ACV Panels Discuss using AI for Trusted Vehicle Valuation and Disposal Strategies at Used Car Week 2023

17 Noviembre 2023 - 10:22AM

ACV (Nasdaq: ACVA), the leading digital automotive marketplace and

data services partner for dealers and commercial clients, just

returned from another year as a platinum-level sponsor and

exhibitor at Used Car Week 2023, which took place in Scottsdale,

Arizona, from November 6-9. This annual conference united all

corners of the used-car industry and facilitated conversations with

dealers on the showroom floor that provided invaluable insights and

learnings.

During the event, several ACV executives shared their insights

on the overall industry, as well as the company’s ongoing work to

enhance its AI-based offerings and capabilities for its dealer and

commercial partners.

ACV Vice President of Major Accounts Kraig Quisenberry moderated

a panel on November 7 discussing the changing role of used-car

managers and their evolving needs to grow this segment of the

industry.

On November 8, ACV CEO George Chamoun participated in a panel

with several leaders in the auto auctions space to discuss the

current wholesale automotive landscape, technological evolutions,

the importance of ancillary services, and creating operational

efficiencies.

On November 9, ACV Vice President of Field Operations Doug

Hadden joined a workshop to discuss new developments in AI and

automotive tech that are helping businesses drive revenue growth.

Additionally, ACV Senior Director of Arbitration & PreScreen

Matt Arias joined a panel on how integrating engine diagnostic

information can enhance vehicle valuations, improve condition

reports and reduce arbitrations, and ACV & MAX Digital Director

of Major Accounts Tim Scoutelas moderated a panel that explored

trending and traditional methods to effectively redistribute

inventory within a group.

In addition to participating in these larger discussions and

presentations, executives were on site at ACV’s booth throughout

the event, engaging with dealers to develop deeper insights into

the challenges and desires dealer and commercial partners are

facing following three years of unprecedented production, inventory

and sales challenges. Key takeaways included:

- Economic Change & Preparation: Dealers

remain concerned about broader economic factors and how they relate

to the wholesale market. Dealers want to know how others in the

industry are navigating high interest rates and the overall market

volatility.

- Steady Supply of New Vehicles and Aged

Inventory: Now that there is a steadier supply of new

cars, dealers believe they no longer need to hold on to every

trade. However, they now need to act expeditiously with confidence

to make the right wholesale or retail decisions for their used

vehicles, paying close attention to turn-times for those they keep.

Large dealer groups are leveraging their multiple franchise stores

to keep retail-ready units within the network but move them to the

stores within the group where core inventory needs match. Dealers

report there is a renewed focus on determining the exit strategy

for every vehicle and having efficient turn-times for retail

units.

- Focus on Valuation: Commercial consignors

continue to emphasize vehicle valuation, depreciation, condition

and days to sell as key criteria as they select the partners who

can aid them in selling their vehicles. They also believe

inspections remain an integral role in the remarketing of vehicles,

including at the time of transport.

“Events like Used Car Week allow us to spend in-person, quality

time with many of our dealer and commercial partners and learn

about the challenges they face in an ever-changing market. I am so

proud of our teammates and thought leaders who were on site this

year,” said ACV CEO George Chamoun. “As the industry continues to

face extraordinary challenges, we remain committed to equipping our

dealers with innovative solutions to ensure they successfully

acquire and value vehicles with the utmost trust and transparency.

From consumer acquisition with tools such as ClearCar, to Private

Marketplaces for large dealer groups or commercial partners, to our

vibrant digital national marketplace to sell wholesale vehicles,

ACV always has our partners' needs top of mind. Their feedback and

insights are crucial as we continue to build our portfolio of

offerings and enhance the remarketing process.”

These topics, including new vehicle supply and the effects of

economic and industry changes, remain central to ACV. As ACV

recently discussed during its Q3 2023 earnings report, the company

expects conversion rates and wholesale price depreciation to follow

normal seasonal patterns for the balance of the year. Executives

also noted that vehicle supply remains lower than historical levels

but believe it will improve as new vehicle production and inventory

continue to recover. ACV continues to address these challenges with

the expansion of its AI-driven inspection solutions, including

ClearCar, which represents ACV’s growing suite of products to

enable dealers to more effectively acquire and value consumer

vehicles.

About ACVACV is on a mission to transform the

automotive industry by building the most trusted and efficient

digital marketplace and data solutions for sourcing, selling and

managing used vehicles with transparency and comprehensive insights

that were once unimaginable.ACV offerings include ACV Auctions, ACV

Transportation, ACV Capital, MAX Digital, True360, and ClearCar.

For more information about ACV, visit www.acvauto.com.

Trademark reference: ACV, the ACV logo, and ClearCar are

registered trademarks or trademarks of ACV Auctions, Inc. or its

affiliates in the United States and/or other countries. All other

trademarks referenced herein are the property of their respective

owners.

Media Contact:Maura

Dugganmaura@acvauctions.com

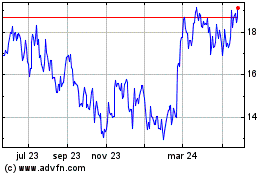

ACV Auctions (NASDAQ:ACVA)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

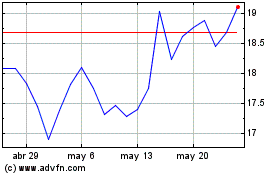

ACV Auctions (NASDAQ:ACVA)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025