Current Report Filing (8-k)

29 Junio 2023 - 7:04AM

Edgar (US Regulatory)

Addus HomeCare Corp false 0001468328 0001468328 2023-06-28 2023-06-28

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): June 29, 2023 (June 28, 2023)

ADDUS HOMECARE CORPORATION

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-34504 |

|

20-5340172 |

| (State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

| 6303 Cowboys Way, Suite 600 Frisco, Texas |

|

75034 |

| (Address of principal executive offices) |

|

(Zip Code) |

(469) 535-8200

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d- 2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e- 4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol(s) |

|

Name of each exchange on which registered |

| Common Stock, $0.001 par value per share |

|

ADUS |

|

The Nasdaq Stock Market, LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company. ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01 |

Entry into a Material Definitive Agreement. |

On June 28, 2023, Addus HealthCare, Inc., an Illinois corporation (“Addus HealthCare”) and a wholly-owned subsidiary of Addus HomeCare Corporation (the “Company”), entered into a Membership Interest Purchase Agreement (the “Purchase Agreement”) with (i) HHH Newco Holdings, LLC, a Michigan limited liability company (“Seller”), (ii) American Health Companies, LLC, a Tennessee limited liability company (“Seller Parent”), (iii) American HomeCare, LLC, a Tennessee limited liability company (“AHC”), (iv) Homecare, LLC, a Tennessee limited liability company (“Homecare”), (v) Tennessee Valley Home Care, LLC (d/b/a Tennessee Quality Care – Home Health), a Tennessee limited liability company (“TQC – Home Health”), and (vi) Tri-County Home Health and Hospice, LLC (d/b/a Tennessee Quality Care - Hospice), a Tennessee limited liability company (“TCQ – Hospice”, and together with AHC, Homecare, and TCQ – Home Health the “Acquired Companies”).

Pursuant to the Purchase Agreement, Addus HealthCare has agreed to directly acquire all of the issued and outstanding membership interests of AHC (the “Transaction”) for a cash purchase price of $106.0 million, subject to customary adjustments for working capital and other items. Based in Franklin, Tennessee, the Acquired Companies currently serve patients across the state of Tennessee.

The Transaction is expected to close in the third quarter of 2023, subject to, among other customary closing conditions, the accuracy of the representations and warranties in the Purchase Agreement, compliance with the covenants in the Purchase Agreement, and completion of all required regulatory approvals. Addus Healthcare and the Seller are also provided certain customary termination rights.

The Seller has made customary representations and warranties with respect to the businesses of the Acquired Companies, as well as customary covenants regarding the operation of the business of the Acquired Companies during the period between the execution of the Purchase Agreement and the closing of the Transaction. In lieu of indemnification by Seller for breaches of representations and warranties, Addus Healthcare has bound a policy for representations and warranties insurance. Consummation of the transaction contemplated by the Purchase Agreement is not subject to any financing condition, and there is no termination or reverse termination fee in connection with the Purchase Agreement.

| Item 7.01 |

Regulation FD Disclosure. |

On June 29, 2023, the Company issued the Press Release announcing the entry into the Purchase Agreement. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits:

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

ADDUS HOMECARE CORPORATION |

|

|

|

|

| Date: June 29, 2023 |

|

|

|

By: |

|

/s/ Brian Poff |

|

|

|

|

|

|

Brian Poff |

|

|

|

|

|

|

Chief Financial Officer |

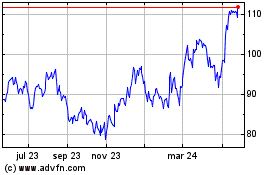

Addus HomeCare (NASDAQ:ADUS)

Gráfica de Acción Histórica

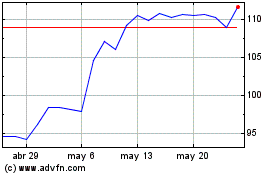

De May 2024 a Jun 2024

Addus HomeCare (NASDAQ:ADUS)

Gráfica de Acción Histórica

De Jun 2023 a Jun 2024