Filed

Pursuant to Rule 424(b)(5)a

Registration

No. 333-260958

PROSPECTUS

SUPPLEMENT

(To

Prospectus dated July 15, 2022)

ANTELOPE

ENTERPRISE HOLDINGS LTD.

$990,000

Convertible Note (Debt Securities)

Up

to 12,500,000 Class A Ordinary Shares issuable upon conversion of the $990,000 Convertible Note

We

are offering, in a registered direct offering to Indigo Capital LP, an accredited investor $990,000 principal amount of Convertible Note,

under Debt Securities (the “Convertible Note”). Securities are being issued pursuant to this prospectus supplement, the accompanying

base prospectus, that certain convertible promissory note purchase agreement, dated November 19, 2024, by and between the Company

and Indigo Capital LP (the “Purchaser”). This prospectus supplement also covers up to 12,500,000

Class A ordinary shares, no par value, issuable from time to time upon conversion of the Convertible Note and in lieu of the payment

of interest payable on the Convertible Note.

No

placement agent is involved in this offering.

Our

Class A ordinary shares are listed on the NASDAQ Capital Market under the symbol “AEHL”. On December 12, 2024, the

closing price of our Class A ordinary shares on the Nasdaq Capital Market was US$0.20.

There

is no established trading market for the Convertible Note, and we do not expect a market to develop. In addition, we do not intend to

apply for the listing of the Convertible Note on any national securities exchange or other trading market.

As of the date of this prospectus supplement,

pursuant to General Instruction I.B.5. of Form F-3, the Company has not conducted any transactions in the last 12 months, other than:

(a) a registered direct offering to the Purchaser to purchase $990,000 Class A Ordinary Shares pursuant to a convertible promissory

note purchase agreement dated September 25, 2024, (b) a registered direct offering to a certain investor to purchase

500,000 Class A Ordinary Shares on July 31, 2024, (c) a registered direct offering to certain investors to purchase

1,300,000 Class A Ordinary Shares on February 23, 2024 and (d) a registered offering to certain investors to purchase up to 31,300,000

Class A ordinary shares, consisting of (i) up to 30,000,000 Class A Ordinary Shares issuable and (ii) 1,300,000 Class A Ordinary Shares

issued upon exercise of certain warrants issued on February 23, 2024.

You

should read carefully this prospectus supplement and the documents incorporated by reference in this prospectus supplement before you

invest. Please see “Risk Factors” on page S-5 of this prospectus supplement and the risk factors incorporated by reference

into this prospectus supplement and the accompanying prospectus for more information.

Neither

the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed

upon the adequacy or accuracy of this prospectus supplement or the accompanying prospectus. Any representation to the contrary is a criminal

offense.

As

of the date of this prospectus supplement, the aggregate market value of the voting and non-voting common equity held by non-affiliates,

computed by reference to the average of the bid and asked prices of such common equity within 60 days prior to the date hereof at $0.20,

was $6,663,847, based on 31,013,740 Class A ordinary shares and 2,305,497 Class B ordinary shares outstanding as of

such date, of which 25,348,607 Class A ordinary shares were held by non-affiliates. Pursuant to General Instruction I.B.5 of Form

F-3, in no event will we sell securities in a public primary offering with a value exceeding more than one-third of our public float

in any 12-month period so long as our public float remains below $75.0 million. During the 12 calendar months prior to and including

the date of this prospectus, we have sold $3,540,000 pursuant to General Instruction I.B.5 of Form F -3.

We

are not a Chinese operating company but a British Virgin Islands holding company with operations conducted by our subsidiaries based

in China and that this structure involves unique risks to investors. Although we currently do not have or intend to have any contractual

arrangement to establish a VIE structure with any entity in mainland China, we are still subject to certain legal and operation risks

associated with our operating subsidiaries in China. Chinese regulatory authorities could disallow our current corporate structure, which

would likely result in a material change in our operations and a material change in the value of the securities we are registering for

sale, including that it could cause the value of such securities to significantly decline or become worthless.

We

are subject to certain legal and operational risks associated with being based in China. PRC laws and regulations governing our current

business operations are sometimes vague and uncertain, and as a result these risks may result in material changes in the operations of

the subsidiaries, significant depreciation of the value of our Class A Ordinary Shares, or a complete hindrance of our ability to offer

or continue to offer our securities to investors. Recently, the PRC government adopted a series of regulatory actions and issued statements

to regulate business operations in China, including cracking down on illegal activities in the securities market, enhancing supervision

over China-based companies listed overseas using variable interest entity structure, adopting new measures to extend the scope of cybersecurity

reviews, and expanding the efforts in anti-monopoly enforcement. As of the date of this prospectus, our Company, the subsidiaries have

not been involved in any investigations on cybersecurity review initiated by any PRC regulatory authority, nor has any of them received

any inquiry, notice or sanction. As of the date of this prospectus, there are currently no relevant laws or regulations in the PRC that

prohibit companies whose entity interests are within the PRC from listing on overseas stock exchanges. However, since these statements

and regulatory actions are newly published, official guidance and related implementation rules have not been issued. It is highly uncertain

what the potential impact such modified or new laws and regulations will have on our daily business operation, the ability to accept

foreign investments and our ability to continue our listing on an U.S. exchange.

Our

Class A Ordinary Shares may be delisted and prohibited from being traded under the Holding Foreign Companies Accountable Act if the Public

Company Accounting Oversight Board (the “PCAOB”) is unable to inspect our auditor. On May 20, 2020, the Senate passed the

Holding Foreign Companies Accountable Act prohibiting an issuer’s securities from being traded on a national exchange if the PCAOB

is unable to inspect the issuer’s auditors for three consecutive years. Pursuant to the Holding Foreign Companies Accountable Act,

(the “HFCAA”), if the Public Company Accounting Oversight Board, or the PCAOB, is unable to inspect an issuer’s auditors

for three consecutive years, the issuer’s securities are prohibited to trade on a U.S. stock exchange. The PCAOB issued a Determination

Report on December 16, 2021 which found that the PCAOB is unable to inspect or investigate completely registered public accounting firms

headquartered in: (1) mainland China of the People’s Republic of China because of a position taken by one or more authorities in

mainland China; and (2) Hong Kong, a Special Administrative Region and dependency of the PRC, because of a position taken by one or more

authorities in Hong Kong. Furthermore, the PCAOB’s report identified the specific registered public accounting firms which are

subject to these determinations. On June 22, 2021, United States Senate has passed the Accelerating Holding Foreign Companies Accountable

Act (the “Accelerating HFCAA”), which, if enacted, would decrease the number of “non-inspection years” from three

years to two years, and thus, would reduce the time before our securities may be prohibited from trading or delisted if the PCAOB determines

that it cannot inspect or investigate completely our auditor. Our former auditor, Centurion ZD CPA & Co (the “CZD CPA”),

the independent registered public accounting firm of the Company, is headquartered in Hong Kong. CZD CPA is currently subject to Public

Company Accounting Oversight Board (“PCAOB”) inspections under a regular basis. Our current auditor, ARK PRO CPA & CO

(the “ARK PRO”), is headquartered in Hong Kong, and is currently subject to the PCAOB inspections under a regular basis.

As of the date of the prospectus, ARK PRO, our current auditor, and CZD CPA, our former auditor, are not subject to the determinations

as to inability to inspect or investigate completely as announced by the PCAOB on December 16, 2021. On August 26, 2022, the PCAOB announced

that it had signed a Statement of Protocol (the “Statement of Protocol”) with the China Securities Regulatory Commission

and the Ministry of Finance of China. The terms of the Statement of Protocol would grant the PCAOB complete access to audit work papers

and other information so that it may inspect and investigate PCAOB-registered accounting firms headquartered in China and Hong Kong.

According to the PCAOB, its December 2021 determinations under the HFCAA remain in effect. The PCAOB is required to reassess these determinations

by the end of 2022. Under the PCAOB’s rules, a reassessment of a determination under the HFCAA may result in the PCAOB reaffirming,

modifying or vacating the determination. However, recent developments with respect to audits of China-based companies create uncertainty

about the ability of ARK PRO or CZD CPA to fully cooperate with the PCAOB’s request for audit work papers without the approval

of the Chinese authorities. In the event it is later determined that the PCAOB is unable to inspect or investigate completely the Company’s

auditor because of a position taken by an authority in a foreign jurisdiction, then such lack of inspection could cause trading in the

Company’s securities to be prohibited under the HFCAA ultimately result in a determination by a securities exchange to delist the

Company’s securities.

During

our fiscal year 2022, we were conclusively listed by the SEC as a Commission-Identified Issuer under the HFCAA following the filing of

our annual report on Form 20-F for the fiscal year ended December 31, 2021. Our auditor for the years ended December 31, 2022, 2021 and

2020, a registered public accounting firm that the PCAOB was not able to inspect or investigate completely in 2021 according to the PCAOB’s

December 16, 2021 determinations, issued the audit report for us for the fiscal year ended December 31, 2021. On December 15, 2022, the

PCAOB issued a HFCAA determination report that vacated its December 16, 2021 determinations and removed mainland China and Hong Kong

from the list of jurisdictions where it had been unable to completely inspect or investigate the registered public accounting firms.

For this reason, we do not expect to be identified as a Commission-Identified Issuer under the HFCAA as of the date of this prospectus.

The

jurisdictions in which our consolidated foreign operating entities are incorporated include mainland China, Hong Kong, and British

Virgin Islands. We hold 100% equity interests in its consolidated operating entities, except for Hainan Kylin Cloud Services

Technology Co., Ltd., in which the Company indirectly holds 51% equity interest. We reviewed (i) the shareholder register provided

by Transhare Corporation, our transfer agent, and (ii) Schedules 13D and 13G filed by the shareholders, the absence of any Schedule

13D or 13G filing made by any foreign governmental entity with respect to the Company’s securities, and the absence of foreign

government representation on its board of directors, we have no awareness or belief that we are owned or controlled by a government

entity in mainland China. We received written confirmations from the directors of the Company and its consolidated foreign

operating entities and each of them represented that he/she is not an official of the Chinese Communist Party. The currently

effective memorandum and articles of association of our Company and equivalent organizing documents of our consolidated foreign

operating entities do not contain any charter of the Chinese Communist Party.

Therefore,

to the best of our knowledge, no governmental entity in mainland China, Hong Kong, or the British Virgin Islands owns shares of our significant

consolidated foreign operating entities.

The

date of this prospectus supplement is December 17, 2024

TABLE

OF CONTENTS

ABOUT

THIS PROSPECTUS SUPPLEMENT

This

prospectus supplement and the accompanying prospectus are part of a “shelf” registration statement on Form F-3 that we filed

with the Securities and Exchange Commission (the “SEC”) using a “shelf” registration process.

This

document contains two parts. The first part consists of this prospectus supplement, which provides you with specific information about

this offering. The second part, the accompanying prospectus, provides more general information, some of which may not apply to this offering.

Generally, when we refer only to the “prospectus,” we are referring to both parts, combined. This prospectus supplement may

add, update or change information contained in the accompanying prospectus. To the extent that any statement we make in this prospectus

supplement is inconsistent with statements made in the accompanying prospectus or any documents incorporated by reference herein or therein

that we filed with the SEC before the date of this prospectus supplement, the statements made in this prospectus supplement will be deemed

to modify or supersede those made in the accompanying prospectus and such documents incorporated by reference herein and therein. You

should read this prospectus supplement and the accompanying prospectus, including the information incorporated by reference herein and

therein.

You

should rely only on the information that we have included or incorporated by reference in this prospectus supplement, the accompanying

prospectus and in any free writing prospectus we may authorize to be delivered or made available to you. We have not authorized anyone

to give any information or to make any representation other than those contained or incorporated by reference in this prospectus supplement,

the accompanying prospectus or any free writing prospectus we may authorize to be delivered or made available to you. You must not rely

upon any information or representation not contained or incorporated by reference in this prospectus supplement or the accompanying prospectus.

This prospectus supplement and the accompanying prospectus do not constitute an offer to sell or the solicitation of an offer to buy

any securities other than the registered securities to which they relate, nor does this prospectus supplement or the accompanying prospectus

constitute an offer to sell or the solicitation of an offer to buy securities in any jurisdiction to any person to whom it is unlawful

to make such offer or solicitation in such jurisdiction.

You

should not assume that the information contained in this prospectus supplement or the accompanying prospectus is accurate on any date

subsequent to the date set forth on the front of the document or that any information we have incorporated by reference herein or therein

is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus supplement or accompanying

prospectus is delivered, or securities are sold, on a later date.

This

prospectus supplement contains or incorporates by reference summaries of certain provisions contained in some of the documents described

herein, but reference is made to the actual documents for complete information. All of the summaries are qualified in their entirety

by the actual documents. Copies of some of the documents referred to herein have been or will be filed or have been or will be incorporated

by reference as exhibits to the registration statement of which this prospectus supplement forms apart, and you may obtain copies of

those documents as described in this prospectus supplement under the heading “Where You Can Find More Information.”

We

further note that the representations, warranties and covenants made by us in any agreement that is filed as an exhibit to any document

that is incorporated by reference into this prospectus supplement or the accompanying prospectus were made solely for the benefit of

the parties to such agreement, including, in some cases, for the purpose of allocating risk among the parties to such agreements, and

should not be deemed to be a representation, warranty or covenant to you. Moreover, such representations, warranties or covenants were

accurate only as of the date when made. Accordingly, such representations, warranties and covenants should not be relied on as accurately

representing the current state of our affairs.

Unless

otherwise stated in this prospectus, or the context otherwise requires, references to the “Company,” “we,” “us,”

“our” or “AEHL” refer specifically to Antelope Enterprise Holdings Ltd. When we refer to “you,” we

mean the potential holders of our securities. Capitalized terms used, but not defined, in this prospectus supplement are defined in the

accompanying prospectus.

PROSPECTUS

SUPPLEMENT SUMMARY

This

summary highlights information contained elsewhere or incorporated by reference in this prospectus supplement and the accompanying prospectus.

This summary does not contain all of the information that you should consider before deciding to invest in our ordinary shares. You should

read this entire prospectus supplement and the accompanying prospectus carefully, including the “Risk Factors” section contained

in this prospectus supplement, our financial statements and the related notes thereto and the other documents incorporated by reference

in this prospectus supplement and the accompanying prospectus.

Our

Business

We

are a British Virgin Islands limited liability company with no material operations. Our operations were conducted in China by our subsidiaries.

We provide livestream e-commerce services, business management and information systems consulting services business.

Livestreaming

Ecommerce Business

Our

livestreaming ecommerce business is operated in China through our 51% subsidiary, Hainan Kylin and its wholly-owned subsidiaries,

Hangzhou Kylin and Anhui Kylin. We aim to provide one-stop solutions for our customers who seek to sell their products utilizing

the emerging sales channel of livestreaming ecommerce. Our customers usually include consumer goods brands, merchants, and

small-scale ecommerce platforms. We believe that livestreaming ecommerce is an important growth engine for consumer good brands as

it leverages the content of livestreaming to boost consumer engagement and sales as it combines instant purchasing of a featured

product and audience participation through a chat function or reaction buttons. Our typical business model involves the promotion

of our customers’ goods by our hosts. Our product management office assesses and selects the products from our customers. We

then connect with different suppliers of hosts and influencers, usually staffing agencies that have a growing and diverse

pool of such individuals. We also work with freelance hosts and influencers. These hosts and influencers register

on Hainan Kylin’s SaaS platform and are matched with the specific products

that

our customers have engaged us to promote. The hosts and influencers then promote our customers’ products on

social media and various e-commerce platforms through livestreaming where a unique link is provided for each product.

The consumer is able to place an order for a product by clicking on the provided link. The purchase orders are either directed to the

sales sites of our customers where the consumer is able to pay for the product directly to the customer and the purchaser receives delivery

of the product directly from the vendor, or directed to third party sites (such as Douyin, China’s most downloaded video-sharing

platform and the mainland Chinese counterpart of TikTok, and Xiaohongshu and Kuaishou (very popular third party

e-commerce platforms), where the participating vendors ship the products to the purchaser upon the purchaser’s payment to

the third party ecommerce site. The third-partye-commerce sites forward the purchase price to our customers after deducting the

applicable costs.

Each

of vendors that engage us for our promotion services are required pay us a service fee in advance, the amount of which is approximately

15% to 30% of the retail price of the product to be promoted by our hosts and influencers. Upon each sale, which is marked by the consumer’s

payment for the product (either to our customer directly or to the third-party site), the corresponding advance payment is recognized

by us as revenue after deducting the commission payable to the host of the livestreaming site. We generally do not have any accounts

receivable or accounts payable in this type of sales cycle. Our service fees are not refundable in the event of a product return

by a consumer.

Hainan

Kylin has a limited operating history as it started its business in September 2021. For the fiscal year 2023, Hainan Kylin accounted

for 98.1% of our total revenue. For the fiscal year 2022, Hainan Kylin comprised virtually all of our ongoing business operations and

accounted for 84.5% of our total revenue.

Business

Management and Consulting Business

We

also provide business management and consulting services which consists of computer consulting services and software development through

our subsidiaries in China, including Chengdu Future and Antelope Chengdu. We diagnose difficulties in infrastructure and enterprise systems

and addresses business challenges that enterprises confront by developing strategies to surmount such hurdles to ensure the healthy growth

and development of our customers. Our consulting teams have advanced technological knowledge and capabilities to implement workflow solutions

via proprietary software products and services to help our customers with customized solutions to solve complex problems. For the years

ended December 31, 2023, 2022 and 2021, 1.4%, 3.9% and 6.0% of our total revenue, respectively was generated from our business management

and consulting business.

Planned

Energy Supply Business

The

Company is aiming to launch energy supply business through AEHL US, formerly known as Million Star US Inc. AEHL US has taken preliminary

steps in developing this business including engaging a broker to source natural gas from natural gas provider in Texas and the procurement

of electricity generators. AEHL US plans to supply power to a data center in Midland, Texas.

AEHL

US also plans to generate revenue by securing hosting sites for cryptocurrency mining operators as it leverages anticipated cost-effective

electricity costs.

Ceramic

Tile Business

We

historically operated a ceramic tile business which are used for exterior siding and for interior flooring and design in residential

and commercial buildings. We were manufacturer of ceramic tiles used for exterior siding and for interior flooring and design in residential

and commercial buildings in China. Since the ceramic tiles manufacturing business has experienced significant hurdles due to the significant

slowdown of the real estate sector and the impacts of COVID-19 in China, we decided to divest the ceramic tiles manufacturing business,

which had been conducted through our two subsidiaries, Hengda and Hengdali. On December 30, 2022, our operating entities for the ceramic

tile business entered into an agreement with an unaffiliated buyer to sell 100% equity interests of our ceramic tile business. On February

21, 2023, our shareholders approved the sale. On April 28, 2023, this transaction was closed.

For

the year ended December 31, 2022, we utilized production facilities capable of producing 1.40 million square meters ceramic tiles, as

compared with the year ended December 31, 2021, when we utilized production facilities capable of producing 2.38 million square meters.

During the year ended December 31, 2022, we had 10 production lines available for production and utilized two production lines during

the peak season. As of December 31, 2022, we had seven production lines available for production (all were from Hengda), one of which

was in use as of December 31, 2022.

Corporate

Information

Our

principal executive office is located at Room 1802, Block D, Zhonghai International Center, Hi- Tech Zone, Chengdu, Sichuan, People’s

Republic of China. Our telephone number at this address is +86 28 8532 4355. Our registered office is Craigmuir Chambers, Road Town,

Tortola, British Virgin Islands, and our registered agent is Harneys Corporate Services Limited. We maintain a website at http://www.aehltd.com

that contains information about our company. Information on this website is not part of this prospectus.

THE

OFFERING

| Convertible

Note Offered by us |

|

Convertible

Promissory Note with a principal amount of $990,000. The Convertible Note is being sold to

Indigo Capital LP with an original issue discount of 10%. The maturity date of the Convertible

Notes is 6 months after the date of issuance.

The

“Discount Rate” of the Convertible Notes shall be 80%. |

| |

|

|

| The

Class A Ordinary Shares |

|

A

holder may convert up to 12,500,000 Class A Ordinary Shares. |

| |

|

|

| Use

of Proceeds |

|

We

estimate that we will receive net proceeds of approximately US$891,000 from this offering based on the offering

price of US$990,000 for the Convertible Note. |

| |

|

|

| |

|

We

intend to use our net proceeds from this offering for, working capital and general corporate purposes. See “Use of Proceeds.”

|

| |

|

|

| Listing |

|

Our

Class A Ordinary Shares are listed on the Nasdaq Capital Market under the symbol “AEHL.” |

| |

|

|

| Transfer

Agent |

|

Equiniti

Trust Company, LLC, EQ, Shareowner Services, or any of their affiliates. |

| |

|

|

| Risk

factors |

|

Investing

in our securities involves a high degree of risk. Before investing in our securities, you should carefully consider the risk factors

described in the section titled “Risk Factors” beginning on page S-5 of this prospectus supplement as well as the risks

identified in documents that are incorporated by reference in this prospectus supplement. |

| (1) |

The

number of Class A Ordinary Shares outstanding immediately before this offering and to be outstanding after this offering is 31,013,740

based on our Class A Ordinary Shares outstanding as of December 12, 2024, but excludes 12,500,000 Class A Ordinary

Shares issuable upon conversion of the Convertible Note as of such date. |

RISK

FACTORS

An

investment in our securities involves risks. We urge you to consider carefully the risks described below, and in the documents incorporated

by reference in this prospectus supplement and the accompanying prospectus, before making an investment decision, including those risks

identified under “Item 3. Risk Factors” in our Annual Report on Form 20-F for the year ended December 31, 2023, which are

incorporated by reference in this prospectus supplement and which may be amended, supplemented or superseded from time to time by other

reports that we subsequently file with the SEC. Additional risks, including those that relate to any particular securities we offer,

may be included in a future prospectus supplement or free writing prospectus that we authorize from time to time, or that are incorporated

by reference into this prospectus supplement or the accompanying prospectus in connection with this offering. The risks and uncertainties

described therein and below are not the only risks facing us. Additional risks and uncertainties not presently known to us or that we

currently deem immaterial may also materially and adversely affect our business and operations. If any of these risks actually occurs,

our business, financial condition, results of operations or cash flow could be seriously harmed. This could cause the trading price of

our ordinary shares to decline, resulting in a loss of all or part of your investment. Please also read carefully the section below entitled

“Special Note Regarding Forward-Looking Statements.”

Risks

Related to the Offering

Raising

additional capital will be difficult and may cause dilution to our shareholders and restrict our operations.

We

expect to finance our cash needs to fund the operation of our newly acquired businesses and for our working capital. Although we have

been able to obtain funding from outside sources in the last year, we cannot be certain that we will be able to continue to do so or

to obtain additional financing on favorable terms.

To

the extent that we raise additional capital through the sale of equity or convertible debt, our shareholders’ ownership interest

will be diluted, and the terms of such securities may include liquidation or other preferences that adversely affect shareholder rights.

Debt financing and equity financing, if available, may involve agreements that include covenants limiting or restricting our ability

to take specific actions, such as incurring additional debt, making acquisitions or capital expenditures.

Since

our management will have broad discretion in how we use the proceeds from this offering, we may use the proceeds in ways with which you

disagree.

Our

management will have significant flexibility in applying the net proceeds of this offering. You will be relying on the judgment of our

management with regard to the use of those net proceeds, and you will not have the opportunity, as part of your investment decision,

to influence how the proceeds are being used. It is possible that the net proceeds will be invested in a way that does not yield a favorable,

or any, return for us. The failure of our management to use such funds effectively could have a material adverse effect on our business,

financial condition, operating results, and cash flow.

There

is no public market for the Convertible Notes or Warrants being offered in this offering.

There

is no established public trading market for the Convertible Note being offered in this offering, and we do not expect a market to develop.

In addition, we do not intend to apply to list such securities on any national securities exchange or trading system. Without an active

trading market, the liquidity of the Convertible Note will be limited.

You

will experience immediate and substantial dilution in the net tangible book value per ordinary share issuable pursuant to this offering

and may experience additional dilution of your investment in the future.

The

effective price per ordinary share issuable pursuant to this offering is substantially higher than the net tangible book value per ordinary

share outstanding prior to this offering. In addition, we may need to raise additional capital to fund our anticipated level of operations,

we may in the future sell substantial amounts of ordinary shares or securities convertible into or exchangeable for ordinary shares.

These future issuances of equity or equity-linked securities, together with the exercise or conversion of any options, warrants and/or

any additional Ordinary Shares or ordinary shares issued in connection with acquisitions, if any, will likely result in further dilution

to investors.

Future

sales of our ordinary shares, whether by us or our shareholders, could cause our ordinary shares price to decline.

If

our existing shareholders sell, or indicate an intent to sell, substantial amounts of our ordinary shares in the public market, the trading

price of our ordinary shares could decline significantly. Similarly, the perception in the public market that our shareholders might

sell our ordinary shares could also depress the market price of our ordinary shares. A decline in the price of our ordinary shares might

impede our ability to raise capital through the issuance of additional ordinary shares or other equity securities. In addition, the issuance

and sale by us of additional ordinary shares, or securities convertible into or exercisable for our ordinary shares, or the perception

that we will issue such securities, could reduce the trading price for our ordinary shares as well as make future sales of equity securities

by us less attractive or not feasible. The sale of ordinary shares issued upon the exercise of our outstanding options and warrants could

further dilute the holdings of our then existing shareholders.

SPECIAL

NOTE REGARDING FORWARD-LOOKING STATEMENTS

This

prospectus supplement, the accompanying prospectus and the other documents we have filed with the SEC that are incorporated herein by

reference contain “forward-looking statements” within the meaning and protections of Section 27A of the Securities Act of

1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking statements include statements with

respect to our beliefs, plans, objectives, goals, expectations, anticipations, assumptions, estimates, intentions, and future performance,

and involve known and unknown risks, uncertainties and other factors, which may be beyond our control, and which may cause the actual

results, performance, capital, ownership or achievements of the Company to be materially different from future results, performance or

achievements expressed or implied by such forward-looking statements. Forward-looking statements in this press release include, without

limitation, the continued stable macroeconomic environment in the PRC, the PRC real estate, construction and technology sectors continuing

to exhibit sound long-term fundamentals, our ability to bring additional ceramic tile production capacity online going forward as our

business improves, our ceramic tile customers continuing to adjust to our product price increases, our ability to sustain our average

selling price increases and to continue to build volume in the quarters ahead, and whether our enhanced marketing efforts will help to

produce wider customer acceptance of the new price points; and our ability to continue to grow our business management, information system

consulting, and online social commerce and live streaming business. All statements other than statements of historical fact are statements

that could be forward-looking statements. You can identify these forward-looking statements through our use of words such as “may,”

“will,” “anticipate,” “assume,” “should,” “indicate,” “would,”

“believe,” “contemplate,” “expect,” “estimate,” “continue,” “plan,”

“point to,” “project,” “could,” “intend,” “target” and other similar words

and expressions of the future.

All

written or oral forward-looking statements attributable to us are expressly qualified in their entirety by this cautionary notice, including,

without limitation, those risks and uncertainties described in our annual report on Form 20-F for the year ended December 31, 2023 and

otherwise in our SEC reports and filings. We have no obligation and do not undertake to update, revise or correct any of the forward-looking

statements after the date hereof, or after the respective dates on which any such statements otherwise are made.

We

may not actually achieve the plans, intentions or expectations disclosed in our forward-looking statements, and you should not place

undue reliance on our forward-looking statements. Actual results or events could differ materially from the plans, intentions and expectations

disclosed in the forward-looking statements we make. We have included important factors in the cautionary statements included in this

prospectus supplement and the prospectus to which it relates that we believe could cause actual results or events to differ materially

from the forward-looking statements that we make. Our forward-looking statements do not reflect the potential impact of any future acquisitions,

mergers, dispositions, joint ventures, collaborations or investments we may make. You should read this prospectus supplement, the accompanying

prospectus and the documents that we incorporate by reference in this prospectus supplement completely and with the understanding that

our actual future results may be materially different from what we expect.

USE

OF PROCEEDS

We

estimate the net proceeds to us from this offering will be approximately $870,000, after deducting estimated offering

expenses payable by us.

The

timing and amount of our actual expenditures will be based on many factors, including cash flows from operations and the anticipated

growth of our business. As of the date of this prospectus, we cannot specify with certainty all of the particular uses for the net proceeds

to us from this offering. As a result, our management will have broad discretion regarding the timing and application of the net proceeds

from this offering, and investor will be relying on the judgment of our management regarding the application of the net proceeds from

this offering.

MARKET

INFORMATION DIVIDEND POLICY

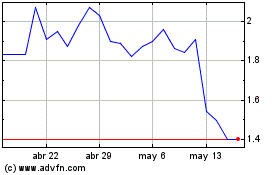

Our

Class A Ordinary Shares are currently traded on the Nasdaq Stock Market under the symbol “AEHL.” On December 12, 2024,

the closing sale price of our Class A Ordinary Shares was $0.20 per share.

We

have not declared or paid any cash dividends on our capital stock during the past five years, and we do not currently intend to pay any

cash dividends on our ordinary shares for the foreseeable future. We expect to retain future earnings, if any, to fund the development

and growth of our business. Any future determination to pay dividends on our ordinary shares will be at the discretion of our board of

directors and will depend upon, among other factors, our results of operations, financial condition, capital requirements and any contractual

restrictions.

DESCRIPTION

OF SECURITIES WE ARE OFFERING

Description

of Convertible Note

The

material terms and provisions of the Convertible Note being offered pursuant to this prospectus supplement and being issued to the Purchaser

are summarized below. The form of Convertible Note will be filed as an exhibit to a Current Report on Form 6-K with the SEC in connection

with this offering. The following summary of certain material terms and provisions of the Convertible Note does not purport to be a complete

description of the Convertible Note, and is subject to the detailed provisions of, and qualified in its entirety by reference to, the

Convertible Note.

Maturity

and Interest

The

principal and any accrued unpaid interest under this Convertible Note shall be due and payable upon demand at any time after May 19,

2025 (“Maturity Date”). The entire unpaid principal and accrued interest of this Note shall become immediately due and

payable upon the Company’s act of bankruptcy, execution of a general assignment for the benefit of creditors, filing or facing

a bankruptcy petition without dismissal for over 90 days, or the appointment of a receiver or trustee.

Interest

will accrue and be payable with each principal installment. Interest under this Convertible Note will not exceed the maximum rate allowed

by law.

Conversion

Upon

the election of the holder at any time, or in the event of an automatic conversion, the Company will issue to the holder a number of

shares equal to the conversion amount divided by the conversion price. The conversion amount means the amount of the Note that will be

converted into Conversion Ordinary Shares. The conversion price is calculated based on the closing price of the Company’s Class

A Ordinary Shares on the trading day immediately preceding the date of the Convertible Note, multiplied by the discount rate of 80%.

Automatic

Conversion

Change

of Control. In the event of a Change of Control prior to full repayment or conversion of the Convertible Note, the outstanding

principal will automatically convert into Class A Ordinary Shares. A Change of Control includes (i) the sale of all or most of the

Company’s assets (except to an Excluded Entity as defined in the Convertible Note), (ii) a merger, consolidation, or

reorganization with another entity (except to an Excluded Entity), or (iii) the transaction in which any person becomes the

beneficial owner of all outstanding voting securities. Exceptions to a Change of Control include changes in incorporation

jurisdiction, creating a holding company with substantially the same ownership, or obtaining Board-approved funding for the Company

in a financing.

Upon

Maturity. Upon the Maturity Date, any outstanding conversion amount will automatically convert into Class A Ordinary Shares, as if

the holder had elected to convert immediately prior to the Maturity Date, without needing the election of the holder.

Mechanics

of Conversion

Upon

the full conversion of this Convertible Note, the holder shall surrender this Note to the Company or any transfer agent and provide any

other applicable transaction documentation. For partial conversions, the holder is not required to surrender the Note but must deliver

a duly executed instrument of satisfaction reflecting the portion converted.

The

Transfer Agent will transmit the conversion ordinary shares to the holder by crediting their account through the Deposit or Withdrawal

at Custodian (DWAC) system within two (2) trading days after the holder submits their election. If the Transfer Agent fails to deliver

the shares on time, the Company will pay the holder $10 per trading day for every $1,000 of conversion ordinary shares until the shares

are delivered or the conversion is canceled.

If

the Company fails to timely cause the Transfer Agent to transmit the shares to the holder, and if the holder is required to purchase

or the brokerage firm purchases, the shares in satisfaction of a sale of the conversion shares, the Company will: (A) pay the holder

in cash the difference between the holder’s total purchase price for the shares and the amount obtained by multiplying the number

of conversion shares by the price at which the related sell order was executed, and (B) at the holder’s option, either reinstate

the portion of the warrant and equivalent number of shares for which such exercise was not honored (deeming the exercise rescinded) or

deliver the number of shares the holder should have received. No fractional shares will be issued upon conversion.

Share

Dividends and Splits

If

the Company, while this Convertible Note is outstanding and not fully converted, (i) pays a share dividend or makes a distribution on

its Ordinary Shares, (ii) subdivides its shares, (iii) combines its shares (including reverse split), or (iv) reclassifies its capital

stock, the conversion price will be adjusted. The new conversion price will be multiplied by a fraction where the numerator is the number

of Class A Ordinary Shares outstanding before the event and the denominator is the number of shares outstanding after. The total conversion

price of this Note remains unchanged.

Subsequent

Rights Offerings

If

the Company grants, issues, or sells Class A Ordinary Shares or equivalent rights to purchase shares, securities, or other property to

its shareholders pro rata (“Purchase Rights”), the holder will have the right to acquire the same Purchase Rights as if the

holder had fully converted this Note into Class A Ordinary Shares before the record date of the offering. However, if exercising such

rights would cause the holder to exceed the limitation, the rights will be held in abeyance until the holder can exercise them without

exceeding the limitation.

Pro

Rata Distributions

If

the Company, while this Convertible Note is outstanding and not fully converted, declares or makes any dividend or distribution of its

assets (or rights to acquire its assets) to the Class A Ordinary Shareholders, the holder will be entitled to participate in the distribution

as if the holder had fully converted the Note into Class A Ordinary Shares before the record date. However, if participating would cause

the holder to exceed the limitation, the excess portion will be held in abeyance until the holder can participate without exceeding the

limitation.

Fundamental

Transaction

If

the Company, while this Convertible Note is outstanding and not fully converted, undergoes a Fundamental Transaction, as defined in the

Convertible Note, the holder may, upon conversion of this Note, choose to receive the same consideration as the Company’s shareholders.

The conversion price will be adjusted. If the Company is not the surviving entity, the successor must assume the Company’s obligations

under this Note and provide a similar security, maintaining the holder’s economic value.

Governing

Law

The

Convertible Note is governed by, and construed in accordance with, the laws of the State of New York.

Description

of Class A Ordinary Shares

The

material terms and provisions of our Class A ordinary shares are described under the caption “Description of Share Capital”

beginning on page 34 to page 37 of the accompanying base prospectus.

We

are authorized to issue 250,000,000 ordinary shares, consisting of (a) 200,000,000 Class A ordinary shares with no par value each, and

(b) 50,000,000 Class B ordinary shares with no par value each, and (ii) 50,000,000 preferred shares with no par value each.

As

of the date of this prospectus supplement, there were 31,013,740 Class A ordinary shares and 2,305,497 Class B ordinary shares

outstanding and no shares of our preferred shares outstanding.

CAPITALIZATION

The

following table sets forth our capitalization as of June 30, 2024:

| | |

As of June 30, 2024 | |

| (in USD’000 except share data) | |

Actual | | |

As Adjusted

(unaudited) | | |

Pro forma as Adjusted

(unaudited) | |

| | |

USD’000 | | |

USD’000 | | |

USD’000 | |

| Shareholders’ Equity | |

| | | |

| | | |

| | |

| Ordinary shares, 300,000,000 shares authorized, 11,678,863 shares issued and outstanding, actual, and 17,612,262 shares issued and outstanding, pro forma as adjusted | |

| 11,678,863 | | |

| 14,612,262 | | |

| 17,612,262 | |

| Additional paid-in capital | |

| 99,346 | | |

| 102,360 | | |

| 103,350 | |

| Statutory reserves | |

| 21,238 | | |

| 21,238 | | |

| 21,238 | |

| Accumulated deficit | |

| (104,733 | ) | |

| (104,847 | ) | |

| (104,847 | ) |

| Accumulated other comprehensive income | |

| 1,294 | | |

| 1,294 | | |

| 1,294 | |

| Total shareholders’ equity | |

| 17,145 | | |

| 20,045 | | |

| 21,035 | |

| Noncontrolling interest | |

| 889 | | |

| 889 | | |

| 889 | |

| Total Equity | |

| 18,034 | | |

| 20,934 | | |

| 21,924 | |

You

should read this capitalization table in conjunction with Use of Proceeds, the financial statements and notes thereto and other financial

information incorporated by reference into this prospectus and any prospectus supplement. Our historical results do not necessarily indicate

our expected results for any future periods.

PLAN

OF DISTRIBUTION

We

have entered into a convertible promissory note purchase agreement directly with the Purchaser in connection with this offering,

and we will only sell Shares to the Purchaser, Indigo Capital, in this offering. Pursuant to the convertible promissory note purchase

agreement, the Purchaser agreed to purchase the Convertible Note for $990,000.

The

securities were offered directly to the Purchaser without a placement agent, underwriter, broker or dealer. All of the securities

sold in this offering will be sold at the same price and we expect a single closing. Our obligation to issue and sell securities to the

Purchaser is subject to the conditions set forth in the convertible promissory note purchase agreement. It is possible that not

all of the securities we are offering pursuant to this prospectus supplement will be sold at the closing, in which case our net proceeds

would be reduced. The closing of this offering is subject to customary closing conditions. We expect that the sale of the securities

will be completed on or around the date indicated on the cover page of this prospectus supplement. We estimate the total expenses of

this offering payable by us will be approximately $99,000.

The

form of convertible promissory note purchase agreement is included as an exhibit to our Current Report on Form 6-K that we will file

with the SEC in connection with the consummation of this offering. See “Where You Can Find More Information.”

We

expect that the sale of the Convertible Note will be completed on or about December 15, 2024.

The

transfer agent for our Class A Ordinary Shares is Equiniti Trust Company, LLC, EQ, Shareowner Services, or any of their affiliates.

LEGAL

MATTERS

The

validity of the Convertible Note and underlying Class A Ordinary Shares and other legal matters as to British Virgin Islands law will

be passed upon for us by Harney Westwood & Riegels. Carter Ledyard & Milburn LLP, New York, New York, will be passing on matters

of United States law for us with respect to the securities offered hereby.

EXPERTS

The

financial statements incorporated by reference in this prospectus have been audited by ARK PRO CPA & Co., and Centurion ZD CPA &

Co., our current and formal independent registered public accounting firms, and are included in reliance upon such reports given upon

the authority of said firms as experts in auditing and accounting.

WHERE

YOU CAN FIND MORE INFORMATION

This

prospectus supplement and the accompanying prospectus are part of a registration statement on Form F-3 we filed with the SEC under the

Securities Act and do not contain all the information set forth or incorporated by reference in the registration statement. Whenever

a reference is made in this prospectus supplement or the accompanying prospectus to any of our contracts, agreements or other documents,

the reference may not be complete and you should refer to the exhibits that are a part of the registration statement or the exhibits

to the reports or other documents incorporated by reference into this prospectus supplement or the accompanying prospectus for a copy

of such contract, agreement or other document. Because we are subject to the information and reporting requirements of the Exchange Act,

we file annual and current reports, proxy statements and other information with the SEC. The SEC also maintains an Internet site at http://www.sec.gov

that contains reports, statements and other information about issuers, such as us, who file electronically with the SEC.

INCORPORATION

OF CERTAIN INFORMATION BY REFERENCE

The

SEC allows us to “incorporate by reference” the information we file with them. This means that we can disclose important

information to you by referring you to those documents. Each document incorporated by reference is current only as of the date of such

document, and the incorporation by reference of such documents should not create any implication that there has been no change in our

affairs since the date thereof or that the information contained therein is current as of any time subsequent to its date. The information

incorporated by reference is considered to be a part of this prospectus and should be read with the same care. When we update the information

contained in documents that have been incorporated by reference by making future filings with the SEC, the information incorporated by

reference in this prospectus is considered to be automatically updated and superseded. In other words, in the case of a conflict or inconsistency

between information contained in this prospectus and information incorporated by reference into this prospectus, you should rely on the

information contained in the document that was filed later.

We

incorporate by reference the documents listed below:

| |

● |

our

Annual Report on Form

20-F for the fiscal year ended December 31, 2023, initially filed with the SEC on May 10, 2024 as amended on December 9, 2024; |

| |

|

|

| |

● |

the

Company’s Current Reports on Form 6-K, as filed with the SEC on June

6, 2024, June

27, 2024, July

3, 2024, August

5, 2024, and September

30, 2024, October

9, 2024, November

5, 2024, November

6, 2024, as amended on November

6, 2024, November

20, 2024 and December 9, 2024; and |

| |

|

|

| |

● |

the

description of our Class A ordinary shares, no par value contained in our annual report on Form 20-F, initially filed with the SEC

on May 10, 2024, and any amendment or report filed with the SEC for the purpose of updating the description. |

All

reports and other documents we subsequently file pursuant to Section 13(a), 13(c), 14 or 15(d) of the Exchange Act prior to the termination

of this offering, including all such documents we may file with the SEC after the date of this prospectus supplement and accompanying

prospectus, but excluding any information furnished to, rather than filed with, the SEC, will also be incorporated by reference into

this prospectus supplement and deemed to be part of this prospectus supplement from the date of the filing of such reports and documents.

You

may obtain a copy of any or all of the documents referred to above, which may have been or may be incorporated by reference into this

prospectus supplement, including exhibits, at no cost to you by writing or telephoning us at the following address:

Edmund

Hen, Chief Financial Officer

Antelope

Enterprise Holdings Ltd

Room

1802, Block D, Zhonghai International Center, Hi- Tech Zone

Chengdu,

Sichuan, People’s Republic of China

info@aehltd.com

Table of Contents

ABOUT THIS PROSPECTUS

Before you invest in any

of our securities, you should carefully read this prospectus and any applicable prospectus supplement, together with the additional information

described in the sections entitled “Incorporation of Documents by Reference” and “Where You Can Find Additional Information”

in this prospectus.

This prospectus is part of

a registration statement on Form F-3 that we filed with the Securities and Exchange Commission (the “SEC”) utilizing

a “shelf” registration process permitted under the Securities Act of 1933, as amended. By using a “shelf” registration

statement, we may sell any of our securities from time to time and in one or more offerings. This prospectus only provides you with a

summary description of these securities. Each time we sell securities, we will provide a supplement to this prospectus that contains

specific information about the securities being offered and the specific terms of that offering. The supplement may also add, update

or change information contained in this prospectus. If there is any inconsistency between the information in this prospectus and any

applicable prospectus supplement, you should rely on the prospectus supplement.

Certain Defined Terms and Conventions

Unless otherwise indicated,

references in this prospectus to:

| |

● |

“China”

or the “PRC” are to the People’s Republic of China, excluding, for the purpose of this prospectus only, Taiwan

and the special administrative regions of Hong Kong and Macau. |

| |

|

|

| |

● |

“RMB”

and “Renminbi” are to the legal currency of China (see “Exchange Rate Information” for translations of RMB

into U.S. dollars in this prospectus). This prospectus contains translations of certain RMB amounts into U.S. dollar amounts at specified

rates. We make no representation that the RMB or U.S. dollar amounts referred to in this prospectus could have been or could be converted

into U.S. dollars or RMB, as the case may be, at any particular rate or at all (also see “Risk Factors”). On June 3,

2022, the exchange rate was RMB 6.6595 to US$1.00. |

| |

|

|

| |

● |

“shares”

are to our shares, par value US$0.024 per share. |

| |

|

|

| |

● |

“$ ”, “US$ ” and “U.S. dollars” are to the legal currency of the United States. |

WHERE YOU CAN FIND MORE

INFORMATION

For the purposes of this

section, the term registration statement means the original registration statement and any and all amendments including the schedules

and exhibits to the original registration statement or any amendment. This prospectus does not contain all of the information included

in the registration statement we filed. For further information regarding us and the Shares offered in this prospectus, you may desire

to review the full registration statement, including the exhibits. The registration statement, including its exhibits and schedules,

may be inspected and copied at the public reference facilities maintained by the SEC at 100 F Street, N.E., Room 1580, Washington, D.C.

20549. You may obtain information on the operation of the public reference room by calling 1-202-551-8090. Copies of such materials are

also available by mail from the Public Reference Branch of the SEC at 100 F Street, N.E., Washington, D.C. 20549 at prescribed rates.

In addition, the SEC maintains a website (http://www.sec.gov) from which interested persons can electronically access the registration

statement, including the exhibits and schedules to the registration statement.

We are subject to the reporting

requirements of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) that are applicable to a foreign private

issuer. In accordance with the Exchange Act, we file reports with the SEC, including annual reports on Form 20-F. We also furnish to

the SEC under cover of Form 6-K material information required to be made public in the British Virgin Islands, filed with and made public

by any stock exchange or automated quotation system or distributed by us to our shareholders. As a foreign private issuer, we are exempt

from the rules under the Exchange Act prescribing the furnishing and content of proxy statements to shareholders. In addition, our officers,

directors and principal shareholders are exempt from the “short-swing profits” reporting and liability provisions contained

in Section 16 of the Exchange Act and related Exchange Act rules.

INCORPORATION OF CERTAIN

INFORMATION BY REFERENCE

The SEC allows us to “incorporate

by reference” the information we file with them. This means that we can disclose important information to you by referring you

to those documents. Each document incorporated by reference is current only as of the date of such document, and the incorporation by

reference of such documents should not create any implication that there has been no change in our affairs since the date thereof or

that the information contained therein is current as of any time subsequent to its date. The information incorporated by reference is

considered to be a part of this prospectus and should be read with the same care. When we update the information contained in documents

that have been incorporated by reference by making future filings with the SEC, the information incorporated by reference in this prospectus

is considered to be automatically updated and superseded. In other words, in the case of a conflict or inconsistency between information

contained in this prospectus and information incorporated by reference into this prospectus, you should rely on the information contained

in the document that was filed later.

We incorporate by reference

the documents listed below:

| |

• |

our Annual

Report on Form 20-F for the fiscal year ended December 31, 2021 filed with the SEC on May 2, 2022; and |

| |

• |

with respect to each offering

of securities under this prospectus, all our subsequent Annual Reports on Form 20-F and any report on Form 6-K that (i) we file or

furnish with the SEC on or after the date on which this prospectus is first filed with the SEC and until the termination or completion

of the offering under this prospectus and (ii) indicates that it is being incorporated by reference in this prospectus. |

Unless expressly incorporated

by reference, nothing in this prospectus shall be deemed to incorporate by reference information furnished to, but not filed with, the

SEC. We will provide to each person, including any beneficial owner, who receives a copy of this prospectus, upon written or oral request,

without charge, a copy of any or all of the documents we refer to above which we have incorporated by reference in this prospectus, except

for exhibits to such documents unless the exhibits are specifically incorporated by reference into this prospectus. You should direct

your requests to the attention of our chief financial officer at our principal executive office located in c/o Junbing Industrial Zone,

Anhai, Jinjiang City, Fujian Province, PRC. Our telephone number at this address is +86 (595) 8576 5053 and our fax number is Fax: +86

(595) 8576 5059.

You should rely only on the

information contained or incorporated by reference in this prospectus, in any applicable prospectus supplement or any related free writing

prospectus that we may authorize to be delivered to you. We have not authorized any other person to provide you with different information.

If anyone provides you with different or inconsistent information, you should not rely on it. We will not make an offer to sell these

securities in any jurisdiction where the offer or sale is not permitted. You should assume that the information appearing in this prospectus,

the applicable supplement to this prospectus or in any related free writing prospectus is accurate as of its respective date, and that

any information incorporated by reference is accurate only as of the date of the document incorporated by reference, unless we indicate

otherwise. Our business, financial condition, results of operations and prospects may have changed since those dates.

PROSPECTUS SUMMARY

Our Business

We are a Chinese manufacturer

of ceramic tiles used for exterior siding and for interior flooring and design in residential and commercial buildings. The ceramic tiles,

sold under the “HD” or “Hengda,” brands are available in over two thousand styles, colors and size combinations.

Currently, we have five principal product categories: porcelain tiles, glazed tiles, glazed porcelain tiles, rustic tiles, and polished

glazed tiles. Ceramic tiles are widely used in the PRC as a construction material for residential and commercial buildings. Ceramic tiles

are used for flooring, interior walls for decorative purposes and on exterior siding due to their resistance to temperature, extreme

environments, erosion, abrasion and discoloration for extended periods of time. Our manufacturing facilities, operated by Jinjiang Hengda

Ceramics Co., Ltd., are located in Jinjiang, Fujian Province, and our manufacturing facilities, operated by Jiangxi Hengdali Ceramic

Materials Co., Ltd., are located in Gaoan, Jiangxi Province. We have begun to execute on a corporate diversification strategy by incorporating

new subsidiaries which are mainly engaged in trending technology businesses in China. These include business management and consulting

including human resource restructuring and optimization, information system technology consulting services including the sales of software

use rights for digital data deposit platforms and asset management systems, and an online social media platform including live streaming

and e-commence platform development and consulting. Two of our new subsidiaries, Chengdu Future and Antelope Chengdu, made a modest contribution

to our financial performance for the year ended December 31, 2020, and Hainan Kylin Cloud Services, Antelope Chengdu and Chengdu Future

jointly made a significant contribution to our financial performance for the year ended December 31, 2021.

Chengdu Future Talented

Management and Consulting Co., Ltd (“Chengdu Future”), located in Chengdu, Sichuan Province, engages in a wide range of business

consultancy services. Its main focus is to provide comprehensive consulting services in the areas of enterprise management, information

systems, human resource management and operations engineering. It helps enterprises to develop and implement innovative solutions to

enable their growth, improve their performance and efficiency and to resolve technical pain points to ensure their financial and operational

stability. Chengdu Future plans to continue to expand the scope of its services and penetrate new markets across China.

Antelope Holdings (Chengdu)

Co., Ltd., (“Antelope Chengdu”), located in Chengdu, Sichuan Province, engages in management consulting services including

system process consulting, project analysis, financial analysis, and software products and services. It diagnoses difficulties in infrastructure

and enterprise systems and addresses business challenges that enterprises confront by developing strategies to surmount such hurdles

to ensure the healthy growth and development of its client companies. Its consulting teams have advanced technological knowledge and

capabilities to implement workflow solutions via proprietary software products and services to help its enterprise clients with customized

solutions to solve complex problems. Antelope Chengdu plans to continue to expand the scope of its services and penetrate new markets

across China.

Hainan Kylin Cloud Services

Technology Co., Ltd (“Hainan Kylin”), headquartered in Hainan Province, is an SAAS service platform that engages in online

social media platforms, including live streaming and e-commence platform development and consulting. Its online presence includes a human

resources platform that matches enterprises with a wide range of freelance workers and entrepreneurs. It is a leader in online employment

matching, including technical, professional and industrial supply chain job candidates, and replaces the traditional human resource structure.

Its online platform also provides entrepreneurial business consulting, skills training, resources for self-employment, counseling, compensation

payment system services and other financial services. The Hainan Kylin online employment platform is designed to save enterprises significant

costs in recruiting and hiring and covers 32 provinces in the PRC. Hainan Kylin also operates social e-commerce platforms such as Yunji

E-Commerce, Leke Unicorn, Douyin Live, KK Live, and others. It currently operates as a multi-channel network, or influencer network,

that works with live streaming video platforms to make their programming, partnerships digital rights, revenue and monetization effective.

It plans to expand its live streaming online platforms by developing an array of professional anchor broadcasters, as well as discover

and provide amateur anchors with training services, who would provide value-added content and services. Hainin Kylin integrates hundreds

of Internet, blockchain and financial institutions on to its online platforms. Its growth plans include entry into digital entertainment

such as video games, computer hardware digital products and e-sports.

Corporate Information

Our principal executive office

is located at Junbing Industrial Zone, Anhai, Jinjiang City, Fujian Province, People’s Republic of China. Our telephone number

at this address is +86 595 8576 5053. Our registered office is Craigmuir Chambers, Road Town, Tortola, British Virgin Islands, and our

registered agent is Harneys Corporate Services Limited. We maintain a website at http://www.aehltd.com that contains information about

our company. Information on this web site is not part of this prospectus.

Securities Being Offered

We may offer and sell shares,

debt securities or warrants in any combination from time to time in one or more offerings, at prices and on terms described in one or

more supplements to this prospectus. The debt securities and warrants may be convertible into or exercisable or exchangeable for our

shares or other securities. The aggregate initial offering price of all securities sold by us under this prospectus will not exceed US$75,000,000.

We may sell these securities directly to you, through underwriters, dealers or agents we select, or through a combination of these methods.

We will describe the plan of distribution for any particular offering of these securities in the applicable prospectus supplement. This

prospectus may not be used to sell our securities unless it is accompanied by a prospectus supplement.

U.S. securities laws currently

limit the value of the common shares that we may sell under this prospectus. For such time as our “public float”—measured

as the value of our share price (as of a date within 60 days before the date of the sale) times the number of shares held by non-affiliates—is

less than $75.0 million, existing law limits the value of shares that we can sell under this prospectus at one-third of our “public

float”, less prior amounts sold through prior primary offerings of securities on Form F-3 within the past 12 months. The public

float is measured at the time of sale, and will necessarily change with the value of our share price and the number of shares held by

non-affiliates. The aggregate value of the stock that we are able to sell is therefore highly contingent on our share price.

China Securities Regulatory Commission and

Cyberspace Administration of China

Antelope Enterprise, our

ultimate British Virgin Islands holding company, does not have any substantive operations other than indirectly holding the equity interest

in our operating subsidiaries in China and other countries and regions. As of the date of this prospectus, (i) Antelope Enterprise’s

business operations are carried out inside China; and (ii) it does not maintain any variable interest entity structure or operate

any data center in China. Antelope Enterprise may still be subject to PRC laws relating to, among others, data security and restrictions

over foreign investments due to the complexity of the regulatory regime in China, and the recent statements and regulatory actions by

the PRC government relating to data security may affect our business operations in China or even our ability to offer securities in the

United States. Neither Antelope Enterprise nor any of our subsidiaries has obtained the approval from either the China Securities Regulatory

Commission (the “CSRC”) or the Cyberspace Administration of China (the “CAC”) for any offering we or the selling

shareholders may make under this prospectus and any applicable prospectus supplement, and Antelope Enterprise does not intend to obtain

the approval from either the CSRC in connection with any such offering, since Antelope Enterprise does not believe, based upon advice

of our PRC counsel, Allbright Law Offices, that such approval is required under these circumstances or for the time being. There can

be no assurance, however, that regulators in China will not take a contrary view or will not subsequently require us to undergo the approval

procedures and subject us to penalties for non-compliance. See “Risk Factors—Risks Related to Doing Business in China.”

RECENT DEVELOPMENTS

December 2020 Private Placement

On December 7, 2020,

the Company executed subscription agreements (each a “Subscription Agreement”) in connection with a $1,314,001 private placement

of its ordinary shares with three accredited investors at the price of $2.32 per share (the “December 2020 Shares”).

All respective purchasers in the offering were “accredited investors” (as such term is defined under rules and regulations

promulgated under the Securities Act), and the Company sold the securities in the Offering in reliance upon an exemption from registration

contained in Section 4(2) and Rule 506 under the Securities Act. There were no discounts or brokerage fees associated

with this offering. The net proceeds of the offering were used for working capital and general corporate purposes.

February 2021 Capital Raising Transaction

On February 12, 2021,

we entered into a Securities Purchase Agreement with certain institutional investors for the sale by the Company of 588,236 shares at

a purchase price of $3.57 per share. The shares were offered by us pursuant to the shelf registration statement on Form F-3 (File

No. 333-228182), which was declared effective by the Securities and Exchange Commission on November 19, 2019. Concurrently

with the sale of the shares, the Company also sold the February 2021 Warrants to purchase 588,236 shares. The aggregate gross proceeds

of this offering were approximately $2.1 million, before commissions and expenses. Subject to certain beneficial ownership limitations,

the five-year February 2021 Warrants will be immediately exercisable at an exercise price equal to $3.57 per share, subject to adjustments

as provided under the terms of the February 2021 Warrants, and will terminate on the five-year anniversary of the initial exercise

date of the February 2021 Warrants. The closing of the sales of these securities took place on February 17, 2021.

The warrants and the shares

issuable upon exercise of the warrants were sold without registration under the Securities Act in reliance on the exemptions provided

by Section 4(a)(2) of the Securities Act as transactions not involving a public offering and Rule 506 promulgated under

the Securities Act as sales to accredited investors, and in reliance on similar exemptions under applicable state laws.

Dawson James Securities, Inc.

acted as our exclusive placement agent, on a best-efforts basis, in connection with the offering. We agreed to pay the Placement Agent

a cash placement fee equal to 8% of the gross proceeds of the offering, plus other expenses of the Placement Agent not to exceed $45,000.

The Placement Agent also received five-year February 2021 Placement Agent Warrants to purchase up to a number of common shares equal

to 5% of the aggregate number of shares sold in the offering, including the warrant shares issuable upon exercise of the warrants, which

such Placement Agent warrants have substantially the same terms as the February 2021 Warrants sold in the offering, except that

such February 2021 Placement Agent Warrants have an exercise price of $4.46 per share and will be exercisable six months from the

effective date of the February 2021 and will terminate on the five year anniversary of the effective date of the February 2021 offering.

June 2021 Capital Raising Transaction

On June 10, 2021, we

entered into Securities Purchase Agreements with three institutional accredited investors pursuant to which the Company sold 913,875