Filed pursuant to Rule 424(b)(5)

Registration No. 333-236897

Prospectus Supplement

(To Prospectus dated May 28, 2020)

2,898,552 Class A ordinary shares

AGM Group Holdings, Inc.

This prospectus supplement

and the accompanying base prospectus relate to an offering of an aggregate of 2,898,552 Class A ordinary shares, par value $0.001

per share (the “Class A ordinary shares”), of AGM Group Holdings, Inc. (the “Company”, “we”, “us”

or “our”).

In a concurrent private placement,

we are also selling warrants to purchase up to an aggregate of 1,449,276 of our Class A ordinary shares (the “Warrants”).

Each Warrant entitles the holder thereof to purchase one Class A ordinary share at an exercise price of $8.30 per share. The Warrants

are exercisable immediately and expire three and a half (3.5) years from the date of issuance. The Warrants and the Class A ordinary shares

underlying the Warrants (the “Warrant Shares”) are being offered pursuant to an exemption from the registration requirements

of the Securities Act of 1933, as amended (the “Securities Act”) contained in Section 4(a)(2) and/or Regulation D thereunder.

There is no established public trading market for the Warrants and we do not expect a market to develop. In addition, we do not intend

to apply for the listing of the Warrants on any national securities exchange or other trading market. Without an active trading market,

we expect the liquidity of the Warrants to be limited.

The sales of our Class A ordinary

shares, the Warrants, and the Warrant Shares will be made in accordance with a certain Securities Purchase Agreement, dated as of December

10, 2021, by and among us and the investors named therein (the “Securities Purchase Agreement”).

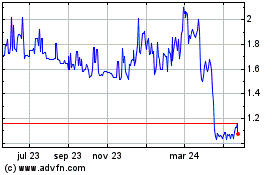

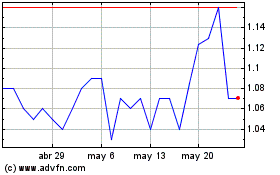

Our Class A ordinary shares

are listed on the Nasdaq Capital Market (“Nasdaq”) under the symbol “AGMH.” On December 9, 2021, the

last reported sales price of our Class A ordinary shares on Nasdaq was $8.67. Our stock price is volatile. During the period from

January 1, 2021 to December 9, 2021, our Class A ordinary shares have traded at a low of $7.38 and a high of $16.61.

We

are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, as amended, and a “foreign

private issuer” as defined under Rule 405 under the Securities Act, and Rule 3b-4c under the Exchange Act of 1934, as amended (the

“Exchange Act”), and, as such, are subject to reduced public company reporting requirements.

As of the date of this prospectus

supplement, the aggregate market value of our outstanding Class A ordinary shares and Class B ordinary shares held by non-affiliates, or

public float, was approximately US$124 million, which was calculated based on 14,256,290 Class A ordinary shares and 0 Class B

ordinary shares held by non-affiliates and a Class A ordinary share price of US$8.67, which was the closing price of our

Class A ordinary shares on Nasdaq on December 9, 2021. Accordingly, we are not subject to the limitations set forth in General

Instruction I.B.5 of Form F-3.

We have retained FT Global

Capital, Inc. (the “Placement Agent”) to act as our exclusive placement agent in connection

with this offering. The Placement Agent is not purchasing or selling any of the securities offered pursuant to this prospectus supplement

and the accompanying base prospectus. See “Plan of Distribution” beginning on page S-13 of this prospectus supplement

for more information regarding these arrangements.

|

|

|

|

Per

Class A

ordinary

share

|

|

|

|

Total

|

|

|

Public offering price

|

|

$

|

6.90

|

|

|

$

|

20,000,000

|

|

|

Placement Agent’s fees and commissions(1)

|

|

$

|

0.52

|

|

|

$

|

1,500,000

|

|

|

Proceeds to us, before expenses(2)

|

|

$

|

6.38

|

|

|

$

|

18,500,000

|

|

|

(1)

|

We will pay the Placement Agent a cash fee of 7.5% of the aggregate gross proceeds raised in this offering. We have also agreed to issue to the Placement Agent or its designees warrants to purchase up to 202,899 Class A ordinary shares, which amount equals 7% of the aggregate number of Class A ordinary shares sold in this offering, excluding the Warrant Shares. In addition, we have agreed to reimburse the Placement Agent for expenses up to $80,000, which amount is not included in the table above. See “Plan of Distribution” beginning on page S-13 of this prospectus supplement for more information regarding the compensation payable to and our other arrangements with the Placement Agent.

|

|

(2)

|

We estimate the total offering expenses of this offering that will be payable by us, excluding the Placement Agent’s fees and expenses, will be approximately $420,000.

|

AGM Group Holdings, Inc. is a holding company with no operations of

its own which conducts operations primarily through its operating subsidiaries in the British Virgin Islands, or BVI, Singapore, Hong

Kong and the People’s Republic of China, or the PRC. Investors in our Class A ordinary shares should be aware that they may never

directly hold equity interests in the Chinese operating entities, but rather they are purchasing equity solely in AGM Group Holdings Inc.,

a BVI holding company. Our Class A ordinary shares offered in this offering are shares of the BVI holding company and are not shares of

our subsidiaries in China. Because of our corporate structure, we as well as our investors are subject to unique risks due to uncertainty

of the interpretation and the application of the PRC laws and regulations. We are also subject to the risks of uncertainty about any future

actions of the PRC government in this regard. We may also be subject to sanctions imposed by PRC regulatory agencies including the China

Securities Regulatory Commission, or CSRC, if we fail to comply with their rules and regulations. If Chinese regulatory authorities disallow

our operating structure in the future, it will likely result in a material adverse change in our financial performance and our results

of operations and/or the value of our Class A ordinary shares, which could cause the value of such securities to significantly decline

or become worthless.

In addition, we face various

legal and operational risks and uncertainties related to being based in and having substantially all of our operations in the PRC. The

PRC government has significant authority to exert influence on the ability of a China-based company, such as us, to conduct its business,

accept foreign investments or list its securities on an U.S. or other foreign exchange. The PRC government also has significant discretion

over the conduct of our business and may intervene with or influence our operations as it deems appropriate to further regulatory, political

and societal goals. The PRC government has recently published new policies that significantly affected certain industries such as the

education and internet industries, and it may in the future release regulations or policies regarding our industry that could adversely

affect our business, financial condition and results of operations. Furthermore, the PRC government has recently indicated an intent to

exert more oversight and control over overseas securities offerings and foreign investment in China-based companies like us. Any such

action, once taken by the PRC government, could significantly limit or completely hinder our ability to offer securities to investors

and cause the value of such securities to significantly decline or in extreme cases, become worthless. For a detailed description of risks

related to doing business in China, see “Risk Factors” filed as Exhibit 99.3 to the current report on Form 6-K filed with

the Securities and Exchange Commission (the “SEC”) on September 29, 2021 and “Risk Factors” in “Item 3.

Key Information—D. Risk Factors” in our Annual Report on Form 20-F for the fiscal year ended December 31, 2020 (the “2020

Annual Report”).

Neither we nor any of our subsidiaries have obtained approval from

either the CSRC or the Cyberspace Administration of China, or CAC, for this offering, and we do not intend to obtain approval from either

the CSRC or the CAC in connection with this offering, since we do not believe that such approval is required under these circumstances

or for the time being. We cannot assure you, however, that regulators in China will not take a contrary view or will not subsequently

require us to undergo the approval procedures and subject us to penalties for non-compliance. Since these statements and regulatory

actions are new, it is highly uncertain how soon legislative or administrative regulation making bodies will respond, what existing or

new laws or regulations or detailed implementations and interpretations will be modified or promulgated, if any, and the potential impact

such modified or new laws and regulations will have on our daily business operation, the ability to accept foreign investments and list

our securities on an U.S. or other foreign exchange.

Investing in our securities

involves a high degree of risk. You should read carefully this prospectus supplement, the accompanying base prospectus and the documents

incorporated by reference into this prospectus supplement and the accompanying base prospectus before accepting any Class A ordinary shares.

The securities offered by this prospectus involve a high degree of risk including but not limited to the volatility of our stock price.

For a description of the risks of investing in our securities, see the section entitled “Risk Factors” beginning on page S-7 as well as the matters described under the caption “Risk Factors” beginning on page 4 of the accompanying base

prospectus.

Neither the SEC, nor the

British Virgin Islands or any state securities commission has approved or disapproved of these securities or determined if this prospectus

is truthful or complete. Any representation to the contrary is a criminal offense.

Delivery of the Class A ordinary

shares pursuant to this prospectus supplement and accompanying base prospectus against payment in U.S. dollars will occur on or about

December 14, 2021.

FT Global Capital, Inc.

The date of this prospectus supplement is December

13, 2021

You should rely only on the information contained

or incorporated by reference in this prospectus or any prospectus supplement. We have not authorized any person to provide you with different

or additional information. If anyone provides you with different or inconsistent information, you should not rely on it. This prospectus

is not an offer to sell securities, and it is not soliciting an offer to buy securities in any jurisdiction where the offer or sale is

not permitted. You should assume that the information appearing in this prospectus or any prospectus supplement, as well as information

we have previously filed with the SEC and incorporated by reference, is accurate as of the date on the front of those documents only.

Our business, financial condition, results of operations and prospects may have changed since those dates.

ABOUT THIS PROSPECTUS SUPPLEMENT

On March 5, 2020, we filed

with the SEC a registration statement on Form F-3 (File No. 333-236897), utilizing a “shelf” registration process relating

to the securities described in this prospectus supplement, which registration statement, as amended, was declared effective by the SEC

on May 28, 2020. Under this “shelf” registration process, we may, from time to time, in one or more offerings, offer and sell

up to US$100,000,000 of any combination, together or separately, of our Class A ordinary shares, Class A ordinary shares in the form of

share purchase contracts, share purchase units, debt securities, warrants, rights, units, or any combination thereof as described in the

accompanying base prospectus.

This document is in two parts,

this prospectus supplement and the accompanying base prospectus, both of which are part of a registration statement on Form F-3 that

we filed with the SEC using a “shelf” registration process.

The two parts of this document

include: (1) this prospectus supplement, which describes the specific details regarding this offering of our Class A ordinary shares

and the privately placed Warrants and other matters relating to us; and (2) the accompanying base prospectus, which provides a general

description of the securities that we may offer, some of which may not apply to this offering. Generally, when we refer to this “prospectus,”

we are referring to both documents combined. You should rely only on the information contained in this prospectus supplement and the accompanying

base prospectus. We have not authorized anyone else to provide you with additional or different information. If information in this prospectus

supplement is inconsistent with the accompanying base prospectus, you should rely on this prospectus supplement. You should read this

prospectus supplement together with the additional information described below under the headings “Where You Can Get More Information”

and “Incorporation by Reference.”

Any statement made in this

prospectus supplement or in a document incorporated or deemed to be incorporated by reference into this prospectus supplement will be

deemed to be modified or superseded for purposes of this prospectus supplement to the extent that a statement contained in this prospectus

supplement or in any other subsequently filed document that is also incorporated by reference into this prospectus supplement modifies

or supersedes that statement. Any statements so modified or superseded will be deemed not to constitute a part of this prospectus supplement

except as so modified or superseded. In addition, to the extent of any inconsistencies between the statements in this prospectus supplement

and similar statements in any previously filed report incorporated by reference into this prospectus supplement, the statements in this

prospectus supplement will be deemed to modify and supersede such prior statements. We will disclose any material changes in our affairs

in a post-effective amendment to the registration statement of which this prospectus is a part, a prospectus supplement, or a future filing

with the SEC incorporated by reference in this prospectus.

The registration statement

that contains this prospectus supplement, including the exhibits to the registration statement and the information incorporated by reference,

contains additional information about the securities offered under this prospectus supplement. That registration statement can be read

on the SEC’s website mentioned below under the heading “Where You Can Get More Information.”

We are responsible for the

information contained and incorporated by reference in this prospectus supplement, the accompanying base prospectus and any related free

writing prospectus that we prepare or authorize. We have not authorized anyone to provide you with different or additional information,

and we take no responsibility for any other information that others may give you. If you receive any other information, you should not

rely on it.

We are offering to sell, and

seeking offers to buy, our Class A ordinary shares pursuant to this prospectus supplement and the accompanying base prospectus only in

jurisdictions where such offers and sales are permitted. This prospectus supplement and the accompanying base prospectus do not constitute

an offer to sell or the solicitation of an offer to buy any securities other than the registered securities to which this prospectus supplement

relates, nor do this prospectus supplement and the accompanying base prospectus constitute an offer to sell or the solicitation of an

offer to buy securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

No action is being taken in any jurisdiction outside the United States to permit a public offering of our Class A ordinary shares or any

of the privately placed Warrants or possession or distribution of this prospectus supplement or the accompanying base prospectus in that

jurisdiction. Persons who come into possession of this prospectus supplement or the accompanying base prospectus in jurisdictions outside

the United States are required to inform themselves about and to observe any restrictions as to this offering and the distribution of

this prospectus supplement and the accompanying base prospectus applicable to that jurisdiction.

You should not assume that

the information in this prospectus supplement and the accompanying base prospectus is accurate at any date other than the date indicated

on the cover page of this prospectus supplement or that any information that we have incorporated by reference is correct on any

date subsequent to the date of the document incorporated by reference. Our business, financial condition, results of operations or prospects

may have changed since that date.

You should not rely on or

assume the accuracy of any representation or warranty in any agreement that we have filed in connection with this offering or that we

may otherwise publicly file in the future because any such representation or warranty may be subject to exceptions and qualifications

contained in separate disclosure schedules, may represent the applicable parties’ risk allocation in the particular transaction,

may be qualified by materiality standards that differ from what may be viewed as material for securities law purposes or may no longer

continue to be true as of any given date.

Except where the context otherwise

requires and for purposes of this prospectus only, “we,” “our,” “us,” “our company,” and

the “Company” refer to:

|

|

●

|

AGM Group Holdings, Inc. (“AGM Holdings”), a company incorporated under the laws of the British Virgin Islands;

|

|

|

●

|

AGM Technology Limited, (“AGM HK”) a company incorporated under the laws of Hong Kong SAR and a wholly-owned subsidiary of AGM Holdings;

|

|

|

●

|

AGM Software Service LTD (“AGM Software”), a company incorporated under the laws of the British Virgin Islands and a wholly-owned subsidiary of AGM Holdings;

|

|

|

●

|

AGM Defi Tech Limited (“AGM Defi Tech”), a company incorporated under the laws of Hong Kong SAR and a wholly-owned subsidiary of AGM Holdings;

|

|

|

●

|

AGM Defi Lab Pte Limited (“AGM Defi Lab”), a company incorporated under the laws of Singapore and a wholly-owned subsidiary of AGM Holdings;

|

|

|

●

|

AGM Tianjin Construction Development Co., Ltd. (“AGM Tianjin”)

(also referred to as 天津安高盟建设发展有限公司 in China),

formerly known as Shenzhen AnGaoMeng Financial Technology Service Co., Ltd. (or 深圳安高盟金融科技服务有限公司

in China), a wholly foreign-owned enterprise (“WFOE”) formed under the laws of the People’s Republic of China (the “PRC”)

and a wholly-owned subsidiary of AGM HK;

|

|

|

●

|

Nanjing Lucun Semiconductor Co., Ltd. (“Nanjing Lucun”) (also referred to as南京禄存半导体有限公司in China), a WFOE formed under the laws of the PRC and a wholly-owned subsidiary of AGM HK;

|

|

|

●

|

Beijing AnGaoMeng Technology Service Co., Ltd. (“AGM Beijing”) (also referred to as 北京安高盟科技服务有限公司 in China), a company incorporated under the laws of the PRC and a wholly-owned subsidiary of AGM Tianjin; and

|

|

|

●

|

Beijing Keen Sense Technology Service Co., Ltd (“Beijing Keen Sense”) (also referred to as 北京肯森瑟科技服务有限公司 in China), a company incorporated under the laws of the PRC and a wholly-owned subsidiary of AGM Defi Tech.

|

SPECIAL NOTICE REGARDING FORWARD-LOOKING

STATEMENTS

This prospectus supplement, the accompanying base prospectus and our

SEC filings that are incorporated into this prospectus supplement contain or incorporate by reference forward-looking statements. All

statements contained in this prospectus supplement, the accompanying base prospectus and our SEC filings that are incorporated into this

prospectus supplement, other than statements of historical fact, including statements regarding our future results of operations and financial

position, our business strategy and plans, and our objectives for future operations, are forward-looking statements. The words “believe,”

“may,” “will,” “estimate,” “continue,” “anticipate,” “intend,”

“expect,” and similar expressions are intended to identify forward-looking statements. We have based these forward-looking

statements largely on our current expectations and projections about future events and trends that we believe may affect our financial

condition, results of operations, business strategy, short-term and long-term business operations and objectives, and financial needs.

Such statements are subject to risks and uncertainties, and actual results may differ materially from those expressed or implied in the

forward-looking statements due to of various factors, including, but not limited to, those identified in the “Risk Factors”

filed as Exhibit 99.3 to the current report on Form 6-K filed with the SEC on September 29, 2021, under the section entitled “Item

3. Key Information—3.D. Risk Factors” in the 2020 Annual Report, the section entitled “Risk Factors” beginning

on page S-7 of this prospectus supplement, and the section entitled “Risk Factors” beginning on page 4 of the accompanying

base prospectus. Moreover, we operate in a very competitive and rapidly changing environment. New risks emerge from time to time. It is

not possible for our management to predict all risks, nor can we assess the impact of all factors on our business or the extent to which

any factor, or combination of factors, may cause actual results to differ materially from those contained in any forward-looking statements

we may make. In light of these risks, uncertainties and assumptions, the future events and trends discussed in this prospectus may not

occur and actual results could differ materially and adversely from those anticipated or implied in the forward-looking statements.

These forward-looking statements

are based on information available as of the date of this prospectus and our management’s current expectations, forecasts and assumptions,

and involve a number of judgments, known and unknown risks and uncertainties and other factors, many of which are outside our control.

Accordingly, forward-looking statements should not be relied upon as representing our views as of any subsequent date. We do not undertake

any obligation to update, add or to otherwise correct any forward-looking statements contained herein to reflect events or circumstances

after the date they were made, whether as a result of new information, future events, inaccuracies that become apparent after the date

hereof or otherwise, except as may be required under applicable securities laws.

Although we believe that our

plans, intentions, and expectations reflected in or suggested by the forward-looking statements we make in this prospectus are reasonable,

we can give no assurance that these plans, intentions, or expectations will be achieved. As a result of known and unknown risks and uncertainties,

our actual results or performance may be materially different from those expressed or implied by these forward-looking statements. Factors

that could cause our actual performance, future results and actions to differ materially from any forward-looking statements include,

but are not limited to, those discussed under the heading “Risk Factors” in any of our filings with the SEC pursuant to Sections

13(a), 13(c), 14 or 15(d) of the Exchange Act. In addition, there is uncertainty about the spread of the COVID-19 virus and the impact

it may have on the Company’s operations, the demand for the Company’s products, global supply chains and economic activity

in general. The forward-looking statements in this prospectus, the applicable prospectus supplement or any amendments thereto and the

information incorporated by reference in this prospectus represent our views as of the date such statements are made. These forward-looking

statements should not be relied upon as representing our views as of any date subsequent to the date such statements are made. Except

as required by law, we undertake no obligation to update publicly any forward-looking statements, whether as a result of new information,

future events, or otherwise.

PROSPECTUS

SUPPLEMENT SUMMARY

The following summary

highlights, and should be read in conjunction with, the more detailed information contained elsewhere in this prospectus supplement, the

accompanying base prospectus, and the documents incorporated therein by reference. You should read carefully the entire documents, including

our financial statements and related notes, to understand our business, the Class A ordinary shares, and the other considerations that

are important to your decision to invest in the Class A ordinary shares. You should pay special attention to the “Risk Factors”

sections beginning on page S-7 of this prospectus supplement and on page 4 of the accompanying base prospectus.

Company Overview

We

are a technology company. Our products and services include: 1) a futures trading solution catering to clients using MetaTrader 5; 2)

FXSC, a retail-orientated online trading education website; 3) a foreign exchange (“Forex”) trading system that provides services

to financial institutions outside of China; and 4) technology hardware research and development, manufacture, and sales. Our mission is

to become one of the key participants and contributors in the global technology hardware supply chain and fintech blockchain ecosystem.

Futures trading system

In September 2019, we, through AGM Defi Lab, completed our development

of a futures trading software which integrates future trading API with MetaTrader 5, a well-known and advanced trading software. However,

during the third quarter of 2020, most futures brokers started to accept a new third-party software API connection method in order

to comply with newly enacted futures regulations and policies in China about the trading terminal API pass-through regulation, which requires

“pass through monitoring”. Brokers will need to know exactly who to use API from what third-party software since, traditionally,

brokers did not need to collect such information. All other software products on the market are required to comply with the new rule.

Accordingly, we were obligated to upgrade and transform the system to enable this new API connection method. We completed the upgrading

and transformation of the system at the end of first quarter of 2021. We plan to conduct new trials and improve the solutions based

on feedbacks.

FXSC, a retail-orientated online trading education

website

In July 2020, we launched

FXSC through AGM Defi Lab, a subscription-based online trading education and social trading network platform for Forex traders. FXSC provides

trading education to users through interactive trading simulation and trading contests, which enable users to choose and participate in

available contests and compete for prizes in a real-time streamed, interactive demo trading environment. FXSC also provides demo trading,

also referred to as virtual trading, paper trading, or trading simulation, which is designed to give users, especially the ones with limited

knowledge and skills, a risk-free trading environment to get familiar with the markets and trading tools. We plan to charge subscription

fees directly to end-users for using the social and educational features of the platform. In addition, through partnership with brokers

that integrate its accounts management system with FXSC, we plan to charge brokers a per client monthly service fee for their clients

using FXSC. The launch of FXSC is expected to build our brand. We plan to use some of the proceeds from this offering to invest in mass

marketing of FXSC.

Forex trading system

Prior to September 2018, through AGM Defi Lab, we provided Forex trading

services, including computer program technical support and solution services and trading platform application services, through a combination

of in-house developed systems and applications, and the licensed trading platform MetaTrader. In addition, we were engaged in Forex

trading brokerage business and generated revenue from gains and losses from trades and Forex brokerage fees and commissions. At

the time, our clients were retail clients and brokerage firms located in China. We voluntarily discontinued the Forex trading system due

to a policy position by the PRC government that would no longer support the Forex trading related business and would restrain certain

accounts holding the deposits payable. In December 2021, we commenced the sale of our trading system software to our brokerage clients

and partners.

Technology hardware

research and development, manufacture, and sales

In

third quarter of 2021, we formed the company’s new growth strategy and the decision to enter into the ASIC chip research and development

to be conducted through AGM HK. In August 2021, we announced the launch of our first ASIC crypto Miner - KOI MINER C16 (“C16”).

C16 is equipped with the C3012 chip made by Semiconductor Manufacturing International Corp.’s N+1 process. C16 has a hash rate up

to 113 TH/s and a power efficiency ratio of 30 J/T, supporting the mining of Bitcoin, Bitcoin Cash (BCH) and other cryptocurrencies.

The

competition of cryptocurrencies mining equipment has grown intense in recent years. Our main competitors are Bitmain, a multinational

semiconductor company, Canaan, a supercomputing solutions provider, and MicroBT, a technology company based on block chain and

artificial intelligence, all of which are located in China and have both ASIC research and development capacities and deep supply chain

connections in China.

C16’s

parameters have surpassed our competitors’ models, including: Antminer S19 pro of Bitmain, which has a power consumption of 3250W

and hash rate of 104TH/S, and AvalonMiner1246 of Canaan, which has an A1246 hash rate of 90TH/S, power consumption

of 3420W and power efficiency of 38J/T, and Whatminer M30S ++ of MicroBT, which has a hash rate of 112TH/S, power consumption

of 3472 W and power efficiency of 31 J/T. Since the launch of C16, we have received orders from buyers in the United States, Canada

and Europe.

We

plan to use some of the proceeds from this offering to develop the technology hardware business.

Recent Development

Strategic Partnership with HighSharp (Shenzhen

Gaorui) Electronic Technology Co., Ltd

As part of our plan to expand into the hardware production business,

in September 2021, we entered into a strategic partnership agreement with HighSharp (Shenzhen Gaorui) Electronic Technology Co., Ltd (“HighSharp”),

a fabless integrated circuit designer that provides advanced semiconductor solutions for supercomputing hardware, pursuant to which, for

a six-month period until March 25, 2022, HighSharp will provide the latest ASIC chip technology and manufacturing services to us and we

will be responsible for client development on a global basis, with a target to generate orders of at least US$100 million during the six-month

term until March 25, 2022. If we and HighSharp achieve the respective targets, we and HighSharp plan to form a joint venture, joined by

HighSharp’s key R&D team members, with the goal to integrate next generation product research and development into fabless integrated

circuit design capabilities that provide advanced semiconductor solutions for supercomputing hardware. AGM Group Holdings, Inc. will own

60% of the equity and HighSharp will own 40% of the equity in the joint venture.

Termination of Equity Transfer Agreement

with Yushu Kingo City Real Estate Development Co., Ltd.

On January 16, 2020, AGM Tianjin

entered into an equity transfer agreement (the “Equity Transfer Agreement”) with all the shareholders of Yushu Kingo City

Real Estate Development Co., Ltd. (“Yushu Kingo”), who collectively owns 100% of the equity interest in Yushu Kingo, pursuant

to which agreement, in exchange for 100% of the equity interest in Yushu Kingo, AGM Tianjin agreed to pay $20,000,000 in

cash and cause AGM Holdings to issue 2,000,000 Class A ordinary shares, valued at $15 per share, subject to the terms and conditions

of the Agreement. AGM Tianjin made advance payments in the amount of $4,937,663.72 (the “Advance Payment”).

On April 6, 2021, AGM Tianjin,

Yushu Kingo and its shareholders entered into a supplement agreement (“Supplement Agreement”) to the Equity Transfer Agreement.

Pursuant to the Supplement Agreement, if AGM Tianjin decided not to proceed with the acquisition contemplated by the Equity Transfer Agreement

and terminate such agreement on or before October 31, 2021, Yushu Kingo’s shareholders shall return the Advance Payment and pay

an additional 10% interest to AGM Tianjin. If Yushu Kingo’s shareholders are unable to make such payment, Yushu Kingo’s shareholders

agreed to transfer the titles of real properties of Yushu Kingo to AGM Tianjin, valued with a 20% discount to market price. The parties

further agreed to conduct a new evaluation of Yushu Kingo’s assets and to enter into supplement agreement based on such evaluation.

Because of the COVID-19 pandemic,

the quarantine and travel restrictions in China, and the massive economic disruption as a result, Yushu Kingo was not able to complete

its construction projects and the audit and due diligence of Yushu Kingo was not completed on time. On October 4, 2021, AGM Tianjin terminated

the Equity Transfer Agreement and Supplement Agreement with the Yushu Kingo and its shareholders. On October 20, 2021, AGM Tianjin entered

into an agreement on transfer of creditor rights with a non-affiliated third party (the “Buyer”). Pursuant to the Transfer

Agreement, AGM Tianjin agrees to sell to the Buyer all of its rights and obligations under the Equity Transfer Agreement and the Supplement

Agreement, namely, the right to receive the Advance Payment plus interest, for a total purchase price of $5,000,000 (the “Purchase

Price”), $2,500,000 of which will be payable on or before December 31, 2021 and the remaining $2,500,000 will be payable on or before

June 30, 2022. The Buyer agrees, in the event it fails to pay the Purchase Price on time, to pay as damages for breach of contract an

amount equal to four times China’s loan prime rate (LPR) of the Purchase Price due.

Holding

Company Structure

AGM Group Holdings, Inc. is

a holding company established in the British Virgin Islands with no operations of its own. We conduct operations primarily through our

operating subsidiaries in the British Virgin Islands, Singapore, Hong Kong and the PRC. The Class A ordinary shares offered in this prospectus

are those of AGM Group Holdings, Inc., the holding company. Shareholders of AGM Group Holdings, Inc. are not directly investing in and

may never hold equity interest in the operating subsidiaries. Our current corporate structure is as follows:

Corporate Information

We were incorporated on April 27, 2015, under the laws of the BVI.

Our principal executive office is located at c/o Creative Consultants (Hong Kong) Limited Room 1502-3 15/F., Connaught Commercial

Building, Wanchai, Hong Kong. Our registered office in the British Virgin Islands is located at OMC Chambers, Wickhams Cay 1, Road Town,

Tortola, British Virgin Islands. Our registered agent in the United States is Vcorp Agent Services, Inc., located at 25 Robert Pitt Drive,

Suite 204, Monsey, NY 10952. We maintain a website at www.agmprime.com. The information contained in our website is not a part

of this prospectus supplement.

Transfers of Cash To and From Our Subsidiaries

AGM

Group Holdings, Inc. is permitted under the laws of the British Virgin Islands to provide funding to our subsidiaries incorporated in

the British Virgin Islands, Singapore and Hong Kong through loans or capital contributions without restrictions on the amount of the funds.

Our subsidiaries are permitted under the respective laws of the British Virgin Islands, Singapore and Hong Kong to provide funding to

AGM Group Holdings, Inc. through dividend distribution without restrictions on the amount of the funds. AGM Group Holdings, Inc. is permitted

to provide funding to our PRC subsidiaries only through loans or capital contributions, subject to satisfaction of applicable government

registration and approval requirements.

We

currently intend to retain all available funds and future earnings, if any, for the operation and expansion of our business and do not

anticipate declaring or paying any dividends in the foreseeable future. Any future determination related to our dividend policy will be

made at the discretion of our board of directors after considering our financial condition, results of operations, capital requirements,

contractual requirements, business prospects and other factors the board of directors deems relevant, and subject to the restrictions

contained in any future financing instruments.

Subject to the BVI Business

Companies Act, 2004 as amended from time to time, and our Amended and Restated Memorandum and Articles of Association, our board of directors

may authorize and declare a dividend to shareholders at such time and of such an amount as they think fit if they are satisfied, on reasonable

grounds, that immediately following the dividend the value of our assets will exceed our liabilities and we will be able to pay our debts

as they become due. There is no further BVI statutory restriction on the amount of funds which may be distributed by us by dividend.

To

make capital contributions to our PRC subsidiaries, the amount of capital contribution shall be limited to the registered capital of our

PRC subsidiaries. However, our PRC subsidiaries may increase their registered capital with the local Administration for Market Regulation

(AMR) at any time. In practice, under the condition that our PRC subsidiaries are prepared with complete materials, the local AMR will

generally approve the application within several business days, and the local bank’s approval for the inward remittances of registered

capital can be also completed within a few business days.

To

make loans to our PRC subsidiaries, according to Matters relating to the Macro-prudential Management of Comprehensive Cross-border Financing,

or PBOC Circular 9 promulgated by the People’s Bank of China, the total cross-border financing of a company shall be calculated

using a risk-weighted approach and shall not exceed an upper limit. The upper limit shall be calculated as capital or assets (for enterprises,

net assets shall apply) multiplied by a cross-border financing leverage ratio and multiplied by a macro-prudential regulation parameter.

The macro-prudential regulation parameter is currently 1, which may be adjusted by the People’s Bank of China and the State Administration

of Foreign Exchange in the future, and the cross-border financing leverage ratio is 2 for enterprises. Therefore, the upper limit of the

loans that a PRC company can borrow from foreign companies shall be calculated at 2 times the borrower’s net assets. When our PRC

subsidiaries jointly apply for borrowing foreign debt, the upper limit of borrowing shall be 2 times of the net assets in the consolidated

financial statement.

Furthermore,

our PRC subsidiaries, as foreign-invested enterprises, may also choose to calculate the upper limit of foreign debt borrowing based on

the surplus between the total investment in projects approved by the verifying departments and the registered capital. We can make loans

to our PRC subsidiaries within the range of the surplus.

In

addition to obtaining financing at the holding company level, AGM Group Holdings, Inc.’s ability to pay dividends to its shareholders

and to service any debt it may incur may depend upon dividends paid by our subsidiaries. If any of our subsidiaries incurs debt on its

own in the future, the instruments governing such debt may restrict its ability to pay dividends to AGM Group Holdings, Inc. In addition,

our PRC subsidiaries are required to make appropriations to certain statutory reserve funds, which are not distributable as cash dividends

except in the event of a solvent liquidation of the companies.

Current

PRC regulations permit our indirect PRC subsidiaries to pay dividends to our indirect subsidiaries in Hong Kong only out of their accumulated

profits, if any, determined in accordance with Chinese accounting standards and regulations. In addition, each of our subsidiaries in

China is required to set aside at least 10% of its after-tax profits each year, if any, to fund a statutory reserve until such reserve

reaches 50% of its registered capital. Each of such entity in China is also required to further set aside a portion of its after-tax profits

to fund the employee welfare fund, although the amount to be set aside, if any, is determined at the discretion of a subsidiary’s

board of directors. Although the statutory reserves can be used, among other ways, to increase the registered capital and eliminate future

losses in excess of retained earnings of the respective companies, the reserve funds are not distributable as cash dividends except in

the event of liquidation.

The

PRC government also imposes controls on the conversion of renminbi into foreign currencies and the remittance of currencies out of the

PRC. Therefore, we may experience difficulties in completing the administrative procedures necessary to obtain and remit foreign currency

for the payment of dividends from our profits, if any.

Under

the current practice of the Inland Revenue Department of Hong Kong, no tax is payable in Hong Kong in respect of dividends paid

by us. The laws and regulations of the PRC do not currently have any material impact on transfer of cash from AGM Group Holdings, Inc.

to the subsidiaries in Hong Kong or from the subsidiaries in Hong Kong to AGM Group Holdings, Inc. There are no restrictions or limitation

under the laws of Hong Kong imposed on the conversion of HK dollar into foreign currencies and the remittance of currencies out of Hong

Kong, nor is there any restriction on foreign exchange to transfer cash between AGM Group Holdings, Inc. and its subsidiaries, across

borders and to U.S. investors, nor is there any restrictions and limitations to distribute earnings from our business and subsidiaries,

to AGM Group Holdings, Inc. and U.S. investors and amounts owed.

Impact of the COVID-19 pandemic on our business and operations

The

COVID-19 pandemic has resulted in quarantines, travel restrictions, limitations on social or public gatherings, and the temporary closure

of business venues and facilities across the world. Many of the quarantine and lockdown measures within China have been relaxed. Nevertheless,

relaxation of restrictions on economic and social activities may lead to new cases which may result in the return of restrictions. The

negative impacts of the COVID-19 pandemic on our business include: (i) the uncertain economic conditions may refrain clients from engaging

our services; (ii) quarantines have impeded our ability to contact existing and new clients, as travel restrictions limited other parties’

ability to visit and meet us in person; although most communication may be achieved via video calls, this form of remote communication

may be less effective in building trust and communicating with existing and new clients; and (iii) the operations of our clients have

been and could continue to be negatively impacted by the COVID-19 pandemic, which may in turn adversely impact their business performance,

and result in a decreased demand for our services.

While

the COVID-19 pandemic is not expected to have significant impact on our business, the prolonged phenomenon of the COVID-19 pandemic and

the effects of mutations in the virus, both in terms of extent and intensity of the pandemic, together with their impact on our industry

and the macroeconomic situations are still difficult to anticipate and may pose substantial uncertainties. In the event the economic environment

does not improve nor there is no significant recovery in the regions where we serve our clients or operate, our business, results of operations

and financial condition could be materially and adversely affected.

The Offering

|

Number of Class A ordinary shares offered by us:

|

|

2,898,552 Class A ordinary shares.

|

|

|

|

|

|

Offering Price:

|

|

$6.90 per Class A ordinary share.

|

|

|

|

|

|

Number of Class A ordinary shares and Class B ordinary shares outstanding prior to the offering:

|

|

21,356,290 Class A ordinary shares and 2,100,000 Class B ordinary shares.

|

|

|

|

|

|

Class A ordinary shares and Class B ordinary shares outstanding after the offering:

|

|

24,254,842 Class A ordinary shares (assuming no exercise of the Warrants or the Placement Agent’s Warrants, as defined below) and 2,100,000 Class B ordinary shares.

|

|

|

|

|

|

Concurrent Private Placement:

|

|

In a concurrent private placement, we are issuing to the purchasers in this offering Warrants to purchase up to 1,449,276 Class A ordinary shares. We will receive proceeds from the concurrent private placement transaction solely to the extent such Warrants are exercised for cash. The Warrants will have an exercise price of $8.30 per share, subject to certain adjustments. The Warrants will become exercisable commencing on the date of issuance and will expire three and a half (3.5) years from the date of issuance. The Warrants will only be exercisable for a whole number of Class A ordinary shares. The Warrants and Warrant Shares are not being offered pursuant to this prospectus supplement and the accompanying base prospectus and are instead being offered pursuant to an exemption from registration under the Securities Act. See “Private Placement of Warrants” beginning on page S-12 of this prospectus supplement.

|

|

|

|

|

|

Gross Proceeds:

|

|

$20,000,000.

|

|

|

|

|

|

Use of Proceeds:

|

|

We intend to use approximately 80% of the net proceeds for developing our technology hardware business, including research and development, sourcing equipment, and recruiting top talent, and the remaining 20% of the net proceeds for the fintech business and general working capital and other general corporate purposes, including mass marketing for the FXSC, talent recruiting and R&D investments to be at the cutting-edge of the business. See “Use of Proceeds” on page S-11 of this prospectus supplement for additional information.

|

|

|

|

|

|

Placement Agent:

|

|

FT Global Capital, Inc.

|

|

|

|

|

|

Placement Agent’s Warrants:

|

|

We have agreed to issue to the Placement Agent warrants to purchase up to a total of 202,899 Class A ordinary shares (equal to 7% of the Class A ordinary shares sold in this offering, excluding the Warrant Shares) (the “Placement Agent’s Warrants”). Such Placement Agent’s Warrants will be exercisable commencing on the date of issuance at a per share price of $8.30, subject to certain adjustments, and will expire three and a half (3.5) years from the date of issuance. The Placement Agent’s Warrants and the underlying Class A ordinary shares may not be transferred or disposed of for one hundred eighty (180) days from the commencement of sales pursuant to this prospectus supplement. See “Plan of Distribution” beginning on page S-13 of this prospectus supplement.

|

|

|

|

|

|

Market for our Class A ordinary shares:

|

|

Our Class A ordinary shares are currently listed on Nasdaq under the symbol “AGMH”.

|

|

|

|

|

|

Risk Factors:

|

|

See

the “Risk Factors” sections beginning on page S-7 of this

prospectus supplement, on page 4 of the accompanying base prospectus, and in the other documents

incorporated by reference into this prospectus

supplement.

|

RISK FACTORS

You should carefully consider the matters described

below, in “Risk Factors” in “Item 3. Key Information—D. Risk factors” in the 2020 Annual Report, in the

“Risk Factors” filed as an exhibit to the Report on Form 6-K filed on September 29, 2021, and all of the information included

or incorporated by reference in this prospectus supplement before deciding whether to purchase our Class A ordinary shares. Our business,

financial condition and results of operations could be materially and adversely affected by any of these risks or uncertainties. In that

case, the trading price of our Class A ordinary shares could decline, and you may lose all or part of your investment. The risks also

include forward-looking statements and our actual results may differ substantially from those discussed in these forward-looking statements.

See “Special Notice Regarding Forward-Looking Statements.”

Risks Related to Our Business and Industry

We

may not be able to completely meet the target in order to form a joint venture with HighSharp (Shenzhen Gaorui) Electronic Technology

Co., Ltd (“HighSharp”) within a reasonable time frame or at all, which could have a negative impact

on our business expansion.

In

September 2021, we entered into a strategic partnership agreement with HighSharp, pursuant to which if we meet a target to generate orders

of at least US$100 million during the six-month term until March 25, 2022 and subject to other customary conditions, we and HighSharp

will form a joint venture, joined by HighSharp’s key R&D team members, with the goal to integrate next generation product research

and development into fabless integrated circuit design capabilities that provide advanced semiconductor solutions for supercomputing hardware.

We will own 60% of the equity and HighSharp will own 40% of the equity in the joint venture.

However,

we cannot guarantee whether we can meet such targets within a reasonable time frame or at all and therefore we may not form the

joint venture. As the joint venture is an important part of our overall strategy to develop our technology hardware business, failure

to continue the strategic partnership with HighSharp could have a negative impact on our business expansion. If the joint venture is delayed,

we will not be able to expand our business to technology hardware as planned and our management’s attention may be distracted.

In

addition, even if we form a joint venture with HighSharp, we may not realize the anticipated benefits of such strategic partnership, and

the operation of the joint venture may disrupt our business and divert management’s time and attention. The planned joint

venture may require us to spend a substantial portion of our available cash, issue stock, incur debt or other liabilities, amortize expenses

related to intangible assets, or incur write-offs of goodwill or other assets. It may also expose us to claims and disputes by shareholders

and third parties, including intellectual property claims and disputes, or may not generate sufficient financial return to offset additional

costs and expenses related to the joint venture. Additionally, we may encounter difficulties or unforeseen expenditures in integrating

the business, offerings, technologies, personnel, or operations. If we incur debt or issue a significant amount of equity securities to

fund such joint venture, such debt may subject us to material restrictions on our ability to conduct our business, as well as

financial maintenance covenants and such equity securities may cause dilution for our existing shareholders and earning per share may

decrease.

Risks Related to This Offering

Management will have broad discretion as

to the use of the proceeds from this offering, and we may not use the proceeds effectively.

We intend to use the net proceeds

from this offering for our technology hardware business, the fintech business and general working capital and other general corporate

purposes. The amounts and timing of our use of the net proceeds will vary depending on a number of factors, including the amount of cash

generated or used by our operations, and the rate of growth, if any, of our business. As a result, our management will have significant

flexibility in applying the net proceeds of this offering. You will be relying on the judgment of our management with regard to the use

of these net proceeds, and you will not have the opportunity, as part of your investment decision, to assess whether the proceeds are

being used appropriately. It is possible that the net proceeds will be invested in a way that does not yield a favorable, or any, return

for us. The failure of our management to use such funds effectively could have a material adverse effect on our business, financial condition,

operating results and cash flow.

You will experience immediate dilution in

the book value per share of the ordinary shares you purchase.

Because the offering price

is higher than the book value per Class A ordinary share, you will suffer substantial dilution in the net tangible book value of the Class

A ordinary shares you purchase in this offering. Based on the offering price of $6.90 per Class A ordinary share, if you purchase the

Class A ordinary shares offered in this offering, you will suffer immediate and substantial dilution per share in the net tangible book

value of the Class A ordinary shares.

Future sales or other dilution of our equity

could depress the market price of our ordinary shares.

Sales of our Class A ordinary

shares, warrants, debt securities or any combination of the foregoing in the public market, or the perception that such sales could occur,

could negatively impact the price of our Class A ordinary shares. We have a number of institutional and individual shareholders that own

significant blocks of our ordinary shares. If one or more of these shareholders were to sell large portions of their holdings in a relatively

short time, for liquidity or other reasons, the prevailing market price of our ordinary shares could be negatively affected.

In addition, we may need to

seek additional capital. If this additional financing is obtained through the issuance of equity securities, debt convertible into equity

or options or warrants to acquire equity securities, our existing shareholders could experience significant dilution upon the issuance,

conversion or exercise of such securities.

CAPITALIZATION

AND INDEBTEDNESS

The

following table sets forth our actual cash and cash equivalents and our capitalization as of September 30, 2021:

|

|

●

|

on an as adjusted basis to give effect to the issuance and sale of the 2,898,552 Class A ordinary shares in this offering (assuming no exercise of the Warrants or the Placement Agent’s Warrants) at a public offering price of $6.90 per share, before deducting estimated offering fees and expenses payable by us.

|

You should read this table

together with our unaudited consolidated financial statements and the related notes and the section entitled “Management’s

Discussion and Analysis of Financial Condition and Results of Operations” in our Report on Form 6-K including interim financial

statement for the nine months ended September 30, 2021 and 2020, filed with the SEC on December 8, 2021, which is incorporated by reference

herein. In addition, 5,000,000 Class B ordinary shares were cancelled on August 13, 2021,

which resulted in an increase in additional paid-in capital of $5,000. The Company intends to file an amendment to the Form 6-K

filed on December 8, 2021 to reflect such cancellation.

|

|

|

As

of September 30, 2021

|

|

|

|

|

Actual

(unaudited)

|

|

|

As

Adjusted

(unaudited)

|

|

|

|

|

US$

|

|

|

US$

|

|

|

Cash and cash equivalents

|

|

$

|

1,403,534

|

|

|

$

|

21,403,543

|

|

|

|

|

|

|

|

|

|

|

|

|

Shareholders’ Equity

|

|

|

|

|

|

|

|

|

|

Class A Ordinary Shares (200,000,000 shares authorized with par value of $0.001, 21,356,290 shares issued and outstanding; 24,254,842 shares issued and outstanding, as adjusted)

|

|

$

|

21,356

|

|

|

$

|

24,255

|

|

|

Class B Ordinary Shares (200,000,000 shares authorized with par value of $0.001, 2,100,000 shares issued and outstanding)

|

|

|

2,100

|

|

|

|

2,100

|

|

|

Additional paid-in capital

|

|

|

8,373,266

|

|

|

|

28,370,376

|

|

|

Statutory reserves

|

|

|

47,169

|

|

|

|

47,169

|

|

|

Accumulated deficit

|

|

|

(5,300,800

|

)

|

|

|

(5,300,800

|

)

|

|

Accumulated other comprehensive income

|

|

|

157,070

|

|

|

|

157,070

|

|

|

Total shareholders’ equity

|

|

$

|

3,300,161

|

|

|

$

|

23,300,170

|

|

|

|

|

|

|

|

|

|

|

|

|

Total capitalization

|

|

$

|

3,300,161

|

|

|

$

|

23,300,170

|

|

The total number of Class

A ordinary shares and Class B ordinary shares reflected in the discussion and tables above is based on 21,356,290 Class A ordinary shares

and 2,100,000 Class B ordinary shares outstanding as of September 30, 2021, but excludes the (i) 1,449,276 Class A ordinary shares underlying

the privately placed Warrants; and (ii) 202,899 Class A ordinary shares underlying the Placement Agent’s Warrants.

DILUTION

If you invest in our Class

A ordinary shares, your interest in our Class A ordinary shares will be diluted to the extent of the difference between the offering price

per Class A ordinary share and the pro forma net tangible book value per Class A ordinary share after this offering. Dilution results

from the fact that the per Class A ordinary share offered hereby is substantially in excess of the book value per Class A ordinary share

attributable to the existing shareholders for our presently outstanding Class A ordinary shares. Our net tangible book value attributable

to shareholders as of September 30, 2021 was $3,291,158, or approximately $0.15 per share.

Our pro forma net tangible

book value of our Class A ordinary shares as of September 30, 2021 gives effect to the sale of our Class A ordinary shares at the offering

price of $6.90 per share, prior to deducting the Placement Agent’s fees and estimated offering expenses. We will have 24,254,842

Class A ordinary shares outstanding upon completion of this offering, assuming no exercise of the Warrants or the Placement Agent’s

Warrants. Our pro forma net tangible book value as of September 30, 2021, which gives effect to the receipt of the net proceeds from

this offering and the issuance of additional Class A ordinary shares in the offering, but assumes no exercise of the Warrants or Placement

Agent’s Warrants, and does not take into consideration any other changes in our net tangible book value after September 30, 2021,

will be approximately $23,291,167, or $0.96 per share. This would result in dilution to investors in this offering of approximately $5.94

per share, or approximately 86%. Net tangible book value per share would increase to the benefit of present shareholders by $0.81 per

share attributable to the purchase of the Class A ordinary shares by investors in this offering.

The

following table sets forth the estimated net tangible book value per share after this offering and the dilution to persons purchasing Class

A ordinary shares in this offering based on the foregoing offering assumptions.

|

|

|

Offering

|

|

|

Public offering price per share ($)

|

|

$

|

6.90

|

|

|

Net tangible book value per share before this offering

|

|

$

|

0.15

|

|

|

Increase per share attributable to payments by new investors

|

|

$

|

0.81

|

|

|

Pro forma net tangible book value per share after this offering

|

|

$

|

0.96

|

|

|

Dilution per share to new investors

|

|

$

|

5.94

|

|

The

following table summarizes as of September 30, 2021, on a pro forma basis, as described above, the number of Class A ordinary shares,

the total consideration and the average price per share (1) paid to us by our existing shareholders and (2) issued to persons

in this offering at an offering price of $6.90 per share, before deducting estimated offering expenses payable by us:

|

|

|

Class A Ordinary

Shares

Purchased

|

|

|

Total

Consideration

|

|

|

Average

Price

|

|

|

|

|

Number

|

|

|

Percent

|

|

|

Amount

|

|

|

Percent

|

|

|

Per Share

|

|

|

Existing shareholders

|

|

|

21,356,290

|

|

|

|

88.0

|

%

|

|

$

|

9,199,176

|

|

|

|

31.5

|

%

|

|

$

|

0.43

|

|

|

New investors

|

|

|

2,898,552

|

|

|

|

12.0

|

%

|

|

$

|

20,000,009

|

|

|

|

68.5

|

%

|

|

$

|

6.90

|

|

|

Total

|

|

|

24,254,842

|

|

|

|

100.0

|

%

|

|

$

|

29,199,185

|

|

|

|

100.0

|

%

|

|

$

|

1.20

|

|

The total number of Class

A ordinary shares and Class B ordinary shares reflected in the discussion and tables above is based on 21,356,290 Class A ordinary shares

and 2,100,000 Class B ordinary shares outstanding as of September 30, 2021, but excludes (i) 1,449,276 Class A ordinary shares underlying

the privately placed Warrants; and (ii) 202,899 Class A ordinary shares underlying the Placement Agent’s Warrants.

To

the extent that we issue additional Class A ordinary shares or Class B ordinary shares in the future, there will be further dilution

to the persons being issued Class A ordinary shares in this offering. In addition, we may choose to raise additional capital because

of market conditions or strategic considerations, even if we believe that we have sufficient funds for our current or future operating

plans. If we raise additional capital through the sale of equity or convertible debt securities, the issuance of such securities could

result in further dilution to our shareholders.

USE

OF PROCEEDS

We estimate that the net proceeds

from this offering will be approximately $18 million after deducting the Placement Agent’s fees and the estimated offering expenses

payable by us.

We

intend to use approximately 80% of the net proceeds for developing our technology hardware business, including research and development,

sourcing equipment, and recruiting top talent, and the remaining 20% of the net proceeds for the fintech business and general working

capital and other general corporate purposes, including mass marketing for the FXSC, talent recruiting and R&D investments to be

at the cutting-edge of the business.

The

amounts and timing of our use of proceeds will vary depending on a number of factors, including the amount of cash generated or used

by our operations, and the rate of growth, if any, of our business. As a result, we will retain broad discretion in the allocation of

the net proceeds of this offering.

DESCRIPTION

OF THE SECURITIES WE ARE OFFERING

Class

A Ordinary Shares

We

are offering 2,898,552 Class A ordinary shares. As of the date of this prospectus, we are authorized to issue 200,000,000 Class A ordinary

shares of $0.001 par value per share and 200,000,000 Class B ordinary shares of $0.001 par value per share. As of the date of this prospectus,

there are 21,356,290 Class A ordinary shares and 2,100,000 Class B ordinary shares issued and outstanding.

For more information regarding

the Class A ordinary shares offered hereby, please see “Description of Shares” beginning on page 7 of the accompanying base

prospectus. You should also refer to our Amended and Restated Memorandum and Articles of Association which were filed as exhibits to the

registration statement of which this prospectus supplement is part and to our 2020 Annual Report.

PRIVATE

PLACEMENT OF WARRANTS

Concurrently

with the sale of Class A ordinary shares in this offering, we will issue and sell to the investors in this offering Warrants to purchase

up to an aggregate of 1,449,276 Class A ordinary shares at an exercise price of $8.30 per share. Each Warrant will be exercisable

immediately upon issuance and will expire three and a half (3.5) years from the date of issuance.

The

exercise price of the Warrants is subject to appropriate adjustment in the event of certain stock dividends and distributions, stock

splits, stock combinations, reclassifications or similar events affecting our Class A ordinary shares and also upon any distributions

of assets, including cash, stock or other property to our shareholders. The terms of the Warrants may make it difficult for us to raise

additional capital at prevailing market terms in the future.

A

holder may not exercise any of the Warrants, and the Company may not issue Class A ordinary shares upon exercise of any of the Warrants

if, after giving effect to the exercise, a holder together with its “attribution parties,” would beneficially own in excess

of 4.99% or 9.99%, at the selection of the holder, of the number of Class A ordinary shares outstanding immediately after giving effect

to the issuance of the Class A ordinary shares issuable upon the exercise of the Warrants.

The Warrants and the Class

A ordinary shares issuable upon exercise of the Warrants will be issued and sold without registration under the Securities Act, or state

securities laws, in reliance on the exemptions provided by Regulation D promulgated under Securities Act and in reliance on similar exemptions

under applicable state laws. Accordingly, the investors may exercise the Warrants and sell the underlying Class A ordinary shares only

pursuant to an effective registration statement under the Securities Act covering the resale of those shares, an exemption under Rule

144 under the Securities Act, or another applicable exemption under the Securities Act.

There

is no established trading market for the Warrants and we do not expect a market to develop. In addition, we do not intend to apply for

the listing of the Warrants on any national securities exchange or other trading market.

We are required within 30

days of the date of the closing of this offering to file a registration statement providing for the resale of the Class A ordinary shares

issued and issuable upon the exercise of the Warrants. We are required to use our best efforts to cause such registration statement to

become effective within 60 days (or 120 days if the SEC reviews and has comments to such registration statement) of the closing of this

offering and to keep such registration statement effective at all times until no purchaser as identified on the signature pages to the

Securities Purchase Agreement owns any Warrants or Warrant Shares.

PLAN

OF DISTRIBUTION

FT Global Capital,

Inc. which we refer to as the Placement Agent, has agreed to act as the exclusive placement agent in connection with this offering, pursuant

to that certain placement agency agreement entered into between us and the Placement Agent, dated December 10, 2021 (the “Placement

Agency Agreement”).

The Placement Agent is not

purchasing any securities offered by this prospectus supplement, nor is it required to arrange the purchase or sale of any specific number

or dollar amount of securities, but the Placement Agent has agreed to use its reasonable best efforts to arrange for the direct sale of

all of the securities in this offering pursuant to this prospectus supplement and the accompanying base prospectus.

We entered into a Securities

Purchase Agreement, dated as of December 10, 2021, with certain investors, and we will only sell to investors who have entered into the

Securities Purchase Agreement.

We expect to deliver the Class

A ordinary shares being offered pursuant to this prospectus supplement on or about December 14, 2021, subject to customary closing conditions.

We have agreed to pay the

Placement Agent upon the closing of this offering a cash fee equal to 7.5% of the aggregate gross proceeds of this offering. We also agreed

to reimburse the Placement Agent for expenses up to $80,000.

The following table shows

the per Class A ordinary share and total cash Placement Agent’s fees we will pay to the Placement Agent in connection with the

sale of the Class A ordinary shares pursuant to this prospectus supplement and the accompanying base prospectus, assuming the purchase

of all of the Class A ordinary shares offered hereby:

|

|

|

Per Class A

Ordinary

Share

|

|

|

Total

|

|

|

Offering price

|

|

$

|

6.90

|

|

|

$

|

20,000,000

|

|

|

Placement Agent’s fees

|

|

$

|

0.52

|

|

|

$

|

1,500,000

|

|

|

Proceeds, before other expenses, to us

|

|

$

|

6.38

|

|

|

$

|

15,500,000

|

|

After

deducting certain fees and expenses due to the Placement Agent and our estimated offering expenses (including reimbursement of Placement

Agent’s accountable expenses, payment of the Placement Agent’s non-accountable expense allowance, and our legal, printing

and other various costs, fees and expenses), we expect the net proceeds from this offering to be approximately $18

million.

Placement Agent’s

Warrants

We

have agreed to issue to the Placement Agent warrants to purchase up to a total of 202,899 Class A ordinary shares (equal to seven percent

(7%) of the Class A ordinary shares sold in this offering). Such Placement Agent’s Warrants will be exercisable at a per share price

of US$8.30. The exercise price is subject to appropriate adjustment in the event of certain stock dividends and distributions, stock splits,

stock combinations, reclassifications or similar events affecting our ordinary share and also upon any distributions of assets, including

stock or other property to our shareholders.

The

Placement Agent’s Warrants may be exercised at any time from the date of issuance, in cash or via cashless exercise, and will terminate

on the forty-two month anniversary of the date of issuance. The Placement Agent’s Warrants and the underlying shares will

be deemed compensation by FINRA, and therefore will be subject to FINRA Rule 5110(e). In accordance with FINRA Rule 5110(e)(1), and except

as otherwise permitted by FINRA rules, neither the Placement Agent’s Warrants nor any of our shares issued upon exercise of the

Placement Agent’s Warrants may be sold, transferred, assigned, pledged or hypothecated, or be the subject of any hedging, short

sale, derivative, put or call transaction that would result in the effective economic disposition of such securities by any person, for

a period of one hundred eighty (180) days beginning on the commencement of sales of this offering. In addition, we have granted the Placement

Agent the registration rights provided to recipients of the Warrants, including one demand registration right and unlimited piggyback

registration rights. These registration rights apply to all of the securities directly and indirectly issuable upon exercise of the Placement

Agent’s Warrants. In compliance with FINRA Rule 5110(g)(8), the one demand registration right and the unlimited piggyback registration

right will expire five and seven years, respectively, from the commencement of sales in this offering.

Tail

We

have agreed to grant the Placement Agent additional tail compensation for any financings

consummated within the 12-month period following the termination of the Placement Agency Agreement to

the extent that such financing is provided to us by investors that the Placement Agent “wall-crossed” on our behalf in connection

with this offering.

Lock-up Agreements

Each

of our officers, directors, and certain existing shareholders have agreed not to offer, issue, sell, contract to sell, encumber, grant

any option for the sale of or otherwise dispose of any ordinary shares or other securities convertible into or exercisable or exchangeable

for ordinary shares for a period of ninety (90) days from the closing date of this offering without the prior written consent of the Placement

Agent pursuant to the Placement Agency Agreement, or for one hundred twenty (120) days from the closing date of this offering pursuant

to the Securities Purchase Agreement.

The Placement

Agent may in its sole discretion and at any time without notice release some or all of the

shares subject to lock-up agreements prior to the expiration of the lock-up period. When determining whether or not to release shares

from the lock-up agreements, the Placement Agent will consider, among other factors,

the security holder’s reasons for requesting the release, the number of shares for which the release is being requested and market

conditions at the time.

No Sales of Similar

Securities; Restrictions on Future Issuances

We

have agreed, for a period until one hundred twenty (120) days after the closing of this offering, subject to certain limited exceptions,

not to issue, enter into any agreement to issue or announce the issuance or proposed issuance of any ordinary shares or securities that