on headline rent). The new, simplified

store labour structure we introduced at the beginning of FY24 has embedded well and will allow

us to drive more efficient use of our store labour budget. In turn, this will help support

planned reductions to store labour hours as we move into FY25. Given profitability constraints,

we will cut back capital expenditure for the remainder of the year to only essential, or already

committed, works.

-- Drive operational improvements: We strengthened Distribution Centre middle-management to help

embed new ways of working and deliver the expected benefits and efficiencies in 2024. We agreed

with iForce, our third-party provider for e-commerce, to move to a more modern distribution

centre with much higher levels of automation which took place in early-January 2024 and is

expected to save us c.GBP1m per annum in operating costs. Following a review of our business

operating model in early 2023, we have improved ways of working across our Buying and newly

formed Merchandising teams and identified tactical system improvements. In early 2024 we will

have a clear roadmap for future system requirements, although the pace of investment will

be balanced with the need to manage costs and cash in the short-term. We also piloted new

EPOS software across 19 stores, which will be rolled out to all stores and replace the current

end-of-life software in the first half of 2024.

Environmental, Social and Governance (ESG)

As a business we are committed to "Doing Business Better" and

our dedicated ESG steering group continues to meet quarterly to

ensure we are fulfilling our mission to make positive and

sustainable changes for our people, our communities and our planet

which will enable us to continue to inspire reading, learning,

creativity and play for generations to come.

Progress during the period includes:

-- Phased out plastic packaging on cards and roll wrap at Christmas and reworked the packaging

on our re-launched core art and craft ranges to be more environmentally friendly.

-- Developed a new charity partnership with the National Literacy Trust to help equip children

and young people with the literacy skills they need to succeed and thrive. This charity is

much better aligned with our purpose, replacing our previous partnership with Cancer Research

UK, and customers and colleagues will start to fundraise for the National Literacy Trust alongside

our other existing charity partner, Mind.

-- Launched a trial takeback scheme with Barnardo's, a children's charity, in 20 stores with

the potential to rollout to all eligible stores (c.400) in 2024. Customers can donate new

or pre-loved books, toys, games and stationery in our stores, which are collected by Barnardo's

and sold in their stores.

-- Sustained our strong colleague engagement scores to place 15(th) in the 'Best Big Companies

to Work For' and 10(th) in Retail Week's 'Top 50 happiest retailers to work for'.

Leadership changes

Following the announcement of the CFO succession at our

preliminary results, Rosie Fordham has now been appointed CFO and

joined the Board effective 31 December 2023. Together with the

appointment of Lynne Tooms as Commercial Director and Simon Peck as

Marketing Director, we now have a strengthened leadership team to

help steer the business through the next phase of development.

Outlook

The Board's expectation for the full year results currently

remains unchanged.(3) Our trading performance in the run up to

Christmas was lower than expected, however this is balanced by an

improving sales trajectory in recent weeks and optimism about new

ranges landing in the spring. Furthermore, operational investments

in our merchandising team and a new way of picking at the

Distribution Centre are expected to start delivering results in the

remainder of the Period, supporting the cost action we have already

taken. In line with the normal working capital cycle, we have

exited Christmas with significant levels of cash and expect to end

the financial year debt-free.

However, there is still a great deal of uncertainty as we move

into 2024. We continue to face significant cost headwinds, the

consumer outlook remains unpredictable and the supply chain

disruption caused by recent attacks on ships in the Red Sea creates

the potential for stock delays and increased freight costs, which

we are carefully monitoring.

Shareholder return of capital and consultation exercise

Following resolution 2 relating to the declaration of the final

dividend not passing at the last AGM on 4 October 2023, we

conducted a shareholder consultation exercise. This consultation

covered alternative forms of capital distributions, with some of

our major shareholders expressing a preference for share buybacks

over the payment of dividends at the AGM. The consultation also

covered resolutions 13, 14 and 15 as set out in our notice of AGM.

We are required under the UK Corporate Governance Code to provide

an update within six months of an AGM where more than 20% of votes

were cast against a resolution.

We have listened to the views of our shareholders in relation to

the above resolutions and taken this consultation exercise into

consideration. In light of current trading, we are now focused on

retaining cash within the business and the Board will therefore not

be proposing any form of shareholder returns in the short-term. The

Board will continue to consider shareholder feedback on returns of

capital within the context of the Company's cash position on an

ongoing basis.

Gavin Peck

Chief Executive Officer

18 January 2024

Footnotes

(1) Data from the British Retail Consortium (BRC) shows a decline in online non-food sales for

every month of the period from May through October:

https://brc.org.uk/insight/market-insight-hub/?topic=Retail%20Sales#9

(2) The seasonality of the business typically results in a loss in the first half of the financial

year, with all profit being substantially generated through Christmas trading in H2. The loss

before tax in H1 FY24 was greater than the previous year as a result of a GBP6.9m net impairment

charge.

(3) Revised guidance was announced in the 9 November 2023 trading update. The Company compiled

estimate of the market's expectation for the FY24 and FY25 pre IFRS 16 Adjusted EBITDA result

is approximately GBP6.0m and GBP8.5m respectively.

Financial Report

Overview

This report covers the 26 week period ended 29 October 2023 ("H1

FY24", "H1" or "the Period") and refers to the comparative "H1

FY23" period of the 26 weeks ended 30 October 2022.

The result for the Period was an Adjusted loss before tax of

GBP7.8m compared with a restated loss before tax of GBP7.3m for H1

FY23. The pre-IFRS 16 Adjusted EBITDA was a loss of GBP8.5m (H1

FY23: loss of GBP6.4m). The result reflects the impact on sales and

significant cost headwinds faced in the challenging macro-economic

environment. The seasonality of the business typically results in a

loss in the first half of the financial year, with all profit being

substantially generated through Christmas trading in H2.

The table below summarises the movements between the H1 FY23 and

H1 FY24 EBITDA results. Revenue increased by 3.1% and the margin

rate improved slightly (albeit less than expected) but there were

cost headwinds such as the increase in National Living and Minimum

Wages (NLMW) and electricity along with investment in IT

infrastructure and support centre headcount which more than offset

this. Further details are provided below.

GBPm

------

H1 FY23 EBITDA(1) (6.4)

Additional margin from year-on-year sales increase 2.0

Higher product gross margin percentage 1.1

Variable web running costs 1.2

Payroll Inflation across Stores and Support Centre (2.0)

Store Distribution costs (1.7)

IT infrastructure (0.8)

Electricity (inflation) (0.7)

Support centre labour investment (0.7)

Other (0.4)

H1 FY24 EBITDA (1) (8.5)

======

At the balance sheet date the Group had net debt of GBP2.5m (H1

FY23: net cash of GBP7.0m) (excluding lease liabilities). Stock was

purchased earlier compared to the prior Period to mitigate the risk

of delays to key seasonal lines that we experienced in FY23 and the

cash position at the end of the Period fully reflects this build of

stock.

(1) The Group tracks a number of alternative performance

measures ("APMs") including pre-IFRS 16 EBITDA, pre-IFRS 16

Adjusted EBITDA and like for like ("LFL") sales, as it believes

these provide stakeholders with additional helpful information.

These are described more fully in Note 1(c) and 4 of the condensed

unaudited financial statements.

Due to rounding, numbers presented throughout this document may

not add up precisely to the totals provided and percentages may not

precisely reflect the absolute figures.

Revenue

Total revenue during the Period increased by 3.1% to GBP122.6

million (H1 FY23: GBP118.9 million). LFL sales increased by 1.6%,

with store LFLs increasing by 3.5% and online sales decreasing by

12.2%.

The number of stores trading decreased by five, from 526 to 521

at the end of the Period. Five new stores were opened, ten were

closed and three stores were relocated to new sites.

The table on the following page shows an analysis of sales and a

reconciliation to statutory revenue.

H1 FY24 H1 FY23 GBPm Variance GBPm Variance %

GBPm

-------- ------------- -------------- -----------

Total LFL sales for Period 130.3 128.2 2.1 1.6%

Non LFL sales 8.7 6.1 2.6 43.2%

Total Gross Sales 139.0 134.3 4.7 3.5%

VAT (15.6) (14.5) (1.1) (7.9%)

Loyalty points redeemed (0.8) (0.9) 0.1 7.6%

Revenue (per statutory accounts) 122.6 118.9 3.6 3.1%

======== ============= ============== ===========

The effective VAT rate was higher than in H1 FY23 due to the

higher sales mix of toys and games compared to the mix of zero

rated books in the comparative year.

Gross profit

H1 FY24 H1 FY23

(Restated

- Note 13)

GBPm % of GBPm % of GBPm % Variance

revenue revenue Variance

------- --------- ------- --------- ---------- -----------

Revenue 122.6 118.9 3.6 3.1

Less: Cost of goods sold (52.5) (52.0) (0.5) (0.9)

Product gross margin 70.1 57.2 66.9 56.3 3.2 4.7

Overhead costs charged to statutory

cost of sales

Store payroll (24.8) (20.2) (23.0) (19.4) (1.7) (7.6)

Store property and establishment

costs (25.4) (20.8) (25.2) (21.2) (0.3) (1.0)

Store PoS & transaction

fees (1.2) (1.0) (0.9) (0.8) (0.3) (32.9)

Store depreciation (excluding

IFRS 16) (1.4) (1.1) (2.2) (1.8) 0.8 37.0

Online variable costs (7.0) (5.7) (8.2) (6.9) 1.2 14.4

IFRS16 impact (excluding

Adjusting items) 5.4 4.4 4.0 3.4 1.3 33.4

Adjusting items (net impairment

charges) (6.9) (5.7) 0.0 0.0 (6.9) (100.0)

Gross profit per financial

statements 8.6 7.0 11.4 9.6 (2.8) (24.2)

======= ========= ======= ========= ========== ===========

-- Product gross margin increased to 57.2% from 56.3% last year. This was due to:

o A significant reduction in 2023 container freight rates versus

2022 rates. This more than offset the negative margin impact of the

factors outlined below.

o The hedged FX rate on payments made in US dollars during H1

was adverse year on year and continues to be a headwind in H2.

Margin was further impacted from the unwind of the adverse hedging

adjustment recognised in stock held at FY23 year end.

o New toys and games ranges delivered as part of improving our

customer proposition saw double digit growth in the Period, however

these attract a lower margin percentage.

o Increased promotional activity, particularly in October, also

moderated gross margin percentage.

-- Store payroll costs increased due to the 9.7% increase in the

NLMW and the corresponding retail management increases. These were

partially mitigated by the changes to our store labour structure

implemented at the start of the Period.

-- Store property and establishment costs increased by GBP0.3m due to:

o A GBP0.7m increase in electricity costs year on year as a

result of adverse hedged prices and higher non consumption rates

due to inflation.

o Service charges were GBP0.5m higher than the prior year which

included the headwind of GBP0.2m of one off credits received in the

prior Period.

o Total rent charges were broadly in line with the previous

year.

o GBP1.3m favourable business rates as a result of the rates

revaluation offset the majority of the above increases.

-- Online variable costs (marketing and fulfilment) in H1 FY24

were primarily lower due to lower sales volumes, however further

cost savings resulted from improvements in the order profile;

average order value and average ticket price increased.

Efficiencies continued to be delivered as a result of improvements

made to the online fulfilment picking process during the prior

Period.

-- The IFRS 16 impact in the table above (and in the

Administration costs table below) represents the additional IFRS 16

depreciation on the notional right of use asset created, less rent,

which is not recognised under IFRS 16. The difference in the size

of the adjustment compared with H1 FY23 is due to the FY23 store

impairment of Right of Use Assets ("RoUAs") resulting in a gain on

modification of leases. Note 4 of the financial statements provides

a reconciliation between pre and post IFRS 16 profit.

Store distribution costs

H1 FY24 H1 FY23

GBPm % of revenue GBPm % of revenue GBPm variance % variance

------- ------------- ------- ------------- -------------- -----------

Distribution costs (6.7) (5.5) (5.0) (4.2) (1.7) (34.0)

Depreciation (0.1) (0.1) (0.0) (0.0) (0.1) (100.0)

------- ------------- ------- ------------- -------------- -----------

Distribution costs (6.8) (5.6) (5.0) (4.2) (1.8) (36.1)

======= ============= ======= ============= ============== ===========

Store distribution costs increased by GBP1.7m to GBP6.7m. Note

that online fulfilment costs are included within the cost of

sales.

-- L abour costs in our retail distribution centre increased by

GBP1.4m as a result of the 9.7% increase in the NLMW and a higher

mix of agency staff, (which incurs a higher hourly rate).

-- Stock was brought into the business earlier to mitigate the

risk of delays to key seasonal lines that we experienced in FY23,

this resulted in increased volumes, and increased labour costs in

September and October. However, c osts were further impacted by

adverse performance metrics due to; increased average size of

product stored and shipped; the higher mix of agency staff, along

with inefficiencies as a result of the implementation of a new grid

picking process.

-- Third party delivery charges increased by GBP0.3m, primarily

due to increased product cube which resulted in higher outbound

pallet volumes.

Administration costs

H1 FY24 H1 FY23

GBPm % of revenue GBPm % of revenue GBPm variance % variance

-------- ------------- -------- ------------- -------------- -----------

Administration costs (13.3) (10.9) (10.9) (9.2) (2.4) (21.9)

Depreciation (1.1) (0.9) (0.5) (0.4) (0.6) (111.2)

IFRS 16 impact 0.3 0.2 0.2 0.2 0.1 36.4

Administration costs (14.2) (11.6) (11.3) (9.5) (2.9) (25.7)

======== ============= ======== ============= ============== ===========

Administration costs increased by GBP2.4m to GBP13.3m.

-- Support centre payroll costs increased by GBP1.0m, GBP0.3m of

which was due to inflationary payrises, which includes the impact

of the 9.7% NLMW increase. The remaining increase is due to the

annualisation of structural changes made in FY23 (a new

Merchandising team was recruited in late FY23).

-- GBP0.8m increase in IT infrastructure costs which included

dual running costs as we piloted the new EPOS software, continued

investment in the strengthening of our IT security and higher costs

as more software transitions to a SaaS basis.

Adjusting items

Due to the challenging macroeconomic environment and the

existence of a material brought forwards impairment charge, all

cash generating units (CGUs) other than stores which have been open

for less than 12 months have been assessed for impairment at the

Period end. No impairment review was performed during the 26 weeks

ended 30 October 2022 and therefore no impairment charges or

reversals were recognised in the comparative interim financial

statements. During the 26 weeks ended 29 October 2023, an

impairment charge of GBP10.1m was recognised against 284 stores. An

impairment reversal of GBP2.6m relating to 73 stores and GBP0.6m

relating to the website has also been recognised. The net impact is

an impairment charge of GBP6.9m. Refer also to Note 5 of the

condensed unaudited financial statements.

H1 FY24 H1 FY23

GBP'm GBP'm

-------- --------

Impairment charges (10.1) -

Impairment reversals 3.2 -

Total adjusting items (6.9) -

======== ========

Net financing expense

Net financing costs in the Period were GBP2.4m (H1 FY23:

GBP2.3m), mostly relating to IFRS 16 notional interest on the

calculated lease liability.

Interest relating to bank facilities was GBP0.3m (H1 FY23:

GBP0.3m) and comprised facility availability charges and

amortisation of the cost of setting up the facility.

Loss before tax

The loss before tax was GBP14.8m (H1 FY23: GBP7.3m loss) which

includes the GBP6.9m (H1 FY23: Nil) impairment charge recognised in

Adjusting items (described above). Due to the seasonality of the

business, the first half of the financial year is typically loss

making, although the loss for the year was worse than the prior

year as a result of the net impairment charge in Adjusting items

(H1 FY23: Nil) and the cost variances described above.

Tax

The Group's total income tax credit in respect of the Period was

GBP3.76 million (H1 FY23: GBP1.99 million). The effective tax rate

on the total loss before tax was 25.4% (H1 FY23: 27.4%), the

Adjusted tax rate was 32.9% (H1 FY23: 27.4%).

The difference between the total effective tax rate and the

Adjusted tax rate relates to certain costs and depreciation charges

(including impairment) being non-deductible for tax purposes.

Earnings per share

The basic and diluted losses per share for the Period was 20.5

pence (H1 FY23 restated: 8.4 pence loss).

Capital expenditure

Capital expenditure in the Period was GBP3.1 million (H1 FY23:

GBP2.5m).

Lower leasehold contributions from landlords compared to H1 FY23

resulted in higher new store capex.

The other notable area of capital expenditure was on store

refits (19 undertaken in the Period).

Capital expenditure for the full year is still expected to be

approximately GBP6.5m.

H1 FY24 H1 FY23 Variance

GBP'm GBP'm GBPm

-------- -------- ---------

New stores and relocations (0.6) (0.0) (0.6)

Store refits and maintenance (1.6) (1.2) (0.4)

IT hardware,software, projects (0.9) (1.3) 0.4

Total capital expenditure (3.1) (2.5) (0.6)

======== ======== =========

Stock

Stock was valued at GBP56.1m at the end of the Period (H1 FY23:

GBP53.6m), an increase of GBP2.5m.

The operating cycle of the business causes maximum stock levels

to occur prior to the Christmas sales peak, and therefore stock

levels typically increase at the half year end compared with the

levels at the year end. In addition to this seasonal build, the

stock value was higher than normal at the end of H1 FY23 due to the

following:

-- Stock was purchased earlier to mitigate the risk of delays to

key seasonal lines that we experienced in FY23, such as diaries and

calendars.

-- The cost value per unit of stock was approximately 3% higher

than in the prior year, primarily reflecting inflationary increases

in cost prices.

-- Stock provision values are lower than the prior year due to

the introduction of full '4-wall' counts in FY23 and the subsequent

reduction in the obsolescence provision.

The higher stock level at the end of H1 is expected to unwind in

the second half of the year resulting in the year end stock value

being broadly in line with the prior year.

H1 FY24 H1 FY23

GBPm GBPm

Gross stock 50.5 46.6

Less: provisions (1.7) (3.2)

------- -------

Stock net of provisions 48.8 43.4

Stock in transit 7.3 10.2

------- -------

Stock per balance sheet 56.1 53.6

======= =======

Cashflow

The Group ended the period with net debt of GBP2.5m. The timing

of the October month end (29(th) October 2023) resulted in payments

falling into H2 FY24, thereby creating a favourable timing

difference (GBP3.0m). The cash position at the end of the Period

fully reflects the build of stock prior to the peak trading

season.

The net cash outflow for the Period was GBP12.8m (H1 FY23:

outflow of GBP9.3m). The size of the outflow during H1 FY24 was

increased by the larger increase in stock as described above, along

with increased capital expenditure on new stores.

The table below shows an abbreviated summarised cashflow

analysis.

H1 FY24 H1 FY23 Variance

GBPm GBPm GBPm

------------- ------------- ---------

Operating cash flows before changes

in working capital 5.1 5.6 (0.5)

Deduct from statutory presentation:

rent payments (13.9) (14.3) 0.4

Deduct from statutory presentation:

RCF drawdown (5.0) (4.0) (1.0)

------------- ------------- ---------

Non IFRS cashflow before working

capital movements (13.8) (12.6) (1.1)

Net movements in working capital (0.2) 3.8 (4.0)

Capex (3.1) (2.5) (0.6)

Tax paid 0.0 (1.5) 1.5

Interest and financing costs (0.4) (0.6) 0.2

Cashflow before loan movements (17.5) (13.4) (4.1)

Drawdown of RCF 5.0 4.0 1.0

Exchange rate movements (0.1) 0.3 (0.4)

Purchase of treasury shares by

EBT (0.1) (0.1) 0.0

Net decrease in cash and cash

equivalents (12.8) (9.3) (3.5)

============= ============= =========

Opening net cash balance excluding

IAS 17 leases 10.2 16.3

Closing net (debt)/cash balance

excluding lease liabilities (2.5) 7.0

Bank facilities

The Group's bank facilities comprise an RCF of GBP20.0m expiring

30 November 2026. The facility includes financial covenants in

relation to the level of net debt to LTM EBITDA and 'Fixed Charge

Cover' or ratio of LTM EBITDA prior to deducting rent and interest,

to LTM rent and interest.

GBP5.0m was drawn under the Group's RCF facility during October

2023.

Dividends

At the AGM shareholders expressed a preference for share

buybacks over dividends and we have continued to consult with our

major shareholders. In light of current trading we are focused on

retaining cash within the business and the Board is not proposing

an interim dividend.

When conditions, such as trade, profit levels and liquidity

support returning cash to shareholders we will re-visit the capital

distribution policy.

Rosie Fordham

Chief Financial Officer

18 January 2024

Unaudited Condensed Consolidated Income Statement

For the 26 weeks ended 29 October 2023

26 weeks to 29 October 2023 26 weeks to 30 October 2022 52 weeks to 30 April 2023

(Restated - Note 13)

-------------------------------- ------------------------------- -------------------------------

Adjusted Adjusting Total Adjusted Adjusting Total Adjusted Adjusting Total

items items items

Note GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

---------------- ---- ---------- --------- --------- --------- --------- --------- --------- --------- ---------

Revenue 3 122,575 - 122,575 118,932 - 118,932 280,102 - 280,102

Cost of sales 5 (106,986) (6,949) (113,935) (107,541) - (107,541) (231,150) (5,052) (236,202)

---------------- ---- ---------- --------- --------- --------- --------- --------- --------- --------- ---------

Gross profit 15,589 (6,949) 8,640 11,391 - 11,391 48,952 (5,052) 43,900

Other operating

income 4 - 4 4 - 4 8 - 8

Distribution

expenses (6,846) - (6,846) (5,031) - (5,031) (10,284) - (10,284)

Administrative

expenses (14,173) - (14,173) (11,278) - (11,278) (24,197) - (24,197)

---------------- ---- ---------- --------- --------- --------- --------- --------- --------- --------- ---------

Operating

(loss)/profit (5,426) (6,949) (12,375) (4,914) - (4,914) 14,479 (5,052) 9,427

Finance income 6 17 - 17 23 - 23 227 227

Finance expense 6 (2,411) - (2,411) (2,364) - (2,364) (4,648) - (4,648)

---------------- ---- ---------- --------- --------- --------- --------- --------- --------- --------- ---------

Net financing

expense (2,394) - (2,394) (2,341) - (2,341) (4,421) - (4,421)

---------------- ---- ---------- --------- --------- --------- --------- --------- --------- --------- ---------

(Loss) / profit

before tax (7,820) (6,949) (14,769) (7,255) - (7,255) 10,058 (5,052) 5,006

Tax 9 2,573 1,184 3,757 1,986 - 1,986 265 - 265

---------------- ---- ---------- --------- --------- --------- --------- --------- --------- --------- ---------

(Loss) / profit

for the period (5,247) (5,765) (11,012) (5,269) - (5,269) 10,323 (5,052) 5,271

---------------- ---- ---------- --------- --------- --------- --------- --------- --------- --------- ---------

(Loss) / profit

before tax and

IFRS 16 4 (11,311) (2,215) (13,526) (9,445) - (9,445) 3,025 (1,488) 1,537

---------------- ---- ---------- --------- --------- --------- --------- --------- --------- --------- ---------

Basic

(loss)/earnings

per share

(pence) 10 (8.4) (17.6) (8.4) (8.4) 16.5 8.4

---------------- ---- ---------- --------- --------- --------- --------- --------- --------- --------- ---------

Diluted

(loss)/earnings

per share

(pence) 10 (8.4) (17.6) (8.4) (8.4) 16.4 8.4

---------------- ---- ---------- --------- --------- --------- --------- --------- --------- --------- ---------

All results arise from continuing operations. The loss for the

period is attributable to equity holders of the Parent company.

Unaudited Condensed Consolidated Statement of Comprehensive

Income

For the 26 weeks ended 29 October 2023

26 weeks to 26 weeks to 52 weeks to

29 October 2023 30 October 2022 30 April 2023

(Restated - Note 13)

GBP000 GBP000 GBP000

------------------------------------------------------------ ----------------- --------------------- --------------

(Loss) / profit for the period (11,012) (5,269) 5,271

Items that may or may not be recycled subsequently into

profit and loss

Cash flow hedges - changes in fair value 2,423 (498) (2,862)

Cash flow hedges - reclassified to profit and loss (278) (1,258) (62)

Cost of hedging reserve - changes in fair value (357) 56 (162)

Cost of hedging reserve - reclassified to profit and loss 135 47 91

Tax relating to components of other comprehensive income (525) - 262

------------------------------------------------------------ ----------------- --------------------- --------------

Other comprehensive income / (expense) for the period, net

of income tax 1,398 (1,653) (2,733)

------------------------------------------------------------ ----------------- --------------------- --------------

Total comprehensive (expense) / income for the period

attributable to equity shareholders

of the Parent (9,614) (6,922) 2,538

------------------------------------------------------------ ----------------- --------------------- --------------

Unaudited Condensed Consolidated Statement of Financial

Position

As at 29 October 2023

29 October 2023 30 October 2022 30 April 2023

(Restated - Note 13)

Note GBP000 GBP000 GBP000

---------------------------------------------------- ---- ---------------- --------------------- -------------

Non-current assets

Intangible assets 12 1,583 1,920 916

Property, plant and equipment 13 9,426 10,161 11,733

Right of use assets 13 57,602 73,852 67,463

Deferred tax assets 8,087 6,694 4,854

---------------------------------------------------- ---- ---------------- --------------------- -------------

76,698 92,627 84,966

Current assets

Inventories 14 56,118 53,571 33,441

Trade and other receivables 9,390 10,469 7,507

Derivative financial assets 18 1,134 1,775 -

Current tax asset 1,170 747 1,149

Cash and cash equivalents 2,458 10,971 10,196

---------------------------------------------------- ---- ---------------- --------------------- -------------

70,270 77,533 52,293

---------------------------------------------------- ---- ---------------- --------------------- -------------

Total assets 146,968 170,160 137,259

Current liabilities

Interest bearing loans and borrowings 15 5,000 4,000 -

Lease liabilities 15 22,110 23,830 23,449

Trade and other payables 60,028 66,948 34,479

Provisions 16 276 204 565

Derivative financial liabilities 18 84 - 1,048

87,498 94,982 59,541

Non-current liabilities

Lease liabilities 15 66,713 81,128 74,766

Provisions 16 893 767 1,298

67,606 81,895 76,064

---------------------------------------------------- ---- ---------------- --------------------- -------------

Total liabilities 155,104 176,877 135,605

---------------------------------------------------- ---- ---------------- --------------------- -------------

Net (liabilities) / assets (8,136) (6,717) 1,654

Equity attributable to equity holders of the Parent

Share capital 17 625 625 625

Share premium 17 28,322 28,322 28,322

Merger reserve (54) (54) (54)

Share based payment reserve 2,782 2,512 2,780

Hedging reserve 1,035 290 (331)

Retained earnings (40,846) (38,412) (29,688)

---------------------------------------------------- ---- ---------------- --------------------- -------------

Total equity (8,136) (6,717) 1,654

---------------------------------------------------- ---- ---------------- --------------------- -------------

Unaudited Condensed Consolidated Statement of Changes in

Equity

Attributable to equity holders

-----------------------------------------------------------------------

Share based

Share Share Merger Hedging payment Retained Total

capital premium reserve reserve(1) reserve earnings equity

For the 26 Weeks Ended 29 October 2023 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

At 30 April 2023 625 28,322 (54) 2,780 (331) (29,688) 1,654

Total comprehensive income / (expense) for

the period

Loss for the period - - - - - (11,012) (11,012)

Other comprehensive income - - - - 1,398 - 1,398

--------------------------------------------- ------- ------- ------- ---------- ----------- --------- --------

Total comprehensive income / (expense) for

the period - - - - 1,398 (11,012) (9,614)

Hedging gains and losses and costs of hedging

transferred to the cost of inventory - - - - (32) - (32)

--------------------------------------------- ------- ------- ------- ---------- ----------- --------- --------

Transactions with owners of the Company

Share-based payment charges - - - 2 - - 2

Acquisition of treasury shares - - - - - (146) (146)

Total transactions with owners - - - 2 - (146) (144)

--------------------------------------------- ------- ------- ------- ---------- ----------- --------- --------

Balance at 29 October 2023 625 28,322 (54) 2,782 1,035 (40,846) (8,136)

--------------------------------------------- ------- ------- ------- ---------- ----------- --------- --------

For the 26 Weeks Ended 30 October 2022 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

As at 1 May 2022 625 28,322 (54) 2,252 2,227 (11,741) 21,631

Cumulative adjustment to opening balance

(Note 13) - - - - - (21,253) (21,253)

--------------------------------------------- ------- ------- ------- ---------- ----------- --------- --------

Restated balance at 1 May 2022 625 28,322 (54) 2,252 2,227 (32,994) 378

--------------------------------------------- ------- ------- ------- ---------- ----------- --------- --------

Total comprehensive expense for the period

Loss for the period - - - - - (5,269) (5,269)

Other comprehensive expense - - - - (1,653) - (1,653)

--------------------------------------------- ------- ------- ------- ---------- ----------- --------- --------

Total comprehensive expense for the period - - - - (1,653) (5,269) (6,922)

Hedging gains and losses and costs of hedging

transferred to the cost of inventory - - - - (284) - (284)

--------------------------------------------- ------- ------- ------- ---------- ----------- --------- --------

Transactions with owners of the Company

Share-based payment charges - - - 260 - - 260

Acquisition of treasury shares - - - - - (149) (149)

Total transactions with owners - - - 260 - (149) 111

--------------------------------------------- ------- ------- ------- ---------- ----------- --------- --------

Balance at 30 October 2022 625 28,322 (54) 2,512 290 (38,412) (6,717)

--------------------------------------------- ------- ------- ------- ---------- ----------- --------- --------

For the 52 Weeks Ended 30 April 2023 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

--------------------------------------------- ------- ------- ------- ---------- ----------- --------- --------

Balance at 1 May 2022 625 28,322 (54) 2,252 2,227 (32,994) 378

Total comprehensive (expense) / income for

the period

Profit for the period - - - - - 5,271 5,271

Other comprehensive expense - - - - (2,733) - (2,733)

--------------------------------------------- ------- ------- ------- ---------- ----------- --------- --------

Total comprehensive (expense) / income for

the period - - - - (2,733) 5,271 2,538

Hedging gains and losses and costs of hedging

transferred to the cost of inventory - - - - 175 - 175

--------------------------------------------- ------- ------- ------- ---------- ----------- --------- --------

Transactions with owners of the Company

Share based payment charges - - - 528 - - 528

Dividend - - - - - (1,492) (1,492)

Own shares purchased by employee benefit

trust - - - - - (473) (473)

Total transactions with owners - - - 528 - (1,965) (1,437)

--------------------------------------------- ------- ------- ------- ---------- ----------- --------- --------

Balance at 30 April 2023 625 28,322 (54) 2,780 (331) (29,688) 1,654

--------------------------------------------- ------- ------- ------- ---------- ----------- --------- --------

(1) Hedging reserve includes GBP391k in relation to changes in

forward points which are recognised in other comprehensive income

and accumulated as a cost of hedging within the hedging reserve

(GBPNIL for the 26 weeks ended 30 October 2022, GBP170k for the 52

weeks ended 30 April 2023).

Unaudited Condensed Consolidated Cash Flow Statement

For the 26 weeks ended 29 October 2023

26 weeks to 26 weeks to 52 weeks to

29 October 2023 30 October 2022 30 April 2023

(Restated - Note 13)

GBP000 GBP000 GBP000

------------------------------------------------------------ ----------------- --------------------- --------------

Cash Flows From Operating Activities

(Loss) / profit for the period (11,012) (5,269) 5,271

Adjustments for:

Depreciation of property, plant and equipment 2,420 2,249 4,458

Impairment of property, plant and equipment 2,787 - 944

Reversal of impairment of property, plant and equipment (293) - (574)

Depreciation of right-of-use assets 14,789 8,000 14,840

Impairment of right-of-use assets 6,874 - 6,126

Reversal of impairment of right-of-use assets (2,140) - (2,562)

Amortisation of intangible assets 374 452 878

Impairment of intangible assets 450 - 1,118

Reversal of impairment of intangible assets (729) - -

Derivative exchange loss / (gain) 344 (390) (721)

Financial income (17) (23) (227)

Financial expense 275 330 518

Interest on lease liabilities 2,136 2,034 4,130

(Profit) / loss on disposal of property, plant and

equipment (174) (18) 149

Profit on disposal of right of use assets and lease

liability (2,583) (39) (1,105)

Profit relating to lease modifications (4,595) - -

(Profit) / loss on disposal of intangible assets (67) - 14

Share based payment charges 2 260 528

Taxation (3,757) (1,986) (265)

------------------------------------------------------------ ----------------- --------------------- --------------

Operating cash flows before changes in working capital 5,084 5,600 33,520

(Increase) / decrease in trade and other receivables (1,823) (1,706) 1,033

Increase in inventories (23,217) (24,030) (3,129)

Increase / (decrease) in trade and other payables 25,559 29,706 (1,443)

(Decrease) / increase in provisions (694) (146) 746

------------------------------------------------------------ ----------------- --------------------- --------------

Cash inflows from operating activities 4,909 9,424 30,727

Corporation tax paid - (1,487) (1,508)

------------------------------------------------------------ ----------------- --------------------- --------------

Net cash from operating activities 4,909 7,937 29,219

Cash flows from investing activities

Acquisition of property, plant and equipment (3,092) (2,744) (7,296)

Capital contributions received from landlords 659 971 1,928

Acquisition of intangible assets (695) (755) (1,309)

Interest received 17 23 227

------------------------------------------------------------ ----------------- --------------------- --------------

Net cash outflows from investing activities (3,111) (2,505) (6,450)

------------------------------------------------------------ ----------------- --------------------- --------------

Cash flows from financing activities

Payment of finance lease liabilities (capital element) (11,788) (12,223) (22,672)

Payment of finance lease liabilities (interest) (2,136) (2,028) (4,130)

Payment of RCF costs (60) (336) (336)

Other interest paid (349) (304) (321)

RCF drawdown 5,000 4,000 4,000

Repayment of bank borrowings - - (4,000)

Dividend paid - - (1,492)

Purchase of treasury shares (146) (149) (473)

------------------------------------------------------------ ----------------- --------------------- --------------

Net cash from financing activities (9,479) (11,040) (29,424)

Net decrease in cash and cash equivalents (7,681) (5,608) (6,655)

Exchange rate movements (57) 299 571

Cash and cash equivalents at beginning of Period 10,196 16,280 16,280

------------------------------------------------------------ ----------------- --------------------- --------------

Cash and cash equivalents at end of Period 2,458 10,971 10,196

------------------------------------------------------------ ----------------- --------------------- --------------

Notes to the Unaudited Condensed Consolidated Interim Financial

Statements

For the 26 weeks ended 29 October 2023

1 Accounting Policies

(a) General Information

TheWorks.co.uk plc ('the Company') is a public limited company

domiciled in the United Kingdom and its registered office is

Boldmere House, Faraday Avenue, Hams Hall Distribution Park,

Coleshill, Birmingham, B46 1AL. These unaudited condensed

consolidated interim financial statements ('interim financial

statements') as at and for the 26 weeks ended 29 October 2023

comprise the results of the Company and its subsidiaries (together

referred to as 'the Group').

(b) Basis of preparation

The interim financial statements have been prepared in

accordance with IAS 34 Interim Financial Reporting, and should be

read in conjunction with TheWorks.co.uk plc financial statements

for the 52 weeks ended 30 April 2023. The interim financial

statements do not include all of the information required for a

complete set of IFRS financial statements. However, selected

explanatory notes are included to explain events and transactions

that are significant to an understanding of the changes in the

Group's financial position and performance since the last annual

financial statements.

The consolidated financial statements are presented in pounds

sterling and all values are rounded to the nearest thousand

(GBP000), except when otherwise indicated.

(i) Going concern

The unaudited condensed financial statements have been prepared

on a going concern basis, which the Directors consider appropriate

for the reasons set out below.

The Directors have assessed the prospects of the Group, taking

into account its current position and the potential impact of the

principal risks which have been identified through the Group's risk

evaluation process.

In preparing its FY23 Annual Report and financial statements

(which were approved on 30 August 2023), the Group prepared a cash

flow forecast. On 9 November 2023, the Group issued its half year

trading update and included a revision to the profit forecast

reflecting the adverse impact on sales and significant cost

headwinds faced in the challenging macro-economic environment. The

revised forecast covers a period of 18 months from the date of

approval of these unaudited condensed financial statements, and is

henceforth referred to as the 'Base Case' scenario. In addition, a

'severe but plausible' 'Downside Case' sensitivity was prepared to

support the Board's conclusion regarding going concern, by stress

testing the Base Case to indicate the financial headroom resulting

from applying more pessimistic assumptions.

In assessing the basis of preparation the Directors

considered:

-- The external environment.

-- The Group's financial position including the quantum and

expectations regarding availability of bank facilities.

-- The potential impact on financial performance of the principal risks.

-- The output of the Base Case scenario, which represents the

Group's estimate of the most likely financial performance over the

forecast period.

-- Measures to maintain or increase liquidity in the event of a

significant downturn in trading.

-- The resilience of the Group to these risks having a more

severe impact, evaluated via the Downside Case which shows the

impact on the Group's cash flows, bank facility headroom and

covenants.

-- The response to situations in which consumer market

conditions are more severe than the Downside Case.

These factors are described below.

External environment

The risks which are considered the most significant to this

evaluation relate to the economy and the market, specifically their

effect on the strength of trading conditions, and the Group's

ability to successfully execute its strategy. The risk of weaker

consumer demand is considered to be the greater of these risks, due

to the continued high level of inflation and its potential effect

on economic growth and consumer spending.

An emerging risk has been noted in relation to the possible

effects of climate change, but this is not expected to have a

material financial impact on the Group during the forecast

period.

Financial position and bank facilities

At the Period end the Group held net debt (excluding lease

liabilities) of GBP2.5m (HY23: GBP7.0m) (Note 15).

The Group's bank facilities comprise a GBP20.0m revolving credit

facility (RCF) which terminates at the end of November 2026. The

facility includes two financial covenants which are structured in a

way that is typical for a retail business of this size and are

tested quarterly:

1. The level of net debt to LTM (last twelve months') EBITDA (maximum ratio 2.5x).

2. The "Fixed Charge Cover" or ratio of LTM EBITDA prior to

deducting rent and interest, to LTM rent and interest (minimum

ratio 1.20x until 31 October 2025, 1.25x until 31 October 2026 and

1.30x thereafter). In December 2023, the Group agreed an Amendment

to the facility agreement which resulted in a reset of the fixed

charge cover. Prior to the amendment, the ratios were, minimum

ratio 1.20x until 31 October 2024, 1.25x until 31 October 2025 and

1.30x thereafter).

Potential impact of risks on Base Case and Downside Case

scenarios

The 'Principal risks and uncertainties' section of the Strategic

report on pages 49 to 53 of the Group's FY23 Annual Report, sets

out the main risks that the Board considers relevant.

It is considered unlikely that all the risks would manifest

themselves to adversely affect the business at the same time. The

Directors have estimated what the most likely combination of risks

might be that could materialise within the going concern assessment

period and how the business might be affected; this combination of

risks is reflected in the Base Case assumptions. As noted above,

the most prominent risk in the near term is considered to be the

risk of lower consumer spending due to a weakened economy, which

could affect sales, costs and liquidity.

The Downside Case scenario takes into consideration the same

risks as the Base Case but assumes that their effects are more

severe, especially if consumer spending weakens further.

Base Case scenario

The Base Case scenario assumptions reflect the following

factors:

-- The Base Case sales growth in H2 FY24 reflects the trading

results over the Christmas period to end of December 2023.The

remaining forecast period reflects a stabilising consumer

environment, and product proposition changes and operational

improvements, offset with supply chain risk

-- The Base Case gross margin percentage reflects the expected

continuation of discounting, offset with favourable freight rates

from stock purchased earlier in the year. FY25 and FY26 margin

reflects improvements as a result of implementing operational

changes in the buying team following the appointment of the new

commercial director, favourable hedged FX rates, offset with

temporarily higher ocean container freight costs expected as a

result of the disruption in the Red Sea.

-- Anticipated further inflationary effects, in particular the

increase in the National Minimum Wage. In respect of other costs,

notably property occupancy costs, it is not expected that there

will be further significant inflationary effects during FY25,

following the significant increases (for example in electricity

costs) already experienced.

-- Capital expenditure levels are in line with the Group's

strategic plan. A significant proportion of the Group's capital

expenditure is discretionary, particularly over a short-term time

period. As a result, if required, it can therefore be reduced

substantially, for example, in the event the Group needing to

preserve cash.

-- The anticipated costs of the Group's net zero climate change

commitments have been incorporated within the Base Case model. As

set out in the climate related disclosures in the annual report,

the impact on the Group's financial performance and position is not

expected to be material in the short term.

Under the Base Case scenario, the Group expects to make routine

operational use of its bank facility each year as stock levels are

increased in September-October, prior to peak sales occurring.

The output of the Base Case model scenario indicates that the

Group has sufficient financial resources to continue to operate as

a going concern and for the financial statements to be prepared on

this basis.

Measures to maintain or increase liquidity in the event of a

significant downturn in trading

If necessary, mitigating actions can and would be taken in

response to a significant downturn in trading such as is described

below, which would increase liquidity.

These include, for example, delaying and reducing stock

purchases, stock liquidation, reductions in capital expenditure,

the review of payment terms and the review of dividend levels. Some

of these potential mitigations have been built into the Downside

Case model, and some are additional measures that would be

available in the event of that scenario, or worse, actually

occurring.

Severe but plausible Downside Case scenario

The Downside Case makes the following assumptions to reflect

more adverse macroeconomic conditions compared to the Base

Case:

-- Store LFL sales are assumed to be 0.5% lower than the Base

case for the remaining year to go in FY24), 4.5% lower than the

Base Case in FY25 and 4.3% lower in FY26.

-- In this scenario online sales are assumed to be lower than in

the Base Case during the forecast Period by 4.4% in FY25 and 4.1%

in FY26.

-- The product gross margin assumptions are 1.0 percentage lower

than the Base Case for FY25 and 1.2% lower than FY26, reflecting a

scenario of increased and extended disruption in the Red Sea

adversely impacting container freight rates. The majority of

expected FX requirements are hedged until the end of FY25. Other

gross margin inputs are relatively controllable, including via the

setting of selling prices to reflect any systematic changes in the

cost price of goods bought for resale.

-- Volume related costs in the Downside Case are lowered where

they logically alter in a direct relationship with sales levels,

for example, forecast online fulfilment and marketing costs. The

model also reflects certain steps which could be taken to mitigate

the effect of lower sales, depending on management's assessment of

the situation at the time. These include adjustments to stock

purchases, reducing capital expenditure, reductions in labour

usage, a reduction in discounts allowed as part of the Group's

loyalty scheme and the suspension of FY25 capital contribution

payments.

o The combined financial effect of the modified assumptions in

this scenario compared with the Base Case, during the forecast

period, including implementing some of the mitigating activities

available, would result in a reduction in store net sales of

approximately GBP13.9m.

o a reduction in online net sales of approximately GBP1.4m.

o a reduction to EBITDA of approximately GBP6.5m.

Under the Downside Case scenario, the Group expects to make

routine operational use of its bank facility each year as stock

levels are increased, prior to peak sales occurring.

The bank facility financial covenants are complied with during

the period.

On the basis of this Downside Case scenario with the "severe but

plausible" set of assumptions as described, the business would

continue to have adequate resources to continue in operation.

However, the Fixed charge covenant headroom at the quarterly

testing points falling within the going concern period is limited,

and there are reasonably plausible scenarios in which this headroom

could be eroded and create a borrowing requirement. For example, if

sales decreased by a further 1% during the going concern period

compared with the Downside Case, a breach of the covenant could

arise, however the Group would likely be in a net cash position at

this point. The Group has a strong relationship with its bank,

HSBC, and has a recent track record of working collaboratively with

the bank to resolve potential covenant issues, for example, a

waiver was agreed by HSBC in 2021 as noted in the Group's FY21

Annual Report and, as noted above, in December 2023 a covenant

amendment was agreed. Despite this strong relationship with the

bank and the recent evidence of successfully managing comparable

situations, if a borrowing requirement arose when the financial

covenants are not complied with, there is a risk that the Group

would not be able to utilise its borrowing facilities if

required.

The Directors believe that, should such a situation arise in

practice, it would have time before a potential breach to mitigate

further, and potentially to make arrangements with the bank, as has

occurred previously, to adjust the covenant levels to prevent a

breach. Furthermore, the Group has successfully managed through

challenging conditions during the COVID pandemic, and the Directors

believe it unlikely that comparably challenging conditions will be

experienced during the forecast period, despite the concerns

regarding the current macroeconomic conditions. Nevertheless,

despite the Directors' confidence in relation to these matters,

there is no certainty as to whether the mitigating actions would

provide the level of liquidity required in the time available to

implement them, nor whether the bank would make adjustments to the

financial covenants.

Conclusion regarding basis of preparation

Based on all of the above considerations the Directors believe

that it remains appropriate to prepare the financial statements on

a going concern basis. However, these circumstances indicate the

existence of a material uncertainty related to events or conditions

that may cast significant doubt on the Group's and the Company's

ability to continue as a going concern and, therefore, that the

Group and Company may be unable to realise their assets and

discharge their liabilities in the normal course of business. The

financial statements do not include any adjustments that would

result from the basis of preparation being inappropriate.

(ii) Accounting policies

The interim financial statements have been prepared on a basis

consistent with the accounting policies published in the Group's

financial statements for FY23.

(c) Alternative performance measures and Adjusting items

The Group tracks a number of alternative performance measures

(APMs) in managing its business, which are not defined or specified

under the requirements of IFRS because they exclude amounts that

are included in, or include amounts that are excluded from, the

most directly comparable measure calculated and presented in

accordance with IFRS, or are calculated using financial measures

that are not calculated in accordance with IFRS.

The Group believes that these APMs, which are not considered to

be a substitute for or superior to IFRS measures, provide

stakeholders with additional helpful information on the performance

of the business. They are consistent with how the business

performance is planned and reported internally, and are also

consistent with how these measures have been reported historically.

Some of the APMs are also used for the purpose of setting

remuneration targets.

The APMs should be viewed as supplemental to, but not as a

substitute for, measures presented in the consolidated financial

statements prepared in accordance with IFRS. The Group believes

that the APMs are useful indicators of its performance but they may

not be comparable with similarly titled measures reported by other

companies due to the possibility of differences in the way they are

calculated.

The key APMs that the Group uses include: like-for-like sales

growth (LFL); Pre-IFRS 16 Earnings before interest, tax,

depreciation and amortisation (Pre-IFRS 16 EBITDA), Profit before

tax and IFRS 16, Pre-IFRS 16 Adjusted EBITDA, Adjusted Profit; and

Adjusted earnings per share. The APMs used by the Group and

explanations of how they are calculated and how they can be

reconciled to a statutory measure where relevant, are set out in

Note 4.

"Adjusted" measures are calculated by adding back or deducting

Adjusting Items. Adjusting items are material in size and unusual

in nature or incidence and, in the judgement of the Directors,

should therefore be disclosed separately on the face of the

financial statements to ensure that the reader has a proper

understanding of the Group's financial performance and that there

is comparability of financial performance between periods.

Refer to Note 5 for information regarding items that were

treated as Adjusting.

(d) Key sources of estimation uncertainty

The preparation of consolidated financial statements requires

the Group to make estimates and judgements that affect the

application of policies and reported amounts.

Critical judgements represent key decisions made by management

in the application of the Group's accounting policies. Where a

significant risk of materially different outcomes exists, this will

represent a key source of estimation uncertainty.

Estimates and judgements are based on historical experience and

other factors, including expectations of future events that are

believed to be reasonable under the circumstances. Actual results

may differ from these estimates.

Key sources of estimation uncertainty which are material to the

interim financial statements are described in the context of the

matters to which they relate, in the following notes:

Description Note

--------------------------------------------------------------------------------------- ----

Going concern 1

Impairment of intangible assets, property, plant and equipment and right-of-use assets 13

--------------------------------------------------------------------------------------- ----

2 Segmental reporting

IFRS 8 requires segment information to be presented on the same

basis as is used by the Chief Operating Decision Maker for

assessing performance and allocating resources.

The Group has one operating segment with two revenue streams,

bricks and mortar stores and online. This reflects the Group's

management and reporting structure as viewed by the Board of

Directors, which is considered to be the Group's Chief Operating

Decision Maker. Aggregation is deemed appropriate due to both

operating segments having similar economic characteristics, similar

products on offer and a similar customer base.

3 Revenue

The Group's revenue is derived from the sale of finished goods

to customers. The following table shows the primary geographical

markets from which revenue is derived.

26 weeks ended 26 weeks ended 52 weeks ended

29 October 2023 30 October 2022 30 April 2023

GBP000 GBP000 GBP000

--------------------------- ---------------- ---------------- --------------

Sale of goods

- UK 120,588 116,933 275,305

- EU (Republic of Ireland) 1,987 1,999 4,797

--------------------------- ---------------- ---------------- --------------

Total revenues 122,575 118,932 280,102