Aimfinity Investment Corp. I (the “Company” or “AIMA”) (Nasdaq:

AIMAU), a special purpose acquisition company incorporated as a

Cayman Islands exempted company, today announced that, in order to

extend the date by which the Company mush complete its initial

business combination from July 28, 2024 to August 28, 2024, I-Fa

Chang, sole member and manager of the sponsor of the Company, has

deposited into its trust account (the “Trust Account”) an aggregate

of $60,000 (the “Monthly Extension Payment”).

Pursuant to the Company’s third

amended & restated memorandum and articles of association

(“Current Charter”), effectively April 23, 2024, the Company may

extend on a monthly basis from April 28, 2024 until January 28,

2025 or such an earlier date as may be determined by its board to

complete a business combination by depositing the Monthly Extension

Payment for each month into the Trust Account. This is the fourth

of nine monthly extensions sought under the Current Charter of the

Company.

About Aimfinity Investment Corp. I

Aimfinity Investment Corp. I is a blank check

company incorporated as a Cayman Islands exempted company for the

purpose of effecting a merger, share exchange, asset acquisition,

share purchase, reorganization or similar business combination with

one or more businesses or entities. The Company has not selected

any business combination target and has not, nor has anyone on its

behalf, initiated any substantive discussions, directly or

indirectly, with any business combination target with respect to an

initial business combination with it. While the Company will not be

limited to a particular industry or geographic region in its

identification and acquisition of a target company, it will not

complete its initial business combination with a target that is

headquartered in China (including Hong Kong and Macau) or conducts

a majority of its business in China (including Hong Kong and

Macau).

Additional Information and Where to Find It

As previously disclosed, on October 13, 2023,

the Company entered into that certain Agreement and Plan of Merger

(as may be amended, supplemented or otherwise modified from time to

time, the “Merger Agreement”), by and between the Company, Docter

Inc., a Delaware corporation (the “Company”), Aimfinity Investment

Merger Sub I, a Cayman Islands exempted company and wholly-owned

subsidiary of Parent (“Purchaser”), and Aimfinity Investment Merger

Sub II, Inc., a Delaware corporation and wholly-owned subsidiary of

Purchaser (“Merger Sub”), pursuant to which the Company is

proposing to enter into a business combination with Docter

involving an reincorporation merger and an acquisition merger. This

press release does not contain all the information that should be

considered concerning the proposed business combination and is not

intended to form the basis of any investment decision or any other

decision in respect of the business combination. AIMA’s

stockholders and other interested persons are advised to read, when

available, the proxy statement/prospectus and the amendments

thereto and other documents filed in connection with the proposed

business combination, as these materials will contain important

information about AIMA, Purchaser or Docter, and the proposed

business combination. When available, the proxy

statement/prospectus and other relevant materials for the proposed

business combination will be mailed to stockholders of AIMA as of a

record date to be established for voting on the proposed business

combination. Such stockholders will also be able to obtain copies

of the proxy statement/prospectus and other documents filed with

the Securities and Exchange Commission (the “SEC”), without charge,

once available, at the SEC’s website at www.sec.gov, or by

directing a request to AIMA’s principal office at 221 W 9th St, PMB

235 Wilmington, Delaware 19801.

Forward-Looking Statements

This press release contains certain

“forward-looking statements” within the meaning of the Securities

Act of 1933 and the Securities Exchange Act of 1934, both as

amended. Statements that are not historical facts, including

statements about the pending transactions described herein, and the

parties’ perspectives and expectations, are forward-looking

statements. Such statements include, but are not limited to,

statements regarding the proposed transaction, including the

anticipated initial enterprise value and post-closing equity value,

the benefits of the proposed transaction, integration plans,

expected synergies and revenue opportunities, anticipated future

financial and operating performance and results, including

estimates for growth, the expected management and governance of the

combined company, and the expected timing of the transactions. The

words “expect,” “believe,” “estimate,” “intend,” “plan” and similar

expressions indicate forward-looking statements. These

forward-looking statements are not guarantees of future performance

and are subject to various risks and uncertainties, assumptions

(including assumptions about general economic, market, industry and

operational factors), known or unknown, which could cause the

actual results to vary materially from those indicated or

anticipated.

Such risks and uncertainties include, but are

not limited to: (i) risks related to the expected timing and

likelihood of completion of the pending business combination,

including the risk that the transaction may not close due to one or

more closing conditions to the transaction not being satisfied or

waived, such as regulatory approvals not being obtained, on a

timely basis or otherwise, or that a governmental entity

prohibited, delayed or refused to grant approval for the

consummation of the transaction or required certain conditions,

limitations or restrictions in connection with such approvals; (ii)

risks related to the ability of AIMA and Docter to successfully

integrate the businesses; (iii) the occurrence of any event, change

or other circumstances that could give rise to the termination of

the applicable transaction agreements; (iv) the risk that there may

be a material adverse change with respect to the financial

position, performance, operations or prospects of AIMA or Docter;

(v) risks related to disruption of management time from ongoing

business operations due to the proposed transaction; (vi) the risk

that any announcements relating to the proposed transaction could

have adverse effects on the market price of AIMA’s securities;

(vii) the risk that the proposed transaction and its announcement

could have an adverse effect on the ability of Docter to retain

customers and retain and hire key personnel and maintain

relationships with their suppliers and customers and on their

operating results and businesses generally; (viii): risks relating

to the medical device industry, including but not limited to

governmental regulatory and enforcement changes, market

competitions, competitive product and pricing activity; and (ix)

risks relating to the combined company’s ability to enhance its

products and services, execute its business strategy, expand its

customer base and maintain stable relationship with its business

partners.

A further list and description of risks and

uncertainties can be found in the prospectus filed on April 26,

2022 relating to AIMA’s initial public offering, the annual report

of AIMA on Form 10-K for the fiscal year ended on December 31,

2022, filed on April 17, 2023, and in the Registration

Statement/proxy statement that will be filed with the SEC by AIMA

and/or its affiliates in connection with the proposed transactions,

and other documents that the parties may file or furnish with the

SEC, which you are encouraged to read. Should one or more of these

risks or uncertainties materialize, or should underlying

assumptions prove incorrect, actual results may vary materially

from those indicated or anticipated by such forward-looking

statements. Accordingly, you are cautioned not to place undue

reliance on these forward-looking statements. Forward-looking

statements relate only to the date they were made, and Aimfinity,

Docter, and their subsidiaries undertake no obligation to update

forward-looking statements to reflect events or circumstances after

the date they were made except as required by law or applicable

regulation.

No Offer or Solicitation

This press release is not a proxy statement or

solicitation of a proxy, consent or authorization with respect to

any securities or in respect of any potential transaction and does

not constitute an offer to sell or a solicitation of an offer to

buy any securities of AIMA, Purchaser or Docter, nor shall there be

any sale of any such securities in any state or jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of such

state or jurisdiction. No offer of securities shall be made except

by means of a prospectus meeting the requirements of the Securities

Act.

Participants in the Solicitation

AIMA, Docter, and their respective directors,

executive officers, other members of management, and employees,

under SEC rules, may be deemed to be participants in the

solicitation of proxies of AIMA’s shareholders in connection with

the proposed transaction. Information regarding the persons who

may, under SEC rules, be deemed participants in the solicitation of

AIMA’s shareholders in connection with the proposed business

combination will be set forth in the proxy statement/prospectus on

Form F-4 to be filed with the SEC.

Contact Information:

Aimfinity Investment Corp. I I-Fa Chang Chief Executive Officer

ceo@aimfinityspac.com (425) 365-2933 221 W 9th St, PMB 235

Wilmington, Delaware 19801

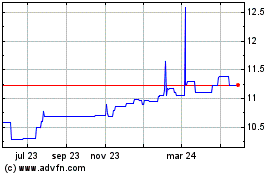

Aimfinity Investment Cor... (NASDAQ:AIMAU)

Gráfica de Acción Histórica

De Dic 2024 a Ene 2025

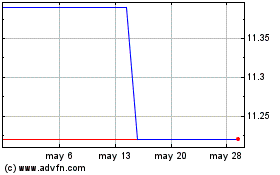

Aimfinity Investment Cor... (NASDAQ:AIMAU)

Gráfica de Acción Histórica

De Ene 2024 a Ene 2025